How To Request A Forbearance With Fedloan Servicing

- Required. Important.

Long term loansHow do you calculate length of loan? Divide the solution of the first equation by the solution of the second equation to calculate the term of the loan. In the example above, enter the calculator whose answer you want to get. This means that it takes about 38 months to repay the loan.What companies offer personal loans?Credible.LightStream.Payoff.SoFi.Mark of Goldman Sachs.The best egg.Read more about personal loans.Upgrade.LendingC

Frequently Asked Questions About Government Assistance

Here are some answers to common questions about student loans:

1. When is the best time to apply?

The online application usually becomes available in early June. We strongly encourage you to apply before the start of August to ensure you receive your funding in time for when tuition and fees are due.

2. Do I have to apply for a financial assistance each school year?

Yes, you will need to submit a new application at the start of each academic year. We encourage students to apply each year. Your financial situation can change each year, therefore, a new assessment is done based on the information you provide for that specific academic year.

3. Why would I apply for government student assistance as opposed to a bank loan?

Government student loans are interest and payment free as long as you are a full-time student. Also you do not need to have any collateral or a co-signor to secure your loan. As well, when you submit your application for funding you will also be assessed for government grants which is money you do not need to repay.

4. Is there a maximum amount of money my parents can earn before I am not eligible to receive financial assistance?

5. I live outside of Saskatchewan, can I apply for government financial assistance?

Yes, if you have not lived in Saskatchewan for 12 consecutive months prior to the start of your study period, you would apply for financial assistance in your home province or territory.

8. How do I apply for a financial assistance?

Graduate students

How To Apply For Federal Student Loans

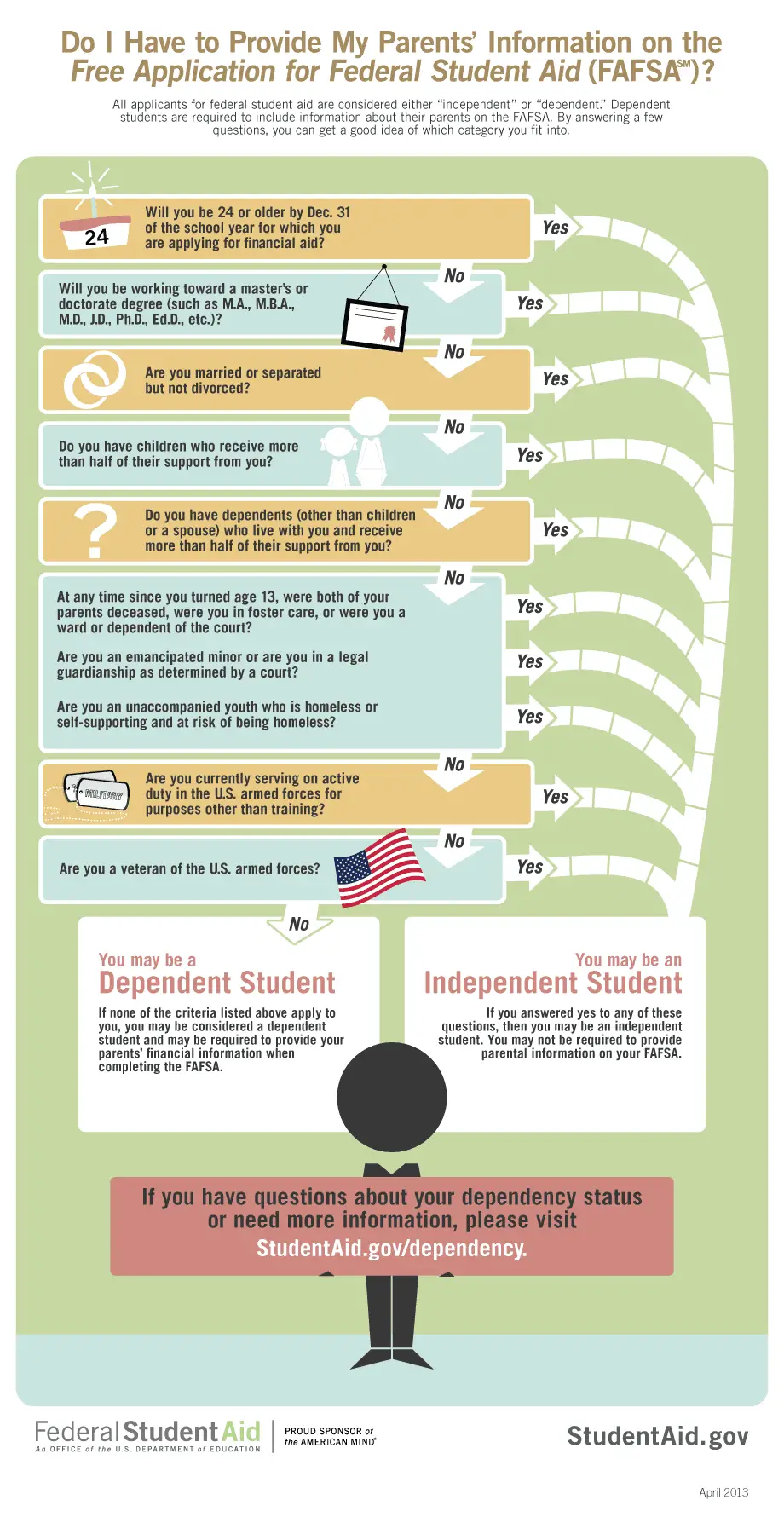

Filling out the FAFSA qualifies you not only for student loans, but for other types of federal financial aid. Depending on your financial need, you may qualify for federal grants, such as the Pell Grant, that can help cover your education costs without needing to be repaid.

If you need to borrow money, federal loans typically have lower interest rates and more flexible repayment options than private loans, so borrow up to the maximum allowed in federal loans before turning to private loans. Heres how to do it.

Recommended Reading: Federal Government Jobs In Virginia

Where Can I Get An Emergency Loan With No Job

Contact companies like ZippyLoan to find out where to start online.

Loan agencyWhat is an agency loan? Definition of agency loan. An agency loan means a principal of $3 million , financed solely from tax revenues, not from bond funds, and subordinated to the principal loan.What are lending agencies?Credit Bureau Definition Credit Bureau means an international financial institution or a bank, insurance company or other source of financing, and a credit bureau means a foreign bank, financial

How To Apply For Federal Student Loans For College

Applying for a federal student loan is free. All you need to do is complete the . In addition to federal student loans, the FAFSA also determines your eligibility for other federal student aid like grants and work-study. You need to submit the FAFSA every year youre enrolled in college to receive federal student aid.

Also Check: Federal Government Day Care Centers

Are There Credit Cards With Guaranteed Approval

- Green dot Primor Visa Gold. The Green Dot Primor card is unique among credit cards secured with bad credit cards.

- First Progress Platinum Prestige Mastercard. The secure First Progress Platinum Prestige Mastercard is a great option if you have bad credit that prevents you from doing this.

- Secure OpenSky Visa.

- Omaha National Bank’s first secure visa.

Value Of Your Funding

Student loans are intended to help cover the cost of your education, plus living expenses where applicable. However, the total amount of loan funding you receive will depend on several factors, including the cost of your program, loan limits, and other eligibility factors. Many provinces provide information on their website to help you determine your eligibility.

For Alberta student loan borrowers, the maximum amount of funding you can receive depends on the program you are registered in. Visit the Alberta Student Aid Loan Limits webpage for more information on the maximum limit available for your program.

Read Also: Government Loan For New Business

Is Bad Credit Loans Legit

Obtaining a legitimate personal loan with a bad credit history is possible these days because the credit market is flexible. For those who cannot get a personal loan due to bad credit, there are better options. These loans are more expensive, but not like payday loans. Here they reveal some of the best legit difficult loans. 23 Nov.

For Students Of The Publicly Funded Post

Tertiary Student Finance Scheme Publicly-funded Programmes

TSFS provides means-tested financial assistance to eligible full-time students. To be eligible for the scheme, you should:

- be registered as a full-time student taking up an exclusively UGC-funded or publicly-funded student place of a recognised course at one of the recognised institutions and

- have the right of abode in the Hong Kong Special Administrative Region or have resided or have had your home in Hong Kong continuously for three complete years prior to the commencement of the course*.(Remarks: This does not cover students holding

- student visas/entry permits

- visas /entry permits under the Immigration Arrangements for Non-local Graduates or

- dependant visas/entry permits which were issued to them by the Director of Immigration when they were 18 years old or above.)

The financial assistance is provided in the form of a grant and/or loan.

Maximum grant:

- tuition fee payable to the concerned local institution

- academic expenses for the course of study and

- compulsory union fees

- $53,890 for 2021/22 academic year

- same for all students

The amount of a grant and/or loan is subject to the assessment of your financial circumstances. But you can obtain a rough estimate by trying the calculator below.

Non-means-tested Loan Scheme for Full-time Tertiary Students

For details please refer to the link below.

You May Like: Not For Profit Board Governance

What Is An Emergency Cash Advance

A cash advance is essentially a short-term loan that is made through your credit card. While getting a cash advance is usually easy, the interest and fees can be high and affect your creditworthiness. But if you have a financial problem and you know that you can pay quickly, this can be a great option.

When To Apply For Federal Student Loans

To apply for a federal student loan, you must first complete the Department of Educations Free Application for Federal Student Aid , then meet the earliest of three possible deadlines:

- the federal student loan deadline set by the government

- the federal student loan deadline set by your state

- the federal student loan deadline set by your school

The reason for the separate deadlines is that your FAFSA form qualifies you for more than one type of financial aid. Grants, scholarships, federal work-study, and federal student loans are all part of the federal aid program. This type of student aid can be awarded by the federal government, by your state, or by your school.

Its important that you check with your schools financial aid office directly, as well as the Department of Education FAFSA main page, to make sure you are prepared to meet the earliest required deadline for the type of federal assistance youll need.

Recommended Reading: Data Governance And Information Governance

What Happens After You Submit The Fafsa

After you submit the FAFSA, the government will send you a , which gives you basic information about your eligibility for federal student aid.

The colleges you included on your FAFSA will have access to this information, and theyll use it to determine the amount of federal grants, work-study, and loans you may qualify for.

The colleges youre accepted to will send you a detailing the financial aid you are eligible to receiveincluding federal student loans, grants, and work-study.

The amount of federal aid you receive from each school can vary, just as the cost of attending each school varies.

What Happens After I Submit An Application

After you submit your application for funding, it is assessed. StudentAid BC assesses your financial need considering allowable costs and resources and determines whether or not you will receive funding.

You will receive a notification of assessment that tells you how much funding you will get. If you applied for assistance for full-time studies you can also check the status of your application online .

The receive your funding section describes the steps you need to take to use your funding to pay for school.

If you do not receive funding, you can appeal your assessment.

You May Like: How Much Does Government Disability Pay

Need Assistance To Repay Your Loan

The Canada Repayment Assistance Plan can provide support.

When you apply for a Canada Student Loan, you are automatically assessed whether you qualify for a grant.

You dont need to take out a loan to get a grant. But, you need to apply and qualify for a loan to get a grant. If you qualify for a loan of at least $1, then you can choose:

A grant differs from a loan because:

- a student may qualify for 1 or more grants

- grants do not have to be paid back and

- a student may be eligible to get more than 1 grant at the same time.

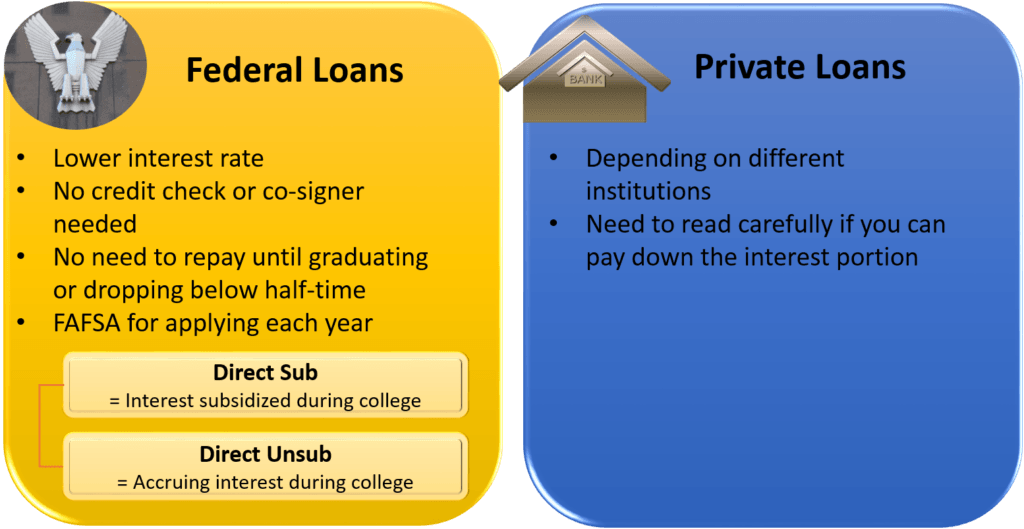

How Student Loan Interest Works

When you take out a student loan, youre required to repay the original amount you borrowed, plus an additional interest payment. The interest payment is based on a percentage of the loan balance, and the percentage is based on the interest rate. You can think of interest as a fee that the lender charges to loan you money.

The interest rate for federal student loans is set every year and is the same for all undergraduate borrowers, regardless of credit history. Interest rates for federal loans are always fixed, which means they will stay the same for the total life of the loan.

The interest rate for private student loans differs per borrower. The interest rate depends on the current rate offered as well as your credit history . The interest rate on private loans can be fixed or variable .

If youre applying for a private student loan and you dont have stable income or good credit, youll probably need a cosigner. Your cosigner should also have a good understanding of how student loans work and their obligation.

Because private student loan interest rates can vary, its important to explore options from different lenders before you apply.

Recommended Reading: Government Help For New Business

Us Government Students Loans

Students who are Citizens or Permanent Residents of the U.S. may apply for a Direct Loan through the William D. Ford Federal Direct Loan Program. Students must be registered in a degree program. Students in any online or correspondence programs are not eligible for U.S. government loan funding. Contact the Financial Aid Coordinator to apply.

Public Service Loan Forgiveness

If you are employed by a government or not-for-profit organization, you may be able to receive loan forgiveness under the Public Service Loan Forgiveness Program.

The Public Service Loan Forgiveness Program forgives the remaining balance on your Direct Loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.

Note: Servicing for this program is managed by another federal student loan servicer. If you enroll in Public Service Loan Forgiveness, your eligible loans will be transferred from Great Lakes to that servicer. Also note, you may not receive a benefit for the same qualifying payments or period of service for Teacher Loan Forgiveness and Public Service Loan Forgiveness.

Don’t Miss: Best Resume For Government Jobs

Can You Get A Real Car Loan With Bad Credit

- Check your creditworthiness. Check your credit score before you start shopping for a car loan.

- Save for the deposit. Building up a deposit can have several advantages.

- Think about how much you can afford. Don’t just think about your monthly loan payment, but how much you can afford.

- Buy from different lenders.

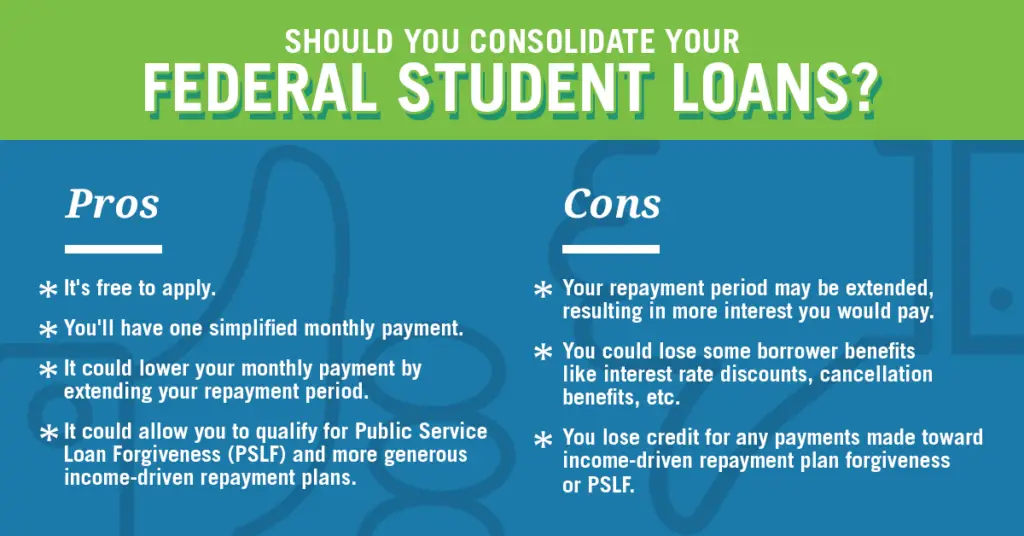

Can You Use Debt Consolidation To Repair Bad Credit

Debt Consolidation Loan. While negative reports cannot be removed from your credit report, there are things you can do to correct your credit score. First, you can get a debt consolidation loan and pay off all your other debts. You will probably have to pay a much higher interest rate, but your monthly payment will be less than the total payments you are currently making.

Also Check: How Do I Sign Up For Government Health Insurance

Canada Student Loan Requirements

To qualify for a student loan in Canada, you must be a Canadian citizen or be a permanent resident of Canada, including landed immigrants. Sadly, government student loans in Canada are not available to international students.

As a student, you are required to register fully for fall and winter terms, and spring/summer if applicable. If you have not done this, you will need to indicate your plans to Financial Aid when you submit your registration form.

If you do not offer all the courses you indicated, your loan assessment will likely be reviewed, reduced or cancelled. So, it is crucial to register for courses you are sure of taking during your course of study.

Student Loan Application Tips

Each year, the Financial Aid and Awards staff see some common problems. Keep these tips in mind to avoid complications with your loan application.

Apply early

Loan applications for the Fall/Winter Terms are usually available in early June from your home provinces website. We suggest completing loan applications by June 30 or mid-November . If you apply later than this, the process at your provincial loan office may not be complete in time to meet the Universitys fee deadlines. If you dont apply until July or August, your loan money will most likely be late, so be prepared to possibly pay late fees on your tuition and perhaps find an alternate means to pay for rent, groceries, etc., if your loan is also covering living expenses.

Dont wait until after you register for classes to apply for a loan! Your loan application is based on your proposed course load actual course load isnt required until the last stages of the application process.

Apply online

Paper applications take significantly longer and unless required by your specific program, they are not recommended. As well, online applications allow you to apply from anywhere in the world. Special consideration or deadline extensions will not be granted if you applied late because you were out of town.

Register for both terms

Read everything

Keep copies of your paperwork

It makes problems easier to solve if we can refer directly to the original paperwork and know where you are in the process.

Ask for help!

You May Like: How To Buy Short Term Government Bonds

How Much To Borrow

Student loans must be repaid with interest. Because of this, youll want to keep the amount you borrow to a minimum. Before you start your loan application, determine how much you can really afford.

Experts recommend saving for at least one-third of future college costs, and covering the remaining two-thirds with current income and student loans.

If you dont have enough in savings, you might be tempted to fill the gap with student loans. But, remember to give yourself limits.

Aim to keep your total student loan debt below your expected starting salary after graduation. This will help keep your debt manageable so that you can realistically pay off the balance within a standard 10-year repayment plan.

Our loan calculator can help you estimate your monthly payment based on the loan amount, interest rate, loan fees and loan repayment term you input.

Grants And Loans For Full

The Canada Student Financial Assistance Program offers student grants and loans to full-time and part-time students. Grants and loans help students pay for their post-secondary education.

- Apply for grants and loans in one application, directly with your province of residence

- You don’t need to repay grants you receive

- You need to repay loans after finishing school, with interest

- You may be eligible for more than 1 type of grant – when you apply with your province, they will assess your eligibility for all available grants

You May Like: Free Government Cell Phones For Senior Citizens

Federal Student Loans Versus Private Student Loans

Federal student loans are made by the U.S. government. A federal loan, such as federal direct loan, will have a lower interest rate than a private loan. Federal loans also typically offer more favorable terms, flexible repayment plans and loan forgiveness options.

When a borrower exhausts their college savings and they reach their federal student loan limits, they may turn to private student loans to help cover the remaining costs. Here are some key differences between a federal student loan and a private student loan:

Do Emergency Loan Are Offered By Banks

There are several ways to get an emergency loan from the bank. Compare banks when applying for a loan with local credit unions. You can get more personalized attention from the credit union, which increases your chances of approval. Often a major bank simply checks the details of your loan application.

You May Like: Best Places To Work In The Federal Government