Types Of Federal Student Loans

There are several types of federal student loans, including:

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- Direct PLUS Loans, of which there are two types: Grad PLUS Loans for graduate and professional students, as well as loans that can be issued to a student’s parents, also known as .

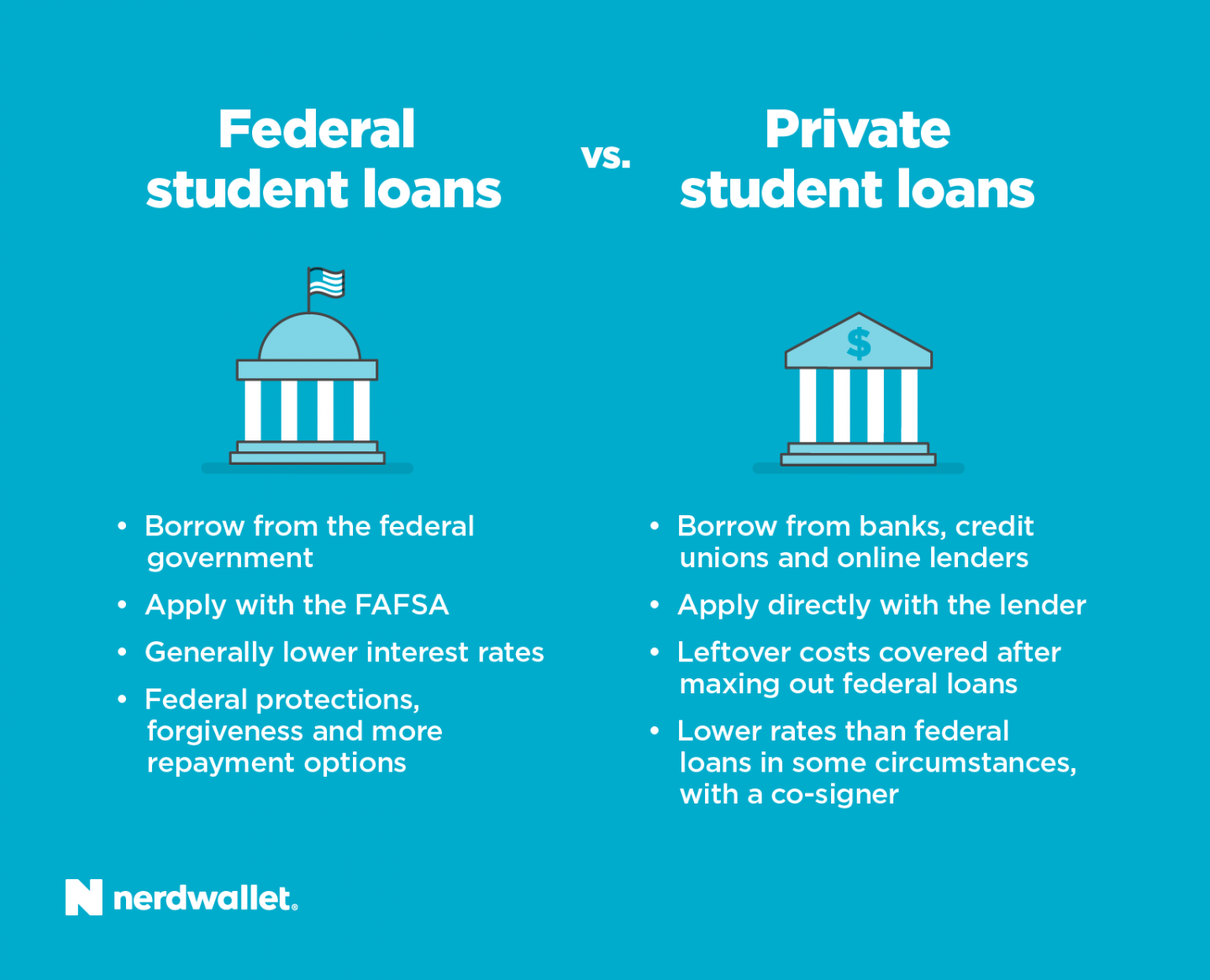

These federal student loans are available through the Federal Direct Loan Program. Since federal loans offer different benefits than private student loans, you should always explore them first.

Learn more about the three types of federal student loans:

Many Ways To Pay For College

Student loans arent the only way to pay for college. There are a variety of resources available to help you get the money you need. Opt for the items at the top of this list first, and work your way down to put your child in the best financial situation possible upon graduation.

To apply for a federal student loan, your child must complete the Free Application for Federal Student Aid , and do so as soon as possible before each year that they will need federal student aid. Note that there are federal and state FAFSA deadlines, and colleges sometimes have individual deadlines. The FAFSA is the main determining factor the government uses to decide how much money borrowers qualify for, and the first students who apply are the first students who will receive a response.

Variable Vs Fixed Loan Interest Rates

A variable interest rate can fluctuate over the life span of a loan. A fixed interest rate is just as it sounds fixed and unchanging for the life of a loan.

While all federal student loans come with a fixed interest rate, offer students the flexibility of a variable interest rate in addition to a fixed interest rate option. At the time of your loan disbursement, you might discover that variable interest rates are lower than the federal student loan fixed rate, but there are advantages to having a stabilized rate.

To learn more, see our resource page.

Read Also: Government Grants For Single Women

Resolve Student Loan Disputes

If you and your loan servicer disagree about the balance or status of your loan, follow these steps to resolve your disputes:

1. Talk with your loan servicer

You may be able to solve a dispute by simply contacting your loan servicer and discussing the issue. Get tips on working through an issue with your loan servicer to resolve the dispute.

2. Request help from the FSA Ombudsman Group

If you have followed the guide and still cannot resolve your issue, as a last resort, contact the Federal Student Aid Ombudsman Group. The FSA Ombudsman works with student loan borrowers to informally resolve loan disputes and problems.

Federal Direct Plus Loan For Parents

The Federal Direct PLUS Loan for Parents is a credit-based alternative loan program specifically designed to provide low cost loans to parents of dependent college bound students. Parents can secure a loan up to the value of the cost of their student’s attendance less any other financial aid their child has been awarded. Repayment of the PLUS Loan begins as soon as the loan is fully disbursed and students must sign a promissory note guaranteeing repayment if the parent or guardian defaults at any time.

Read Also: How To Get A Government Email Address

Student Loans From Banks

Banks provide a variety of loans including home loans, car loans, and personal loans. Similarly, you can use a bank to get a student loan to pay for your college or university tuition. Banks provide you with loans that must be repaid monthly over a set period of time. However, some banks provide special terms such as interest-only payments during school and after graduation up to a certain number of years. Since your bank loan would be repaid in monthly installments, it is best to borrow only what you need to keep your payments manageable.

Do note, that banks often have high requirements, so qualifying for a student loan may be difficult. However, if you have good credit and stable finances, you may be able to take advantage of their low-interest rates and flexible terms.

Q Who Is Doing All This Borrowing For College

A. About 75% of student loan borrowers took loans to go to two- or four-year colleges they account for about half of all student loan debt outstanding. The remaining 25% of borrowers went to graduate school they account for the other half of the debt outstanding.

Most undergrads finish college with little or modest debt: About 30% of undergrads graduate with no debt and about 25% with less than $20,000. Despite horror stories about college grads with six-figure debt loads,only 6% of borrowers owe more than $100,000and they owe about one-third of all the student debt. The government limits federal borrowing by undergrads to $31,000 and $57,500 . Those who owe more than that almost always have borrowed for graduate school.

Where onegoes to school makes a big difference. Among public four-year schools, 12% ofbachelors degree graduates owe more than $40,000. Among private non-profitfour-year schools, its 20%. But among those who went to for-profit schools,nearly half have loans exceeding $40,000.

Among two-year schools, about two-thirds of community college students graduate without any debt. Among for-profit schools, only 17% graduate without debt .

Read Also: Fpwa Federal Government Grant Program

Canada Student Loan Program

You can apply for a CSLP through the National Student Loan Centre if you want to continue your education full-time or part-time. A student can acquire a loan to cover up to 60% of their tuition fees through the CSLP.

Canada Student Loan Program EligibilityFor Full-Time Students

To be eligible for this loan, you must first meet certain criteria such as:

- Be a permanent resident in the province that offers the grant or loan.

- Be a full-time student .

- Full-time students must take at least 60% of the total course load for the year.

Canada Student Loan Program EligibilityFor Part-Time Students

Part-time students have slightly different requirements, such as:

- Income must not exceed the income threshold for part-time students.

- Are administratively documented as a part-time student in a qualified program.

- Be enrolled in at least 20% of a full-course load.

Make sure to check the local and federal student loan websites to see if your province of residence has any further requirements to qualify.

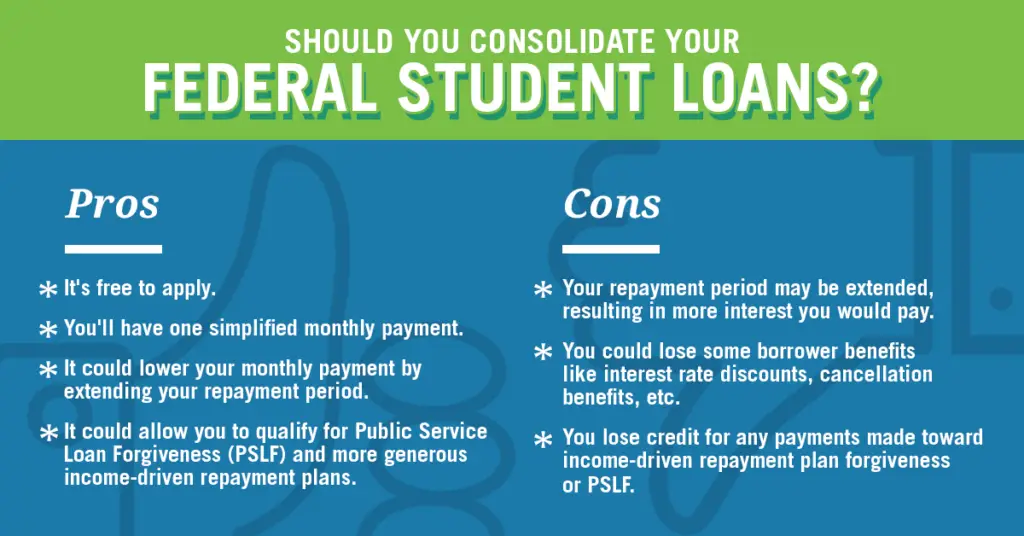

Alternatives To Federal Student Loans

Although federal student loans can be the most affordable way to borrow for school, they are not your only option for paying for your education. Alternatives may include:

- Scholarships and grants: Available from schools, federal, state, and local governments, and private institutions, these should be exhausted first because they don’t have to be paid back.

- Private student loans: These come from banks, online lenders, and credit unions. They can be more expensive than federal loans but are a good option if you’ve maxed out your eligibility for federal aid.

To make sure you keep your borrowing costs as low as possible, always compare all your options and never borrow more than you need to pay for the essentials like tuition and basic living expenses.

Recommended Reading: Government Contracts For Disabled Veterans

Financial Supports For Self

- Indigenous students are not required to make the fixed student contribution. Typically, students are expected to contribute to their educational costs by providing a fixed student contribution up to $3,000 per year. There is no fixed student contribution for Indigenous students, students with disabilities, students with children, and students who are, or were, Crown wards. Therefore, these students may be eligible to receive more funding.

- Funding you receive from the federal government’s Post-Secondary Student Support Program , Métis Nation Post-Secondary Education Strategy and Inuit Post-Secondary Education Strategy is not considered a financial resource when you apply for student aid. This means that you do not have to declare this type of funding and it will not be deducted from the amount of student loans and grants you would be offered.

How The Us Government Created The Student Loan Crisis

President Joe Biden unveiled a sweeping plan on Wednesday to let delinquent student loan borrowers transfer tens of thousands of dollars in debt to taxpayers. If he were a biblically minded leader, Biden would have used his nationally televised press conference to repent of his role in creating the student loan crisis in the first place.

Bidens student loan bailout lets individuals write off $20,000 in unpaid student loans if they received Pell Grants or $10,000 if they did not. The plan is open to households that make up to $250,000 a year or individuals who make $125,000. It would also reduce the number of people who have to make student loan payments at all, as well as the amount and time they must pay before US taxpayers pick up the tab for their full loan.

While much of the commentary has focused on students who refused to make their loan payments, few have discussed how successive presidential administrations set those students up for failure. The federal government largely nationalized the student loan industry in 2010 via a piece of legislation related to Obamacare, the Health Care and Education Reconciliation Act of 2010. The US government now holds 92 percent of all student loans and the nations total student debt has more than doubled, from $811 billion in April 2010 to $1.748 trillion in April 2022.

These policies made student loan debt effectively permanent and unpayable.

A similar version of this story appeared in The Washington Stand.

You May Like: What Is Grant Money From The Government

Q Whats With All These Proposals To Forgive Student Debt

A. Some Democratic candidates are proposing to forgive all or some student debt. Sen. Elizabeth Warren, for instance, proposes to forgive up to $50,000 in loans for households with less than $100,000 in annual income. Borrowers with incomes between $100,000 and $250,000 would get less relief, and those with incomes above $250,000 would get none. She says this would wipe out student loan debt altogether for more than 75% of Americans with outstanding student loans. Former Vice President Joe Biden would enroll everyone in income-related payment plans . Those making $25,000 or less wouldnt make any payments and interest on their loans wouldnt accrue. Others would pay 5% of their discretionary income over $25,000 toward their loan. After 20 years, any unpaid balance would be forgiven. Pete Buttigieg favors expansion of some existing loan forgiveness programs, but not widespread debt cancellation.

Forgivingstudent loans would, obviously, be a boon to those who owe moneyand wouldcertainly give them money to spend on other things.

But whoseloans should be forgiven? What we have in place and we need to improve is asystem that says, If you cannot afford your loan payments, we will forgivethem, Sandra Baum, a student loan scholar at the Urban Institute, said at aforum at the Hutchins Center at Brookings in October 2019. Thequestion of whether we should also have a program that says, Lets alsoforgive the loan payments even if you can afford them is another question.

Federal Student Loan Borrowing Limits

Each type of federal student loan has imposed limits based on the year of attendance, the status of the student , and other financial aid received for education. Heres a quick overview:

- First-Year Undergraduate Students Dependent students can borrow $5,500 with no more than $3,500 in subsidized loans independent students can borrow $9,500, with no more than $3,500 in subsidized loans.

- Second-Year Undergraduate Students Dependent students can borrow $6,500, with no more than $4,500 in subsidized loans independent students can borrow $10,500, with no more than $4,500 in subsidized loans.

- Third-Year and Beyond Undergraduate Students Dependent students can borrow $7,500, with no more than $5,500 in subsidized loans independent students can borrow $12,500, with no more than $5,500 in subsidized loans.

- Graduate and Professional Students $20,500 of unsubsidized only

The aggregate loan limit for dependent students is $31,000 with no more than $23,000 as subsidized. Independent undergraduate students can borrow $57,500, with no more than $23,000 in subsidized loans, while graduate and professional students can borrow $138,500, with no more than $65,500 in subsidized loans.

If you have met your federal student loan limit, private loans can fill the gap. Check out our guide to the best private student loans to get started.

You May Like: Federal Government Jobs Austin Tx

Qualifying For Federal Student Loans

To qualify for federal student loans, there are fundamental eligibility requirements that must be met, including:

- Be a U.S. citizen or eligible non-citizen

- Have a valid Social Security number

- Be enrolled or accepted for enrollment as a student with an eligible degree or certificate program, at least half-time

- Maintain academic progress in college

- Show you are qualified to obtain a college degree or career school education

- Are not in default on existing federal student loans

Anyone attending school may apply for federal student loans, and so long as the maximum loan amounts are not yet met and eligibility requirements stay in place, federal student loans are still an option.

There may be some circumstances in which you lose your eligibility for federal student loans. If there is not a feasible way to regain eligibility for federal student loans, private student loans may be the next best option.

Options For Borrowers Who Are In Repayment

You have several options if you are a borrower in repayment, which means you will be required to begin making payments on your loans. Here are some options for making this feasible:

Enter Standard Repayment: When a students grace period has expired, they enter repaymentthat is, they are required to begin making payments on their loans. If they can afford to, the student can begin making the loan payments as scheduled.

Enroll in a Repayment Plan with Lower Payment Rates Tied to Income: Depending on the total amount of loans and repayment schedule, the amount of payments may seem completely out of reach. However, there are a number of repayment plan options that are designed to make repayment affordable by tying the amount of repayment to the amount of income you are making. Entering one of these plans may be a good option for borrowers who are unable to afford the loan payments on a standard plan. These plans include Income Based Repayment , Income Contingent Repayment , and Pay As You Earn . Although the details of these three income-driven plans differ, they generally work in the same way. Borrowers pay between 10 and 20 percent of their discretionary income toward their loans . After 20 to 25 years of making these payments, the loans are forgiven, even if the borrower has not paid the total amount owed. More details about income-driven plans is available on the federal student aid website.

Recommended Reading: Government Funding For Religious Organizations

Student Loans In The United States

|

|

Student loans in the United States are a form of financial aid intended to help students access higher education. In 2018, 70 percent of higher education graduates had used loans to cover some or all of their expenses. With notable exceptions, student loans must be repaid, in contrast to other forms of financial aid such as scholarships, which are not repaid, and grants, which rarely have to be repaid. Student loans may be discharged through bankruptcy, but this is difficult.

Student loan debt has proliferated since 2006, totaling $1.73 trillion by July 2021. In 2019, students who borrowed to complete a bachelor’s degree had about $30,000 of debt upon graduation.:1 Almost half of all loans are for graduate school, typically in much higher amounts.:1 Loan amounts vary widely based on race, social class, age, institution type, and degree sought. As of 2017, student debt constituted the largest non-mortgage liability for US households. Research indicates that increasing borrowing limits drives tuition increases.

The default rate for borrowers who do not complete their degree is three times the rate for those who did.:1 A 2018 Brookings Institution study projected that “nearly 40 percent of students who took out loans in 2004 may default by 2023.”

Direct Plus Loans For Parents

Parents may choose to offset the cost of higher education by obtaining loans to help pay for those expenses.

Benefits: PLUS loans can help cover the educational expenses not met by federal student aid. Additionally, parents can defer payment on loans until after the student’s graduation. As these loans are not need-based, parents don’t need to demonstrate financial need to apply.

Eligibility: Eligibility depends on a modest credit check. An endorser may be required if the borrower has adverse credit. Some schools require that a FAFSA be completed before a PLUS loan can be awarded, but some do not.

Also Check: Government Jobs In Conway Sc

Applying For Government Student Loans

Before applying for any government loan you must complete the Free Application for Federal Student Aid . The FAFSA is required for all forms of Federal aid programs. Whether you are applying for a Federal loan, grant or scholarship the FAFSA is your first step and must be submitted early to meet any deadlines for your loan or grant applications.

“Education is the most powerful weapon which you can use to change the world.” – Nelson [email protected]

Other Features That May Interest You

- Parents are not expected to contribute to your education costs if you are an independent student. If you have been out of high school for four years or more before the first day of class of the current study period, or you have been in the workforce for at least two years before the first day of class of the current study period, you are considered an independent student. Independent students may be eligible to receive more funding than dependent students because there is no expected contribution from their parents.

- Funding is available for students with dependents. If you are a full- or part-time student with dependent children, you may be eligible for monthly living allowances based on your income and the number and age of your children. This also includes a monthly allowance for daycare. Additionally, students with dependents are eligible to access all other student loan and grant programs.

- If you live away from home, you can use your funding to visit your family. If you are a student living in a different community than your family home , an allowance may be included for one return trip home for each period of 16 weeks, to a maximum of $600 per semester/term.

Recommended Reading: Government Lifeline Cell Phone Program