Debt Settlement As An Alternative To Bankruptcy

Government Programs for Debt Relief

Filing for Chapter 7 or Chapter 13 Bankruptcy can plague you with a set of challenges, such as lawsuits, monetary judgments, or garnished wages which you may want to avoid, not to mention the long term impact on your credit score which it may incur. If you want to avoid bankruptcy, debt settlement is a viable and recommended alternative by the Federal Trade Commission. Under debt settlement, a debtor can receive a lump sum agreement or installment through which he or she will pay off debt at a reduced, fractional rate of the total account balance, perhaps at around half, or more or less depending on the debtors situation. Though debtors can hire a firm to help with creating a debt settlement plan, the FTC warns against for-profit firms as they are often out to scam debtors. Debtors can create their own self-managed debt settlement plan or look into free credit counseling agencies.

Read Also: What Is Of306

Try To Settle The Debt

Debt settlement may be worth considering if you’re already behind on your debt and your missed payments have already taken a toll on your credit score.

With this approach, you can offer to settle your debt for less than what you owe. However, you’ll typically need to pay a lump-sum amount, so it might not be an option for some people.

If you want to settle but don’t have the cash on hand, you can enlist the help of a debt settlement company or a debt attorney, who can help you negotiate and give you some time to save up for the settlement amount.

Note, however, that debt settlement can damage your credit score significantly because it signifies that you’re not paying as you originally agreed.

Fresh Start Program For Irs Tax Relief

In 2013, the IRS created the Fresh Start Program. Its purpose was to make it easier for taxpayers that had fallen behind on their taxes. This provides immense relief since it stops things like tax liens and wage garnishment.

Here is what the law provides:

- Fresh Start increases the amount of debt required to trigger a Notice of Federal Tax Lien. Now if you owe less than $10,000, you dont need to worry about liens.

- Fresh Start also made it easier to file an Installment Agreement if you owe less than $50,000. You can use the streamlined online application and skip the full financial statement usually required to set up an IA.

- Fresh Start also expanded and improved Offer in Compromise access. The IRS is more relaxed in evaluating taxpayers ability to repay back taxes. Now its easier to qualify for an OIC.

Also Check: Minority Owned Business Government Contracts

Government Protection Against Debt And Debt Collectors

One of the biggest government debt relief programs is the legal protections that it offers. This includes the Fair Debt Collection Practices Act , which limits the actions of debt collectors. If you are behind in payments, then the last thing you want to face is harassment from a debt collector. The FDCPA prohibits debt collectors from very specific behavior including the use of abusive or threatening language, and threats of arrest.

Another area that the government offers debt relief is through collection laws and statute of limitations. These offer you protection in the case of a lawsuit and a potential judgment. These laws are both state specific and relate to the type of debt and assets.

One final area that the government offers debt relief is through a court approved bankruptcy, either a Chapter 7 liquidation, or a Chapter 13 court payment plan. Bankruptcy is generally considered a last-resort solution and not many people can qualify for a Chapter 7 bankruptcy or complete a Chapter 13 bankruptcy.

Student Loan Debt Relief

There is a wide range of methods for student loan relief. The best choice usually depends on the type of student debt you have federal or private.

Relief options for federal student loans that dont affect eligibility for other federal relief programs:

Private student loan relief options:

- Student loan refinancing

- Private student loan settlement

Its important to note that you can use private refinancing for federal student loans. However, it converts federal debt to private. You lose all eligibility for federal relief moving forward.

Also, discharging student loans through bankruptcy is not as easy as other types of debt. To discharge, you must prove that not discharging those debts will cause continued financial hardship. Its possible to discharge these debts through bankruptcy. But youll need a good attorney to get the results you want.

Need to find relief from student loan debt? Talk to a specialist now to find the right solution.

Also Check: Kansas City Mo Government Jobs

Get Your Debt Under Control

Your debt can seem out of control if you owe a large amount, but there are ways to get rein it in. That could include a debt settlement company or working directly with your creditor. Either way, seeking help from credit counseling or a debt settlement company could help you feel less overwhelmed. It is important to remember that scammers could be preying on others during this vulnerable time. Do your research to make sure you are working with a legitimate company.

National Debt Relief Reputation & Consumer Reviews

Consumer reviews on National Debt Relief are a mixed bag. Many find it hard to glean information about the program without first providing sensitive information or undergoing a soft credit pull. Others claim NDR does not deliver what it promises. Some consumers feel they were misled by NDR and feel it failed to disclose just how much it would be taking in fees. Some were not made aware theyd have to pay federal income taxes. The main problems seem to be misinformation and lack of communication.

National Debt Relief is a real company working to eliminate consumer debt, but there are more than a few strings attached. Dont start adding up your savings without first considering the taxes and fees you will owe and the impact on your long-term credit history.

Dont expect to be in the clear after a phone call. The process takes time and patience, and though debt settlement comes with drawbacks, its benefits outshine at least one alternative. NDR may not be all its cracked up to be, but in many cases, it still beats bankruptcy.

6 Minute Read

Don’t Miss: Free Government Phones In Modesto Ca

Federal Student Loan Forgiveness

If you have federal student loans, you may be eligible for some form of loan forgiveness. These are the three most common types of loan forgiveness:

- Public Service Loan Forgiveness : Certain jobs offer student loan forgiveness. For instance, if you work for a nonprofit organization or the government, you may qualify for PSLF. With PSLF, your loan balance is forgiven after you work for a qualifying employer for 10 years while making payments on your loans. The forgiven balance is not taxable as income.

- Income-driven repayment plan forgiveness: If you cant afford your payments, you may be able to lower them by applying for an IDR plan. And, after 20 to 25 years of making payments on your loans, the remaining balance is forgiven. However, the forgiven amount is taxable as income.

- Total and Permanent Disability Discharge: If you have a complete and permanent disability, you can qualify for loan discharge. If your loans are forgiven after Jan. 1, 2018, the remaining balance is not taxable as income.

Tax Management And Relief

CuraDebt will also handle taxes. Once they collect all of your financial documents, they will also collect all the documents youll require for tax returns.

Through this program, you will be able to deal with different types of taxes like wage garnishments and tax penalties, personal and business taxes and back taxes as well as trust fund penalties and tax lien.

There arent hidden fees either. They only offer flat-fee prices and is dependent on the amount youll need to settle.

There are a variety of options in the settlement of the tax debt. Here are 6 of them:

- Installment agreements

Recommended Reading: Debt Statute Of Limitations Ohio

Recommended Reading: Government Help With Medical Bills

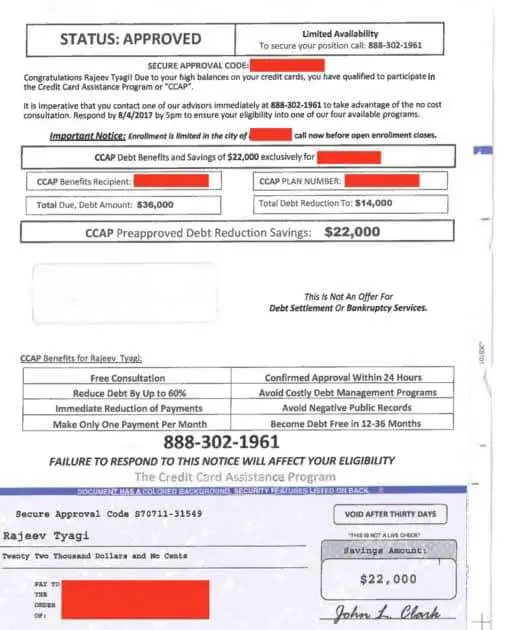

Key Ways To Spot A Debt Relief Scam

The two most obvious signs of a potential debt relief scam are:

1. They Contact You First

If you receive an unsolicited call or contact from someone offering to help you eliminate your debt, be extra cautious. There’s a good chance they’re a scammer.

2. They Ask for Fees Upfront

This is the most obvious sign of a debt relief scam. If the person/company offers to help get rid of your debt but first you have to pay them a fee, they’re probably lying to you. Cut off contact and file a complaint with us.

Best National Debt Relief Programs

Brittney is a credit strategist and debt expert with years of experience applying her in-depth knowledge of the credit and personal finance industries to write comprehensive, user-friendly guides on the products and strategies readers can use to make smart financial decisions throughout the credit-building process.

Edited by: Lillian Guevara-Castro

Lillian brings more than 30 years of editing and journalism experience, having written and edited for major news organizations, including The Atlanta Journal-Constitution and the New York Times. A former business writer and business desk editor, Lillian ensures all BadCredit.org content equips readers with financial literacy.

When bills are piling up and you begin to fall behind on payments, debt relief programs can provide much-needed assistance to get out from the under the weight of all those unpaid notices and back on the path to good credit. Keep reading for our take on how to approach seeking out debt relief programs.

There is a small aquatic plant, called duckweed, that can expand from a few small leaves and take over the entire surface of your aquarium in a matter of months. While many fishkeepers will argue that duckweed has its place in moderate amounts, it can help keep your water clean too much of it can be a serious problem.

You May Like: Qlink Wireless Free Government Cell Phones

Contact Your Credit Card Issuer

It might not sound like the best move when you can’t pay your credit card balance, but contacting your credit card company is always a good idea if you’re worried about missing a payment.

Depending on your situation and the card issuer, potential relief can come in the form of one of the following:

-

Reduced interest rate: Some credit card companies may agree to lower your interest rate for a set period to cut the amount of interest that’s accruing on your balance.

-

Lower monthly payment: Your card issuer may agree to a modified payment plan that involves a reduced monthly payment for a set amount of time.

-

Forbearance: In some situations, you may be able to get your credit card payments paused for a short period of time. That said, interest may still continue to accrue, and forbearance doesn’t reduce your actual balance.

-

Fee waivers or refunds: If you’re already behind, you may be able to convince your credit card company to waive late fees or refund past late fees that have already been added to your account.

Keep in mind that these options are entirely at the discretion of your card issuer, so there’s no guarantee that you’ll get the relief you’re looking for.

“The best approach is to be persistent and polite. You will need to keep good records of your debt,” says Latham. “A realistic goal is to negotiate a modified payment plan that either extends the repayment period, reduces the amount you owe or a combination of both.”

Governor Hochul Announces $672 Million Electric And Gas Utility Bill Relief For New Yorkers

One-Time Bill Credit Available to Help More Than 534,000 New Yorkers Pay Utility Bills

Largest Utility Customer Financial Assistance Program in State History

Governor Kathy Hochul announced today that 478,000 residential customers and 56,000 small businesses in New York State will receive assistance totaling $672 million to pay off unaffordable past due utility bills. Today’s announcement is the largest utility customer financial assistance program in state history and follows a series of policies announced last week to address energy affordability and emissions reductions as part of Governor Hochul’s State of the State address.

“Every New Yorker deserves affordable energy, yet too many New Yorkers are at risk of having their lights turned off due to financial problems caused by the pandemic,” Governor Hochul said. “Earlier this month, I laid out extensive proposals to make energy more affordable in my State of the State address, and with this historic electric and gas utility relief we’re achieving another major milestone to help New Yorkers stay warm during the cold winter months.”

In the June round of bill relief, utility shareholders provided more than $36 million in contributions to benefit customers. In today’s round of bill relief, utility shareholders provided an $101 million to benefit customers an amount that far exceeds any utility contributions for pandemic relief across the United States.

You May Like: Best Government Jobs In Florida

Beware Of Debt Settlement Scams

Some companies offering debt settlement programs may engage in deception and fail to deliver on the promises they make for example, promises or guarantees to settle all your credit card debts for, say, 30 to 60 percent of the amount you owe. Other companies may try to collect their own fees from you before they have settled any of your debts a practice prohibited under the FTCs Telemarketing Sales Rule for companies engaged in telemarketing these services. Some fail to explain the risks associated with their programs: for example, that many consumers drop out without settling their debts, that consumers credit reports may suffer, or that debt collectors may continue to call you.Avoid doing business with any company that promises to settle your debt if the company:

- charges any fees before it settles your debts

- touts a “new government program” to bail out personal credit card debt

- guarantees it can make your unsecured debt go away

- tells you to stop communicating with your creditors, but doesnt explain the serious consequences

- tells you it can stop all debt collection calls and lawsuits

- guarantees that your unsecured debts can be paid off for pennies on the dollar

What Is Debt Management

A or DMP is a debt relief solution that allows you to streamline monthly credit card payments. A credit counseling agency can review your budget and credit card debts and then create a personalized plan for paying them off.

You make one monthly payment to the credit counselor. That payment is then distributed among your creditors. Depending on the terms of your plan, your credit card companies may agree to waive fees or reduce your interest rates.

The trade-off is that you typically must close your credit accounts as a condition of your enrollment. The credit counseling agency may or may not charge a fee for their services. This debt relief option could make sense if you simply need help staying on top of your credit card payments.

Read Also: Federal Government Department Of Compensation Financial Aid Program

Debt Forgiveness For Seniors Via Bankruptcy

Bankruptcy often evokes with stigma and negative connotations, but for seniors buried under debt, its sometimes the only option.

While filing for bankruptcy impacts future financing, this may not be as big of a deal for someone in advanced age. Getting a fresh financial start, while being able to keep your home and retirement accounts safe, may be the most appealing option for seniors in debt.

There are two types of bankruptcy to consider. One or the other could pave the way for debt forgiveness for seniors, but at a cost.

Chapter 7 bankruptcy

Chapter 7 liquidates some of your assets in order to make good on your debts. In the majority of cases, your debts will then be discharged however, alimony, child support and most student loans, among other things, would likely not be forgiven.

Your credit score will suffer in the short term, and the bankruptcy will show up on your credit report for 10 years, but you can still rebuild your credit.

And while some of your assets are up for grabs, your retirement accounts are off limits. Its also likely that youll be able to retain a portion of your home equity.

Chapter 13 bankruptcy

Chapter 13 puts a repayment plan in place that generally lasts three years, after which your remaining debts are discharged. The good news here is that your assets are safe.

What Debt Settlement Options Are Available

Getting help with your credit card debt settlement isnt free. Consider the time and frustration you could endure with trying to fix your credit issues on your own.

When you do business with a debt settlement company, you will have to show that you have the money to pay down the debt. Some companies may ask for a dedicated bank account, which the money then will be sent by an independent third party. The funds are still yours and if its an interest bearing account, you will be entitled to this.

A reasonable fee for account maintenance may be added on. This could include transferring the funds from your account to pay your creditors and the debt settlement company when settlements occur.

A credit card debt settlement company can charge you only a portion of its full fee for each debt it settles. For example, you owe money to three creditors and the settlement negotiation is only successful with one of your creditors. For every successful debt settlement, the company can charge you another portion of its full fee.

A common approach is if the companys fees are based on a percentage of the amount you save through the settlement, then the company must tell you both the percentage it charges and the estimated dollar amount it represents. This may be called a contingency fee.

Read Also: Government Jobs In Miami Dade County