Affordable Care Act Basics

Guidance for agents and brokers completing the PY 2021 training. This module provides important background information on the Affordable Care Act, identifying major health care reforms and consumer protections required for assisting consumers.

Issued by: Centers for Medicare & Medicaid Services

Issue Date: August 19, 2020

HHS is committed to making its websites and documents accessible to the widest possible audience, including individuals with disabilities. We are in the process of retroactively making some documents accessible. If you need assistance accessing an accessible version of this document, please reach out to the .

DISCLAIMER: The contents of this database lack the force and effect of law, except as authorized by law or as specifically incorporated into a contract. The Department may not cite, use, or rely on any guidance that is not posted on the guidance repository, except to establish historical facts.

Topic

Choosing A Health Insurance Plan

Reading the fine print is important when choosing health care plans. These questions may help:

- Can I go to any doctor, hospital, clinic, or pharmacy I choose?

- Are specialists, such as eye doctors and dentists covered?

- Does the plan cover special conditions or treatments such as pregnancy, psychiatric care, and physical therapy?

- Does the plan cover home care or nursing home care?

- Will the plan cover all medications my physician may prescribe?

- What are the deductibles? This is the amount you must pay each year before your insurance company will begin paying claims.

- Are there any co-payments? This is the amount of money you pay each time you receive medical services or a prescription.

- If there is a dispute about a bill or service, how is it handled?

How To Get Health Coverage

You can get health care coverage through:

- A group coverage plan at your job or your spouse or partner’s job

- Your parents’ insurance plan, if you are under age 26

- A plan you purchase on your own directly from a health insurance company or through the Health Insurance Marketplace

- Government programs such as

Also Check: Government Land Auctions Washington State

Health Insurance Coverage Reforms

Through a series of provisions that create premium and cost-sharing subsidies, establish new rules for the health insurance industry, and create a new market for health insurance purchasing, the Affordable Care Act makes health insurance coverage a legal expectation on the part of U.S. citizens and those who are legally present.68 The Act both strengthens existing forms of health insurance coverage while building a new, affordable health insurance market for individuals and families who do not have affordable employer coverage or another form of minimum essential coverage such as Medicare or Medicaid.9 In expanding existing coverage, the Act fundamentally restructures Medicaid to cover all citizens and legal U.S. residents with family incomes less than 133% of the federal poverty level and to streamline enrollment.10,11

In addition to establishing universal coverage and shared responsibility, the Affordable Care Act sets federal standards for health insurers offering products in both the individual and small-group markets, as well as employer-sponsored health benefit plans.6,14 These requirements considerably expand on federal standards first introduced as part of the Health Insurance Portability and Accountability Act of 1996.15 Some of the requirements become effective prior to 2014.16 The broadest reformsprohibitions against pricing and coverage discrimination against adultsbecome effective in 2014, when the mandate and subsidies go into effect.6

Implications For Public Health Policy And Practice

The Affordable Care Act will fundamentally alter the policy landscape in which public health is practiced. The legislation will take years to implement, and its full meaning can only be conceptualized at this point. But January 2014 will arrive in the blink of an eye. How do public health practitioners and policy makers seize the opportunities presented by this seminal change in policy while also working with others to rise to its challenges?

Certain aspects of the lawincluding the availability of prevention or health center fundingpresent important funding opportunities. These opportunities are vital to communities throughout the country, and public health agency responsiveness and assistance to local community coalitions will be key. At the same time, these aspects of the Act perhaps represent relatively familiar public health practice turf, from a conceptual and practical perspective.

The law requires nonprofit hospitals to engage in major community health planning hospitals also will be expected to demonstrate how their investment of resources into the communities they serve reflects the priorities contained in their plans. How can public health agencies engage in hospitals around planning? How can agencies and communities assure optimal use of the resources that will be invested in these community planning activities and the resulting impact of plans on hospitals’ community benefit expenditures?

Read Also: Where Can I Go To Get A Government Phone

Affordable Care Act Program Integrity Provisions

The Affordable Care Act includes numerous provisions designed to increase program integrity in Medicaid, including terminating providers from Medicaid that have been terminated in other programs, suspending Medicaid payments based on pending investigations of credible allegations of fraud, and preventing inappropriate payment of claims under Medicaid.

Areas of interest under this provision:

- Provider enrollment

- Pending investigations of credible allegations of fraud

- National Correct Coding Initiative

- Recovery Audit Contractors

Automatic Enrollment In Health Plans

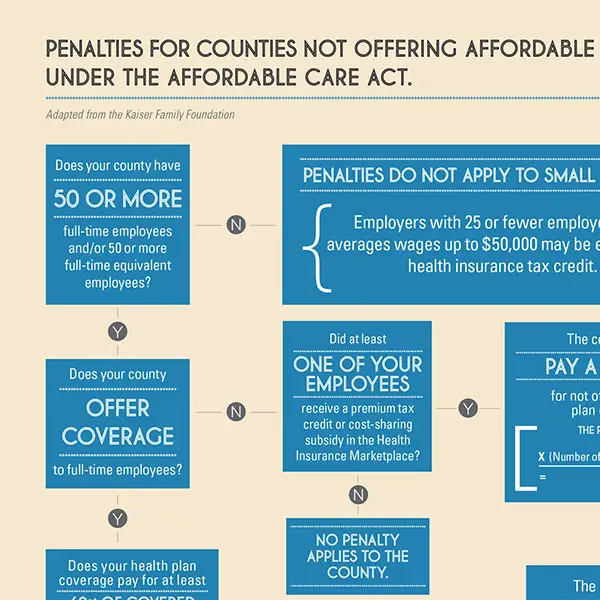

Q2. The Affordable Care Act amended the Fair Labor Standards Act by adding a new section 18A, requiring employers with more than 200 full-time employees to automatically enroll new full-time employees in the employers health benefits plans and continue enrollment of current employees. What Agency is responsible for guidance under this new FLSA provision?

A2. The Secretary of Labor has delegated responsibility for FLSA section 18A rulemaking, and for regulations under new section 18B of the FLSA, Notice to Employees of Coverage Options, to the Employee Benefits Security Administration within the Department of Labor. EBSA and the Department of the Treasury will coordinate to develop the rules that will apply in determining full-time employee status for purposes of the amendments to the FLSA and the rulemaking by the Treasury Department under the Internal Revenue Code to develop the rules that will apply in determining full-time employee status for purposes of the amendments made by the Affordable Care Act to the Internal Revenue Code.

Q3. When do employers have to comply with the new automatic enrollment requirements in section 18A of the FLSA?

You May Like: Government Assisted Apartments For Seniors

Affordable Care Act Information

On March 23, 2010, the President signed the Patient Protection and Affordable Care Act, P.L. 111-148, as amended by the Health Care and Education Reconciliation Act of 2010, P.L. 111-152, March 30, 2010. On June 28, 2012, the U.S. Supreme Court in National Federation of Independent Business v. Sebelius upheld most of the general provisions of this statute. The law contains a number of sections that create new requirements on insurance providers, states, individuals, and employers.

One provision contained in the law is known as the individual mandate which requires that all Americans be covered by health insurance or pay an annual financial penalty assessed by the Internal Revenue Service, unless waived under certain limited circumstances. The minimum amount of the penalty is $95 during 2014 for each individual covered by the Federal income tax return, rising to $325 per individual for 2015 and then $695 per individual in 2016. The penalty amount is governed by a formula that contains certain capped limitations as well as an alternative computation based upon a percentage of household income. Significantly, to avoid the penalty, an individual must maintain continuous coverage by a qualified health plan for at least one day of each and every month during the tax year.

Individuals who may wish to receive price quotes for policies delivered through an exchange include:

A transmittal memorandum from OPM to Chief Human Capital Officers is available here.

Improving The Public’s Health And Training Health Professionals

In addition to insuring most Americans, making an effort to rationalize health care, investing in primary health care in medically underserved communities, and broadening coverage for effective clinical preventive health services, the Affordable Care Act makes direct public health investments. Part of these investments come in the form of new regulatory requirements related to coverage of clinical preventive services without cost sharing, a fundamental shift in the relationship between health insurance and clinical preventive care. In addition, the Act provides for the development of a national prevention plan and the establishment of a Prevention and Public Health Trust Fund to finance community investments that will improve public health.38 The Fund, with a value set at $15 billion, provides additional funding for prevention activities beginning in FY 2010 and continuing annually.

The Act also targets specific subpopulations for new public health and health investments, particularly the area of Indian health care, which receives focused attention aimed at improving the performance of health and health-care programs.39 New investments are made in school-based health centers, oral health-care prevention activities, tobacco cessation programs for Medicaid-enrolled pregnant women, and the addition of personalized prevention planning to Medicare.40

Read Also: Government Grants For Window Replacement

How To Sign Up For Obamacare

Obviously, you can use your States health insurance marketplace to sign up for private insurance, get access to subsidies, or apply for Medicaid or CHIP, but there are five ways to sign up including the Healthcare.gov website.

Preexisting Condition Exclusions For Children In The Individual Market

Q6. Some States have expressed an interest in permitting issuers to screen applicants for eligibility for alternative coverage options before offering a child-only policy. Is this allowed?

A6. Yes, under certain circumstances, issuers may screen applicants for eligibility for alternative coverage options before offering a child-only policy, provided this practice is permitted under State law. Screening is limited to circumstances in which all child-only applicants, regardless of health status, undergo the same screening process, and the alternative coverage options include options for which healthy children would potentially be eligible, such as the Childrens Health Insurance Program and group health insurance.

States are encouraged, subject to State law, to require issuers that screen for other coverage to enroll and provide coverage to the applicant effective on the first date that the child-only policy would have been effective had the applicant not been screened for an alternative coverage option. States are also encouraged to impose a reasonable time limit, such as 30 days, at which time the issuer would have to enroll the child regardless of pending applications for other coverage.

Finally, nothing in this FAQ should be construed to relieve the issuer of its obligation to enroll a child applicant in coverage.

Also Check: Colt 45 Series 80 Government Model

Consumer Rights And Protections

The Affordable Care Act also implements other landmark consumer protections that end the worst insurance company abuses. Under the new law:

- Insurers will be prohibited from denying coverage to children with pre-existing conditions. Additionally, children will no longer have specific benefits denied because of a pre-existing condition. Learn more about Childrens Pre-Existing Conditions.

- Approximately 10,700 people whose coverage is dropped each year because they get sick and made an unintentional mistake on their application will not have their coverage rescinded. Learn more about Curbing Insurance Cancellations.

- Before reform, cancer patients and individuals suffering from other serious and chronic diseases were too often forced to limit or go without treatment because of an insurers lifetime limit on their coverage. Insurance companies are now banned from placing lifetime limits on coverage. Up to 20,400 people who typically hit their lifetime limits along with nearly 102 million enrollees in plans with lifetime limits can live with the security of knowing that their coverage will be there when they need it most.

Dependent Coverage Of Children To Age 26

Q5. My group health plan normally charges a copayment for physician visits that do not constitute preventive services. The plan charges this copayment to individuals age 19 and over, including employees, spouses, and dependent children, but waives it for those under age 19. Is this permissible?

A5. Yes. The Departments regulations implementing PHS Act section 2714 provide that the terms of a group health plan or health insurance coverage providing dependent coverage of children cannot vary based on age . While this generally prohibits distinctions based upon age in dependent coverage of children, it does not prohibit distinctions based upon age that apply to all coverage under the plan, including coverage for employees and spouses as well as dependent children. In this case, the copayments charged to dependent children are the same as those charged to employees and spouses. Accordingly, the Departments will not consider the arrangement described in this question to violate PHS Act section 2714 or its implementing regulations.

You May Like: War Dogs Government Contract Website

Making Primary Health Care More Accessible To Medically Underserved Populations

An estimated 60 million individuals are considered medically underserved as a result of a combination of elevated health risks and a shortage of primary health-care professionals.36 To begin to more rapidly alleviate this shortage in advance of the implementation of the health insurance coverage requirements, the Act invests in a major expansion of community health centers and the National Health Service Corps. Over the fiscal year 2011 to FY 2015 time periods, the Act will invest $11 billion in health centers and $1.5 billion in the National Health Service Corps. Together, these expansions are expected to result in a doubling of the number of patients served, raising the total number of health center patients from 20 million in 2010 to approximately 40 million by 2015.37

Better Access To Care

The health care law builds on what works in our health care system. And it fixes whats broken by providing you with more health insurance choices and better access to care.

Free Prevention Benefits: Insurers are now required to cover a number of recommended preventive services, such as cancer, diabetes and blood pressure screenings, without additional cost sharing such as copays or deductibles. 137 million Americans with private health coverage have gotten better preventive services coverage as a result.

Coverage for Young Adults: Under the law, most young adults who cant get coverage through their jobs can stay on their parents plans until age 26 a change that has already allowed 5.7 million young adults to get health coverage and given their families peace of mind.

The Health Insurance Marketplace: The Health Insurance Marketplace is a one-stop shop where consumers can choose a private health insurance plan that fits their health needs. Most people who shop in the Marketplace qualify for financial assistance that lowers their monthly premiums and makes coverage affordable.

You May Like: Where To Buy Old Government Vehicles

Shining A Light On Insurance Rate Hikes

Thanks to the Affordable Care Act, health insurers are being held accountable for health insurance rate increases. Insurance companies are now required to disclose to its customers rate increases of 10% or more and justify these increases and HHS and the states have the authority to determine whether these increases are reasonable. For the first time, you can find all of this information about rate increases in their state in one location, at

While HHS does not have the authority to require companies to roll-back proposed increases, public pressure can be powerful, and some states. These states have the authority to reject unreasonable premium increases and many have. In fact, since the passage of health reform, the number of states with this authority has increased from 30 to 37.

States are using rate review to bring real savings to consumers:

To learn more about rate review, visit:

The Future Of Obamacare

The Affordable Care Act is here to stay, President Obama declared this spring in the wake of the Supreme Courts second major ruling on his signature health care law. Those words rekindled the already heated discussion among health care experts, political pundits, economists, and others over the fate of the ACA. Most suggest that the only way to undo health care reform now is the election of a Republican president in 2016 and that even by then, the law may be too entrenched to uproot.

In the meantime, as remaining provisions of the ACA are phased in, governors and legislatures across the country will continue to be divided over Medicaid expansion and insurance exchanges, and legal and policy experts will continue to clash over the individual mandate, contraceptive coverage, and other components of the law. In other words, regardless of studies and statistics, it is safe to say that the Obamacare debate is still far from over.

Read Also: Government Assistance Programs For Business

Medicaid Expansion In Practice

As of December 2019, 37 states had adopted the Medicaid extension. Those states that expanded Medicaid had a 7.3% uninsured rate on average in the first quarter of 2016, while the others had a 14.1% uninsured rate, among adults aged 18 to 64. Following the Supreme Court ruling in 2012, which held that states would not lose Medicaid funding if they did not expand Medicaid under ACA, several states rejected the option. Over half the national uninsured population lived in those states.

The Centers for Medicare and Medicaid Services estimated that the cost of expansion was $6,366 per person for 2015, about 49 percent above previous estimates. An estimated 9 to 10 million people had gained Medicaid coverage, mostly low-income adults. The Kaiser Family Foundation estimated in October 2015 that 3.1 million additional people were not covered because of states that rejected the Medicaid expansion.

Studies of the impact of Medicaid expansion rejections calculated that up to 6.4 million people would have too much income for Medicaid but not qualify for exchange subsidies. Several states argued that they could not afford the 10% contribution in 2020. Some studies suggested rejecting the expansion would cost more due to increased spending on uncompensated emergency care that otherwise would have been partially paid for by Medicaid coverage,

Medicaid expansion by state

Deductibles and co-payments

For the group market , a 2016 survey found that: