Learn About The Childrens Health Insurance Program

If your income is too high for Medicaid, your child may still qualify for the Childrens Health Insurance Program . It covers medical and dental care for uninsured children and teens up to age 19.

Is my child eligible for CHIP?

CHIP qualifications are different in every state. In most cases, they depend on income.

How do I apply for CHIP benefits?

You have two ways to apply for CHIP:

- Fill out an application through the Health Insurance Marketplace.

What else do I need to know about CHIP?

- You can apply for and enroll in Medicaid or CHIP anytime during the year.

- Get information on other common types of health insurance, such as Medicare, and find help paying for medical bills.

Barangay Micro Business Enterprise

Recognizing that microbusinesses keep a lot of communities thriving, especially in remote and suburban areas, the government signed the Barangay Micro Business Enterprise Law in 2002. The benefits under this law help out microentrepreneurs in the Philippines by giving them incentives to help run their small businesses.

When entrepreneurs register as a BMBE, they get to enjoy several benefits. They are granted the following:

Officially registering as a BMBE reduces the amount of taxes, fees, and charges youll need to deal with at the start of setting up a business.

Your business can qualify as a BMBE if it meets the following criteria:

If youre interested in registering as a BMBE, you can find out more and download the application form from the DTI website. Fill it up and submit it, along with your DTI registration for sole proprietorship, at your nearest DTI Negosyo Center.

Prisons And Budgets: Prisons Versus Payouts

In democracies, government programs compete for shares in the budget. In the West, when budgets are made by government leaders alone, prisons often fare badly. Justice ministers are rarely powerful members of the cabinet. When prison-building bonds are put to the public for a vote, they fare better. Generally, however, welfare programs have much greater budget appeal than prisons: they involve tangible, spendable individual benefits and produce powerful interest groups to defend and expand their benefits. There are also greater payoffs for spending on policing than on prisons. Policing is an at-hand benefit compared to prisons. Moreover, governments have found that solving a few scandalous crimes and demonstrating government control of the streets may obviate the need for large numbers of routine arrests and prosecutions.

The drive to separate punishment policy from crime policy is often mirrored in the creation of separate ministries for crime and punishment headed by ministers known for being tough on crime and laxiste soft on crime . To separate punishment from crime is the triumph of the antipunishment movement. Whence the regular complaint: Interior catches, Justice releases.

E.M. Immergut, in, 2001

Don’t Miss: Fidelity Government Cash Reserves Fdrxx

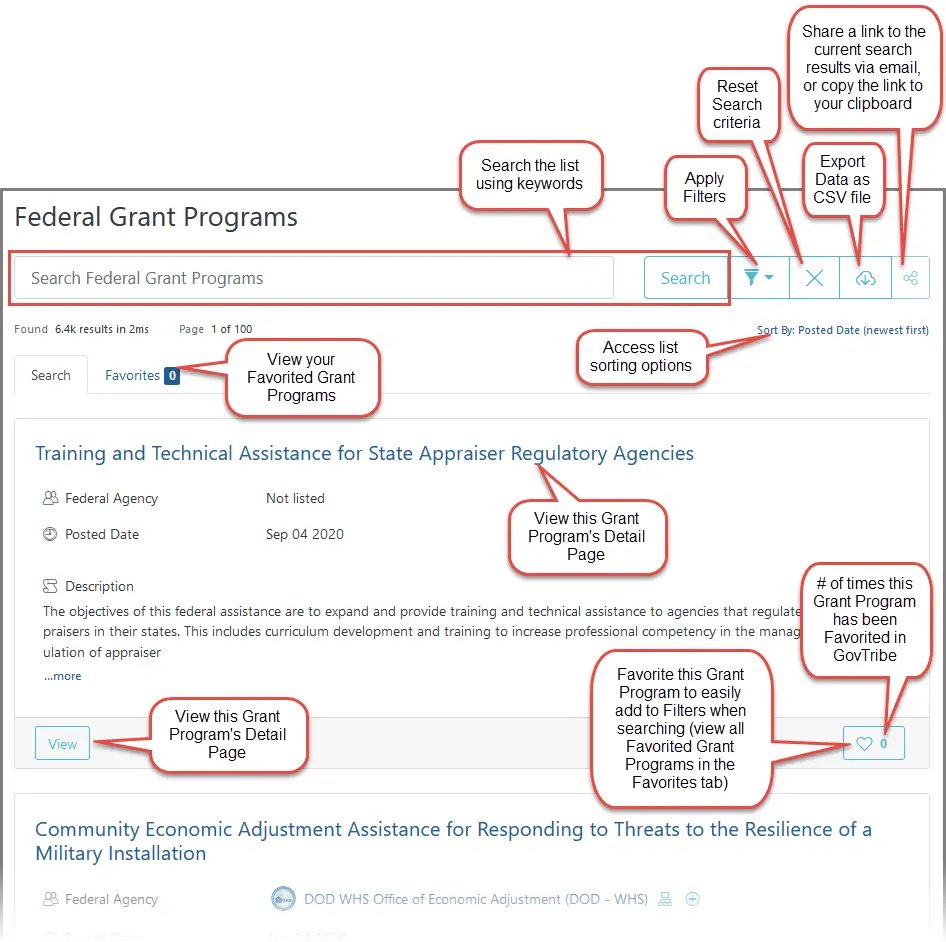

What Is A Grant From The Government

A grant is one of the ways the government funds ideas and projects to provide public services and stimulate the economy. Grants support critical recovery initiatives, innovative research, and many other programs. You can find a list of projects supported by grants in the Catalog of Federal Domestic Assistance . You can also learn about the federal grant process and search for government grants at Grants.gov.

Subsidized Housing Housing Vouchers And Public Housing Programs

Housing Assistance helps low-income families, seniors, and people with disabilities get into affordable private or government-owned rental housing. The Housing Choice Voucher Program gives certificates to rent approved units. The subsidy allows recipients to pay no more than 30 percent of their income. It provides 1.2 million units of public housing and local agencies administer it to 2.2 million renters. This is the old Section 8 program. The Public Housing Agency also allows some families to use the voucher to purchase a modest home.

There is also the Low-Income Home Energy Assistance Program , providing energy assistance and weatherization programs. It provides $3.4 billion in block grants to the states.

Don’t Miss: Government Job Openings In Atlanta Ga

Data Security And Integrity

We implement physical, technical, and administrative safeguards designed to maintain data accuracy, integrity, and security, prevent unauthorized access, and facilitate correct use of personal data. Our security measures take into account the risk of harm to you and Customers, as well as the availability of technology, industry common practices, effectiveness of mitigation controls, and the sustainability of those controls by us.

Although we maintain the controls listed herein, transmission of data is not without risk and we complete security of your personal data cannot be guaranteed. Please note, you are responsible for keeping your login credentials secret at all times, including your username and password.

In the event we believe the security of your personal data in our possession or control may be compromised, we may seek to notify you by e-mail and you consent to our use of e-mail as a means of such notification.

Your Rights And Control Under Eu Gdpr

Data Controllers and Processors.

Our Customers use our Services to post job opportunities, evaluate job applicants, manage their human resource activities, and train their workforce. In conducting these activities, the Customer maintains control over what personal data is collected, how it is used, how long it is retained, and who it is disclosed to. For purposes of the EU GDPR, the Customer is considered a data controller in these respects and we are a data processor. In other instances, such as when we use cookies or contact you about our Services, we will determine the means and purpose of processing.

EU Data Subject Rights.

Data subjects in Europe whose personal data we receive through appropriate safeguards have legal rights to determine whether we hold personal data about them, to access personal data we hold about them, and to obtain its correction, update, amendment, or deletion in appropriate circumstances. In particular, your rights may include:

If you visited our website and you want to exercise any of the above rights please contact our support team or privacy team at the contacts listed herein. If your request is for the right to be forgotten as it relates to our use of cookies, you can achieve this by clearing the cookies in your browser settings.

Lawful Basis for Processing.

For personal data subject to the European Union General Data Protection Regulation and ePrivacy Directive, we rely on multiple legal bases for processing, including:

You May Like: Government Jobs Fort Collins Co

Assistance For Small Businesses

The COVID-19 public health crisis and resulting economic crisis have created a variety of challenges for small, micro, and solo businesses in communities across the country. The Treasury Department is providing critical assistance to small businesses across the country, facilitating the urgent deployment of capital and support to help these organizations not just persevere, but recover on solid footing.

Q: Does A Homeowner Have Income As A Result Of The Governments Having Paid Some Of The Homeowners Mortgage Loan By Making A Pra Investor Incentive Payment To The Holder Of The Loan

A2: No. This payment by the government on behalf of the homeowner is excludible from the homeowners income under the general welfare exclusion. Excluding this amount from the homeowners gross income is consistent with the treatment of Pay-for-Performance Success Payments, which are addressed in Revenue Ruling 2009-19 PDF.

Recommended Reading: Government Student Loan Repayment Calculator

Other Types Of Benefits And Programs For The Unemployed

Educational Help

Federal agencies offer many unemployment education and training programs. They are generally free or low cost to the unemployed.

Self-Employment Help

Self-employment assistance programs help unemployed workers start their own small businesses. Delaware, Mississippi, New Hampshire, New York, and Oregon offer this program.

What About Unemployment Benefits

Each state operates its own unemployment benefits program. Depending on your states program and requirements, you might be able to qualify for an unemployment insurance program in your state. These programs pay a cash amount if you lose your job through no fault of your own. Some states also provide extended unemployment benefits when there is high unemployment, meaning you can collect on your unemployment insurance for 13 weeks. You can apply for an extension once your regular unemployment benefits run out. Although the details for how to apply and qualify vary by state. And remember, you must report all unemployment benefits you received in a given calendar year as income when you file your taxes for that year.

In addition to unemployment benefits through your state, the federal and state government work together to provide all kinds of unemployment help and job training programs. If youve been laid off from a job, there are a number of employment and training programs run by the U.S. Department of Labor. These include retraining programs to apprenticeship programs to vocational skills programs to special programs for farm workers, refugees older Americans still in the workforce, and Native Americans. You can learn about all of these different programs and what you might be able to apply for at the U.S. Department of Labors CareerOneStop.org site.

Also Check: Home2 Suites By Hilton Mobile I 65 Government Boulevard

Can I Refinance A First And Second Mortgage Through Harp

In order to refinance both a first and second mortgage through HARP, you must meet two additional requirements, according to MakingHomeAffordable.gov:

Donât Miss: Federal Government Day Care Centers

Government Community Economic Development Program

Government programs in community economic development go back to at least the early industrial era. Tenement and poverty area clearance and clean up schemes have been part of national, state, and local level to transform low income areas. The most well recognized community or neighborhood level programs were launched with Jane Adams at Hull House in Chicago at the turn of the twentieth century. The aim of Hull House, later called the Settlement House Programs, was to provide professional interventions in a community in a way that assisted the community leaders in helping themselves. As this idea was refined new programs emerged to accomplish many of the same goals. In England, Local Housing Councils took on similar roles with the low income workers.

The efforts described above do not represent all government efforts in the field of community economic development. In some cases, government programs have community economic development as a secondary or lower consideration. Further, new government programs are spawned to meet new circumstances such as welfare reform. The range or type of programs described above represents a classical typology rather than an exhaustive list. This type of program is seen in most of the industrialized world in one or more of these forms.

Pamela Doty, Brenda Spillman, in, 2015

Don’t Miss: Government Of Canada Student Loans

What Are The Costs To Refinance Via Harp

Closing costs for HARP refinances should be no different than for any other mortgage. You may pay points, you may pay closing costs, you may pay neither. How your mortgage rate and loan fees are structured is between you and your loan officer. You can even opt for a zero-cost HARP refinance. Ask your loan officer about it.

Recommended Reading: Government Grants For College Students

If Am A Tenant Is Financial Assistance Available

If you are a tenant and are struggling financially due to COVID-19, visit consumerfinance.gov/renthelp for more information on what assistance is available, or call our Disaster Response Network directly at , where youll get tips on communicating with your landlord and help navigating the rental assistance application process and more.

Recommended Reading: Government Mutual Life Insurance Company

Recommended Reading: Government Filing Fee For Trademark

Supplemental Security Income 26

Dollar amounts in this table may not agree to amounts for the same program in our financial statements or narrative discussion as 1) the data in this table may be on a different year basis and 2) the data in this table may be drawn from a source that prepares the data on an accrual rather than a cash basis. Details may not add to the total due to rounding.

We limited the data in this table to the years presented to provide the most recent data but to also fit the table to the page. Additional years of data and more detail may be found on our website. Click More detail to access it.

1Total historical payments for 1980 are estimated.

2 Recipients are those with Federally Administered Payments in Current-Payment Status.

Supplemental Security Income is a federal program designed to help aged, blind, and disabled people who have little or no income. It provides cash to meet basic needs for food, clothing, and shelter.

The monthly maximum benefit amounts for 2021 are $794 for an eligible individual, $1,191 for an eligible individual with an eligible spouse, and $397 for an essential person. The monthly amount is reduced by subtracting monthly countable income. In the case of an eligible individual with an eligible spouse, the amount payable is further divided equally between the two spouses. Some states supplement SSI benefits.

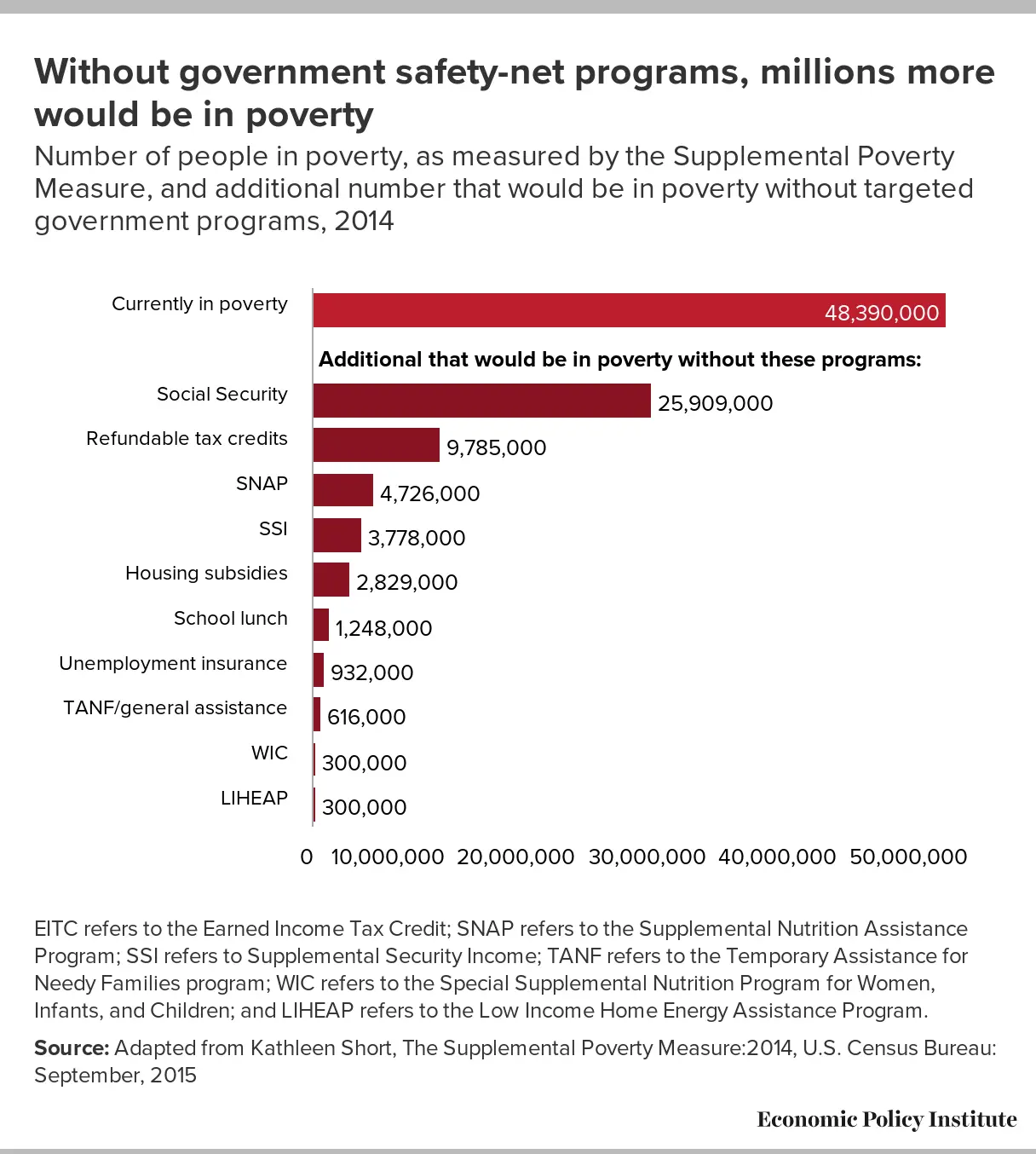

In 2018, SSI payments were $52 billion or 1% of aggregate government expenditures.

Eligibility and enrollment

- age 65 or older

and:

Outcome : Economic Growth And Employment

Also Check: Short Term Disability Government Assistance

Whats Available How To Qualify And Where To Apply

The COVID-19 pandemic put government assistance programs into overdrive, as many people who never needed them before now had to use them. Heres a descriptive list of major government assistance programs for individuals and businesses, with links to where and how to apply to them and applicable deadlines.

Government Assistance For Employment And Income

The government also provides some was for the senior people to add earnings if they can. These are also independent ways of living not depending on other types of assistance. So there are programs for the senior people where they can get employment and add income.

American Job Centers

American Job centers ensure easy access to the job for the senior people. The senior people can go to this program in case they want to go for any employment and employment skills required. Additionally, there are different types of training and skill set for the senior people who can have access to a job under this program.

Senior Community Service Employment Program

The Department of Labor provides the opportunity for senior people for long-term jobs. This program also helps the senior people get additional training and skill to get updated with the job that they are going to do. The senior people who want to learn new skills through training and want to start any job, this program can be helpful.

Supplemental Security Income

Supplemental Security Income is a federal program that makes sure to add income for needy senior people. You may need to meet some guidelines such as age and limited income and assets The senior people can get both social security and supplemental security income as well.

Social Security

Retirement

Recommended Reading: Qualifications For Free Government Phone

Demographics Of Tanf Recipients

Some have argued that welfare has come to be associated with poverty. Political scientist argues that blacks have overwhelmingly dominated images of poverty over the last few decades and states that “white Americans with the most exaggerated misunderstandings of the racial composition of the poor are the most likely to oppose welfare”. This perception possibly perpetuates negative racial stereotypes and could increase Americans’ opposition and racialization of welfare policies.

In FY 2010, African-American families comprised 31.9% of TANF families, white families comprised 31.8%, and 30.0% were Hispanic. Since the implementation of TANF, the percentage of Hispanic families has increased, while the percentages of white and black families have decreased. In FY 1997, African-American families represented 37.3% of TANF recipient families, white families 34.5%, and Hispanic families 22.5%.As of 2013, the US population as a whole is composed of 63.7% whites, 16.3% Hispanic, 12.5% African-American, 4.8% Asian and 2.9% other races. TANF programs at a cost of about $20.0 billion have decreased in use as Earned Income Tax Credits, Medicaid grants, Supplemental Nutrition Assistance Program benefits, Supplemental Security Income , child nutrition programs, Children’s Health Insurance Program , housing assistance, Feeding Programs , along with about 70 more programs, have increased to over $700 billion more in 2013.

Search For Financial Assistance From The Government

Benefits.gov is a free website that can help you determine which types of government assistance you might qualify for. You can also find out how and where to apply.

- Using the Benefit Finder, answer questions about yourself and your needs. Afterwards, you can find out if youre eligible for programs to help you pay for:

- Utilities and other necessities

Check back with Benefits.gov in the future to see if youre eligible for additional benefits. You can report major life events or see if new benefit programs have become available.

Recommended Reading: Articles On Politics And Government