Is Government Gaap Necessary

Should CPA students no longer have to learn the basics of government accounting? According to a new AICPA exposure draft, Maintaining the Relevance of the Uniform CPA Examination, Given the specialized nature of the content assessed in the state and local governments section of the CPA exam and thus the potential limited applicability to a majority of newly licensed CPAs, the AICPA is considering the potential removal of state and local government accounting content from the CPA Exam .

This news was a surprise to this author. After all, state and local governments have become very large economic drivers, rivalling big business. Governments have a larger impact on more people than corporations because every American pays taxes and receives government services and benefits. Isnt it important for CPAs to learn and understand government accounting?

A better question might be, Why do we need governmental accounting at all, much less on the CPA exam? As former Senator Mark Kirk once asked the author, Isnt one plus one in the private sector the same as one plus one in the public sector?

Determination Of The Fair Value Of Assets Acquired Through Business Combinations

In significant business combinations, the Group has used external advisors when estimating the fair values of property, plant and equipment and intangible assets. For property, plant and equipment, comparisons have been made of the market prices of similar assets, and the depreciation of the acquired assets due to aging, wear and other similar factors has been estimated. The fair value measurement of intangible assets is based on estimates of the future cash flows associated with the assets.

Consolidated Financial Statement Example

So, what does a Consolidated Financial Statement actually look like? This is a typical example showing the standard format, using a fictitious company. It shows the main statements in different formats and refers to the relevant IFRS paragraphs which they relate to.

Source:

Read Also: 8774182573

Preparing Consolidated Financial Statement Under Ias 27

Circumstances when the parent company doesnt need to present consolidated statements:

First, lets talk about where the parent companyParent CompanyA holding company is a company that owns the majority voting shares of another company . This company also generally controls the management of that company, as well as directs the subsidiary’s directions and policies.read more doesnt need to prepare and present the consolidated statements

- If the parent company is a fully or partially owned subsidiary, then the presentation of consolidated statements is not required. But that is subject to the fact that if the owners dont question the parent company for not representing the consolidated statements.

- Suppose the parent companys stock or debt isnt traded in any public market, for example, stock exchange, over-the-counter market, etc. In that case, its not required for the parent company to present consolidated financial statements.

- If the parent company is on the brink of filing its financial statements with a security commission for issuing any instruments in the public market, then it would not be required for the parent company to present a consolidated balance sheet.

- Lastly, if any parent of this parent company presents the consolidated statements according to the mandate of International Financial Reporting Standards , then it would not be necessary for this parent to present any consolidated statements for public use.

Which Type Of Financial Statement To Use

When deciding whether to file a consolidated financial statement or a combined financial statement, it’s a good idea to check with your financial advisor or accountant as to which he or she recommends. When, however, the parent company owns more than 50 percent of a subsidiary, you will have no choiceyou must file a consolidated financial statement.

If you are a director of the parent corporation or LLC, and the general public knows your parent company and its brand better than it knows the subsidiaries, consider filing a consolidated financial statement.

After all, if the public hasn’t heard of your subsidiaries, but they can sing the jingle to your parent company or recite the commercial word for word, the investing public won’t be as concerned about the subsidiaries as separate entities. The investor just needs to know that the parent company is healthy and economically viable.

If it’s more important to be able to assess each entity or company on its own meritsinstead of as part of the unified wholethen the combined financial statement may be more suitable.

As stated earlier, the combined statement is much easier to prepare, since it simply requires a separate financial statement for each entity. A combined statement also makes sense in the event that two or more entities are under common control, but there is no actual parent company.

About the Author

Ronna L. DeLoe, Esq.

Read Also: Hiro Mortgage Program Legit

The Consolidated Financial Statements

The Consolidated Financial Statements show the provinces financial position at the end of the previous fiscal year, its financial activities during the reporting period and its financial position at the end of the reporting fiscal year. The statements are linked, and figures that appear in one statement may affect another.

The provinces financial statements are presented on a consolidated basis, meaning that the provinces statement of financial position and statement of operations reflect the combination of ministry results as well as financial results for entities that are controlled by the government . Therefore, reported revenues and expenses of the province can be affected directly by the activities of ministries as well as the performance of controlled entities such as government business enterprises and broader public sector organizations, i.e., hospitals, school boards and colleges. In addition, the provinces results are also affected by transfer payments made to non-consolidated entities, such as municipalities and universities.

The financial statements comprise:

When reading the Consolidated Financial Statements, it is essential to also read the accompanying notes and schedules, which summarize Ontarios significant accounting policies and provide additional information on underlying financial activities, market value of investments, contractual obligations and risks.

What Gaap Principles Govern The Consolidation Of Financial Statements

Please understand project in full.

The purpose of this Key Assignment is to get familiar with annual reports and to understand the financial implications of the following:

- Equity method of accounting versus consolidation

- Reporting of investments based on cost/equity

- Goodwill reporting

- Intercompany and intracompany transactions

Access the companys Web page on the Internet to read its most recent annual report. The annual report is typically found in an Investor Relations or Company Information section within the companys Web site. If the company does not provide a full annual report, select another company for your project. Verify that the full annual report includes the following:

- A letter or report to shareholders from the president of the company

- A section providing managements discussion and analysis of the business

- A report from the auditor

- The companys financial statements

- Supplemental notes to the financial statements

Once you have found a full annual report, complete each part of the assignment.

Please cover all of the items listed in the questions below. You can select more than 1 company if your chosen company does not have all the items listed below.

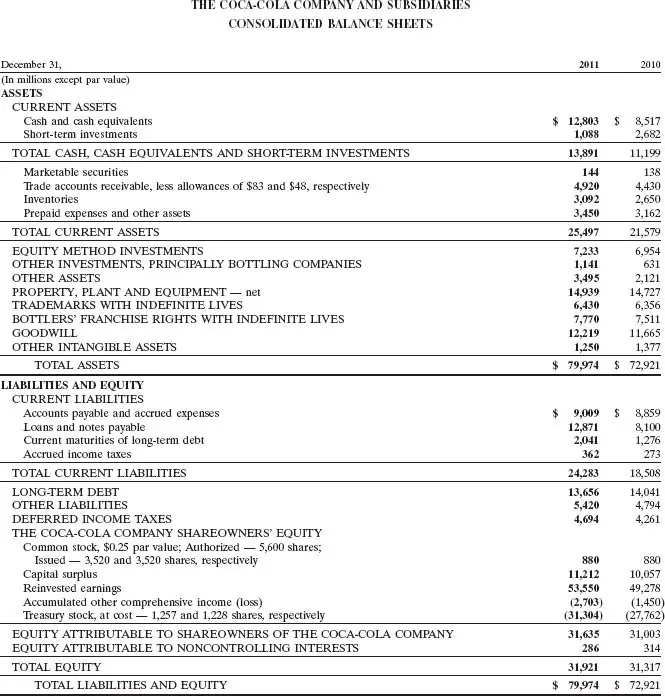

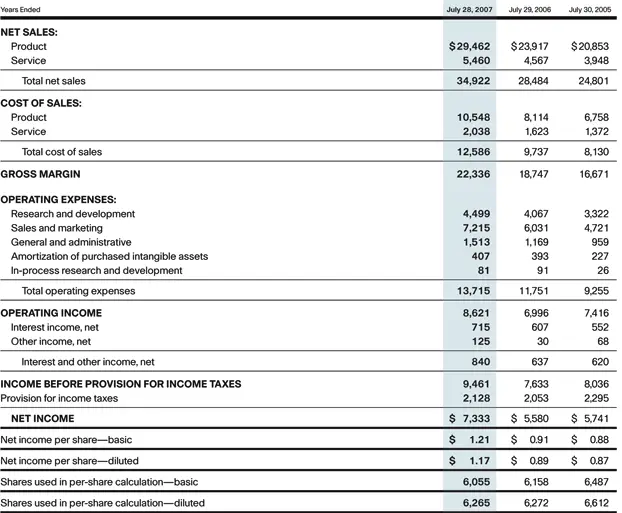

Using the financial statements of your company , write a 1,0001,500 word paper that addresses the following questions:

- What GAAP principles govern the consolidation of financial statements?

- How are consolidated and equity methods of accounting different?

Don’t Miss: Safelink Stolen Phone Replacement

What Gaap Principles Govern The Consolidation Of Financial Statements How Are Consolidated And Equity Methods Of Accounting Different

Key Assignment Draft IMPORTANT NOTE: You may have to research more than 1 company to complete the Key Assignment. Plan accordingly. The purpose of this Key Assignment is to get familiar with annual reports and to understand the financial implications of the following: Equity method of accounting versus consolidation Reporting of investments based on cost/equity Goodwill reporting Intercompany and

Preparing Consolidated Financial Statement Under Us Gaap

If you are in the USA or follow GAAP, here are a few things you should consider while preparing a consolidated financial statement

- If a company has majority voting power in another company , then consolidation of financial statements can be done.

- According to GAAP, if your business holds 20% to 50% in equity, you need to report your financial statements under the equity method. The reasoning behind this is that as a company when you have 20%-50% equity in the other company, you can exert your influence.

- According to GAAP, subsidiary companies equity portions ofretained earningsRetained EarningsRetained Earnings are defined as the cumulative earnings earned by the company till the date after adjusting for the distribution of the dividend or the other distributions to the investors of the company. It is shown as the part of owners equity in the liability side of the balance sheet of the company.read more should be removed in consolidated statements.

- If the subsidiary is not fully owned, then non-controlling interest should be used.

- While producing the consolidated statements, the balance sheets of subsidiary companies should be adjusted to the current fair market value of the assets.

- While preparing the consolidated income statement, if the parent companys revenue is the expense of the subsidiary, it should be removed entirely.

Also Check: Government Jobs In Las Vegas Nv

Accounting Rules For Consolidation

Successful businesses commonly encounter opportunities to grow through acquisitions — by buying up competitors or other businesses. When your business acquires a controlling stake in another, accounting rules require you to consolidate your financial statements. This is the case regardless of whether you absorb the new company or leave it operating as a separate business.

Presentation Of Consolidated Financial Statements

A parent company presenting its consolidated financial statements must present these statements along with its standalone financial statements.

The users of financial statements of a parent company are typically concerned with and are required to be educated about, the results of operations and financial position of not only the company itself but also of that group together.

This requirement is served by offering the users of financial statements

- Standalone financial statements of a parent and

- Consolidated financial statements that provide financial information about the business group as that of a lone enterprise without respect to the legal restrictions of the distinct legal entities

Recommended Reading: Government Grants For Auto Repair Shops

Gaap Requirements For Consolidated Financial Reporting

GAAP requires companies to eliminate intercompany transactions from their consolidated statements. In order to avoid double counting them, they must exclude movements of cash, revenue, assets, or liabilities from one entity to another.Intercompany transaction examples might include:

-

Interest one subsidiary earns from a loan paid to another subsidiary

-

‘Management fees’ that a subsidiary pays the parent company

-

Sales and purchases among subsidiaries

Accounting Policies And Valuation Criteria Applied

The accounting standards and policies and the valuation criteria applied in preparing these consolidated financial statements may differ from those used by some of the entities in the BBVA Group. For this reason, the necessary adjustments and reclassifications have been introduced in the consolidation process to standardize these principles and criteria and comply with the EU-IFRS.

The accounting standards and policies and valuation criteria used in preparing these consolidated financial statements are as follows:

2.2.1 Financial Instruments

Measurement of financial instruments and recognition of changes in subsequent fair value

All financial instruments are initially accounted for at fair value which, unless there is evidence to the contrary, shall be the transaction price.

All the changes in the financial instruments, except in trading derivatives, arising from the accrual of interests and similar items are recognized under the headings Interest and similar income or Interest and similar expenses, as appropriate, in the accompanying consolidated income statement for the year in which the accrual took place . The dividends paid from other companies are recognized under the heading Dividend income in the accompanying consolidated income statement for the year in which the right to receive them arises .

Financial assets held for trading and Other financial assets and liabilities designated at fair value through profit or loss

- Available-for-sale financial assets

Read Also: Www.qlinkwireless.com/register

Transform Your Consolidation Accounting

Financial consolidation creates a single source of truth for companies structured with multiple subsidiaries or other affiliated entities. Private companies may choose to consolidate their financial statements to improve their corporate decision-making or gain tax advantages, but its a strict requirement for publicly traded companies. To stay compliant, make sure your financial team is up to date on recent updates to the U.S. GAAP reporting requirements.

Consolidation accounting is a time-intensive undertaking, but the right financial consolidation software can help you create your consolidated financial statements faster. Want to spend less time creating financial reports and more time identifying trends, threats, wins, and opportunities from your data? Longview can accelerate your consolidation processes and transform your office of the CFO. Visit our Consolidation Resource Center to learn more and start streamlining your financial consolidation process today.

C Government Of Canada Consolidated Financial Statements

the Government of Canada Accounting Handbook should be referred to for the appropriate accounting policy and/or guidance in its application.

You May Like: Dental Grants For Seniors

The Estimates Of The Province Of Ontario

The governments spending Estimates for the fiscal year commencing April 1 are presented to members of the Legislative Assembly following the presentation of the Ontario Budget by the Minister of Finance. The Estimates outline the spending plans of each ministry and are submitted for approval to the Legislative Assembly according to the Supply Act. For electronic access, go to:

What Are Consolidated Financial Statements

Consolidated financial statements are financial statements of an entity with multiple divisions or subsidiaries. Companies can often use the word consolidated loosely in financial statement reporting to refer to the aggregated reporting of their entire business collectively. However, the Financial Accounting Standards Board defines consolidated financial statement reporting as reporting of an entity structured with a parent company and subsidiaries.

Private companies have very few requirements for financial statement reporting but public companies must report financials in line with the Financial Accounting Standards Boards Generally Accepted Accounting Principles . If a company reports internationally it must also work within the guidelines laid out by the International Accounting Standards Boards International Financial Reporting Standards . Both GAAP and IFRS have some specific guidelines for companies who choose to report consolidated financial statements with subsidiaries.

Consolidated Financial Statements

You May Like: Congress Mortgage Stimulus Program Middle Class

Ownership Accounting: Cost And Equity Methods

There are primarily three ways to report ownership interest between companies. The first way is to create consolidated subsidiary financial statements. The cost and equity methods are two additional ways companies may account for ownership interests in their financial reporting. Overall, ownership is usually based on the total amount of equity owned. If a company owns less than 20% of another company’s stock, it will usually use the cost method of financial reporting. If a company owns more than 20% but less than 50%, a company will usually use the equity method.

Financial Assets And Liabilities

Financial assets

Financial assets are classified into the following categories: financial assets at fair value through the statement of income, investments held to maturity, loans and receivables and available-for-sale financial assets. Financial assets are classified on the basis of their purpose of use upon initial recognition.

At the end of the reporting period, the Group assesses whether objective indication exists of impairment of an individual financial asset other than those measured at fair value through the statement of income. There is impairment in a financial asset if objective indication exists thereof and if it has an effect on expected future cash flows from the financial asset that can be reliably evaluated. A significant decline in a counterparty’s result, a debtor’s breach of contract and, for equity instruments, a significant or persistent decline in value below its cost, for example, can be considered as objective indication of impairment.

Financial assets at fair value through the statement of income

Investments held to maturity

Investments held to maturity are financial assets with fixed or determinable payments that mature on a fixed date and which the Group has the positive intention and ability to hold until maturity. They are measured at amortised cost using the effective interest rate method, less any impairment losses.

Loans and receivables

Available-for-sale financial assets

Cash and cash equivalents

Financial liabilities

Fair value hierarchy

Read Also: Easy Government Contracts

Trust Funds Under Administration

The following trust funds under administration are not included in the Consolidated Financial Statements of the province.

The Workplace Safety and Insurance Board is responsible for administering the Workplace Safety and Insurance Act 1997, which establishes a no-fault insurance scheme that provides benefits to workers who experience workplace injuries or illnesses.

The Public Guardian and Trustee for the Province of Ontario delivers a unique and diverse range of services that safeguard the legal, personal and financial interests of certain private individuals and estates. It also plays an important role in helping to protect charitable property in Ontario.

The Motor Vehicle Accident Claims Fund operates under the authority of the Motor Vehicle Accident Claims Act. The Act provides compensation for eligible losses occasioned by unidentified and uninsured motor vehicles.

The Pension Benefits Guarantee Fund provides protection, subject to specific maximums and specific exclusions, to Ontario members and beneficiaries of privately sponsored single-employer defined benefit pension plans in the event of plan sponsor insolvency. The PBGF is governed by the Pension Benefits Act and its Regulation and is administered by the Chief Executive Officer of the Financial Services Regulatory Authority of Ontario as of June 8, 2019. Prior to June 8, 2019, the PBGF was administered by the Superintendent of Financial Services Commission of Ontario.

| 329 | N/A |