Incidence And Value Of Government Assistance Benefits By Annual Hours Of Work Hourly Wage Decile Industry And State

This report examines participation in eight federal and state means-tested programs for low-income families: EITC the refundable portion of the Child Tax Credit SNAP the Low Income Home Energy Assistance Program the Supplemental Nutrition Program for Women, Infants, and Children the Section 8 Housing Choice Voucher program Medicaid and the Temporary Assistance for Needy Families program or equivalent state and local cash assistance programs.4

For all of these programs, eligibility is restricted to individuals with low total family incomes, often some percentage of the federal poverty line. Certain programs have additional requirements, such as the presence of young children in the family, income below some percentage of the median rental cost in the persons region, or total family assets below a certain threshold. Most programs also are designed to phase out as family incomes risei.e., as a familys income increases, benefits levels decrease at some proportional ratesuch that higher labor earnings still result in a net increase in total income. Medicaid eligibility, however, terminates above a specific income threshold.5

Families and individuals receiving public assistance, by age of family head and family work status

EPI analysis of Current Population Survey Annual Social and Economic Supplement microdata, pooled years 20122014

Copy the code below to embed this chart on your website.

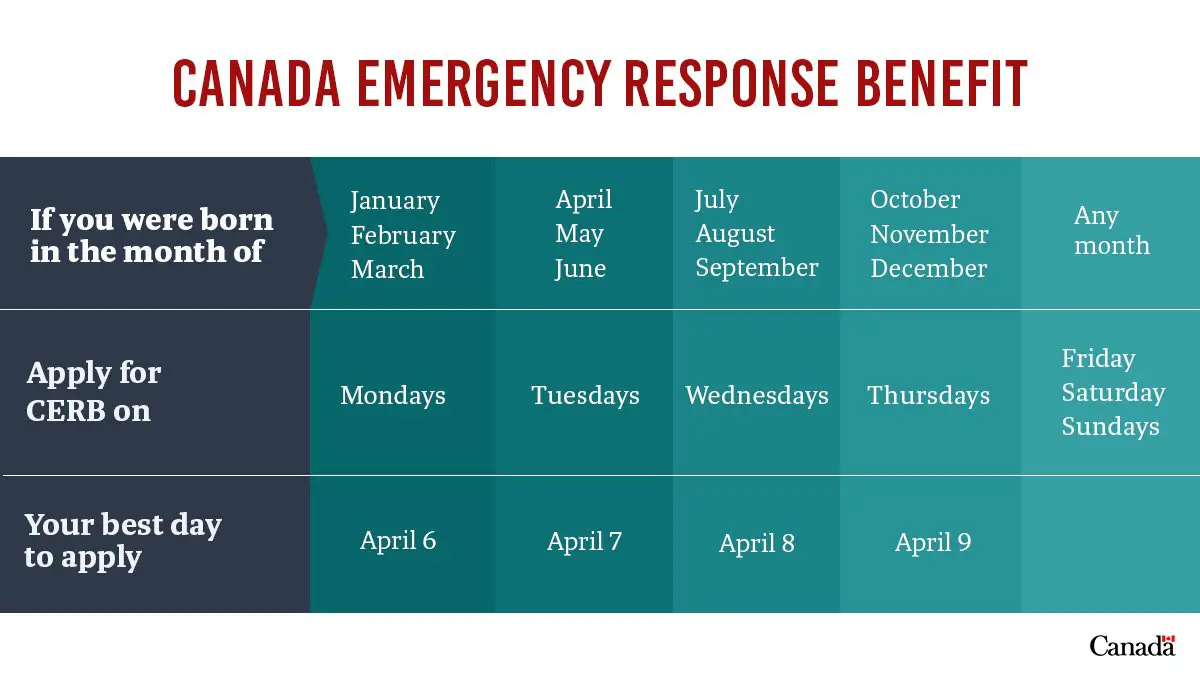

Unemployment Insurance And Covid

Unemployment insurance is a joint federal and state program that pays part of your wages when you lose your job through no fault of your own. Individual states run the program, each with its own eligibility and filing requirements. Many allow you to file online, by phone, orin person, though the COVID-19 pandemic has temporarily halted in-person applications in many places. Some states provide extended benefits when unemployment is high. But that doesn’t necessarily mean you qualify for extended help.

The federal government provided relief for unemployed individuals during the pandemic through three special programs:

All three of these programs officially expired on Sept. 5, 2021. Eligible individuals may still qualify for unemployment claims as long as they are still unemployed and are within the first 26 weeks of their UI benefits.

Federal Employees Retirement System

FERS, which replaced the Civil Service Retirement System in 1987, provides benefits to civilian government workers through three programs: a Basic Benefit Plan, Social Security, and the Thrift Savings Plan .

Eligibility for FERS benefits is determined by your age and number of years of service. The CSRS and FERS planning and applying websites provide complete information depending on how close you are to retirement.

Don’t Miss: Government Fee For Trademark Registration

Employer Benefits And Assistance For Caregivers

Your employers health care plan may cover some medically-related caregiving expenses. This coverage usually depends on your relationship with the person you’re caring for.

When caring for someone, you may have to take some time off work or change your regular working hours. Speak with your employer to determine what options are available. Some employers might offer flexible work arrangements, such as the ability to work from home. In addition, employers may provide paid or unpaid leave which can be used for caregiving responsibilities.

Your employer may offer other forms of assistance, such as an Employee Assistance Program . An EAP is a confidential service designed to help you manage issues in your personal life that could have an impact on your work, such as having to care for someone who is ill.

Contact your employer, manager, human resources department, union or employee representative to learn what benefits and services might be available to you and the person you’re caring for.

Adults Disabled Before Age 22

An adult who has a disability that began before age 22 may be eligible for benefits if a parent is deceased or starts receiving retirement or disability benefits. We consider this a “child’s” benefit because it is paid on a parent’s Social Security earnings record.

The disabled “adult child” including an adopted child, or, in some cases, a stepchild, grandchild, or step grandchild must be unmarried, age 18 or older, have a disability that started before age 22, and meet the definition of disability for adults.

Example

It is not necessary that the disabled “adult child” ever worked. Benefits are paid based on the parent’s earnings record.

- A disabled “adult child” must not have substantial earnings. The amount of earnings we consider “substantial” increases each year. In 2021, this means working and earning more than $1,310 a month.

Working While Disabled: How We Can Help

Recommended Reading: City Of Las Vegas Job Openings

Do You Have A Comprehensive And Detailed Retirement Plan

Whether you have low income or are feeling financially free, having a detailed and comprehensive retirement plan is an absolute necessity.

The NewRetirement retirement planning calculator is widely considered the best free online tool. It is highly detailed and easy to use, best of all it saves your information so you can quickly make adjustments as your finances and plans evolve.

Terms of Use: Your use of this site constitutes acceptance of the Terms of Use.

Qualify Through Your Child Or Dependent

Any member of your household can make your household eligible if they participate in one of the programs above. For example, if your child or dependent participates in the Free and Reduced-Price School Lunch Program or is enrolled in a USDA Community Eligibility Provision school, your household qualifies for the ACP benefit.

You can apply online or with the assistance of your internet company.

Read Also: Government Grants For Auto Repair Shops

I Am On The Ontario Disability Support Program Or Ontario Works What Income Support Do I Qualify For

The Ontario Disability Support Program provides income support to persons with serious health problems, and Ontario Works provides everyone else in need of financial assistance, provided that they meet the eligibility criteria. Currently, a single person receives up to $1,169 from ODSP or $733 per month from OW.

Did You Know Half A Million Eligible Canadians Dont Claim Their Rightful Disability Benefits

In addition to being put off by the CRAs complex application processes, many Canadians dont realize that their chronic condition meets the threshold for the Canadian Disability Tax Credit .

Claiming your rightful Canadian disability benefits isnt necessarily tied to the name of your condition, but how severely it affects your day-to-day life. That means severe cases of otherwise commonplace conditions can qualify, while mild cases of less common ones may not. In order to be eligible to qualify:

Read Also: Government Grants For Home Repairs

Appendix C: Discussion Of Imputed Subminimum Hourly Wage Values In The Cps

For the vast majority of observations within the ASEC sample, imputing an hourly wage from the respondents reported annual wage income, weeks worked per year, and usual hours worked per week yields a plausible hourly wage value. However, for a small but not insignificant portion of the sample9.9 percentimputed wage values fall below the federally mandated minimum wage of $7.25 per hour. Some of these values fall below the wage floor almost certainly due to measurement error compounded by the imputation process. It is understandably difficult for some individuals to recount accurately their total wage income and total time in the workforce for a 12-month period three months removedespecially if they changed jobs, worked only a portion of the year, or worked inconsistent hours.

Appendix Figure CA shows the distribution of all imputed wage values below the federal minimum wage and the distribution of all imputed wage values, both as shares of their respective totals, by respondents reported usual hours worked per week. The distribution shows that subminimum wage values disproportionately occur among individuals who worked less than 35 hours per week. Appendix Figures CB1 and CB2 show the distribution of subminimum wage values and total wage values by respondents reported weeks worked in the previous year. As expected, subminimum wage values disproportionately appear among part-year workers.

| Usual hours worked per week | Wage values below $7.25 |

|---|

| Wage decile |

|---|

Social Security Disability Insurance Benefits

Social Security Disability Insurance benefits are paid to people who cannot work for at least one year due to a medical condition or who are expected to die from that condition.

To be eligible, you must:

- Have worked in a job or jobs covered by Social Security

- Meet Social Securitys definition of disability

- Have worked long enough and recently enough to qualify for disability benefits

Additional information about SSDI can be found in the Social Security Disability Benefits brochure. The Social Security Disability Planner helps you determine if you are eligible. If you believe you qualify, you can apply online.

Don’t Miss: What Is Congress Mortgage Stimulus Program For The Middle Class

Special Rules For People Who Are Blind Or Have Low Vision

We consider you to be legally blind under Social Security rules if your vision cannot be corrected to better than 20/200 in your better eye or if your visual field is 20 degrees or less, even with a corrective lens. Many people who meet the legal definition of blindness still have some sight and may be able to read large print and get around without a cane or a guide dog.

If you do not meet the legal definition of blindness, you may still qualify for disability benefits if your vision problems alone or combined with other health problems prevent you from working.

There are a number of special rules for people who are blind that recognize the severe impact of blindness on a person’s ability to work. For example, the monthly earnings limit for people who are blind is generally higher than the limit that applies to non-blind disabled workers.

In 2021, the monthly earnings limit is $2,190.

Lost Wages Assistance Program

The Lost Wages Assistance program, created Aug. 8, 2020, was a federal-state unemployment benefit that provided $300 to $400 in weekly compensation to eligible claimants. The federal government provided $300 per claimant from the Disaster Relief Fund , and states were asked to provide the remaining $100.

LWA was established in response to the expiration of the FPUC program on July 31, 2020, and designed to offer compensation through Dec. 27, 2020.

Read Also: Government Grants For Dental Implants

What Medical Conditions Qualify For The Disability Tax Credit

The disability tax credit is different from other disability benefits plans. The above disability plans focus on how your medical condition affects your ability to work. The is not focused on your ability to work. Rather, it focuses on impairment with your daily activities.

Eligibility Criteria for the Disability Tax Credit

- be blind

- be in at least one basic activity of daily living

- be significantly restricted in two or more basic activities of daily living

- need life sustaining therapy

You will automatically qualify for the disability tax credit if your medical condition causes blindness or you to need life sustaining therapy.

To qualify as blind your visual acuity in both eyes must be 20/200 or less or your field of vision in both eyes is 20 degrees or less.

To qualify under the life sustaining therapy requirement, the therapy must be needed to support a vital function, and you must need it at least 3 times per week for an average of 14 hours per week.

The basic activities of daily living include the following:

- Speaking

- Dressing

- Mental functions necessary for everyday life

To qualify for the disability tax credit you must show that you are markedly restricted in one of these areas. A marked restriction means that you are unable to do the BADL or take an inordinate amount of time to do it. This restriction must be present 90% of the time.

Learn the secrets for winning disability benefits, even after a denial

Childs Health Insurance Program

CHIP offers free or low-cost medical and dental care to uninsured kids up to age 19 whose family income is above Medicaids limit but below their states CHIP limit. In addition to Medicaid, six million children received additional benefits from CHIP. It covers hospital care, medical supplies, and tests. It also provides preventive care, such as eye exams, dental care, and regular check-ups. CHIP is also administered through CMS in the Department of Health and Human Services.

Recommended Reading: Rtc Employment Las Vegas

Awareness And Application Issues

Most of the government support schemes out there aren’t splashed across billboards or getting a lot of airplay, but it may take a while for the money to come through.

Vittorio Cintio, national president of the Australian Association of Social Workers , says that while the information for financial support programs is available on the DHS website, getting hold of the benefits is another matter.

“The overall interface between the system and the people is not user-friendly,” Cintio says. “Often criteria, verification, etc., are written in legalese and not easy to understand. Especially when support payment programs are rushed out in times of drought, fire and COVID in our aim to provide additional services we can inadvertently cause confusion.

The overall interface between the system and the people is not user-friendly. Often criteria, verification, etc., are written in legalese and not easy to understand

Vittorio Cintio, national president, Australian Association of Social Workers

“It is a complex service system and navigating between federal and state/territory payment options can be difficult for support workers to navigate, let alone individuals.

“This can and usually does cause stress, agitation, trigger depressive episodes and can impact on mental health, and when this occurs, it can affect people’s ability to take in new information learn about the different payment options.

Depending on your circumstance, you may be eligible for Family Tax Benefit.

Cons Of Government Food Programs

- Social stigma for recipients

- Consistency and quality of state-run programs vary

- Limitations on what products can be purchased

- Mandated work requirements difficult for adults with children

The table below lists eligibility requirements for federal food programs.

| Program |

|---|

| 60 or older and must meet state guidelines |

Also Check: Good Jobs For History Majors

Vita And Tce Tax Filing Assistance Programs

The IRS has two in-person tax assistance programs: the Volunteer Income Tax Assistance program and Tax Counseling for the Elderly . Both offer free tax-preparation assistance to qualified individuals. VITA generally applies to you if your income is $57,000 or less, you are disabled, or you have limited English-speaking skills. TCE is for citizens aged 60 or older.

You can find VITA and TCE program sites using either the IRS TCE/VITA locator tool or the AARP Foundation Tax-Aide site locator tool.

Due to the coronavirus pandemic, all TCE sites and many VITA sites are closed until further notice. Use the VITA locator tool to find out if a site near you is open.

Emergency Broadband Benefit Program

The EBB opened for enrollment on May 12, 2021, and provides a monthly discount of $50 to $75 for households that qualify. The program also grants a one-time discount of up to $100 toward a new laptop, desktop, or tablet purchased from participating providers.

Your household is eligible if at least one member meets one of the following criteria:

- Has income at or below 135% of the current Federal Poverty Level or participates in certain assistance programs, such as SNAP, Medicaid, or Lifeline.

- Is approved to receive benefits under the free and reduced-price school lunch program or the school breakfast program, including through the USDA Community Eligibility Provision in the 2020 to 2021 school year.

- Received a Federal Pell Grant during the current award year.

- Experienced a substantial loss of income due to job loss or furlough since Feb. 29, 2020, and the household had a total income in 2020 at or below $99,000 for single filers and $198,000 for joint filers.

- Meets the eligibility criteria for a participating provider’s existing low-income or COVID-19 program.

To apply, do one of the following:

- Contact a participating broadband provider directly to learn about its application process.

- Go to GetEmergencyBroadband.org to apply online and to find participating providers near you.

The EBB program is scheduled to end six months after the Department of Health and Human Services declares an end to the pandemic, or if the program runs out of funds.

Don’t Miss: Federal Grants For Dentures

You Or Your Family Members May Be Eligible For Increased Benefits

Our mission is to deliver Social Security services that meet the changing needs of the public.

It’s not unusual for a benefit recipient’s circumstances to change after they apply or became eligible for benefits. If you, or a family member, receive Social Security or Supplemental Security Income , certain life changes may affect eligibility for an increase in your federal benefits. For example, if your spouse or ex-spouse dies, you may become eligible for a higher Social Security benefit.

To find out if you, or a family member, might be eligible for a benefit based on another persons work, or a higher benefit based on your own work, see the information about benefits on the Social Security website. You can also use the Benefit Eligibility Screening Tool to find out if you could get benefits that Social Security administers. Based on your answers to questions, this tool will list benefits for which you might be eligible and tell you more information about how to qualify and apply.

The questions and answers below are about a few of the life changes that could possibly increase your benefits.

Trillium Drug Program Application

To submit a Trillium Drug Program application or supporting documentation, you can either:

- fax the documents to

- e-mail the documents to

If faxing or emailing, you must mail the original signed form to the TDP by Canada Post when the outbreak is over. We will update this page to tell you when you have to mail us your documents.

When you mail us the original application, please write in bold letters “Resubmit Originals” on the application form.

Read Also: Government Contractors Charleston Sc