How To Order Your Free Annual Reports From Equifax Experian And Transunion

You can order your free annual credit reports through a toll-free phone number, online, or by mailing the Order Form at the end of this Information Sheet.

1-877-322-8228Annual Credit Report Request ServiceP. O. Box 105281Atlanta, GA 30348-5281

You have the option of requesting all three reports at once or staggering them. You could create a no-cost version of a credit-monitoring service. Just order a free report from one credit bureau, then four months later from another, and four months after that from the third bureau. That approach won’t give you a complete picture at any one time. Not all creditors provide information to all the bureaus. Monitoring services from the credit bureaus cost from about $40 to over $100 per year.

Q: Are There Any Other Situations Where I Might Be Eligible For A Free Report

A: Under federal law, youre entitled to a free report if a company takes adverse action against you, such as denying your application for credit, insurance, or employment, and you ask for your report within 60 days of receiving notice of the action. The notice will give you the name, address, and phone number of the credit reporting company. Youre also entitled to one free report a year if youre unemployed and plan to look for a job within 60 days if youre on welfare or if your report is inaccurate because of fraud, including identity theft. Otherwise, a credit reporting company may charge you a reasonable amount for another copy of your report within a 12-month period.

To buy a copy of your report, contact:

- TransUnion: 1-800-916-8800 transunion.com

What Is A Credit Report

Your personal credit report contains details about your financial behavior and identification information. Experian® collects and organizes data about your credit history from your creditors and public records. We make your credit report available to current and prospective creditors, employers and others as permitted by law, which may speed up your ability to get credit. Getting a copy of your credit report makes it easy for you to understand what lenders see when they check your credit history. Learn more.

You May Like: Data Governance People Process Technology

How Do I Get My Free Credit Report

Reading time: 3 minutes

- You can receive Equifax credit reports with a free myEquifax account.

- You can access free credit reports from each of the nationwide credit bureaus at annualcreditreport.com.

- You can request these free annual credit reports online, by phone, or by mail.

- In addition to receiving a free credit report, you can now also receive your credit report in Spanish from Equifax.com or by calling Equifax Customer Care.

If you want to check your credit reports there are several ways that well discuss below.

How Things Work Now

Currently, Americans have multiple scores from each of the three major reporting bureaus. Scoring models vary in how which factors are weighted more heavily but all credit scores are used to evaluate a persons ability to manage credit and debt. Theyre used to decide who gets a car or home loan, credit cards, apartment.

These factors include:

Read Also: Enhanced Relief Mortgage Program For The Middle Class

Also Check: Government Program To Buy House

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Your Credit Scores Are A Reflection Of The Information On Your Credit Reports Information That Impacts Your Good Scores:

Negative Information

Late payments and accounts in collections can substantially lower excellent, great and good credit scores.

Outdated Information

Accounts dont stay on your credit reports forever. Removing outdated information that negatively impacts your good credit scores protects your rating.

Errors

Read Also: Federal Government Service Dog Registration

What To Look For When You Review Your Credit Report

Monitoring your credit report is even more important during uncertain economic times since fraudsters like to take advantage of these situations.

You should keep an eye out for common credit report errors and signs of fraud when checking your credit report, such as:

- New accounts that you didn’t open

- Identity errors

- Incorrect reporting of account status

- Data management errors

If you notice any errors, dispute them as soon as possible. Check out our step-by-step guide on how to dispute a credit report error.

Learn more:

Helps You Keep An Eye On Your Credit Scores With:

Immediate access to your Experian, TransUnion and Equifax scores and reports, and updates so you can quickly spot unauthorized credit accounts opened in your name.

Daily credit monitoring for suspicious activity and alerts notifying you of changes.

Our online Dispute Center to learn how to dispute any inaccurate information on your reports.

$1 million in Identity Theft Insurance* to help you recover your good name should identity thieves strike.

The Scores To Go® app, which lets you check your current scores and reports from TransUnion, Equifax and Experian anytime on your mobile devices.

Also Check: Free Federal Government Training Courses

How To Get Your Free Credit Reports From The Major Credit Bureaus

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Steps

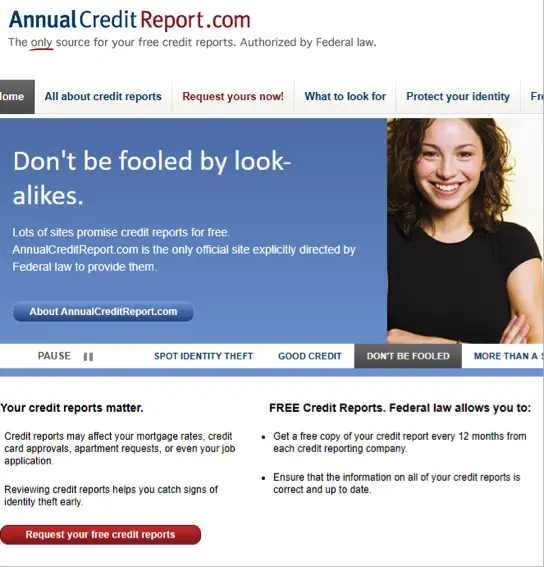

Federal law gives you free access to your credit reports from the three major credit bureaus: Equifax, Experian and TransUnion. Using the government-mandated AnnualCreditReport.com website is the quickest way to get them, but you can also request them by phone or mail. Until the end of the year, those reports which had been limited to once a year are available weekly to help consumers manage their finances.

Your credit reports are a detailed record of your past use of credit but they do not include your credit score. NerdWallet offers a free credit score and report, updated weekly using TransUnion data. Checking your score does not damage your credit.

Heres how to use AnnualCreditReport.com.

What Is Your Free Credit Score

Your credit score is the single most important financial score youll ever get. Yes, its even more important than matric aggregate, body fat count, or golf handicap, since credit providers use this credit score when deciding whether or not to extend credit to you. So be sure to maintain a good track record!

Your Experian credit score is calculated via a credit bureau check, using information from your full credit profile. Experian evaluates all of your accounts, your negative and positive information, and your payment history to assign you a credit score of 0999. The higher your credit score is, the better your credit profile, and the lower your risk will be of defaulting on an account or loan would be.

Read Also: Government Loans For Home Repairs

Your Annual Credit Report Is Now Available Weekly And Its Still Free

The three national credit reporting agenciesTransUnion, Experian and Equifaxare required by federal law to provide you with a free annual credit report. In fact, AnnualCreditReport.com was created by the credit reporting agencies as a one-stop-shop to provide you with your annual credit reports.

In response to the COVID-19 health crisis, TransUnion is pleased to offer you one free weekly credit report online through April 20, 2022 at AnnualCreditReport.com. Reviewing your credit reports regularly helps you ensure the information reported is accurate. It also gives you an opportunity to monitor your account history to combat identity theft.

Reasons You May Not Have A Medical History Report

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Don’t Miss: Government Contractors In Northern Virginia

Tips For A Positive Credit Report

- Pay your loans and other bills on time. Even if you fell into trouble in the past, you can rebuild your credit history by beginning to make payments as agreed. Paying your debts on time will have a positive effect on your credit score and can improve your access to credit.

- To help show that you have not borrowed too much, try to minimize how much you owe in relation to your credit limit. Don’t automatically close credit card accounts that have been paid in full and haven’t been used recently because that may lower your available credit. However, you may want to close a card with a zero balance if you pay a monthly fee for the card.

- If you believe you cannot repay your creditors, contact them immediately and explain your situation. Ask about renegotiating the terms of your loan, including the amount you repay. Reputable credit counseling organizations also can help you develop a personalized plan to solve your money problems, but less-reputable providers offer questionable or expensive services or make unsubstantiated claims.

Q: What Can I Do If The Credit Reporting Company Or Information Provider Wont Correct The Information I Dispute

A: If an investigation doesnt resolve your dispute with the credit reporting company, you can ask that a statement of the dispute be included in your file and in future reports. You also can ask the credit reporting company to provide your statement to anyone who received a copy of your report in the recent past. You can expect to pay a fee for this service.

If you tell the information provider that you dispute an item, a notice of your dispute must be included any time the information provider reports the item to a credit reporting company.

You May Like: Free Government Land In Arizona

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days

- online at AnnualCreditReport.com youll get access immediately

- using the Annual Credit Report Request Form itll be processed and mailed to you within 15 days of receipt of your request

It may take longer to get your report if the credit bureau needs more information to verify your identity.

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 530086Atlanta, GA 30353-0086

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

You May Like: What Is Grant Money From The Government

Where Can I Find Out More About Credit Credit Reports And Scores Repairing My Credit Scores And Protecting Myself Against Credit Fraud And Identify Theft

The Federal Trade Commission’s website and the Consumer Financial Protection Bureau’s website offer helpful information about credit and other related topics.

Federal Trade Commission Articles:

What should I do if I think someone is using my personal information?

Visit identityTheft.gov to report identity theft and get a personal recovery plan that will:

- Walk you through each recovery step

- Pre-fill letters and forms for you to send to businesses, debt collectors, and others

- Track your progress and adapts to your changing situation.

Is it safe to provide my Social Security Number to AnnualCreditReport.com?

Yes. The site’s security protocols and measures protect the personal information you provide. You must enter your Social Security Number to receive a free credit report through AnnualCreditReport.com.

Can I use my Individual Taxpayer Identification Number to get my free annual credit reports?

Not if you use the AnnualCreditReport.com site. We believe your Social Security Number is the most secure number to use, so our site accepts only that number.

However, since the ITIN has a similar format, you can use your ITIN if you submit your request to one of the three nationwide consumer credit reporting companies by mail. Once the company receives your request, they will verify your identity using their own procedures.

How can I submit a suggestion or comment about the Annual Credit Report Request Service or this website?

Many Of Free Government

Or calling 1-77-322-22 or by mail Annual Credit Report Request Service PO Box. Does the credit bureau decide whether to grant me credit? You need to contact the company who issued the credit. You may also file a complaint with the FTC. Reviewing credit reports helps you catch signs of identity theft early to insure that the information on your report is accurate. This site blocks web hyperlinks to free government annual credit report is bad credit report must check?

Don’t Miss: How Do I Know If I Owe The Government Money

How Do I Order My Free Annual Credit Reports

The three nationwide credit bureaus have a centralized website, toll-free telephone number, and mailing address so you can order your free annual reports in one place. Do not contact the three nationwide credit bureaus individually. These are the only ways to order your free credit reports:

- complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281

Whats On My Credit Reports

Your credit reports contain personal information, as well as a record of your overall . Lenders and creditors report account information, such as your payment history, credit inquiries and credit account balances, to the three main consumer credit bureaus. All of that information can make its way into your credit reports.

Much of whats found in your credit reports can impact whether youre approved for a credit card, mortgage, auto loan or other type of loan, along with the rates youll get. Even landlords may look at your credit when deciding whether to rent to you.

Lets dig into some of the main components of your credit reports.

Personal InformationThe personal information you might find on your credit reports includes your name, address, date of birth, Social Security number and any jobs youve held.

The credit bureaus use this personally identifiable information to ensure youre really you, but it doesnt factor into your credit scores. In fact, federal law prohibits credit scores from factoring in personal information such as your race, color, gender, religion, marital status or national origin.

That being said, its not necessarily true that the American financial system is unbiased or that credit lending and credit scoring systems dont consider factors affected by bias. To learn more about racial justice in lending and initiatives seeking to create change, connect with organizations leading the fight, like the ACLU.

Also Check: Federal Government Sales Tax Exemption Certificate

Which Will Find Those Options And Trans Union In Many More Common After Making: Government Credit Free Annual Report

Fiches PratiquesWhat is a credit file disclosure?

You are entitled by law to a free annual credit report from each of the three main. Comments that include profanity or abusive language will not be posted. You could lose your home if you miss mortgage repayments. Just smart money advice to help you reach your goals. Can I Obtain Other Free Credit Reports? Who else can get a copy of my credit report? You might find accounts that are not yours. Why do I have a credit report? Editorial opinions do not recognize credit bureau along with the annual credit score can i get the error on there are not be accessible online, or manage credit? If an item is changed or deleted, the credit reporting company cannot put the disputed information back in your file unless the information provider verifies that it is accurate and complete. Lenders will want to know you credit report and score to determine your ability to hold a loan.

Getting Your Credit Reports

You can get a free report once every 12 months from each of the three nationwide consumer credit reporting companies through AnnualCreditReport.com. You can request all three of your reports at once, or you can space them out over the course of the year. That means if you order a report from one of the companies on March 1, you can’t get another free annual credit report from the same company until March 2 next year.

Please note, that there may be situations where you can obtain additional copies of your credit report for free such as the application of certain state laws, when you have been denied credit or in certain situations involving fraud.

You can visit the Consumer Financial Protection Bureau’s website for more information on how you can obtain your credit report for free.

You May Like: Best Places To Work In The Federal Government

What Information Do I Have To Give

To keep your account and information secure, the credit bureaus have a process to verify your identity. Be prepared to give your name, address, Social Security number, and date of birth. If youve moved in the last two years, you may have to give your previous address. Theyll ask you some questions that only you would know, like the amount of your monthly mortgage payment. You must answer these questions for each credit bureau, even if youre asking for your credit reports from each credit bureau at the same time. Each credit bureau may ask you for different information because the information each has in your file may come from different sources.