Charitable Or Nonprofit First

You might qualify for charitable or nonprofit assistance if you have low to moderate income. Charities and nonprofits are non-government organizations that can offer you educational and financial resources when you buy a home. Nonprofits usually have income qualifications that dictate who can get help.

Down Payment Assistance: How To Get Help Buying A House

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If you want to become a homeowner, but you dont have enough cash for a down payment, a state or local down payment assistance program might be able to help.

Most states and many counties and cities offer grants and no-interest loans to help home buyers pay for down payments and closing costs.

Association Of Community Organizations For Reform Now

Since its inception in 1970, ACORN has grown to become the largest community organization of low- and moderate-income families in the nation. With over 350, 000 members and chapters across the U.S. as well as cities in Argentina, Peru, Mexico, the Dominican Republic and Canada, ACORN has helped develop communities through campaigning and fundraising for better housing, schools, neighborhood safety, health care and job conditions, to name a few.

Don’t Miss: Government Assistance To Pay Bills

Who Qualifies For First

You cant get first-time homeowner benefits if you own a rental or investment property, even if you dont live in it.

If you opt for a government-backed loan like a USDA loan, VA loan or an FHA loan, note that your home also has to meet certain higher safety standards before you qualify. Local and state government programs also tend to have income restrictions.

Tax deductions and employer-sponsored programs are often more flexible. You can deduct your mortgage insurance on your personal home even if you have other properties up to the limits mentioned earlier.

Employer-sponsored programs are entirely up to the discretion of the employer and state sponsor if there is one. Many state-employer partnership programs also use the previously mentioned 3-year rule for deciding who is and who is not considered a first-time home buyer.

Some buyers believe that they might not qualify for first-time buyer programs. If you arent sure whether you qualify, the best thing to do is talk to a Home Loan Expert at Rocket Mortgage. They can take a look at your unique situation and point you in the right direction.

Down Payment Assistance Program

Homeownership! The American Dream!

The City of Memphis, through its Division of Housing and Community Development , offers financial assistance to its citizens through the Down Payment Assistance Program , to assist with meeting the financial requirements of purchasing a home. DPA provides funds to help meet the down payment and closing cost requirements needed to complete the closing.

We have a variety of programs that provide assistance to homebuyers meeting program eligibility requirements. Requirements may include income limits, employment, location of the home, and being a first-time homebuyer. All properties must be located within the city limits of Memphis and must be assessed Memphis City taxes. The maximum sales price for all programs is the current HOME Value Limits, as determined by the Department of Housing and Urban Development . Based on funding availability, the maximum amount of assistance is up to 10% of the sales price, not to exceed $10,000.

If you are ready to purchase a home, information is available to help you determine which program may fit your needs. Please click on the links below to learn more about the various programs available.

Citywide DPA Programs:

Targeted Area DPA must purchase home through MHA HOPE VI Program, maximum income limit is 80% area median income.

To Apply for DPA:

3) Please complete the Income-Asset Questionnaire and submit to your lender at application.

Down Payment Assistance Program Process

Recommended Reading: List Of Government Contracts Available

How Can I Move Forward

USAGrantApplication.org assists you in your search for housing grants. We offer a self-help reference tool: a grant-specialized website where the nations grants and grantors are researched and catalogued, creating one site that will significantly reduce your time and effort spent looking for grant information. Our research experts are always seeking new information to add to our site so you get the most updated research. With our help, you can find and apply for free government housing grants.

The Property You Buy With Your Equity Loan

The property must be:

- sold by a Help to Buy registered homebuilder

- the only home you own and live in

It must not have been lived in by anyone before you buy it.

Theres also a maximum property purchase price limit for the home you buy depending on which region its in. You can buy a home up to and including the maximum property purchase price limit.

| Region |

|---|

| £700 | £58.33 |

The interest rate increases every year in April, by adding the Consumer Price Index plus 2%.

Your interest payments will decrease if you make a part repayment of the equity loan. This is because the amount the interest rate is applied to will reduce.

Also Check: Government Money For New Business

Am I Eligible For The Help To Buy Scheme

To qualify for the scheme, youâll need to tick the following boxes:

- You must be an Australian citizen

- You must be at least 18 years of age

- You must not own any other property or land in Australia or elsewhere

- Your income must not exceed $90,000 if you are an individual and $120,000 if you are a couple

- You must intend to use the home as your principal place of residence

- You must have a deposit of at least 2 per cent of the propertyâs value

- You must qualify for the remainder of the purchase price through a home loan with a participating lender.

Down Payment Assistance : What Is It

If you qualify for our programs, TSAHC will provide you with a mortgage loan and funding to use for your down payment. You can choose to receive the assistance as a grant or a deferred forgivable second lien loan . If youre eligible, you can essentially receive free money to help you buy a home. To qualify, you must have a credit score of 620 and meet certain income requirements.

Don’t Miss: Hotels On Government Street In Mobile Alabama

Finally Close The Deal

Once your offer has been accepted by the inspector, you must close the sale. Before closing, you should check your financial data to verify that your employment status hasnt changed and that the mortgage payment is possible. You will need to inspect the home within 24 hours of closing to ensure that there are no damages and that it is clean. The moment of truth is To accept the terms of the contract, and to transfer title to the property, you will need to sign many papers. You will be asked to bring a cashiers check made by an Escrow company, or to transfer funds to the company. You will receive the keys to your new house once you have signed all documents. Important: Remember to bring your ID.

Figure Out How Much You Can Afford For A Home

Homeownership can be very exciting, but it isnt always the best thing for everyone. Before you decide to buy a home, make sure you carefully consider the costs.

According to Canada Mortgage and Housing Corporation , your monthly housing costs should not be more than about 35% of your gross monthly income. This includes costs such as mortgage payments and utilities.

Your entire monthly debt load should not be more than 42% of your gross monthly income. This includes your mortgage payments and all your other debts.

Also Check: Government Funded Teaching Assistant Courses Online

How To Apply For The Help To Buy Scheme

We at Home Loan Experts can assist you with applying for the Help to Buy scheme when the government starts accepting applications for it.

Even if you dont qualify for the scheme, there are other programs for you to choose from, including the following:

- If this is your first home, there are other for home buyers, including the .a comparison between the Help to Buy and First Home Guarantee Scheme.

- You can apply for a , which helps you borrow up to 105% of the securitys value.There are also and available.

With limited places available, competition for a spot in this scheme is sure to be fierce. Dont delay! Discuss your situation with our mortgage brokers today, and well find the best home loan scheme for your situation.

Call us on 1300 889 743 or fill in.

National Homebuyers Fund Down Payment Assistance

Some first-time home buyer programs provide grants, rather than assistance securing a mortgage. The National Homebuyers Fund Down Payment Assistance is one example. The NHF is a nonprofit public benefit corporation that provides grants to qualified borrowers for closing and/or down payment costs, including first-time home buyers and repeat buyers, says Bitton.

The assistance is up to five percent of the mortgage loan amount, and it can be used for down payment or closing costs. The program isnt one-size-fits-all, so the assistance could be forgiven or there could be repayment options, depending on the buyers situation.

You May Like: Best Colleges For Political Science And Government

How Do I Get A First

Start by exploring the housing finance agency in your state. You’ll likely come across a number of programs designed especially for first-time buyers such as yourself. Many programs offer grants to help turn your homeownership dream into reality.

Be aware that not all first-time homebuyer grants are the same. Fund amounts depend on various factors, including location, credit score, income, and family size. An experienced lender can also point you in the right direction as far as grants are concerned.

How Can I Apply

Start by researching what programs are available in your area, if any. HUD has a list of local home buying programs by state. Check with your city and county to see if they offer any loans or grant programs. Search their websites for information on how to apply. Reach out to them via email or phone for specific answers you cant find online. Make sure your mortgage lender works with the program.

Recommended Reading: Government Programs To Help Remodel Home

Good Neighbor Next Door Grants: 50% Off The House

Theres one federal government program that makes all other forms of down payment assistance look insignificant.

The Good Neighbor Next Door program provides a 50% discount on the list price of the home.

But it works only for qualified people, including:

- Law enforcement officers

- Emergency medical technicians

- Teachers working pre-kindergarten through 12th grade

In addition, you must buy a home listed for sale by the U.S. Department of Housing and Urban Development . These HUD homes are located in targeted revitalization areas.

If youre in one of those occupations, and are prepared to commit to living for at least three years in a neighborhood thats still developing, then youre going to want to explore this program further.

Help To Buy: Equity Loan

You can get an equity loan towards the cost of buying a new-build home as a first-time buyer.

The Help to Buy: Equity Loan scheme will close to new applications at 6pm on 31 October 2022.

This guidance applies to England. Theres different guidance on how to apply for an equity loan in Scotland and how to apply for an equity loan in Wales.

Also Check: Free Government Phones In North Carolina

Help To Buy Scheme: Federal Government Shared Equity

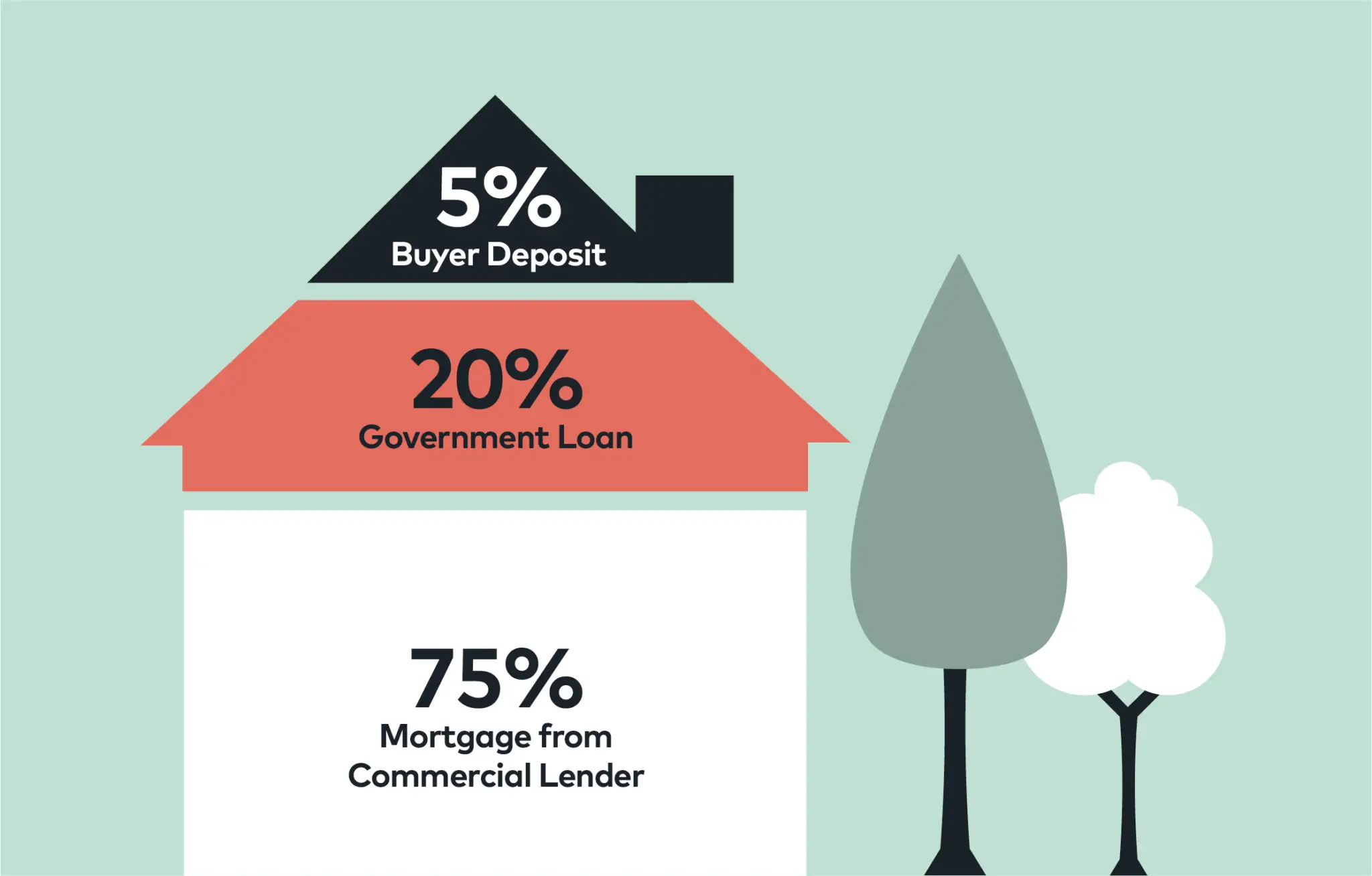

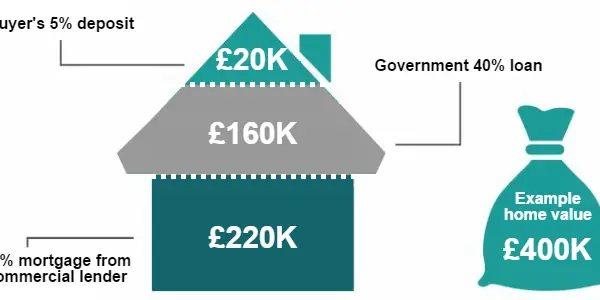

Laborâs flagship housing policy, Help to Buy, is a shared equity scheme where the government will co-purchase a home with an eligible buyer, reducing the amount needed for a deposit.

With housing affordability being a key factor in the 2022 election, the new government has its work cut out for it when it comes to addressing an increasingly dire situation for those looking to enter, or re-enter, the market.

Labors solution to this is the Help to Buy scheme heres everything you need to know.

Save For A Down Payment

The average first-time home buyer puts just 6% down on a new home. Yet, many loan programs require as little as 3% down or no down payment at all.

Keep in mind you still have to pay closing costs, which are typically around 2% to 5% of your mortgage loan amount. And if you put less than 20% down youll almost certainly have to pay for mortgage insurance.

In addition, you may need cash reserves in your savings account so that your lender knows you can make your monthly mortgage payments if you should suffer a financial setback.

However, dont let the down payment scare you away from homeownership. Many buyers qualify without even knowing it.

You May Like: What Government Grants Are Available For Electric Cars

What Do You Need To Qualify For First Time Homebuyer Program

Help buying a home for the first time . Governmental and non-profit programs often have strict definitions of first-time buyers. You are considered a first-time buyer if you have not owned a home for the last three years.

Renting or investing in property is not eligible for first-time homeownership benefits, regardless of whether you live there yourself. Consider a USDA loan, FHA loan, or other government-backed loan, but keep in mind that your house must also meet certain standards before you qualify. Income restrictions are also common in government programs.

Most programs offered by employers and by the government are more flexible. Mortgage insurance for your personal home can be deducted even if you have other properties. A state sponsor or employer-sponsored program has sole discretion over the program.

The three-year rule is also used in many employer-state partnership programs, which means you can qualify as a first-time home buyer if you havent owned a residence for at least three years prior to purchasing your home.

What Is The Help To Buy Scheme And How Does It Work

Reportedly commencing from early 2023, the governments offering 10,000 applicants per year who have at least 2% of the purchase price saved the chance to borrow up to 40% of the purchase price of a new home and up to 30% for an existing home.

This will save would-be homebuyers the dilemma of waiting until they have sufficient savings or paying sometimes tens of thousands of dollars in Lenders Mortgage Insurance .

The new government wants to help buyers get into the market. Picture: realestate.com.au/buy

The government claims this could save some buyers up to 40% over the life of the loan.

Shared equity loans are already operating in Victoria with the Victorian Homebuyer Fund and Western Australia to help would-be buyers get into the market.

Borrowers would repay the loan when they sell the property or over time pay to increase their stake in the property.

You May Like: Government Bank Owned Foreclosed Homes In Polk County

Who Qualifies For Housing Grants

Housing grants can be used for a wide range of people with a wide range of needs: from first-time homeowners to people who have owned in the past to those interested in seniors-only communities. Free government housing grants exist for families, two-member households, and one-member homes.

Unlike a home loan, grants are not strictly based on your financial security and credit rating. People with lower income and even poor credit are encouraged to apply for free government housing grants.

Two Home Buyer Programs: Which Is Right For You

TSAHCs mortgage loans with down payment assistance are offered through the following programs. You dont have to be a first-time home buyer to use either program!

Homes for Texas Heroes Program

If youre in a hero profession, this is the home loan program for you. Hero professions include:

- Professional educators, which includes the following full-time positions in a public school district: school teachers, teacher aides, school librarians, school counselors, and school nurses

- Police officers and public security officers

- Firefighters and EMS personnel

- Correction officers and juvenile corrections officers

- Nursing faculty and allied health faculty

Home Sweet Texas Home Loan Program

If you dont qualify under one of the professions listed above, this is the best program for you.

You May Like: How Much Does The Us Government Spend On Healthcare

Section 203 Of The Fha

If you dont want to spend a lot of money on your home renovations or improvements, you might look into section 203 FHA loans. This loan is guaranteed by the institution. After the improvements are made, the loan calculates your homes worth. They will then calculate the value of your home after all improvements have been made. They will lend you money to pay for renovations and let you pay them in small installments. You will be required to make a 3.5% deposit and upgrade must exceed $ 5,000 in order to apply. Make sure that your contractor knows the rules. 203 , Loan Its policies and its repayment times.

The Labor Governments Help To Buy Scheme Explained

Australia has a new government, and hopeful homebuyers will be interested to hear it has very different ideas about how to tackle housing unaffordability than the previous one.

In early May, the Labor Party unveiled its plan to help Australians purchase a home, dubbed the Help to Buy scheme. It hopes to reduce upfront and ongoing mortgage costs by letting households enter a co-ownership arrangement with the government.

Under the scheme, the government will make an equity contribution of up to 40 per cent on purchases of new homes, and up to 30 per cent on purchases of existing homes.

While that means the government will own a portion of the property â and can claim its equity and share of any capital gain if the home is sold â homebuyers can purchase an additional stake in the property when they are able to do so.

According to the ALP, the scheme could lead to savings of $380,000 on a new Sydney home, $255,000 on a new Melbourne home, and $195,000 on a new Brisbane home.

It will only be available to individuals who earn up to $90,000 per year and couples with a combined income of up to $120,000 per year. Eligible Australians must also have at least 2 per cent of a propertyâs value saved up for a deposit.

Up to 10,000 households will be able to access the scheme each financial year.

Also Check: Top Government Contracts Law Firms