What Financial Help Is Available For Home Repairs

Home improvement loan programs help with home repairs and modifications. They are the most common type of government financial assistance for home improvements. Some programs are available nationwide, while others are only available at the state or county level.

Find Loans and Other Incentives

- Learn about the HUD Title 1 Property Improvement Loan program. Loan amount and repayment terms are limited based on the type of property.

- Find out about the 203 Rehabilitation Mortgage Insurance Program. It lets homebuyers and homeowners borrow an extra $35,000 through their mortgage for home repairs and improvements.

- For programs in your community, contact:

We Know Government Loans

FedHome Loan Centers specializes in delivering advantageous government loan products and in providing solutions for customers seeking flexible credit qualifying requirements with low out-of-pocket costs. Today, the best loan products for someone with perfect or even bad credit are government insured home loans.

Government backed loans make it easier to qualify and with less money down . VA and USDA loans are the only opportunities currently available to buy a home with zero down. Conforming mortgage loans made by private institutions now typically require from 20 30% down and do not accept borrowers with bad credit.

Along with our sister websites, VA Home Loan Centers , Coole Real Estate and Coole Mortgage we offer a full spectrum of real estate services including: innovative sales and marketing methods, affordable financing options and successful sellers assistance programs. All of our valuable services are offered at a low cost or even at no out of pocket cost to the consumer whenever possible.

FedHome Loan Centers Agents and Loan Specialists are committed to customer satisfaction. Our highest priority is to help our clients to make wise, informed and affordable financial decisions that will enhance their homeownership experience and create a secure and sustainable lifestyle for years to come.

Contact FedHome Loan Centers today to connect with a knowledgeable Loan Specialist. Your Agent will skillfully advise you with your loan government loan decisions.

Why Do Bad Credit Personal Loans Have High Fees And Interests Rates

The first thing you need to be aware of with bad credit personal loans is that they are very expensive. The reason for this is due to the fact that people with poor credit default on their loan payments far more often than those with good credit. So lenders view anyone with poor credit as a big risk. Because of this, they charge high interest rates and upfront fees to compensate for their higher losses and to ensure they get the most out of someone before they default on their payments. This may not be fair, but that’s often the way it’s done.

Recommended Reading: Contracting Vehicles For Government Contracts

Does The Government Offer Home Loans For Senior Citizens

The government-insured Home Equity Conversion Mortgage is a common reverse mortgage option for senior citizens above the age of 62. The HECM allows homeowners to convert their homes equity into cash to pay off their existing mortgage. In addition to other eligibility factors, the Department of Housing and Urban Development requires borrowers to complete a HUD-approved reverse mortgage counseling session.

Rocket Mortgage does not currently offer HECMs.

Can A Personal Loan Repair My Poor Credit Rating

You should also recognize that getting a bad credit personal loan – whether it’s secured or unsecured – wont fix your payment history. It took time for your credit rating to fall, and it will take a lot longer for it to go up again. One loan wont magically fix it however, time and managing your money better will help your poor credit rating recover. Thats the great thing about the credit rating system in Canada – it recognizes that bad things can happen to good people. So you can fix your credit and avoid personal loans with high fees and bad credit interest rates by managing your money and situation better.

Related: How to Repair Your Credit Score and Improve Bad Credit.

You May Like: What Are Swift Trucks Governed At

Tips For Buying A House With A Low Income

- Improve your credit profile ahead of time. Review your credit reports and dispute any errors you find. Pay all of your accounts on time and lower your credit usage to below 30% of your available limit. This may help improve your credit score before you apply for a mortgage.

- Increase your income or lower your DTI ratio. If you have the time, pick up a side hustle to increase your income to save up for closing costs and a down payment. You should also pay down your outstanding debt, especially credit card balances, which can help lower your debt-to-income ratio.

- Get a mortgage preapproval. Home sellers are likely to take you seriously if you have a mortgage preapproval when you put in an purchase offer. A preapproval tells you how much a lender might be willing to lend you, based on a review of your overall financial picture.

- Choose your real estate agent wisely. Focus on finding a real estate agent who is knowledgeable about local housing conditions, as well as local and national homebuying programs for low-income borrowers.

- Look for homebuying assistance programs. Check with your states housing finance agency for available homebuying assistance programs, including grants or loans to help cover your down payment or closing costs.

Stay Away From Hard Credit Inquiries

While getting an insurance quote wont affect your credit score, applying for any type of new credit will. Having too many hard inquiries on your credit is not a good thing.

When applying for any type of financial transaction that requires a credit pull, always check if its a hard or soft pull. Avoid doing anything requiring a hard pull close to when you apply for a mortgage.

Also Check: What Is The Government Mileage Reimbursement Rate

What Happens When You Apply For Credit

Whenever your business applies for any kind of credit a loan, a credit card, a mortgage or vehicle finance, for example the lender requests your credit report from a credit reference agency .

CRAs are organisations that maintain information about the credit youve held and/or applied for over time.

Lenders use that information to decide whether to grant you credit and, if so, how much and on what terms.

In the UK, the three main CRAs are Experian, TransUnion and Equifax. They collect data on your businesss credit history and put it into a credit report that they update every month and hold for six years.

They look at public data about your company to determine its net worth and whether it holds a healthy amount of cash.

The CRAs have numerical scales that they use to give your business a credit score. They typically group scores into categories such as excellent, good, fair, poor and very poor.

What Term Can I Borrow Over

Terms depend on the product type you choose. For example, term loans and asset finance facilities are available for up to six years, but overdrafts and invoice finance available for up to three years. Thats why its important to research your financial options carefully, if term length is important to you, you should consider a loan product that enables you to pay over a longer-term.

Donât Miss: Can I Get A Replacement Safelink Phone

You May Like: T Mobile Discounts For Government Employees

Best Mortgage Lenders Of 2022 For Low Or Bad Credit Score Borrowers

A home loan with bad credit is possible, even if youre a first-time home buyer. These low credit score mortgage lenders specialize in serving borrowers with credit challenges.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Your credit score tells lenders how likely you are to pay back the money you borrow. A high score sends all the right signals, while a low credit score, sometimes referred to as bad credit, can keep you from getting approved. When it comes to buying a home, a bad credit score generally falls below 620.

The depends on the type of loan. Government-backed loan programs FHA, VA and USDA generally have lower credit score requirements than conventional mortgages. But its the lender that ultimately decides what the minimum credit score will be for each loan product.

Lenders consider more than just credit score when evaluating a mortgage applicant. If your is at or near a lender’s minimum, they could demand a bigger down payment, charge a higher interest rate or require you to pay more fees. In short, you could end up paying more for your home loan. The best way to avoid these penalties is to elevate your credit score before you apply.

First Time Home Buyers With Bad Credit

First time home buyers often have bad credit due to other credit events in their lives. As a first time home buyer, it will be extremely difficult for you to qualify for a conventional loan if you have bad credit.

Some of the other government loans such as VA or USDA are not as forgiving as FHA loans. Most lenders require a FICO score of 620 for those loan programs. Plus, you also would need to be a veteran or live in a rural area to qualify.

If you are a first time home buyer and have bad credit combined with a low down payment, a low credit score FHA loan may be the best option for you.

You May Like: Free Small Business Government Grant Application

Va Mortgage: The Cheapest Monthly Mortgage Payments

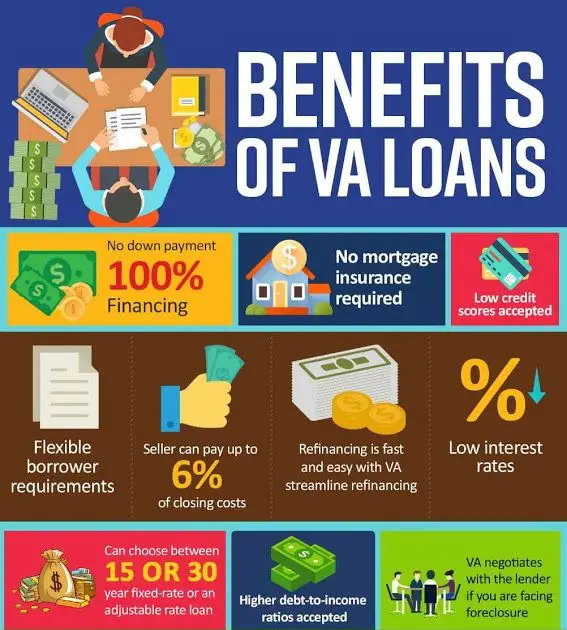

If you have military experience, the VA mortgage should be the first low-income mortgage option you check out. It requires zero down payment and the seller can pay all or most of your closing costs.

Theres no monthly mortgage insurance and that can save you hundreds per month. No mortgage insurance means you can buy more home with less monthly income compared to other loan types.

And, VA loans are more lenient on debt ratio and credit score requirements. Many low-income individuals and families have used a VA loan to buy their first home.

To be eligible, you must have US military service experience of at least

- 90 days or more in wartime if currently on active duty

- 181 days or more in peacetime

- 24 months or the full period for which you were ordered, if now separated from service.

- 6 years, if in the National Guard or Reserves

If you are eligible, you could be very close to owning your own home despite currently being on a low income.

Check Your Credit Report For Errors

If youve never applied for a mortgage, you have never seen your mortgage credit report, and more than one-third of credit reports contain errors.

You can preview your report before you apply from AnnualCreditReport.com. You can also get your mortgage credit report as part of an online mortgage pre-approval.

Get pre-approved with Homebuyer.com to check your credit report.

Errors are pervasive for renters whove changed residences a lot, people who pay or defer on student loans, and men and women who have changed their legal names.

Recommended Reading: Where Do You Find Government Contracts To Bid On

Can I Get A Mortgage With Poor Credit

Consumers with poor credit can access mortgage loans but may have to pay higher interest rates. Many mortgage lenders tolerate less than perfect credit, but only up to a point.

Federally sourced or guaranteed mortgages generally accept lower scores than do private ones.

Private lenders also offer mortgages for folks with bad credit. Some have features unavailable from federal loans, including 100% financing , seller contributions, no income limits, and no mortgage insurance requirement.

When shopping for a bad credit mortgage, keep a few things in mind:

- Minimum credit scores vary among lenders.

- You must generally be two or more years past bankruptcy and three years from a home foreclosure.

- You wont be eligible if you owe back taxes to the IRS or are behind on your student loan payments.

Less than perfect credit, especially with outstanding debt, can limit the loan amount even the best mortgage lender will offer you. If your home shopping can wait, you can use the time to raise your low credit score by paying your bills on time and reducing your debt. Doing so will broaden your mortgage options and may lower the mortgage rate youll have to pay.

Down Payment Assistance Programs

The money you put “down” or the down payment on your home loan can be one of the largest hurdles for many first-time homebuyers. That’s why CalHFA offers several options for down payment and closing cost assistance. This type of assistance is often called a second or subordinate loan. CalHFA’s subordinate loans are “silent seconds”, meaning payments on this loan are deferred so you do not have to make a payment on this assistance until your home is sold, refinanced or paid in full. This helps to keep your monthly mortgage payment affordable.

MyHome Assistance Program CalHFA Government Loans : MyHome offers a deferred-payment junior loan of an amount up to the lesser of 3.5% of the purchase price or appraised value to assist with down payment and/or closing costs.

CalHFA Conventional Loans: MyHome offers a deferred-payment junior loan of an amount up to the lesser of 3% of the purchase price or appraised value to assist with down payment and/or closing costs.

Forgivable Equity Builder Loan Home equity has proven to be one of the strongest ways for families to build and pass on intergenerational wealth and CalHFA is committed to improving equitable access to homeownership for all Californians. The Forgivable Equity Builder Loan gives first-time homebuyers a head start on this with immediate equity in their homes via a loan that is forgivable if the borrower continuously occupies the home as their primary residence for five years.

Recommended Reading: Sap Data Governance Best Practices

Fha Loan: A Great Mortgage Option For Lower Incomes

Youve probably already heard of the FHA loan program. Its another government-backed loan type that helps low-income individuals purchase a home. Here are the highlights of this program:

- 3.5% down payment

- The seller can pay all or most of your closing costs

- Allows lower credit scores than conventional financing

As a low-income home buyer, here are some additional features of an FHA loan that you will be interested in:

- The 3.5% down payment can come from down payment gift money.

- FHA has more lenient debt ratio requirements than conventional financing, meaning you might qualify with a lower income.

- FHA does not require you to have the extra money in the bank after closing the loan.

- You can use a co-signer .

FHA is designed with low-income families in mind. It has helped millions break into homeownership despite traditional barriers.

Good Neighbor Next Door Homes Discounted 50% Just A $100 Down Payment Needed

The Good Neighbor Next Door program is a special loan type offered by the US Department of Housing and Urban Development . It allows law enforcement officers, teachers and emergency personnel to buy homes at a 50% discount!

Heres how it works. You find a home on HUDs GNND website and make an offer. If more than one person submits an offer, a random lottery is held to see whose offer is accepted.

If you are selected, you must prove that you are an approved type of public worker.

HUD establishes a silent second mortgage for 50% of the listed price. But if you live in the home for a full 3 years, that debt is erased!

You can use various types of financing for this program. But if you use FHA, your down payment requirement is only $100.

If you meet the above criteria, this is a perfect low-income mortgage option. After all, you only have to make payments on 50% of the homes purchase price. Contact one of our loan professionals here to check interest rates and get started.

You May Like: How Are Governments Using Blockchain Technology

What Help Is Available For My Home Energy Bill

The Low Income Home Energy Assistance Program may be able to help with:

- Assistance to pay your heating or cooling bills

- Emergency services in cases of energy crisis, such as utility shutoffs

- Low-cost home improvements, known as weatherization, that make your home more energy efficient and lower your utility bills.

LIHEAP funds may not be used to pay water and sewer bills.

Why Apply For A Government

Government-backed loans are advantageous in that the risk to the lender is reduced, therefore they can approve more applications. Depending on the loan scheme, it may also come with features or benefits that you dont normally see with other loan products.

The UK Government has offered several different types of business loan over recent years, including:

- Low interest loans

- Government-guaranteed loans

Finance under the Recovery Loan Scheme is currently available in the form of term loans, overdrafts, invoice financing and asset financing.

Some government-backed funding programs run indefinitely while others, such as the recent coronavirus loan schemes, are open for a fixed period.

Check your eligibility for a Funding Circle business loan in 30 seconds without affecting your credit score.

Recommended Reading: Government Help To Purchase A Home

What Else Do I Need To Know Before Starting A Home Repair

Tips for Hiring a Contractor

Finding a good contractor to do repairs and improvements to your home is important. Before hiring a contractor, get tips from the Federal Trade Commission on avoiding home improvement scams. Also, find out how you can report a problem, if you encounter any issues with work you’ve had done on your home.

Watch Out for Utility Lines Before You Dig – Call 811

Before digging on your property, . Utilities will come out to mark the area to help you avoid damaging or being injured by underground utility lines. The timing for processing your request differs from state to state. Some states allow for an online digging request.