What Is A Hybrid Car Tax Credit

A federal hybrid car tax credit is available to consumers who buy plug-in electric vehicles in the United States.

A federal hybrid car tax credit is available to consumers who buy plug-in electric vehicles in the United States. According to the U.S. Department of Energy, you can receive a tax credit of up to $7,500 for each electric vehicle you purchase on or after January 1, 2010. The IRS will give a federal tax credit of $2,500 to $7,500 for the purchase of new electric vehicles on or after January 1, 2019. This credit will last until each participating manufacturing sells 200,000 EVs in the U.S.

Electric Vehicle Tax Exemptions

In addition to the rebates for purchasing electric vehicles, please be aware that:

- The luxury surcharge tax is applied to EVs priced at or above $75,000. For other vehicles, it kicks in at $55,000. Therefore, most EVs will not have the higher tax rate applied.

- Used EVs are PST exempt.

- These changes were announced with the BC Budget 2022. See links to bulletins here.

Plug In BC

Plug In BC Collaborative: Plug In BC is a program of the Fraser Basin Council, working with government, industry, community groups, and institutions. It provides information and support around plug-in vehicles and charging throughout British Columbia.

Emotive

The Electric Vehicle Experience: Emotive is a B.C.-wide campaign to increase public knowledge about electric vehicles. Learn about the benefits of EVs and why electrification matters.

Where To Get Your Rebate

Rebates are available for eligible BEVs and PHEVs purchased or leased on or after July 8, 2021.

Rebates are available at the point of sale from participating automotive dealers. If the dealer does not offer point of sale rebates, visit the Access your rebate page to begin the rebate application process. Applications must be submitted within 30 days of purchase to qualify and will be provided on a first come-first serve basis.

Recommended Reading: Us Government Seized Boats For Sale

Eversource Ev Rate Program

Eversource is offering a voluntary electric vehicle rate program which is available to any level 2 or level 3 charging station whose load is separately metered and available for use by the public. Eligibility for this rate is subject to the review and approval of Eversource.

Take advantage of this program to help support the deployment of EV charging infrastructure throughout Connecticut!

Recommended Reading: How Can I Get Government Assistance For Housing

In The Event You Be Eligible For The Crossbreed Vehicle Refund

You may be surprised to learn that you can get up to $7,500 in tax credits for your new vehicle, if youre wondering if you qualify for the Hybrid Car Rebates. The volume of the credit history depends on the battery size, meaning that an entirely electrical car can assert a more substantial volume of credit rating than the usual plug-in crossbreed. While this credit rating is a great way to have a income tax split in your new motor vehicle, you cant depend upon it to fund the complete car.

Initially, you should find out which automobile models be eligible for the Travel Clean Rebate. There are many different car models that qualify for this credit, but the most popular hybrids are not eligible. These automobiles include the Ford Fusion and Milan Hybrids, the Honda Information and Accord hybrids, the Toyota RAV4 Hybrid, and the Toyota Camry Hybrid. Its also worthy of mentioning the plug-in crossbreed Toyota Prius Connect-in will never be eligible for the credit history.

Also Check: Us Government Grants For Senior Citizens

Incentives By Electric Vehicle Model

The federal electric vehicle tax credit is based on the vehicles battery pack, not the price. The credit amount will begin to drop and eventually completely phase out when the manufacturer sells 200,000 units of a particular model.

The federal tax credit only reduces your tax liability. For example, even if a vehicle qualifies for the full $7,500 and you owe $5,000 in taxes, it will only credit the $5,000. You will not receive the rest of the credit of $2,500.

In the table below, we summarize the 2020 and 2021 EV models with available rebates when purchasing.

| Make |

|---|

| $7,500 |

Manufacturers May Make Changes

Carmakers could adjust some prices to help customers obtain the credit.

The Tesla Model 3, for instance, comes in three trim levels. Just the least expensive, the Model 3 Standard Range, currently qualifies.

At press time, Tesla had removed pricing for the Model 3 Long Range from its website. That may be a coincidence. But we wouldnt be surprised to learn that the automaker was exploring lowering its price to meet the new requirements.

Other manufacturers could bring production to the U.S. to meet the new rules. Kia, for instance, builds its electric vehicles in South Korea. But the company is in the process of building a new plant in Georgia to bring production stateside. Kias EVs may be eligible when that factory opens.

Recommended Reading: Data Governance Process Flow Chart

Which Electric Cars Qualify For Federal Incentives Under The New Rules

Nineteen cars all electric vehicles or plug-in hybrids likely qualify for a federal tax credit today. A handful more will gain eligibility early in 2023. All will lose eligibility when government agencies finish drafting rules the law requires unless the automotive industry makes quick changes.

Thats the takeaway from a list of likely eligible vehicles published by the U.S. Department of Energys Alternative Fuels Data Center late yesterday. But the word likely is doing some work there. Even the government seems less than sure about how the new government incentive program works.

How To Claim The California Ev Rebate

California offers several incentives, including a $7,000 grant based on income eligibility, a $1,500 California Clean Fuel Reward, discounted charging rates during off-peak hours, rebates for level 2 installation, and free charging for one year based on region.

Due to California EV rebates’ high cost and popularity, they installed an income limit of $150,000 for an individual or $300,000 for joint filers. Plug-in hybrids with electric ranges under 35 miles or EVs with a base price above $60,000 are not eligible. The California rebate is cash or a check at the point of sale. A mailed check may take up to 18 months to arrive.

To learn more about the process and apply for a rebate, head to Californias Clean Vehicle Rebate page.

Recommended Reading: What Is The Government Doing About Homelessness In America

Tesla Sues Ontario Government Over Incentive Program

When newly minted Ontario Premier, Doug Ford, landed in office, he essentially deleted the provinces Electric and Hydrogen Vehicle Incentive Program . Ontario did however promise to honour the up to $14,000 rebate on qualifying vehicles as long as they were delivered, registered and plated before September 10th. The car also had to be purchased from a dealer.

Tesla has taken serious offense to this move. Why? Because the province also stipulated that the incentive would end without delay for those who ordered their vehicle from the manufacturer. Some Tesla customers put a down-payment on their Model 3 over two years ago and have yet to receive their precious and affordable electric car. When they put money down, they were banking on the rebate. Its gone now.

Tesla Canada filed a lawsuit with the Ontario Superior Court of Justice that states that the government deliberately and arbitrarily and without warning excluded Tesla customers. The lawsuit also adds: The Minister of Transportations decision suddenly left hundreds of Tesla Canadas Ontario customers in the unfair position of no longer being eligible for the rebate they had expected to receive when they ordered their vehicles.

Clean Vehicle Assistance Program

Participants who receive a vehicle grant buy-down and/or financing through the CVA Program, may be eligible to participate in the Clean Vehicle Rebate Project . The CVA Program provides grants and financing assistance to low-income Californians for the purchase of a new or used hybrid or electric vehicle. Please note that CVRP may have different vehicle and applicant eligibility requirements than the CVA Program. For more information on the CVA Program and its eligibility requirements please visit the website: .

Recommended Reading: Can I Get Money From The Government

Department Of Treasury And Finance

https://www.treasury.sa.gov.au

- Show submenu for About usAbout us Menu

To support the uptake of electric vehicles in South Australia, the government is providing a $3,000 subsidy and a 3-year registration exemption on eligible new battery electric and hydrogen fuel cell vehicles first registered from 28 October 2021.

As at 5 August 2022 there are 6,745 electric vehicle subsidies remaining.

Further incentives to support the uptake of electric vehicles are being provided under South Australias Electric Vehicle Action Plan.

Subsidies on the purchase of a battery electric and hydrogen fuel cell vehicle

A $3,000 subsidy is available for 7,000 new battery electric and hydrogen fuel cell vehicles valued below $68,750 registered in South Australia from 28 October 2021.

Subsidies are limited to one per individual person residing in South Australia and two per business located in South Australia. The vehicles will be required to be registered in South Australia and must not have received a rebate in another jurisdiction.

See the Subsidy Terms and Conditions for the full eligibility criteria and the FAQs for further information.

Frequently Asked Questions

Even The Government May Not Know How This Works

Congress drafted and passed the Inflation Reduction Act quickly as Democrats in the Senate reached a surprise agreement late last month. That has left the government agencies charged with enacting it scrambling to do so soon.

Some of the information they publish may change. The Alternative Fuels Data Center says its list of eligible vehicles will be updated as more information becomes available.

We expect to see a few corrections soon. The Lucid Air, for instance, is on the list. But the Air is a sedan with a price tag starting at $87,400 well over the laws $55,000 cap for sedans.

Unless weve misunderstood something in our reading of the law, the Air shouldnt appear on the list.

Also Check: Government Center Garage Monthly Parking

**note On Electric Scooters

The electric scooters eligible for the program must be included in the âlimited-speed electric motorcycleâ category, which excludes electric power-assisted bicycles.

Would you like to learn more about the specifics of each type of vehicle eligible for the Roulez vert program? Go to the Vehicle types page.

Dont Miss: Data Governance And Metadata Management

What Are The Ozev Standards Based On

Plug-in vehicles must meet two simple criteria to qualify for a grant, whereas cars were formerly put into three categories, depending on their range from a single charge and carbon dioxide emissions.

The latest simplified rules state simply that cars must emit zero emissions. These new rules replace a set that stipulated that plug-in cars could emit up to 70g/km of CO2 using the WLTP emissions test standard. They should also be able to drive 70 miles in electric mode. The figures used come from the standard industry test that every new car must undertake. They arent representative of real-world conditions , but are currently the only common standard.

|

CO2 emissions |

|

|

20% of RRP |

£7,500 |

*Wheelchair accessible vehicles are eligible for up to £2,500 , and can cost up to £35,000. Vehicles eligible to convert include: Citroen e-Berlingo, Citroen e-SpaceTourer, Nissan e-NV200, Peugeot e-Rifter and Vauxhall Vivaro-e Life. The number of WAV grants available is limited.

Don’t Miss: When Is Open Enrollment For Government Healthcare

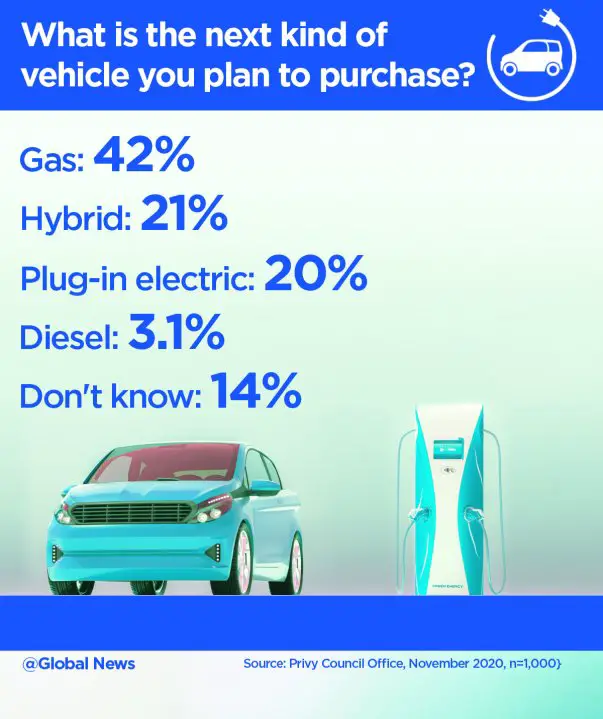

Does An Ev Make Sense

There are many benefits to owning an electric car, from reduced maintenance to a lower carbon footprint.

Although the upfront cost might be more expensive than traditional cars, an EV can still make financial sense. Federal EV incentives will help reduce the initial cost of the car, and the overall lifetime savings will keep your car ownership costs low.

Pairing your EV with solar panels will make the costs even lower, further increasing your savings. Solar panels are an attractive investment thanks to a 30% tax credit and higher-than-ever electric prices. Now is the time to go all out on renewable energy, adding solar panels to charge up your electric vehicle, saving you money for years to come.

Estimate your EV charging savings with solar panels

How To Receive The Incentive

The incentive will be applied at the point-of-sale by the dealership. It will appear directly on the bill of sale or lease agreement on eligible ZEVs on, or after, the eligibility date. The dealer must apply taxes and fees to the purchase or lease before applying the incentive.

The dealer must submit the documentation required to be reimbursed for an incentive provided to consumers at the point-of-sale.

The federal incentive for eligible ZEVs will be applied in addition to any provincial or territorial incentive offered.

Read Also: Paper Application For Free Government Phone

Clean Air Zone Charges

Part of the UK governments efforts to improve air quality has seen the introduction of Clean Air Zones some of which have charging systems in place for vehicles that dont meet minimum emission standards.

Buses, coaches, heavy goods vehicles Euro VI

Vans, minibuses, taxis, private hire vehicles, cars Euro 6 and Euro 4 some local authorities set different standards for this vehicle type

Motorcycles Euro 3

An example of such a zone is Londons Ultra-Low Emissions Zone, in place since 2019, and now includes postcodes up to the North and South circular roads.

Other than London, at present, only Bath and Birmingham have charging CAZ plans firmly in place. Many more cities will follow, with Bristol and Bradford planning a CAZ for 2022.

Research commissioned by Northgate Vehicle Hire found that more than a quarter of businesses with fleets dont know about CAZ plans. With the UKs current reliance on conventionally-fuelled vehicles estimated to be 300,000 HGVs and over 4,000,000 vans, this is a worrying statistic.

Find out more about Clean Air Zones and how you can prepare your business here.

What Do People Think Of The2021 Honda Clarity Hybrid

Consumer ratings and reviews are also available for the 2021 Honda Clarity Hybrid and all its trim types. Overall, Edmunds users rate the 2021 Clarity Hybrid 5.0 on a scale of 1 to 5 stars. Edmunds consumer reviews allow users to sift through aggregated consumer reviews to understand what other drivers are saying about any vehicle in our database. Detailed rating breakdowns are available as well to provide shoppers with a comprehensive understanding of why customers like the 2021 Clarity Hybrid.

You May Like: Federal Government Nursing Jobs In Maryland

What Vehicles Are Covered Under The Rebates

Nine electric cars and 12 plug-in hybrids are eligible under the incentive program, according to the federal government.

Electric vehicles

Mini Cooper S E Countryman

Mitsubishi Outlander PHEV

Toyota Prius Prime

Smart Fortwo models are also included in the program, however, the manufacturer recently announced it is discontinuing the model in the U.S. and Canadian markets citing a declining market.

How Can I Access The Free Level Two Charger

Those who utilize the incentive will receive the free charger from the province. Once the Province receives all the necessary documentation from the dealer, the consumer will receive their free level two charger by courier. The consumer will be responsible for any costs related to installation of the level two charger.

You May Like: Agencies That Hire For Government Jobs

What Is The New Federal Ev Tax Credit For 2022

The Build Back Better bill will increase the current electric car tax credit from $7,500 to $12,500 for qualifying vehicles. President Bidens EV tax credit builds on top of the existing federal EV incentive.

The base amount of $4,000 plus $3,500, if the battery pack is at least 40 kilowatt-hours, remains the same. You can qualify for the additional $5,000 if:

- $4,500 EV Tax Credit: If your EV was made in the US with a union workforce

- $500 EV Tax Credit: If at least 50% of the battery components in your EV are made in the US

Some other notable changes include:

- EV vans, trucks, and SUVs with an MSRP of up to $80,000 qualify

- The electric car tax credit is only available to individuals with a gross income of $250,000 or less

Electric Car Rebates And Incentives: What To Know By State

If you own an electric car or want to purchase one soon, youll need to know what EV incentives exist that can help you defray costs. Many states offer rebates and tax deductions to make the transition to electric vehicles more attractive, like electricity discounts or bill credits. These bonuses can also apply to plug-in hybrid electric vehicles , fuel cell electric vehicles, electric motorcycles, and more.

This article will outline the incentives available in each state. Because state incentives continue to evolve, we plan to update as new information becomes available. See our story on federal incentives to find out about those.

Use our jump links below to connect to your state or Washington, D.C., faster.

Recommended Reading: Government Pell Grants For Single Mothers

Theres Never Been A Better Time To Go Electric Save Up To $7500 When Purchasing An Ev In Nl

Are you considering an all-electric vehicle? With our EV Rebate Program, now you can save $2,500 on the purchase or lease of a 100% all-electric vehicle and $1,500 for a plug-in hybrid. That means you can save up to $7,500 when you combine our rebate with current federal incentives for the purchase of a new EV.

Youll feel great driving an EV, knowing that you are contributing to a greener future for Newfoundland and Labrador. Youll feel even better knowing that the majority of the electricity used to charge your vehicle comes from our provinces clean, renewable energy sources. And, electricity is cleaner and cheaper than gas. A 400 km road trip in your EV would cost less than $10 at todays electricity rates if you charged at home! And with 14 public fast-charging stations available from St. Johns to Port aux Basques, its easier than ever to charge on the go. You can drive across the island without ever having to worry about where to plug in next.

Get your rebate and hit the road!

Rebates will be issued to qualified participants for eligible all-electric EVs and plug-in hybrids purchased on or after April 1, 2022. Electric motorcycles and bikes are not eligible. Completed applications will be accepted from April 1, 2022 to March 15, 2023. Rebates are available on a first-come, first-serve basis or until program funding is depleted.

Eligibility

To qualify for the rebate:

Eligible Electric Vehicles