Fact : In Many Cities Health

In a well-functioning competitive market, prices for the same service will not vary widely within a given place: consumers will avoid a business that charges much higher prices than its competitors. However, many health-care markets dramatically violate this expectation. Figure 7 focuses on health-care price variation within selected metro areas, showing that some metropolitan statistical areas feature much more price variation than others. For example, estimates from the Health Care Cost Institute show that the price for a blood test ranges from $22 to $37 in Baltimore, Maryland, but in El Paso, Texas, the same range is $144 to $952. For a C-section delivery, prices vary widely both across and within markets: the 10th to 90th percentile range is 9.3 times larger in the San Francisco, California, metro area than in the Knoxville, Tennessee, metropolitan area.

Some variation in prices is due to differences in quality and amenities: one medical practice might take more time with patients, have nicer facilities, or employ more experienced medical teams, allowing it to charge correspondingly higher prices. But much of the variation is likely related to market imperfections that limit the ability and incentive for patients to shop for the lowest price .

A Hamilton Project proposal by Michael Chernew, Leemore Dafny, and Maximilian Pany would address this type of health-care price dispersion with regulatory interventions directed at the most egregious price growth.

Us Health Outcomes Lag Behind Those Of Other Countries

Despite Americans spending significantly more on healthcare compared with the residents of other developed countries, they do not enjoy better outcomes. In fact, the U.S. lags behind other countries when common health metrics are considered.

Among the wealthier European countries of the current 38 Organisation for Economic Cooperation and Development members the life expectancy for individuals born in 2020 is much higher than in the U.S. In Switzerland, it is 83.2 years, while in France it is 82.3 years, and 80.4 years in the United Kingdom. The life expectancy for U.S. residents, at 77.3 years.

The American health system falls short of other national systems in cost and results, with costs far exceeding those of other wealthy countries. Americans also pay more for healthcare than residents of other major countries do, though residents of comparable countries enjoy better healthcare outcomes and live longer.

The Substantial Price Tag

All total, our Hopkins team estimated a grand total of 48% of all federal spending going to the countrys medical-industrial complex.

As if that werent enough, we havent even included whats spent on employer-sponsored health benefits. The average American spends $11,121 on health insurance a year. Employers contribute an additional $5,288 to your health care cost from a pool of money allocated for wages and benefits money that could otherwise go to your paycheck.

Thats a hefty tab!

No wonder Americans get ticked off when basic medical care is not covered. American workers are spending 55% more on insurance premiums than they were a decade ago. Over the same time, their deductibles and co-pays are going up. Remarkably, on top of what people spend on health care through taxes and insurance, the average American now spends approximately $3,000 each year on services that are not covered.

All this means that if you earn $52,000 a year, you are contributing $22,474, nearly half of your allocated wages, on health care.

Don’t Miss: Harford County Jobs Available

Federal Government Funds Two

Contrary to popular perceptions that healthcare financing in the US is predominantly private, Americans pay the worlds highest health-related taxes, study finds.

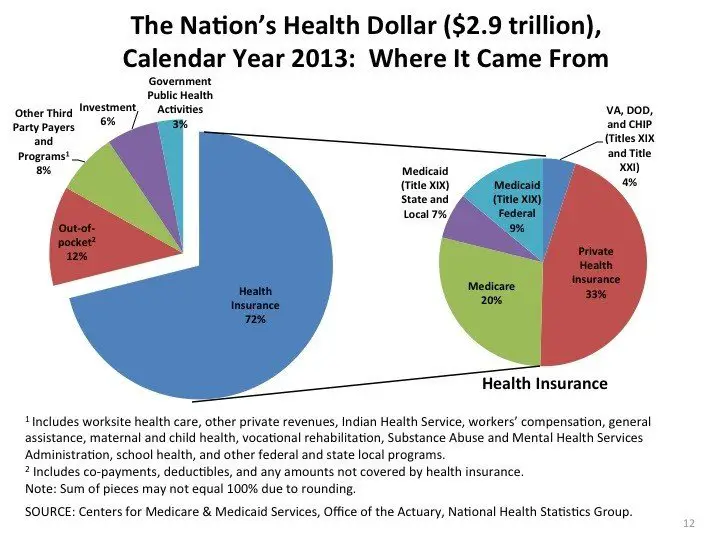

Tax-funded expenditures accounted for 64.3% of US healthcare spending in 2013, according to a new study in American Journal of Public Health.

Researchers tabulated official data from CMS, the Office of Management and Budget, the US Census Bureau, and the Internal Revenue Service on direct government spending for health programs and public employees health benefits for 2013 and projected figures through 2024. They calculated the value of tax subsidies for private spending from official federal budget documents and figures for state and local tax collections.

Contrary to public perceptions and official Centers for Medicare and Medicaid Services estimates, government funds most health care in the United States, concluded the studys authors, David U. Himmelstein, MD, and Steffie Woolhandler, MD, MPH, of the City University of New York School of Public Health at Hunger College. Drs Himmelstein and Woolhandler are cofounders and leaders of Physicians for a National Health Program , a nonprofit organization that advocates for a single-payer health system.

Drs Himmelstein and Woolhandlers data show Americans pay the worlds highest health-related taxes, they said, which conflicts with popular perceptions that the US healthcare financing system is predominantly private.

How Congress Really Spends Your Money

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

The Balance / Hilary Allison

Current U.S. government spending is $4.829 trillion. That’s the federal budget for the fiscal year 2021 covering October 1, 2020, through September 30, 2021. It’s 20.7% of gross domestic product according to the Office of Management and Budget Report for FY 2021.

Also Check: Government Grants For Dental Work

Who Does Us Borrow Money From

The public holds over $21 trillion, or almost 78%, of the national debt. 1 Foreign governments hold about a third of the public debt, while the rest is owned by U.S. banks and investors, the Federal Reserve, state and local governments, mutual funds, pensions funds, insurance companies, and savings bonds.

National Health Spending Per Capita Spiked In 2020 Though General Economic Price Inflation Was Modest

Health spending per capita increased by 9.3% between 2019 and 2020. The Personal Consumption Expenditure price Index grew 1.2%, in line with previous years. Trends going forward may change. In 2021, prices for food, energy, and motor vehicles grew rapidly. There has not yet been a measurable impact of inflation in the health sector at this point. Since many provider payment contracts are set in advance, there is a lag time in health sector prices reflecting the inflation in labor, goods, and services.

Don’t Miss: Government Jobs For History Majors

How Much Does The Us Spend On Health Care

The USA is a global leader and is considered one of the most developed countries. However, theres a dark side to it. Unaffordable medical care draws a grim picture. The majority of Americans dread visiting a doctor because they arent sure whether they will be able to foot the bill. Employers are contributing less to the health insurance of their employees, which is becoming more and more expensive each year.

Health care spending statistics show that the gap between citizens that can afford regular medical care and those that cant will only widen with time. Medical expenses are high enough to cause lifelong financial issues for citizens. The USA is probably the only wealthy country where the percentage of GDP spent on medical costs is almost 20%. A simply unacceptable fact.

Healthcare Spending Increased By 97% In 2020 Largely Because Of The Impacts Of The Covid

The 2020 National Health Expenditures Report, only ahead of print in Health Affairs, found that US healthcare spending increased by 9.7 percent last year to $4.1 trillion. That breaks down to about $12,530 per person.

As a result of the sharp increase, healthcares share of gross domestic product experienced a historic increase from 17.6 percent in 2019 to 19.7 percent in 2020.

Dig Deeper

The substantial growth in spending was the largest since 2002 and driven by the unprecedented government response to the global pandemic, Micah Hartman, a statistician in the CMS Office of the Actuary and first author of the Health Affairs article, said in a press release. Federal spending increased rapidly in 2020 as the government increased public health spending to combat the pandemic and provided significant assistance to providers.

Federal spending on healthcare increased by 36.0 percent in 2020 largely in response to the pandemic, per the report. The spending included financial assistance given to providers through the Provider Relief Fund and the Paycheck Protection Program. Together, the two programs have allocated $175 billion of federal funds to healthcare providers struggling financially during the pandemic.

The federal government also increased public health spending for COVID-19 vaccine development, testing, and health facility preparedness. These efforts cost nearly $115 billion.

- Tagged

You May Like: Sacramento Jobs Government

Don’t Add More Cash Cut The Waste

What do we do about it? The answer is not to throw more money into the system as most political candidates like to propose in grandiose plans they parade around in an election cycle. As I learned when I researched my new book, “The Price We Pay,” we already spend enough money to provide every American with the best health care on the planet. Its time to cut the waste.

We need to examine health cares overpriced services, middlemen and the perverse incentive structure that promotes unnecessary tests and procedures. The lack of transparency around the business of medicine has created a fog that enables the price gouging and kickbacks that profit some on the backs of everyday Americans. Given the toll of health care on everyday Americans and businesses, and how our astronomical spending threatens every other national priority, transparencys time has come.

We also need to change the way we talk about health care spending. The next time you catch somebody saying their health insurance plan or their employer or Medicare covered their health care bills correct them. You and them and all of us are paying the bills through tax dollars and your insurance premiums.

Lets change the lexicon in America to point out whats really happening a shell game of taking money from everyday Americans to enrich the medical industry.

We need immediate solutions:‘Medicare for All’ is a distant dream. Here’s how to start fixing health care right now.

Rising Health Costs Threaten Trust Fund Solvency And Fiscal Sustainability

Rising health care costs represent a threat to both the Medicare program and the federal budget more broadly.

Medicare Part A is funded through the Hospital Insurance trust fund, which is financed primarily with a 2.9 percent payroll tax, split between employers and employees . Currently, Medicare Part A costs and revenues are roughly equal, but costs are growing more quickly. As a result, CBO projects the Medicare Trust fund will be depleted by 2026, and the Medicare Trustees project insolvency by 2029.

Ensuring Medicare solvency will require closing a gap in excess of $100 billion per year by the end of the decade and equal to 0.64 percent of payroll over 75 years. Thats the equivalent of immediately increasing revenue by 16 percent or reducing spending by 14 percent.

Failure to address the costs of Medicare Part A will ultimately mean a 10 to 15 percent benefit cut, as benefits are limited to trust fund revenue. Other federal health programs have no similar constraint.1 Instead, rising health care costs will result in increased federal borrowing and are a key contributor to the unsustainable rise of the federal debt.

Had federal health care costs remained stable since 2010, debt would total 85 percent of GDP by 2028 and fall to about 75 percent by 2040.

You May Like: Huntsville Al Government Jobs

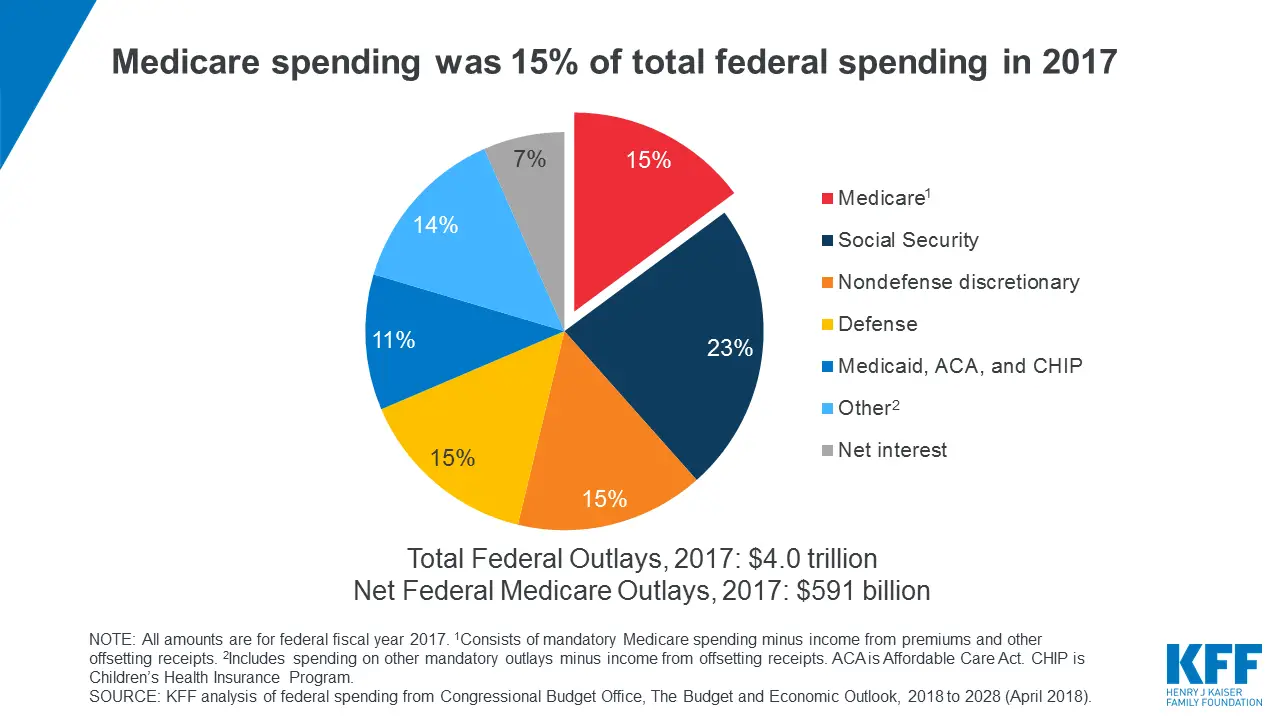

American Health Care: Health Spending And The Federal Budget

The United States spends more on health care than any other country in the world, and a large share of that spending comes from the federal government.

In 2017, the United States spent about $3.5 trillion, or 18 percent of GDP, on health expenditures more than twice the average among developed countries.

Of that $3.5 trillion, $1.5 trillion, is directly or indirectly financed by the federal government. In other words, the federal government dedicates resources of nearly 8 percent of the economy toward health care. By 2028, we estimate these costs will rise to $2.9 trillion, or 9.7 percent of the economy. Over time, these costs will continue to grow and consume an increasing share of federal resources.

Over the long term, the rising cost of federal health care spending is clearly unsustainable. Without a course correction, the result will be program insolvency, crowding out of important public priorities, and a growing federal debt.

Given how central health care spending is to the federal budget, it is important to understand how that spending is distributed and how it will grow. This paper will provide background on major health care programs in the federal budget. It is the first in a series called the American Health Care initiative, a joint collaboration of the Committee for a Responsible Federal Budget and the Concerned Actuaries Group.

On A Per Enrollee Basis Private Insurance Spending Has Typically Grown Faster Than Medicare And Medicaid Spending

Per enrollee spending by private insurance grew by 46.8% from 2008 to 2020 â much faster than both Medicare and Medicaid spending growth per enrollee . Generally speaking, private insurance pays higher prices for healthcare than Medicare and Medicaid.

However, per enrollee spending in private insurance declined by 0.4% in 2020 from 2019, while it continued to increase in Medicare and Medicaid though at a slower pace than in 2019. Spending in 2020 was volatile â with increased care related to COVID, of services for non-COVID care, and higher spending related to insurance overhead and profit â resulting in different patterns across payers.

Don’t Miss: Us Government Jobs San Antonio

This Spending Growth Resulted From Strong Federal Support In 2020 And Waning Support In 2021 The Numbers Showed

Including federal government support, national health spending grew by 3.4% in 2021, according to new data released by Altarum.

This growth in spending, the analysis found, reflected the fact that support from the federal government was strong in 2020, likely in response to the recession caused by the COVID-19 pandemic, and was lower in 2021.

Taking these support dollars out of both 2020 and 2021 estimates, spending growth from 2020 to 2021 would have been 8.4%, as the economy continued to recover.

With the increased federal government assistance, health spending fell below January 2020 levels only in March 2020. Without this assistance, spending would have remained below January 2020 levels throughout most of 2020 and through February 2021, numbers showed.

Including the federal support, health spending in December 2021 represented 18.8% of GDP it was 17.8% of GDP if the additional government expenditures are excluded.

For all of 2021, health spending represented 18.5% of GDP with the support and would have been 18.1% without it.

WHAT’S THE IMPACT

Prices paid by private insurance for healthcare services increased somewhat in January to 3.2% year-over-year, while Medicare and Medicaid price growth was significantly slower, at 1.1% and 1.6% respectively.

Hospital care prices were the fastest growing major category, at 2.9% year-over-year, while prescription drug prices increased 1.3% after a long period of zero and negative price growth throughout 2021.

Health Insurance Is A Growing Share Of Total Health Expenditures And Out

Most of the recent health spending growth is in insurance programs, both private and public. Private insurance expenditures now represent 27.9% of total health spending , and public insurance , represented 40.2% of overall health spending in 2020 . Although out-of-pocket costs per capita have generally been rising, compared to previous decades, they now make up a smaller share of total health expenditures.

Also Check: Grants To Start A Trucking Company

Forecasting Future Health Care Expenditures In The Usa

And what does the future hold for medical expenses in the USA? Lets find out.

22. National health spending is estimated to reach $6 trillion by 2027.

The Centers for Medicare and Medicaid Services estimated that by the year 2027, national health spending would reach $6 trillion. The annual growth rate is projected to be 5.7%. Currently, health care expenses in the US represent 17.7% of GDP. It is expected to reach 19.4%.

23. Spending on prescription drugs is estimated to grow at an annual average of 6.1%.

Due to using new prescription drugs and more frequent treatment of chronic conditions, spending on prescription drugs is expected to increase, much like a general health care cost increase. This is due to many factors, like the introduction of new prescription drugs, for example.

24. Hospital spending is expected to increase at an annual average of 5.7% until 2027.

Along with Medicare and Medicaid spending, hospital spending has grown too. This is attributed to the increasing number of enrollees. It is estimated that higher wages will also contribute to hospital spending between the years 2020 and 2027.

25. It is projected that spending on physician services will grow at an annual rate of 5.4%.

Discretionary Vs Mandatory Spending

Discretionary spending requires an annual appropriation bill, which is a piece of legislation. Discretionary spending is typically set by the House and Senate Appropriations Committees and their various subcommittees. Since the spending is typically for a fixed period , it is said to be under the discretion of the Congress. Some appropriations last for more than one year . In particular, multi-year appropriations are often used for housing programs and military procurement programs.

Direct spending, also known as mandatory spending, refers to spending enacted by law, but not dependent on an annual or periodic appropriation bill. Most mandatory spending consists of entitlement programs such as Social Security benefits, Medicare, and Medicaid. These programs are called “entitlements” because individuals satisfying given eligibility requirements set by past legislation are entitled to Federal government benefits or services. Many other expenses, such as salaries of Federal judges, are mandatory, but account for a relatively small share of federal spending.

The share of Federal spending for mandatory programs has been increasing as the U.S. population ages, while the discretionary spending share has fallen.

Read Also: Government Suburban