Local Government Emergency Loans For Small Businesses: Contracting With Financial Institutions For Loan Administration

The COVID-19 public health crisis is giving rise to an unprecedented economic crisis. Economic activity across the nation has slowed considerably, and many small businesseswhich were operating successfully only one month agoare now struggling to survive. As their bills pile up but no revenue comes in, some businesses will run out of cash and be forced to shut down permanently. Business closures on a vast scale would likely inhibit a recovery for years after the current crisis subsides. The economy will rebound more quickly after the crisis if these small businesses keep their staff in place and are able to resume operations as soon as restrictions are lifted.

One way to assist small businesses during a cash crunch is to establish an emergency loan program. The federal Small Business Administration offers a disaster loan product for this purpose, but the process takes 60-90 days for the SBA loan to be issued by a bank. Some businesses would be forced to lay off workers in the interim, and many businesses still wouldnt have enough cash to remain solvent while waiting for the SBA loan.

The two models are described in the table below:

Risk mitigation measures risk of financial loss through borrower default

Risk mitigation measures risk related to fiscal control over funds

Time is of the essence: approval and statutory authority during an emergency

Geographic limitation

Emergency powers do not override statutes and the state constitution

Finding The Best Government Loan Lender For You

âWhen you talk about access to credit and people that might need the flexibility of these programs they may reach out to one lender and get one answer, and they might reach out to another lender and get a completely different answer,â Banfield says.

Borrowers should always shop multiple mortgage lenders to find the best terms and most suitable options for their personal situation.

You Can Strengthen Your Finances

Purchasing a home through a government-insured loan can open a lot of financial doors for borrowers. As a homeowner, youll start building equity and credit which will help your financial portfolio moving forward. For many people, the lack of assets and credit history is a recurring obstacle that stands in the way of important purchases like buying a car, qualifying for other loans and more.

Most government insured loans have a limit to the amount that you can borrow.

Upon first thought, you may consider this to be a negative factor, however, these limits are calculated based off of a percentage of your total income, taking your debt-to-income ratio into consideration. This can be helpful because it ensures youre purchasing a home within your financial means. Such structure not only helps make homeownership a reality, but it sets you up for continued financial success and growth that you can afford.

Read Also: What Is Congress Mortgage Stimulus Program For The Middle Class

Also Check: Government Opportunities For Small Businesses

How Hard Is It To Get A Small Business Loan

Getting a small business loan may prove more challenging than other financing options like business credit cards. Although qualification requirements vary by lender, most lenders typically look at the business owners personal credit score and the business annual revenue. Many lenders require a minimum personal credit score of 600 to 660 and annual revenue between $100,000 and $250,000.

We recommend confirming the qualification requirements with your preferred lender before applying.

Va Mortgages & Home Loans

Veterans Affairs loans are available to active duty military personnel, retired military personnel , Reservists or National Guard members and their families.

VA mortgages are guaranteed by the U.S. Department of Veterans Affairs and are made to encourage lenders to work with Veterans and their families. Our experienced loan representatives will work with you to acquire a Certificate of Eligibility in order to apply. Current loans are available up to $625,500, depending on the actual location of the subject home.

The VA Loan Guarantee allows the purchase of New York homes without a down payment, providing the purchase price does not exceed the reasonable value of the home. The Veteran will need to occupy the residence in order to qualify. VA refinance loans of an existing residence are also available and can be streamlined they may not require an appraisal and the closing costs may be rolled into the new loan.

Get more details about VA mortgages in NY including details about how to qualify, refinancing options, loan limits, and more by reviewing our guide to New York VA mortgages.

Read Also: Alcatel Government Phone Customer Service

Are Government Loans The Same As Grants

A Government loan, as loans in general, will need to be repaid with interest, whereas a grant does not.

Start-ups and small businesses with little or no assets to borrow against, often find that open market borrowing is out of their reach and Government loans can bridge this gap with a focus on the longer-term benefits.

These can often be in the form of low-cost Government loans with the potential for discounted rates.

The Government offers financial help to small businesses through more than 200 grants for a clear purpose and where there is a potential for a benefit to the local economy.

This assistance can target saving money on premises, machinery and IT equipment for example, but will require time and effort to successfully apply.

Most small business grants are available for start-ups or new businesses with a goal to create jobs and stimulate the economy.

The Government grant does not need to be paid back, there is no interest payable and you retain all the equity in your business.

IMPORTANT UPDATE: While the Government has responded to the Coronavirus pandemic with a variety of guaranteed loan schemes and grants it is vitally important that as a business owner you recognise the following:

Although the Coronavirus Business Interruption Loan Scheme is generous and wide ranging, there will be many businesses who will be unable to access this scheme due to the financial profile of their business PRIOR to the coronavirus pandemic.

We suggest the following two steps:

What Is A Government Loan

The U.S. government offers loan programs through different departments to support the needs of individuals, businesses, and communities. These loans provide capital for those who may not qualify for a loan from a private lender. Government loan programs can help:

- Improve the overall national economy and quality of life of its citizens

- Encourage innovation and entrepreneurship

- Improve the countrys human capital

- Reward veterans and their dependents for past contributions and help with present needs

Individuals and small businesses with little or no seed capital or collateral may find the terms for a private loan unaffordable. Low-cost government loans attempt to bridge this capital gap and enable long-term benefits for the recipients and the nation.

Read Also: Why We Need Data Governance

Who Has The Right To Buy

You will probably have the right to buy if you are a secure tenant of a social housing landlord, including:

- a local authority

- a non-charitable housing association

If youre a tenant in Wales, you dont have the right to buy your home. You can ask your landlord if theyll sell your home to you, but they dont have to agree to do it.

In November 2015, the Government extended right to buy to housing associations in a pilot scheme with 5 housing associations. The tenants of those associations can start the process but cant complete the purchase until the right to buy for housing associations is enforced by statute .

To qualify, you must also have been a secure tenant of a social housing landlord for at least 3 years.

As a tenant, you will not have the right to buy if you are:

- a tenant of a property owned by a charity, although you may be entitled to a lump sum grant to help you buy on the open market

- a tenant of sheltered housing or housing specifically designated for older people

- an undischarged bankrupt. If you have rent arrears, you can still apply for the right to buy but you need to clear the arrears before the sale can go ahead.

Some assured tenants have what is called the preserved right to buy. You may have the preserved right to buy if the local authority sold your home to another landlord while you were renting it for example, to a housing association. Your landlord can tell you if you have the preserved right to buy.

A Canada Small Business Financing Loan Is Commonly Used For:

- New businesses looking for financial support to start or grow a company

- Established businesses experiencing issues with cash flow as a result of a large investment

Not sure if this product is right for your business?

85% of the loan is guaranteed by the Federal government.

Previous Purchases Are Eligible

Purchases made within the past six months are eligible for financing.

Repayment Options That Work for You

- Floating rate principal plus interest

- Floating rate principal including interest

- Fixed rate principal plus interest rate

- Fixed rate principal including interest

Terms That Meet Your Needs

- Equipment loans up to a 10-year amortization

- Leasehold improvements up to a 7-year amortization

- Real property loans/ immovable up to 15-year amortization

Donât Miss: How Does Rocket Mortgage Work

You May Like: What Are Short Term Government Bonds

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Happens After You Submit The Fafsa

After you submit the FAFSA, the government will send you a , which gives you basic information about your eligibility for federal student aid.

The colleges you included on your FAFSA will have access to this information, and they’ll use it to determine the amount of federal student loans, grants, and work-study you may qualify for.

The colleges youre accepted to will send you a detailing the financial aid you are eligible to receiveincluding federal student loans, grants, and work-study.

The amount of federal aid you receive from each school can vary, just as the cost of attending each school varies.

Don’t Miss: Ok Google Free Government Phones

Advance Child Tax Credit

Because of the COVID-19 pandemic, the CTC was expanded under the American Rescue Plan of 2021. The IRS pre-paid half the total credit amount in monthly payments from July to December 2021. When you file your 2021 tax return, you can claim the other half of the total CTC.

Learn more about the Advance Child Tax Credit.

Government Home Loans: What Options Are Available

SimpleMoneyLyfe » Mortgages » Government Home Loans: What Options Are Available?

Disclaimer: This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. Read our Disclaimer Policy for more information.

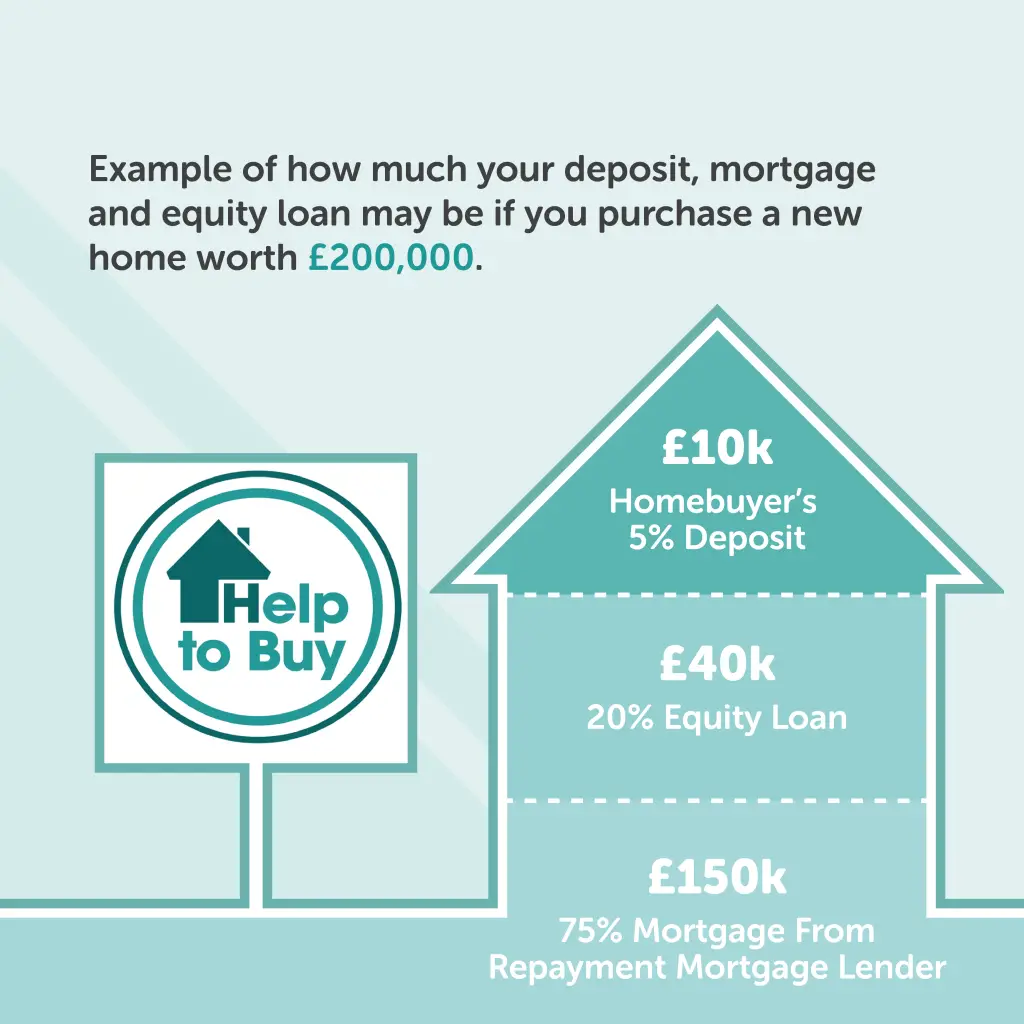

With the average home price in the U.S hovering around $287,148, buying a home can be pretty expensive.

This is one of the many reasons why most homebuyers take out mortgages to purchase their dream home.

And if youre like millions of potential home buyers planning to take out a mortgage to finance the purchase of your next home, youll have to decide between two major types of mortgages: Conventional loans and Government home loans.

Weve created a short guide to everything you need to know about government home loans.

So, lets get started!

You May Like: Government Grants To Restore Historic Homes

Housing And Urban Development Loans

The largest part of the government loan pie is for financing home loans. This category has the largest number of loan programs, including loans for buying homes, making homes energy efficient, interest rate reduction, and paying for home repairs and improvements. Common loan programs include:

The government can also fund the education of aspiring students for unique research or courses available only in foreign locations. Additional conditions, like working in public service upon graduation, may be attached to loans for foreign programs.

In August 2022, President Biden announced student loan relief for people with federal student loans. Individuals can receive up to $20,000 in loan cancellation if their income is less than $1250,000 and they received a Pell Grant in school. If they did not receive a Pell Grant, they are eligible for up to $10,000 in cancellation.

Education loans are considered to be the riskiest category for lenders and sponsors, as such loans are heavily dependent on individuals and may not be backed by physical collateral .

What Type Of Security Do I Need For A Government Loan

Often, not much security is needed, as many government-backed loans are offered to help businesses that donât have access to the security more traditional loan providers require. Start-up loans are unsecured, while the EFG schemes sees the government provide the security to the lender.

Other loans will vary, but the British Business Bank is a good place to find out more. The bank aims to increase the supply of finance available to smaller businesses where markets donât work well.

There are services for businesses in the âstart-upâ, âscale-upâ and âstay aheadâ stages, to help with the sourcing of the right kind of finance.

Recommended Reading: What Gaap Principles Govern The Consolidation Of Financial Statements

Business And Industrial Loans

No country or community can flourish with a stagnant marketplace. Innovation, entrepreneurship, employment, and healthy competition are important to the overall development of a nation’s economy.

The loan programs offered in the business and industrial loan categories aim to encourage these aspects of development. Business loans are available for small, mid-sized, and large businesses and industries for various periods of time.

Funding can be used to buy land, facilities, equipment, machinery, and repairs for any business-specific needs. Other unique variants in these government loan programs include offering management assistance to qualifying small start-ups with high growth potential, among others.

Options For Students Homeowners And Businesses

When you need to borrow money, the U.S. government can be an appealing source of funding. Government loans typically have borrower-friendly featurestheyre relatively easy to qualify for and might have lower rates than you can find with private lenders. However, it can be a challenge to find out about the many different government loan programs in order to take advantage of them.

Don’t Miss: Government Loans For Low Income Families

Her Majesty Queen Elizabeth Ii

21 April 1926 to 8 September 2022

A Budgeting Loan can help pay for:

- furniture or household items

- clothes or footwear

- costs linked to moving house

- maintenance, improvements or security for your home

- travelling costs within the UK

- costs linked to getting a new job

- maternity costs

- repaying loans taken for the above items

Crisis Loans are not available any more.

You may be eligible for a Budgeting Loan if youve been on certain benefits for 6 months.

- Yes this page is useful

- No this page is not useful

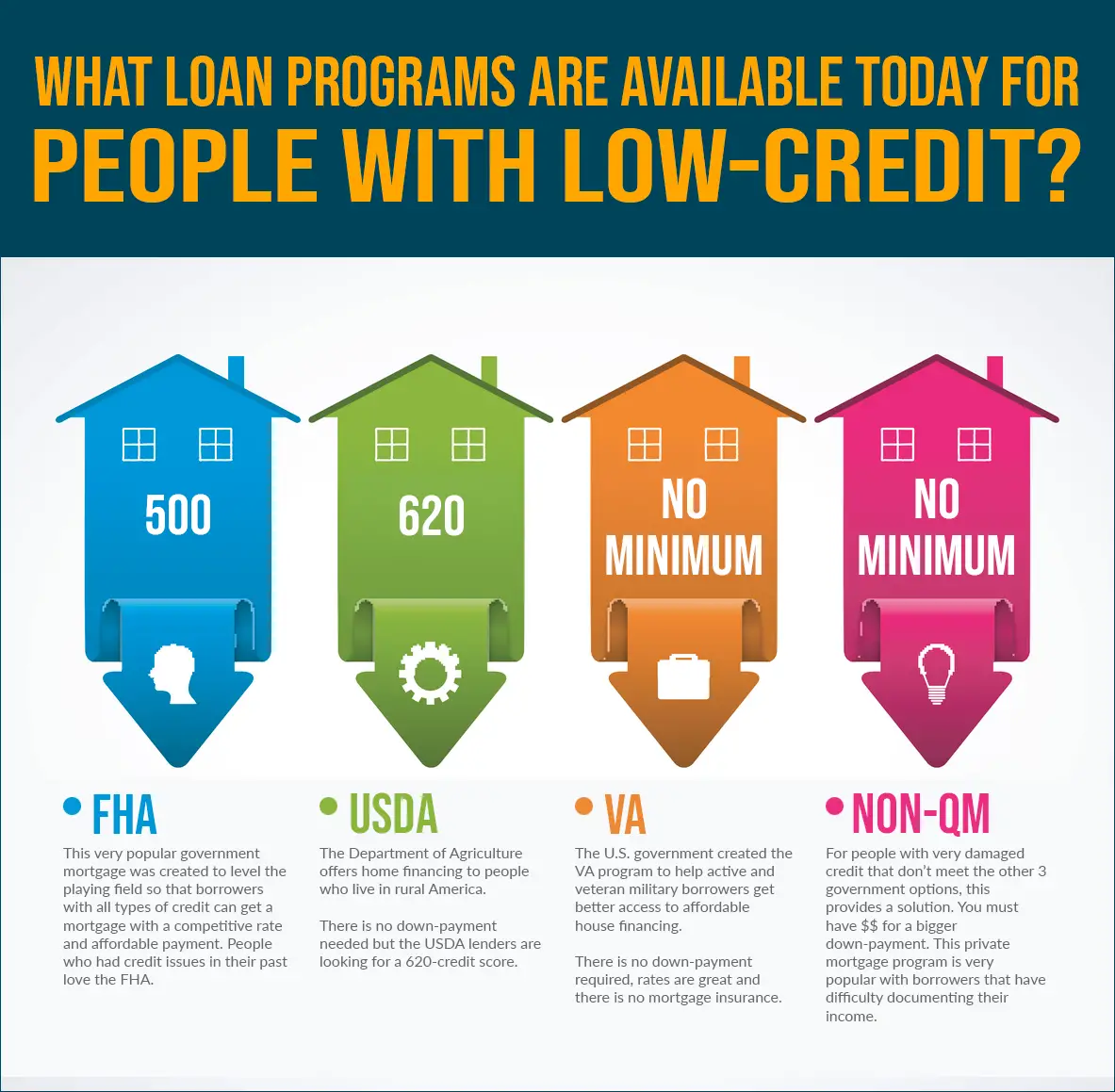

There Are Lenient Credit Requirements

Not everyone has a perfect credit score, thats why government-insured loans can be fitting for those individuals who may have less-than-desirable credit scores. A conventional loan typically requires a credit score above 620. But FHA and VA loans are available for homebuyers with credit scores of at least 580.

Dont Miss: Dental Implant Assistance Programs

Recommended Reading: How To Get A Job In Dc Government

What Are The Costs Of A Government Loan

For start-up loans there are no application or early repayment fees. They also have a fixed annual interest rate of six per cent, making it easier to plan repayments. Home Building Fund loans must be repaid with interest set at a pre-agreed variable rate.

For EFG loans, there will be the loan sum, interest payments and any fees to the lender. There is also a guarantee fee equivalent to two per cent per annum on the outstanding balance, collected quarterly throughout the loan term.The cost of loans secured via the British Business Bank or the various regional schemes will vary. Check programme details to determine the full cost.

Government Loan Schemes For Small Scale Businesses

| Name of the Scheme | |||

|---|---|---|---|

| At the discretion of SIDBI | Rs.10 lakh onwards | Up to 10 years including 3 years moratorium | |

| Pradhan Mantri Mudra Yojana | Varies from bank to bank | Up to Rs.10 lakh | Varies from bank to bank |

| Varies from bank to bank | Varies from bank to bank | 5 years to 7 years | |

| Stand-Up India Scheme | Up to base rate + 3% + tenor premium | Rs.10 lakh to Rs.1 crore | 7 years |

| MSME Loans in 59 minutes | 8.5% onwards | Rs.1 lakh to Rs.5 crore | As per the bank |

Recommended Reading: Where To Buy Government Surplus

How Much Can I Get For A Startup Business Loan

Startup business loans typically range from $1,000 to $250,000. However, the loan amount you receive depends on your and the business creditworthiness. Most lenders require businesses to have been in operation for at least six months to two years and meet minimum annual revenue requirements. Be sure to check with your desired lender to ensure your startup is eligible.