Agriculture Rural And Farm Service Loans

These loans provide funding to encourage farming, which can lead to food security and rural development. Several loan programs are available for agriculture and farm service. Capital allows the purchase of livestock, feed, farm machinery, equipment, and even farmland within the eligibility criteria.

Loans are also available for constructing on-farm storage, cold-storage, and processing and handling facilities for selected commodities. Other available loans cover fisheries, financing for aquaculture, mariculture, and commercial fishing industries. The dedicated Rural Housing Farm Labor Housing Loans and Grants program offers capital for the development and maintenance of housing for domestic farm laborers.

Eligibility Criteria For The Medium Income Group I

For those falling under the Medium Income Group or MIG II

- Yearly income of the household from Rs. 12 lakh up to Rs. 18 lakh

- Home loan amount on which subsidy is calculated up to Rs. 12 lakh

- Rate of interest subsidy 3%

- The houses carpet area up to 200 square metres

Eligible candidates from MIG I & MIG II categories can avail a maximum subsidy on home loan interest of up to Rs. 2.35 lakh.

Note: The carpet area is the actual area within the walls where you can lay a carpet. It is excluding the inner walls thickness and common spaces like stairs or lobby.

What Is A Government Loan

The U.S. government offers loan programs through different departments to support the needs of individuals, businesses, and communities. These loans provide capital for those who may not qualify for a loan from a private lender. Government loan programs can help:

- Improve the overall national economy and quality of life of its citizens

- Encourage innovation and entrepreneurship

- Provide protection againstand relief fromdisasters

- Improve on the countrys human capital

- Reward veterans and their dependents for past contributions and help with present needs

Individuals and small businesses with little or no seed capital or collateral may find the terms for a private loan unaffordable. Low-cost government loans attempt to bridge this capital gap and enable long-term benefits for the recipients and the nation.

Don’t Miss: Congress Mortgage Stimulus Program For Middle Class 2021

What Will The Loan Cost

There are upfront costs involved in buying or building a home with the loan, including:

- a minimum deposit of 2% of the purchase price of your home, or the difference between the maximum loan you are eligible for and the purchase price of the property.

- Example 1: You are eligible to borrow a maximum of $200,000 but the purchase price of the property is $250,000, you will need a deposit of $50,000 which is 20% of the purchase price.

- Example 2: You are eligible to borrow the full amount of $250,000 to purchase the property. You will need a deposit of $5,000 which is 2% of the purchase price.

- application fees

- you will need to get independent financial advice and you will be reimbursed up to $100 if your loan is approved

- mortgage registration fees.

What Are Fha Loan Interest Rates Now

Below are the current average FHA interest rates. Zillow will show you the FHA interest rates that are applicable to your situation. You can instantly get personalized FHA quotes from multiple lenders by submitting a loan request with less than 20% down. To find FHA interest rates, use the filter button. Enter your income and credit score to see what interest rate you might qualify for. If you are looking to speak to a lender you can reach out to anyone on your list.

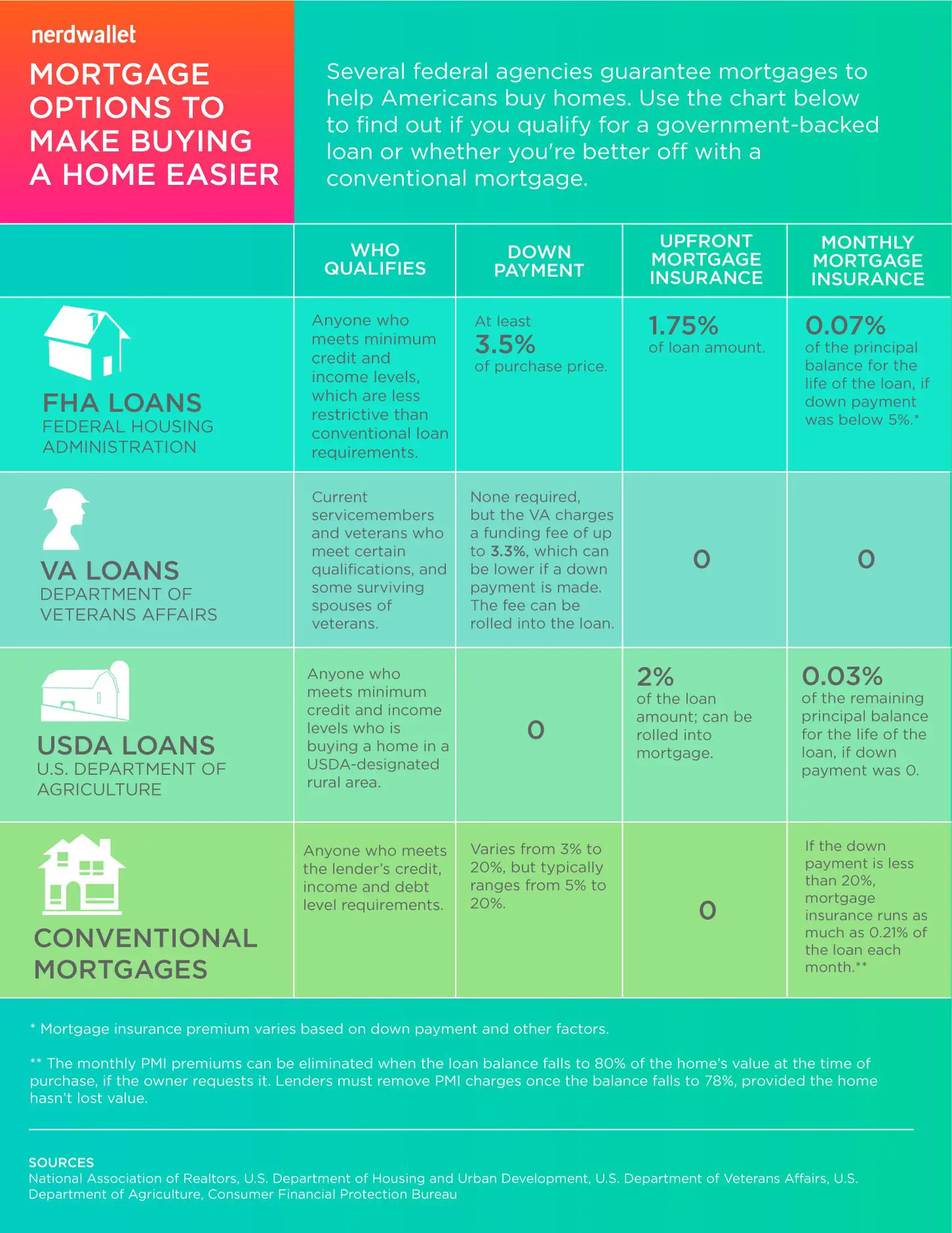

FHA is a housing loan assistance the is given to help low income families with housing, Those who does not have god credit record or a good financial conditions it is very hard for them to find a housing loan for them. The FHA, USDA, VA are kind of financing options where any low income individual can apply for loan with less interests rate, You can visit and read more grants and government loans information on Getgovtgrants

Read Also: Rtc Careers Las Vegas

Can I Renovate Or Rehab With A Government Loan

The government wants you to turn fixer-uppers into valuable, livable housing. Thats why most government loan programs offer options to help you renovate your current home or rehab a home that you plan on buying.

For example, an FHA 203 loan can allow you to borrow as little as $5,000 to put toward home improvements.

Eligibility Criteria For The Lower Income Group

For applicants falling under the LIG or Lower Income Group

- Yearly income of the household from Rs. 3 lakh up to Rs. 6 lakh

- Home loan amount on which subsidy is calculated up to Rs. 6 lakh

- Rate of interest subsidy 6.50%.

- The houses carpet area up to 60 square metres

Applicants from the EWS and LIG categories can avail of a maximum home loan subsidy of up to Rs. 2.67 lakh.

You May Like: Government Jobs Las Vegas No Experience

Interest Rates And Fees If You Refinance Your Home

The interest rate on the refinanced part of your mortgage may be different from the interest rate on your original mortgage. You may also have to pay a new mortgage loan insurance premium.

You may have to pay administrative fees which include:

- appraisal fees

Your lender may have to change the terms of your original mortgage agreement.

Cm Thackeray States That 323 Lakh Homes Ready Under The Maha Aawas Abhiyan

Chief Minister of Maharashtra, Uddhav Thackeray stated that around 15 lakh people have been benefited from the total of 3.23 lakh homes built under the development scheme of Maha Aawas Abhiyan Rural Scheme since November 2020. During the virtual inauguration of the scheme, the Chief Minister stated that the rural development scheme had a target of building 8 lakh houses in 100 days. From the 8 lakh houses, 3.23 lakh have been built.The construction of these houses started in November 2020 and the residents would include construction workers, citizens with no land, etc.

16 June 2021

Don’t Miss: Assurance Wireless Virginia

Buying A Home With Uncle Sam

Depending on your situation, buying, building, renovating or refinancing a home with a government loan could make it easier to achieve your dream of homeownership.

You dont have to run around to different government agencies either. You may be able to source all of your loan options from the same lender or mortgage broker. They can help you figure out which loans you qualify for and which options are the best for your home buying journey.

Does The Government Offer Home Loans For Senior Citizens

The government-insured Home Equity Conversion Mortgage is a common reverse mortgage option for senior citizens above the age of 62. The HECM allows homeowners to convert their homes equity into cash to pay off their existing mortgage. In addition to other eligibility factors, the Department of Housing and Urban Development requires borrowers to complete a HUD-approved reverse mortgage counseling session.

Rocket Mortgage does not currently offer HECMs.

You May Like: Free Government Flip Phones

Get Ahead On Your Home Loan

Smart ways to get ahead:

- Aim to save a 20% house deposit. A bigger deposit means a smaller loan, and you’ll avoid lender’s mortgage insurance .

- Compare loan options from at least two lenders. Focus on your ‘must haves’ to find one that best meets your needs.

- Look for the lowest interest rate. A home loan is a long-term debt, so even a small difference in interest adds up over time.

- Factor in all the costs involved in buying a house, such as building inspection, legal fees, stamp duty and insurance.

- Be realistic with the amount you borrow. Interest rates or your circumstances could change, so give yourself some breathing room.

- Make fortnightly repayments. You’ll pay off your mortgage faster by making an extra month’s repayment each year.

- Talk to your lender if you’re struggling with repayments. If you’ve received a default notice, get free legal advice straight away.

Pnc Bank Compared To Other Mortgage Lenders

| PNC Bank | |||

|---|---|---|---|

| 0% for VA and USDA 3% for conventional 3.5% for FHA | 0% for VA and USDA 3.5% for FHA 3% to 5% for conventional | ||

| Where does the lender operate? | All 50 states and Washington, D.C. | 47 states and Washington, D.C. | All 50 states and Washington, D.C. |

| Major loan types | Conventional, jumbo, VA, FHA, USDA, adjustable-rate, fixed-rate, refinance, cash-out refinance, streamline refinance, home equity lines of credit | Conventional, jumbo, VA, FHA, USDA, construction loans, adjustable-rate, fixed-rate, several refinance programs, home equity loans, home equity lines of credit | Conventional, jumbo, VA, FHA, USDA, various renovation loans, adjustable-rate, fixed-rate, refinance, cash-out refinance, reverse mortgages, home equity loans, home equity lines of credit |

Don’t Miss: Free Dental Implants Grants

What You Need To Know

- The U.S. government has loan programs designed to help low- and moderate-income home buyers, U.S. veterans and home buyers looking for homes in rural areas

- Government home loans usually have lower credit score and down payment requirements than conventional loans

- Like a conventional mortgage, you can buy, build, refinance, renovate, draw equity and more with government-backed loans

Demand For Affordable Housing May Rise Further During The Second Wave Of Pandemic

According to the real estate industry, the year 2020 was expected to be the year of recovery for them especially the housing sector. However, all the forecasts suffered a blow due to the outbreak of Covid-19 in India. Due to the outbreak, the industry accepted digitisation which helped them adapt to the new normal of working from anywhere even when the second wave of Coronavirus hit the country in 2021. Due to this the demand for affordable houses and workspaces with ticket size of Rs 35-50 lakh in Tier 2 and 3 cities/towns have risen. It is expected that despite the outbreak of the second wave of the pandemic and frequent lockdowns in many Indian states, this year is likely to see a growth in the housing segment of the realty industry.

04 June 2021

Don’t Miss: Federal Jobs Las Vegas

How Long Do I Have To Pay For Fha Mortgage Insurance

Your annual MIP length will be determined by the LTV ratio and the loan start date. FHA loan numbers as of June 3, 2021, If the LTV is higher than 90% at the time of loan origination, the borrower will be responsible for mortgage insurance. The borrower will have to pay mortgage insurance for the entire term of the loan or for 11 year if your LTV is less than 90%.

Pros And Cons Of Conventional Loans

Conventional loans are not limited to purchasing a primary residence. For example, eligible borrowers can use the loan to buy a rental property or vacation home. Lenders of conventional mortgages typically only require borrowers to purchase mortgage insurance when they cant come up with a 20% down payment, but once a borrower pays down enough of the mortgages principal, insurance can be canceled.

Because conventional mortgages are not guaranteed by the government, they typically have stricter lending requirements, including a higher credit score and a lower debt-to-income ratio.

Also Check: Governmentjobs.com Las Vegas

Home And Property Disaster Loans

Home and property disaster loans can help pay for home damage that insurance doesnt cover after a declared disaster. Homeowners can apply for up to $200,000 to rebuild their homes after a natural disaster and an extra $40,000 to replace lost possessions. However, you cant use these loans to upgrade your home or build more structures that werent there before the disaster.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Also Check: Government Contracts For Box Trucks

Federal Government Housing Policies

The federal government won’t give you a home loan, but it can support you to get a home loan with a smaller deposit through several schemes:

- First Home Loan Deposit Scheme. Under the First Home Loan Deposit Scheme a limited number of eligible first home buyers can buy or build a home with just a 5% deposit. You borrow the remainder through an approved lender and then apply for the scheme. This allows you to get a home with a low deposit while avoiding the added cost of lenders mortgage insurance .

- Family Home Guarantee. This scheme allows eligible single parent borrowers to buy a home with just a 2% deposit and avoid LMI too.

Single Family Housing Guaranteed Loan Program

- National Homeownership Month:Annual Lender Rankings

What does this program do?

The Section 502 Guaranteed Loan Program assists approved lenders in providing low- and moderate-income households the opportunity to own adequate, modest, decent, safe and sanitary dwellings as their primary residence in eligible rural areas. Eligible applicants may purchase, build, rehabilitate, improve or relocate a dwelling in an eligible rural area with 100% financing. The program provides a 90% loan note guarantee to approved lenders in order to reduce the risk of extending 100% loans to eligible rural homebuyers so no money down for those who qualify!

Who may apply for this program?Applicants must:

- Meet income-eligibility

- Agree to personally occupy the dwelling as their primary residence

- Be a U.S. Citizen, U.S. non-citizen national or Qualified Alien

What is an eligible rural area?Utilizing this USDA’s Eligibility Site you can enter a specific address for determination or just search the map to review general eligible areas.

Why does Rural Development do this?

This program helps lenders work with low- and moderate-income households living in rural areas to make homeownership a reality. Providing affordable homeownership opportunities promotes prosperity, which in turn creates thriving communities and improves the quality of life in rural areas.

How do I apply?

This list of active lenders is searchable by state and every effort is made by the SFHGLP team to keep this up to date.

Read Also: Government Programs To Stop Foreclosure

Can I Finance My Closing Costs

With an FHA loan, your closing costs usually cannot be financed into the loan amount. However, they can almost always be paid by the seller or the lender. FedHome Loan Centers can provide a lender rebate up to 2.75% toward your closing costs on a purchase transaction.

Your down payment doesnt have to come from your own funds either. The down payment can come as a gift from a family member, employer or approved down payment assistance group. FHA loans also allow for a non-occupant cosigner to help the borrower qualify for the loan.

Non-traditional credit sources such as insurance, medical and utility payments can be used to help build credit history if traditional credit is unavailable. With an FHA refinance, you can significantly lower your monthly payment with no out of pocket costs and may even be able skip a monthly payment during the process.

Government To Pace Up Housing Projects Under The Pmay Scheme

Under the PMAY schemes both Urban and Rural, the government had scaled down the targets earlier and had set them up to the construction of 21.4 million houses under the PMAY-Rural scheme and 11.2 million houses under the PMAY-Urban scheme by 2022.At the current scenario, the government will be required to pace up the construction projects to achieve the targets in the next one and half years. The rating agency ICRA has stated that the projects are way beyond schedule and it is important to speed up the process. As per the revised targets, the government had sanctioned 19.55 million houses under the PMAY-R scheme out of which 14.16 million or 67% has been delivered. Under the PMAY-U scheme, almost 11.2 million units have been sanctioned and 4.8 million units have been delivered indicating a completion of 43%. ICRA has also mentioned that the performance is likely to be affected in FY22 as well due to the COVID-19 situation.

14 July 2021

Recommended Reading: Government Benefits For Legally Blind

Who Is Eligible For The Pradhan Mantri Home Loan Subsidy

The interest subsidy on home loan by the government of India is available for 3 income groups: EWS, LIG, and MIG. Read on to know more about the eligibility criteria for the EWS or Economically Weaker Section. The annual income of the household up to Rs. 3 lakh

- Home loan amount on which subsidy is calculated up to Rs. 6 lakh

- Rate of interest subsidy 6.50%

- The houses carpet area up to 60 square metres

Business And Industrial Loans

No country or community can flourish with a stagnant marketplace. Innovation, entrepreneurship, employment, and healthy competition are important to the overall development of a nation’s economy. The loan programs offered in the business and industrial loan category aim to encourage these aspects of development. Business loans are available for small, mid-sized, and large businesses and industries for various periods of time.

On March 27, 2020, President Trump signed into law a $2 trillion emergency stimulus package called the CARES Act. As part of the new legislation, the Small Business Administration established the Paycheck Protection Program, a $350 billion loan program. It’s available to businesses with 500 or fewer employees to help cover healthcare costs, payroll, rent, utilities, and other costs. The SBA also expanded some of its existing programs, including the Economic Injury Disaster Loan Program. The funding was later extended when President Biden signed the American Rescue Plan Act into law in March of 2021.

Funding can be used to buy land, facilities, equipment, machinery, and repairs for any business-specific needs. Other unique variants in these government loan programs include offering management assistance to qualifying small start-ups with high growth potential, among others.

You May Like: Government Jobs Sacramento