Judicial Challenges Of Publicly Funded Faith

Because of the many questions that have been raised regarding funding faith-based organizations under charitable choice rules, a plethora of legal challenges have been filed, with varying results. The only case challenging faith-based funding programs to reach the Supreme Court did not address the constitutionality of providing public funding to religious organizations for social programs. Instead, the case addressed the threshold litigation issue of standingâdefining the scope of possible litigants who were legally able to challenge programs under the Faith-Based Initiative. Other cases in lower courts in which the litigants had standing to challenge charitable choice rules have had mixed results, indicating that no clear answer has prevailed for the many questions relating to funding of programs implemented by religious organizations.

Democrats Need Religious Voters

Democratic Congresswoman Grace Meng, the lead Democratic co-sponsor of the FEMA legislation, was brought up as a devout Christian and has a substantial Orthodox constituency in her Queens district. Those elements made the legislation a no-brainer, she said.

âAs a representative of a diverse and multicultural neighborhood, people needed to know their government is there for them regardless of their faith,â she said. . âWe in the Democratic Party need to do a better job of reaching out to people in the faith community.â

Meng noted that her bill included constitutional protections: Money could not go to âchurch pews and Biblesâ but to secular services provided by a house of worship.

Espinoza Government Funding And Religious Choice

Published online by Cambridge University Press: 26 October 2020

- Thomas C. Berg

- Affiliation:James L. Oberstar Professor of Law and Public Policy, University of St. Thomas School of Law

- Douglas Laycock

- Affiliation:Robert E. Scott Distinguished Professor of Law and Professor of Religious Studies, University of Virginia, and Alice McKean Young Regents Chair in Law Emeritus, University of Texas

Recommended Reading: Government Marketing And Procurement Llc

Charities And Organizations The Helps Non

There are many Charities as well federal government authorities are working towards newly set up business as well business which is struggling with finding growth. the federal government always support newly born entrepreneur who has a better idea but struggling with funds. so do happens with nonprofit organizations, nonprofit organizations work to help society without expecting profit or return for their works.Grants.gov is the governments organization that helps nonprofits organizations to find funding for their mission. Grants.gov has various others grants too to offer for many i.e they have grants for small business, they have grants for women, they have grants for veterans, They have grants for students as well as single parents. you can grants for nonprofit organizations by visiting their site online. many other charities help. If you want to explore more information about government grants near you you can find it

Apply For Grants for Non-Profit organizations

Advocates Say Government Can Assist Faith

Advocates assert that government should assist faith-based social programs as long as it does so in a nondiscriminatory fashion without any endorsement or coercion. They acknowledge that the redemptive power of religion is critical to such organizations effectiveness, but they are confident that these organizations distinguish between permissible social services and impermissible proselytizing.

Advocates are also reassured that the governments requirement that initiatives include secular alternatives protects beneficiaries from improper religious pressure. And they defend religiously based hiring as crucial to the success of such programs.

Recommended Reading: Government Program To Buy House

A Simple Guide To Church Grants For Non

Are you a member of a church that needs repairs, additional buildings or space, or other costly additions that your congregation just cant support? There are many faith-based grants for churches that exist, and that can help you expand, repair, and work more effectively in your community. This guide helps you understand the basics of church grants so you can get started.

Problems Faced By Nonprofit Organizations

Operational capacity support is a continuing problem faced by nonprofit organizations that rely on external funds to maintain their operations, in large part because nonprofit organizations have very little control over their source from earnings. Organizations rely on supporting their operations, often through contracts subsidies or grants, like tax credits or vouchers. The sort of income is critical for the viability and value of the corporation, as it impacts the reliability or predictability with which the company create applications or maintain facilities can employ and keep employees.

Don’t Miss: Government Assistance Buying A Car

Judge Not Lest Ye Be Judged

The conservative majority on the Supreme Court has persisted since 1971, and it has left its imprint on church-state separations. Most recently, last year, the court ruled 7-2 that a church may receive government funds for secular purposes â in that case, repaving a playground. Court rulings, Diament noted, tend to shape the overall debate by signaling to partisans what is winnable and what is not. He said he did not expect a fight on the FEMA law.

âTo take an extreme position on that would be at odds with Supreme Courtâs understanding of the constitution,â he said.

Presented By The John Seigenthaler Chair Of Excellence In First Amendment Studies

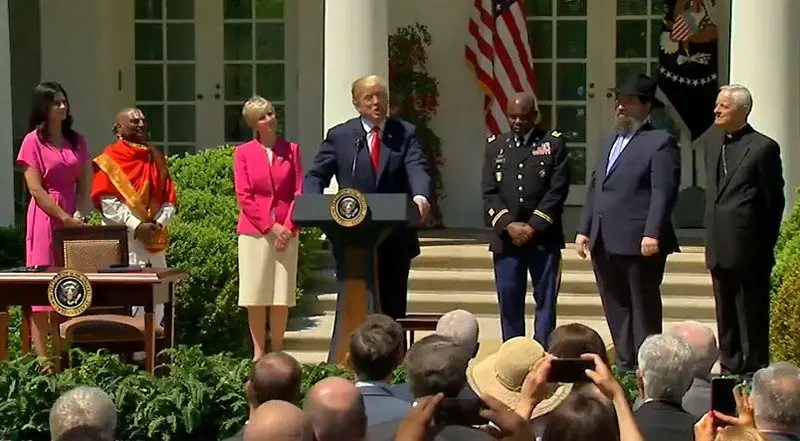

President Bush signs executive orders to advance his “faith-based initiative” at a meeting of religious and charitable leaders in 2002 in Philadelphia. Hoping to involve churches and religious organizations more deeply in government efforts to address social ills, Bush signed executive orders aimed at giving those groups a leg up in the competition for federal money.

The U.S. government has long helped churches, religious neighborhood groups, and faith-related charities to pursue their public goals. The recent expansion of government funding for faith-based social programs, however, has sparked concerns about the constitutionality of such assistance.

Read Also: Government Programs For Rural Development

Selectivity In Employment Of Religious Organizations Receiving Public Funds

Federal law provides protection to employees to ensure that neither the government nor private employers discriminate on the basis of religion. In some cases, however, an employer’s preferences in hiring are protected by the First Amendment. The First Amendment ensures the right of religious organizations to exercise their religion without governmental interference, which has led to some exceptions in employment nondiscrimination laws for religious organizations. The Civil Rights Act of 1964 and the First Amendment govern the rights of religious organizations to consider religion in employment decisions.

Title VII of the Civil Rights Act of 1964

The Civil Rights Act of 1964 created protections for civil rights across a wide spectrum, including religion. Title VII of the act prohibits discrimination in employment on the basis of race, color, religion, national origin, or sex.21 Title VII prohibits discriminatory treatment of employees on the basis of their religious beliefs and requires employers to make reasonable accommodations for employees’ religious practices.

First Amendment Protections

Limitations Applicable to Government Contractors: Executive Orders 11246 and 13279

Executive Order 11246, in effect since 1965,29 requires that all federal procurement contracts and federally assisted construction contracts include provisions that prohibit employment discrimination based on religion. Section 202 of the Order provides:

Preemption of State and Local Civil Rights Laws

Us Supreme Court Endorses Taxpayer Funds For Religious Schools

By Andrew Chung, Lawrence Hurley

5 Min Read

WASHINGTON – The U.S. Supreme Court narrowed the separation of church and state in a major ruling on Tuesday by endorsing Montana tax credits that helped pay for students to attend religious schools, a decision paving the way for more public funding of faith-based institutions.

The 5-4 decision, with the conservative justices in the majority and the liberal justices dissenting, was a boost to conservative Christian activists who have fought for years to make state taxpayer funds available for children to attend religious schools in the form of contentious voucher programs.

The ruling, written by Chief Justice John Roberts, represented the courts latest expansion of religious liberties. The court backed a Montana program that gave tax incentives for people to donate to a scholarship fund that provided money to Christian schools for student tuition expenses.

President Donald Trumps administration supported the Montana parents. His education secretary, Betsy DeVos, is a prominent supporter of such school choice plans benefiting private and religious schools rather than secular public schools. Christian conservatives are an important voter bloc for Trump, seeking re-election on Nov. 3.

This decision represents a turning point in the sad and static history of American education, and it will spark a new beginning of education that focuses first on students and their needs, DeVos said.

You May Like: How Does The Government Monitor Social Media

What Does Churches Together Do

Churches Together in England is an ecumenical organisation and the national instrument for the Christian Churches in England. It helps its Member Churches work better together. Churches Together in England supports a network of Intermediate Bodies, each usually covering an English county or metropolitan area.

H Unfunded Mandates Reform Act

Section 4 and of UMRA, 2 U.S.C. 1503-, excludes from coverage under that Act any proposed or final Federal regulation that enforces constitutional rights or establishes or enforces any statutory rights that prohibit discrimination on the basis of race, color, religion, sex, national origin, age, handicap, or disability. Alternatively, this final rule would not qualify as an unfunded mandate because the requirements in this final rule apply exclusively in the context of Federal financial assistance, so most, if not all, mandates are funded. The rule in any event will not require expenditures by State, local, or tribal governments of $100 million or more per year. Accordingly, this rulemaking is not subject to the provisions of UMRA.

Recommended Reading: Government Jobs Bergen County Nj

It Was A Political Win

âThere was no political cost to be paidâ by Obama in backing faith-based partnerships, said Marc Stern, the general counsel for the American Jewish Committee. AJC opposed Bushâs office in 2001, but more recently lobbied to advance the disaster relief bill. Stern said Democrats were going to vote for Obama anyway, and Obama as the nominee had to tack to the center.

Additionally Obama, with his past as a community worker in a troubled Chicago neighborhood, had experienced the benefits of partnering with churches to alleviate strife.

âHe disappointed the strict church-state separationists,â Diament recalled.

Obama once in office sweetened the deal for liberals, inviting them to join a 25-person advisory council that tinkered for two years on recommendations that would protect the Faith-Based office from violating constitutional separations.

Under Trump, the office has been moribund, but he has aggressively embraced many of its principles. Just a month before the disaster aid bill had passed, he used his executive powers to remove the restrictions.

D Agency For International Development

USAID received a total of 28,518 comments on its January 17, 2020 NPRM, and did not consider any comments received after that comment end date of February 18, 2020. Of the comments received, 28,044 were identical or nearly identical to other comments received, leaving 474 comments that were unique or representative of a group of substantially similar comments. In addition, many of those comments were identical to comments provided to the other Agencies and addressed above in the Joint Preamble, and most of these cross-cutting comments did not directly apply, or did not apply in the same way, to USAID. Some of those cross-cutting comments included additional remarks or references specific to USAID’s proposed rule.

As reflected below, unless otherwise specified, for those comments received by USAID that are addressed fully in the Joint Preamble, USAID adopts those responses to the extent applicable to USAID’s regulations. We address in this Part III.D of the preamble the USAID-specific comments not addressed elsewhere in the preamble and provide the USAID-specific findings and certifications.

Some of the cross-cutting comments addressed in the Joint Preamble were not received by USAID, but are nevertheless applicable to the USAID regulations. Unless noted either in the Joint Preamble or this agency-specific Part III.D, we concur in the resolution of the issues in that part of the preamble.

1. Notice and Alternative Provider Requirements

Changes: None.

Affected Regulations:.

You May Like: Government Contractors In Hampton Roads

I Conflicts With Other Federal Laws Programs And Initiatives

Summary of Comments: Multiple comments claimed that the NPRMs could create inconsistency with numerous Federal statutes. They also charged, without any additional specifics or elaboration, that the NPRMs failed to consider conflicts with applicable nondiscrimination statutes, including Titles VI and VII of the 1964 Civil Rights Act, the Americans with Start Printed Page 82099Disabilities Act, Section 504 of the Rehabilitation Act, Title IX of the Education Amendments of 1972, Section 1557 of the Affordable Care Act, the Fair Housing Act, the Violence Against Women Act, the Victims of Crime Act, the Omnibus Crime Control and Safe Streets Act, the Family Violence Prevention Services Act, and Executive Order 11246.

One commenter claimed that the NPRMs were improper because they violated the Treasury and General Government Appropriations Act of 1999, Public Law 105-277, div. A, 101 , codified at 5 U.S.C. 601 note, by failing to include a Family Policymaking Assessment, which, in certain circumstances, requires agencies to assess the impact of proposed agency actions on family well-being. The commenter critiqued the NPRMs because the Agencies failed to determine whether a proposed regulatory action strengthens or erodes the stability or safety of the family or increases or decreases disposable income or poverty of families and children.

Changes: None.

Government Has History Of Partnering With Faith

Although most scholars agree that the establishment clause of the First Amendment forbids government from favoring any particular faith, they differ over whether government efforts to enlist the aid of religious social service organizations threaten the healthy separation of church and state, which the establishment clause protects.

Government and faith-based organizations have been partners since Colonial America. The Congress that wrote the First Amendment also set aside in the Northwest Ordinance public land for churches. Presidents George Washington and Thomas Jefferson funded Christian missions for Indian tribes. Government programs for newly emancipated African Americans funneled much of their money through religious schools and social agencies. Local and state governments supported hospitals, medical clinics, orphanages, and homes for the aged operated by religious groups. Both state and federal governments have long granted tax breaks to religious institutions.

Also Check: Identity Governance And Access Management

Can Religious Organizations Accept Government Funding And Maintain Their Religious Freedom

Recently, due to the COVID-19 crisis, federal financial assistance became available to churches and other religious organizations that have experienced economic hardship as well as to businesses. Many church leaders are wondering whether churches can accept this government funding and still maintain their religious liberty? The short answer is yes for now. This post will examine the new law, discuss religious liberty concerns, and provide information on how to apply for this loan.

B Regulatory History And Legal Background

As explained in the NPRMs, the primary purpose of this final rule is to implement the most recent in a series of executive Start Printed Page 82044orders that address issues that affect faith-based and community organizations. As discussed in Part I above, the NPRMs provided a summary of those executive orders, as well as the Attorney General’s Memorandum that was drafted and published pursuant to . Because many of the commenters who addressed also referenced the Attorney General’s Memorandum, the Agencies respond to those comments in the discussion of below.

1. Executive Orders 13199 and 13279

Summary of Comments: A number of commenters who supported and opposed the proposed rules referenced President George W. Bush’s Executive Orders 13199 and 13279. Some commenters stated that the proposed rules were consistent with which helped to ensure that faith-based organizations have equal protection and opportunity under the law as they work to meet the social needs of American communities.

One commenter objected that these executive orders sidestepped the bipartisan process and allowed for government-funded religious discrimination. Some commenters also expressed the sentiment that and this final rule were contrary to the separation of church and state.

Changes: None.

Affected Regulations: None.

2. Executive Orders 13498 and 13559

Changes: None.

Affected Regulations: None.

3. Executive Orders 13798 and 13831 and the Attorney General’s Memorandum

Changes: None.

Don’t Miss: Sap Master Data Governance Best Practices

F Discrimination On The Basis Of Religious Character Or Exercise

Existing regulations required eight of the Agencies and their intermediaries not to discriminate in selection of service providers based on religious character or affiliation. VA’s existing parallel provision barred discrimination based on religion or religious belief or lack thereof.. Existing regulations for DHS, USAID, DOJ, DOL, and HHS also required any grant, document, agreement, covenant, memorandum of understanding, policy, or regulation used by the Agencies not to disqualify any organization based on its religious character or affiliation. USDA, VA, ED, and HUD did not have such an existing provision on disqualification.

In the NPRMs, all Agencies proposed changes relating to such provisions. With regard to discrimination, DHS and HUD proposed to include prohibitions when based on religious character,affiliation, or exercise, while the other Agencies proposed to include a prohibition when based on religious exercise or affiliation but not religious character. With regard to disqualification, eight Agencies proposed to include prohibitions when based on religious exercise or affiliation, USDA omitted that language from its proposal, and no Agency proposed a prohibition when based on religious character. Eight Agencies proposed to add that religious exercise for multiple provisions, including these provisions, incorporates the statutory definition from RLUIPA that also applies to RFRA.

1. Religious Character

2. Religious Exercise

Court Has Upheld Faith

The Supreme Court has never struck down a government-funded, faith-based social program.

It upheld a federal construction grant to a Catholic hospital in Bradfield v. Roberts , a federal grant to a faith-based counseling program for teenagers in Bowen v. Kendrick , and, more recently, a series of programs involving indirect aid. The current Court is satisfied if government assistance is neutral that is, nonreligious as well as religious organizations are equally eligible to compete for funding and beneficiaries are offered genuine choices about where to go for assistance.

Relying on the Lemon test as modified by Agostini v. Felton , the Court accepts as a sufficient secular purpose combating social and economic problems. The Court does demand safeguards to prevent the diversion of public funds for religious purposes. However, it presumes that faith-based organizations will comply with government restrictions and therefore that little oversight is necessary.

Recommended Reading: Where To Cash A Government Check For Free