How Do I Pay Off My Student Loans Early

Kudos for asking this question! The fastest way to pay off your student loans is with the debt snowball. Heres how it works:

Step 1: List all your debts from smallest to largest, regardless of interest rate.

Step 2: Make minimum payments on all your debts except the smallest.

Step 3: Throw as much money as you can on your smallest debt .

Step 4: Repeat until each debt is paid in full and youre debt-free!

When you pay more than your minimum monthly payment, be sure to let your student loan servicer know that you want the extra payment to go toward the principal. Otherwise, they may just put it toward the next months interest.

Public Service Loan Forgiveness Calculator For 2022

You can use the Public Service Loan Forgiveness calculator below to find out how much you could save by using the best student loan forgiveness program out there. This PSLF calculator is also completely updated, using the latest 2022 federal poverty line numbers that the government publishes each January. Use our PSLF calculator tool below to minimize your monthly payments and forgiven balance.

You can use the calculator below to get a quick idea of how much PSLF forgiveness you could receive, and you can use the button above to get the complete PSLF calculator sent to your email.

How To Apply For Bidens Student Loan Forgiveness Program

Most borrowers will have to submit a simple application before their loan forgiveness can be processed. The application is expected to be released in early October. Subscribe to the Department of Educationâs mailing list to be notified when the application is open.

After you submit an application, expect loan forgiveness in four to six weeks. The Department of Education will accept applications until December 31, 2023 and process them as theyâre received. However, if you want your loans forgiven before payments resume on January 1, 2023, the department recommends submitting an application by November 15, 2022.

About 8 million borrowers wonât have to do anything to get forgiveness. If the government has recent income data for you, it can automatically process your loan cancellation. If youâre not sure if this describes you, submit an application to be safe.

Read Also: Document Management System For Government

What Is A Student Loan Repayment Calculator

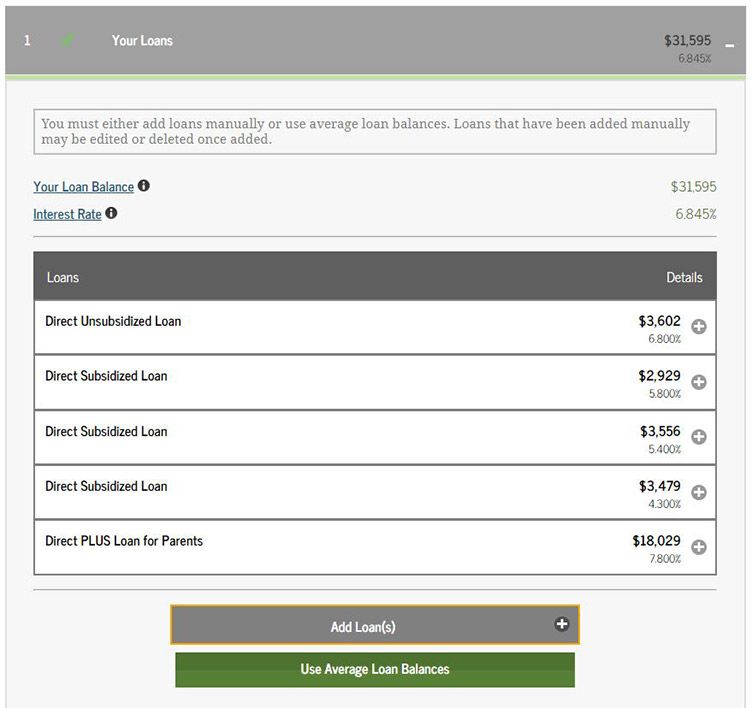

A student loan repayment calculator automatically calculates your monthly student loan payment based on three pieces of information:

- Your student loan balance, or how much you owe

- Your interest rate, which is typically assigned when you borrow the loan

- Your loan term, or how many years youll be paying back your loan

After you input each of these numbers, the calculator will show you how much youll be paying on your student loan each month.

How To Repay Loans Faster

Most people like the feeling of being debt-free. Listed below are some of the strategies to repay loans faster.

Pay Extra

If there is no prepayment penalty involved, any extra money going towards a loan will be used to lower the principal amount due. This will speed up the time in which the principal due finally reaches zero and reduces the amount of interest due because of the smaller principal amount that is owed.

Biweekly Payments

For loans that require monthly repayments, submitting half of the monthly payment every two weeks instead of one monthly payment can speed up the repayment of loans in two ways. Firstly, less total interest will accrue because payments will lower the principal balance more often. Secondly, biweekly payments for a whole year will equal 26 yearly payments because there are 52 weeks in a year. This is equivalent to making 13 monthly payments a year. Before making biweekly payments, make sure there are no prepayment penalties involved.

Refinance

Loan refinancing involves taking out a new loan, often with more favorable terms, to replace an existing loan. Borrowers can refinance their loans to shorter terms to repay the loans faster and save on interest. However, borrowers normally need to pay refinancing fees upfront. These fees can be very high. Be sure to evaluate the pros and cons before making the refinancing decision.

Don’t Miss: Can I Get A Government Grant To Buy A House

Limitations Of The Federal Student Loan Repayment Calculator

As good as it is, five factors can throw the U.S. Department of Educations repayment estimator for a loop in evaluating IDR plans:

Find out if refinancing is right for you

- Compare actual rates, not ballpark estimates Unlock rates from multiple lenders in about 2 minutes

- Wont impact credit score Checking rates on Credible wont impact your credit score

- Data privacy We dont sell your information, so you wont get calls or emails from multiple lenders

Income-driven repayment plans can help borrowers manage tough times by lowering their monthly payment. But since your payments are being spread out over a longer period of time without an interest rate reduction up to 25 years your total repayment costs may increase significantly.

If you qualify to refinance at a lower rate, you could not only lower your monthly payment, but reduce the total amount of interest payments you make over the life of your loan.

While refinancing isnt for everyone if you refinance government loans, youll lose access to IDR programs and the potential to qualify for loan forgiveness many borrowers decide the savings they can achieve outweigh the value of those federal borrower benefits.

Use Your Results To Save Money

If you have unsubsidized or private student loans, you can lower your total to repay by making monthly interest payments while youre going to school. Or, you may opt to make a lump sum payment of the total interest that accrues before repayment begins. Either method will prevent the interest that accrues from being capitalized. The result: a lower monthly bill amount.

You can submit more than your monthly minimum to pay off your loan faster. The quicker you finish paying your loans, the more youll save in interest. Learn how to pay off your student loans fast.

If youre having trouble making payments on your federal loans, you can extend the term to 20 or 25 years with an income-driven repayment plan. Income-driven plans lower your monthly loan payments, but increase the total interest youll pay throughout the life of your loan.

Private lenders may allow you to lower monthly payment temporarily. To permanently lower monthly payments youll need to refinance student loans. By doing so, you replace your current loan or loans with a new, private loan at a lower interest rate. To qualify youll need a credit score in the high 600s and steady income, or a co-signer who does.

Recommended Reading: Work At Home Government Jobs Data Entry

Avoiding Delinquency And Default

If you don’t make payments on your student loans, your loan is delinquent. Your loan is considered delinquent from the day after you miss a payment untilyou make up that missed payment or it enters default. When a loan is delinquent, late fees may be charged to your account, and missed payments are reportedto the four nationwide credit bureaus. If you haven’t made a payment for more than 270 days,your loan enters default. In default, the full balance of your loan is due immediately, and there may be other financial and legal consequences.Fortunately, there are options for turning things around.

Default Dangers

- Negative impact on your credit score and your ability to borrow money in the future

- Withholding of federal tax refunds

- Wage garnishment

- Loss of future federal aid eligibility

Fix-It Options

How Pslf Can Work In Your Favor

Remember, you have to repay your loans under an income-driven repayment plan to be eligible for PSLF. Four popular income-driven repayment plans are Income-Based Repayment , Income-Contingent Repayment , Pay As You Earn and Revised Pay As You Earn . Almost anyone with federal student loans can apply for these plans, regardless of their employer.

Theres a big difference between repaying a loan on an IDR plan working toward PSLF and one that isnt: the length of the loan. You could potentially complete the 120 required qualifying payments to be eligible for PSLF in as little as 10 years. By comparison, for example, the Standard Repayment Plan can take 10 to 30 years. Plus, if youre on an IBR plan and dont earn a high salary, your payment will be on the lower side during the life of the loan. If you begin to earn more money, you can stay in the PSLF program and use the cap on PAYE or IBR so youll still have a loan balance to forgive.

Recommended Reading: Government Assistance For First Time Homebuyers

How Long Will It Take To Pay Off Your Student Loans

- Plug your student loan info into the student loan calculator to get your current debt-free date. This is when youll pay off your student loans if you keep making only minimum payments. Were not going to lieit can be a little depressing to see that date, especially if youve got a long way to go. But dont stop there!

- If you have multiple student loans, youll also see how much faster you can pay them all off by using the debt snowball method. This plan gives you serious momentum. Plus, it can save you a ton in interest!

- But youre not done yet! Add an extra monthly payment to boost your progress even more. Once you see how much sooner you can be debt-free, youll be ready to attack those student loans with everything youve got!

Ways How To Pay Off Your Student Loans Faster

Pay Extra

Pay Extra

Paying extra even a few times a year on your principal will help pay down your balance quicker. Be sure to ask your loan servicer to apply the extra payments to the principal and not an earlier release date though.

Pay More Frequently

Pay More Frequently

Paying every 2 weeks instead of monthly may allow you to budget better and also possibly pay a little more each payment.

Prepare a Monthly Budget

Prepare a Monthly Budget

Knowing exactly what your monthly expenses currently are and exactly where you spend your money will help you identify places you can cut back on spending and where you can potentially add those additional funds to paying down your student loan faster.

Establish a Separate College Savings Account

Establish a Separate College Savings Account

Work with your bank to set up a new account that is used just to pay your student loans, have money automatically moved into this account each month, that way, the money isnt lumped with your other expenses.

Find a job that qualifies you for Student Loan Forgiveness

Find a job that qualifies you for Student Loan Forgiveness

Teaching, Public Service, Nonprofit Organizations, Military and Government Organizations might be eligible for student loan forgiveness if you work for them.

Try to avoid Loan Repayment Programs and Loan Consolidation

Try to avoid Loan Repayment Programs and Loan Consolidation

Explore Interest Rate Reductions

Explore Interest Rate Reductions

Use Tax Credits and Tax Deductions

Don’t Miss: Government Jobs For Veterans In Texas

See How Much You Could Save With A Lower Interest Rate

You might also think about refinancing your student loans for lower rates. Through refinancing, you can choose new repayment terms and potentially save money on interest.

You can check your refinancing rates with online lenders with no impact on your credit score. If you pre-qualify for a lower rate, use this calculator to see how much money that new rate would save you over the life of your loans. If the savings are significant, it might make sense to refinance.

But be careful about refinancing your federal student loans with a private lender, as doing so means sacrificing federal repayment plans and forgiveness programs.

Where The Federal Student Loan Calculator Is Useful

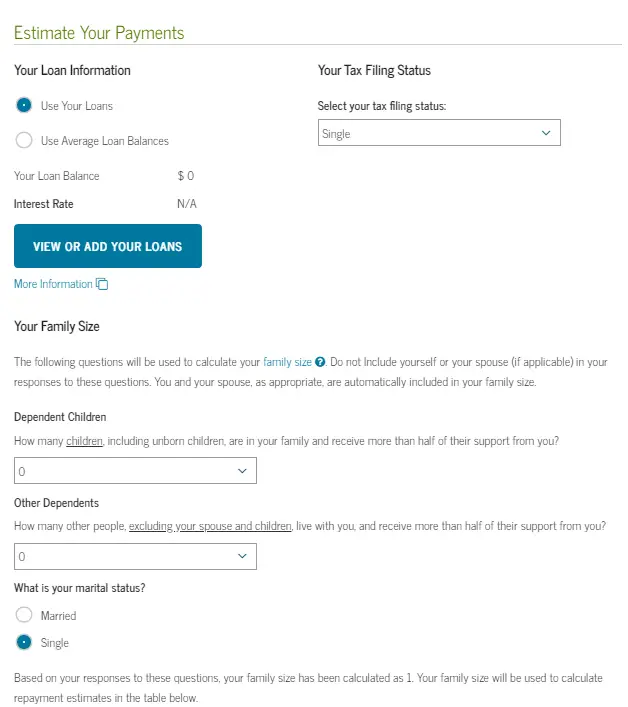

The government offers four income-driven repayment programs that base monthly payments on your disposable income and family size. You can use the federal student loan calculator to determine what your monthly payments would be with each repayment plan.

The four IDR plans are:

Good to know:

In addition to the four IDR plans, the Department of Education offers three repayment plans that are not income-driven: Standard, Graduated, and Extended.

- The Standard Repayment Plan is the default payment plan for all federal student loans. Payments are a fixed amount that ensures your loans are paid off within 10 years, or 10 to 30 years for Consolidation Loans.

- The Graduated Repayment Plan is available for all borrowers. Payments begin lower and gradually increase over time, typically every two years. This repayment plan also ensures that your loans are paid off within 10 years .

- The Extended Repayment Plan is only available to borrowers with more than $30,000 in outstanding Direct Loans. Payments may be fixed or graduated, and must be paid off within 25 years.

The Department of Education also offers a repayment program for older FFEL loans, the Income-Sensitive Repayment Plan. Under this plan, your monthly payments increase or decrease depending on your annual income and are determined by a 10-year repayment period.

Don’t Miss: Amazon Prime Government Assistance Discount

Understand Your Repayment Options

After you know who and how much you owe, and have a sense of your personal budget,it’s time to learn about your repayment options. Your repayment plan determines how much you pay each month, including what you may pay in interest,over the life of your loan.

This means that choosing a repayment plan is usually about paying as much as you can afford each month ,but not more than you can afford .

Different Loans For Different Folks

Before getting into the different types of available loan programs, lets do a quick refresher on how exactly student loans work. Like any type of loan , student loans cost some small amount to take out and they require interest and principal payments thereafter. Principal payments go toward paying back what youve borrowed, and interest payments consist of some agreed upon percentage of the amount you still owe. Typically, if you miss payments, the interest you would have had to pay is added to your total debt.

In the U.S.A., the federal government helps students pay for college by offering a number of loan programs with more favorable terms than most private loan options. Federal student loans are unique in that, while you are a student, your payments are deferredthat is, put off until later. Some types of Federal loans are subsidized and do not accumulate interest payments during this deferment period.

Recommended Reading: What Is The Fidelity Government Money Market Fund

Lender And Bonus Disclosure

All rates listed represent APR range. Commonbond: If you refinance over $100,000 through this site, $500 of the cash bonus listed above is provided directly by Student Loan Planner.

CommonBond Disclosures: Refinancing

Offered terms are subject to change and state law restriction. Loans are offered by CommonBond Lending, LLC , NMLS Consumer Access. If you are approved for a loan, the interest rate offered will depend on your credit profile, your application, the loan term selected and will be within the ranges of rates shown. If you choose to complete an application, we will conduct a hard credit pull, which may affect your credit score. All Annual Percentage Rates displayed assume borrowers enroll in auto pay and account for the 0.25% reduction in interest rate. All variable rates are based on a 1-month LIBOR assumption of 0.15% effective Jan 1, 2021 and may increase after consummation.

CommonBond Disclosures: Private, In-School Loans

Student Loan Planner® Disclosures

Commonbond Disclosures: Private In

Offered terms are subject to change and state law restriction. Loans are offered by CommonBond Lending, LLC , NMLS Consumer Access . If you are approved for a loan, the interest rate offered will depend on your credit profile, your application, the loan term selected and will be within the ranges of rates shown. If you choose to complete an application, we will conduct a hard credit pull, which may affect your credit score. All Annual Percentage Rates displayed assume borrowers enroll in auto pay and account for the 0.25% reduction in interest rate. All variable rates are based on a 1-month LIBOR assumption of 0.15% effective Jan 1, 2021 and may increase after consummation.

Recommended Reading: Government Medical Insurance For Low Income

Applying For Federal Financial Aid

The process for obtaining federal financial aid is relatively easy. You fill out a single form, the Free Application for Federal Student Aid and send it to your schools financial aid office. Then they do the rest. The FAFSA is your single gateway to Stafford loans, Perkins loans and PLUS loans. Many colleges also use it to determine your eligibility for scholarships and other options offered by your state or school, so you could qualify for even more financial aid.

There is really no reason not to complete a FAFSA. Many students believe they wont qualify for financial aid because their parents make too much money, but in reality the formula to determine eligibility considers many factors besides income. By the same token, grades and age are not considered in determining eligibility for most types of federal financial aid, so you wont be disqualified on account of a low GPA.

What Will My Repayment Schedule Be

Your repayment term, or the amount of time it takes to pay off student loans, depends on the type of loan you took out and the payoff plan you choose. Federal student loans come with a standard repayment term of 10 years, but you can opt for a 20- or 25-year term if you choose an income-driven repayment plan, which ties monthly payments to your income. Private loans often come with terms of five, 10 or 15 years.

You May Like: Us Government Jobs Entry Level