Withholding Taxes On Wages

If youre an employer, you need to withhold Massachusetts income tax from your employees wages. This guide explains your responsibilities as an employer, including collecting your employees tax reporting information, calculating withholding, and filing and paying withholding taxes.This guide is not designed to address all questions that may arise nor does it address complex issues in detail. Nothing contained herein supersedes, alters or otherwise changes any provision of the Massachusetts General Laws, Massachusetts Department of Revenue Regulations, Department rulings, public written statements or any other sources of law or published guidance.Updated: September 15, 2022

You Can Outsource Payroll Tax

Payroll tax is complex. The calculations are nitpicky, and the penalties are steep. Even paying payroll taxes just a day late comes with a 2% penalty on the amount due, with that penalty rising as high as 15% for past due payroll taxes.

If youâd rather not deal with the stress, we highly recommend outsourcing your payroll to a company like Gusto. Theyâll take the headache out of everything from paying your employees the right amount at the right time to handling pesky withholding calculations and payroll taxes. Whenever you need to check your records, youâll have automatically generated pay stubs to review with all the essential information.

Determining Federal Income Tax Withholding

The Internal Revenue Service expects taxpayers to pay taxes on wages at the time theyre earned. This is done through federal income tax withholding. The amount of federal income tax withheld varies by individual, based on the data in Form W-4, which all employees are required to submit to their employer.

The form includes information about whether a worker will file a tax return as married or single, the number of withholding allowances claimed by the worker and whether an additional amount should be withheld from each paycheck. Form W-4 includes a worksheet to help employees determine the correct amount of allowances for their financial situation. The IRS also provides a free online paycheck calculator to help determine the correct number of withholding allowances.

Recommended Reading: Government Employee Car Rental Discount

When Youll Get Paid

When you receive your paycheck depends on the timing of the companys payroll. Employees typically receive a paycheck either weekly or every other week. Receiving a paycheck monthly is less common.

Compensation is typically paid via check or direct deposit directly into the employees checking account.

When youre hired, you should be notified about payroll timing and options for getting paid. Starting a new jobor leaving your current position sometime soon? You might not receive your check at the regularly expected time.

Depending on the payroll cycle, company policy, and state law, your pay may lag. For example, when youre starting a new job, its not uncommon to receive your first paycheck a week or two after the usual time.

And, when you leave a job, you may receive your check on the last day youve worked or on the last regular pay date for the pay period. There are no federal laws mandating exactly when the last check must be issued, although some states specify that you must be paid immediately. In any case, you must be paid for the time youve worked.

Dont Miss: Rtc Employment Las Vegas

How Much Taxes Are Taken Out Of A $1000 Check

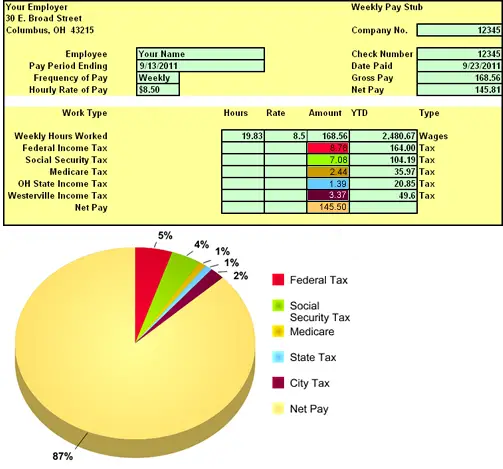

TaxEducation > my_first_job” alt=”Ohio Department of Taxation > TaxEducation > my_first_job”>

TaxEducation > my_first_job” alt=”Ohio Department of Taxation > TaxEducation > my_first_job”> Paycheck Deductions for $1,000 Paycheck For a single taxpayer, a $1,000 biweekly check means an annual gross income of $26,000. If a taxpayer claims one withholding allowance, $4,150 will be withheld per year for federal income taxes. The amount withheld per paycheck is $4,150 divided by 26 paychecks, or $159.62.

Also Check: Government Mortgage Payment Act Of 2020

Current Fica Tax Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Combined, the FICA tax rate is 15.3% of the employeeâs wages.

Do any of your employees make over $147,700? If so, the rules are a little different, and they may owe additional Medicare tax. Read more at the IRS.gov website.

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Also Check: Free Grant Money For Home Improvements Government

Overview Of Pennsylvania Taxes

Pennsylvania has a flat state income tax rate of 3.07%. This is the lowest rate among the handful states that utilize flat rates. However, many cities in the Keystone State also collect local income taxes. There are 2,978 taxing jurisdictions with rates ranging as high as 3.8398% in Philadelphia, 3.6% in Reading and 3.4% in Scranton.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

How To Determine Gross Pay

For salaried employees, start with the person’s annual salary divided by the number of pay periods. For hourly employees, it’s the number of hours worked times the rate .

If you are not sure how to pay employees, read this article on the difference between salaried and hourly employees.

Here are examples of how gross pay for one payroll period is calculated for both salaried and hourly employees if no overtime is included for that pay period:

Let’s say your employee makes an annual salary of $30,000. This salary is divided by the number of pay periods in the year to get the gross pay for one pay period. If you pay salaried employees twice a month, there are 24 pay periods in the year, and the gross pay for one pay period is $1,250 .

An hourly employeeis paid at an hourly rate for the pay period. If an employee’s hourly rate is $12 and they worked 38 hours in the pay period, the employee’s gross pay for that paycheck is $456.00 .

You May Like: Government Help To Refinance Mortgage

Texas Median Household Income

| 2010 | $48,615 |

Payroll taxes in Texas are relatively simple because there are no state or local income taxes. Texas is a good place to be self-employed or own a business because the tax withholding wont as much of a headache. And if you live in a state with an income tax but you work in Texas, youll be sitting pretty compared to your neighbors who work in a state where their wages are taxed at the state level. If youre considering moving to the Lone Star State, our Texas mortgage guide has information about rates, getting a mortgage in Texas and details about each county.

Be aware, though, that payroll taxes arent the only relevant taxes in a household budget. In part to make up for its lack of a state or local income tax, sales and property taxes in Texas tend to be high. So your big Texas paycheck may take a hit when your property taxes come due.

How Much Money Gets Taken Out Of Paychecks In Every State

See where there are fewer tax withholdings. Taxes 101

Its payday, and you log on to your bank account hoping to see a hefty deposit, but it has a lot less heft than you expected. You can thank payroll taxes for that. They take a big bite out of paychecks each month, and just how big depends on where you live. If youre single and you live in Tennessee, expect 16.5% of your paycheck to go to taxes and thats the state with the lowest tax burden in the nation.

Support Small Biz: Dont Miss Out on Nominating Your Favorite Small Business To Be Featured on GOBankingRates Ends May 31

To find out just how much taxpayers in each state can expect to have withheld from their biweekly paychecks, GOBankingRates analyzed the average income data from the U.S. Census Bureau and combined that information with federal and state tax rates provided by the Tax Foundation. The result is precisely what gets pulled out of the typical persons biweekly paycheck in each state, sorted from the lowest amount for single filers to the highest.

- Total income taxes paid: $8,797

- Tax burden: 16.5%

- Amount taken out of an average biweekly paycheck: $338

Joint Filing

- Total income taxes paid: $7,067

- Tax burden: 13.25%

- Total income taxes paid: $9,113

- Tax burden: 20.22%

Read Also: Government Assistance Paying Electric Bill

Don’t Miss: Free Government Phones Milwaukee Wi

The Irs Can Take Some Of Your Paycheck

When the IRS issues a levy, it will send a notice to your employer requiring the business to send part of your paycheck to the IRS.

Youll get to keep a certain amount of your paycheck. The IRS determines your exempt amount using your filing status, pay period and number of dependents.

For example, if youre single with no dependents and make $1,000 every two weeks, the IRS can take up to $538 of your check each pay period. IRS Publication 1484 explains how to figure out the exempt amount.

On top of garnishing your wages, the IRS can levy your bank accounts, Social Security income and accounts receivable. The IRS will use the levied money to pay down your back taxes, but you cant designate the payments toward any particular tax bill.

Whats The Difference Between A Deduction And Withholding

In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions. These are known as âpre-tax deductionsâ and include contributions to retirement accounts and some health care costs. For example, when you look at your paycheck you might see an amount deducted for your companyâs health insurance plan and for your 401k plan. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax. Some deductions are âpost-taxâ, like Roth 401, and are deducted after being taxed.

In our calculators, you can add deductions under âVoluntary Deductionsâ and select if itâs a fixed amount , a percentage of the gross-pay , or a percentage of the net pay . For hourly calculators, you can also select a fixed amount per hour .

Read Also: Are There Government Grants For Home Repair

How Much Is Fers Removal

Most FERS employees pay 0.8% of basic salary for basic FERS benefits. To see also : How much is the average federal pension?. The agency contributes 10.7% or more to FERS. The basic benefit of FERS provides retirement, disability, and survivor benefits and can be reduced for early retirement or to provide survivor protection.

How much is the FERS deduction?

Overall, the basic benefit of FERS is 1% of your high-3 average salary times your years of credible service. FERS employees can currently contribute up to 11% of basic salary to the Savings Plan. An automatic government contribution adds 1% of base salary to the TSP account of each FERS employee.

How much is FERS lump sum?

Basic Death Grant When an FERS employee dies, the surviving spouse is entitled to a death grant equal to 50% of the deceaseds current salary plus a one-time payment of $ 34,991.

How We Make Money

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters.

Also Check: How To Change Your Government Name

Irs’s Withholding Tax Calculator

To help you determine if and/or how much to adjust your 2022 withholding, use the IRS’s Tax Withholding Estimator as soon as you can. Have your most recent pay stub and a copy of your 2021 tax return handy to help estimate your 2022 income. Again, you must act quickly, since we’re almost to the end of the year.

We also recommend using the tax withholding calculator early in 2023 to see if additional adjustments are beneficial going forward. In fact, it’s a good idea to check your withholding every year. And the earlier in the year you do it and make any necessary changes the better. That way your tax withholding will be more even and accurate throughout the year.

But remember that you aren’t required to submit a new W-4 form to your employer unless you’re starting a new job. If your company doesn’t receive a new form from you, it will just continue to withhold taxes based on the most recent W-4 it has on file for you.

How Much Of Your Paycheck Goes To Taxes And Why

Its your first payday at a new job. You make $15 an hour, and you worked 80 hours over the past two weeks. Your paycheck hits your account, but you dont see $1,200 you see something closer to $950.

Thats because your employer deducted the taxes you owe the federal government. If you were a contractor or freelancer, you would have to calculate this amount and pay it yourself, but your companys payroll administrator does it for you as an employee.

Taxes are important. They fund essential public services and spaces like education, transportation, Medicare, Social Security, parks, and much more. Theyre not a bad thing it just sucks when people who make a lot of money dont have to pay nearly as much as you do in comparison. Instead of making $2,400 every four weeks, you earn about $1,900, so now you have to budget accordingly.

Several factors influence how much of your paycheck goes to taxes, though. Lets go over where your money goes and whether or not you could see it again.

You May Like: Government Dental Assistance For Seniors

You May Like: Federal Government Work From Home Jobs

How To Calculate Federal Income Tax Withholding Using The Wage Bracket Method

In IRS Publication 15-A, find the tables marked âWage Bracket Percentage Method Tables.â Use the table corresponding to your employeeâs pay period.

Check form W-4 to determine whether the employee files income tax as married or single and the number of allowances they claim.

Find the employeeâs gross wage for the pay period in columns A and B. The wage should be over the amount found in column A but under the amount found in column B.

Subtract the amount found in Column C.

Multiply the result by the percentage found in Column D.

Check form W-4 to determine if the employee requests additional tax withheld from each paycheck. If they do, add that amount to the final number.

The end result is the amount you should withhold from the employeeâs paycheck for that pay period.

The Percentage Method is much more complicatedânot recommended if youâre doing this alone. If you want to learn more about the Percentage Method, you can read all about both methods in IRS Publication 15-A.

Once youâve figured out how much income tax to withhold from your employeesâ paychecks, your next step is to figure out how much FICA to withhold , and how much youâll be required to pay on their behalf.

Are There Other Federal Payroll Taxes

In addition to FICA or SECA taxes, a few other payroll taxes are levied on certain employees:

- Federal Unemployment Tax Act taxes are only paid by employers, at a rate of 6 percent for the first $7,000 of earned income per employee. FUTA taxes support funding for state-administered unemployment insurance programs.

- Railroad Retirement Act taxes are paid by railroad employees and employers to fund retirement programs for railroad workers.

- Other payroll taxes are mostly comprised of taxes paid by federal employees to fund their own retirement programs.

Read Also: Government Car Loans For Disabled

Payroll Taxes Have A Larger Impact On Lower

Payroll taxes are regressive: low- and moderate-income taxpayers pay a bigger share of their incomes in payroll tax than do high-income people, on average. The bottom fifth of taxpayers paid an average of 6.1 percent of their incomes in payroll tax in 2021, according to Tax Policy Center estimates, while the top fifth paid 5.7 percent and the top 1 percent of taxpayers paid just 2.1 percent. About two-thirds of taxpayers pay more in federal payroll taxes than personal income taxes. These figures include the employer and employee shares of the payroll tax.

However, if one looks at the overall impact of Social Security and Medicare the benefits they provide as well as the taxes they collect these programs are progressive. Social Security benefits represent a higher proportion of a workers previous earnings for workers at lower earnings levels and while all Medicare beneficiaries are eligible for the same health care services, high-income beneficiaries pay more in Medicare taxes and premiums. Low-income Medicare beneficiaries are also eligible for help paying for their premiums and cost sharing. Variation in state laws and practices makes it difficult to assess the distributional effect of UI.