Types Of Government Loans

There are several types of loans available, and new programs occasionally come up in response to events like environmental disasters and other crises. The most common loans available with government assistance are:

- Student loans

- Housing loans, including disaster and home improvement loans

- Business loans, including farms and ranches.

Let’s take a look at some of the most common options.

Private Vs Government Loans

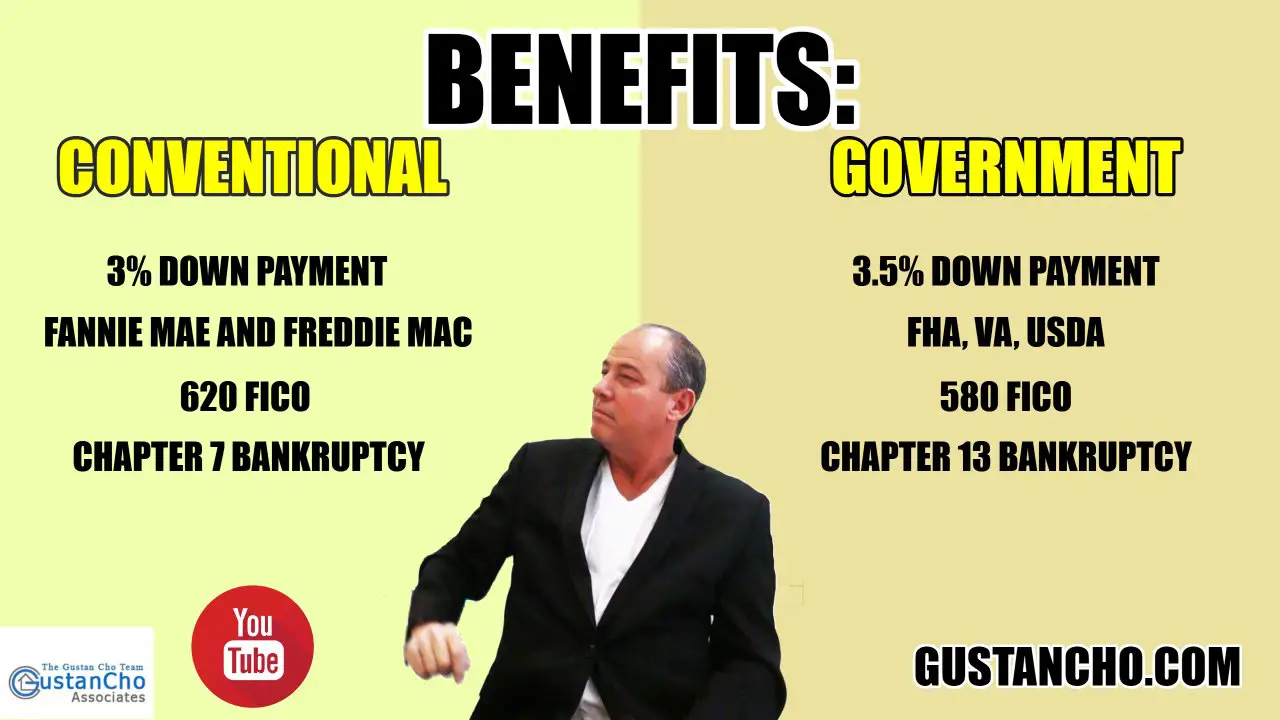

Private loans, made by a private lender like a bank or credit union, are different than government loan programs. It may be more difficult for certain borrowers to qualify for loans through private lenders.

For example, a private mortgage lender may require good credit scores and a large down payment. But you might be able to qualify for an FHA mortgage with a lower down payment and flexible credit qualification.

Who Is Eligible For Government Financial Hardship Grants

Anyone who is suffering with emergencies can apply for these government hardship grants, here we are sharing the list of eligibility criteria as well as who can apply for these financial hardship assistance.

Also Check: Entry Level Government Jobs San Diego

When To Seek A Personal Grant

Think of a personal grant as an alternative to two things: doing without and taking on debt. Some grants are designed to help with consumer spending for things like childrens clothes and school supplies. Others are designed to help with long-term investments like a home purchase.

If youre facing financial need, consider applying for a grant. Unlike payday loans and installment loans, personal grants wont leave you with expensive interest payments. You dont have to pay to apply for government grants, either, so the only things you have to lose are the time and effort it takes to submit the grant applicants.

Dont expect instant turnaround, however. Remember that youre dealing with the government. That means you should expect a certain level of bureaucracy. The process of getting a federal grant to meet your financial needs may not be as fast as going to the payday lender around the corner, but government grants are a much safer option than high-cost loans.

Pandemic Government Hardship Grants Covid 19

![How To Use studentloans.gov [Explained] How To Use studentloans.gov [Explained]](https://www.knowyourgovernment.net/wp-content/uploads/how-to-use-studentloans-gov-explained-find-your-best.jpeg)

The coronavirus pandemic has forced the authorities to have a set of economic measures to attempt and handle a health crisis that has left Millions dead round the world, according to official statistics. The Government has approved a set of economic and social measures to decrease the effect of the crisis produced by the coronavirus, especially among the most vulnerable groups. The government has approved several decrees to confront the financial effect with help for the unemployed and loans to the self-employed and SMEs, although the announced plan to encourage the hospitality industry is long overdue. You an read more about $7000 Government Grants To get help instantly for your need

Here youll find out what helps by coronavirus are available for you, your loved ones or your company. Weve grouped them by home and household equipment, occupation -both if you work for someone else or if Youre self explanatory -, fiscal and economic issues, judicial processes, gender violence, prison and family environment.

Recommended Reading: Government Jobs Las Vegas No Experience

How Can I Qualify For A Coronavirus Hardship Loan

Some hardship loans require you to document how you’ve been impacted. House says lenders are currently more focused on proof that you’ll be able to repay the loan.

“For the most part, requirements are the same as they normally are when applying for a loan: a credit report and score that reflects a good payment history, and income that supports repayment,” House says. “But many places are also offering loans to people who have less-than-perfect credit.”

How Government Loans Work

In many cases, the government does not lend money directly. Instead, private lenders such as banks and finance companies provide funding, and the U.S. government guarantees the loan. Put another way, the government promises to repay your lender if you, the borrower, fail to do so. You as the borrower may also be required to pay a utilization fee.

Government guarantees reduce risk and make lenders more willing to lend at attractive rates. Plus, youre more likely to get approved in situations when you might not otherwise qualify for a loan.

Don’t Miss: Hotels Government Camp Oregon

Get Loans From A Business Or Online Lender If You Have No Credit Or Low Rates

A number of banks and online lenders offer funds to lower income borrowers, college students, people without a bank account and other borrower. There are buy now pay later assistance programs from payment/fintech companies such as Paypal, regulated check cashing stores or pawn shops , funds for senior citizens, and other hardship loan programs. A list of for-profit lenders is below

Buy Now Pay Later companies, such as Paypal and Venmo, offer installment loan products for borrwer with no or a low credit rating or even bank account. They also allow the borrower to get the item they are shopping for today but to pay back the funds in a short window of time, such as a few weeks. It is similar to layaway in some aspects. But BNPL is a great way for low income families, or those with limited or no credit, to get a short term loan. Learn more on .

Some private companies offer emergency hardship loans but they come with a very high interest rate. They should only be used as a last resort . in addition, always review the fine print as well as repayment terms. Examples of these personal loans for low income families or those with bad credit include , which usually require the borrower to give up some items as collateral.

Government Hardship Grants For Single Mothers

The single mother can access Many Grants if she is the head of the family, with at least one economic dependent. This is because, being the department that protects and promotes prosperity in the population, they are responsible for offering a good amount of social assistance. Single mothers often face the challenge of managing household expenses alone for themselves and their children. Single mothers are usually overwhelmed by financial problems. Not only do they have to pay the bills for the family, but they generally have to make additional payments to the daycare centers and child caregivers while they go to work. All of them focus on improving the quality of life of each resident of the country equally. It is worth mentioning that, of all its initiatives, one of the most successful is the Emergency Grants for Single Mothers. Fortunately, many states have financial assistance options designed to help those families who encounter financial difficulties, and some areas may offer programs especially for single parents.

Financial Hardship grants for single mothers

Read Also: Dental Implant Grants For Low Income

What Happens If You Cant Pay Back A Payday Loan On Time

There can be serious consequences if you dont repay your loan by the due date.

Depending on the laws in your province, these consequences may include the following:

- the payday lender may charge you a fee if there isnt enough money in your account

- your financial institution may also charge you a fee if there isnt enough money in your account

- the total amount that you owe, including the fees, will continue to increase

- the payday lender could call your friends, relatives or employer in attempts to contact you to collect the money

- the payday lender could deal with a collection agency and this could be included on your credit report

- the payday lender or collection agency could sue you for the debt

- the payday lender or collection agency could seize your property

- the payday lender could go to the courts to take money from your paycheques

If you cant make your payday loan payments on time, it can be easy to get stuck in a debt trap.

Infographic: Payday loans: An expensive way to borrow money!

The infographic Payday loans: An expensive way to borrow money! is illustrating an example of what can happen when you take out a payday loan.

You need $300 for household repairs. You get a $300 payday loan for 2 weeks. Over the 2-week period, youll pay $51 in charges, which is equivalent to a yearly interest rate of 442%. You owe $351.

If you dont make your payment, youre charged a $40 penalty. You now owe $391.

Before you make a decision, explore your options.

Cheques And Hold Periods

When you deposit a cheque in person at your bank, you have immediate access to the first $100 of all the money you deposited. Youll have access to the $100 on the next business day if you make the deposit in any other way, such as at an ATM. If the cheque is for $100 or less, the bank must provide you with the entire amount.

Don’t Miss: Government Benefits For Legally Blind

Tips For Managing Your Finances

- To ensure you can retire and achieve your other financial goals, you need to be in control of your finances. A financial advisor can help with this. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If youre not ready to work with an advisor, creating a stringent budget a good first step towards mastering your finances. SmartAssets budget calculator can help you start.

Repaying Federal And Private Student Loans

- Federal student loans: Following a six-month grace period, you generally begin to make payments.

- Private student loans: Youll generally have a six-month grace period. If you elected to make in-school fixed or interest payments with our , youll continue to make those payments during your grace period. After that, youll begin to make principal and interest payments.

Also Check: Entry Level Government Jobs San Antonio Tx

Who Can Get A Grant

The federal government awards grants to organizations including:

-

State and local governments

-

Non-profit organizations

-

Businesses

The intent of most grants is to fund projects that will benefit specific parts of the population or the community as a whole. What you might see about grants online or in the media may not be true. The federal government does not offer grants or free money to individuals to start a business or cover personal expenses. For personal financial assistance, the government offers federal benefit programs. These programs help individuals and families become financially self-sufficient or lower their expenses.

The Federal Government Doesnt Just Take Your Tax Money Throughout The Year And Then Send You A Refund The Following Spring Sometimes When You Need Money Uncle Sam Can Also Lend You Some In The Form Of A Government Loan

Different types of government loans are available, but they all share a similar purpose: improving the overall economy by investing in people, communities and businesses.

Whether you want to start a business, buy a home or fund an education, the U.S. government offers the opportunity to apply for loans, typically designed for a specific purpose. These loans are designed to support local communities, encourage entrepreneurship, help veterans and active-duty military families, and provide access to education.

Lets look at the types of loans available from the U.S. government, how they work and who might qualify for one.

Don’t Miss: Local Government Federal Credit Union Member Connect

Buying A Business With The Sba : Next Steps

Once youve decided that an SBA 7 loan is for you, youll need to contact a lender to help you get started. The paperwork, terms, and jargon involved in putting together an application package for an SBA loan can be overwhelming. You can get personalized guidance at SBA7a.Loans. Because we live and breathe the SBA 7 loan process, we know how to help you at every stage of the process. We’ll match you with the lender most likely to approve your request, even if we have to look outside the SBA platform.

Telephone Cellphone And Internet

- Many communications companies are suspending cancelling services, waiving fees and arranging payment plans. See the Keep America Connected Campaign to learn about services available.

- The federal Lifeline Support for Affordable Communications Program might be a good option if you need only basic telephone service. You can see if you are eligible by reviewing the information available at lifelinesupport.org

Don’t Miss: City Of Las Vegas Government Jobs

Gather Your Application Documents

If you think you qualify, the best place to start is the SBA website, which includes a loan application checklist. Use this to gather your documents, including your tax returns and business records.

Here are some of the documents you will need before applying:

-

SBAs borrower information form.

-

Statement of personal history.

-

One-year cash flow projection.

Hardship Grants Provide You Fast Cash

At present there are a large number of individuals that are in a bad financial situation and who desperately need to acquire cash, either from a help, loan, credit or subsidy, to address unique issues or unforeseen events. Occasionally, that little contribution of cash thats required can provide a great boost to the individual and this feel calmer and able to deal with the urgency which may have arisen.

Because of the delicate state of the labour market, a lot of people have lost their jobs but cant stop paying their monthly bills for electricity, gas or water, amongst others. In some instances some savings might have been saved, although sadly it is cash that usually doesnt last long, especially when you have family charges and other costs that cant be put aside in any manner. Saving is always recommended but in some situations it becomes an unlikely option because of the number of expenses that daily entails.

You May Like: Government Grants For Dental Work

Government Grants For Anything Easy Grants To Get

Government Hardship grants are easy grants to get and are also known as grants for anything. These grants are designed in such a manner so it can help individuals to fulfill their needs. You can easily apply for free hardship grants from the government by using the information given above, we would love to know if you find something else to fulfill your hardship need.

Consumer Credit And Other Loans And Debt

-

If you have trouble keeping up with your bills, be sure to ask for help. You may be able to pay some by the due date and the rest when you have adequate resources. You may be able to renegotiate your payment due dates or the monthly minimum amounts due.

-

Tips and suggestions if you are struggling with paying or your auto loans

-

Tips for Getting out of Debt

-

Reputable are generally non-profit organizations that can advise you on your money and debts, and help you with a budget. Some may also help you negotiate with creditors. There are specific questions you can use when looking for a credit counseling organization to work with you.

-

Review your credit report to ensure the credit bureaus have correct and complete information about your use of credit. The three national credit bureaus Equifax, Experian and TransUnion — are offering consumers free online credit reports weekly through April 2021.

Don’t Miss: Government Grants For Home Repairs

Down Payment Assistance For Buying A New House

Down Payment assistance has become very popular now a days as we all know that the price of lands, the cost of constructions has spiked up. its not easy for everyone to buy a new house with full payment. These down payment assistance help first time home buyer to buy homes with low interest loans. down payment assistance is a state wise programs, so the interest rate may be vary from state to state.

How Do Government Loans Work

When the government lends money to individuals, it usually doesn’t do it directly. Instead, it guarantees those loans issued by banks, credit unions and other private lenders. This guarantee protects the lender if the borrower fails to repay the loan.

In some cases, however, a government loan does indeed come directly from Uncle Sam. For instance, the U.S. Department of Agriculture might lend money directly to a farmer or rancher using money appropriated by Congress as part of the USDA budget. The USDA may issue and service the loan without help from a private lender.

Furthermore, a government loan may be subsidized or unsubsidized. For example, the federal government pays the interest on a subsidized student loan that’s accrued while you’re in school, but with an unsubsidized student loan, you’re always responsible for paying the interest.

Why does the government support loans? The reasons include the potential to offer:

- Lower interest rates compared with private loans.

- Better odds of being approved versus private loans.

- Capital for business owners who might not be able to secure it through private loans.

- Flexible repayment and forgiveness plans.

- No credit checks.

Don’t Miss: Jobs For History Majors In Government

Consider Cheaper Ways Of Borrowing Money

If you need the money immediately, look into less expensive alternatives.

For example:

- asking for a pay advance from your employer

- getting a loan from family or friends

- getting a line of credit from your financial institution

- getting a cash advance on a credit card

- getting a personal loan from your financial institution

Lines of credit

A line of credit allows you to withdraw money whenever you want, up to a certain credit limit. You pay interest on the amount you borrow until you pay it back in full.

Cash advances on a credit card

Unlike purchases, when you take a cash advance on a credit card, youre charged interest right away. However, the interest rates you pay are much lower than with payday loans.

If you dont have a credit card and youve had credit problems in the past, you may be able to get a secured credit card from a bank or other financial institution.

Personal loans

Personal loans let you borrow a fixed amount of money. You must pay back the loan, plus interest, over a fixed period of time.