Applying For Tax Exempt Status

Once you have followed the steps outlined on this page, you will need to determine what type of tax-exempt status you want.

Note: As of January 31, 2020, Form 1023 applications for recognition of exemption must be submitted electronically online at www.pay.gov. As of January 5, 2021, Form 1024-A applications for recognition of exemption must also be submitted electronically online at www.pay.gov. As of January 3, 2022, Form 1024 applications for recognition of exemption must be submitted electronically online at www.pay.gov as well. A grace period will extend until April 30, 2022, where paper versions of Form 1024 will continue to be accepted. For more information, please refer to the Form 1024 product page.

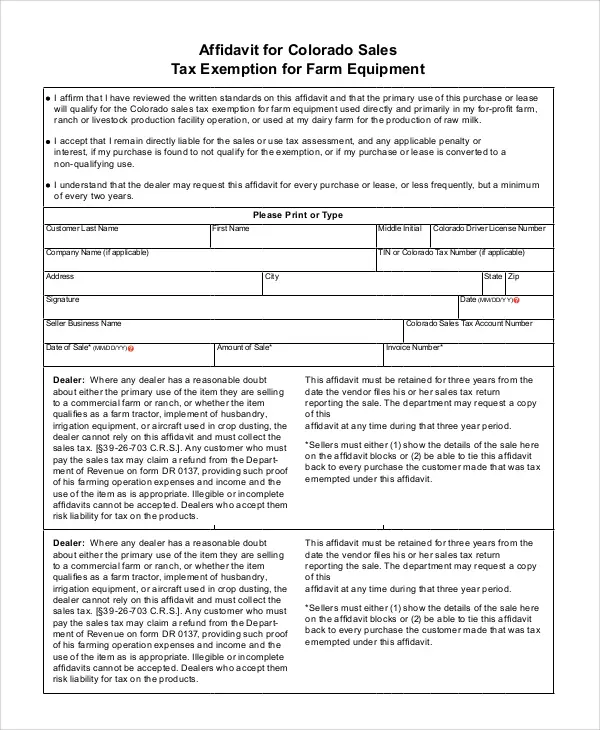

Farm Equipment That Is Certainly Not Exempt

If you are leasing or buying agricultural machinery, you might not be aware of the tax exemption on farm equipment. Agriculture is the raising and harvesting of any commodity, according to the IRS. It involves growing poultry, dairy cows, and also molluscan shellfish. People who are involved in the purchase and selling of agricultural products are not regarded as those who produce agriculture, however. , although you can still buy farm machinery that is eligible for a tax exemption permit

State Tax Exemption Rules And Regulations

Through the Department of States Diplomatic Tax Exemption Program, the U.S. Government meets its obligations under Article 34 of the Vienna Convention on Diplomatic Relations and Article 49 of the Vienna Convention on Consular Relations, as well as other similar treaties and agreements, to provide exemption from state and local sales, restaurant, lodging/occupancy and other similar taxes charged to customers.

Generally, states, territories, the District of Columbia and localities develop their own statutes, and regulations concerning the manner in which vendors may grant such tax exemptions to foreign missions and their members.

The information below is provided to better assist vendors with understanding the applicable state and local rules and regulations concerning this issue. This listing is not exhaustive of all such statutes/regulations. Therefore, if a vendor does not find information specific to their location, they are encouraged to contact the Department of States Office of Foreign Missions or the appropriate tax authority. OFMs Headquarters, located in Washington, DC, can be reached 8:00am to 5:00pm by telephone at 895-3500, option 2 or by electronic mail at .

Recommended Reading: Ap Comparative Government And Politics Online Course

United States Government Agencies And Instrumentalities

United States Government agencies and instrumentalities include the Departments of Defense, Army, Navy, Air Force, United States hospitals, American Red Cross, Federal Reserve Banks, federal land banks, federal housing projects, federal housing authorities, United States Postal Service, and any other department of the Federal Government whose activities are directly under federal control and whose purchases are paid for from the federal treasury.

Emergency Telephone Users Surcharge

The Emergency Telephone Users Surcharge, also known as the 9-1-1 surcharge, is not imposed upon the United States, its agencies and instrumentalities, its unincorporated agencies or instrumentalities, the American National Red Cross, or a corporation wholly owned by the United States. For additional information, see publication 39A, Emergency Telephone Users Surcharge and Prepaid 911 Surcharge.

Read Also: How Much Does The Us Government Spend On Healthcare

Motor Vehicle Fuel Tax

Sales of motor vehicle fuel to the United States and its agencies and instrumentalities, are subject to the motor vehicle fuel tax except when sold to the United States government armed forces for use in ships or aircrafts, or for use outside of California. A licensed supplier making an exempt sale of motor vehicle fuel without tax should retain supporting documentation from the armed forces branch purchasing the motor vehicle fuel such as a U.S. government purchase order. Any person who makes sales of tax-paid motor vehicle fuel to the United States armed forces for use in ships or aircraft, or use outside of California may file a claim for refund for the tax paid with the California State Controller. Or, in lieu of filing a claim for refund with the State Controller, a licensed supplier may claim a credit on their CDTFA Supplier of Motor Vehicle Fuel Tax Return.

State Tax Exemption Information For Government Charge Cards

When you use a Government Purchase Card such as the “GSA SmartPay” travel card for business travel, your lodging and rental car costs may be exempt from state sales tax.

- Centrally Billed Account cards are exempt from state taxes in EVERY state. Certain states require forms for CBA purchase cards and CBA travel cards.

- Individually Billed Account travel cards are not exempt in all states. Certain states where IBA cards are exempt require forms.

Not sure if your travel card is CBA or IBA? Check on the GSA SmartPay Website.

A charge card for certain U.S. Government employees to use when buying mission-related supplies or services using simplified acquisition procedures, when applicable, and when the total cost does not exceed micro-purchase thresholds.

Don’t Miss: Government Student Loans Without Cosigner

Sales To Individuals Insured Under The Medicare Program

Your sales to individuals insured under Part A of the Medicare program are tax-exempt when Medicare pays you directly. However, your sales to individuals covered under Medicare Part B do not qualify for this exemption, even when the patient assigns the claim for reimbursement to you. Please see Regulation 1591, Medicines and Medical Devices, for additional information.

Irs Perseverance Note From Mit

An organization is granted federal tax exemption according to the IRS determination letter. Without it, the department of income are only able to unconditionally take Develop G-6. A conditional acceptance, even so, may be transformed in a long term exemption. The organizations taxation-exemption app have to consequently include MITs Internal revenue service dedication note for taxes exemption develop. If MIT is granted tax-exemption in the IRS determination letter, it is obvious that the organizations tax-exempt status is secure.

Recommended Reading: Best Government Grants For Small Business

Exempt Sales And Leases

Your sales and leases of merchandise to the United States government are generally exempt from California sales and use tax. This includes sales and leases to:

- The United States or its unincorporated agencies and instrumentalities. Examples include: the Postal Service, branches of the armed services, military exchanges, federal courts, and agencies such as the U.S. Forest Service, and the Department of Housing and Urban Development.

- Any incorporated agency or instrumentality of the United States that is wholly owned either by the United States or by a corporation that is wholly owned by the United States. Examples include: the Resolution Trust Corporation and the Federal National Mortgage Association .

- The American National Red Cross, including its chapters and branches.

- Incorporated federal instrumentalities that are not wholly owned by the United States, unless federal law permits taxing them. Examples of the former include: federal reserve banks, federal credit unions, federal land banks, and federal home loan banks.

If you are unsure whether an agency, corporation, or other organization fits into one of the categories listed here, please contact the California Department of Tax and Fee Administration Customer Service Center for assistance at 1-800-400-7115 .

State And Local Tax Exemptions

Evidence of exemption. Evidence needed to establish exemption from State or local taxes depends on the grounds for the exemption claimed, the parties to the transaction, and the requirements of the taxing jurisdiction. Such evidence may include the following:

A copy of the contract or relevant portion.

Copies of purchase orders, shipping documents, credit-card-imprinted sales slips, paid or acknowledged invoices, or similar documents that identify an agency or instrumentality of the United States as the buyer.

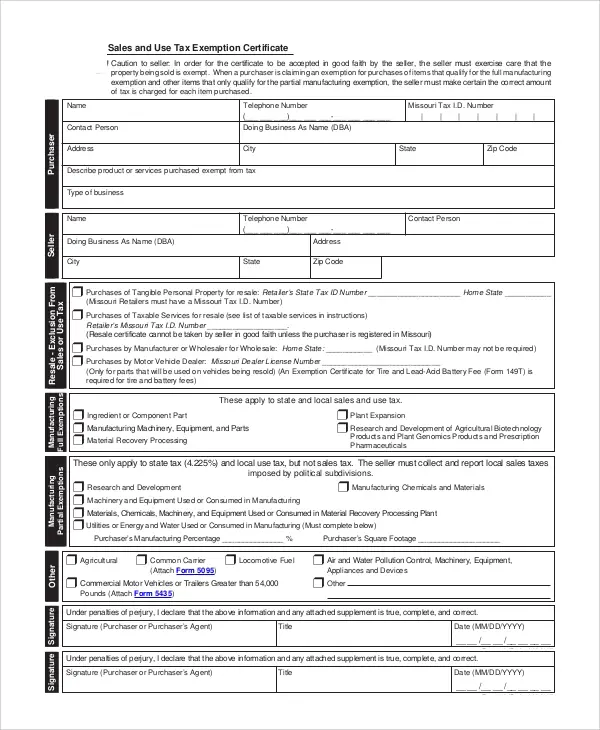

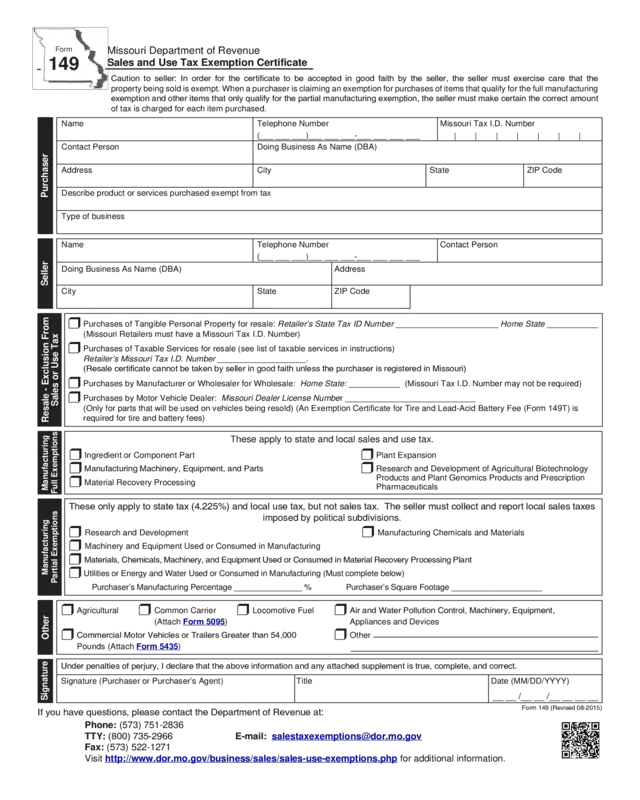

A U.S. Tax Exemption Form .

A State or local form indicating that the supplies or services are for the exclusive use of the United States.

Any other State or locally required document for establishing general or specific exemption.

Shipping documents indicating that shipments are in interstate or foreign commerce.

Furnishing proof of exemption. If a reasonable basis to sustain a claimed exemption exists, the seller will be furnished evidence of exemption, as follows:

Under a contract containing the clause at 52.229-3, Federal, State, and Local Taxes, or at 52.229-4, Federal, State, and Local Taxes , in accordance with the terms of those clauses.

Under a cost-reimbursement contract, if requested by the contractor and approved by the contracting officer or at the discretion of the contracting officer.

Under a contract or purchase order that contains no tax provision, if-

Also Check: Cash For Junk Cars Government Program

Exempt Organizations Forms & Instructions

The freely available Adobe Acrobat Reader software is required to view, print, and search the items listed above.

1Because Form 990-N must be filed electronically, a paper version may not be filed and is not available for download.

2Because Form 1023, Form 1023-EZ, Form 1024 and Form 1024-A must be filed electronically, a paper version may not be filed and is not available for download.

3Because Form 8871 must be filed electronically, a paper version of Form 8871 may not be filed and is not available for download.

4Because Form 8976 must be filed electronically, a paper version may not be filed and is not available for download.

Us Government Tax Exempt Form For Hotels

Us Government Tax Exempt Form For HotelsTax Exemption Kinds appear in many different types. These include the Contractors Exemption Qualification, Services in Battle, MIT, and Quasi-Authorities. If you are unclear of your particular circumstance, you can check the details on each form type below to decide which one is best for you. If you dont already have one, you can get a copy of this form from your county assessor. You are able to snail mail or electronically distribute the shape for the Section when youve finished it. Us Government Tax Exempt Form For Hotels.

Also Check: Cash Loan For Government Employees

United States Tax Exemption Form

Current Revision Date: 04/2015

GSA-FAR 53.229

Choose a link below to begin downloading.

PDF versions of forms use Adobe Reader.

FORMS LIBRARY ASSISTANCE:

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you’ve entered.

Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense.

Rates for foreign countries are set by the State Department.

Qualification Of Contractors Exemption

To get creating items that are exempt from income taxation, installers in the state of Illinois should have a Contractors Exemption Certificate taxes exemption type. A qualification is valid to the project it titles along with the contracts stated worth. A new exemption certificate would be necessary if you got a new contract. If youre working with one in the state of Wisconsin, you must give your subcontractor a copy of your exemption certificate.

You May Like: How Much Do Government Bonds Cost

Special Taxes And Fees

The State of California imposes, in addition to sales and use tax, several special taxes and fees. How these other taxes and fees apply to sales to the United States government vary. Below are the general rules for the application of the taxes and fees administered by the California Department of Tax and Fee Administration .

Who Can Claim Exemption On Taxes

If you BOTH: have no federal income tax responsibility in 2020 and you anticipate having no federal income tax liability in 2020, you may claim exemption from 2021 federal tax withholding. Federal income tax is not deducted from your salary if you claim exemption, but you may owe penalties and taxes when you complete your 2020 tax return.

You May Like: True Wireless Free Government Phone

Lodging Tax Exemption For Government Travelers

THIS ARTICLE HAS BEEN ARCHIVED. INFORMATION MAY BE OUT OF DATE. CONSULT THE JOINT TRAVEL REGULATIONS FOR CURRENT POLICY INFORMATION.

Want to make yourself look like a model employee? Of course you do! Heres how

Some states and U.S. territories exempt federal travelers from paying lodging tax. If you happen to be going to TDY to one of those locations, you have the perfect opportunity to save your organizations money and demonstrate your awesomeness to your boss. The next time youre slated to go TDY, firstview the list of states and territories that exempt federal travelers from lodging tax. If your TDY destination is on the list, you should take full advantage of their generosity. After all, travel funds are tight these days.

A few considerations regarding lodging tax exemption :

– You must be on official travel. Translation: just because youre a member of the federal government doesnt qualify you for lodging tax exemption for personal travel, such as when making reservations for your upcoming family reunion.

– You must be pay for the hotel with your Government Travel Charge Card. It doesnt count if you use your personal card, cash, or the barter system.

– You should call the hotel vendor and ask about their lodging tax exemption policy. Even if the state exempts federal travelers from lodging tax, not all hotels honor the exemption. If they dont honor it, consider expressing your displeasure by staying at a rival hotel that does offer tax exemption to federal travelers.

What Does Tax Exempt Mean

Tax Exempt Form Us Government Income or transactions not subject to federal, state, or municipal taxes are tax-exempt. Tax-free items may be reported and shown for informational purposes solely on a taxpayers individual or corporate tax return. The tax-exempt entity is not taken into account when determining taxes.

A firm or organization that restricts the amount of taxable income or gifts is said to be tax-exempt. Religious and benevolent institutions are among these organizations.

Tax Exempt Form

A tax exemption is the right to have some or all of ones income exempt from federal or state taxation. Most taxpayers are eligible for exemptions that can be used to lower their taxable income, while some people and organizations are entirely free from paying taxes.

Read Also: Small Business Government Assistance Programs

Documentation Required For Your Records

When you make a tax-exempt sale or lease, be sure to retain documentation that clearly shows that the transaction is tax-exempt. For sales to the U.S. government, documentation can include items such as:

- Purchase orders.

- Copy of U.S. government credit card or credit card number,

- Documents showing direct payment by the U.S. government, and

- Shipping and related documents if there is a question that the merchandise might have been sold directly to an individual in the armed services rather than to the U.S. government.

Nonprofits And Other Qualifying Organizations

The Comptroller’s Office issues sales and use tax exemption certificates to certain qualifying organizations, entitling them to make specific purchases without paying sales and use tax and is renewed every five years.

The following organizations can qualify for exemption certificates:

- Nonprofit charitable, educational and religious organizations

- Volunteer fire companies and rescue squads

- Nonprofit cemetery companies

- Government agencies

Certificates issued to nonprofit religious, educational, and charitable organizations, nonprofit cemeteries, credit unions, qualifying veterans organizations and volunteer fire companies or rescue squads are printed on white paper with blue ink and contain an expiration date of September 30, 2022. Certificates issued to governmental entities are printed on white paper with red ink and contain no expiration date.

An organization may use its exemption certificate to purchase tangible personal property that will be used in carrying on its work. This includes office supplies and equipment and supplies used in fundraising activities, but does not include items used to conduct an “unrelated trade or business” as defined by Section 513 of the U.S. Internal Revenue Code.

An exemption certificate should not be confused with a , which is used by manufacturers, wholesalers and retailers to purchase, free of tax, the items they sell.

Also Check: Government Jobs In New Braunfels Tx

Sales To Federal Contractors

Businesses working under contract to the federal government are usually not considered agents of the United States. Consequently, your sales to those contractors do not qualify as tax-exempt sales to the U.S. government. However, federal supply contractors may issue a resale certificate when they buy tools, equipment, direct consumable supplies, and overhead materials that they will use on a government contract, provided that title to the property passes to the U.S. government before the contractor uses it. For more information, see Regulation 1618, United States Government Supply Contracts.

U.S. government construction contractors are considered end users of materials and fixtures they furnish and install as part of their government construction contracts. Your sales of materials, fixtures, and supplies to such contractors are generally taxable. However, U.S. government contractors are considered retailers of machinery and equipment they furnish in fulfilling their government contracts. They may issue a resale certificate for the purchase of such an item, provided title to the machinery or equipment will pass to the United States before the contractor makes any use of it. For additional information, see Regulation 1521, Construction Contractors, and publication 9, Construction and Building Contractors.

Diplomatic Sales Tax Exemption Cards

The Departments Office of Foreign Missions issues diplomatic tax exemption cards to eligible foreign missions and their accredited members and dependents on the basis of international law and reciprocity. These cards facilitate the United States in honoring its host country obligations under the Vienna Convention on Diplomatic Relations , Vienna Convention on Consular Relations , and other treaties to provide relief from certain taxes.

The cards provide point-of-sale exemption from sales tax and other similarly imposed taxes throughout the United States. At the time of payment when making a purchase, the cardholder must present the card to the vendor in person. The vendor may verify the cards validity online or by calling OFM during business hours. The vendor should retain a copy of the front and back of the card for accounting and reporting purposes.

Types of Sales Tax Exemption Cards

Mission Tax Exemption Cards

Diplomatic tax exemption cards that are labeled as Mission Tax Exemption Official Purchases Only are used by foreign missions to obtain exemption from sales and other similarly imposed taxes on purchases in the United States that are necessary for the missions operations and functions. All purchases must be paid for with a check, credit card, or wire transfer transaction in the name of the foreign mission.

Personal Tax Exemption Cards

Other personnel may also be eligible to apply for a card if they qualify based on a treaty other than the VCDR or VCCR.

Don’t Miss: Masters In Government And Politics