How To Buy I Bonds

After inflation rose to a 40-year high in 2022, Series I savings bonds — better known as “I Bonds” — re-entered the mainstream conversation. In their latest release, I Bonds pay an annualized rate of 9.62%. Given persistent inflation, they will continue to pay competitive interest in the immediate future.

This article will review where and how to purchase I Bonds and answer a number of frequently asked questions.

Treasury Bond Risks Vs Returns

With investing, usually the higher the risk, the higher the return. This applies here: Bonds usually have less risk versus stocks, which means they usually generate lower returns versus stocks. Because Treasury bonds are typically safer than other bonds, that also means investors will likely see lower returns.

When financial advisors talk about asset allocation within a portfolio, it means investment dollars are spread among three main asset classes, or groups of similar investments. Stocks generally provide the greatest long-term growth potential but are the most volatile. Bonds can generate income and compared to stocks, usually have more modest returns and can help balance out volatility. Cash has the least risk and lowest return to buffer volatility or cover unexpected expenses.

Bond Duration Impacts Interest

You can see this play out with the returns on Treasurys under normal market conditions. The shorter the time frame, the lower the expected return, because theres less risk of interest rates changing too much. That means T-bills have the lowest returns compared with T-notes or T-bonds. The longer the time till maturity, the greater the chance that interest rates could change, hence greater investment risk and volatility.

» Interested in giving a bond as a gift? Read all about savings bonds

Also Check: If You Owe The Government Money

Are I Bonds Tax

You do have to pay federal income taxes on Series I savings bonds interest. Since the interest on I bonds compounds , you still get the benefit of a decent investment.

You can pay taxes on I bonds in one of two ways:

-

Cash: You pay taxes at the end of the bonds life, when the government repurchases them.

-

Accrual: You pay taxes each year on the interest accrued on the bonds principal value.

Where Can I Buy Government Bonds

In general there are two broad categories investors can consider when looking to invest in government government bonds: Treasury bonds and municipal bonds. Both are options for investors seeking to build out the low-risk portion of their portfolio or just save money at higher, low-risk rates.

Government bonds can also be a great place to start if you are new to bond investing overall. Treasuries and municipals and are usually top low-risk bond options also considered alongside money market accounts, certificates of deposit, and high yield savings accounts.

You May Like: Get A Free Computer From The Government

Can You Buy I Bonds In An Ira

Unfortunately, you can’t purchase I Bonds in your individual retirement account or in any other tax-advantaged account. You’ll need to use any available cash or your tax refund to purchase I Bonds.

Remember that the balance of your I Bond allocation will sit in your TreasuryDirect account. You must hold the bonds for at least a year, and you will lose the last three months’ worth of interest if you redeem the bonds before five years have passed since the purchase.

What Types Of Bonds Are There

There are three main types of bonds:

- Corporate bonds are debt securities issued by private and public corporations.

- Investment-grade. These bonds have a higher credit rating, implying less credit risk, than high-yield corporate bonds.

- High-yield. These bonds have a lower credit rating, implying higher credit risk, than investment-grade bonds and, therefore, offer higher interest rates in return for the increased risk.

- Municipal bonds, called munis, are debt securities issued by states, cities, counties and other government entities. Types of munis include:

- General obligation bonds. These bonds are not secured by any assets instead, they are backed by the full faith and credit of the issuer, which has the power to tax residents to pay bondholders.

- Revenue bonds. Instead of taxes, these bonds are backed by revenues from a specific project or source, such as highway tolls or lease fees. Some revenue bonds are non-recourse, meaning that if the revenue stream dries up, the bondholders do not have a claim on the underlying revenue source.

- Conduit bonds. Governments sometimes issue municipal bonds on behalf of private entities such as non-profit colleges or hospitals. These conduit borrowers typically agree to repay the issuer, who pays the interest and principal on the bonds. If the conduit borrower fails to make a payment, the issuer usually is not required to pay the bondholders.

Don’t Miss: How Does The Government Monitor Social Media

Competitive Vs Noncompetitive Auction Bidding

When you bid on Treasury securities, you have the option of submitting a noncompetitive bid or a competitive bid. Most individual investors opt for noncompetitive bidding. With a noncompetitive bid, you are essentially saying you will accept the rate/yield/discount margin at the conclusion of the auction. You are able to spend up to $5 million on a noncompetitive bid.

With a competitive bid, you specify a rate/yield/discount margin that you will accept. Once the auction is over, youll receive some, all or none of your bid depending on the rate/yield/discount margin that the Treasury ends up issuing. With a competitive bid, youre able to bid on a maximum of 35% of the securities being issued.

Once the deadline to submit bids has passed, the Treasury will issue securities to all noncompetitive bidders. Then, it will issue to the competitive bidder with the lowest rate/yield/discount margin and continue up until it runs out of securities. The rate/yield/discount margin at which it stops will be what all successful bidders receive.

Taxation On Tax Free Bonds

Yes, income tax may be applicable even on tax free bonds. How? Interest income generated from tax free bonds are tax free. But capital gain from such bonds are still taxable. How there will be a capital gain?

When someone sells their bond holdings to other, in secondary market for profit, this will be treated as capital gains. Example: Buying a bond at Rs.1,000 and selling it in secondary market for Rs.1,050. The capital gain so earned in the hands of the seller is taxable. Read more about income tax planning.

The applicable tax rates are as below:

- Short Term Capital Gain Tax: Income tax will be applicable as per ones tax slab.

- Long Term Capital Gain Tax:

- 10% : Listed Bond with No indexation benefit.

- 20% : Listed Bond with indexation benefit.

- 20% : Unlisted bond & no indexation benefit.

Recommended Reading: Government Assistance Home Buying Programs

Should You Buy I Bonds Now

If youre looking at the yield on your savings account and youre worried about inflation eating away at your moneys buying power, now could be a great time to look into I bonds, which boast interest rates at an all-time-high of 9.62%.

The interest rate will stay at 9.62% until the first business day of November. On that day, the Treasury Department will announce a new rate based on inflation and possibly set a new fixed rate.

Because of the unique way the interest rates work on I bonds, if you buy one any time between now and November, you will lock in a full six months of 9.62% interest. Guaranteed. Then, your interest will compound, be added to your bonds principal value and then your rate will change to the new rate thats announced in November.

For example, if you purchased an I bond any time in August, youd receive an annualized rate of 9.62% for six months.

Even in a catastrophic scenario where the interest rate in November drops to 0%, you can still predict your return for the year: 9.62% between August and January and then 0% between February and July. Your worst-case scenario? An annual return of 4.81%.

So if inflation is eating away at your savings I bonds are looking like a pretty good deal right now.

Some Accounts Need Additional Identity Verification

Tommy Blackburn, a Richmond, Virginia-based CFP and senior financial planner at Mason and Associates who frequently helps clients purchase I bonds, said one of the main pain points is additional identity verification.

It can be very difficult obtaining the signature guarantee from major financial institutions and local ones.Tommy Blackburnsenior financial planner at Mason and Associates

In some cases, investors must fill out an account authorization form to prevent fraud, according to a Treasury official. This requires signing the form at a bank or credit union, notated with a “signature guarantee,” before mailing it back.

“In our experience, it can be very difficult obtaining the signature guarantee from major financial institutions and local ones,” Blackburn said. However, a Treasury official said they are working to expand certification to any notary public.

You May Like: How To Get A Contract With The Federal Government

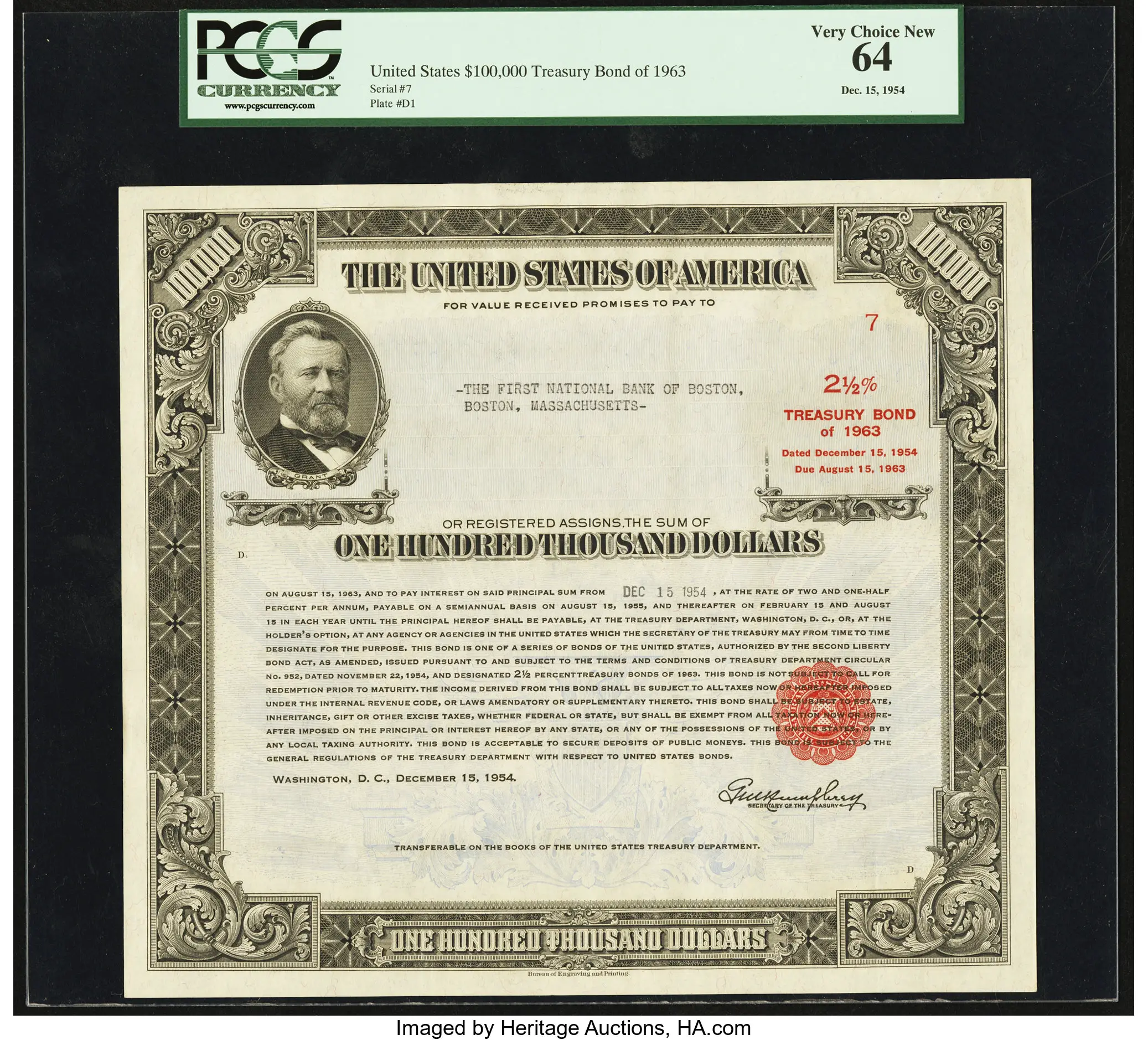

What Are Treasury Bonds

U.S. Treasury bonds are fixed-income securities issued and backed by the full faith and credit of the federal government, which means the U.S. government must find a way to repay the debt. Treasury bonds are considered low-risk investments that are generally risk-free when held to maturity, given the status of the U.S. government and its economy. Relative to other higher-risk securities, Treasury bonds have lower returns. Regardless, U.S. Treasury bonds remain sought-after because of their perceived stability and liquidity, or ease of conversion into cash.

Although investors will owe federal taxes on Treasury bonds, one perk is that the interest generated from owning Treasurys is state and local income tax-free.

Beware Of I Bonds’ Drawbacks

Before you invest, it’s important to be aware of a few rules that come with investing in I bonds. The biggest red flag for short-term investors: You can’t redeem these bonds for a year after you purchase them, and you’ll owe a penalty equal to three months’ interest if you cash out any time over the first five years of owning the bond.

That means you’d be wise to avoid sinking cash into I bonds unless you have a well-funded emergency fund, says Neerukonda. “If there is any chance you need this money within the next 12 to 15 months, then you need to think very cautiously about this,” he recently told CNBC Make It.

You can generally buy no more than $10,000 worth of I bonds per person per calendar year, though you can buy an additional $5,000 worth using money from your tax refund if you file Form 8888.

And remember that website that was crashing in late October? That’s still the only place to buy I bonds, and even when the site is up and running, it’s no picnic, Bret Stephens, a CFP with AdvicePoint in Wilmington, North Carolina, previously told Make It.

“It’s a huge hassle to open the account and navigate the website,” he said. “Imagine if the DMV had an online store that’s what this experience is like.”

You May Like: Free Government Assistance For Home Repairs

Buying Treasuries In The Secondary Market

Buying Treasuries in the secondary market is easier than most people think. Many brokerages give their customers full access to the bond market, but fees vary. If buying and selling Treasuries is important to you, many of the best brokerages offer free trading for Treasury bonds.

Even better, you completely avoid the annual fees of ETFs and the money market. Buying standard U.S. government bonds is easier than buying most other bonds because all you need to know is the time to maturity. TIPS can be trickier to trade.

When you buy bonds on the secondary market through a broker, you can hold them in an IRA or another tax-free retirement account. Buying on the secondary market also makes it easier to sell Treasury bonds at a later date.

We recommend the best products through an independent review process, and advertisers do not influence our picks. We may receive compensation if you visit partners we recommend. Read our advertiser disclosure for more info.

| Compare the Best Online Brokers |

|---|

| Company |

| $0 for stock/ETF trades, $0 plus $0.65/contract for options trade |

Can The Borrower Pay Its Bonds

The answer to this question is paramount, because if a company cant pay its bonds its promise to pay back money lent, with interest theres no reason for the average investor to consider buying them. With some sleuthing, you can estimate whether the company is able to meet its debt obligations.

Bonds are rated by ratings agencies, with three big ones dominating the industry: Moodys, Standard & Poors and Fitch. They estimate creditworthiness, assigning credit ratings to companies and governments and the bonds they issue. The higher the rating AAA is the highest, and it goes down from there, like school grades the greater the likelihood the company will honor its obligations and the lower the interest rates it will have to pay.

» Feeling sustainable? Learn about green bonds

Corporate bonds. Beyond ratings, the quickest way to determine the safety of a company-issued bond is by looking at how much interest a company pays relative to its income. Like a homeowner paying off a mortgage every month, if the company doesnt have the income to support its payments, there will be trouble eventually.

» Read more:How to build your bond allocation the right way

Don’t Miss: End User Computing Governance Framework

Michelle Singletary On Retirement And Personal Finance

Early retirement: Want in on the great retirement boom? Early retirement sounds tempting, but the math can be a major reality check. Here are the five things you should know.

New retirement rules: As the pandemic upends the economy, theres never been a better time to examine the conventional wisdom about retirement.

Move over, crypto: A record number of workers are becoming millionaires with their boring 401s and IRAs. Many never earned six-figure salaries. Meet the newly minted millionaires next door.

Questionable sources: There is so much you need to do to manage your money that its a good thing to get recommendations. But you need to consider the source and whether the advice is in your best interest, biased or appropriate given your personal circumstances and money style.

In hindsight: If you could, what retirement planning advice would you give to your younger self based on what you know now? Heres what some retirees say are their biggest regrets.

Read more personal finance and retirement perspectives by Michelle Singletary.

Buying Through A Broker Or Bank

It’s also possible to invest in Treasury securities through a financial institution, like a brokerage or bank. It’s probably the easiest method since the broker will watch the US Treasury Department auctions and place your bid for you. However, depending on the institution, you may be charged a fee to place the bid.

The auctions, and TreasuryDirect, only offer new issues. So if you want to buy an older T-bill, note, or bond, you have to get one that’s already trading on the secondary market . You will need to buy through a brokerage or financial services company, or an online trading platform. Commission charges may apply.

You’ll also need a brokerage or investment company to purchase a Treasury bond mutual fund or exchange-traded fund . The big advantage of choosing a fund, as opposed to the securities themselves, is that you can buy fund shares for a fraction of the bonds’ price. And of course, with these funds which own a basket of various T-bills, notes, and bonds you get immediate diversification for the income portion of your portfolio.

Recommended Reading: Federal Government Jobs In Maine

Inflation Is Driving Up Demand For I Bonds

I bond interest has two parts, a fixed rate and variable rate, adjusting every six months based on the Consumer Price Index, a key measure of inflation.

More from Personal Finance:

“We are also in the process of developing an updated, modern replacement for the current TreasuryDirect system,” they added.

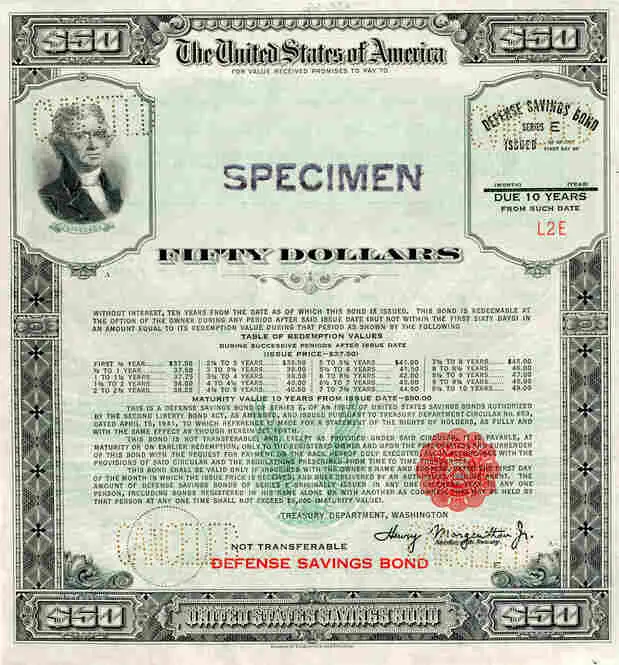

Buying Paper Series I Savings Bonds

The only way to get a paper savings bond now is to use your IRS tax refund.

You can buy any amount up to $5,000 in $50 increments.

We may issue multiple bonds to fill your order. The bonds may be of different denominations. We use $50, $100, $200, $500, and $1,000 bonds. Again, the amount of your purchase can be any multiple of $50, from $50 to $5,000. You need to tell us only the amount. We determine denominations.

To buy paper savings bonds, you use IRS Form 8888 to specify how much of your refund should go to savings bonds and how much to you directly .

On Form 8888, you also specify who will own the bonds. That means, you can give paper savings bonds to yourself or to anyone else . If you have enough money in your refund, you can buy multiple bonds and, if you wish, you can give them multiple registrations.

You may buy up to $5,000 in paper savings bonds with each year’s tax refund.

Read Also: Government Assistance For Credit Card Debt

What Are The Benefits And Risks Of Bonds

Bonds can provide a means of preserving capital and earning a predictable return. Bond investments provide steady streams of income from interest payments prior to maturity.

The interest from municipal bonds generally is exempt from federal income tax and also may be exempt from state and local taxes for residents in the states where the bond is issued.

As with any investment, bonds have risks. These riskes include:

The issuer may fail to timely make interest or principal payments and thus default on its bonds.

Interest rate risk. Interest rate changes can affect a bonds value. If bonds are held to maturity the investor will receive the face value, plus interest. If sold before maturity, the bond may be worth more or less than the face value. Rising interest rates will make newly issued bonds more appealing to investors because the newer bonds will have a higher rate of interest than older ones. To sell an older bond with a lower interest rate, you might have to sell it at a discount.

Inflation risk. Inflation is a general upward movement in prices. Inflation reduces purchasing power, which is a risk for investors receiving a fixed rate of interest.

Liquidity risk. This refers to the risk that investors wont find a market for the bond, potentially preventing them from buying or selling when they want.