Are There Other Possible Explanations For Negative Bond Yields

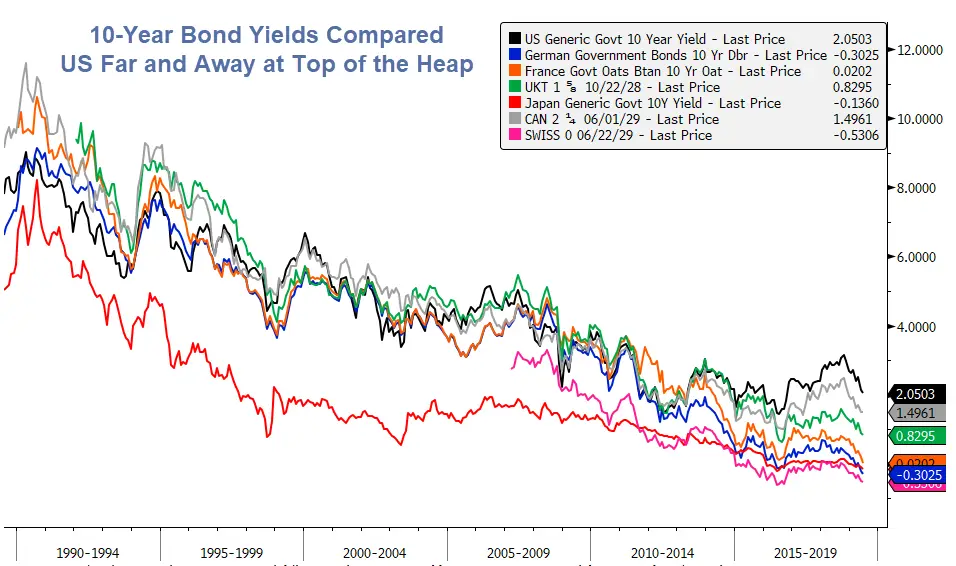

Besides a supply/demand imbalance, investors may be expecting deflation to continue such that after taking deflation into account, the real return on the bonds is positive. However, Japan has had periods of deflation for more than a decade, but has only recently had negative bond yields.

Another possible explanation for the negative bond yields is that foreign investors expect that returns on the bonds in their home currency will be positive when translated from Swiss Francs, Euros, Krone, Yen, etc. The implied expectation being that those currencies will continue to appreciate, possibly due to continuing deflation in those countries.

Listings Of Ishares Swiss Domestic Government Bond 3

Take advantage of all comfort features and portfolio comparisons with justETF Premium. The Premium version includes features like simulation of ETF portfolios, details analysis, monitoring, rebalancing and more.

Sign up now and take advantage of justETF Premium.

- Historic return simulation of ETF portfolios

- Performance and risk analysis

- 5 portfolios included

Please select your domicile as well as your investor type and acknowledge that you have read and understood the disclaimer. The fund selection will be adapted to your selection.

How To Get Started With Government Bonds

When a government wants to issue bonds, it will usually do so via a bond auction, where the bond will be bought by large banks or financial institutions. Those institutions will then sell the bonds on, often to pension funds, other banks, and individual investors. Sometimes, governments sell bonds directly to individual investors.

Alternatively, there is one other way of speculating on government bonds. CFD trading enable you to trade on fluctuating bond prices using leverage, without having to buy or sell the bonds themselves. Find out more about how to trade bonds.

Government bond ETFs are funds that can track the prices of fixed-income securities. They offer many of the benefits of buying government bonds, but with additional liquidity and transparency.

You May Like: Data Domains In Data Governance

Investing Money In Swiss Banks

Returns: -0.5% to 0.5% p.a.Risks: There is no collateral that the bank can provide to investors.

Indeed, the Swiss bank system is considered one of the safest and most secure both in terms of keeping your capital intact as well as keeping your funds away from prying eyes. But if you are looking to multiply or even slightly grow your money you might be better off looking at another option, as interest rates are far from leading positions in the world, or Europe for that matter.

Be it a savings account, a deposit, or an online trading account the money is safe indeed, but it sticks to a strict diet, so to say, interest-wise. In recent years, some deposits have even been subject to negative interest rates.

Useful resources on Bank Investments in Switzerland:

Returns of Swiss banks savings accounts,

Good Prospects For Swiss Corporate Bonds

Swiss bonds can provide attractive, risk-adjusted returns in the current, low yield environment, we believe. The opportunities available, however, require a specialist and dedicated approach.

Investors in Swiss bonds currently face extremely low or negative bond yields1, as well as receiving increasingly limited return from lengthening duration. Falling interest rates have been the main driver of performance in recent years for the Swiss bond market, and especially benefited passive investment solutions. Going forward, however, we see very limited scope for interest rates to drop further.

Bond investors could find better options in corporate bonds, where a highly-specialised investment approach can help them navigate the distinctive features of the Swiss market. There are compelling arguments for moving into Swiss corporate credit with shorter-dated exposure, rather than taking on the additional interest rate risk inherent in buying longer-dated bonds.

Over the past decade, there has been a significant increase in A to BBB-rated corporate bonds denominated in Swiss francs2. In our view, this creates more openings for specialists, and a bigger, more diversified universe in which to invest.

Also Check: How To Get A Free Computer From The Government

Buy Swiss Government Bond Funds

Go to Yahoo! Finance. See Resources for a link.

Enter RPIBX in the “Get Quotes” box. This is an international bond fund managed by T. Rowe Price. Familiarize yourself with the price performance by studying the price chart for a 6-month, one-year and two-year time frames.

Research other international bond funds that hold Swiss government bonds. You can start with LUX, a fund managed by UBS, or BCV Dynagest International Bond Expo denominated in CHF by inputting security number 2388558 into Yahoo! Finance’s “Get Quotes” box.

Purchase shares by contacting your stockbroker. If you do not have a broker, sign up with E-trade or Fidelity. See Resources for a link.

Warnings

-

This is not to be construed as investment advice.

References

- This is not to be construed as investment advice.

Writer Bio

Working as a full-time freelance writer/editor for the past two years, Bradley James Bryant has over 1500 publications on eHow, LIVESTRONG.com and other sites. She has worked for JPMorganChase, SunTrust Investment Bank, Intel Corporation and Harvard University. Bryant has a Master of Business Administration with a concentration in finance from Florida A& M University.

Best Major Types Of Investment Options In Switzerland

There currently exists quite an array of options as far as investments are concerned. The key to a successful portfolio lies in the careful and thoughtful decision making process that best fits your investment goals, keeping in mind capital, timeframe and potential risks. Below, youll find a breakdown of the major types of investments. Hopefully, it will be a useful tool as you create your investment strategy.

Also Check: Government Employee Car Rental Discount

Swiss Currency As A Safe Haven

The Swiss currency has been a long-time safe-haven investment. During the 2011 European sovereign debt crisis, there was such high demand for francs that the Swiss National Bank was forced to peg its currency to the euro at a rate of 1.20 euros per franc. This was done in order to prevent its own economy and export sector from suffering.

Compared to other safe havens like gold, the Swiss currency is available on a large scale. It’s also highly liquid. And, it’s backed by the robust Swiss economy, which itself is seen as the world’s leading banking center. Many institutional investors and governments are fond of using Swiss francs for this purpose on the other hand, retail investors are often more focused on other assets.

The Swiss franc’s safe-haven status was tainted in 2011. This was when Switzerland pegged the currency to the euro to steady its economy. Many large foreign exchange brokers and investors faced billions in losses they were then declared insolvent. Since then, some people are hesitant to invest in Swiss francs. That’s because the central bank can be unpredictable.

Where Does The Swiss National Bank Come In

The Federal Finance Administration is one of the divisions of the Department of Finance. This section is specifically tasked with overseeing the national debt.

However, the FFA doesnt carry out that work directly. Instead, it delegates the day-to-day management of the national debt to the Swiss National Bank, which is based in Zurich.

Read Also: Federal Government Watch List Search

What Happens When The Borrower Defaults On The Bond

This depends on whether the bond is secured against any asset or not. If it is, then its relatively simple to apply to a court for seizure of the asset for liquidation. If it isnt, then a generic insolvency proceeding against the borrower may commence in which the court will attempt to isolate and liquidate the assets of the borrower in order to repay the loan.

Investing In Swiss Bonds: A Comprehensive Guide

Most investors believe that stock is the most traded asset in the world. The truth is that theres another asset class that is 1.5 times the size of stocks.

We are talking, of course, about bonds. In 2017, the global bond market was sized at over $100 trillion, which dwarves the equity market . Your surprise would be forgiven because if you read the news, over 80% of the coverage concentrated exclusively on stocks.

In this article, we will dive deep into the bond world and explore the magical combination it has with Switzerland.

You May Like: Government Filing Fee For Trademark

Risks Of Bond Cfds Trading

Interest rate risk if there’s a rise in the interest rates, then the price of an existing bond will fall because investors will demand a higher return to compensate for the extra risk that they’re taking on with their investment.

The threat of default – if you buy a bond and its issuer becomes bankrupt or can’t pay back its debts, then you could lose all of your investment and any money that you’ve made in the meantime because the bond market is so illiquid. This leads to a lot more risk for investors who buy bonds than compared to if they had simply bought shares.

since there are so many different types of bonds available, what happens in one part of the bond market might have a knock-on effect on other areas. For example, if there’s an expectation that a country is headed into economic trouble and will default on its debts, this can lead to weakness in their government bonds but strength in corporate and municipal bonds as investors try to get their money out of the weakest and into the safest. This can cause some traders to panic and sell off all their positions in bonds, even when they’re making money just because they want to get out before everything crashes down.

Buying And Selling Government Bonds

Just like shares, government bonds can be held as an investment or sold on to other traders on the open market.

Using our above example, say that your 10-year bond is half way to maturity, and that youve spotted a better investment elsewhere. You want to sell your bond to another investor, but because better investment opportunities have arisen your 5% coupon now looks a lot less attractive. To make up the shortfall, you might sell your bond for less than the £10,000 you originally invested.

An investor buying the bond would still get the same coupon rate 5% on £10,000. But their yield would be higher, because they paid less to get the same return.

A bond with a price that is equal to its face value is said to be trading at par if its price drops below par it is said to be trading at a discount, and if its price rises above par it is trading at a premium.

You May Like: Government Loans For College Students

Direct Real Estate Investments: Investing In Swiss Property

Returns: From 2% to 4% p.a. for mid-market 10% and higher for luxury properties.Risks: The demand can be dependent on nearby factories and offices of big companies.

Real estate investments are considered a cornerstone of building wealth, but when it comes to the Swiss real estate market, the most lucrative deals are closed to investors who cant put at least a million dollars on the table.

The cost to buy a property or an apartment downtown in a city like Zurich starts from 600K CHF up. From my 20 years experience investing in real estate, I can tell you that the best returns are made on properties in premium locations, where the prices start from 2M 4M CHF.

You can make double-digit returns if the deal was properly structured and you are skillful enough to manage the property well. There are other models to increase the profit even more, like long-term leasing: owners are often willing to give up to 30% discount if the property is being rented for 20 years, as they can transfer vacancy risk onto the lessee.

Unfortunately, putting a few million into a property is not an option for many. Rates in rural areas and city outskirts are more accessible for beginning investors, but the rental rates are also too low to make this option attractive, considering its risks. Lets consider this option in detail.

Pluses of real estate investment:

- Properties in central areas have a stable, diversified demand.

- You can leverage your money to buy a more expensive property.

When A Currency Is Too Strong

Back in 2011, the European debt crisis was roiling, the EU and international investors looking for safety bought up Swiss francs, driving up the currencys value. The stronger Swiss francs started to hurt the countrys exports. At this time, policymakers in Switzerland decided to artificially cap their currency at 1.20 against the euro in an attempt to prevent the Swiss franc from becoming too strong. To maintain this cap, the Swiss central bank printed more francs and bought euros with them.

In an unanticipated move in January 2015, the Swiss National Bank suddenly freed its currency by removing the artificial cap it had placed on the Swiss franc against the euro a little over three years before. The move came as a shock for the forex market and send the value of the franc, a stable and conservative currency soaring. In the ensuing chaos, many traders and brokers experienced huge losses.

Despite the unexpected decision and its fallout, investors still see the Swiss franc as a safe haven backed by a robust financial system and strong competitive economy.

You May Like: Government Policies To Reduce Greenhouse Gas Emissions

The Most Important Risks Of Bonds Are As Follows:

This is the risk that the issuer does not repay the principal invested and/or pay the coupons . It is often said that government bonds have a lower credit risk than corporate bonds. This is because a government can increase its taxes if it needs more money. However, plenty of examples also can be found in the past when governments did not repay their bonds. This risk is significantly higher in emerging markets.

Interest rate risk

This is the risk that the value of the bond declines when market interest rates increase. The value of a bond with a fixed coupon moves in the opposite direction from interest rates. The reason is that when the market interest rate increases, investors can obtain a new bond with a higher coupon. This automatically reduces the value of the bonds already issued with a lower coupon. Conversely, the value of a fixed-income bond increases when market interest rates drop.

Lets consider a simple example. Perhaps you purchase a bond with 1% interest rate and lets say that interest rate is in line with current market interest rates. If the market interest rates increase to 1.5%, then people will be able to purchase bonds with a 1.5% rate of interest. Those bonds, once they reach maturity, will pay out more than your bond, simply because interest rates increased. While the bond market is a bit more complicated than this example, this expresses, in basic terms, how interest rates may affect your investment value.

Currency risk

What Does Switzerlands Debt

Economists and financiers are not so much interested in how much a country owes, but whether a country is able to pay off its debts.

A country that has a large annual income has a greater capacity of paying off a particular sum of money than a country that doesnt earn much money each year.

The national annual income is called gross domestic product, or GDP, and most financial statistics of a country are usually measured against that figure.

Also Check: Free Annual Fico Score Government

Benefits Of Bond Cfds Trading

Longer-term investment strategy bonds give you more time to wait for the right conditions to make some money off of your trades. You can hold onto a bond until it reaches maturity if you expect that its value will go up and then sell it for profit or hold onto it as a long-term investment in case the market starts going in your favour.

The taxation rules are quite favourable income from capital gains and coupon payments are taxed at a lower rate than if you collected the dividends made on shares or if you’d earned interest on a savings account. This is because the government considers them to be more stable investments that might not see huge swings in value over time which could be considered more risky.

Low transaction costs the commissions that you have to pay on bond trades are generally very low because there’s a lot less activity than in other markets which reduces fees and gives you a better chance at making money when bonds prices move up or down in value.

The broad nature of bonds with bonds, you have access to different types of investment strategies because bond trading is all about fixed-income investments. These include corporate bonds which are an issue that’s traded on a corporation’s credit rating, municipal bonds which are issued by government agencies and treasury bonds which belong to the national government of a particular country like the USA or the UK.

How To Buy Swiss Francs

Consumers in the United States can purchase Swiss francs from most major banks to spend or invest as they see fit. Or, they can buy Swiss francs as a currency investment with an exchange-traded fund. Foreign currency investments can produce profits, but they also carry the risk of losses due to the potential value growth of the U.S. dollar compared to the franc.

Also Check: Entry Level Government Jobs Colorado

How Is Switzerlands National Debt Managed

The Federal government is Bern is responsible for the national debt and answerable to the national parliament.

The central governments Federal Department of Finance is directly responsible for setting the governments budget and looking after the national debt policy.

Switzerland has four official languages, so the Department of Finance has four names: Eidgenössisches Finanzdepartement , Département fédéral des finances , Dipartimento federale delle finanze , Departament federal da finanzas .

How Is A Negative Bond Yield Possible

You may think that getting paid to borrow money is impossible, but that is what the Swiss government did recently.As you may have read last week, Switzerland became the first government ever to sell 10 year bonds with a negative yield: on April 7 Switzerland sold 10 year bonds with a yield of -0.055%. How is this possible?

You May Like: Government Bank Owned Foreclosed Homes In Polk County