When To Use The Current Mileage Reimbursement Rate

Usually, when people talk about the mileage rate, they mean the business ratefor example when you drive your personal vehicle for business purposes and are reimbursed the costs. Depending on whether youre an employee or self-employed the rate might even be different.

The IRS sets the standard mileage rate each year, and it represents the ceiling for tax-deductible mileage.

For employees

Businesses often choose to reimburse employees by the standard mileage rate method, as it is the simplest in terms of administration work. If this is the case for you, then you use the current mileage rate to calculate the reimbursement you should receive from your employer on a monthly basis. If you are located in California, check out deducated article on California mileage reimbursement.

Keep in mind that it’s up to your employer to set the rate and the rules for reimbursement, but the IRS’s standard mileage rate is the limit for what is tax-deductible. If you’re paid more per mile than the current IRS mileage rate, anything above it is considered taxable income.

If you want to learn more about other employee reimbursement methods, take a look at our mileage reimbursement for employees guide.

For self-employed

What Was The Cra Mileage Rate In 2021

The CRA mileage rate for 2021 was on average 2¢ lower, meaning that it was set at:

- 59¢ for the first 5,000 kilometers driven

- 53¢ after the first 5,000 kilometers

- An additional 4¢ per kilometer in the Northwest Territories, Yukon, and Nunavut.

This increase is the consequence of higher driving costs. The CRA adjusts the rate for inflation as well as gas, maintenance, insurance, and repair costs. Practically, the agency takes all the factors of owning and operating a car into consideration.

What Is Considered To Be Business Mileage

The IRS defines business mileage as mileage that is driven between two places of work, permanent or temporary. Some common types of trips that are considered business-related include:

- Travelling between two different places of work

- Meeting clients and going on customer visits

- Running business-related errands

For more information and examples on what qualifies as business mileage, see the IRS publication on transportation.

Recommended Reading: Government Jobs In Los Lunas Nm

What Is The Cra Vehicle Allowance

This is a payment that employees are entitled to receive from their employer if theyre using their own personal vehicle for business purposes. This vehicle allowance is an additional payment to the employees wages or salary. Calculated according to the CRA rate of mileage, more commonly known as the per-kilometre rate, employees are permitted to claim vehicle expenses on their income tax returns, unless the allowance is not taxable or is based on a suitable per-kilometre rate.

How Should Employers Reimburse The Cra Vehicle Allowance

Employers operating and/or paying business taxes in Canada must sign a government-mandated T2200 form. After filling out your section, you may distribute it to your employees so they can deduct the work expenses they accrued from their income. A form signed by you, the employer, means you recognize that the employee has paid for these expenses and according to their contract with you, the agreed conditions for deduction were met. The Form T2200, Declaration of Conditions of Employment is available for you to download and print from the Government of Canada website. Once an employee claims the vehicle allowance expenses to the CRA, it is recommended that both the employee and employer keep these on record to back up the claim in case of an audit or questioning. Information on additional employment expenses can be found by reviewing the Guide T4044, Employment Expenses

Read Also: Free Credit Report Yearly Government

Cra Mileage Rate: A 2022 Guide

After covering the most important topics and considerations for employee mileage reimbursement in the US, itâs time to move north and see how all this works in Canada.

The institution in charge of drawing up and enforcing tax laws in the Great White North is the Canada Revenue Agency . And itâs this authority that should be consulted when it comes to the legal framework for reimbursing your employees.

The main point of our article will be the CRA mileage rate in 2022, but weâll also talk about everything you should know for reimbursing your employees properly while keeping your expenses in check.

Irs Increases Mileage Rate For Remainder Of 2022

IR-2022-124, June 9, 2022

WASHINGTON The Internal Revenue Service today announced an increase in the optional standard mileage rate for the final 6 months of 2022. Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes.

For the final 6 months of 2022, the standard mileage rate for business travel will be 62.5 cents per mile, up 4 cents from the rate effective at the start of the year. The new rate for deductible medical or moving expenses will be 22 cents for the remainder of 2022, up 4 cents from the rate effective at the start of 2022. These new rates become effective July 1, 2022. The IRS provided legal guidance on the new rates in Announcement 2022-13PDF, issued today.

In recognition of recent gasoline price increases, the IRS made this special adjustment for the final months of 2022. The IRS normally updates the mileage rates once a year in the fall for the next calendar year. For travel from January 1 through June 30, 2022, taxpayers should use the rates set forth in Notice 2022-03PDF.

“The IRS is adjusting the standard mileage rates to better reflect the recent increase in fuel prices,” said IRS Commissioner Chuck Rettig. “We are aware a number of unusual factors have come into play involving fuel costs, and we are taking this special step to help taxpayers, businesses and others who use this rate.

Read Also: How To Buy Government Surplus

How Is Policygenius Different From Other Insurance Sites

Policygenius is an insurance , not an insurance company. There’s no shortage of companies out there offering fast or easy insurance coverage, but we think a marketplace is the best way to compare them all and Policygenius combines that marketplace experience with online tools, an expansive educational library, and guidance from real, licensed humans to help you get covered with confidence.

More Mileage Tax Deduction In 2022

Many businesses have been suffering because of the increased gas prices and other goods. Deducting 4% more in 2022 Q1 & Q2 than in 2021 , and then further increasing that in 2022 Q3 & Q4 by 6,4% means that youll be able to deduct more when you file a Mileage Tax Deduction in 2022. The increase of the Standard Mileage Rate in 2022 can mean a bit of a relief to many and also a good reason to make sure that you create a 100% IRS-Proof Mileage Log, that meets every expectation. With MileageWise, you can get the most out of your business mileage tax deduction, track your business miles automatically with an app, and create your mileage log for taxes in just 7 minutes a month.

You May Like: Government Help For New Business

What Are The 2021 Cra Mileage Rates For Various Provinces

Generally speaking, provinces share what vehicle allowance rates they consider reasonable, with the territories receiving an added 4¢ per kilometre. The 2021 reasonable vehicle allowance rate per kilometre is as follows:

- 59¢ per km for the first 5,000 km driven.

- 53¢ per kilometre driven after the first 5,000 km.

- An additional 4¢ per km driven in the Northwest Territories, Nunavut, and Yukon.

Find the latest kilometre rates for your province or territory here, as well as the vehicle mileage rates for previous years.

Mileage Reimbursement In 2022

Tax Cuts and Jobs Act of 2017 temporarily abolished various personal itemized deductions until December 31, 2025, prohibiting taxpayers from claiming deductions for unpaid employee travel expenses. Previously, various personal deductions of over 2% of Adjusted Gross Income had been deductible.

Many companies use the IRS mileage rate to reimburse employees for business trips by car. Mileage Reimbursement is a profitable solution for both the employer and the employee, depending on what method the parties use:

- Car allowance

- Standard mileage rate

- FAVR , which is the combination of the first two

Also Check: Top 50 Best Government Financial Assistance Programs

Irs Issues Standard Mileage Rates For 2022

IR-2021-251, December 17, 2021

WASHINGTON The Internal Revenue Service today issued the 2022 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes.

Beginning on January 1, 2022, the standard mileage rates for the use of a car will be:

- 58.5 cents per mile driven for business use, up 2.5 cents from the rate for 2021,

- 18 cents per mile driven for medical, or moving purposes for qualified active-duty members of the Armed Forces, up 2 cents from the rate for 2021 and

- 14 cents per mile driven in service of charitable organizations the rate is set by statute and remains unchanged from 2021.

The standard mileage rate for business use is based on an annual study of the fixed and variable costs of operating an automobile. The rate for medical and moving purposes is based on the variable costs.

It is important to note that under the Tax Cuts and Jobs Act, taxpayers cannot claim a miscellaneous itemized deduction for unreimbursed employee travel expenses. Taxpayers also cannot claim a deduction for moving expenses, unless they are members of the Armed Forces on active duty moving under orders to a permanent change of station. For more details see Moving Expenses for Members of the Armed Forces.

Taxpayers always have the option of calculating the actual costs of using their vehicle rather than using the standard mileage rates.

New 2022 Irs Standard Mileage Rates

The Internal Revenue Service has issued new standard mileage rates for operating an automobile for business, charitable, medical or moving purposes in 2022.

IRS mileage rates will increase in 2022.

getty

The new IRS mileage rates apply to travel starting on January 1, 2022.

- 58.5 cents per mile for business purposes

- 18 cents per mile for medical or moving purposes

- 14 cents per mile for charitable purposes

The new mileage rates are up from 56 cents per mile for business purposes and 16 cents per mile for medical or moving purposes in 2021. The new mileage rates increased because of changes in fuel prices, fuel economy and insurance costs.

The portion of the business mileage rate that is attributable to depreciation is 26 cents per mile in 2022, unchanged from 26 cents per mile in 2021.

If an employees actual costs of operating a vehicle for business purposes is higher, they can deduct a higher amount if they document the actual expenses.

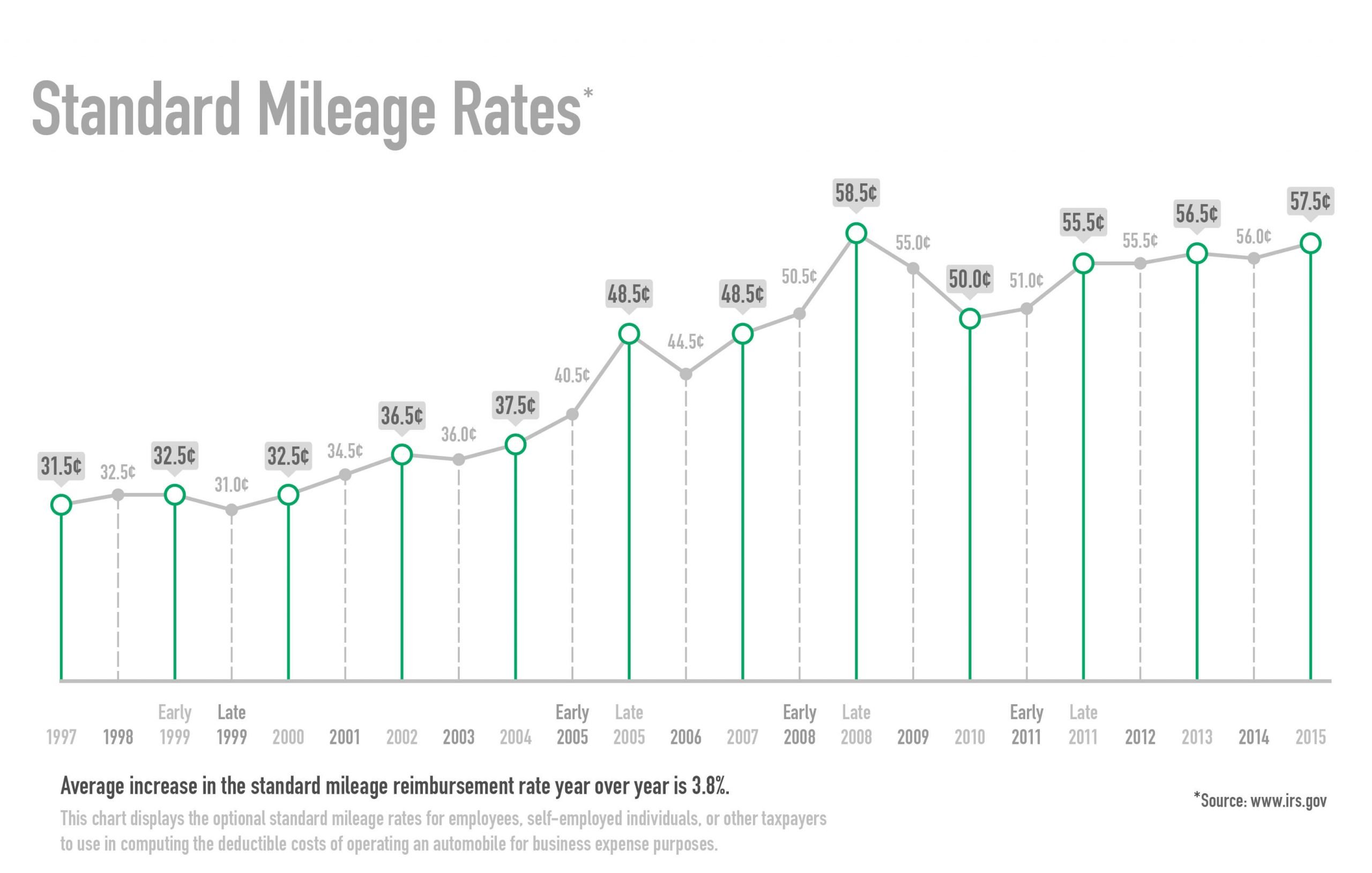

The IRS sets new mileage rates for business and medical/moving travel annually. The charitable rate is set by law and does not change.

You May Like: Government Camp Rooms For Rent

Employment Law Related To Mileage Reimbursement

On the federal level, there is no requirement for employers to reimburse employees for mileage when using personal vehicles for company purposes. However, all employers are federally required to reimburse employees for any work-related expense to a point. When failure to reimburse employees including for mileage and vehicle costs causes an employees net pay to fall below the federal minimum, employers could be open to lawsuits and the legal penalties associated with failure to pay the minimum wage.

On the employment law side, you are required to reimburse employees for expenses, said Danielle Lackey, chief legal counsel at Motus. You want to make sure youre reimbursing them enough to cover their expenses.

Certain states including California, Illinois and Massachusetts do mandate that employers reimburse employees for mileage and vehicle expenses related to work.

Each year, the IRS sets its mileage reimbursement rate. In 2020, the standard mileage rate is $0.575 per mile. Many employers reimburse employees at this rate, but the IRS rate is a national average based on the previous years data. It is more useful for tax deduction purposes than for setting a true reimbursement rate for your employees.

When establishing a mileage reimbursement policy, it is important to consider that fuel costs vary significantly by geography.

Do You Have To Pay Employees For Business Driving Expenses

If you live in certain states or pay employees minimum wage, you might have to reimburse them for business driving expenses.

California and Massachusetts require mileage reimbursement. Check your states labor department website for the most up-to-date regulations.

You cant expect employees earning at or near minimum wage to pay for their business driving expenses. The Fair Labor Standards Act kickback rule says if an employees driving expenses cause them to earn less than minimum wage, the employer must reimburse them.

When an employee earns at or near minimum wage, any unreimbursed expense triggers the FLSA kickback violation.

The FLSA kickback rule comes up commonly for food delivery drivers who use their own cars. Employers must track the travel of employees earning near minimum wage to ensure theyre not underpaid.

For example, say you own a pizza shop in Connecticut and pay your delivery drivers $12 per hour, the minimum wage. The drivers use their own cars to make deliveries.

If your employees have to pay for gas used for deliveries, theyre technically using their earnings to benefit the company. The FLSA says those costs cannot cause an employees hourly rate to fall below minimum wage.

Say a delivery person works for four hours, earning $48 in gross wages .

| Gross wages |

|---|

Don’t Miss: Government Programs To Avoid Foreclosure

Use Automated Solutions To Track Mileage

Some software, like Motus mileage reimbursement application, can eliminate over-reporting of mileage by your drivers and make documenting your mileage reimbursement easy.

Employers often ask employees to manually track miles we found the number of miles tracked by auto-capture versus manual capture is 20% lower, Lackey said. She added that people are not necessarily lying or trying to cheat the system, but often just rounding up to the nearest mile.

How Standard Mileage Rates Work

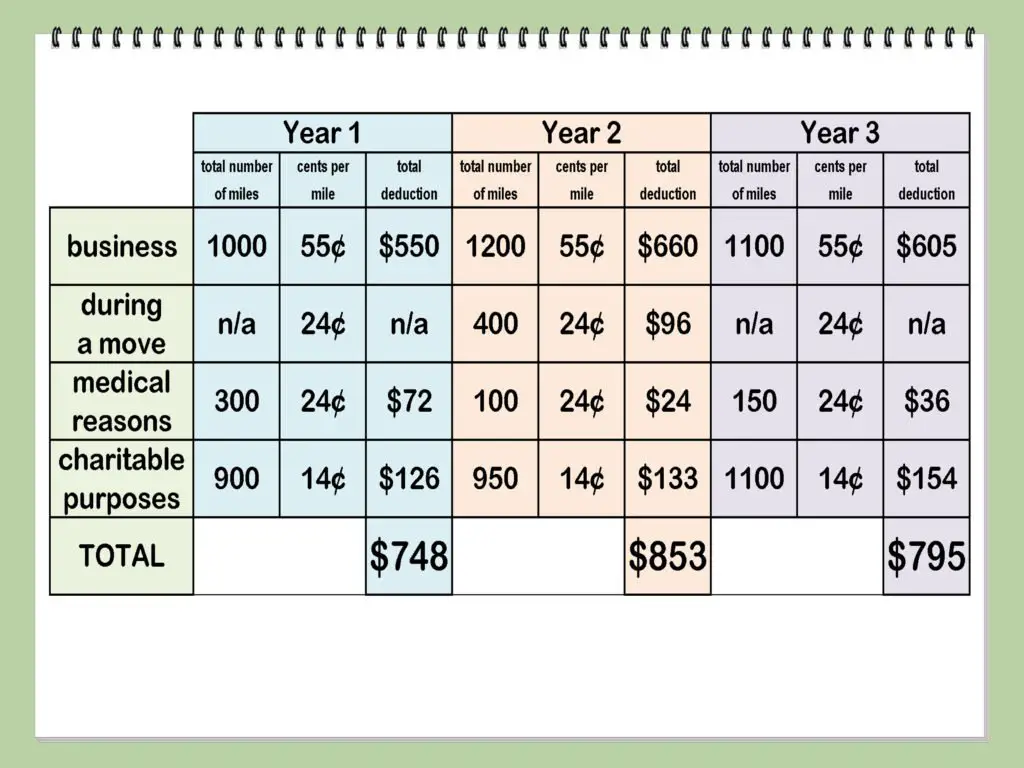

IRS optional standard mileage rates are prescribed by IRS Revenue Procedure 2019-46. This procedure lists the rules for deducting the costs of operating a vehicle for business, charitable, medical, or moving expenses.

Taxpayers are not required to use standard rates but may, instead, use the actual costs of driving the vehicle for an allowable reason. Normally, the IRS calculates standard mileage rates annually based on a determination of the average cost of maintaining a vehicle per mile.

For 2022, the extraordinarily high cost of fuel and petroleum products has resulted in a mid-year adjustment. As noted, this is unusual, having last occurred more than a decade ago in 2011, for the same reason. The rate adjustment in 2011 was 4.5 cents per mile from 51 to 55.5 cents per mile.

The table below shows the IRS optional standard mileage rate rates for the first and second half of calendar year 2022.

| Use |

|---|

| 14 cents/mile |

You May Like: Government Funding Programs For Low Income Families

How Does Policygenius Make Money

Were an independent insurance broker, so we get paid a commission by insurance companies for each sale. Insurance commissions are already built into the price of an insurance policy, so youre not paying any extra for working with us to buy a policy. Our compensation on any particular purchase may vary depending on a number of factors, including the type and size of product, the insurer, and the volume of business we have with an insurer, but we don’t push for or give preference to any one insurer over another because of the commission. We’re here to fight for you, not for ourselves.

Irs Raises Standard Mileage Rate For July To December 2022

On June 9, 2022, the Internal Revenue Service issued Announcement 2022-13, increasing the optional standard mileage rate for the final six months of 2022 from 58.5 cents per mile to 62.5 cents per mile. The new rate will be effective for traveling beginning on July 1, 2022, through December 31, 2022. The old rate of 58.5 cents per mile will remain in effective through June 30, 2022.

In the IRS press release, IRS Commissioner Chuck Rettig noted: The IRS is adjusting the standard mileage rates to better reflect the recent increase in fuel prices. We are aware a number of unusual factors have come into play involving fuel costs, and we are taking this special step to help taxpayers, businesses and others who use this rate.

The standard mileage rate is a national average rate, which takes into account a variety of factors including fuel costs, depreciation and insurance and other fixed and variable costs. The optional business standard mileage rate is used to compute the deductible costs of operating an automobile for business use in lieu of tracking actual costs. This rate is also used as a benchmark by the federal government and many businesses to reimburse their employees for mileage. Employers continue to have the option to use other methods that calculate the actual costs of using their vehicle rather than using the standard mileage rates.

You May Like: Solar Panels For Home Government Scheme

Runzheimer International Calculates The Rates

Runzheimer is the leading business vehicle technology and solutions provider. It’s worked with the IRS since 1980 to calculate the business mileage deduction rate using a consistent method and statistical analysis of vehicle cost components. Using detailed data from across the nation, the rate measures auto insurance premiums, maintenance costs, vehicle depreciation, and fuel and other costs that reflect the movement of prices in the marketplace.

Costs of operating an automobile include depreciation, insurance, repairs, tires, maintenance, gas, and oil. The rate for medical and moving purposes is based on the variable costs, such as gas and oil. The charitable rate is set by law.