Do Treasury Bonds Pay High Interest

A number of other Treasury securities are paying the highest yields since 2008. But this isnt the case for Treasury bonds, though yields have moved higher there, too.

Investors are demanding higher returns because inflation has picked up, McBride says.

Many people like the safety offered by investing in Treasury bonds, which are backed by the U.S. government. But that safety comes at a cost a lower coupon rate. Investors looking for higher interest payments might turn to corporate bonds, which typically yield more. But theyll have to take on some extra risk for that extra return.

Buying a bond issued by one of the top companies may be relatively low risk, but its still not as low risk as buying a U.S. government bond. And corporate bonds can range from relatively safe to extremely risky, so you need to know what youre purchasing if you buy them.

Some government bonds tied to inflation have started paying higher rates to account for increasing costs. Government-issued Series I bonds purchased between November 2022 and April 2023 will pay interest at an annual rate of 6.89 percent, according to TreasuryDirect. The interest rate on I bonds is tied to inflation and changes every six months.

Another option are Treasury Inflation Protected Securities , which are Treasury securities designed to preserve the investors purchasing power.

The price of the bond is adjusted relative to change in the Consumer Price Index, McBride says.

Government Bond: What It Is Types Pros And Cons

James Chen, CMT is an expert trader, investment adviser, and global market strategist. He has authored books on technical analysis and foreign exchange trading published by John Wiley and Sons and served as a guest expert on CNBC, BloombergTV, Forbes, and Reuters among other financial media.

Duration: Understanding The Relationship Between Bond Prices And Interest Rates

Consider a bond investment’s duration to understand the potential impact of interest rate fluctuations.

There is a common perception among many investors that bonds represent the safer part of a balanced portfolio and are less risky than stocks. While bonds have historically been less volatile than stocks over the long term, they are not without risk.

The most common and most easily understood risk associated with bonds is credit risk. Credit risk refers to the possibility that the company or government entity that issued a bond will default and be unable to pay back investors’ principal or make interest payments.

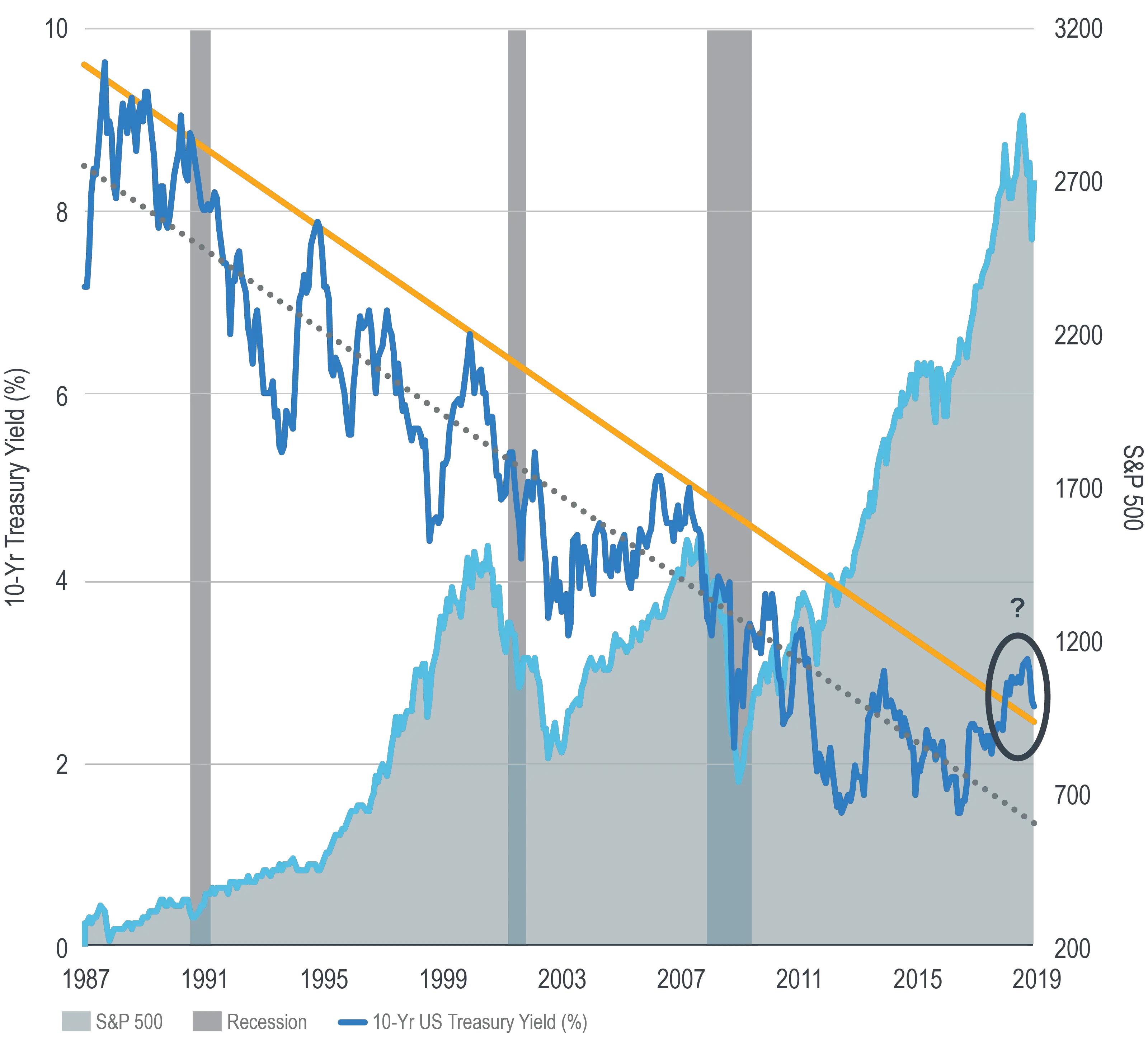

Bonds issued by the US government generally have low credit risk. However, Treasury bonds are sensitive to interest rate risk, which refers to the possibility that a rise in interest rates will cause the value of the bonds to decline. Bond prices and interest rates move in opposite directions, so when interest rates fall, the value of fixed income investments rises, and when interest rates go up, bond prices fall in value.

If rates rise and you sell your bond prior to its maturity date , you could end up receiving less than what you paid for your bond. Similarly, if you own a bond fund or bond exchange-traded fund , its net asset value will decline if interest rates rise. The degree to which values will fluctuate depends on several factors, including the maturity date and coupon rate on the bond or the bonds held by the fund or ETF.

Don’t Miss: What Are The Free Government Phones

Inflation Expectations Determine The Investors Yield Requirements

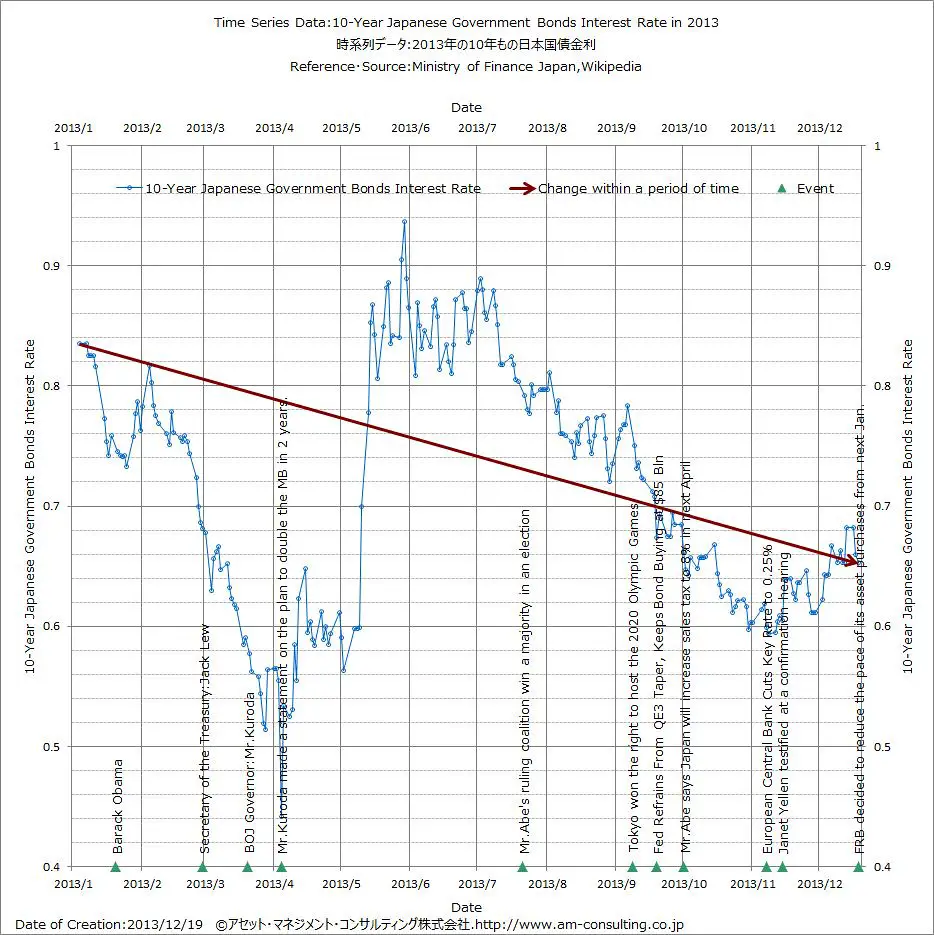

Inflation is a bonds worst enemy. Inflation erodes the purchasing power of a bonds future cash flows. Typically, bonds are fixed-rate investments. If inflation is increasing , the return on a bond is reduced in real terms, meaning adjusted for inflation. For example, if a bond pays a 4% yield and inflation is 3%, the bonds real rate of return is 1%.

In other words, the higher the current rate of inflation and the higher the future rates of inflation, the higher the yields will rise across the yield curve, as investors will demand a higher yield to compensate for inflation risk.

Note that Treasury inflation-protected securities can be an effective way to offset inflation risk while providing a real rate of return guaranteed by the U.S. government. As a result, TIPS can be used to help battle inflation within an investment portfolio.

What Are Treasury Bonds

Treasury bonds are government debt securities that are issued by the U.S. Federal government and sold by the U.S. Treasury Department. T-bonds pay a fixed rate of interest to investors every six months until their maturity date, which is in 20-30 years.

However, the interest rate earned from newly-issued Treasuries tends to fluctuate with market interest rates and the overall economic conditions of the country. During times of recession or negative economic growth, the Federal Reserve typically cuts interest rates to stimulate loan growth and spending. As a result, newly-issued bonds would pay a lower rate of return in a low-rate environment. Conversely, when the economy is performing well, interest rates tend to rise as demand for credit products grows, leading to newly-issued Treasuries being auctioned at a higher rate.

Don’t Miss: What Government Programs Are Available For Single Mothers

Using A Bond’s Duration To Gauge Interest Rate Risk

While no one can predict the future direction of interest rates, examining the “duration” of each bond, bond fund, or bond ETF you own provides a good estimate of how sensitive your fixed income holdings are to a potential change in interest rates. Investment professionals rely on duration because it rolls up several bond characteristics into a single number that gives a good indication of how sensitive a bond’s price is to interest rate changes. For example, if rates were to rise 1%, a bond or bond fund with a 5-year average duration would likely lose approximately 5% of its value.

Duration is expressed in terms of years, but it is not the same thing as a bond’s maturity date. That said, the maturity date of a bond is one of the key components in figuring duration, as is the bond’s coupon rate. In the case of a zero-coupon bond, the bond’s remaining time to its maturity date is equal to its duration. When a coupon is added to the bond, however, the bond’s duration number will always be less than the maturity date. The larger the coupon, the shorter the duration number becomes.

10-year bond vs. 6-month bond

*A simultaneous change in interest rates across the bond yield curve. This hypothetical example is an approximation that ignores the impact of convexity we assume the duration for the 6-month bonds and 10-year bonds in this example to be 0.38 and 8.87, respectively. Duration measures the percentage change in price with respect to a change in yield.

Should I Invest In I Bonds In 2022

The current inflation interest rate of 9.62% makes I Bonds very attractive for savvy investors. Note that the actual rate youll likely get will be less than that since youll likely forfeit 3 months worth of interest. If you want a guaranteed investment that will protect your cash from inflation, then you can consider I Bonds. However, they are not right for every investment portfolio. If you want help with your finances and are interested in having a comprehensive financial plan, feel free to schedule a discovery call with one of our financial advisors today! Please note, for compliance reasons, we are unable to provide financial or investment advice during this call.

Dont Miss: Is An Fha Loan A Government Loan

You May Like: Government Home Loan Programs For Bad Credit

A Bond’s Relative Yield

The maturity or term of a bond largely affects its yield. To understand this statement, you must understand what is known as the yield curve. The yield curve represents the YTM of a class of bonds .

In most interest rate environments, the longer the term to maturity, the higher the yield will be. This makes intuitive sense because the longer the period of time before cash flow is received, the greater the chance is that the required discount rate will move higher.

What Is Interest Rate For Government Bonds

When a government of India issues the bonds it will generally make regular interest payments during the life of the Gov Bond and repay the initial investment, or principal amount, when the bonds expire on their maturity date.Generally, short-term bonds are known as Treasury Bills in India with a maturity of less than one year.T-bills are available with different maturity periods ranging from 91 days to 365 days.On the other side, bonds with a maturity of more than a year, ranging from 5 to 40 years are long-term securities knows as Government Bonds .Both the central and state governments can issue government bonds. Though, the bonds issued by state governments are also known as State Development Loans .In this article, we will discuss in detail about the Interest Rate for Government Bonds India in 2021.

Also Check: State Of Nevada Unclassified Jobs

Don’t Miss: Federal Government Jobs Austin Tx

Debt Management Website Disclaimer

The information on this website is issued by New Zealand Debt Management for informational purposes. To the extent that this website refers to an offer of securities, no offer is made to anyone accessing this website outside of New Zealand and otherwise than in compliance with any applicable securities laws or regulations.

Nominal Bonds, Inflation-Indexed Bonds and Treasury Bills: Wholesale domestic government debt securities, including nominal bonds, inflation-indexed bonds and Treasury bills cannot be purchased directly from New Zealand Debt Management by individuals. Only registered tender counterparties who participate in a Government Securities tender process are able to purchase Government Securities from New Zealand Debt Management. Any offer documents provided or contained on this website relating to Government Securities contain an offer to registered tender counterparties only.

Where Government Securities are offered on the secondary market to any person in any jurisdiction, such Government Securities are not offered, and must not be bought or sold, except under circumstances that will result in compliance with any applicable securities laws or regulations.

Users accessing this website from outside New Zealand acknowledge and accept that they will comply with any applicable securities laws or regulations.

Us Department Of The Treasury

- Racial Differences in Economic Security: HousingOctober 27, 2022Statement by Secretary of the Treasury Janet L. Yellen on the Announcement of the Price CapDecember 1, 2022 To date, Tribal governments have planned or begun implementing over 3,000 culturally relevant projects and services https://t.co/2eXqGBbsY6 Fri, 12/02/2022 – 15:13

Recommended Reading: Federal Government Work From Home Jobs

How Many Funds Are There In Nps

NPS funds are categorized depending upon the kind of instruments they invest in. At present, there are four different instruments to choose from: equities, corporate bonds, government bonds, and alternative assets. The Pension Fund Regulatory and Development Authority has authorized the following fund managers to manage NPS funds:

- ICICI Prudential Pension Fund

Risk Of Selling Before Maturity

If you buy a bond and hold it to maturity, youll get back the face value. But if you sell a bond before maturity, youll get market value. This can be more or less than the face value.

The market value of a bond depends on supply and demand. Market interest rates have the biggest impact on the price of bonds. The credit risk of the issuer and how long the bond is issued for can also have a big impact on the price of a bond.

The price of fixed rate bonds and indexed bonds moves in the opposite direction to market interest rates:

- If market interest rates rise, the price of these bonds falls.

- If market interest rates fall, the price of these bonds rises.

The price of floating rate bonds doesnt move very much when interest rates change because their coupon payment rate adjusts.

Some bonds can be hard to sell. If youre planning to sell before maturity, look for bonds with high liquidity, for example, AGBs.

Dont Miss: Government Programs To Help Remodel Home

Recommended Reading: Government Funding Programs For Real Estate Investors

Bond Prices And The Fed

When people refer to “the national interest rate” or “the Fed,” they’re most often referring to the federal funds rate set by the Federal Open Market Committee . This is the rate of interest charged on the inter-bank transfer of funds held by the Federal Reserve and is widely used as a benchmark for interest rates on all kinds of investments and debt securities.

Fed policy initiatives have a huge effect on the price of bonds. For example, when the Fed increased interest rates in March 2017 by a quarter percentage point, the bond market fell. Within a week, the yield on 30-year Treasury bonds dropped to 3.04% from 3.14%, the yield on 10-year Treasury notes fell to 2.43% from 2.60%, and the two-year T-notes’ yield fell from 1.40% to 1.27%.

The Fed raised interest rates four times in 2018. After the last raise of the year announced on Dec. 20, 2018, the yield on 10-year T-notes fell from 2.79% to 2.69%.

The COVID-19 pandemic has seen investors flee to the relative safety of government bonds, especially U.S. Treasuries, which has resulted in yields plummeting to all-time lows. On March 9, 2020, the 10-year T-note was yielding 0.54% and the 30-year T-bond was at 0.99%, the lowest point during the pandemic.

The sensitivity of a bond’s price to changes in interest rates is known as its duration.

What Are The Types Of Government Bonds

The terminology surrounding bonds can make things appear much more complicated than they actually are. Thats because each country that issues bonds uses different terms for them.

In the US, bonds are referred to as Treasuries. They come in three broad categories, according to their maturity:

- Treasury bills expire in less than one year

- Treasury notes expire in one to ten years

- Treasury bonds expire in more than ten years

Government bonds from the UK, India and other Commonwealth countries, for example, are referred to as gilts. The maturity of each gilt is listed in the name, so a UK government bond that matures in two years is called a two-year gilt.

Other countries will use different names for their bonds so if you want to trade bonds from governments outside of the US or UK, its a good idea to research each market individually.

Read Also: Government Funding For Low Income Families

How Are I Bonds Interest Rate Calculated

I Bonds interest rate is a combination of two rates which is called the composite interest rate. It is calculated based on a fixed interest rate and an inflation-adjusted rate. The interest structure is what makes I Bonds quite unique.

The composite interest rate is a complex formula: Composite rate =

2. The inflation adjusted-interest rate is calculated twice a year which is usually May 1 and November 1.

When you go to the Series I Bonds, it will say youll get 9.62% interest rate from May until October 2022.

The Interest Gets Added To The Bond’s Value

I bonds earn interest from the first day of the month you buy them.

Twice a year, we add all the interest the bond earned in the previous 6 months to the main value of the bond.

That gives the bond a new value .

Over the next 6 months, we apply the new interest rate to that entire new value.

This is called semiannually compounding . That way, your money grows not just from the interest percentage but from the fact that the interest is calculated on a growing balance.

How do you find the current value of an I bond? If the bond is in TreasuryDirect, look in your account there. If the bond is paper, use the Savings Bond Calculator.

Note: For bonds less than 5 years old, values shown in TreasuryDirect and the Calculator donât include the last 3 months of interest. Thatâs because if you cash a bond before 5 years, we donât pay you the final 3 months of interest.

Recommended Reading: Work At Home Government Jobs Data Entry

Combining The Two Rates

To get the actual rate of interest we combine the fixed rate and the inflation rate, using the equation in the example below.

- The combined rate will never be less than zero. However, the combined rate can be lower than the fixed rate. If the inflation rate is negative , it can offset some of the fixed rate.

- If the inflation rate is so negative that it would pull the combined rate below zero, we dont let that happen. We stop at zero.

Daily Treasury Par Yield Curve Rates

This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative quotations obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. For information on how the Treasurys yield curve is derived, visit our Treasury Yield Curve Methodology page.

Also Check: Government Programs To Help Buy A Car

Low Risk Predictable Income

Most default superannuation funds will have a proportion of their members’ money invested in government bonds because of their low risk and predictable supply of income.

Like shares, some government and corporate bonds can be traded on the ASX. Government bonds that can be traded on the ASX are known as Exchanged Traded Australian Government Bonds.

There are two main types of Australian Government Bonds that are listed on the Australian Securities Exchange :

- Treasury Bonds: These are medium to long-term debt securities that carry an annual rate of interest fixed over the life of the security. Interest is paid every six months, at a fixed rate, which is a percentage of the original face value of $100. The bonds are repayable at face value on maturity.

- Treasury Indexed Bonds: These are medium to long-term bonds. The capital value of the bonds is adjusted for movements in the Consumer Price Index , which measures inflation. Interest is paid quarterly, at a fixed rate, on the adjusted face value. At maturity, investors receive the capital value of the bond – the value adjusted for movement in the CPI over the life of the bond.

The Australian Government has never defaulted on the interest payments on the bonds that it has issued or on the repayment of the principal amount invested in them.

This is why government bonds are considered to be a highly secure investment product, second only to cash at the bottom of the risk spectrum.