How Do Medicare Advantage Plans Work

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare. If you join a Medicare Advantage Plan, you’ll still have Medicare but you’ll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare.

These “bundled” plans include

, and usually Medicare drug coverage .

Transferring Medicare To Another State

If you move to another state or region, you will need to find a new Medicare Advantage plan available in that area. According to CNBC, you will have two months to change and update your plan after youve arrived in your new state of residence.

If you have Original Medicare, all you need to do if you move is give Medicare your new address and location info.

Attract Large Employers To Group Medicare Advantage

Proposals for phasing in Medicare for all typically contrast their political appeal, lower incremental taxes, and practical feasibility with a purer version of Medicare for All. However, many phased proposals would also undermine group insurance, by giving all employees the choice of Medicare or by gradually reducing the age of eligibility for Medicare. Joe Bidens presidential campaign promised to give all Americans the choice of his public option.42-46

Meanwhile, many large employers are beginning to look to the public sector for help in controlling the medical prices that account for threefourths of their escalating ESI premiums. Having largely exhausted costshifting strategies, employers cannot escape hefty annual premium increases, more than 4% in recent years.25 In a 2020 survey of 90 large and midsized selfinsured employers, nearly threefourths favored hospital rate regulation onethird saw Democratic proposals for a Medicare public option as helpful .47

Recommended Reading: Assurance Wireless Las Vegas Nv

How Is Medicare Funded

The Medicare program was established in 1965 and it set up two separate Medicare trust funds to cover program expenses:

- The Medicare Hospital Insurance, or HI Trust Fund gets money primarily from payroll taxes. It gets much smaller amounts from income tax on Social Security benefits and Medicare Part A premiums paid by those who dont qualify for premium-free Part A. The money in this trust fund pays for Part A expenses such as inpatient hospital care, skilled nursing facility care, and hospice.

- The Medicare Supplemental Medical Insurance, or SMI Trust Fund gets its Medicare funding primarily from money Congress allocates for the program and from Part B premiums and Medicare Part D Prescription Drug Plan premiums. This fund pays for outpatient health care, durable medical equipment, certain preventative services and prescription drugs.

The Medicare funding sources are the same whether you are enrolled in Original Medicare or a Medicare Advantage plan.

How Are Benefits Paid Under Medicare Advantage

Medicare Advantage plans are offered by private insurance companies contracted with Medicare to provide program benefits. Under Medicare Advantage, the insurance company receives a set amount of money each year per enrollee to cover health care expenses for the year. The amount is usually exactly the same for each enrollee and it doesnt increase or decrease depending on the individuals actual medical costs.

In addition to the Part B premium, which you must continue to pay when you enroll in Medicare Advantage, some Medicare Advantage plans also charge a separate monthly premium.

The insurance company uses this pool of money from the Medicare Trust Funds plus any additional premiums paid by plan members to pay the covered health care expenses for everyone enrolled in a particular plan. Claims for people enrolled in Medicare Advantage are paid by the insurance company and not by the Medicare program as they are for those enrolled in Original Medicare.

Because the insurance companies have a set amount of Medicare funding each year to cover all of their members health care expenses, they often have special rules and requirements to help keep costs down. Many plans require you to get care from network providers or get prior authorization for any expensive tests and procedures.

You May Like: Government Grant For Dental Implants

Do All Private Insurance Companies Have The Same Medicare Advantage Plans

Although the Medicare funding is the same for all insurance companies offering Medicare Advantage plans, each company chooses what types of plans and benefits it will offer. No matter what company and plan type you select, however, you are still entitled to all the same rights and protections you have under Original Medicare.

Its important to note that plan premiums may also vary depending on the plan you select and where you live. You may be able to enroll in a zero-premium Medicare Advantage plan and you may have other costs, such as copayments and coinsurance.

Costs For Medicare Advantage Plans

What you pay in a Medicare Advantage Plan depends on several factors. In most cases, youll need to use health care providers who participate in the plans network. Some plans wont cover services from providers outside the plans network and service area. Learn about these factors and how to get cost details.

Don’t Miss: Entry Level Government Jobs Sacramento

How To Enroll In A Medicare Advantage Plan

Once youve done your research and found a Medicare Advantage plan that fits your needs, there are various ways to enroll:

-

Use Medicares Plan Finder to find the plan in your area. Click on Enroll.

-

Go to the plans website to see if you can enroll online. Contact the plan to get a paper enrollment form. Fill it out and return it to the plan provider.

You will need your Medicare number and the date your Medicare Part A and/or Part B coverage started. You must be enrolled in Medicare Parts A and B before you can buy a Medicare Advantage plan.

Keep in mind that you can only enroll in a Medicare Advantage plan during your Initial Enrollment Period or during the Open Enrollment Period from Oct. 15 to Dec. 7. Once youre enrolled in a Medicare Advantage plan, you can switch plans during Medicare Advantage Open Enrollment from Jan. 1 to March 31 each year.

How Do Medicare Advantage Carriers Make Money

Bids that meet all qualifications receive approval. Benchmark amounts vary depending on the region. Benchmark amounts can range from 95% to 115% of Medicare costs. If bids come in higher than benchmark amounts, the enrollees must pay the cost difference in a monthly premium.

When bids are lower than benchmark amounts, Medicare and the health plan provide a rebate to enrollees after splitting the difference in cost. A new bonus system works to compensate for health plans that have high-quality ratings. Advantage plans that have four or more stars receive bonus payments for their quality ratings.

Don’t Miss: Rtc Employment Las Vegas

How Medicare Part D Prescription Drug Plans Differ Between States

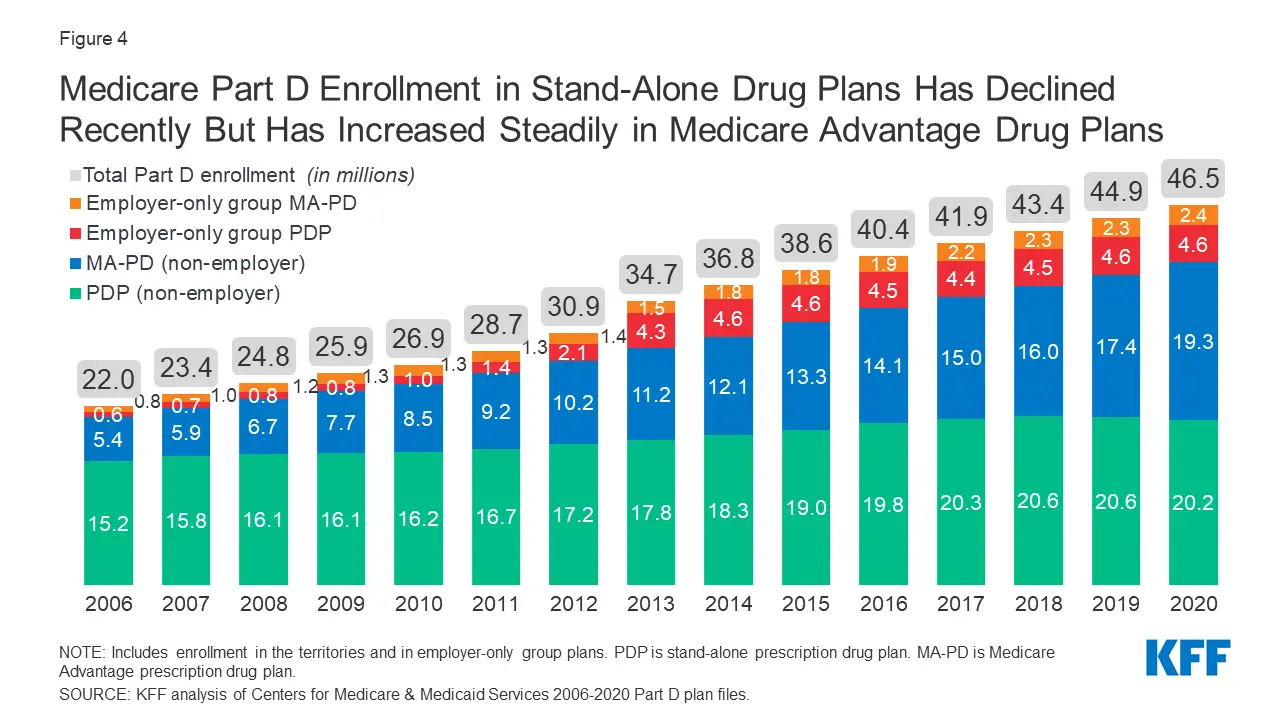

Medicare Part D prescription drug plans are private insurance plans that work with Original Medicare to help cover the costs of your prescription medicine. Many Medicare Advantage plans also provide prescription drug coverage.

Plan prices and plan availability varies from state to state, but all states are required to have open enrollment in Medicare Part D plans at the same time as open enrollment for Original Medicare October 15 to December 7 every year.

The availability of Medicare Part D plans vary from state to state. The number of plans available in any state in 2019 ranged from 22 choices in Alaska to 30 choices in California, Pennsylvania and West Virginia, according to the Kaiser Family Foundation.

Why Is Medicare Advantage A Bad Choice

Medicare Advantage can become expensive if you’re sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient’s choice. It’s not easy to change to another plan if you decide to switch to Medigap, there often are lifetime penalties.

Don’t Miss: Best Entry Level Government Jobs

What Else Should You Know About Free Medicare Advantage Plans

When signing up for a Medicare Advantage plan thats free , its important to calculate your out-of-pocket costs.

You should consider the following:

- The type of medical services you think youll need and how often you will need them.

- Whether the doctors or medical suppliers you use will accept Assignment. Assignment requires that they accept the Medicare-approved amount as full payment for covered services.

- Whether or not the Medicare Advantage plan provides additional benefits that may require you to pay an extra premium.

- Whether you are eligible for or getting Medicaid or assistance from your state for health care costs.

General Fund Revenue As A Share Of Total Medicare Spending

This measure, established under the Medicare Modernization Act , examines Medicare spending in the context of the federal budget. Each year, MMA requires the Medicare trustees to make a determination about whether general fund revenue is projected to exceed 45 percent of total program spending within a seven-year period. If the Medicare trustees make this determination in two consecutive years, a “funding warning” is issued. In response, the president must submit cost-saving legislation to Congress, which must consider this legislation on an expedited basis. This threshold was reached and a warning issued every year between 2006 and 2013 but it has not been reached since that time and is not expected to be reached in the 20162022 “window”. This is a reflection of the reduced spending growth mandated by the ACA according to the Trustees.

Don’t Miss: Government Jobs Vegas

D: Prescription Drug Plans

Medicare Part D went into effect on January 1, 2006. Anyone with Part A or B is eligible for Part D, which covers mostly self-administered drugs. It was made possible by the passage of the Medicare Modernization Act of 2003. To receive this benefit, a person with Medicare must enroll in a stand-alone Prescription Drug Plan or public Part C health plan with integrated prescription drug coverage . These plans are approved and regulated by the Medicare program, but are actually designed and administered by various sponsors including charities, integrated health delivery systems, unions and health insurance companies almost all these sponsors in turn use pharmacy benefit managers in the same way as they are used by sponsors of health insurance for those not on Medicare. Unlike Original Medicare , Part D coverage is not standardized . Plans choose which drugs they wish to cover . The plans can also specify with CMS approval at what level they wish to cover it, and are encouraged to use step therapy. Some drugs are excluded from coverage altogether and Part D plans that cover excluded drugs are not allowed to pass those costs on to Medicare, and plans are required to repay CMS if they are found to have billed Medicare in these cases.

Medicare’s Annual Open Enrollment Period Offers A Chance To Reevaluate And Change Advantage Coverage

- Medicare Advantage plans must have medical loss ratios of at least 85%

- If you live in the designated service area of the specific Medicare Advantage plan, and have Part A and Part B , you may join the plan.

- You can switch back to Original Medicare during the annual open enrollment period or the Medicare Advantage open enrollment period.

Also Check: Dental Implants Grants

How Is Medicare Part B Funded

The Supplementary Medical Insurance trust fund is whats responsible for funding Part B, as well as operating the Medicare program itself. Part B helps to cover beneficiaries doctors visits, routine labs, and preventive care.

This trust fund receives funds through the following avenues:

- Funds that are sanctioned by the United States Congress

- Interest accrued through trust funds investments

- Part B and D-related premiums

- The SMI trust fund is also responsible for funding Part D

How Many Americans Have Medicare Advantage Coverage

As of September 2021, there were nearly 28 million Americans enrolled in Medicare Advantage plans more than 43% of all Medicare beneficiaries.

Enrollment in Medicare Advantage has been steadily growing since 2004, when only about 13% of Medicare beneficiaries were enrolled in Advantage plans. Managed care programs administered by private health insurers have been available to Medicare beneficiaries since the 1970s, but these programs have grown significantly since the Balanced Budget Act signed into law by President Bill Clinton in 1997 created the Medicare+Choice program.

Also Check: City Jobs Las Vegas Nevada

Rules For Medicare Advantage Plans

Medicare pays a fixed amount for your care each month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare.

Each Medicare Advantage Plan can charge different

. They can also have different rules for how you get services, like:

- Whether you need areferralto see a specialist

- If you have to go to doctors, facilities, or suppliers that belong to the plan for non-emergency or non-urgent care

These rules can change each year.

Hospital Insurance Trust Fund

How is it funded?

- Payroll taxes paid by most employees, employers, and people who are self-employed

- Other sources, like these:

- Income taxes paid on Social Security benefits

- Interest earned on the trust fund investments

- Medicare Part A premiums from people who aren’t eligible for premium-free Part A

What does it pay for?

- Medicare Part A benefits , like inpatient hospital care,skilled nursing facility care,home health care, andhospicecare

- Medicare Program administration, like costs for paying benefits, collecting Medicare taxes, and fighting fraud and abuse

You May Like: Government Grants For Dental Implants

Covered Services In Medicare Advantage Plans

Most Medicare Advantage Plans offer coverage for things Original Medicare doesnt cover, like fitness programs and some vision, hearing, and dental services. Plans can also choose to cover even more benefits. For example, some plans may offer coverage for services like transportation to doctor visits, over-the-counter drugs, and services that promote your health and wellness. Plans can also tailor their benefit packages to offer these benefits to certain chronically-ill enrollees. These packages will provide benefits customized to treat specific conditions. Check with the plan before you enroll to see what benefits it offers, if you might qualify, and if there are any limitations. Learn more about what Medicare Advantage Plans cover.

What Is Medicare Part C

A Medicare Advantage Plan is another Medicare health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called Part C or MA Plans, are offered by private companies approved by Medicare.

If you join a Medicare Advantage Plan, the plan will provide all of your Part A and Part B coverage. Medicare Advantage Plans may offer extra coverage, such as vision, hearing, dental, and/or health and wellness programs. Most include Medicare prescription drug coverage .

Medicare pays a fixed amount for your care every month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare. However, each Medicare Advantage Plan can charge different out-of-pocket costs and have different rules for how you get services . These rules can change each year.

Recommended Reading: Government Suburban

What Is Medicare Advantage

Medicare Advantage is another way to get your Original Medicare benefits. Private insurance companies offer Medicare Advantage plans and some may charge $0 premiums. However, you must still continue to pay your Medicare Part B premium and your Part A premium if it applies. Medicare Advantage plans must offer everything Original Medicare covers except hospice care, which is still covered by Medicare Part A. Some Medicare Advantages plans offer extra benefits, such as prescription drug coverage, routine dental, routine vision, and wellness programs.

Subsidizing Private Insurance Plans To Provide Medicare And Medicaid Benefits Is It Working

U.S. social insurance programs traditionally have been paid out to beneficiaries directly by the federal government. But the last two decades have seen an accelerated effort to subsidize private health insurance plans to provide Medicare and Medicaid benefits.

The United States has a large private health insurance sector accounting for more than $1.1 trillion of health-care spending in 2016. Yet the taxpayer-funded Medicare and Medicaid account for even more than that, about $1.2 trillion, or some 40 percent of overall health-care spending in this country.

In Medicaid, which provides health care to low-income Americans, as many as 80 percent of beneficiaries are enrolled in publicly-funded, but privately-run managed care plans. That figure for Medicare, which covers the elderly and disabled, stands at more than 30 percent for their medical coverage, and many more for their drug coverage.

Over the past decade, the share of subsidization of privately run insurance plans as opposed to direct reimbursement of providers in public spending on Medicare and Medicaid has almost doubled, increasing from 22 percent to 40 percent.

These changes raise very different policy questions, as this moves us from thinking about how, for example, Medicare should reimburse health-care providers, to how it should pay private insurers, said Stanford Health Policy health economist,

But is that the best use of our tax dollars?

They created a model that focused on two things:

Read Also: Scott Serota Salary

How Is Medicare Part A Funded

Your hospital coverage through Part A has funding through the Hospital Insurance trust fund. This trust fund covers inpatient care like hospice, home health care, and skilled nursing facilities.

Typically, people pay 2.9% on Medicare taxes from their payroll earnings. The 2.9% comes from 2 parties employers contribute 1.45%, and employees contribute 1.45%.

Another source of funding for the program comes from:

- Income taxes on Social Security benefits

- Premiums associated with Part A

- Interest accrued on trust fund investments

Funding For Medicare Advantage

Private insurance companies receive a set amount of federal Medicare funding for providing Part A and Part B coverage through Medicare Advantage plans. Each insurance company is approved and contracted by Medicare and must fulfill guidelines for coverage as established by the government.

Medicare Advantage plans are also financed by monthly premiums paid by subscribers. The premium amounts vary by company and plan. Subscribers may also be asked to pay a certain amount of their expenses in the form of a deductible or copayment.

Eldercare Financial Assistance Locator

- Discover all of your options

- Search over 400 Programs

Don’t Miss: Free Government Phone Las Vegas