Are $2000 Monthly Stimulus Checks Possible

In response to President Biden’s American Jobs Plan proposal, a group of 21 senators on March 30 sent a letter urging the inclusion of stimulus checks in the legislation. The group called for recurring payments as long as the pandemic lockdown continued, meaning people would get monthly checks from the government. No amount for the payments was specified.

We urge you to include recurring direct payments and automatic unemployment insurance extensions tied to economic conditions in your Build Back Better long-term economic plan, wrote the group, which consisted of Sen. Elizabeth Warren, D-Massachusetts, Sen. Bernie Sanders, I-Vermont, and others.

An earlier stimulus check proposal, put forward during the early days of the American Rescue Plan in late January, also suggested monthly payments until the pandemic is over, but did not mention an amount. However, Rep. Ilhan Omar, D-Minnesota, tweeted earlier in January that she wanted to see $2,000 per month.

If that amount sounds familiar, it’s because now-Vice President Kamala Harris threw her support behind $2,000 recurring checks during the negotiations for the second stimulus check legislation in the summer of 2020.

The proposal has also gained plenty of support outside of Congress: Six online petitions calling for $2,000 monthly stimulus checks until the end of the pandemic have been posted. The biggest petition, on Change.org, has been signed by more than 2.8 million people and has a stated goal of reaching 3 million.

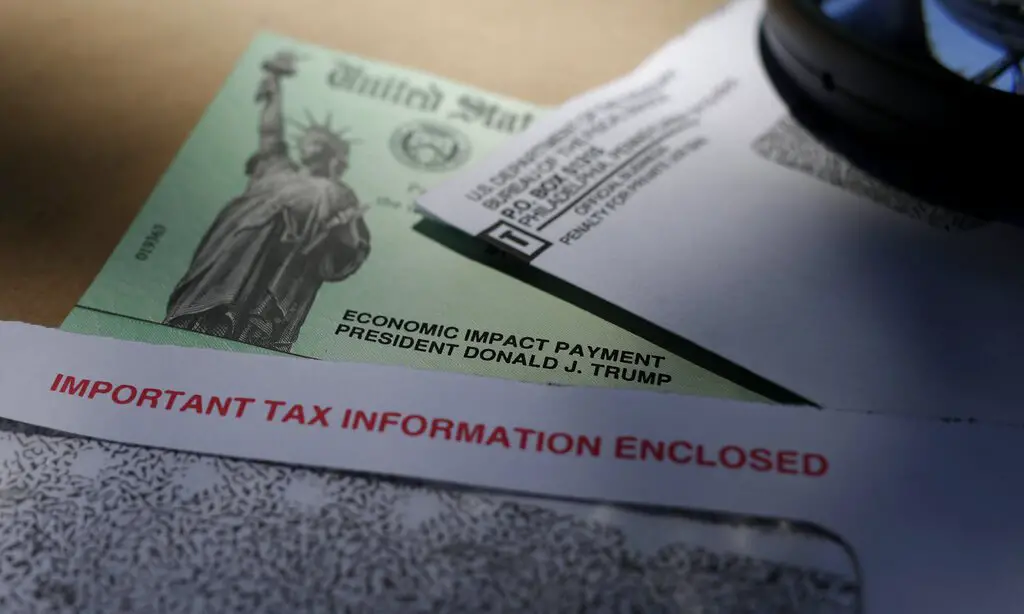

First Stimulus Check Payment In 2020

The $2.2 trillion dollar stimulus bill has now been signed into law. Under this bill there is the widely reported economic stimulus payment checks of $1,200 per adult and $2400 for couples. For families they would provide $500 for every eligible child. The full stimulus check would be made to those earning less than $75,000 and would phase out to zero for those earning more than $99,000 . Head of household tax filers will get the full payment if they earned $112,500 or less.

In the phase out range for every $100 you earn above the lower limit payment drops by $5 until you reach the maximum limit .

Example If Brian made $67,000 last year based on his latest filed tax return, he would get the full $1200 payment. If he had made $90,000 he would only be eligible for $450 . If he had made $110,000 he wouldnt be eligible at all.

| 2019 or 2018 Filing Status | Income Below Which FULL Stimulus is Paid | Maximum Income To Qualify for Partial Stimulus |

|---|---|---|

| Single or married filing separate | $75,000 | |

| $198,000 |

Example My wife and I made $185000. We filed jointly. Are we eligible to get anything from the 2020 stimulus? Answer You would be eligible to get $650.00 under the direct payment program. Up to $150,000, you get 100% of the $2,400 stimulus payment. Anything over 150,000, you would subtract 5% of the amount over $150,000. So in your scenario, 35k over 150k. 5% of 35k is $1750, So $2400- $1750=$650.00

Don’t Throw Away The Irs Letter About Your Stimulus Payment

Hold on to that IRS letter that confirms your stimulus payment, including giving the amount and how the IRS sent your money. That letter from the IRS — Notice 1444-C — is your proof that the IRS sent a payment in case you don’t actually receive it or if you received less than you qualify for and need to claim the missing amount later. Here’s more on what to do with that IRS letter.

Read Also: City Of Las Vegas Government Jobs

When Will I Receive My Stimulus Check: Summary

In summary, if you are asking when youll will receive your third stimulus check in 2021, the answer is that, if you have have direct deposit setup, it will arrive very soon and it will take slightly longer if they send you a check.

The government has setup a website that allows us to track our stimulus payment. Be sure to visit that page if you are still uncertain about the status of your payments.

Stay tuned to this page for more information as we will make daily updates during these unfortunate times of the coronavirus.

Is The Stimulus Check Taxable Will I Have To Pay It Back

No, the stimulus check is considered a refundable tax credit, which means it is not considered taxable income. In essence, this is like a refund you get in advance of filing your 2020 tax return.

The IRS will compare your AGI from your 2020 tax return and the AGI used to determine your stimulus check amount . If the amount of your stimulus check was lower than you would have received based on your AGI from 2020, then the IRS will give you the difference.

If you saw the example from above, we used a single taxpayer with an AGI of $80,000. They would receive a stimulus check of $950 because that income fell in within the phase-out limits. If this same individual has an AGO of $75,000 or lower in 2020, the IRS would give them the difference, in this case, they would receive an additional $250.

If your income exceeds the AGI limits in 2020, the IRS will not clawback the stimulus payments you received.

You May Like: Federal Government Watch List Search

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

Both the first and second stimulus check cannot be reduced to pay any federal or state debts. Unlike the first stimulus check, your second stimulus check cannot be reduced if you owe past-due child support payments and is protected from garnishment by creditors and debt collectors.

If you use direct deposit and owe your bank overdraft fees, the bank may deduct these from your payment.

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, back taxes, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first and second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

Stimulus Check Round : Is A Second Round Coming

A second stimulus package was officially presented on the Senate floor in late July as the HEALS Act, but the timing of when it might arrive is still in limbo.

In addition to $1,200 direct payments, the HEALS Act continues federal unemployment benefits , offers a Paycheck Protection Program sequel for business loans, and provides more funding to help schools and COVID-19 testing, treatment and vaccine research.

You May Like: Government Employee Discounts Universal Studios Orlando

Turbotax Review 2020 Is Turbotax The Best Diy Tax Software

About Ryan Guina

Ryan Guina is the founder and editor of Cash Money Life. He is a writer, small business owner, and entrepreneur. He served over 6 years on active duty in the USAF and is a current member of the IL Air National Guard.

Ryan started Cash Money Life in 2007 after separating from active duty military service and has been writing about financial, small business, and military benefits topics since then. He also writes about military money topics and military and veterans benefits at The Military Wallet.

Ryan uses Personal Capital to track and manage his finances. Personal Capital is a free software program that allows him to track his net worth, balance his investment portfolio, track his income and expenses, and much more. You can open a free account here.

Best Ways To Spend Your Stimulus Check

If you’re fortunate enough to be researching the best ways to spend your stimulus check, you’ll want to put the payment to good use. But how to spend your stimulus check depends on your situation, and whether you have enough emergency savings.

Unless you already have 6 months worth of emergency money saved, consider depositing your stimulus check for a rainy day. You’ll be gland you have some cash on hand when an unexpected expense comes up.

Confident your savings is padded enough? Examine your debts. If you’re dealing with any high-interest debts, specifically from credit card companies, try to pay them back in full. This will help your credit score long term.

Once your savings and debts are in order, and you’re looking to get that $1,200 off your hands, you can invest in stocks, bonds, or mutual funds. You could also support local businesses, or donate to those in need. It entirely depends on your circumstances, so weigh your choices wisely.

According to a report in , researchers have found that many of those who have received stimulus payments are using it to pay rent and bills, as well as for food and non-durable goods. The non-durable category includes such supplies as laundry detergent, paper and other items with a shorter life span.

Don’t Miss: Government Filing Fee For Trademark

Economic Recovery For Some

READ MORE: Officials: Gov. Tom Wolf To Turn Over Mask Rules To Schools In January

Relief payments were intended to ease COVIDs economic impact and support the economy in the process. The third round of relief payments started back in March, courtesy of the American Rescue Plan . Over the following months, about 169 million people received up to $1,400 each. That accounted for nearly all of the $422 billion set aside. The ARP checks closely followed the $600 payments from January, which came nine months after the $1,200 payments from the pandemics early days. They seem to have worked, but have also helped many who didnt actually need the money.

In the third quarter of 2021, the U.S. economy grew at an annualized rate of 2.0 percent, according to the most recent estimate from the Bureau of Economic Analysis. Thats a major slowdown from the torrid pace in the second quarter, which saw 6.7 percent growth. The Conference Board forecasts continued though slower growth through the rest of the year. The countrys gross domestic product , an estimate of economic activity across the U.S., has surpassed pre-pandemic levels. By that general measure, the economy has fully recovered.

Do I Need To Do Anything To Get A Stimulus Payment

The payments are automatic if you:

- Filed a 2019 or 2020 tax return.

- Receive Social Security retirement, survivor or disability benefits , Railroad Retirement benefits, Supplemental Security Income or Veterans Affairs benefits.

- Registered for the first payment online at IRS.gov using the agencys Non-Filers tool by November 21, 2020. OR

- Submitted a simplified tax return that has been processed by the IRS.

You May Like: Federal Government Dental And Vision Insurance

When Will My Stimulus Payment Be Sent

California’s stimulus payments are going out twice a month, or about every two weeks, though some may go out earlier or later. Those who qualify and have already set up direct deposit when filing their 2020 tax return can expect an electronic payment.

Most direct deposit stimulus payments will be issued before Oct. 31. If you filed a state tax return after Sept. 1, you might have to wait at least 45 days for the return to be processed and have a check issued.

As for paper checks, those will start going out Oct. 6, and will continue through January of next year. Paper checks will be sent in batches based on the last three digits of the ZIP code on your 2020 tax return. If your tax return is processed during or after the date of your scheduled ZIP code payment, the Franchise Tax Board says, you should allow up to 60 days after your return has been processed.

For a list of timeframes based on ZIP codes, check here. Note that you should allow up to three weeks for a check to arrive by mail once it’s been sent.

Californians Getting More $600 And $1100 Stimulus Checks Next Week: Here’s The Latest

Another check is on its way to two of every three California residents through the Golden State stimulus program.

California stimulus checks provide direct cash relief to those hit hardest by the pandemic.

Though a fourth stimulus check isn’t on Washington’s agenda, and enhanced federal unemployment benefits expired for millions last month, an estimated 9 million Californians are getting some extra relief aid in year two of the pandemic.

A third batch of Golden State Stimulus II payments is getting sent out on Oct. 5. The first batch, amounting to 600,000 payments, went out Aug. 27, and the second batch, on Sept. 17, was much larger, with at least 2 million Californians receiving the benefit. Approximately two-thirds of California taxpayers are eligible for a payment of $600, and some qualifying families will receive an additional $500.

These state-only checks are part of the $100 billion “California Comeback Plan” aimed at providing immediate relief to families and business that’ve been the most negatively impacted by the pandemic. Gov. Gavin Newsom’s office called it “the biggest state tax rebate in American history.”

Read on to find out if you’ll be getting a Golden State Stimulus II check, what you need to do to get your money, and when your check could arrive. Also, here’s everything you need to know about the 2021 child tax credit, which is providing the vast majority of families across the US with advance monthly checks to help cover expenses and basic necessities.

Read Also: World Bank Federal Government Grant

What Can I Do If I Havent Received My Payments Or If Im Eligible To Receive More

There are several scenarios where individuals may not have received any or all of the payments theyre eligible for. Common situations include:

- You dont normally file taxes and the IRS doesnt have your recent information on file.

- You moved or changed bank accounts since the last time you received a tax refund or other benefit.

- You had a child in 2020 and are eligible to receive EIPs for your dependents.

- You were previously claimed as a dependent but became independent in 2020. For example, you turned 19 , 24 , graduated, or got married.

To receive your first and second EIP or an adjusted amount, you can still file a late 2020 return. You will face no late filing penalties if you have no balance due to the IRS. The Recovery Rebate Credit on Line 30 on the IRS Form 1040 is where you can claim any EIP you are eligible for but have not yet received.

I Receive Social Security Retirement Disability Survivors Ssi Or Veterans Benefits Do I Automatically Qualify For An Economic Impact Payment

In some cases, if you receive certain benefits, you will automatically receive an Economic Impact Payment. Make sure you read further to know if this applies to you and to know if you need to send the IRS any additional information, and how you will be receiving your payment.

The IRS is working to make it easier for certain beneficiaries to receive the Economic Impact Payment by using information from benefit programs to automatically send payment.

You will qualify for this automatic payment only if:

- You were not required to file taxes in 2018 or 2019 because you had limited income and

- You receive one of the following benefits:

- Social Security retirement, survivors, or disability from the Social Security Administration

- Supplemental Security Income from the Social Security Administration

- Railroad Retirement and Survivors from the U.S. Railroad Retirement Board

- Veterans disability compensation, pension, or survivor benefits from the Department of Veterans Affairs

If you qualify for an automatic payment, you will receive $1200 . You will receive this automatically the same way you receive your benefits, either by direct deposit or by check. You will not need to take any further action to receive this.

No matter how you receive your payment, the IRS will send you a letter in the mail to the most current address they have on file about 15 days after they send your payment to let you know what to do if you have any issues, and contact information for any questions.

You May Like: How Are Governments Using Blockchain Technology

A Fourth Stimulus Check In 2022

There has been talk of a fourth stimulus check towards the end of 2021 or in early 2022 as part of the new spending bills being debated in Congress.

But at this stage there are no additional stimulus payments planned. With the economy rebounding strongly and unemployment claims falling, it will be hard to get Congress to justify spending billions of dollars on more stimulus payments. But some states like California, are making state specific stimulus payments to lower income workers which may be replicated in other states.

There is also the monthly Child Tax Credit stimulus payment starting in July for families who have qualifying dependents. While this is not technically a fourth dependent stimulus and rather more of an advanced tax credit it will act like a stimulus payment because it is being paid directly by the IRS to nearly 70 million dependents and their families.

The IRS has also been making millions ofplus-up or catch-up stimulus payments to those who have filed their 2020 tax returns. Based on these filings the IRS reviewed earlier stimulus payments eligibility and if they found underpaid or missed payments mainly due to a change in income or missing dependents they then issued these supplementary payments. Theseplus-up payments started being paid in mid-April and will progress through the year.

Where Can I Get More Information

You can read the full Coronavirus Aid, Relief and Economic Security Act bill, which included other provisions, such as the Families First Coronavirus Response Act, which expands the Family Leave Act.

You can also visit the IRS website for additional information. The IRS does not recommend calling at this time. All updates will be on their website.

Recommended Reading: Government Loan For New Business