What Is Medicare Part C

A Medicare Advantage Plan is another Medicare health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called Part C or MA Plans, are offered by private companies approved by Medicare.

If you join a Medicare Advantage Plan, the plan will provide all of your Part A and Part B coverage. Medicare Advantage Plans may offer extra coverage, such as vision, hearing, dental, and/or health and wellness programs. Most include Medicare prescription drug coverage .

Medicare pays a fixed amount for your care every month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare. However, each Medicare Advantage Plan can charge different out-of-pocket costs and have different rules for how you get services . These rules can change each year.

Recommended Reading: Government Suburban

Hospital Insurance Trust Fund

- Income taxes paid on Social Security benefits

- Interest earned on the trust fund investments

- Medicare Part A premiums from people who arent eligible for premium-free Part A

What does it pay for?

- Medicare Part A benefits , like inpatient hospital care,skilled nursing facility care,home health care, andhospicecare

- Medicare Program administration, like costs for paying benefits, collecting Medicare taxes, and fighting fraud and abuse

You May Like: Government Grants For Dental Implants

Medicare Vs Private Insurance Costs

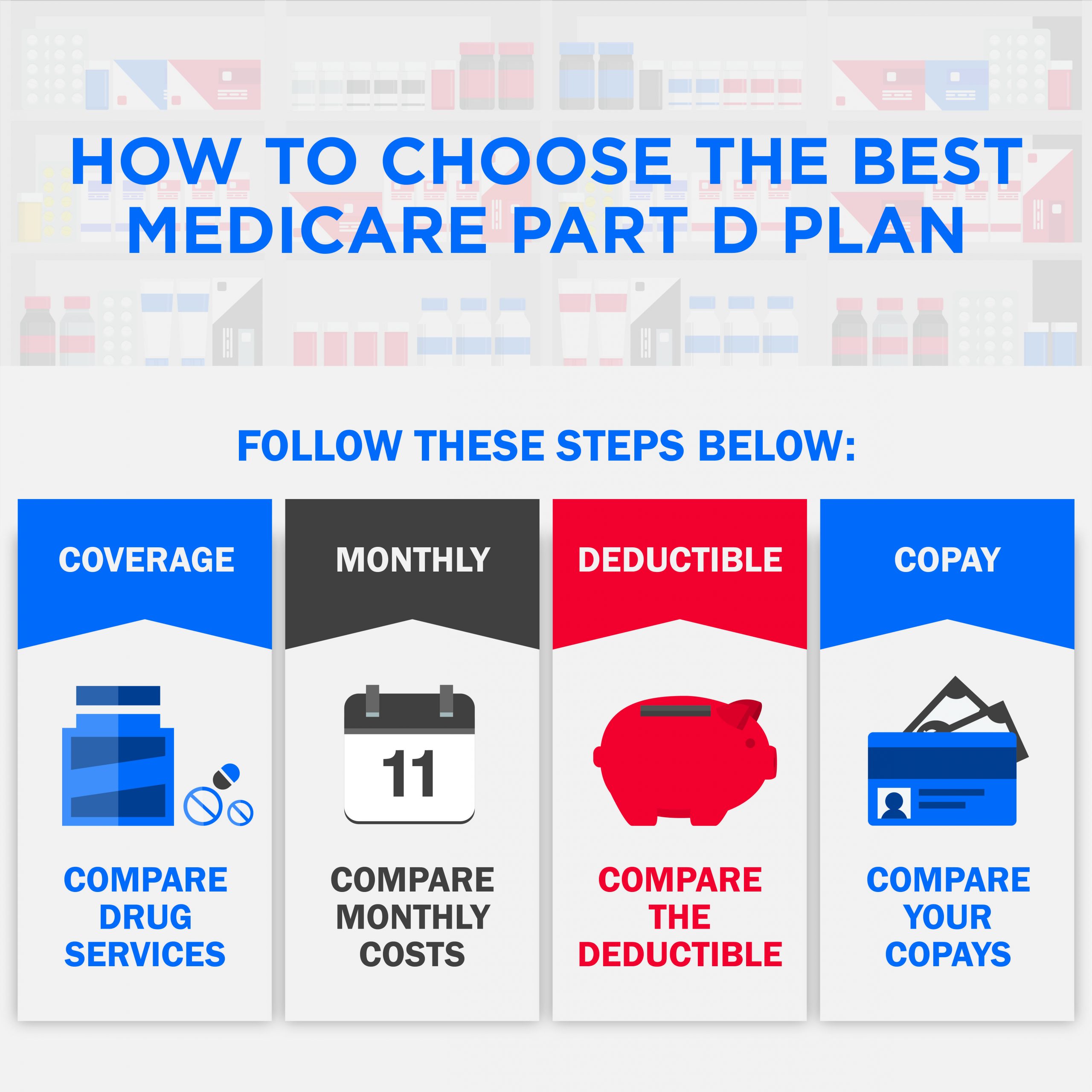

Making a direct cost comparison between Medicare and private insurance plans is challenging due to several factors, such as:

- Employers who provide private insurance plans may also pay for some or all of the monthly premium.

- Some people sign up for privately administered Medicare Advantage plans, which also vary in cost but may be more cost effective than original Medicare for some people.

- A Medigap policy cover costs such as deductibles and copays, but the monthly premium for Medigap policies varies.

- Medicare premiums only cover one person. However, private insurers may extend coverage to other family members, such as dependents.

Other factors affecting the cost of private insurance include:

- the age of the person

- where they live

- the benefits of the plan

- the out-of-pocket expenses

Generally, private insurance costs more than Medicare. Most people qualify for a $0 premium on Medicare Part A.

Read Also: Government Benefits For The Unemployed

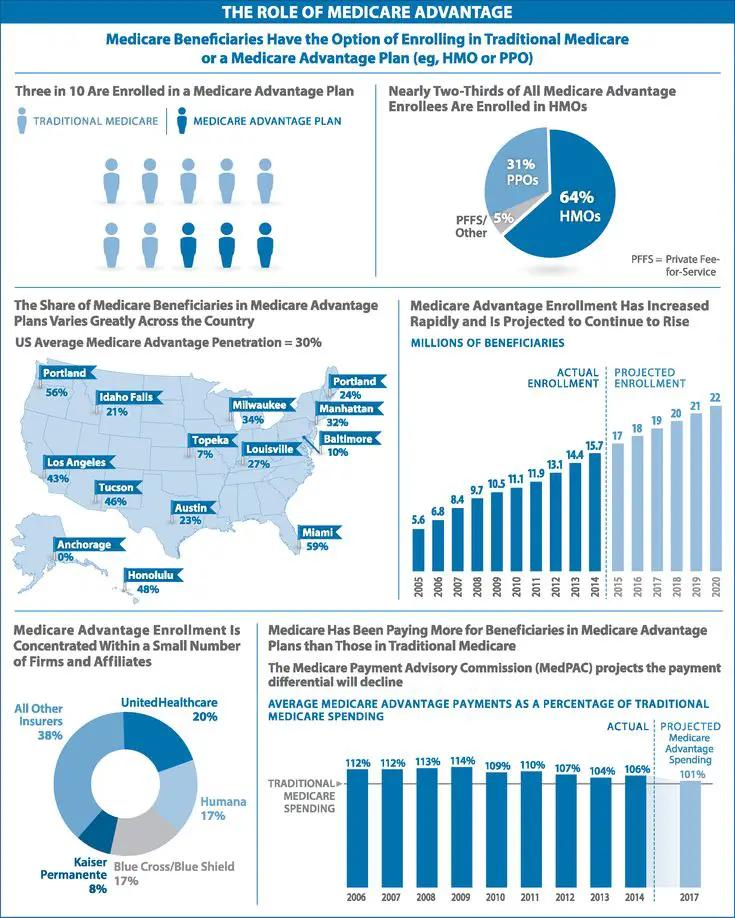

How Many Americans Have Medicare Advantage Coverage

As of September 2021, there were nearly 28 million Americans enrolled in Medicare Advantage plans more than 43% of all Medicare beneficiaries.

Enrollment in Medicare Advantage has been steadily growing since 2004, when only about 13% of Medicare beneficiaries were enrolled in Advantage plans. Managed care programs administered by private health insurers have been available to Medicare beneficiaries since the 1970s, but these programs have grown significantly since the Balanced Budget Act signed into law by President Bill Clinton in 1997 created the Medicare+Choice program.

Also Check: City Jobs Las Vegas Nevada

Do I Need Medicare Or An Obamacare Plan

When it comes to choosing between Medicare or Obamacare, theres no single right answer.

You can check with healthcare.gov to determine your eligibility and to make sure you dont let your health insurance coverage lapse.

To learn more about Medicare Advantage plans that may be available in your area, a licensed insurance agent can help you compare plan specifics such as costs, coverage networks and benefits.

Learn about Medicare Advantage plans in your area

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

1 CMS. Medicare Enrollment Dashboard. Retrieved Dec. 2020, from https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/Dashboard/Medicare-Enrollment/Enrollment%20Dashboard.html.

2 Kaiser Family Foundation.. Retrieved Dec. 2020, from www.kff.org/health-reform/state-indicator/marketplace-enrollment.

3 MedicareAdvantage.com’s The Average Cost of Medicare in 2022 report. .

4 TZ Insurance Solutions LLC internal sales data, 2020. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

5 Kaiser Family Foundation. Average Marketplace Premiums by Metal Tier, 2018-2021. Retrieved Dec. 2020 from https://www.kff.org/health-reform/state-indicator/average-marketplace-premiums-by-metal-tier.

About the author

Don’t Miss: Government Contracts In South Carolina

Failed Attempt At Savings: 19972003

The BBA’s goals with respect to Medicare Advantage can be summarized in the following question: Could Medicare Advantage be reformed so that Medicare could participate in the managed care dividend enjoyed by private employers? In the latter half of the 1990s, Republicans , centrist Democrats, and some policymakers began to look to Medicare as a source for reducing the deficit . Debate centered on the idea of premium support, in which Medicare beneficiaries would be given a lump sumin effect, a voucherthat could be used to pay for a private plan or for the premium for TM, a model used by some private employers as well as the Federal Employees Health Benefit Program . Aaron and Reischauer , among others, argued that such a policy would promote competition and efficiency in Medicare, give beneficiaries a choice, and capture some of the managed care dividend for Medicare.

After an intense debate, Congress passed the BBA, in which Medicare’s at-risk contracting with health plans was formally designated as Part C of Medicare and named Medicare+Choice . The intent was to encourage competition and the growth of managed care in the Medicare program, with the hope that this would save Medicare funds. Most Democrats, however, vehemently opposed the defined-contribution initiative and succeeded in having the topic assigned to a bipartisan commission for study. In the meantime, Medicare remained a defined benefit program.

Medicare Program Savings And Employer

Between 1997 and 2003 Medicare continued to lose money on those beneficiaries who enrolled in MA plans, partly because of the payment floors and partly because of favorable selection into Part C. Indeed, the continued favorable selection overwhelmed the ability of risk adjustment to pay less for less expensive beneficiaries. An analysis of the Medicare Current Beneficiary Survey found that in the early 2000s, MA enrollees were less likely than TM enrollees to report that they were in fair or poor health, that they had functional limitations, or that they had heart disease or chronic lung disease . But the analysis found no difference in reported rates of diabetes or cancer.

The evolution of Medicare and commercial insurance also continued to differ. On the private side, traditional indemnity insurance had all but disappeared in the private market, a stark contrast from Medicare . Moreover, the BBA’s treatment of Part C suffered from bad timing because of a halt in the downward trends in the growth of health spending achieved by managed care in the private market in the mid-1990s.

Also Check: What Government Loans Are Available

Medicare Supplement Medigap Insurance

Medicare Supplement insurance is health insurance sold by private insurance companies to cover some of the “gaps” in expenses not covered by Medicare.

For policies sold before June 01, 2010, there are fourteen standardized plans A through L. For policies sold on or after June 01, 2010, there are 11 standardized plans A through N. Each standardized Medigap policy must provide the same basic core benefits such as covering the cost of some Medicare copayments and deductibles. Some of the standardized Medigap policies also provide additional benefits such as skilled nursing facility coinsurance and foreign travel emergency care. However, in order to be eligible for Medigap coverage, you must be enrolled in both Part A and Part B of Medicare.

As of June 1, 2010, changes to Medigap resulted in modifications to the previously standardized plans offered by insurers. Medigap plans H, I, and J, which contained prescription drug benefits prior to the Medicare Modernization Act, were eliminated. Plan E was also eliminated as it is identical to an already available plan. Two new plan options were added and are now available to beneficiaries, which have higher cost-sharing responsibility and lower estimated premiums:

- Plan M includes 50 percent coverage of the Medicare Part A deductible and does not cover the Part B deductible

- Plan N does not cover the Part B deductible and adds a new co-payment structure of $20 for each physician visit and $50 for each emergency room visit

Covered Services In Medicare Advantage Plans

Most Medicare Advantage Plans offer coverage for things Original Medicare doesnt cover, like fitness programs and some vision, hearing, and dental services. Plans can also choose to cover even more benefits. For example, some plans may offer coverage for services like transportation to doctor visits, over-the-counter drugs, and services that promote your health and wellness. Plans can also tailor their benefit packages to offer these benefits to certain chronically-ill enrollees. These packages will provide benefits customized to treat specific conditions. Check with the plan before you enroll to see what benefits it offers, if you might qualify, and if there are any limitations. Learn more about what Medicare Advantage Plans cover.

Also Check: Government Loans For Bad Credit

How Is Medicare Part B Funded

The Supplementary Medical Insurance trust fund is whats responsible for funding Part B, as well as operating the Medicare program itself. Part B helps to cover beneficiaries doctors visits, routine labs, and preventive care.

This trust fund receives funds through the following avenues:

- Funds that are sanctioned by the United States Congress

- Interest accrued through trust funds investments

- Part B and D-related premiums

- The SMI trust fund is also responsible for funding Part D

Medicare Vs Private Insurance Premiums

The table below provides a general comparison of the costs of Medicare and private insurance. However, it shows the average monthly premiums for private insurance in 2021 and the costs for Medicare plans in 2022.

| Private insurance | |||

| $22,221 per year for families | Free for people who have paid Medicare tax for 40 quarters | Standard monthly premium of $170.10 | $33.37 on average, but purchased in addition to other Medicare plans |

| $7,739 per year for individuals | $274 for people who have paid Medicare tax for 3039 quarters | Income-related adjustments to Part B premiums go from $238.10 to $578.30 for people who filed an income higher than $91,000 per year on their previous tax return | |

| $5,969 per year for family coverage for employees after the employer covers part of the cost | $499 for people who have paid Medicare tax for fewer than 30 quarters |

Recommended Reading: Government Surplus Buses For Sale

Where Does Federal Medicare Funding Come From

Funding for federal health insurance comes from two trust funds which are dedicated to Medicare use and held by the U.S. Treasury.

The Hospital Insurance Trust Fund is funded by federal payroll taxes and income taxes from Social Security benefits. Its used to pay for Medicare Part A expenses such as hospital, skilled nursing, hospice and home health care.

The Supplementary Medical Insurance Fund is composed of funds approved by Congress and Part B and Part D premiums paid by subscribers. Its used to pay for Medicare Part B expenses such as medically necessary and preventive services such as doctors visits and lab tests.Medicare cost $705.9 billion in 2017 and covered more than 58 million Americans.

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B. Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your Initial Enrollment Period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

Note: Important Upcoming Change Rules for 2023 and later: If you accept the automatic enrollment in Medicare Part B or if you sign up during the first three months of your IEP, your coverage will start the month youre first eligible. Beginning January 1, 2023, if you sign up during the month you turn 65 or during the last three months of your IEP, your coverage starts the first day of the month after you sign up.

The following chart shows when your Medicare Part B becomes effective in 2022:

| In 2022, if you sign up during this month of your IEP | Your Part B Medicare coverage starts |

|---|---|

| One to three months before you reach age 65 | The month you turn age 65. |

| The month you reach age 65 | One month after the month you turn age 65. |

| One month after you reach age 65 | Two months after the month of enrollment. |

| Two or three months after you reach age 65 | Three months after the month of enrollment. |

The following chart shows when your Medicare Part B becomes effective in 2023:

Also Check: Blue Cross Blue Shield Government

What Is Medicare Advantage

Medicare Advantage is another way to get your Original Medicare benefits. Private insurance companies offer Medicare Advantage plans and some may charge $0 premiums. However, you must still continue to pay your Medicare Part B premium and your Part A premium if it applies. Medicare Advantage plans must offer everything Original Medicare covers except hospice care, which is still covered by Medicare Part A. Some Medicare Advantages plans offer extra benefits, such as prescription drug coverage, routine dental, routine vision, and wellness programs.

Medicare Advantage/part D Contract And Enrollment Data

The Medicare Advantage / Part D Contract and Enrollment Data section serves as a centralized repository for publicly available data on contracts and plans, enrollment numbers, service area data, and contact information for MA, Prescription Drug Plan , cost, PACE, and demonstration organizations.

The monthly updates to these contract and enrollment reports are scheduled to be published to the web site by the 15th of each month.

An inventory of the currently available reports is provided below with a brief description of the content.

Don’t Miss: How To Switch Government Phone

How Do The Benefits Differ

Private insurance and original Medicare plans provide varying benefits and coverage.

Most of both types of plans cover hospital care and outpatient medical services, including doctors visits, physical therapy, and diagnostic tests.

However, Medicare may have gaps in coverage that private insurers cover. For example, Medicare does not cover prescription drugs, meaning that a person needs to get a Medicare Part D plan. However, private insurance plans often include prescription drug coverage.

Medicare Advantage plans, which replace original Medicare, may offer coverage that more closely resembles that of a private insurance plan. Many Medicare Advantage plans offer dental, vision, and hearing care and prescription drug coverage.

Rules For Medicare Advantage Plans

Medicare pays a fixed amount for your care each month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare.

Each Medicare Advantage Plan can charge different

. They can also have different rules for how you get services, like:

- Whether you need areferralto see a specialist

- If you have to go to doctors, facilities, or suppliers that belong to the plan for non-emergency or non-urgent care

These rules can change each year.

Don’t Miss: Best Business For Government Contracts

What Is A Wellcare Medicare Advantage Preferred Provider Organization Or Ppo Plan

A Preferred Provider Organization, or PPO*, plan offers enrollees more flexibility in choosing their health-care providers. Typical features include:

- You may get your health care from any doctor or facility you prefer, but you generally pay less if you use providers in the plans network.

- You dont need to choose a primary care doctor or get a referral to see a specialist of your choice.

- Usually, PPOs include prescription drug coverage, as described above.

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medicare hospital insurance if they have worked and paid Medicare taxes long enough. You can sign up for Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Read Also: Easy To Get Government Grants

Funding For Medicare Advantage

Private insurance companies receive a set amount of federal Medicare funding for providing Part A and Part B coverage through Medicare Advantage plans. Each insurance company is approved and contracted by Medicare and must fulfill guidelines for coverage as established by the government.

Medicare Advantage plans are also financed by monthly premiums paid by subscribers. The premium amounts vary by company and plan. Subscribers may also be asked to pay a certain amount of their expenses in the form of a deductible or copayment.

Eldercare Financial Assistance Locator

- Discover all of your options

- Search over 400 Programs

Disadvantages Of Medicare Advantage Plans

In general, Medicare Advantage Plans do not offer the same level of choice as a Medicare plus Medigap combination. Most plans require you to go to their network of doctors and health providers.

Since Medicare Advantage Plans cant pick their customers , they discourage people who are sick by the way they structure their copays and deductibles. Many enrollees have been hit with unexpected costs and denial of benefits for various types of care deemed not medically necessary.

Read Also: How The Us Government Works