Open Market Operations In The United States

The Federal Reserve implements monetary policy largely by targeting the federal funds rate. This is the rate that banks charge each other for overnight loans of federal funds, which are the reserves held by banks at the Fed.Open market operations are one tool within monetary policy implemented by the Federal Reserve to steer short-term interest rates using the power to buy and sell treasury securities.

Interest On The National Debt And How It Affects You

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

The interest on the national debt is how much the federal government must pay on outstanding public debt each year. The interest on the public debt for fiscal year 2021 is estimated to be $413 billion, according to the Congressional Budget Office .

The intragovernmental debt is what the government owes the Social Security Trust Fund and other federal agencies. It’s not part of the public debt and doesn’t impact the interest on the debt. That’s because it’s money the government owes itself.

How Is It Calculated

When the federal government uses Treasury bills as loans, the interest rate associated with these bills varies. The amount of the bill and when it was issued are factors that contribute to the interest rate associated with the debt. Interest rates are set based on demand in the market, so these rates may differ from one bill to the next, depending on when the government took on this debt.

When theres a big demand for Treasury bills, the interest rate is generally low. However, when the demand is low, the interest rate increases and the federal government owes more interest on these bills. To calculate the federal governments current interest rate, you would need to separate all these debts and their respective interest rates, then add up these calculations.

Recommended Reading: Are There Government Grants For Home Repair

Bonds And Interest Rates

When it comes to how interest rates affect bond prices, there are three cardinal rules:

Interest rate changes are among the most significant factors affecting bond return.

To find out why, we need to start with the bond’s coupon. This is the interest the bond pays out. How does that original coupon rate get established? One of the key determinants is the federal funds rate, which is the prevailing interest rate that banks with excess reserves at a Federal Reserve district bank charge other banks that need overnight loans. The Fed sets a target for the federal funds rate and maintains that target interest rate by buying and selling U.S. Treasury securities.

When the Fed buys securities, bank reserves rise, and the federal funds rate tends to fall. When the Fed sells securities, bank reserves fall, and the federal funds rate tends to rise. While the Fed doesn’t directly control this rate, it effectively controls it through the buying and selling of securities. The federal funds rate, in turn, influences interest rates throughout the country, including bond coupon rates.

Cost Of Security For Debts

General application of interest: departments may seek security for debts due to the Crown to mitigate the risks of non-repayment of a receivable. As part of the management of security for debts, departments may incur costs such as those related to the appraisal, registration or realization of a security. Unless legal counsel advises that it is prohibited by law, the appraisal, registration, realization and any associated legal costs should be charged with interest to the debtor. The interest should be calculated from the time the costs are incurred until they have been recovered.

Legal consultation: to provide authority for charging interest and to avoid disputes and litigation, the guidance of legal counsel should be sought to ensure that these considerations are reflected in the documents that establish the debt and the security.

Also Check: Government Grants For Trucking School

Overpayments Or Erroneous Payments

General application of interest: in accordance with section 155.1 of the FAA and the regulations, interest is payable to the Crown on any amount owed resulting from an overpayment or an erroneous payment that is not received by the due date.

Example A department paid a supplier twice for the same invoice . The amount paid in excess must be collected. The department issues a demand for repayment to the supplier and specifies a due date. Interest will be payable by the supplier if the repayment is not received by the department by the due date specified on the demand.

Repayment arrangement: when an overpayment or erroneous payment occurs, arrangements will be made for repayment and departments will charge interest only when repayment is overdue.

Fraud and other offences: under the regulations, when departments make overpayments or erroneous payments as a result of fraud, falsification, willful misrepresentation or any other offence, these payments will incur interest charges from the date on which the overpayment or erroneous payment is made.

Salary overpayment: interest may be charged on amounts due resulting from overpayments or erroneous payments to employees of salaries, wages, benefits and allowances when a repayment is not received by the due date in the agreed-upon repayment schedule, where one exists. If no repayment schedule exists, then interest accrues as of the due date of the full amount.

Calculating The Upfront Costs Of Renting Vs Buying

How the Federal Reserve affects mortgage rates and how rising interest rates affect home prices are just part of the puzzle for renters. The upfront costs are another. When debating whether to rent or buy, there are several expenses to keep in mind. One of the biggest is your down payment.

Staley says renters shouldnt assume theyre locked out of buying if they cant afford to put 20 percent down.

If youre looking to put 20 percent down on a $200,000 home, youd need to save $40,000, Staley says. That could be a hard target for some buyers to hit, but there are mortgages available that offer much lower down payment requirements. For example:

- FHA loans: These are backed by the Federal Housing Administration and allow qualified buyers to purchase a home with as little as 3.5 percent down.

- USDA loans: The U.S. Department of Agriculture offers mortgage loans that require no down payment at all. These loans are available to eligible buyers who purchase qualified properties in rural areas.

- VA loans: This is another no down payment mortgage option thats designed for qualifying veterans.

If you opt for one of these loan options, remember that you may still be responsible for paying closing costs, which can run between 2 and 5 percent of the homes purchase price, according to Zillow.

Don’t Miss: Government Grants For Higher Education

Look At The Big Picture Before Making A Move

If how rising interest rates affect home prices is a concern, its also important to consider your short- and long-term plans and how they may affect your bottom line.

Renters who intend to stay in the same home for a long time should buy, rather than rent, Davis says.

Davis says theres an immediate loss associated with the closing costs buyers pay upfront but that loss is regained as equity increases. Someone who buys a home and then sells it a year later because theyre relocating for a new job has less opportunity to recover that initial loss.

On the other hand, renting could be the better option for the long term in certain situations. If your job isnt as stable as youd like it to be and youre concerned about keeping up with your mortgage payments, renting may create less pressure financially. Renting long term could also make more sense if youd like to build up a bigger down payment.

Thinking about the type of lifestyle that appeals to you most can be helpful in guiding your decision.

Owning a home has many rewards, Prasky says. Its a place you can call your own, there may be tax breaks and its an investment for your future, but it comes with a lot of responsibility. If you dont mind yard work and upkeep, then buying might be the right option.

NMLS ID 684042

Check your inbox for a welcome email with financial tips to get you started, and look for our Modern Money newsletter each quarter.

When Do The Regulations Not Apply

Figure 3 below summarizes circumstances when the regulations do not apply.

Figure 3: When do the regulations not apply?

The regulations do not apply to interdepartmental transactions, amounts owed by departments and Crown corporations receivables.

Section 155.1 of the FAA, under which the regulations are made applies unless another act of Parliament, or any regulation, order, contract, or arrangement states otherwise.

Interdepartmental transactions: the regulations do not apply to interdepartmental receivables. Any amounts owing by another department are not subject to interest and administrative charges.

Amounts owed by departments: the regulations do not apply when a department owes amounts to third parties, such as for the late payment of invoices from suppliers or for the late or non-payment of salaries to employees. Another authority is required for the federal government to pay interest on overdue accounts such as an authority provided under a Treasury Board policy or directive .

Crown corporations receivables: the regulations do not apply to amounts owed to a Crown corporation, as stated in paragraph 3 of the regulations.

Recommended Reading: Government Assistance For Stay At Home Moms

Provision Of Goods Services Or The Use Of Facilities

General application of interest: although departments are to minimize receivables in program design, certain types of goods, services, or uses of facilities may be provided on credit. Overdue accounts related to these receivables are subject to the regulations, and interest accrues starting on the due date specified in a demand for payment or included in any terms and conditions for the provision of the goods, services or the use of facilities.

Compound Interest And Savings Accounts

When you save money using a savings account, compound interest is favorable. The interest earned on these accounts is compounded and is compensation to the account holder for allowing the bank to use the deposited funds.

If, for example, you deposit $500,000 into a high-yield savings account, the bank can take $300,000 of these funds to use as a mortgage loan. To compensate you, the bank pays 1% interest into the account annually. So, while the bank is taking 4% from the borrower, it is giving 1% to the account holder, netting it 3% in interest. In effect, savers lend the bank money which, in turn, provides funds to borrowers in return for interest.

The snowballing effect of compounding interest rates, even when rates are at rock bottom, can help you build wealth over time Investopedia Academy’s Personal Finance for Grads course teaches how to grow a nest egg and make wealth last.

You May Like: How To Apply For A House From Government

Interest Rates And Tax Rates

On March 25, 2020, the Ontario government announced a fivemonth relief period for Ontario businesses who are unable to file or remit select provincial taxes on time, due to the special circumstances caused by the coronavirus in Ontario. Beginning April 1, 2020, penalties and interest will not apply to Ontario businesses that miss any filing or remittance deadline under select provincial taxes. Learn more.

Ontario’s tax system funds public services such as roads and highways, health care, hospitals, education, social services and provincial parks.

Government Bonds With High Interest Rates

Before we get started, let me clarify that this article is not intended to provide any kind of investment advice. Any investment is potentially risky, and investing in government debt typically based in random foreign currencies can be especially risky even for experienced investors.

Basically, any decision you make with this information is yours alone and youre responsible for the consequences of your own investments.

With that said, here are the worlds highest yielding government bonds as of September 2018.

Argentinas peso appears to once again be headed for financial ruin

Also Check: Can I Qualify For Government Assistance

How Much Of The Federal Budget Goes To Interest On The National Debt

When the federal budget is created, the interest on national debt is taken into consideration. This interest must be addressed in the budget to ensure the federal government is still considered a credible and trustworthy borrower with outside entities.

The amount of the federal budget that goes to interest on the national debt depends on the current interest rates on Treasury bills. Since this interest rate varies, so does the percentage of the budget thats applied to interest on the national debt. For example, by the end of 2010, public debt was over $9 trillion and 10-year Treasury bill interest rates averaged 3.21%. The government set aside 5.7% of the federal budget to pay for the interest on the national debt.

By the close of 2020, the interest rate on a 10-year Treasury bill is expected to be at 0.6%. In April 2020, the U.S. public debt was $24.97 trillion. The government plans to set aside 8.7% of federal spending in 2020 to cover the interest on the national debt. As the years go by, the interest on public debt continues to increase, so the percentage of the federal budget thats used to cover this interest also increases.

Where To Find Economic Indicators

Smart bond investors pay close attention to key or “leading” economic indicators, primarily watching for any potential impact they may have on inflation and, because there is a close correlation, interest rates. Various branches of the federal government keep tabs on many, but not all, of these leading indicators. Here are a few useful online resources:

Don’t Miss: Government Jobs That Train You

The Effects Of Declining Interest Rates

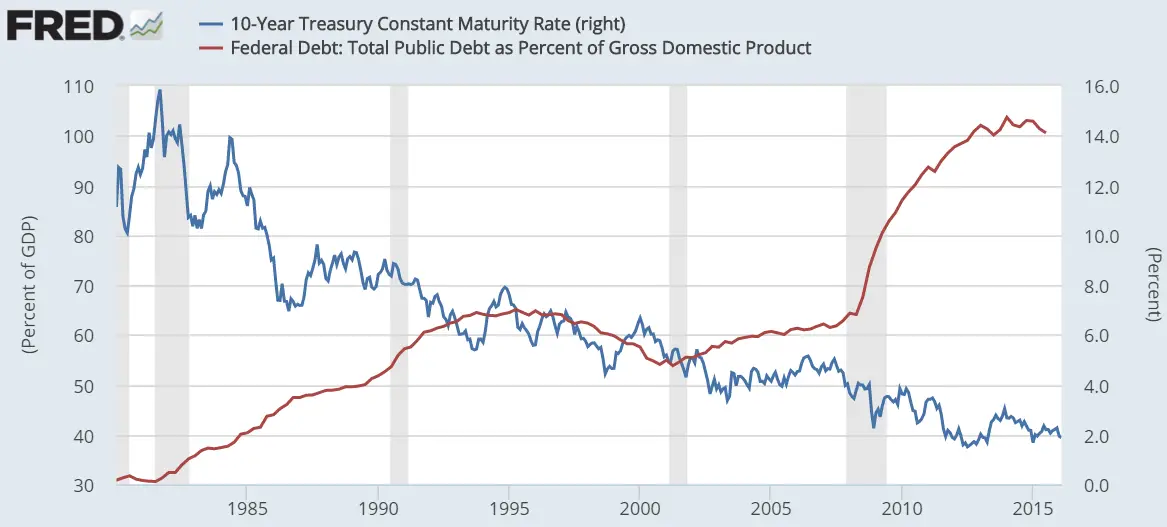

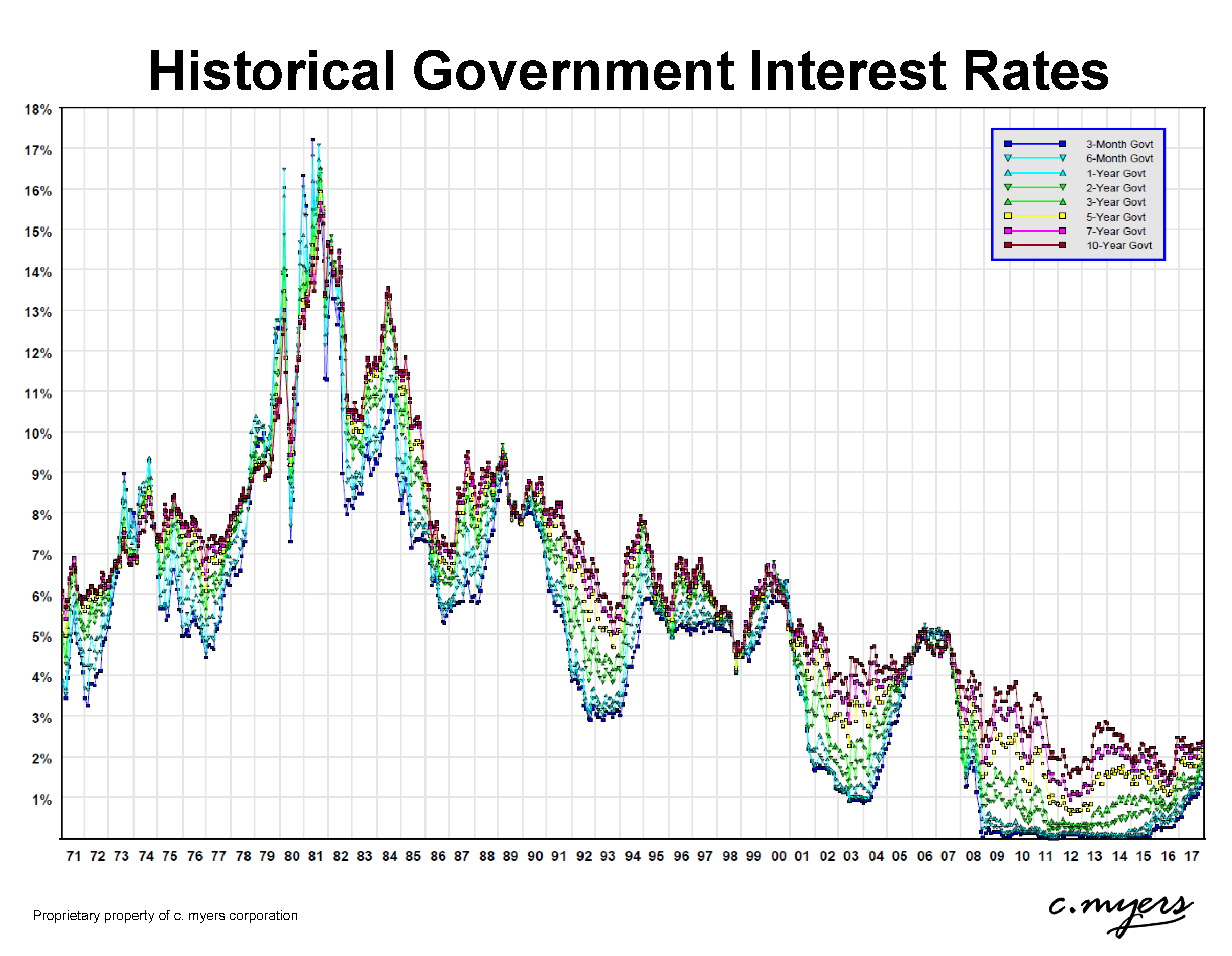

Interest rates on Treasury securities have fallen to historically low levels, allowing net outlays for interest to remain low relative to gross domestic product even as debt held by the public has surged in the past few years to its highest level relative to GDP since the 1940s.2 For example, rates on 3-month Treasury bills declined from an average of almost 5 percent in 2007 to a low of just 0.03 percent in 2015 those rates averaged 0.7 percent in fiscal year 2020. Similarly, rates on 10-year Treasury notes have dropped from an average of close to 5 percent in 2007 to an unprecedented low of 1.1 percent in 2020. As a result, despite the dramatic increase in debt held by the publicfrom 35 percent of GDP at the end of 2007 to 100 percent at the end of 2020net interest as a percentage of GDP fell from 1.7 percent in 2007 to 1.2 percent in 2015 before rising to 1.8 percent in 2019 . Although the debt increased significantly in 2020, net interest outlays declined both in dollars and as a percentage of GDP last year.

How The Government Reduces Interest

When interest on national debt gets out of control, there are a few ways the government can reduce it, such as:

- Lowering the interest rate: The Federal Reserve has the power to lower interest rates but this is only done in extreme circumstances when all economic factors are in line.

- Raising taxes: The federal government can increase the revenue it has to address interest by raising taxes and reducing tax cuts available to U.S. taxpayers.

- Slowing spending: Interest on debt increases as the debt increases. When the government slows its spending, the interest on public debt wont increase as quickly.

- Reconfiguring the federal budget: In addition to reducing the budget, the federal government may also focus its spending more on programs that promote economic growth, such as job creation. This stimulates the economy and may lead to lower interest rates.

Interest on the national debt continues to increase as public debt increases. The interest is addressed with a percentage of the federal budget. The rising interest on national debt has an impact on U.S. citizens because it takes away from other programs and threatens Social Security program funding.

Image Source

Don’t Miss: Us Federal Government Registration Sam System For Award Management

Interest Rates And Discrimination

Despite laws, such as the Equal Credit Opportunity Act , that prohibit discriminatory lending practices, systemic racism prevails in the U.S. Homebuyers in predominantly Black communities are offered mortgages with higher rates than homebuyers in white communities, according to a Realtor.com report published in July 2020. Its analysis of 2018 and 2019 mortgage data found that the higher rates added almost $10,000 of interest over the life of a typical 30-year fixed-rate loan.

In July 2020, the Consumer Financial Protection Bureau , which enforces the ECOA, issued a Request for Information seeking public comments to identify opportunities for improving what ECOA does to ensure nondiscriminatory access to credit. Clear standards help protect African Americans and other minorities, but the CFPB must back them up with action to make sure lenders and others follow the law, stated Kathleen L. Kraninger, director of the agency.

Borrower’s Cost Of Debt

While interest rates represent interest income to the lender, they constitute a cost of debt to the borrower. Companies weigh the cost of borrowing against the cost of equity, such as dividend payments, to determine which source of funding will be the least expensive. Since most companies fund their capital by either taking on debt and/or issuing equity, the cost of the capital is evaluated to achieve an optimal capital structure.

You May Like: Federal Government Pro Bono Program