How To Buy Health Insurance If You Dont Qualify For A Subsidy

A health insurance subsidy provides tax credits to qualifying individuals to make monthly health insurance premiums more affordable. If your annual income is too high to qualify for a subsidy, you can shop for more affordable alternatives, such as short-term plans, to fulfill your health insurance needs until you can purchase more comprehensive coverage.

Aca Subsidies Obamacare Subsidies In 2019

Obamacaresubsidies are granted by the federal government. The government offers twosubsidies. First, there is the Advanced Premium Tax Credit, which reduces thecost of your premium. Second, there is the Cost Sharing Reduction subsidy. Thisreduces your deductible, copays, and coinsurance. The amount you get depends onyour family size and income level.

Also Check: How Much Is The Er Without Insurance

Do I Qualify For Subsidies

If you are a low or middle-income family or individual you might be eligible for subsidies under the Affordable Care Act.

For most subsidies, you would qualify for a premium tax credit if you earn less than four times the federal poverty level. If you earn less than the federal poverty level, you wont qualify for ACA subsidies, but you might be able to get Medicaid, CHIP or some other government program.

There are also some additional criteria:

- You must currently live in the US & be a US citizen or legal resident

- You cannot currently be incarcerated

- In 2018, you would qualify for subsidies if the least expensive plan in your area costs more than 8.05% of your modified adjusted gross income

Note: the Federal Register sets the poverty level annually. In 2018, the poverty level for an individual is $12,140 in annual income. There are adjustments made based on the size of your household.

When applying for subsidies, your income is an estimate of what youll be making during the coverage year NOT what you earned last year. If you earn more during the coverage year than estimated, you will need to pay back some of that subsidy. But if you end up making less, you can get an additional subsidy when filing your tax returns for that year.

If youre curious about how much you or your family might be eligible for, heres a handy subsidy calculator.

Recommended Reading: Best Resume For Government Jobs

A Review Of The Metal Tiers

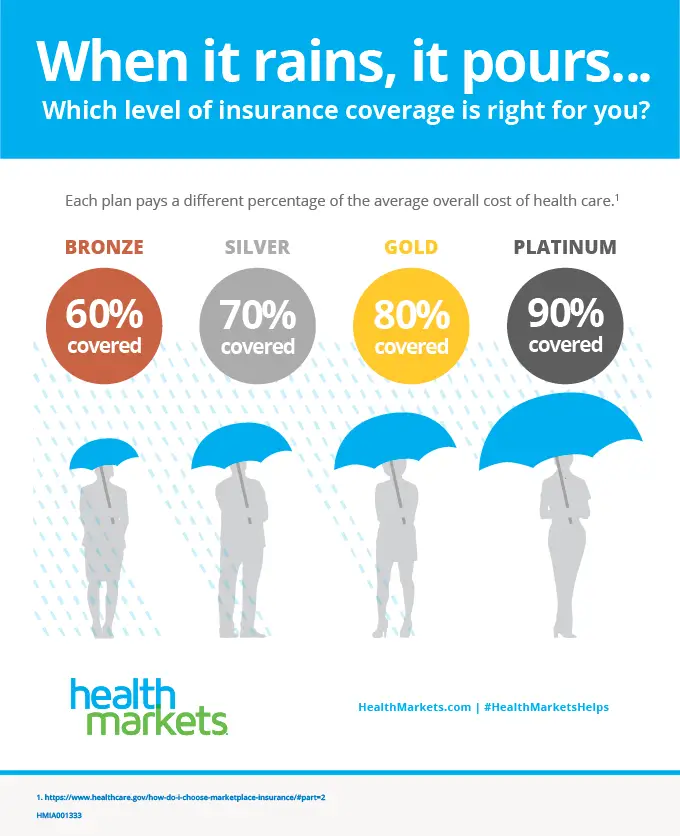

As a quick review, health care plans available through a health insurance marketplace are categorized into four levels, each of which is named after a metal: Bronze, Silver, Gold, Platinum. Bronze plans usually have the lowest premiums, followed by Silver plans.

The level of the plan is unrelated to the quality of the plans coverage. The difference is in how the insurance company splits the costs with you. So if you have a Bronze plan, the insurance provider will generally cover 60% of your insurance costs, which mostly applies after you hit your deductible.

Which type of subsidy you are trying to get will determine which of the metal tiers you can use. The advance premium tax credit is available for any metal tier, but cost-sharing reductions require you to use a Silver plan, as we will discuss in the next sections.

How Do I Determine If I Qualify For Obamacare Subsidies

According to an analysis completed by Covered California, 922,000 consumers will be eligible for a health insurance subsidy in 2020.

If you think you may be one of these consumers, below are some factors that will impact whether or not you qualify:

- Your income. The most significant factor in determining if you qualify for an insurance subsidy is your total household income. The subsidies are based on the amount you expect to earn in the coming year. If that amount is between 100 and 600 percent of the federal poverty line then you will likely qualify.

- Your household size. As your family size increases so does the income threshold to qualify for a subsidy. For example, you would not qualify for a subsidy as an individual making $75,000 per year, but you would if you had a family of four at the same income level.

- Where you live. You may be eligible for a larger subsidy if you live an area that is more expensive for health insurance.

The end of the open enrollment period is coming! Do not run the risk of a penalty for failing to get health insurance. With Affordable Care Act subsidies, health insurance may cost less than you think. Contact a licensed agent today to help you determine if you are eligible.

Also Check: Us Government I 9 Form

Health Coverage For People With Disabilities

If you have a disability, you have three options for health coverage through the government.

-

Medicaid provides free or low-cost medical benefits to people with disabilities. Learn about eligibility and how to apply.

-

Medicare provides medical health insurance to people under 65 with certain disabilities and any age with end-stage renal disease . Learn about eligibility, how to apply and coverage.

-

Affordable Care Act Marketplace offers options to people who have a disability, dont qualify for disability benefits, and need health coverage. Learn about the .

What Happens At Tax Time

Unless you have a supernatural ability to predict the future, theres a good chance you wont perfectly estimate your annual income on your application. Dont worryeverything gets sorted out at tax time. If you make more money during the year than you expected , youll repay a portion of your subsidy. If you make less, youll receive a refund.

You May Like: Government Furnished Property Compliance Checklist

Learn About The Childrens Health Insurance Program

If your income is too high for Medicaid, your child may still qualify for the Childrens Health Insurance Program . It covers medical and dental care for uninsured children and teens up to age 19.

Is my child eligible for CHIP?

CHIP qualifications are different in every state. In most cases, they depend on income.

How do I apply for CHIP benefits?

You have two ways to apply for CHIP:

- Fill out an application through the Health Insurance Marketplace.

What else do I need to know about CHIP?

- You can apply for and enroll in Medicaid or CHIP anytime during the year.

- Get information on other common types of health insurance, such as Medicare, and find help paying for medical bills.

Are You Eligible For Health Insurance Subsidy

Depending on your household size and income, you may qualify for this assistance.

- People age 18 and older, even students, who file their own federal taxes, may be able to get both types of aid.

- People who dont have a job and don’t have COBRA coverage may also be able to get one or both types of aid.

- Native Americans and Alaskan natives may also be able to get help with their Marketplace or Tribal health plan.

Read Also: Government Funding For Swimming Lessons

How Do I Know If I Qualify

To receive help covering your health insurance, you have to meet a few requirements:

-

Income: Your estimated annual income largely determines the subsidy type and amount youll receive. Its very important to calculate this number correctly for maximum savings, so be sure to follow our nifty income estimator guide.

Read Also: Starbucks Benefits For Part Time

How To Get Cobra

Group health plans must give covered employees and their families a notice explaining their COBRA rights. Plans must have rules for how COBRA coverage is offered, how beneficiaries may choose to get it and when they can stop coverage. For more COBRA information, see COBRA Continuation Coverage. The page links to information about COBRA including:

Recommended Reading: Government Grants For Homeowners Improvements

How To Get Health Coverage

You can get health care coverage through:

- A group coverage plan at your job or your spouse or partner’s job

- Your parents’ insurance plan, if you are under age 26

- A plan you purchase on your own directly from a health insurance company or through the Health Insurance Marketplace

- Government programs such as

How Big Will Your Subsidy Be

You can use our subsidy calculator to see the subsidy amount that will be available to you. For people receiving unemployment compensation, the exchange will disregard any income above 139% of the poverty level for 2021.

The 2020 poverty level numbers are used to determine subsidy eligibility for 2021, so you can find the poverty level for your household size, multiply it by 1.39, and enter that number into the subsidy calculator. And if you need help finding a plan, our direct enrollment entity can provide assistance.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

Don’t Miss: Government Assistance For Dementia Patients

The Subsidies Apply To Both Premiums And Out

The unemployment-based subsidies are two-fold:

- They provide full premium subsidies, which means they fully cover the cost of the benchmark plan in your area.

- They provide the most robust level of cost-sharing reductions, which means theyll boost the benefits of any Silver-level plan so that its better than a Platinum plan.

What Exactly Is A Silver Plan

In the exchanges, insurers offer Bronze, Silver, Gold andin a few areasPlatinum plans. . All must cover the ACAs essential health benefits, and cannot refuse to cover you or charge you more because you suffer from a pre-existing condition.

The difference between the four tiers is their actuarial value. Bronze and Silver plans tend to have lower premiums, with higher co-pays and deductiblesup to a maximum of $8,550 in out-of-pocket costs in 2021 After an enrollee hits the out-of-pocket limit, the insurer pays for all essential benefits, as long as the patient stays in-network.

Gold and Platinum plans premiums are higher, but deductibles, copays, and total out-of-pocket exposure on those plans are often lower. Silver plans pay roughly 70% of enrollees expected healthcare costs, and generally have premiums that are higher than Bronze plans, but lower than Gold plans.

Its important to understand, however, that because the cost of cost-sharing reductions has been added to Silver plan rates in many states, you may find that there are Gold plans in your area that are less expensive than silver plans. Shop carefully!

You May Like: Diesel Mechanic Jobs In Government

How Do I Apply

Go to Shop and Compare and compare coverage options and costs. Begin by estimating your annual household income to see if you can get financial help. Next, choose a health plan that is the best fit for you and your family. Make your first payment and you are covered.

Once you start the application, youll either qualify for low-cost or no-cost Medi-Cal, or depending on your estimated income, youll have the option to choose from specific health plans offered through Covered California, likely with financial help to pay your premium.

Premium Tax Credits Lower Your Health Care Premiums

Premium tax credits lower the amount you pay monthly for your health care plan. If you qualify, you have two choices for the way you use this aid. After you sign up for your qualified health plan, you can have the federal government pay the tax credit right to the insurance carrier each month. This lowers the monthly premium amount you pay. Your other choice is to get a tax credit when you file your federal income taxes. This means you pay the full amount of your insurance premium each month. Then, you get the total credit after you file your taxes. You can use the premium tax credit toward any qualified health plan on the Marketplace.

Recommended Reading: What Is Master Data Governance In Sap

What Youll Pay When You Need Medical Care

If you enroll in a Silver plan, youll get the full benefits of the unemployment-based subsidies, meaning that youll have fairly low out-of-pocket costs if you need medical care later this year. Any Silver plan you choose will have a maximum out-of-pocket of no more than $2,850 in 2021, and its common to see these plans with deductibles that range from $0 to $500. Copays for office visits and many prescriptions also tend to be fairly low.

If you choose a non-Silver plan, the normal cost-sharing will apply. No matter what plan you select, your out-of-pocket maximum for in-network care wont exceed $8,550 this year, but the specifics of the coverage will vary considerably from one plan to another.

Who Qualifies For An Aca Subsidy

Eligibility for health insurance subsidies depends on income. However, because of the negative economic impact produced by the COVID-19 pandemic, you might qualify for a health insurance subsidy is you received unemployment benefits in 2021.

Income-based eligibility for a health insurance subsidy requires a household to earn an income that is no more than 100 percent of the federal poverty level. For states that have expanded Medicaid coverage, the income qualification for a health insurance subsidy is 136 percent of the federal poverty level.

Also Check: Best Free Government Cell Phone Service

Getting Started In The Marketplace

To get started, visit HealthCare.gov or your states version of it. Either way, youll get a quick side-by-side comparison of the plans available to you.

The database allows you to choose from four tiers of health insurance: Bronze, Silver, Gold, and Platinum. Bronze plans are the least expensive but require the highest copays and deductibles. Platinum plans are the most expensive, and they may have more bells and whistles than you want or can afford.

During the enrollment process, youll learn whether youre eligible for the Advanced Premium Tax Credit or a cost-sharing reductionand if so, youll find out how much you can save. If you do qualify for savings, you must buy your plan through the Marketplace.

Example Of How To Calculate The Health Insurance Subsidy

Keep in mind that the exchange will do all of these calculations for you. But if you’re curious about how they come up with your subsidy amount, or if you want to double-check that your subsidy is correct, here’s what you need to know:

Tom is single with an ACA-specific modified adjusted gross income of $24,000 in 2022. FPL for 2021 is $12,880 for a single individual.

Don’t Miss: How Much Does Government Disability Pay

Alternative Health Insurance Options

If you are an individual under the age of 30 or qualify for a hardship exemption and are in generally good health, you may be eligible for a catastrophic plan. Catastrophic plans are low-premium plans that tend to have a high-deductible but offer ACA-compliant coverage.

In most states, you can also buy short-term health insurance plans. Premiums for short-term plans tend to be substantially lower than those of comprehensive health plans available on the marketplace.

Although they are called short-term plans, you typically can keep your coverage up to 3 years in most states by simply renewing your plan annually. While these plans do not offer the comprehensive coverage of a major-medical health insurance plan, they do provide an affordable alternative to ACA-compliant plans that can keep you covered in worst-case scenarios.

If you enroll in a short-term plan, you will pay a monthly premium and a deductible. These plans typically offer the following benefits:

- Some prescription medications

- Visits to your doctor

- Hospitalization due to illness or injury

Keep in mind that short-term plans can deny coverage for these services based on a pre-existing medical condition.

Understanding The Aca’s Premium Tax Credit Health Insurance Subsidy

The Affordable Care Act includes government subsidies to help people pay their health insurance costs. One of these health insurance subsidies is the premium tax credit which helps pay your monthly health insurance premiums. This article will explain how these subsidies work, who is eligible, and how they’ll affect your tax return.

Despite significant debate in Congress over the last few years, premium subsidies continue to be available in the health insurance marketplace/exchange in every state. And the American Rescue Plan has made the subsidies larger and more widely available for 2021 and 2022.

The premium tax credit/subsidy can be complicated. In order to get the financial aid and use it correctly, you have to understand how the health insurance subsidy works. Here’s what you need to know to get the help you qualify for and use that help wisely.

You May Like: Are There Any Government Programs For First Time Home Buyers