The Focus Of Governmental Financial Reporting

The key measurement focus in a government funds financial statements is on expenditures, which are decreases in the net financial resources of a fund. Most expenditures should be reported when a related liability is incurred. This means that a governmental fund liability and expenditure is accrued in the period in which the fund incurs the liability.

The focus of governmental funds is on current financial resources, which means assets that can be converted into cash and liabilities that will be paid for with that cash. Stated differently, the balance sheets of governmental funds do not include long-term assets or any assets that will not be converted into cash in order to settle current liabilities. Similarly, these balance sheets will not contain any long-term liabilities, since they do not require the use of current financial resources for their settlement. This measurement focus is only used in governmental accounting.

What Is Fund Accounting In Government

Fund accounting is the way governments track revenues with purpose restrictions against the expenditures made for those g p purposes. Fund accounting makes it easier to identify which monies are available for specific purposes.

Fund-based accounting, or fund accounting, is a system used by nonprofit organizations and government agencies to manage their money. Fund accounting differs in purpose from the system used in regular for-profit businesses because the goal is to maintain accountability and track how funding is used rather than monitor the profitability of a company. Whether associated with a nonprofit or a donor who contributes to a variety of charities, learning about fund accounting will help you understand the financial structure of these types of organizations.

Who Uses Fund Accounting? Because the purpose of fund accounting is to manage donations, funding from outside sources or income from fundraising, organizations that do not operate for profit use this accounting method. Some entities that might use this system include:

Charitable organizations Nonprofit nursing homes or hospitals Educational institutions Foundations for the arts

Budgets, Programming and Fundraising When a nonprofit sets up its fund structure, it creates a separate fund for each major division or function within the organization. Examples of funds may include:

1. Restricted funds:

2. Unrestricted funds:

Specialized Software For Fund Accounting

While is it not strictly necessary to use an accounting software specifically designed for a nonprofit, software with unique features designed to meet the needs of a nonprofit may prove helpful. Terminology in the programs often aligns with nonprofit lingo, and many packages offer features that help to track donations, create budgets by fund and issue donor letters. However, do your research before making a purchase to ensure that you will get the features you need without paying for extras that will not truly benefit you.

References

You May Like: Canadian Government Grants For Small Business

What Is Npo Fund Accounting

In fund accounting, an organization will divide its resources into funds, resulting in a self-balancing set of accounts.

Each fund is set up similarly to a general ledger and made up of a combination of assets, liabilities, revenues, expenses, and a net asset balance . While commercial businesses will rely on a single general ledger, NPOs who use fund accounting will have multiple funds.

An Intro To Nonprofit Fund Accounting

What is fund accounting, and what does it have to do with nonprofits, charitable, or religious organizations? Its a standard almost all nonprofit organizations and churches have to adhere to in one way or another, and it differs from basic accounting. If you work for a nonprofit or church, this information is for you.

Fund accounting is a method of bookkeeping used by a nonprofit organization that illustrates accountability, rather than profitability. In a business, you want to know how much was spent, how much was earned, and how much was left over. With a nonprofit, you want to know these things, but you also want to make sure your income and expenses are allocated for the proper purposes.

It can potentially get very complicated, depending on the needs of your organization. FASB117 and FIN46 are the government agencies that outline all needs of a nonprofit accounting system. However, for this particular course, we will solely focus on what it is and how you can implement it for your organization.

Luckily, there is accounting software made specifically for nonprofit organizations, and it can make handling these things much easier.

Also Check: Government Job Openings In Atlanta Ga

The Basis Of Accounting

The accrual basis of accounting is adjusted when dealing with governmental funds. The sum total of these adjustments is referred to as the modified accrual basis. Under the modified basis of accounting, revenue and governmental fund resources are recognized when they become susceptible to accrual. This means that these items are not only available to finance the expenditures of the period, but are also measurable. The available concept means that the revenue and other fund resources are collectible within the current period or sufficiently soon thereafter to be available to pay for the current periods liabilities. The measurable concept allows a government to not know the exact amount of revenue in order to accrue it.

Fund Accounting Basics For Canadian Nonprofit Organizations

Written by Alex Oulton, CPA, CA

While there are plenty of similarities between the accounting systems used by commercial businesses and Nonprofit Organizations , the key difference lies in their sources of revenue. In commercial business, revenue comes from sales or profits from investments. In NPOs, revenue is a combination of sales or investments plus contributions .

NPOs must also differentiate between contributions and all other sources of revenue, as contributions can often come with restrictions. In Canada, many NPOs choose to track and report on their finances using fund accounting. Fund accounting is an accounting system that uses the restricted fund method to help distinguish between restricted and unrestricted contributions in their financial reports. Contributions can be restricted or unrestricted and these can be tracked using the deferral method of accounting or the fund method of accounting.

You May Like: Government Grants For Trucking School

Budgets Programming And Fundraising

When a nonprofit sets up its fund structure, it creates a separate fund for each major division or function within the organization. Examples of funds may include:

- General fund: Used for routine management expenses of the organization.

- Fixed asset fund: Used for maintenance of buildings, expansion of facilities, equipment, etc.

- Fundraising: Funds used to raise additional income, maintain donor relations, etc.

- Program funds: Used for carrying out the programs and services of the organization.

Within each of these funds there can be subcategories that are coded and tracked separately. For example, a church may have a variety of programs offered to several groups of people, such as Children’s Programming, Family Activities or Community Outreach. Each group would have its own subcategory within the Program Fund. Once a budget is established, each group would be allocated a specific amount of money that they could spend on their programs throughout the year.

As the year progresses, money spent by each group would be recorded in the appropriate fund. Assuming that the accounting ledger is kept up to date, at any time during the year, a manager of that group’s funds should be able to see exactly how much money has been spent, what it was spent on and how much money remains in the fund. This type of detailed accounting helps members stick to the budget, while ensuring that funds are spent carefully for each designated purpose.

What Is A Cost Reimbursement Grant

A reimbursement grant provides funding to grant recipients after expenses have been incurred. The grantee must follow a certain procedure to obtain the reimbursement for project expenses. Reimbursements are provided on a set payment schedule after the organization has submitted sufficient documents to verify expenses.

You May Like: Articles On Politics And Government

Accounting Basis And Financial Reporting

Like profit-making organizations, nonprofits and governments will produce Consolidated Financial Statements. These are generated in line with the reporting requirements in the country they are based or if they are large enough they may produce them under International Financial Reporting Standards , an example of this is the UK based charity Oxfam. If the organization is small it may use a cash basis accounting, but larger ones generally use accrual basis accounting for their funds.

Nonprofit organizations in the United States have prepared their financial statements using Financial Accounting Standards Board guidance since 1993. The financial reporting standards are primarily contained in FAS117 and FIN43. FASB issued a major update in 2016 that changed reporting net assets from three primary categories to two categories, restricted and unrestricted funds and how these are represented on financial statements.

Nonprofit and governments use the same four standard financial statements as profit-making organizations:

The Governmental Accounting Standards Board

Given the unique needs of governments, a different set of accounting standards has been developed for these organizations. The primary organization that is responsible for creating and updating these standards is the Governmental Accounting Standards Board . The GASB is tasked with the development of accounting and financial reporting standards for state and local governments, while the Financial Accounting Standards Board has the same responsibility, but for all other entities not related to governmental activities.

You May Like: Government Filing Fee For Trademark

How Do Propitiatory Funds Work

Proprietary Funds are broadly classified into two categories. They include enterprise funds and internal service funds. As far as an enterprise fund is concerned, it can be seen that it is mainly used in order to account for any activity for which external users are charged a subsequent fee against those goods and services. An activity is categorized under enterprise fund only if it meets the following criteria

- The activity is funded using debt. This debt can only be secured by a stated pledge from the net proceeds from the activity.

- The activitys stated provision costs are meant to be covered with the stated fees, under the mentioned rules and regulations.

- The stated activitys pricing policy is designed to recover its cost.

On the other hand, an internal service fund is used in order to account for activities that mainly provide goods and services to other funds. These funds might include departments, agencies, primary governments, or even other government-related agencies of the primary government on basis of cost-reimbursement. This fund is only used in cases where the reporting government is assumed to be the primary participant from the stated activity.

Additionally, it can be stated that generally, examples of Internal Service Funds include general purchases, as well as information systems. On the contrary, examples of external funds include public utilities, as well as airports.

Why Your Organization Needs It

Fund accounting is a very detailed and confusing process. Ultimately, it is the most accurate method of accounting. By utilizing this system of tracking funds, you can maintain accurate financial records for your organization and all of its directives, empowering you to generate powerful financial statements and make key decisions. Most importantly, it can keep government agencies like the IRS off your back.

In the next lesson we will look at money that goes into and out of your organization, and how to set up your chart of accounts.

Don’t Miss: Government Jobs In Los Lunas Nm

What Are The Two Types Of Proprietary Funds

There are two types of proprietary funds: enterprise funds and internal service funds. This chapter describes the basic characteristics and accounting for proprietary funds, both enterprise and internal service funds. Proprietary funds use the accrual basis of accounting and the economic resources measurement focus.

State And Local Government Funds

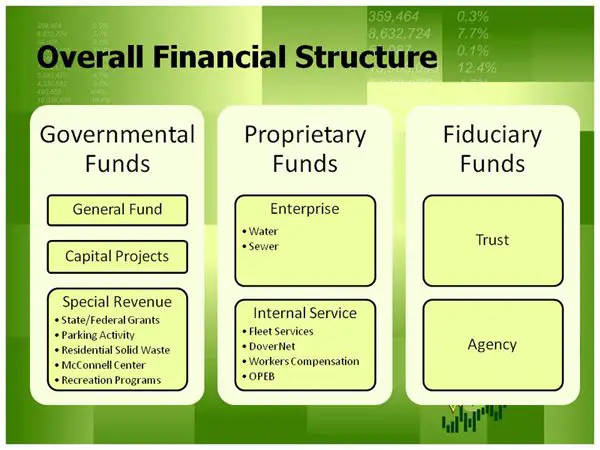

State and local governments use three broad categories of funds: governmental funds, proprietary funds and fiduciary funds.

Governmental funds include the following.

Proprietary funds include the following.

- Internal service funds are used for operations serving other funds or departments within a government on a cost-reimbursement basis. A printing shop, which takes orders for booklets and forms from other offices and is reimbursed for the cost of each order, would be a suitable application for an internal service fund.

- Enterprise funds are used for services provided to the public on a user charge basis, similar to the operation of a commercial enterprise. Water and sewage utilities are common examples of government enterprises.

Fiduciary funds are used to account for assets held in trust by the government for the benefit of individuals or other entities. The employee pension fund, created by the State of Maryland to provide retirement benefits for its employees, is an example of a fiduciary fund. Financial statements may further distinguish fiduciary funds as either trust or agency funds a trust fund generally exists for a longer period of time than an agency fund.

Fixed assets and long-term debts

Accounting basis

Proprietary funds, used for business-like activities, usually operate on an accrual basis. Governmental accountants sometimes refer to the accrual basis as “full accrual” to distinguish it from modified accrual basis accounting.

Financial reporting

Read Also: Is Unitedhealthcare A Government Insurance

What Are The Advantages Of Fund Accounting

The term fund accounting refers to a system of financial record keeping that focuses on how an organization uses its finances. Fund accounting highlights where money comes from and how it is spent, with a spotlight on accountability rather than profitability. Nonprofit groups and government agencies frequently use this type of financial reporting system, also known as nonprofit accounting or government accounting.

Many accounting systems show profitability, or how much money a company makes. Fund accounting emphasizes the how instead of the how much. This type of reporting shines a light on the receipt and spending of money during a given time period. Funds used by a nonprofit or government agency often come with restrictions and rules about how money can be spent. The use of fund accounting provides a detailed picture of an organizations incoming and outgoing finances.

Clarity is one of the main advantages of fund accounting, because this system illustrates important details about an organizations spending. The government and special service agencies often give money to nonprofits in the form of grants or other donations. These funds typically have a specific purpose and regulations for how money can be used. It is illegal for an organization to misuse government or donated money designated for a particular function. Nonprofit accounting offers a way to identify specific funds and track how they are used.

Journal Entry For Government Funds

As mentioned earlier, it can be seen that government funds normally comprise funds collected from taxes and other various incomings. These incomings are assumed to be the revenue for these government funds. In order to record this particular revenue, the following journal entry is made:

| Particular |

| xxxx |

For all the subsequent entries, it can be seen that all journal entries are duly recorded in terms of ensuring that all commercial activities are recorded in a proper manner. All respective accounting entries are supposed to be recorded so that they are not missed out upon. Therefore, these journal entries are maintained following which financial statements are subsequently drawn for all the respective years.

For all the different fund types, separate financial statements are maintained, and this helps to analyze and audit all the different funds accordingly. Eventually, all these different categories of funds are amalgamated to get a holistic view of the performance of the government in terms of funds received, and the relevant expenses associated with these different heads.

Read Also: Government Jobs No Experience Necessary

What Are The Three Types Of Government Funds How Are They Used

Therethree major typesfundsThese typesgovernmentalgovernmental fundsfund isfundgovernment

. Moreover, what type of accounting does the government use?

Among the basic principles of governmental GAAP is fund accounting. This is the most common form of government accounting in the United States. It’s used at the federal, state, and local levels.

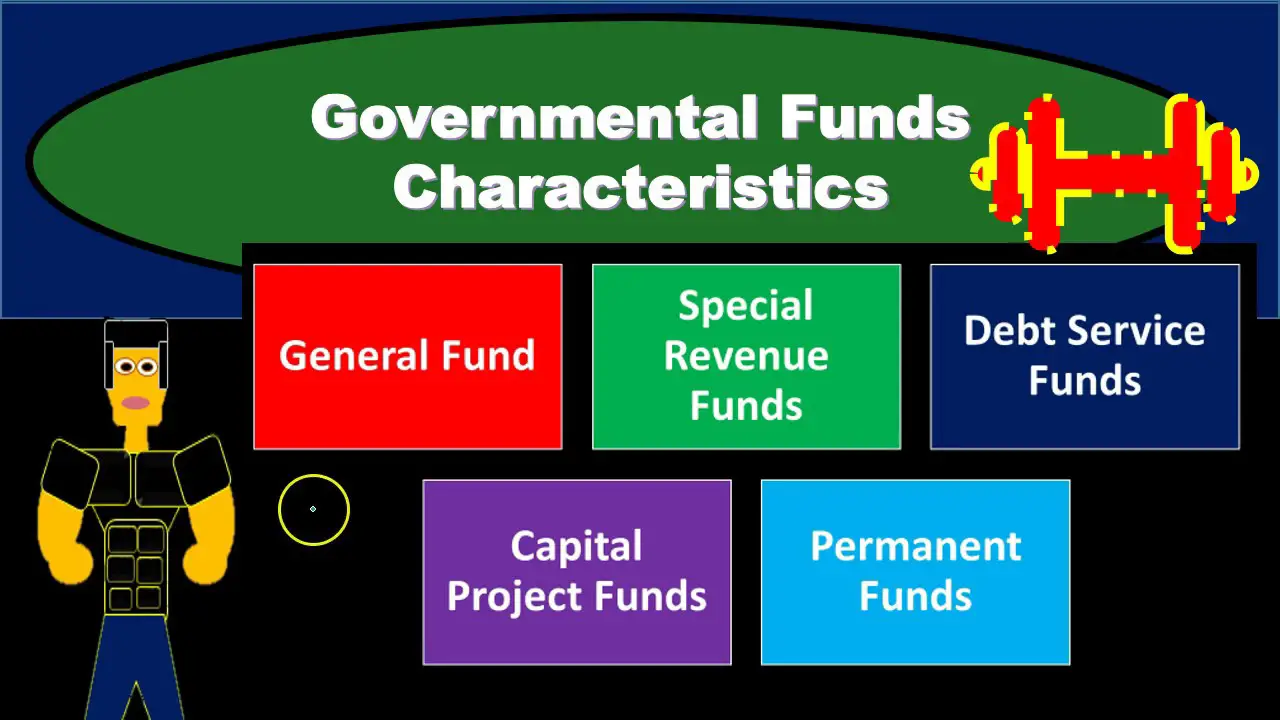

Subsequently, question is, what are the three categories of funds prescribed by GASB standards? The three categories of funds are governmental, proprietary, and fiduciary. The fund types included in each category are shown below: The basis of accounting used by governmental funds is modified accrual.

Also to know is, what are the fund categories used by governments?

Four fund types are used to account for a government’s governmental- type activities. These are the general fund, special revenue funds, debt service funds, and capital projects funds. Basis of Accounting: All governmental funds are accounted for using the modified accrual basis of accounting.

What type of fund is a debt service fund?

A debt service fund is a cash reserve that is used to pay for the interest and principal payments on certain types of debt.

When To Use Fund Accounting

This method of accounting is used by almost all nonprofit organizations, and will likely be needed on a daily basis. Heres an example of how it becomes important for a nonprofit.

Suppose you manage a nonprofit that helps stray animals, and your operations are pretty straightforward at the moment. You receive money from donations, and you spend a little to keep the lights on. Nothing too fancy.

Now lets say you decide to get a little fancy. You apply for a grant that provides $5,000 to be spent on veterinary functions. This money comes in the form of a check that you deposit into your organizations checking account. Before this check, you had $3,000 in your checking account.

Here come the questions for you:

- How are you going to record the receipt of this $5,000?

- How will you record the expenses that use the funds from the grant?

- Will you know how much money is left at any given point in time?

Accounting for funds in this fashion allows you to answer these questions and more. In a properly set-up system, this fund would have its own asset, liability, equity, income, and expense balances, making it a completely separate entity within your organization. You would still be able to see simple information for your organization as a whole. However, each fund would be independent of others.

Also Check: Indiana Government Grants For Small Business