Solar Tax Credit Impacts

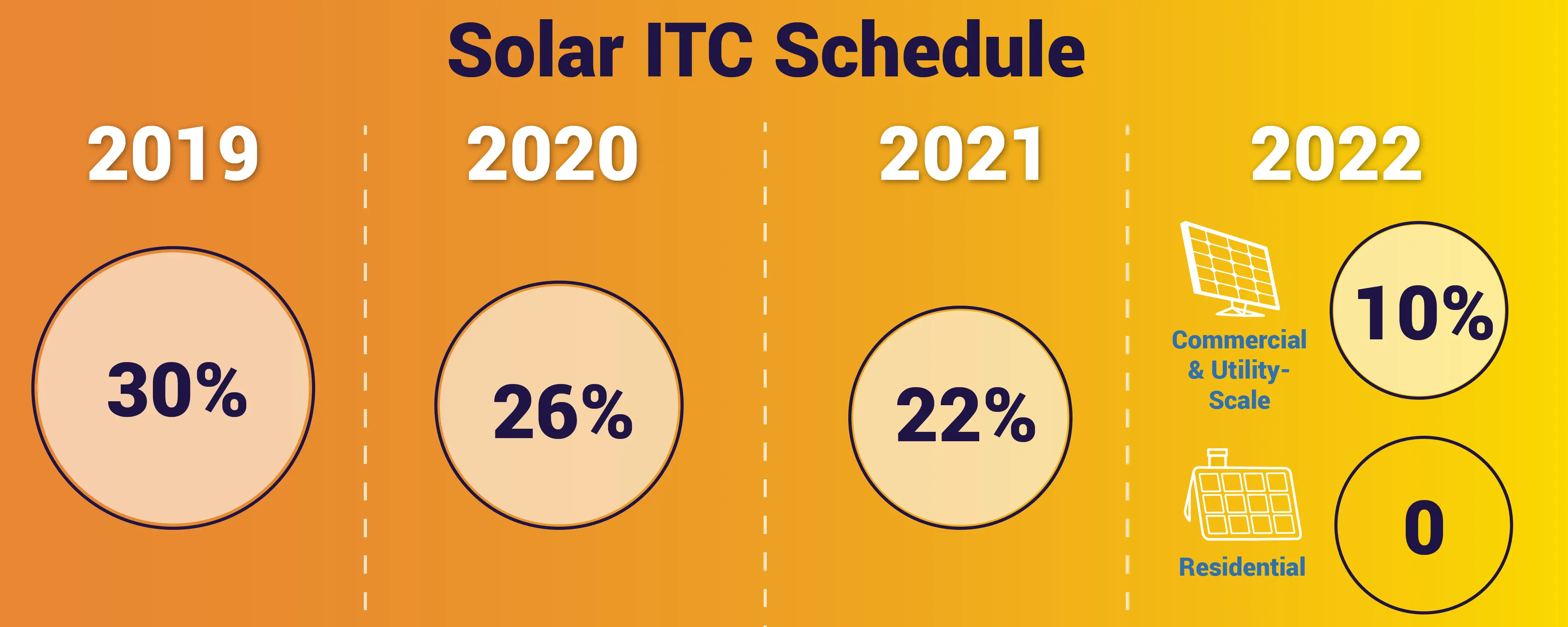

According to a summary shared by Sen. Schumers office, the two-year extension of the federal Investment Tax Credit for solar projects will retain the current 26 percent credit for projects that begin construction through the end of 2022, rather than expiring at the end of 2020 as they would have under existing law. The ITC will fall to a 22 percent rate for projects that begin construction by the end of 2023, and then fall to 10 percent for large-scale solar projects and to zero percent for small scale solar projects in 2024.

Many of the large-scale solar development set to be completed through 2023 have used “safe-harbor” provisions to secure the original 30 percent ITC credit, removing the risk of seeing project financing disrupted by a reduction in the tax credits, Manghani noted.

But a two-year extension is a much better outcome than the industry had expected, Manghani said. It will provide significant upside to solar growth in 2022 through 2025, as more projects can secure the 26 percent and 22 percent credits through “commence-construction” or “safe-harboring” provisions by 2023.

Whats more, the bill provides the industry a full extra year to negotiate longer-term tax credits or tie renewables directly with future carbon policies with the friendly Biden administration, Manghani noted. Utility-scale solar power is already cost-competitive against coal-fired power across the world and with natural-gas-fired power in many markets.

Freedom Solar Is An Installer You Can Trust

A solar panel installation is a big project, and its important to know that youre working with a reliable and reputable team. Whether youre an average homeowner or a large business such as Whole Foods or Office Depot, Freedom Solar is dedicated to making our clients switch to solar power an easy and affordable transition.

So if youre thinking about going solar, ready to make the switch to a lifetime of green energy, or interested in reducing your tax burden by lowering your electric bill, were here to help you begin the journey with our 7 Steps to Solar process.

Well find every available financial incentive, practice COVID-19-conscious installation methods, and offer lifetime service and monitoring to meet your needs! Take a look at what our customers say on how we deliver on our promises. Contact us to request a free, no-obligation virtual consultation with one of our energy consultants or, if youd like to learn more about the ITC, visit Energy Sage and the Solar Energy Industries Association .

Frequently Asked Questions: Federal Solar Tax Credit

Will I get a tax refund if the solar investment tax credit exceeds my tax liability?

No, the federal solar ITC is a nonrefundable tax credit. However, if you do not use all of your tax credit, you can carry over the unused amount to the following year.

Can I use the federal solar tax credit against the alternative minimum tax?

Yes, you can use your solar tax credit either against the federal income tax or against the alternative minimum tax.

Will there be another federal solar tax incentive after the current one expires?

A new solar tax credit would require an act of Congress. While it is certainly possible, it isn’t something that can be predicted with any certainty.

Can I claim the credit if I’m not a homeowner?

Yes, but only under specific circumstances. Specifically, you must be either a tenant-stockholder at a cooperative housing corporation or a member of a condominium complex to claim the federal solar tax credit.

Can I claim the credit if I am not connected to the grid?

You do not have to be connected to the electric grid to claim the solar tax credit. You only need to have a solar power system that’s generating electricity for your home.

Can I claim the credit if my solar panels are not installed on my roof, but on the ground on my property?

Yes. The solar panels do not have to be installed on the roof in order for you to claim the tax credit, just so long as they are generating solar energy for your home.

Also Check: Government Grants To Start Trucking Business

The Florida Renewable Energy Technologies And Energy Efficiency Act

The 2006 Florida Renewable Energy Technologies and Energy Efficiency Act, signed into law on June 19, 2006, provides consumers with rebates and tax credits for photovoltaic systems.

The purchase of photovoltaic systems covered under the Florida Renewable Energy Technologies and Energy Efficiency Act qualifies the consumer to receive a substantial rebate. The rebate is based on the manufacturers power output rating of the modules. The amount is $4.00 per Watt with a cap of $20,000 for residential photovoltaic systems and a $100,000 cap for commercial, publicly owned, or private not-for-profit photovoltaic systems.

Is The Solar Energy Tax Credit Refundable

The ITC is a nonrefundable credit. However, according to Section 48 in the Internal Revenue Code, the credit can be carried back one year, or carried forward in the next 20 years.

Therefore, if you dont have a tax liability this year, but you had one last year, youll still be able to claim your credit or if you dont have one this year but will at one point in the next two decades, your credit will still be available for claiming.

Also Check: City Of Las Vegas Government Jobs

How Do I Use The Tax Credit To Pay Down My Loan

Mosaics solar loan programs are built to be flexible, simple and affordable and, in the case of CHOICE loans, the monthly payments are specifically structured with the federal tax credit in mind. However, whether you opt for a CHOICE or a PLUS loan, you have the option of reducing your monthly loan payments by using your federal tax credit or your own savings. Heres how it works:

CHOICE: Mosaics CHOICE loan product is structured with the federal tax credit in mind, with lower monthly payments you can lock in by applying the full amount of your credit. Heres how it works:

- If you make the voluntary CHOICE prepayment before the end of month 18, it can reduce your monthly payment beginning in month 19

- The earlier the CHOICE payment is applied, the lower future payments will be

- If you pay down your loan by less than the specified CHOICE target loan balance, your monthly payment goes up

Its your CHOICE!

PLUS: Mosaics PLUS loan product which can be used to finance other home improvements, in addition to solar and batteries has monthly payments that do not assume the use of the federal tax credit. However, if you opt to use either the tax credit or personal savings to make voluntary prepayments to reduce your loan principal in the first 18 months, your monthly payments will be reduced for the remainder of the loan term just like CHOICE. However, unlike CHOICE, if you choose to not make any extra pre-payments, your monthly payments will not increase.

Logo

How Does The Solar Tax Credit Work In 2021

The federal solar tax credit is the most popular financial incentive for homeowners looking to go solar. The 26% tax credit is a dollar-for-dollar reduction of the income tax you owe. Many homeowners think they are not eligible for the solar tax credit because they dont have an additional tax bill at the end of the year.

This is not the case, the federal solar tax credit can get back a refund of the taxes you have already paid out of your weekly or fortnightly paycheck. Also, if you dont have enough tax liability to claim the credit in that year, you can roll over the rest of your credits to future years.

Recommended Reading: City Jobs Las Vegas Nevada

Q Are There Incentives For Making Your Home Energy Efficient By Installing Alternative Energy Equipment

A. Yes, the residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified property. Qualifying properties are solar electric property, solar water heaters, geothermal heat pumps, small wind turbines, fuel cell property, and, starting December 31, 2020, qualified biomass fuel property expenditures paid or incurred in taxable years beginning after that date. Only fuel cell property is subject to a limitation, which is $500 with respect to each half kilowatt of capacity of the qualified fuel cell property. Generally, this credit for alternative energy equipment terminates for property placed in service after December 31, 2023. The applicable percentages are:

What Does The Credit Cover

Homeowners who install and begin using a solar PV system can claim a federal solar tax credit that currently covers 26% of the following costs:

- Labor costs for solar panel installation, including fees related to permitting and inspections

- All additional solar equipment, such as inverters, wiring and mounting hardware

- Energy storage devices that are powered exclusively through the solar panels, including solar batteries

- Sales taxes paid for eligible solar installation expenses

Read Also: City Of Las Vegas Government Jobs

Federal Tax Credit For Residential Solar Energy

OVERVIEW

The federal solar tax credit for solar energy upgrades to your home may not be around for much longer. Here’s how to claim this credit.

In an effort to encourage Americans to use solar power, the U.S. government offers tax credits for solar-powered systems. Let’s take a closer look at some of the benefits of the solar tax credit and how you can claim it.

Productivity Tools Your Team Will Love

Supercharge your team and colleagues with a host of additional efficiency features, including as-built field navigation, serial number geo-location and data collection order tracking. Site notes centralize communication and knowledge sharing between parties. Collect all info in one place required for warranty claims and financial or M& A due diligence. Print, securely share and export in various file formats. Raptor Solar also offers download of original aerial inspection imagery and data for maximum auditability.

Read Also: City Of Las Vegas Government Jobs

Solar Rebates And Incentives By State

No matter where you live, you can take advantage of federal solar programs like the Investment Tax Credit. However, states often have unique incentives only available to their residents. If youre curious as to what your state offers to help offset the cost of going solar, check out our state rebates and incentives pages.

EnergySage is the nation’s online solar marketplace: when you sign up for a free account, we connect you with solar companies in your area, who compete for your business with custom solar quotes tailored to fit your needs. Over 10 million people come to EnergySage each year to learn about, shop for and invest in solar. .

Enter your zip code to see solar quotes near you

Solar Tax Credit Amounts

Installing renewable energy equipment in your home can qualify you for a credit of up to 30% of your total cost. The percentage you can claim depends on when you installed the equipment.

- 30% for equipment placed in service between 2017 and 2019

- 26% for equipment placed in service between 2020 and 2022

- 22% for equipment placed in service in 2023

As a credit, you take the amount directly off your tax payment, rather than as a deduction of your taxable income.

Also Check: Polk Real Foreclosure

Wind Tax Credit Impacts

Wind power will also benefit from the tax extensions provided for in the bill. The Production Tax Credit for wind power projects, usually claimed by onshore developers, will remain at 60 percent for projects that begin construction by the end of 2021, rather than being reduced to 40 percent as called for in previous law. Absent any future changes in law, the PTC will be reduced to zero starting in 2022.

Action by the U.S. Treasury earlier this year extended safe-harbor provisions an extra year to make allowance for coronavirus-related project slowdowns, which offered relief for projects struggling with disruptions to supply chains and permitting and construction delays.

Offshore wind will gain significant tax benefits as well, through the extension of the ITC that can be used in lieu of the PTC for funding wind projects. Under previous law, any wind project seeking to use this ITC option would have seen its availability expire completely as the PTC is wound down over the coming two years.

But the new ITC rules will allow offshore wind projects to retain access to a full 30 percent credit for projects that begin construction through 2025. Thats a major new boost for the estimated 28 gigawatts of offshore wind projects being planned for the U.S. East Coast through 2030, some of which have been forced to push back completion dates due to delays in federal permitting that could threaten access to higher levels of tax credits.

Purchase Vs The Solar Lease

If youre a retiree looking to keep your tax liability low, then leasing a system is most likely the best option. However, if you’re looking to take advantage of tax breaks and have complete ownership of your system, then making a purchase is the likely solution.

We can help you explore all financing options and help you get started with little to no money out of pocket.

Read Also: Dental Grants For Seniors

Ease Of Use & Security Throughout

Our web and mobile portal enable you to get the most out of Raptor Solar. Get an unlimited number of users, including from outside your organization. With the mobile app for iOS and Android, view your GPS position overlaid on your as-built while on site. Scan serial number barcodes, document site notes and upload photos all while on site. The mobile app can also be used in the field to access your inspections as well as view data from inverters, weather stations and more. All with enterprise-grade security throughout.

Here’s How To Take Advantage Of The Solar Tax Credit Extension In 2021

Get all the details on the US government’s tax credit for residential solar panels.

If you’re thinking about installing solar panels, you may have heard of the solar Investment Tax Credit, also called the federal solar tax credit. The current federal solar tax credit guidelines were extended through 2022 when former President Donald Trump signed the Consolidated Appropriations Act, 2021 this past December. That’s good news for anyone interested in getting a residential solar panel set up in the next couple years at the same 26% tax credit as 2020.

Burning coal, oil and natural gas for heat and electricity accounts for roughly 75% of US greenhouse gas emissions. These pollutants contribute to rising global temperatures and sea levels, changes in weather patterns and other factors associated with climate change.

Renewable alternatives, such as geothermal energy, wind power and solar power, reduce the footprint caused by these fossil fuels. Various incentives exist in the US for commercial and residential use of renewable energy, including the federal solar tax credit. President Joe Biden has already signaled strong interest in environmental issues by rejoining the Paris Climate Agreement on his first day in office. That suggests the 26% federal solar tax credit might be extended beyond its current deadline at the end of 2022, but the Biden administration hasn’t made any changes to the federal solar tax credit .

Read on to learn how to take advantage of this tax credit.

Recommended Reading: Governmentjobs.com Las Vegas

Unlimited Inspection Reports & Digitization

Get unlimited inspection reports and analytics from the market leader in aerial thermography. Raptor inspections are input agnostic drones, planes, satellites or sensors yours or ours. Access industry-leading training to ensure your data collection meets specifications. Each solar anomaly is identified, classified, localized and prioritized. Raptor Solar can even digitize, standardize and store historical third party reports. Compare to each other or to your Raptor reports for degradation measurements and a holistic view of your assets.

Federal Solar Tax Credit Filing Step

Fill in Form 1040 as you normally would. When you get to line 53, its time to switch to Form 5695.

Step 1: Find out how much your solar credit is worth.

- Enter the full amount you paid to have your solar system installed, in line 1. This includes costs associated with the materials and installation of your new solar system. As an example, well say $27,000.

- For this example, well assume you only had solar installed on your home. Enter 0 for lines 2, 3 and 4.

- Line 5 Add up lines 1 through 4. Example: 27,000 + 0 + 0 + 0 = 27,000

- Line 6 Multiply the amount in line 5 by 26% Example: 27,000 x .26 = 7,020

- Line 7 Check No. Again, for this example, were assuming you didnt have any other systems installed, just rooftop solar.

- Lines 8, 9, 10 and 11 Dont apply to you in this example for the same reason. You can fill each with 0 and skip down to line 12.

Step 2: Roll over any remaining credit from last years taxes.

- Line 12 If you filed for a solar tax credit last year and have a remainder you can roll over, enter it here. If this is your first year applying for the ITC, skip to Line 13.

- Line 13 Add up lines 6, 11 and 12 Example: 7,020 + 0 + 0 = 7,020

Step 3: Find out if you have any limitations to your tax credit.

Recommended Reading: Government Dental Grants For Seniors