Health Professions Student Loans

Specialized student loans exist for students studying specific areas of medicine such as nursing, dentistry, optometry, sports medicine, or veterinary medicine. Each loan has its own requirements about accepted areas of study and financial need.

Learn more about medical education loans from the Health Resources and Services Administration , a part of the U.S. Department of Health and Human Services.

Despite your financial standing or field of study, you can find an education loan that suits your needs. It can help you and your family to fund your higher education and reduce the financial burden of school.

Find Out What’s Available Then Figure Out What You Can Pay Back

There are limits to almost everything in life, including how much you can borrow on student loans. Student loan limits are based on a variety of factors, including the type of loan , your year in school, and how much it costs to attend your school of choice.

Its important to keep in mind that the maximum amount you can borrow isnt necessarily the amount you should borrow. You should only borrow as much as you can expect to be able to pay back under the terms of the loanand the interest rate is part of that calculation. All this makes for a tricky landscape, which starts with knowing whats available.

Note that as a result of the 2020 economic crisis, the U.S. Department of Education has suspended loan payments, waived interest, and stopped collections through September 30, 2021.

William D Ford Federal Direct Loan Program

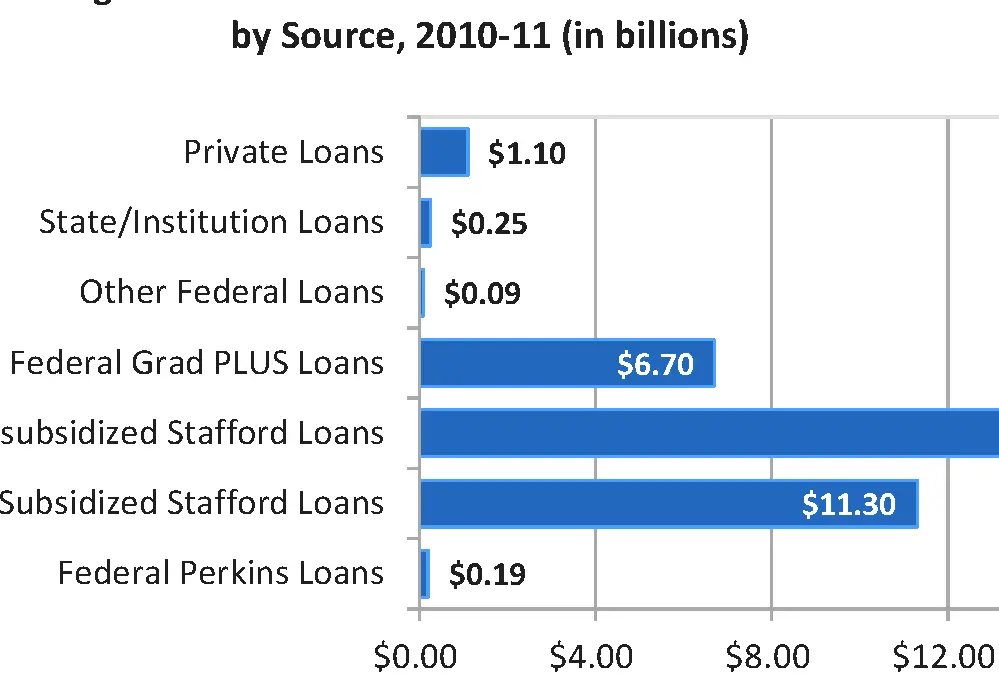

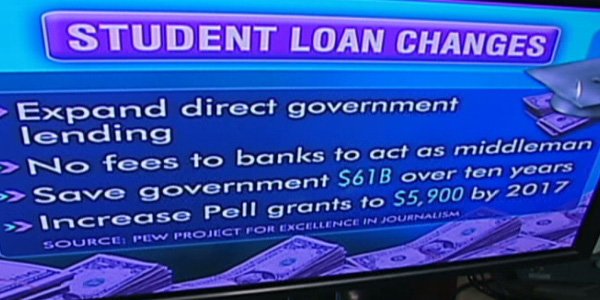

Student lending has undergone a recent shift. In the past, Stafford Loans were the cornerstones of the federal student lending program. Loan amounts were determined by schools and government administrators, and then students entered into loan agreements with private lenders who supplied the funds. Under the terms of the Health Care and Education Reconciliation Act of 2010, Federal Direct Loans are issued straight from the Department of Education thus reducing administration costs.

Federal loans are either Subsidized or Unsubsidized distinguished by who pays the interest during certain periods of repayment.

Subsidized Loans are currently offered with 3.4% interest rates, and qualified borrowers are not responsible for interest payments:

- While the borrower is enrolled in school

- During a six-month grace period after a borrower leaves school*

- During qualified periods of loan repayment deferment

* An important change to Direct Loans repayment terms stipulates that loans issued after July 1st, 2012 do not qualify for government interest payments during the six-month grace period following school. Student borrowers are responsible for interest during the grace period, so unpaid interest is added to the total loan debt.

Also Check: Government Job Openings In Atlanta Ga

More Time To Pause Payments

Federal loan deferment lets you postpone payments due to economic hardship for up to three years, while private student loans generally arent as flexible. Its common for private lenders to offer payment postponement for 12 months, for instance, in three-month increments. Look for lenders that offer more.

» MORE: How do I know if my student loans are federal?

Comparing Federal Loans Vs Private Loans

The great majority of student loans are made through the William D. Ford Federal Direct Loan Program, but when students need more help to complete their college education, they turn to private lenders, such as banks or credit unions.

The major difference between federal student loans and private student loans is the cost and the use of credit scores in determining eligibility.

Undergraduate students applying for federal loans will not have to go through a credit check. Graduate students seeking federal loans must go through a credit check and could be denied loans if there is adverse information in their credit history.

Other differences between public and private student loans include:

8 Minute Read

Recommended Reading: How To Apply For Government Subsidized Housing

Flexible College Student Loans

Loans for student education offer a greater degree of flexibility, as well as more manageable terms and conditions than standard loans. Federal and private lenders understand the demands of a college career, and both strive to make student loans easier to manage.

Federal loans are by far the most flexible of education loans, allowing students to borrow much needed funds for college at incredibly appealing terms. The amount of federal loans is determined by financial need, and almost all college-bound students are eligible for government loans. Students currently enrolled in college can take advantage of government-sponsored programs with low fixed interest rates and deferred payments, such as the Stafford Loan and the Perkins Loan. As a subsidized loan program, the Federal Direct Stafford Loan is an especially attractive option for borrowers who qualify.

For a Stafford Loan that is subsidized by the government, the government will pay all interest accrued on the loan while the student is enrolled in college.

Federal Student Loan Interest Rates

Federal student loan interest rates and fees are set at the start of each academic year and remain fixed for the life of the loan. Federal loans come with a standard repayment schedule and offer a wide range of repayment assistance options, including forgiveness for qualified borrowers, forbearance, deferments, and Income-Based Repayment or Pay As You Earn plans that tailor the monthly payments to your income level. For more details on eligibility criteria, repayment assistance, and current rates, visit the Federal Student Aid website.

To apply for federal student loans, you need to complete the .

Recommended Reading: Government Benefits For Legally Blind

Grants And Loans For Full

The Canada Student Financial Assistance Program offers student grants and loans to full-time and part-time students. Grants and loans help students pay for their post-secondary education.

- Apply for grants and loans in one application, directly with your province of residence

- You don’t need to repay grants you receive

- You need to repay loans after finishing school, with interest

- You may be eligible for more than 1 type of grant – when you apply with your province, they will assess your eligibility for all available grants

Canada Student Grant For Full

This grant is available to full-time students in financial need. You are automatically assessed when you apply for student aid with your province or territory.

If you are in school part-time, see grant for part-time students.

Note: This grant is not available to students from the Northwest Territories, Nunavut and Quebec. They have their own student aid programs.

Recommended Reading: Free Grant Money For Home Improvements Government

How Much Can You Borrow

In addition to private loans, there are three main types of federal student loans: Direct Subsidized, Direct Unsubsidized, and Direct PLUS.

First, consider a Direct Subsidized Loan. Subsidized federal loans are simple to obtain, usually less expensive than PLUS or private loans, dont require a or cosigner, and have built-in protections and repayment options that unsubsidized, PLUS, and private loans don’t have. Subsidized federal loans are available for undergraduate students only. Unsubsidized federal loans can be taken out by both undergrads and graduate/professional students.

What Are The Interest Rates On Federal Student Loans

The interest rate on federal student loans is established annually and varies depending on the type of loan. Federal student loans also have fees, which will be deducted from your award. Below are the interest rates and fees for Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans first disbursed on or after July 1, 2021, and before July 1, 2022.

You May Like: Government Filing Fee For Trademark

Federal Direct Loans: The Largest Student Loan Program

Spread the Knowledge. Share:

The federal Direct Loan Program is the biggest source of low-interest college loans. In fact, almost any college student can get one.

The following information applies to undergraduate Direct loans disbursed on or after July 1, 2020 through June 30, 2021. Loan rates and fees are updated annually.

Maximum Lifetime Limit For Student Aid

There are lifetime limits on the number of weeks you can receive student aid. This includes interest-free periods while you are in school. Once a lifetime limit has been reached, interest starts to accumulate. You will also have to start paying back the loan 6 months after you graduate or finish your studies.

Full-time students can receive student aid for no more than 340 weeks, except:

- students enrolled in doctoral studies can receive student aid for up to 400 weeks

- students with permanent disability can receive student aid for up to 520 weeks

Also Check: Best Buy Government Employee Discount

Interest Rates And Origination Fees

CURRENT INTEREST RATES

The interest rate for new Federal Direct Subsidized and Unsubsidized loans first disbursed on or after July 1, 2021, and prior to July 1, 2022, is a fixed rate of 3.73%.

ORIGINATION FEES

For loans disbursed on or after October 1, 2020 and before October 1, 2021, the origination fee will be 1.057%.

To apply for a Direct Student Loan at New College, you must:

- Complete a FAFSA and submit it to New College using the code 039574.

- Complete and submit verification paperwork and supporting documents if selected.

- Complete the online Entrance Interview here if you have never borrowed a Direct Loan before.

- E-sign a Master Promissory Note here with the U.S. Department of Education.

- Once you have registered and completed the requirements listed above, accept your loan offer on your student NEWcleis account. Loans are generally available to accept online starting one month prior to the beginning of the fall semester.

Nationalization Of Higher Education Is Not The Solution

To address the escalating student debt crisis, some presidential candidates have proposed the radical policy of nationalizing the higher education industry under the guise of free college tuition. While the effects of a higher education system based on free tuition are hypothetical for the United States, examples from other countries demonstrate the effects of free tuition on student enrollment, college accessibility, and educational quality.

Chile has moved toward a free tuition model in recent years. In 2014, the newly elected socialist government pledged to phase in free university tuition, first extending this benefit gradually based on family income, with the goal of covering students of all economic backgrounds by 2020. This makes Chile a real-time gauge of whether such policies have the desired effect of increasing affordability and accessibility. In a recent study on these changes in higher education in Chile, Alonso Bucarey finds that 20 percent of low-income students enrolled at the baseline would be denied admission under fixed college capacities, and with complementary policies that include investing in additional capacity, the enrollment rate of low-income students would drop by 10 percent. These findings demonstrate that, far from achieving increased affordability and accessibility, free college tuition actually pushes college further out of reach for the poorest students, owing to the increased competition for placement.

Recommended Reading: How To Cash Government Check Without Id

Federal Direct Plus Loan For Parents

The Federal Direct PLUS Loan for Parents is a credit-based alternative loan program specifically designed to provide low cost loans to parents of dependent college bound students. Parents can secure a loan up to the value of the cost of their student’s attendance less any other financial aid their child has been awarded. Repayment of the PLUS Loan begins as soon as the loan is fully disbursed and students must sign a promissory note guaranteeing repayment if the parent or guardian defaults at any time.

Federal Student Loan Benefits

- You have flexibility. Though any student loanfederal or privateis a legal agreement and must be paid back with interest, federal student loans generally offer more flexible options than private student loans. For example, with federal student loans, the borrower can change their repayment options even after the loan has been disbursed .

- You can make payments based on your salary. Some federal student loans allow for income-driven repayment plans, which cap payments based on the borrowers income and family size.

- You dont need a strong credit history to get federal student loans. Unlike with private student loans, most federal student loans dont require the borrower to have a strong credit history. This can be especially helpful for recent high school graduates who plan on attending college but havent had enough time to build up credit of their own.

- You dont need a cosigner. With most federal student loans, other than Direct PLUS Loans, the borrowers credit is not considered, so its not necessary to apply with a cosigner.

Don’t Miss: How To Get Us Government Security Clearance

Age Differences In Student Loan Debt

According to an analysis by CNBC, when broken down by age, the highest student debt loads are carried by adults between the ages of 25 and 49, with the lowest debt loads carried by adults aged 62 and older.

As of 2021 approximately 7.8 million Americans below the age of 25 carry student loan debt, with an average balance of almost $15,000. Within the group with the largest amount of student debt, adults between the ages of 35 and 49, the average individual balance owed exceeds $42,000, with the average debt load for adults between the ages of 50 to 61 being only slightly lower. These balances are composed of the balance of the debt that adults owe for their own education, and additional amounts they borrow in order to finance their children’s college educations.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Government Jobs Bergen County Nj

Leaving The Country To Evade Repayment

Debt evasion is the intentional act of trying to avoid attempts by creditors to collect or pursue one’s debt. Some news accounts report that individuals are fleeing the US in order to stop repaying their student loans. While leaving the country does not discharge the loan or stop interest and penalties from accruing, it is generally more difficult to collect debts against debtors who reside in foreign nations.

International addresses make it more difficult to find people, and collection companies would usually need to hire an international counsel or a third party collector to recoup the debt, cutting into their profits and reducing their incentive to go after a debtor. ‘It increases our expenses to go overseas,’ says Justin Berg of American Profit Recovery, a debt collection agency in Massachusetts. ‘Our revenues are cut by more than half,’ he says.”

Some nations may enter into agreements with the US to facilitate the collection of student loans.

After default, co-signers of student loans remain liable for repayment of the loan. Cosigners are often the parents of the borrowers.

What You Should Know About Federal Student Loans

Spread the Knowledge. Share:

Many students take out loans to help pay for college. Federal student loans are loans provided by the U.S. government. These loans usually have better terms than loans from banks or other private sources. Heres what you need to know about federal student loans for college.

On Aug. 6, 2021, the U.S. Department of Education announced a final extension of the student loan payment pause until Jan. 31, 2022. The pause includes the following relief measures for eligible loans: a suspension of loan payments, a 0% interest rate, and stopped collections on defaulted loans.

You May Like: Data Domains In Data Governance

Federal Direct Plus Loans

Federal Direct PLUS loans are available to parents of dependent undergraduate students, as well as to graduate or professional students enrolled in school at least half time. PLUS loans do not have a cap on the amount that can be borrowed, but you can’t borrow more than the cost of attendance at the specific school youor your child, if you’re the parentsare attending. Cost of attendance is defined as tuition and fees, room and board, books, supplies and equipment, transportation, and miscellaneous expenses.

Unlike Federal Direct loans, PLUS loans do require a credit check but not a specific credit score. Borrowers cannot, however, have an adverse credit history unless someone agrees to be an endorser on the loan or they can prove extenuating circumstances for the adverse credit history. Apply for a Federal Direct Parent PLUS loan here and a Federal Direct Graduate PLUS loan here.

Public Service Loan Forgiveness

Borrowers who are employed full time by a government or not-for-profit organization may be eligible for federal student loan forgiveness after a certain period of time.

The program requires borrowers to make 120 monthly payments on their federal loans before being considered for forgiveness. Additionally, those payments must be made through certain repayments plans and while you are employed by a qualifying organization.

Standard repayment plan payments qualify, but you will not save any money through forgiveness if you make 120 monthly payments on this plan, as the balance will be paid in full. If you intend to seek loan forgiveness, you should switch to an income-driven repayment plan.

The PSLF program is a great benefit for those passionate about working in nonprofit or government industries, especially ones that dont pay high salaries. The requirements are tight, though, so its not in your best interest to chase forgiveness through this program if youre not fully committed to it.

Don’t Miss: Small Business Requirements For Government Contracts