Administration Of Construction Contracts

13.2.1 The standard federal construction contract form should be used for all construction contracts over $100,000 except those which, in the judgment of the contracting authority, must be modified to meet special circumstances. The principles and policies expressed in the Standard Construction contract are the prerogative of the Treasury Board. However, the style and content of the Standard Construction contract are the responsibility of the Department of Public Works and Government Services Canada.

Sba Government Contracting Classroom

Do you want to develop a more in-depth understanding of government contracting before diving into the federal marketplace? The SBA Government Contracting Classroom is a wonderful online course series that thoroughly explains what you need to know about government contracts for small business. These courses are a great resource to learn more about the specific forms and processes involved in registering for, finding, and winning government contracts for small businesses.

The Top 10 Government Contractors Bloomberg Government

Posted: Lockheed Martin Corp. Obligations: $48.3B.Boeing Co. Obligations: $28.1B.General Dynamics Corp. Obligations: $21.0B.Northrop Grumman. Obligations: $16.4B.Raytheon. Obligations: $15.9B.United Technologies Corp. Obligations: $10.3B.McKesson Corp. Obligations: $9.7B.Leidos Inc. Obligations: $8.2B.Huntington Ingalls Inc. Obligations: $7.8B.L3Harris Corp. Obligations: $7.8B. The report does not yet account for the Raytheon and See full list on about.bgov.com

Recommended Reading: Dental Implant Grants For Seniors

Top 10 Government Contractors

Posted: In 2015 Lockheed Martin was once again named the governments largest contractor, with $36.2 billion in obligated contracts in 2015. Clearance: Required, Size: Variable Amazon Web Services is approaching $10 billion in annual revenues, with a growing business as a cloud provider for the Intelligence Community and Federal Government.

How To Get Government Contracts: Prepare Your Proposal

Though you likely have experience creating proposals and scope of work orders for prospective clients in the private sector, little can prepare you for the unique process of preparing a government contract proposal. In fact, completing a bid or proposal for a government agency may be more akin to completing your business taxes or a stack of forms for the DMV.

Even so, there are plenty of opportunities to share your unique value add and let your business shine within the pages of your proposalâas long as you fit within the confines of agency formats and expectations.

Recommended Reading: Governmentjobs.com Las Vegas

Payment Of A Letter Of Credit

6.1 After an offer is accepted within the specified time after the closing date for bidding, and if the contractor refuses to enter into the contract or refuses or is unable to furnish any required contract security or contract support letter of credit, the Crown may demand payment under the bid support letter of credit in accordance with its terms. Proceeds from the letter of credit shall be applied in accordance with the terms and conditions governing the bid solicitation.

6.2 During the performance of a contract, if the contractor does not comply with all the terms and conditions of the contract, the Crown may demand payment under the contract support letter of credit in accordance with its terms. Proceeds from the letter of credit shall be applied in accordance with the terms and conditions of the contract.

6.3 The Crown demands payment under the terms and conditions of a letter of credit by presenting one or more written demand for payment, signed by an authorized departmental representative identified in the Letter of Credit by his office.

Seek A Subcontracting Opportunity

While the SAM.gov database handles direct contracts with government agenciesâknown in government terms as prime contractsâthere is another form of government contracts for small businesses to explore: subcontracting.

As the name suggests, subcontracting opportunities involve negotiating contracts with current government contractors to complete a portion of the work designated by the prime contractors. In other words, subcontractors are the vendorâs vendor. Subcontracting on government contracts can be both a lucrative business opportunity and a chance to learn more about government contracting before attempting to bid on prime contracts directly with the U.S. government.

Similar to SAM.gov, the SBA maintains a searchable database called SUB-Net that highlights available subcontracting opportunities. If youâre just getting started with government contracting or would like a layer of experience between government agency clientele and your own business, searching SUB-Net for subcontracting opportunities is a great starting point.

Recommended Reading: Government Grant For Dental Implants

List Of Available State Certifications

For most small businesses looking to grow their operations, targeting your local, city, county, or state government is the ideal way to have dependable sources of income that can help your business plan during tough economic times. Trying to fight for these contracts however, can be very cut-throat as many businesses are often looking for the same ideal contracts and the government agencies often only have them posted for a few short days up to a month.

Obtaining the correct business certifications for your enterprise is crucial in order to gain easy access to both federal government and corporate contracts. Certification provides your small business with a nationally-recognized and highly-respected status that makes your company stand out against marketplace competition for elite and distinguished clients.

As a small business owner, you and many others are most likely trying to find ways to successfully win your bids without giving away your shirt trying to be the lowest bid. So what options are available to help you win the bid without bidding too low? For most small business owners a great method for standing out is to seek a city, county or state certification.

As a business owner, its often difficult to determine exactly how many certifications youre eligible for in your local state. BizCentral USA has compiled a list of the various certifications available at the city, county or state level.

| State | |

| State | None |

List Of Government Job Titles

There are many types of government jobs, and not all government job titles are represented on this listing of federal jobs. This list of careers illustrates that many government positions provide competitive starting salaries.

Attorney Investigate and prosecute criminal and civil cases.

Salary range $80,297 to $167,636.

Biologist or Natural Resources Manager Evaluate and manage natural resources at national parks, forests, and other properties.

Salary range $69,301 to $90,097.

Mathematician or Statistician Perform various mathematical calculations and reports.

Salary range $56,233 to $117,191.

IT Specialist Manage, maintain, and secure information technology systems.

Salary range $47,686 to $114,590.

Contract Specialist Analyze costs, write contracts, and manage contract execution.

Salary range $41,365 to $88,500.

Engineer Design, simulate, analyze, test, and implement various engineering projects.

Salary range $61,218 to $99,172.

Office Automation Specialist Develop automation processes and provide technical support for software installations and updates.

Salary range $45,918 to $59,694.

Education Program Specialist Create criteria for grants and contracts.

Salary range $83,398 to $108,422.

Dentist Perform dental procedures.

Salary range $103,395 to $225,000.

Economist Research and analyze competition, markets, mergers, and theoretical economic models.

Salary range $55,237 to $117,191.

Salary range $42,391 to $80,912.

Salary range $83,398 to $152,352.

You May Like: Dental Lifeline Network Dental Implant Grant

Dynamic Small Business Search

Approximately one-quarter of all federal contracts are set aside each year for small businesses. The DSBS is maintained by the Small Business Administration . The DSBS is free to use and allows small businesses to access a list of federal contracts specifically set aside for small businesses.

In addition to meeting the numerical requirements to qualify as a small business, a company must also meet the other general requirements to qualify are federal contracts that aside for small businesses. Those qualifications are:

· The company must be a for-profit business

· The company must be independently owned and operated

· The company cannot dominate the field nationally for its particular product or service and,

· The company must be physically located and operate within the United States or one of its territories.

Approximately one-quarter of all federal contracts are set aside each year for small businesses.

Work With A Dc Fractional General Counsel On Federal Government Contracts

A DC fractional general counsel helps you with every aspect of federal government contracting. From preparing your internal operations and accounting to submitting proposals and completing the work. Contact Steve Thienel today to see how you can benefit from the guidance, support, and legal advice of an experienced general counsel.

Read Also: George Washington University Government Contracting Certificate

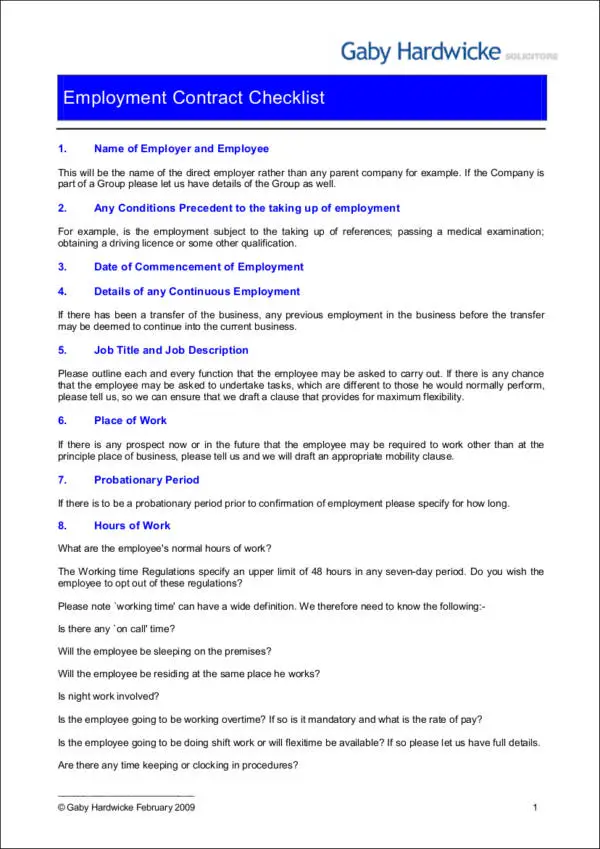

Follow The Uniform Contract Format

No matter the type, all solicitations share the expectation that aspiring contractors follow a specific format. Success in procuring government contracts has as much to do with your ability to follow instructions in the proposal formatting and submission process as the substance of your proposal. So, make sure that you follow all schedules and forms within the solicitation in the exact order, structure, and time frame requested. The SBAâs free âGovernment Contracting 101â online course is a great resource for in-depth understanding of the purpose, forms, and expectations for each of the 10 sections within the Uniform Contract Format.

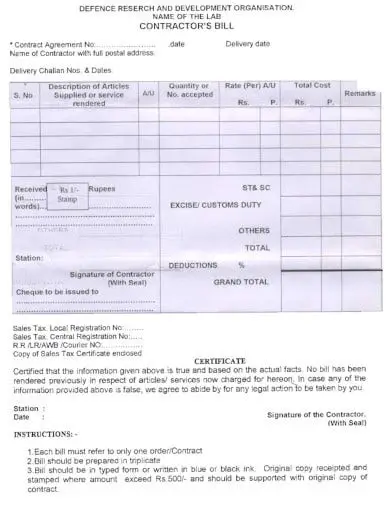

Preparation Of T1204 Supplementary Slips For Contracts For Services

16.15.1 As mentioned at paragraph 4.2.6 of this policy, pursuant to paragraph 221 of the Income Tax Act, payments exceeding $500.00 made by departments and agencies under applicable service contracts, including contracts involving a mix of goods and services, must be reported on a T1204 supplementary slip.

16.15.2 Departments must report on a T1204 any payments related to printing contracts in the manner indicated in this section.

16.15.3 Exceptions. Contract purchases for services that are exempt under this requirement are direct purchases made using acquisition cards, direct purchases under local purchase orders, grants and contributions, utility payments, and rental or leasing of office space and equipment and other “goods”.

16.15.4 The amount to be reported on each information slip is the total of payments made to the enterprise in the calendar year, including any goods portion, expenses, indirect costs, etc., but excluding GST/HST.

16.15.5 All forms of enterprises should receive these slips, including sole proprietorships , corporations and partnerships.

16.15.6 Slips are required for service contracts where a Canadian resident is working outside the country. The payments made to non-residents providing services in Canada are not reported on T1204 supplementary slips, not being part of this reporting requirement. See section 16.15 for information on tax treatment of non-residents who perform services in Canada.

Read Also: Government Grants For Auto Repair Shops

Criminal Code The Financial Administration Act And The Trade Agreements

12.5.1 The Criminal Code of Canada, Section 748, Sub-Section 3 prohibits anyone who has been convicted of an offence under:

- Section 121, Frauds upon the Government

- Section 124, Selling or Purchasing Office or

- Section 418, Selling Defective Stores to Her Majesty,

from holding public office, contracting with the government or receiving a benefit from a government contract, unless the Governor in Council has restored these capabilities to the individual or the individual has received a pardon.

12.5.2 As stated in article 4.2, Related requirements, contracts are subject to the screening requirements of the Security Policy of the Government of Canada. The contracting authority is responsible for ensuring compliance. Contract administrators, therefore, must ensure that any necessary security clearances and/or reliability checks are carried out so that contractors and their employees, where applicable, are acceptable under the policy .

12.5.3 As required by the Prime Ministers Conflict of Interest and Post Employment Code for Public Office Holders, September 1985, contracting authorities are to ensure that all requirements are met. These include inserting clauses, approved by Treasury Board, into every contract entered into by the Crown. They are contained in Appendix G.

Format Requirements For Submission To Treasury Board

The Treasury Board Secretariat should have copies of all supporting documents referred to in the submission. In some cases, a summary of the essential details of a document may suffice. The Treasury Board Submissions Guide provides general information on the format, structure and processing of submissions to the Treasury Board. It also provides guidance on some of the content requirements. For complex, urgent or sensitive issues, discussions with the Secretariat analyst, prior to finalization of the submission, may shorten the time required for approval.

Don’t Miss: Sacramento Federal Jobs

I: Basic Contracting Limits

Entry into a contract or contractual arrangement must be approved by the Treasury Board if the amount payable, including all applicable taxes, fees and amendments, exceeds the stated monetary limit for the contracting authority identified in the basic limits schedules.

When an exceptional limit for a specified program is lower than the basic limit for its corresponding schedule, the lower exceptional limit applies.

Schedule 1: construction

- Competitive construction contract: up to $11,500,000

- Competitive architectural and engineering contract up to $1,850,000

- Non-competitive architectural and engineering services contract up to $150,000

- For housing and detachment projects:

- competitive construction contract up to $23,000,000

- competitive architectural and engineering services contract up to $3,700,000

Until March 31, 2025, the Minister responsible for Shared Services Canada may enter into and amend non-competitive contracts for up to $22.5 million to support IT operations for the GC where IP rights of the supplier prevent the contract from being competed.

Appendix M Lobbyists And Contracting

Recommended Reading: Free Dental Implants Grants

How To Get Government Contract Jobs

Posted: Sep 26, 2017 · Visit the government contractor’s website to view career opportunities available. A list of open positions will be provided, along with a brief description, requirements and how to apply. Important background information about the company is also provided, allowing the job seeker to become familiar with the potential employer.

National Association Of Government Contractors Nagc

Posted: amc/account executive academic / research academic/faculty accounting admin / clerical administration administrative assistant administrative/support advanced practice registered nurses / physician assistants advertising/marketing/public relations/communications advising/counseling airport

You May Like: Government Contractors Charleston Sc

List Of Departments Government Jobs In Usa Types Of

Posted: In the USA, departments need to fill many different government jobs. This federal jobs list shows the jobs typically associated with major federal departments. Department of Agriculture Mathematician or Statistician IT Specialist Biologist or Natural Resources Manager Department of Commerce Department of Defense Department of Education

Become A Federal Contractor

Posted: Prime contractors bid on and win contracts directly from government agencies. Subcontractors join prime contractor teams, usually to provide a specific capability or product. For your small business to serve as a prime contractor or subcontractor, youll need to legally qualify as a small business and register as a government contractor.

Recommended Reading: Semper Fi Auto Repair Las Vegas

Agreement On Internal Trade

8.8.1 The AIT is an agreement on Canadian internal trade, which aims to reduce barriers to trade within Canada. It was signed by the 10 provinces and2 territories and came into effect on July 1, 1995. Chapter 5 of AIT is intended to create a system that will allow fairness and equal access to government procurement for all Canadian suppliers in order to reduce cost, and develop a strong economy.

8.8.2 Deleted.

Government Bids & Contracts

Posted: GovernmentBids.com is powered by mdf commerce, offering a range of services in government contracts, government RFPs, government bids and government procurement systems. Most popular bid categories: Construction bids , Architectural and Engineering bids , Grounds and Landscaping bids , IT/Technology Consulting bids , Janitorial and Cleaning …

Don’t Miss: Grants For Owner Operators

Appendix E Federal Contracts For Building Services In The Province Of Ontario