The Purpose Of Form W

IRS Form W-9, also known as a W9, is one of the many tax documents required by the IRS to help accurately estimate the taxes owed by contract workers in a given tax year. Its a request for information about the contractors you pay as well as an agreement with those contractors that you wont be withholding income tax from their pay contractors must pay their own taxes on this income.

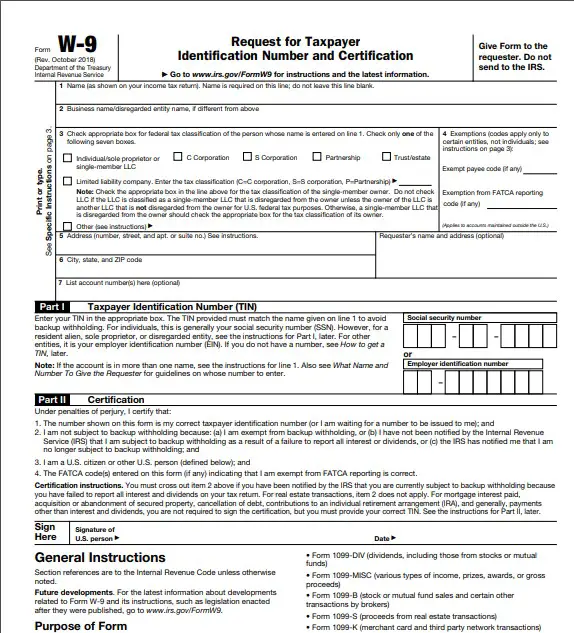

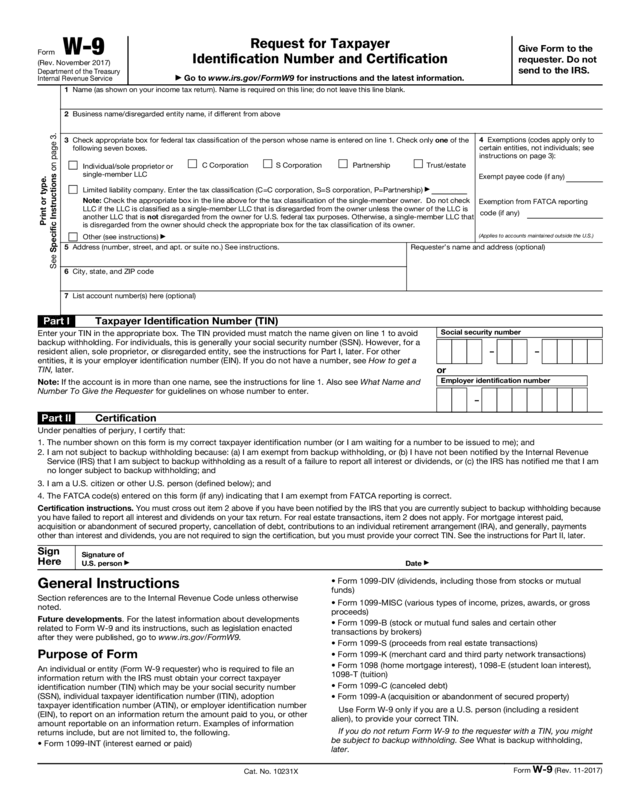

A W-9 form includes two parts. Part I is identification data about the payee. Part II is the certification, or signature, confirming that the ID info is correct. It can be called a request for taxpayer identification number and certification but W-9 is more typically used.

W-9s can be e-signed and sent back to you digitally, saving time for contract workers and companies alike.

Discover more about e-signatures.

Information Required On A W

Before you file this information, check that your contractor has filled out all the required items.

- Name of the payee or their business name. For a business, this name must match the name entered on the legal LLC formation documents, unless it is an individual/sole proprietorship or single-member LLC

- The payees federal tax classification or how they plan on filing their taxes for this income. The payee will check the appropriate box for one of the following: individual/sole proprietorship or single-member LLC, C corporation, S corporation, partnership, trust/estate, limited liability company , or other.

- The payees full current mailing address.

- The payees taxpayer identification number . For US citizens operating as an individual or sole proprietor, this is generally their SSN . For other entities and businesses, the TIN will be the employer identification number that is associated with their business name. And for resident aliens, a special individual taxpayer identification number must be applied for.

- Less commonly used fields include exempt payee code, which is used to notify the requester that the payee is exempt from having taxes withheld.

No Matter How You File Block Has Your Back

Read Also: Blue Cross And Blue Shield Government

Failure To Remit Form W

If someone asks for a completed Form W-9, it’s usually for a good cause. Be skeptical for requests where you’re not sure why your information is needed or who is making the request. It is expected that requests as part of normal business operating activities will be fulfilled.

There are some repercussions if you do not remit Form W-9. First, the payor is required to begin withholding taxes from future payments. As of 2022, the current withholding rate is 24%. In addition, there are the following penalties for non-compliance:

- $50 penalty for every failure to furnish a correct TIN to a requestor unless you are able to provide errors that were not willful neglect.

- $500 penalty if you make a false statement with no reasonable basis that results in no backup withholding.

- Other fines and/or imprisonment for willfully falsifying certifications or affirmations.

- Civil and/or criminal penalties for disclosing or misusing another party’s W-9 information in violation of Federal law.

How Do I Fill Out A W

As an LLC, you’ll provide the same type of information on a W-9 as individual contractors, but with two differences:

Recommended Reading: How To Sell To State And Local Government

Implementation Of The W

Adobe Acrobat Sign Makes Collecting W

For business owners, time-saving digital processes for W-9s and employment contracts are a must. Merck KGaA wanted to alleviate administrative headaches so employees could spend more time on issues than paperwork. By implementing an electronic signature process with Adobe Acrobat Sign, they saw a 1,400% increase in faster time to signature.

When it comes to collecting and securely storing important documents like W-9 forms, Adobe Acrobat Sign removes the steps of printing out and filing physical paperwork, resulting in faster turnarounds. Plus, you can store completed forms securely in Adobe Document Cloud for easier access to critical information.

Recommended Reading: Free Government Grants For Dental Implants

The Information Part At The Top:

1. Print your full legal name here.

2. If you operate under a business name , write that here.

3. âFederal tax classificationâ is a fancy way of saying, âHow does your business file your taxes.â In this part, you must report what kind of business entity type you are for tax purposes by checking the appropriate box. Youâve got seven different choices:

5-6. Enter your contact information here.

7. The account number section only applies if you need to send account information to the recipient of form W-9. If youâre unsure, itâs best to reach out to whoever requested the form W-9 from you.

Who Has To Fill Out A W

There are four common situations in which you might be required to fill out and send someone a W-9 form:

Youâre a contractor, freelancer, or consultant and plan on getting paid more than $600 by one particular client in a tax year. Theyâll need you to send them a completed W-9 before they can send you a Form 1099-MISC form. Youâll need that to report your income to the IRS.

Banks sometimes also need a W-9 when you open a new account with them.

Your bank or the financial institution you invest with might also need a completed W-9 from you in order to submit one of the other types of 1099 forms, which theyâll use to report things like interest income, distributions, and proceeds from real estate transactions .

If someone forgives or cancels a debt you owe them, theyâll need to file Form 1099-C with the IRS. Theyâll need you to send them a completed W-9 to complete the process.

If someone other than a client, bank, or other financial institution asks you for a W-9 form, you might want to think twice about sending one. This type of information can lead to identity theft and should be protected as such.

Also Check: What Kind Of Government Is The Us

Who Needs A W

It is a popular myth that contractors and freelancers don’t have to pay taxes. Self-employment does not erase the requirement of filing a tax return. In fact, taxes for contractors are usually more complicated than the taxes of an employee. This is because employers withhold the proper taxes on behalf of the employee. ICs and freelancers are responsible for withholding their own taxes. This guide addresses the first step of this process: the W-9.

For Independent Contractors and the Clients They Work With

Here’s a run-down of how it works for both the contractor and the business.

Your client will ask you to complete and return a W-9 Form. On it, you will need to provide your full legal name, address, and TIN. Your TIN may be your social security number. If you have an EIN, you may use it provided that you also include the name of your business that’s associated with it. Be sure and double-check all the information you provide for accuracy. One very important note: submit the finished W-9 to your client. Do not submit it to the IRS.

For Those Who Hire Independent Contractors

Have each independent contractor or freelancer complete a W-9. This should be done as early as possible, ideally during the time of hire. If someone takes a long time to return the W-9, follow up with them. It’s important that you get the form completed by the contractor every tax year you work with them so that the IRS doesn’t have a missing form to use as a flag for auditing you.

Employer and Employee

Who Asks For A Completed W

The person or business paying you is responsible for requesting the W-9 Form from you. However, the requester has no obligation to file the W-9 with the IRS. That person keeps the form on file and uses this information to prepare other returns, such as 1099 Forms and 1098 Forms, as well as to determine whether federal tax withholding is necessary on the payments you receive.

Don’t Miss: Free Debt Relief Programs Government

Government Forms Printable W 9

Government Forms Printable W 9The W-9 form is a tax return that the Irs needs from individuals who are getting payments from business. The form is utilized to verify the identity of the individual and their address in order to make sure that they are not being paid under a different name.

This form is likewise used by business to track any payments made to specialists and other people so that they can meet their tax obligations with the IRS.

The IRS W-9 form is a tax form that freelancers will be required to fill out if they are not an employee of the business they are working for. This form is used to report the income and taxes withheld from them. The W-9 form can be completed online or in hard copy.

Who Can File Form W

A W-9 form is a formal written request for information only and is used solely for the purpose of confirming a persons taxpayer identification number . An employer or other entity that is required to file an informational document with the IRS, such as Form 1099, must obtain your correct TIN to report any earnings or losses that may affect your federal tax return or your taxable income. For most individuals, the TIN will be their Social Security Number .

The W-9 differs from a W-4 Formwhich is more commonly supplied by employees to direct employersin that the W-9 does not inherently arrange for the withholding of any taxes due. Any required taxes based on gains related to the provided W-9 are the responsibility of the TIN holder listed on the document unless the taxpayer is subject to backup withholding. If backup withholding is required, this will need to be noted on the W-9, to properly inform the entity receiving the information of the need to withhold accordingly.

Read Also: Government Jobs In Madison Wi

What Is A W

A W-9 for a business entity contains information about the amounts paid to that business by another business during a calendar year. It contains the same basic information as an individuals W-9, but rather than having personal names and information, it instead lists the businesss legal name, address and Employee Identification Number number.

Taxes Done Right For Freelancers And Gig Workers

TurboTax Self-Employed searches 500 tax deductions to get you every dollar you deserve.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: Government Programs For Troubled Youth

How To Fill Out Form W

Form W-9 is one of the most straightforward IRS forms to complete, but if tax forms make you nervous, dont worry. Well walk you through the proper way to complete it.

All pages of Form W-9 are available on the IRS website. In addition, the form may include a specific set of instructions provided by the IRS.

What Are Examples Of W

While tax form W-9 is used most commonly by independent contractors, gig workers, and freelancers who are paid $600 or more by a business, it can also be used to report other types of income to the IRS. Examples of the types of income include:

- Acquisition or abandonment of secured property

- Cancellation of debt

- Contributions the taxpayer made to an IRA

- Mortgage interest the taxpayer paid

- Real estate transactions

- Stock and mutual fund sales and broker transactions

Read Also: Blue Cross Blue Shield Government

What If Im Collecting W

If your small business is collecting W-9s, you should make sure to send them well before the 1099 deadline. The deadline for form 1099-MISC and 1099-NEC is January 31, and most other 1099s are due around the same time.

To be safe, some businesses will send out Form W-9 to every single one of their contractors to fill out ahead of time, even if they donât expect them to perform $600 of work for them. Some accountants will even suggest collecting a W-9 before issuing any payments at all to encourage people to file up-front.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein.

Friends donât let friends do their own bookkeeping. Share this article.

When Should You Ask For A W

When you begin working with a contractor or freelancer that you will be paying, you should request that the contractor complete a Form W-9 prior to starting any engagement. Failing to do so could prove troublesome after beginning the work.

Therefore, before starting any work with a person or business, be sure to ask for a Form W-9 if they havent already provided you with one. Failing to do so could make you required to pay withholding taxes on the money that you pay them.

TurboTax Tip: Companies who engage you as a contractor or make payments to you for services you provide will likely ask for a completed W-9. Likewise, banks, brokerage firms and other payers typically ask for a completed W-9 to prepare your 1099s to report items such as interest, dividends, cancellation of debt and more.

Don’t Miss: Government Grants For Hot Water Heaters

When To Request A W

Form W-9 is essential for doing business with independent contractors and freelance workers. If your company pays people or small businesses more than $600 each for completed work, and those people arent employed by you, you need to collect a W-9 for tax purposes.

Your company is not required to pay the Social Security or Medicare taxes or withhold income taxes on payments to independent contractors. Because of this, the IRS needs to know who youre paying so they know who to collect from. Keep your W-9s stored securely and use them at years end to report how much you paid each contractor.

What Is Form W

A W-9 form is an Internal Revenue Service tax form that is used to confirm a person’s name, address, and taxpayer identification number for employment or other income-generating purposes. The confirmation can be requested for either an individual defined as a U.S. citizen or a person defined as a resident alien.

A W-9 form is also known as a Request for Taxpayer Identification Number and Certification form.

Read Also: Government Help For Disabled Homeowners

If You Get One From Someone You Dont Know

If youâre a contractor and you receive a Form W-9 from an individual or business who is not a client, donât fill it out. Sending your Social Security number and other personal information to a stranger could be dangerous. Scammers will sometimes send W-9s to collect the SSNs of unsuspecting individuals.

If youâre suspicious about a W-9 that someone has sent you, ask them which tax forms they plan on sending you back after you fill it out. If you canât get a straight answer, talk to a tax professional. Remember that the only reason anyone would ever need a W-9 from you is because they need it to send you some kind of IRS form.