Tax Free Rrsp Withdraw Home Buyers Plan

If you are purchasing your first home, the HBP program allows you to withdraw money from your RRSP without incur withholding tax.

Whos eligible for the Home Buyers Plan?

- CRAs definition for First Time Home Buyer is someone who in the four year period , did not occupy a home that you owned, or one that your current spouse or common-law partner owned. For example, even if you owned a home four years ago, if you have been renting for the past four years before your most current home purchase, you will still be eligible for this program.

- The closing date of your home purchase must be before October 1st of the year after you withdrew the funds from RRSP.

- You must be a resident of Canada at the time of the RRSP withdrawal.

- If you have participated in the Home Buyers Plan before, you have to pay down the HBP balance to zero before you can participate again.

How much can I withdraw from my RRSP tax-free?

You can withdraw up to $35,000 from your RRSP tax-free per purchaser. You can also withdraw the funds from more than one RRSP account. If you are buying a property with your spouse, you can both take advantage of this program if you are eligible to make the combined limit $70,000.

How can I repay the Home Buyers Plan?

You have up to 15 years to reply the amount you withdrew from the program. The program has a two year grace period, i.e. you dont have to start paying it back until two years after your withdrawal.

To Sum it Up

Underused Housing Tax Act

Further to a consultation period from August to September 2021, the government drafted legislation for the Underused Housing Tax Act to address speculative transactions and reduce vacancies in Canada.

The Underused Housing Tax is a tax of 1% based on the value of residential property owned by a non-Canadian non-resident and thats considered underused or vacant. Exceptions include vacation or recreational properties and properties where the owner, their children or spouse or common-law partner reside. This measure is effective as of Jan. 1, 2022.

Read This Before Applying For The First

By Tamar Satov on June 17, 2022

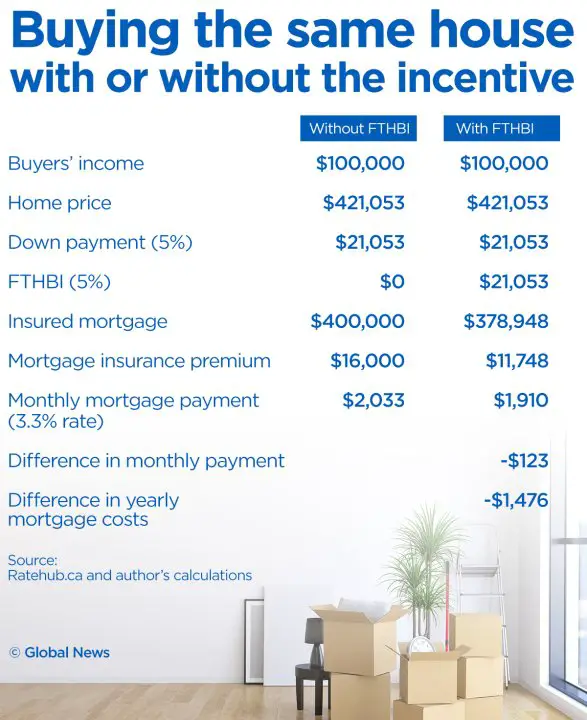

The FTHBI promises to help make real estate more affordable, but theres a catch: Its a loan you have to repay with a share in your homes growth in value.

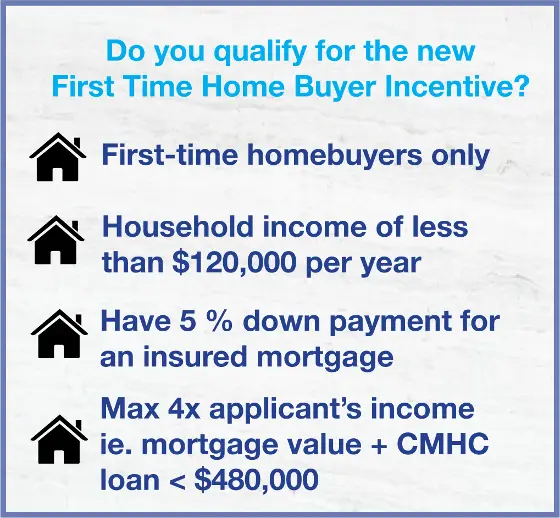

In a red-hot real estate market, a little help with the down payment on a home can go a long wayespecially when youre a first-time buyer without the advantage of equity in an existing property. So when the Canadian federal government decided, in 2019, to begin offering first-time home buyers down payment assistance under the First-Time Home Buyer Incentive , it seemed eligible buyers were in for a bargain.

Before you text your real estate agent and start browsing available listings, there are a few things you should know about the FTHBI. First, youll have to meet certain eligibility criteria. Second, the incentive is not free money, but a form of loan from the Government of Canadawhich will eventually need to be paid back.

Lets take a look at the specifics of the FTHBI, including recent changes to the program and the potential pitfalls home buyers should be aware of.

Watch: What is the First-Time Home Buyer Incentive

Read Also: Government Auto Insurance For Low Income

First Home Super Saver Scheme

The First Home Super Saver Scheme allows first-home buyers to save a deposit for their first home inside their super account, to take advantage of the concessional tax treatment.

Under the scheme, the government has increased the total amount of savings borrowers can release from super to make a deposit on a home from $30,000 to $50,000.

Tip: Youll need a determination letter from the ATO specifying the amount that can be released from your super to use as a deposit for a home loan.

Other Government Resources For First

First-time home buyers often find it helpful to take a homebuyer education course before buying. And, if you use a government-run mortgage or down payment assistance program, homebuyer education is often required.

Many courses can be found online or through government housing agencies like Freddie Mac and Fannie Mae. Some are free, while others are available for a fee that typically ranges from $75 to $100, Gravelle says.

Even if you are not required to take this class, its worth your time and expense.

Homeownership is an important responsibility, and having a better understanding will ensure greater success, Anderson says.

You may even qualify for counseling through HUD for free.

There are HUD-approved housing counseling agencies in every state that can help borrowers navigate the process for no charge, adds Anderson.

Don’t Miss: Modernizing Government Technology Act Of 2017

Fha Alternative: Homeready And Home Possible

Note that FHA isnt the only low-down-payment loan option available.

Fannie Mae and Freddie Mac two government-sponsored enterprises each offer a mortgage program with just 3% down. Fannie Maes low-down-payment option is called HomeReady and Freddie Macs is called Home Possible.

Though these arent technically government mortgage loans, they offer many similar benefits, such as flexible credit score and income guidelines. They also have reduced private mortgage insurance premiums, which means you might pay a lot less in mortgage insurance costs on a HomeReady or Home Possible loan than an FHA loan.

These programs are definitely worth exploring if youre considering an FHA mortgage.

Land Transfer Tax Rebate

Its also called the First Time Home Buyer Rebate. Its a refund of part or all of your Land Transfer Tax when you purchase your first home.

Who is eligible for the First Time Home Buyer Rebate?

- To be considered a First Time Home Buyer for Land Transfer Tax Rebate, you must have NEVER owned a home before. It means you can only qualify for the rebate once.

- The property you are purchasing must be your primary residence. it cannot be a rental property.

- You have to move into the property within 9 months after the title of the property has been transferred to you, which usually happens on the closing date.

How much is the Land Transfer Tax Rebate?

For the Province of Ontario, the rebate is up to $4,000 on a home purchase. The Land Transfer Tax Rebate for Toronto is up to $4,475.

If you are buying a property together with your spouse, and your spouse owned a home before, you can still claim a refund up to the maximum amount as long as your spouse didnt own a home after you are together.

When will I receive the Land Transfer Tax Rebate?

At the time of closing, your lawyer usually applies for the rebate on your behalf. Therefore, it will reduce your Land Transfer Tax owning at closing. If your Land Transfer Tax is less than the maximum rebate amount, it reduces to zero.

Try our Land Transfer Calculator to see how much you can save through the land transfer tax rabate.

Don’t Miss: Boston Sports Club Government Center

What Does That Mean In Real Terms

Assuming that Canadian housing prices increase to the same degree over the next 25 years as they did in the previous 25 , your $500,000 home in 2022 could be worth $2,350,000 million in 2047.

Thats just considering normal appreciation of the home as it was when you bought it. What if over the 25 years you made significant renovations, adding to the base value of the home? It could now be worth even moreand so will the slice you owe the government.

That sounds off alarm bells for Martin. Will you have the money somewhere to pay that off? she says to ask yourself. Lots of people choose to stay in their homes and, after 25 years, theyre getting close to retirement. Id be concerned that this repayment would come as a surprise 25 years after you buy your house.

Those who sell well before the 25-year limit and must repay the incentive at the time of sale could also be in for a shock. Whenever you sell this house, you need to count on giving back the percentage of your equityand thats on top of closing costs, legal fees, land transfer taxes and real estate commissions, she says.

First Homes Scheme: Discounts For First

If youre a first-time buyer, you may be able buy a home for 30% to 50% less than its market value. This offer is called the First Homes scheme.

The home can be:

- a new home built by a developer

- a home you buy from someone else who originally bought it as part of the scheme

The First Homes scheme is only available in England.

You May Like: Entry Level Government Jobs Sacramento

State And Local Government Grants

Some state and local governments sponsor housing grants for qualified first-time buyers. Grant sizes start at $500. Monies can be applied toward closing costs, mortgage rate reduction, or a down payment.

Many local housing grants require buyers to meet minimum credit standards and earn a household income within a specific, lower-income range.

To qualify for a state or local housing grant, find your municipalitys public-facing website, search for housing assistance or housing grants, and review your local program requirements.

See if you qualify here.

To Qualify For A Home Equity Line Of Credit At A Bank You Will Need To Pass A Stress Test

Can I buy a house using the program and rent it out?

No. The incentive is to help first-time homebuyers purchase their first home with the intent to occupy the property. Investment properties are not eligible.

There may be an exception for situations of hardship.

IMPORTANT: The property must be located in Canada and must be suitable and available for full-time, year-round occupancy.

Read Also: What Jobs Are Government Jobs

Can You Combine Calhfa Loans With Financial Assistance Programs

Finding it hard to pick among these many financial aid options? You may not have to choose.

Sometimes, California Housing Finance Agency loans can be combined with other assistance offers, while others cant, says Tony Mariotti, a licensed real estate agent and the CEO of RubyHome in Los Angeles.

The trade-off, however, is that you might need to pick a loan with a slightly higher interest ratebut it may pay off, so its worth crunching the numbers. For instance, while the CalPLUS FHA Program comes with a slightly higher 30-year fixed rate than the CalHFA, a CalPLUS loan can be combined with the CalHFA ZIP, which can assist with closing costs and prepaid items, including the FHAs mandatory mortgage insurance premium.

In some cases, you can even combine a CalPLUS loan with two financial assistance programs, offering home buyers three ways to save money. For instance, while the CalPLUS Conventional Program comes with a slightly higher 30-year fixed rate than the CalPLUS FHA loan, you can combine it with the MyHome Assistance Program and the CalHFA ZIP.

Just know that some loans, however, cant be combined. When in doubt, ask your loan officer or real estate agent for guidance.

Regional First Home Buyer Support Scheme

The Regional First Home Buyer Support Scheme will potentially help 10,000 Australians a year who are living in regional areas buy their first home with at least a 5% deposit.

First-home buyers can buy a home with a deposit as low as 5% of the property value and the government will guarantee the other 15%, allowing borrowers to avoid paying LMI.

The scheme will start in January 2023.

Recommended Reading: Federal Government Free Credit Report

Transforming Student Debt To Home Equity Act Of 2022

- Status: Introduced to the House

- Originally Introduced: April 1, 2022

- Latest Action Taken: April 1, 2022 Referred to the Committee on Financial Services

The Transforming Student Debt To Home Equity Act gives concessions to first-time buyers with monthly student loan payments to help them stop renting and start buying. The bill lowers mortgage rates for buyers, provides discounts on government-owned homes, and makes down payment assistance available.

The programs minimum eligibility standards are

- Must be a first-time home buyer

- Must be approved for a mortgage

- Must agree to own and live in the new home for 3 years

- Must have federal student loans not in default

- Must agree to take a homeownership class

Down Payment Assistance Mortgages

Down payment assistance mortgages are loans that replace a home buyers typical cash down payment with borrowed money at favorable terms.

Access to down payment money at below-market mortgage rates is one form of down payment assistance. Instead of making a down payment using cash from a bank account, home buyers borrow money from a bank at 1 percent with ten years to pay it back.

Deferred mortgages are another form of home buyer down payment assistance.

A deferred mortgage is a loan that requires no repayment while you still live in the house that you bought. You repay the deferred mortgage only when you sell your home or refinance it.

For example, lets say you borrow $25,000 for a down payment using a deferred mortgage and choose to sell in five years because your homes value doubled. After your closing, you pay the $25,000 back to the lender and keep the rest of the profit for yourself.

Typically, down payment assistance mortgages are available through local foundations and municipal governments only. Theyre often limited to first-time buyers whose income falls below area averages and whose credit history shows a decent record of on-time payments. Learn more about down payment assistance programs.

Find out if youre eligible here.

Also Check: Dell Federal Government Employee Discount Program

Government Of Canada Homebuyer Incentives And Rebates

Purchasing a home can be both exciting and overwhelming. The Government of Canada offers a number of financial incentives to help you throughout the homebuying journey. Incentives for first-time buyers, tax credits, rebates and other programs are available. Find out which incentives might be right for you.

First Generation Down Payment Assistance

- Status: Introduced to the House

- Originally Introduced: July 16, 2021

- Latest Action Taken: July 22, 2021 The bills sponsor made introductory remarks on the measure

The First Generation Down Payment Assistance program is included within the Housing is Infrastructure Act of 2021. It awards $25,000 cash grants to first-time buyers toward the purchase of their home.

The First Generation Down Payment Assistance program is similar to the Downpayment Toward Equity Act, but with simpler qualification standards. Specifically, the program changes the definition of first-generation home buyer to include all first-time buyers whose parents or legal guardians dont own a home currently.

The programs minimum eligibility standards include:

- Must be a first-time home buyer

- Must meet income and purchase price limitations for the area

- Must be purchasing a primary residence second homes and rental properties are not allowed

- Must use a government-backed mortgage such as a conventional loan, FHA loan, or USDA loan

- Must have parents or legal guardians who dont currently own a home, unless you lived in foster care at any point in your lifetime

Read Also: How Do I Get Free Government Internet

The Homebuyercom Forgivable Mortgage

The Homebuyer.com forgivable mortgage is a mortgage that behaves like a housing grant. Approved buyers receive cash for a down payment of up to 5% of their purchase price with no interest charged and repayment required.

Not everyone is eligible for the Homebuyer.com forgivable mortgage. At a minimum, recipients must have average credit ratings, qualify for an FHA loan, and agree to accept a 30-year fixed-rate mortgage. Buyers may also be required to attend a 1-hour online educational seminar.

Check your eligibility for the forgivable mortgage here.

Get pre-approved for a mortgage today.

First Home Buyer Assistance Scheme: 1 August 2020 31 July 2021

New homes |

Existing homes |

Vacant land |

|---|---|---|

|

|

|

Read Also: What Is The Free Government Cell Phone

Explore Your Home Buying Options

If youre getting serious about buying a home, its worth connecting with a mortgage lender. Your loan officer can help you explore your options, look into assistance programs, and gauge your eligibility.

Not only will this give you some direction, but getting pre-approved is also often required to make an offer on a home.

So, when youre ready, your first step should be to reach out and talk to a mortgage lender about your options.

Paying Off The Fthbi Loan When You Sell

Lets say you find a $500,000 condo in Vancouver, and you take out a FTHBI loan of 5% of the purchase price, or $25,000. Then, when you decide to sell the home 10 years later, its worth $800,000.

At the time of sale, youll owe the FTHI program 5% of the sale price not the $25,000 you originally borrowed, but $40,000.

Keep in mind that the FTHBI also works the opposite way. If your home decreases in value while you own it, the 5% or 10% repayment amount will be less than what you originally borrowed. Its not the greatest of consolation prizes, but the shared equity format means the government is taking the risk right along with you.

Also Check: Government Land Grants For Farming