Factors That Impact Air Conditioner Installation Prices

We mentioned already that the cost of a new air conditioner can range from $3,000 and $7,500+. However, the units alone typically only cost somewhere between $1,300 and $5,500.

So how do you go from a $1,300 unit to spending $3,000+ on a new air conditioner? The answer is installation, labour, materials, and contractor overhead costs.

Starting Your A/c Up Again

What is the proper way to start your Air Conditioner up after the winter? Well there are a few steps home owners should take to ensure that their A/C runs smoothly and that this summer remains a cool one inside their house. As always most people wait for hot weather to start their air conditioners, and of course thats when they find out that the compressor…

Save On Energy Whole Home Program

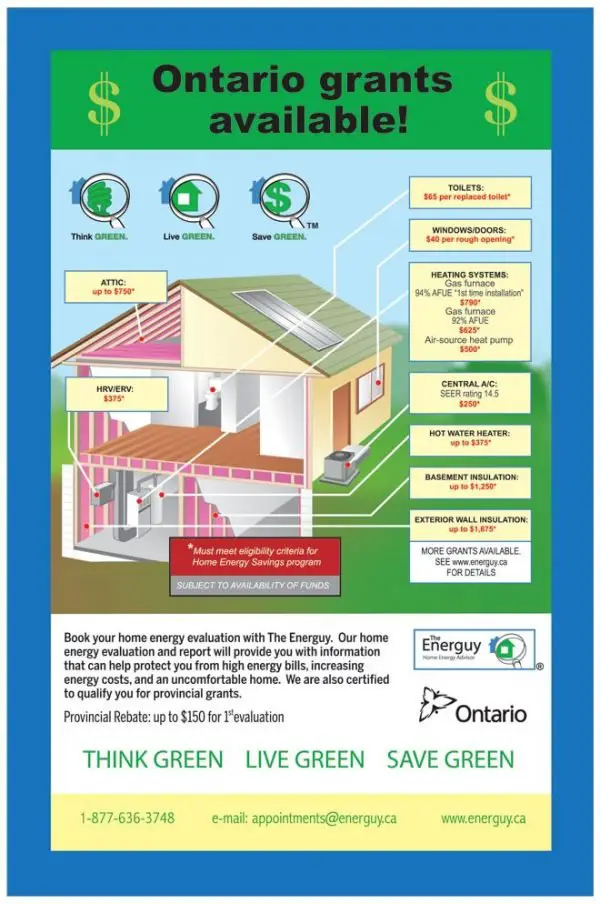

The Whole Home Program is an energy- and money-saving program created to allow all Ontario homeowners to benefit from a wide range of rebates.

Truly, why not receive thousands of dollars in incentives to make upgrades throughout your entire house, use less energy, and save money? Get money back for saving the planet and your bank account? Yes please!

The first step is to get an energy assessment done on your home. It only takes about 2 hours. While it is a requirement of the program, it also helps you learn the best ways to reduce your energy use, such as replacing your furnace, replacing windows, or installing new or more insulation.

The second step is to finish the recommended upgrades, whether you hire someone for all of them or just for the ones that need a certified contractor. Finishing 2 or more upgradessuch as replacing your current refrigerator with an ENERGY STAR® refrigerator and getting $75 in your pocket for itthrough this program will result in you receiving even more great rebates.

But, since the more you upgrade with this program, the more you save, so why not upgrade a few more items that could save you money?

Different rebates are offered in different areas through different operators, so enter your postal code here to find out whats being offered in your area, or to determine what utility company offers this program in your area.

Recommended Reading: Government Grants To Start Trucking Business

Don’t Miss: Federal Government Dental And Vision Insurance

Energy Star Tax Credit

The Energy Star Tax Credit is not a government program and it makes you confused about it. But still, it will be helpful for you to get the free air conditioner unit for you and your family. Even it is not the part of the free air conditioning unit from the government but works for helping the people with the free air conditioner.

Even they also provide you the 10 percent of the cost of the air conditioner. Sometimes they provide the amount of $50 to $300 to help the people who want to buy an air conditioner for their family. But if there is someone who badly needs the air conditioner then it may possible that the grant amount goes up to $500. So, the person can buy the air conditioner for their family and give them a better time of their life.

The Energy Star Tax credit is a tax rebate program that helps you and provides you with funds from the taxes that you pay over years. Or that tax you pay to the government from your income, they provide that tax amount in the form of financial assistance to the people. Under this grant program of free air conditioning units, you are qualified to get the HVAC units and air conditioners that are energy efficient and energy star certified.

For eligible for this grant program, you have to do just one thing and that is you have to fill the application form. You can find the application form from their official website of government and submit the form. Also, you have to attach all the required documents along with the application form.

A Guide To Ac And Heating Rebates & Incentives

When youre looking for a new air conditioning or heating system, it is important to factor in the total cost of ownership, not just the initial sticker price. Here are a few points to consider:

- Higher efficiency units cost more, but can result in more rebates, incentives. While higher efficiency systems often are priced higher, they also tend to come with greater rebates and government incentives.

- Government agencies and power companies want you to be efficient. Government agencies and power companies want to encourage the use of higher efficiency equipment to help reduce power consumption during the summer cooling season. That is the time which most often stresses the ability of the local power plant to keep up with demand.

- Incentives are offered by federal, state or local governments and utility companies and change frequently. These often come in the form of direct rebates, tax credits or tax deductions and can total more than $1,000 per system, depending on your geographic location and the type of system purchased.

TIP: Incentives for air conditioners and heat pumps are generally tied to efficiency ratings and performance. The efficiency of air conditioning systems in the U.S. is measured by Seasonal Energy Efficiency Rating or SEER. Heat pumps are measured by Heating Seasonal Performance Factor or HSPF. A higher SEER or HSPF number signifies higher efficiency.

You May Like: Health Insurance For Retired Government Employees

Purchase An Energy Star Air Conditioner To Optimize Savings

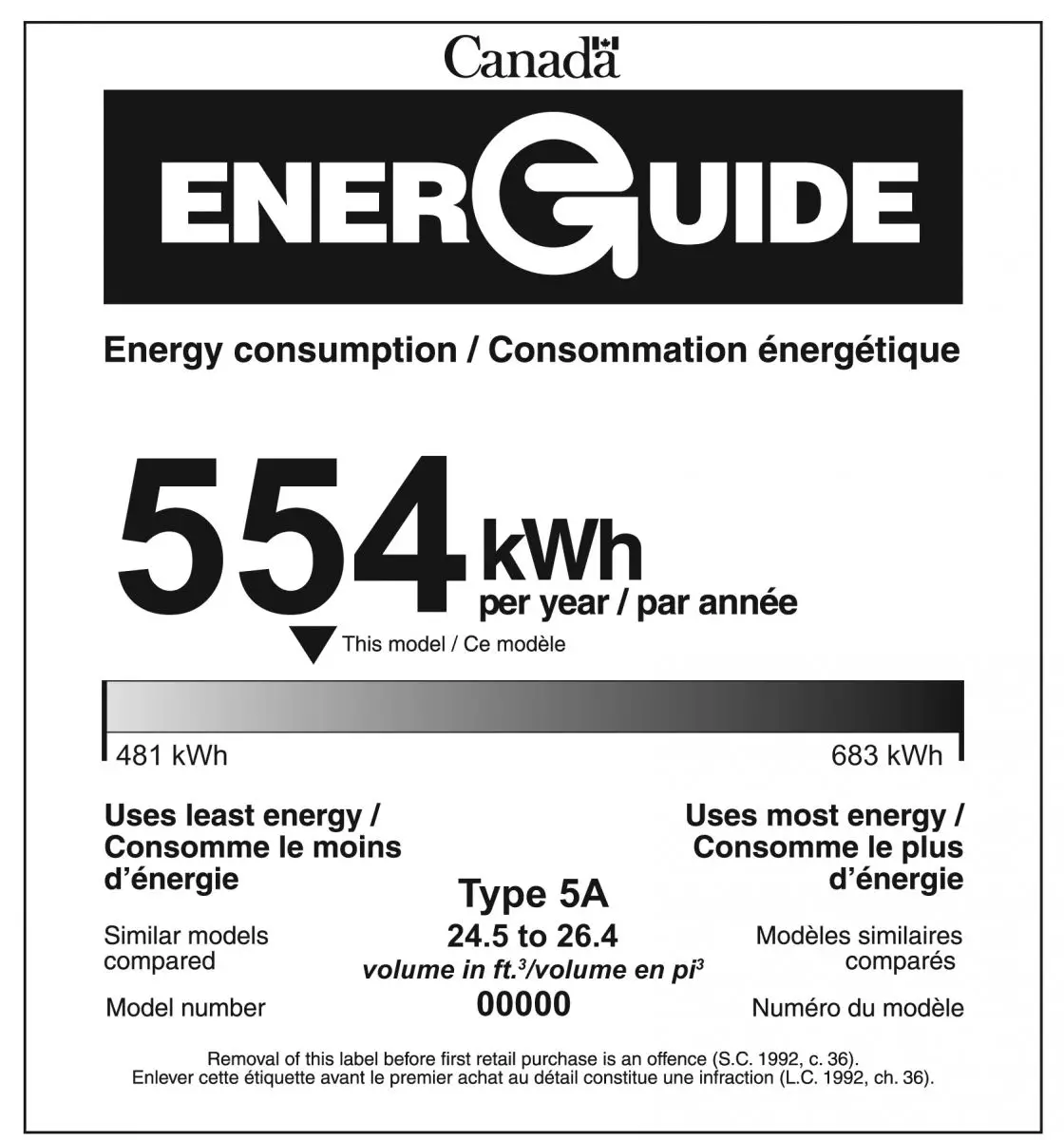

To optimize cost effectiveness, always purchase an ENERGY STAR-qualified residential central air conditioner. ENERGY STAR is a federal label that certifies energy efficiency using various standardized methods. These products meet efficiency requirements of the Federal Energy Management Program and are life cycle cost-effective.

Who Qualifies For A Heat Pump Tax Credit Or Rebate

Any taxpayer would qualify for the federal tax credits.

For the tax credit program, the new incentives will apply to equipment installed on January 1, 2023 or later.

As for the rebate programs, Urbanek says it would be surprising if they turn out to apply retroactively. The rebates depend on income. Specifically:

- If your household income is less than 80 percent of your states median household income, you are eligible for 100 percent of the rebates available. So if you spend $10,000 on a heat pump and a heat pump water heater, you could get $9,750 back, depending on the specifics of your states rebate program.

- If your household income is 80 percent to 150 percent of your states median income, you are eligible for 50 percent of the rebates available. So for a $10,000 heat pump and heat pump water heater, you could get $4,875 back, depending on specifics.

- If your household income is more than 150 percent of your states median income, you are not eligible for these rebates.

Also Check: Cricket Wireless Free Government Phone

What Contractor You Buy From Can Impact Prices

Each HVAC company is its own entity, and each one will charge different prices for various services. Their prices depend on many things, including their overhead and the level of service they provide. Well talk more about that later.

Going for the best price isnt always the best move. You may find some particularly cheap deals advertised on classified sites, for example, especially in metropolitan areas like the Greater Toronto Area.

However, you often get what you pay for. The trade-offs with an inexpensive company could include:

- Poor workmanship

- Lack of experience and training

- No additional warranty coverage or the manufacturer warranty being voided/not honoured

- Not having access to the same level of service

- The company not being established and reliable

- Getting a refurbished unit instead of a new one

We regularly receive calls for help from consumers in these situations. For these reasons, we generally advise caution with companies that offer rates that seem too good to be true.

Your best bet to get a good price and good value is to work only with established and reputable distributors. Our partner contractors have been thoroughly assessed and have proven themselves to be reliable and trustworthy companies with the right training and qualifications.

See our Certification page for more info on criteria to look for when choosing a contractor.

Air Source Heat Pump Rebate Program

If your home is heated electrically, consider taking advantage of Union Gass rebate of up to $5,800 when you buy a qualifying air source heat pump after your home energy assessment as part of your eligible upgrades.

Dont worry about having learn everything about ASHPs because your advisor will recommend the best model for your needs and wallet and will also fill out and send in the rebate form for you. The amount you could get back could be anywhere from $1,900 when you buy a ductless ASHP to $5,800 for a ductless ASHP .

While you cant combine this rebate with another heating system rebate, your ASHP purchase thankfully doesnt count towards the $5,000 rebate maximum, so you actually end up getting as much as $10,800 back all together if you go with a new ASHP plus all the other required upgrades.

Again, remember the $250 bonus if you make more than 2 qualifying upgrades!

Read Also: Government Grants To Fix Your Home

Take Advantage Of State Local And Utility Company Incentives

Unfortunately, federal tax credits for Residential Energy Efficiency expired at the end of 2021. But there are numerous incentive programs available from utility companies, local governments and state agencies to help you save on energy efficiency.

Check out the Database of State Incentives for Renewables & Efficiency for detailed information on state incentives and policies for renewable energy and energy efficiency improvements. There is an interactive map where you can click on your state to find available programs. Many of these qualify for state or local rebates on a more energy efficient air conditioner.

You can use the available filters to narrow your search. Include air conditioner in the search field, as well as your state or municipality, for more specific information.

In Texas, for example, Austin Energy offers a Commercial Rebate Program that covers air conditioning, lighting, roofs, chillers and more. In New York, Massachusetts, Rhode Island, New Hampshire and other areas, the Cool Choice program provides rebates for high efficiency air conditioning systems and other HVAC equipment.

Rg& e Programs & Incentives

Commercial and Industrial Rebates Rebates of up to $7,500 for installing high-efficiency boilers, furnaces, unit heaters, controls and thermostats, steam traps, demand control ventilation, and more. Learn more.

Multifamily Energy Efficiency Program Equipment replacement and rebates designed to reduce electricity and/or natural gas use in apartment and condominium complexes, including lighting upgrades, water saving measures, occupancy controls, and pipe insulation. Learn more.

Don’t Miss: What Is The Return On Government Bonds

Why Choose Energy Star Products

Saving energy saves you money and reduces your impact on the environment. ENERGY STAR is the mark of high-efficiency products in Canada. Their qualified products meet strict technical specifications for energy performancetested and certified. The Government of Canada website lists all the rebates and incentives for select ENERGY STAR® qualified products in Canada listed by province.

Heating And Cooling Upgrade Rebates

Program:

The Victorian Government will provide energy-efficient heating and cooling for 250,000 low income and vulnerable households by reducing the upfront cost of purchasing energy-efficient reverse cycle split systems.

The Home Heating and Cooling Upgrades Program will be delivered through a base rebate of $1,000 provided towards the cost of purchasing and installing a high-efficiency heating and cooling system with a limit of one rebate per household.

Households can receive an additional $200 if they need to cap their old gas heater or $500 if they need to upgrade their switchboard.

On 1 November 2021 the program was expanded to include rental properties.

Don’t Miss: How Do Government Phones Work

How Do I Apply For The Tax Credits

To claim the tax credits, fill out IRS Form 5695 and file it with your tax returns. Tax credits are administered by the IRS. For questions about how to apply, please contact the IRS or a tax professional.

*Disclaimer: The tax credit information contained within this website is provided for informational purposes only and is not intended to substitute for expert advice from a professional tax/financial planner or the Internal Revenue Service .

This post was originally published June 4, 2020. Updated January 15, 2021.

Find Product Efficiency Requirements

The U.S. Environmental Protection Agency provides residential central air conditioner program requirements and efficiency criteria on the ENERGY STAR website. Manufacturers meeting these requirements are allowed to display the ENERGY STAR label on complying models. Federal buyers can use ENERGY STAR’s list of certified residential central air conditioners to identify or verify complying models. Buyers can also find qualified products on the Consortium for Energy Efficiency/Air Conditioning, Heating and Refrigeration Institute Directory of Efficient Equipment database. As of January 2021, the version 6.0 ENERGY STAR product specification for central air conditioners was not published. Please check ENERGY STAR’s central air conditioners web page for updates on the version 6.0 specification.

Recommended Reading: What Government Benefits Are Available To Me

Eligible For Government Rebates If Installing New Furnace Or Ac

Are you trying to live a greener lifestyle? Did you know that upgrading your current home comfort systems is a great way to reduce your carbon footprint, and that you could be eligible to receive government grants to help cover the costs of purchasing a new system?

As an added bonus, youll also end up saving on energy bills! Homeowners who upgrade their heating and cooling systems to more energy-efficient models can qualify for government and utility rebates. By purchasing these more efficient systems you can receive as much as $10,000 in rebates. Lets talk about which products fall under the rebate category, the different types of government rebates available for installing energy conscious heating and cooling equipment, how to get started and more.

Free Water Heater Programs

The process for using government grants to fund free water heaters provides a model to follow for all HVAC replacement systems. A small percentage of low-income families might get a new unit gratis, while rebates and lower utility costs balance the equation for more people.

Once again, payment plans spread over the life of your water heater make the arrangement work. Even middle-class families can upgrade their systems without any out-of-pocket costs courtesy of gas or electricity savings and rebates.

Read Also: How To Get Government Medical Insurance

Enbridge Home Conservation Program

This program, offered and administered by Enbridge, is designed to help you make your entire home work to save you money. Like the Save On Energy Whole Home program, a home assessment is a required component so you can reap the benefits of all the upgrades and rebates included in this program. All you have to do is book an appointment with a certified energy advisor to get started.

Once your advisor has examined your home, they will recommend the best energy-efficient measure for you. For example, perhaps you need more or better insulation. You could get anywhere from $250 to $1,750 back, depending on the type and location of the insulation you install.

Or maybe you could benefit from a new furnace. This program will give you $1,000 rebate for replacing a furnace that meets these eligibility requirements:

- Less than 95% AFUE natural gas, propane, or oil furnace

- 89% or less AFUE natural gas, propane, or oil boiler with a 95% or higher AFUE condensing natural gas, propane, or oil furnace

- 90% or higher AFUE condensing natural gas, propane, or oil boiler

An additional $2,100 could be yours for retrofitting, and you could even qualify for up to $5,000 for installing 2 or more eligible measures and completing the pre-energy audit if you are a qualified homeowner.

And there are additional incentives available as well, such as rebates for installing smart thermostats .

Am I Eligible To Claim Hvac Rebate

It sounds great, doesnt it? But whats the bottom line? How do you know if youre eligible?

First up, if the system meets the qualifications in the section above, its energy star certified. This proof is often in the form of an AHRI certificate or a manufacturer certification. As a homeowner, you should keep proof for your own records, but you dont need to attach to your tax return when you file. In addition, to be eligible for the tax credit, the system must be installed at your existing home, which is also your primary residence.

Unfortunately, tax credits are not available for new constructions or rentals, so its only for systems that you replaced or added at your current home.

Also, if youve already claimed $500 from the Non-business Energy Property Tax Credit since 2005, you wont be eligible to claim any more credits.

Read Also: City Of Las Vegas Government Jobs

Don’t Miss: 9000 Dollar Grant From Government

What Are The Documents Needed For Free Air Conditioner From Government

As you know like every assistance and program this cooling assistance and program also needed some paper work to verify you identity, income status and living standard. Here is the list of Documents that will need to Submit with your application.

Financial Assistance For Pregnant Mothers

There are several firms, which did not help only disabled people but also help people who have medical problems. They help them by providing a free air conditioner. If there is someone who needs financial assistance for buying the air conditioner then there are various organizations that help them with funding to buy an air conditioner. With the help of the government, ones dream of having an air conditioner can become true.

Not only the government organizations but there are several non-government and non-profit organizations, that provides help for the free air conditioner to the needy people. They provide help to the people with their free air conditioning unit. From the NGOs, various grant programs are organized for providing the free air conditioning unit. These grant programs are organized on the stages as well as o the local level. So, one can look in their local area for the offices of those NGOs and organizations and contact them to get help for getting the free air conditioner from them in this hot summer.

Read Also: Government Grants For Religious Organizations