Grants To Help You Start Or Grow Your Business

Simply Business runs an annual competition to support small businesses to set up or grow their business. Business Boost gives away a cash grant to one winning business that captures our judges imagination.

Our 2021 winners were awarded £25,000 for their diversity and inclusion business based in Brighton.

You can register your interest now and be the first to know about how you can win funding for your business.

Fuel Growth In Your Startup With A Small Business Grant

The first few months of running a business are often the most challenging. It takes time for a business to become profitable, but costs can add up quickly.

Small business grant programs can make a world of difference for a new small business owner. Not only do they provide a vital injection of funds, but they can also help to establish connections in your industry and build buzz around your product.

If your business has the potential to innovate your industry and build new technologies to serve the public good, chances are youre a great candidate for a small business grant.

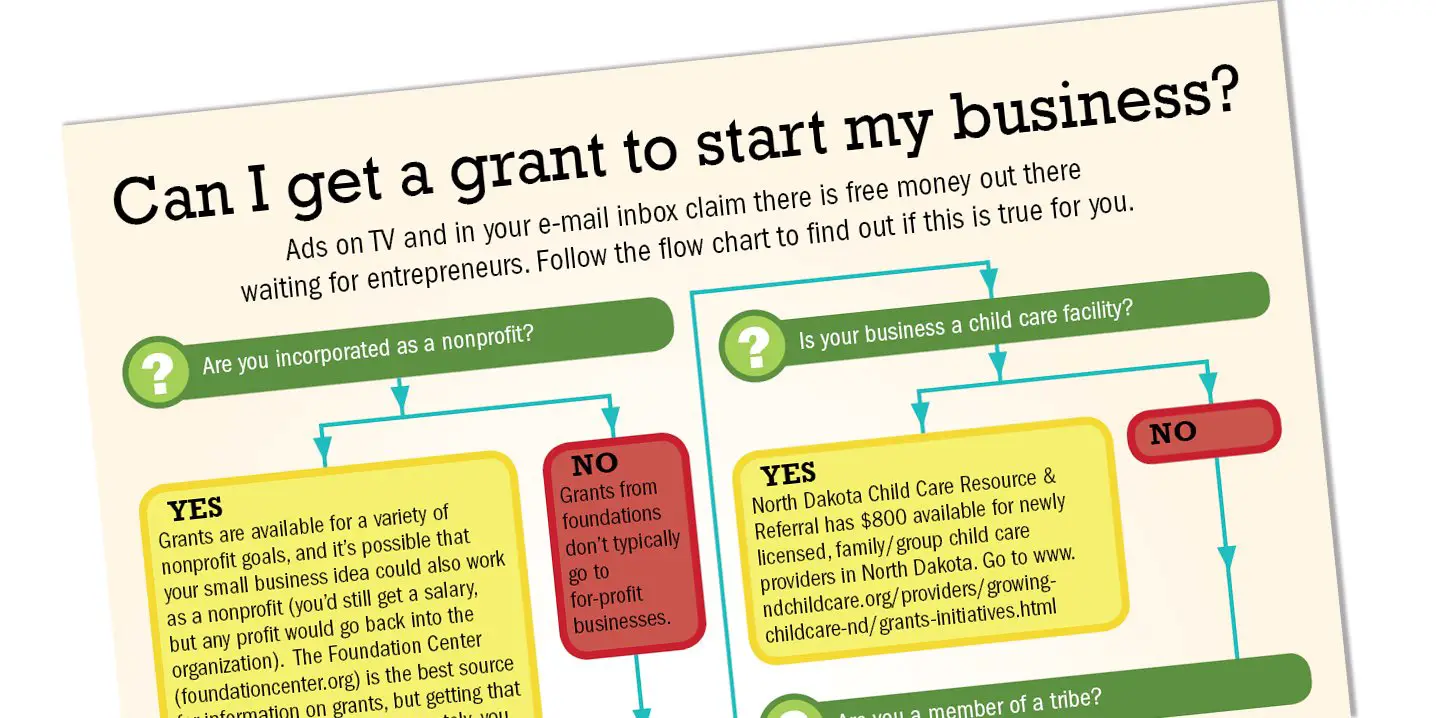

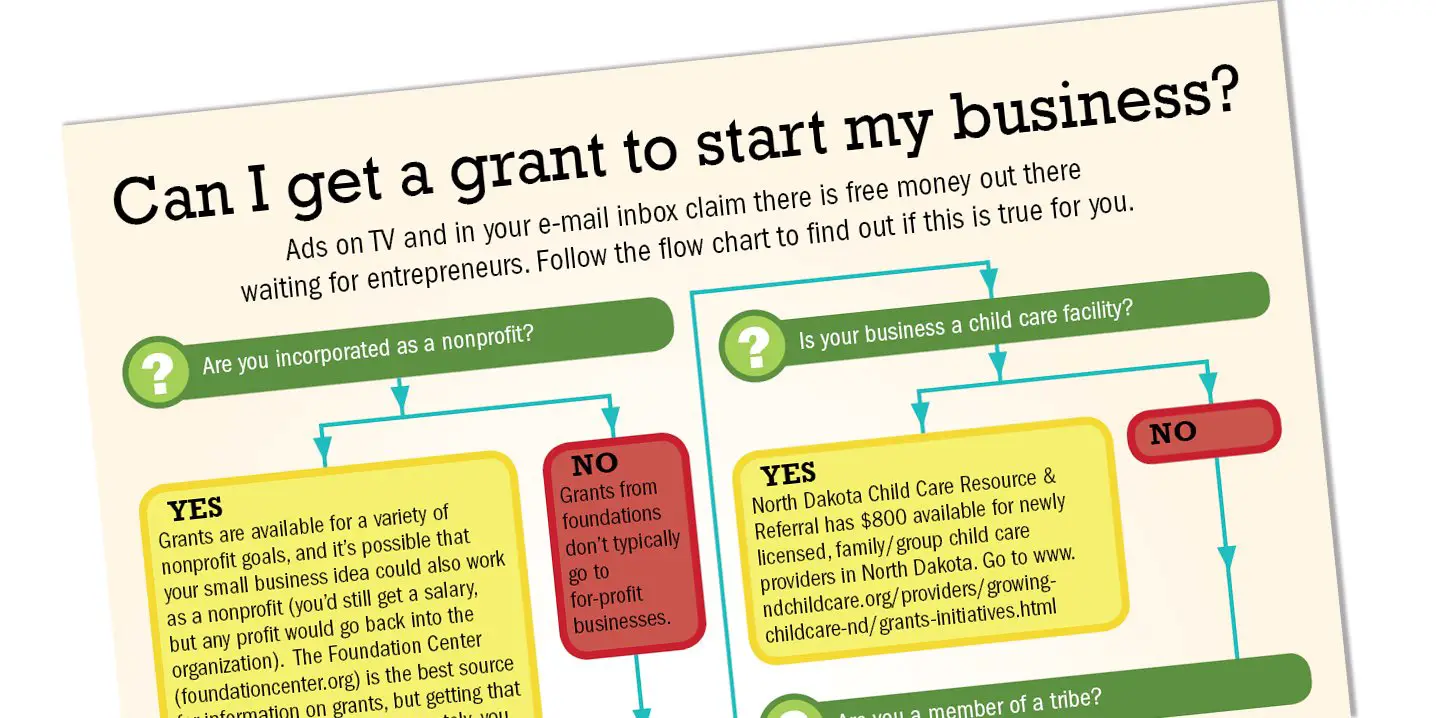

No Federal Grants For Businesses

The federal government does not offer grants for starting or growing a business. It only provides grants for nonprofit and educational institutions. These organizations focus mainly on medicine, technology development, and other related fields. Find out more about federal grants.Some state and local programs offer business grants. They usually require you to match the funds. Or, they may expect you to combine the grant with other forms of financing, such as a loan.

Don’t Miss: Ibm Data Governance Maturity Model

Small Business Grants For Startups

Many small business grants are open only to businesses that have been operating for a few years and have an established product or service. However, its often the newest businesses that need the most financial assistance and traditional loans to start a business can be hard to find. Therefore, you might check out these grants for small business startups.

Dos And Donts How To Get Approved For A Government Business Grant

- Tailor your application for a specific grant. Each has different criteria that you must meet and is designed for a specific purpose. Your application needs to be specific to all of these.

- Address all eligibility criteria and answer every application question. Be succinct yet thorough and answer all questions. If you are unable to answer a question on the grant application then it usually means youre not ready. Rather than guessing or leaving it blank, make sure you get informed.

- Have a grant strategy. It helps to know which grants you are eligible for ahead of time. This means you can map out an application timeline and systematically address each grant.

- Consider specific projects instead of the business as a whole. Most grants are awarded for specific business activities such as product development, making import/export agreements and recruiting or training staff. For example, a technology startup is most likely eligible for grants, but only because its products or services meet certain criteria, not simply because its a technology startup.

You can also use a professional grant writers services to potentially improve your chances, to save time or help you enact a complex grant strategy with many applications. Ask about their experience, fees and success rate before hiring and dont be afraid to shop around. It can be helpful to find a grant writer who specialises in your industry or with the type of grant you want.

Also Check: How To Apply Government Business Loan

Alternatives To Grant Funding

If youre not sure whether grant funding is right for you and your business, there are alternatives to consider, including business loans and equity finance.

With a business loan, you simply borrow a lump sum of money and then repay this sum with added interest. You can typically borrow up to 25% of your annual turnover or £10,000 to £50 million. Lenders include high-street banks, challenger banks, online lenders and small local specialists.

Equity finance, on the other hand, is a way of raising fresh capital by selling shares of your company in return for a share of the profits, usually a share in the ownership of the business and/or a share in the running of the business. It can be a good option for new or small businesses finding it hard to get a loan.

Small Business Development Centers

Once youve exhausted your searches for grants from federal agencies, the next stop on your list should be local and state business grants. You may be able to hit paydirt and find some of these on your own, but theres a free, local resource that may help.

Small Business Development Centers are a business owners best friend. Local, regional, state, and national offices mentor small business owners and help them understand business financing options, craft marketing strategies, and connect to other local small business owners .

One thing they can help with, for example, is creating a business plan that can help you create an exciting vision for your company, and a compelling pitch on how youll use the grant money. They may also be able to help you navigate federal small business grants.

One thing they can help with is navigating the grant process. Very few people have as much visibility as SBDC advisors do on the local business grant scene. Its the one appointment you cant afford not to make when searching for small business grants.

Read Also: Us Government Monitoring Social Media

Rural Energy For America Program

This grant program, run by the Department of Agriculture, centers on small businesses in eligible rural areas looking to purchase, construct, or install renewable energy systems or energy efficiency improvement technologies. You can partner one of these federal business grants with a USDA loan guaranty as well, and together theyâll back up to 75% of your eligible project costs.

Are There Any Downsides To Business Grants

A variety of factors make many business owners skeptical of the free money that business grants offer. While every grant has a different application period, rules, terms, and conditions, here are some potential downsides you should keep in mind when applying.

As mentioned above, business grant funds are taxable income for IRS purposes. The funds will still be free money for your business, but you will need to make sure you dont spend the entire payout without planning for the added income in your tax bill.

Business grant applications take time. Youre already a time-crunched business owner wearing a million hats, do you really have time to apply for every business grant opportunity you come across? Its a valid complaint about business grants. The likelihood of winning the grant can be small depending on the size of the contest, so you have to make your own cost/benefit analysis to figure out if your most precious asset time is worth it.

Small business grants may require campaigning. Many business grants require a social media component, where you campaign or share something publicly about your grant application. Thats not necessarily a negative if you have an active and vocal social media following, but campaigning does take additional time and some business owners may understandably not want to be as public about their search for money.

Read Also: Government Funded Solar Energy Programs

Know What Youll Be Spending The Grant Money On

Some organizations may stipulate what grant money will be spent on, but even when they dont, its still important to have an idea of how you plan on using the money. When an organization is determining whether to issue your business a grant, having a business plan and knowing how the money will be spent will help them understand more clearly how your business aligns with their mission.

Grants For Women To Start A Business

Business grants for women is a popular topic â and no wonder. According to research from Kaufman, 40 percent of first time entrepreneurs in the United States are women. Even more impressive? The number of women-run businesses in the US is growing at twice the rate of man-owned businesses. The rate of women starting businesses and startups throughout the country is at an all-time high.

But, women arenât getting nearly as much money for those businesses as men are. In the startup world, women founders got only 2 percent of VC funding in 2017. That means women are forced to look to other money sources when theyâre looking to launch a startup or small business. With access to that funding source so dramatically limited many female founders are looking for business grants for women.

Another women-only financing option for people look for business grants for women is women-only incubators and accelerators. Incubators and accelerators both offer varying combinations of funding, workspace, mentorship, and community.

While many women-only incubators and accelerators are based in bigger metropolitan areas, itâs worth doing search for women-only incubators and accelerators in your region, as this is an area that has seen a lot of growth in recent years. It seems like maybe the tech industry is starting to recognize how important it is to include women?

, as well as other funding options.

Don’t Miss: Government Grants For Daycare Business

Tip : Create A Compelling Narrative

You may not have lived a life full of adventure, but chances are you have a story to tell about yourself and how you came to be a business owner and grant applicant. Providing these details as a contiguous story with a trajectory and destination can increase your applications chances of standing out. Ask your friends what they find interesting about you if youre drawing blanks.

Us Economic Development Administration

The EDA is mandated to foster economic development in all US communities. Grant money is part of the solution and can be viewed on the EDA website, which is constantly being updated to reflect recent funding opportunities. For example, the most recent funding opportunity listed is the Fiscal Year 2020 Public Works and Economic Adjustment Assistance Programs. This grant provides $587 million in funding opportunities for small businesses affected by natural disasters in 2018. Clicking the link redirects you to the Grants.gov website, where you can view details about the grant.

You May Like: Federal Government Jobs In Md

Finding Startup Assistance And Creating A Grant Strategy

Creating a grant strategy is recommended for businesses that plan on applying for more than one grant. This involves mapping out a calendar of relevant grants, eligibility requirements and their application periods ahead of time. Follow this calendar to make the grant juggling more manageable.

Can I really get multiple government grants?

Remember that grants are more than just money infusions. Government business assistance also comes as low-interest loans, workshops, mentoring, training, subsidies, tax benefits, allowances and much more, depending on the type of help.

Taking advantage of everything on offer can give your business an edge but might take a lot of organisation and planning.

This is where a grant strategy comes in.

- A grant strategy lets you plan ahead to make sure your startup achieves eligibility in the required time.

- You are able to apply as soon as a grant opens. Being at the front of the queue like this improves your chances because many grants have limited funding and close when the money runs out.

- If there is a conflict of timing or you dont have the resources to apply for everything you want, then a grant calendar helps you prioritise, reschedule and weigh the benefits of different options.

- A grant calendar should work alongside your business timeline. For example, you should look for employment grants to coincide with hiring new people or plan to reduce your emissions when there are grants or programs to assist.

Government Sources For Small Business Grants

There are a wide variety of grants from the government from both the federal and state level.

Grants.gov: The first place all small businesses should go to look for a federal grant. Its a database of thousands of grants with powerful filters that will help you quickly narrow down the results to grants that you have a good chance of getting.

Small Business Administration Grants: The SBA mainly helps small businesses find conventional means of funding .

But they also have a few grant programs, targeted specifically at businesses involved with research or exporting.

Here are the primary grants they sponsor:

SAM.gov Grants : This is another great federal grant database with a modern re-design. While there is some overlap with Grants.gov, youll find a few unique ones as well that makes it worth your time to check. You can use the advanced search filters to only see grant results, or also see other funding sources like loans.

You May Like: Is Naca A Government Program

What Are Government Small Business Grants

Government grants for small businesses are different from loans in that you dont have to pay them back. They come in varying sums of money from hundreds to thousands of pounds and are available through schemes that operate both on a national and regional level.

Some are designed for those already in business, while others help people who are just starting out. Most grants are aimed at specific industries or community groups, so theyre not open to everyone.

Theres high competition for grants because its essentially free money. Youll have to check eligibility criteria because there may be certain things you have to prove before you can apply. Some may also ask you to match the amount. For example, if the grant is £5,000, you may need to match it with £5,000 too.

Still, none of thats a reason to give them a miss. Grants are a very attractive form of finance, not just because there are no repayments but because they wont need you to give up any equity in your business or offer any security like you might have to with a loan.

Natural Resource Sales Assistance Program

In addition to the billions of dollars spent purchasing goods and services, the federal government also sells large amounts of natural resources and surplus property. The SBA Natural Resource Sales Assistance Program sets aside a percentage of these goods for bidding by small businesses only. In addition, federal agencies sometimes divide surplus materials into smaller parcels, making it easier for small businesses to purchase. The five categories are:

- Timber and related forest products.

- Strategic materials.

- Leases involving rights to minerals, coil, oil and gas.

- Surplus real and personal property.

The program also provides training for small businesses on government sales and leasing.

Don’t Miss: Government Jobs West Chester Pa

Ben Franklin Technology Partners

Ben Franklin Technology Partners has been investing in startups in central and northern Pennsylvania for more than 30 years. Tech startups can potentially receive up to four yearly infusions of cash totaling around $500,000. Small manufacturers may be eligible for a one-time investment of up to $250,000. To learn more about eligibility, check out their website.

Look For Grants Within Your Industry

A lot of small business grants are industry specific, so it can help narrow down your search if you focus on organizations and research institutions within your particular industry. Focusing on one industry also builds buzz around your business, and can help build connections with industry figures who may be able to offer guidance and investment opportunities.

Recommended Reading: How To Sell To Us Government

Grants For Young People

Certain grants are limited by age to young entrepreneurs. If youre aged between 18 and 30 and meet certain other criteria, you can get a grant of between £1,000 and £5,000 for the governments Enterprise Programme for Young People. The Princes Trust also works with 18-30-year-olds to help them develop their business ideas.

Capital Investors For Small Businesses

Capital investors refer to both angel investors and venture capital funds. Accredited investors can help provide funding for your business startup in return for equity ownership or convertible debt .

The biggest benefit to capital investors is that they can provide you with large sums of money in a relatively short amount of time. At times, they can also provide valuable mentorship as you work to grow your own business.

Learn more:

You May Like: Environmental Social And Corporate Governance Esg

United States Department Of Agriculture

USDAs business programs provide financial backing and technical assistance to stimulate rural business creation and growth. Loans, loan guarantees and grants are available to individuals, businesses, cooperatives, farmers and ranchers, public bodies, non-profit corporations, Native American Tribes and private companies in rural communities. For more information, please visit the USDA website.

Alternatives To Small Business Grants

If you dont have the patience to apply for a small business grant and wait to see if youve been awarded it, look to other options to get the financing you need.

There are plenty of small business loans available, no matter what your credit profile. If your business is established and you have excellent credit, you might qualify for a bank or SBA loan with lower interest rates. If you want access to some cash now and more later, look for a line of credit.

If youre working to build your credit, you may be able to get a merchant cash advance or invoice financing. And if youre just looking for a way to purchase what your business needs, there are plenty of small business credit cards available to you.

This article was originally written on November 19, 2019 and updated on June 13, 2022.

Also Check: Free Government Money To Buy A House