How Much Does The Us Government Spend Per Year

Federal Budgetyearfederal budgetU.S.in the United States

FY 2018 revenues were 16.4% of gross domestic product , versus 17.2% in FY 2017. Tax revenues averaged approximately 17.4% GDP over the 1980-2017 period. During FY2017, the federal government collected approximately $3.32 trillion in tax revenue, up $48 billion or 1.5% versus FY2016.

Likewise, how much does the US government make a year? In 2015, total federal revenues in fiscal year 2015 are expected to be $3.18 trillion. These revenues come from three major sources: Income taxes paid by individuals: $1.48 trillion, or 47% of all tax revenues. Payroll taxes paid jointly by workers and employers: $1.07 trillion, 34% of all tax revenues.

Subsequently, one may also ask, what is the US budget for 2019?

In 2019, the government spent $4.45 trillion.

What does the US government spend the most money on?

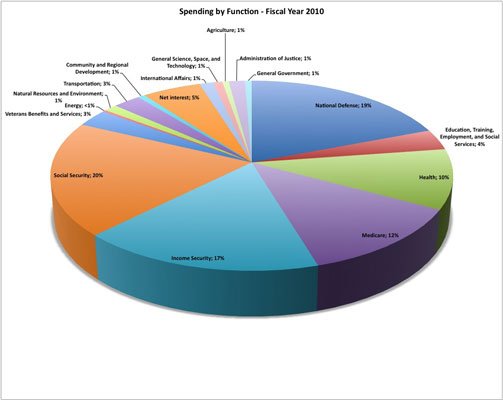

Federal Spending BreakdownAlmost two-thirds of federal spending goes toward paying the benefits required by Social Security, Medicare, and Medicaid. The interest payments on the national debt consume 7.8% of the budget. These are also required to maintain faith in the U.S. government.

How Much Does Medicare Cost The Government

The ever-increasing personal cost of Medicare benefits in the form of premiums and copayments is a point of contention among Medicare recipients across the country. Additionally, Medicare recipients have seen their share of payroll taxes for Medicare deducted from their paychecks throughout their working years. There is less awareness about how the cost of Medicare benefits is funded by the government.

Kaiser Family Foundation examined the sources of Medicare funding in 2018. Medicare recipients may be surprised to learn that payroll taxes accounted for only 36% the federal governments general fund, 43% and premiums, a mere 15%. The remaining revenue came from transfers from states, Social Security benefit taxes and earned interest.

Medicare spending statistics

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services , which is the agency that administers Medicare:

- Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure.

- The rise in Medicaid spending was 3% to $597.4 billion, which equates to 16% of total national health expenditure.

- The biggest share of total health spending was sponsored by the federal government and households while state and local governments accounted for 16.5%.

- For 2018 to 2027, the average yearly spending growth in Medicare is projected to exceed that of Medicaid and private health insurance.

How Much Does The Us Spend On Education 2018

The President requests $59 billion in discretionary appropriations for the Department of Education in fiscal year 2018, a $9 billion or 13 percent reduction below the 2017 annualized Continuing Resolution level. The request includes $1.4 billion to support new investments in public and private school choice.

How much money does the federal government give to public schools?

According to the US department of Education, the Federal Government contributes about 8% to funding US public schools. To fund the remaining balance per student in the public education System, state and local governments are mandated to allocate money towards education.

Don’t Miss: Can The Government Mandate A Vaccine

What Are The Countries Receiving Foreign Aid Doing With All That Cash

What countries do with their foreign assistance from the United States depends on what the aid is earmarked for.

In countries like Iraq, for example, 55% of its $454 million in aid for 2020 was designated for military assistance according to USAID. This can include a broad range of programming, from counter-terror operations to strengthening legal and judicial systems.

On the other end of the spectrum, Kenya was set to receive almost exclusively humanitarian assistance funding in 2020 . As in previous years, the majority of economic aid was designated for emergency response, along with developmental food aid and food security assistance, and maternal and child health.

A Concern distribution of tarpaulins to displaced families in Katale, Masisi, DRC. Concerns programming in the region is made possible by funding from the US government, amongst other sources. Photo: Kieran McConville

What Is The Federal Reserves Role In Federal Finances

The Federal Reserve Act of 1913 established the Federal Reserve System as the central bank for the United States. The Fed works closely with the Department of the Treasury, which manages the finances of the federal government.

For example, the Fed:

- Issues Treasury securities and conducts auctions of these securities to raise funds for the federal government.

- Processes monetary transactions on behalf of Treasury, including issuing payments and other government receivables.

You may have noticed that the first table included Federal Reserve Deposit of Earnings in the miscellaneous revenue category. Thats because once the Fed pays its expenses, remaining profits are sent to Treasury to be used by the federal government.

However, the Federal Reserve does not set fiscal policy for the federal government. Knowing the difference between fiscal policy and monetary policy is essential to understanding who does what:

- Fiscalpolicy refers to the U.S. governments revenue collection and spending decisions. Congress and the administration conduct fiscal policy.

- Monetary policy refers to actions that central banks take, such as to influence the supply of money in the economy and influence interest rates in markets. The Federal Reserve conducts monetary policy.

Read Also: How To Get Fund For Startup From Government

How Fiscal Policy Affects The Economy

How do the financial decisions of the federal government impact the U.S. economy? Gross domestic product is one measure of economic health, as it provides an economic snapshot of the country. GDP measures the value of goods and services produced in a given time period.

On the revenue side, people and businesses earn more if an economy is performing well, which provides more revenue to draw taxes from thus increasing government revenue. On the spending side, government purchases are one of the expenditure components of GDP.

One way to assess the federal governments ability to finance the national debt is to compare debt levels to GDP, as seen in the Explore Debt section of Your Guide to Americas Finances. Doing this, we can observe the government’s ability to utilize the resources at hand to finance the debt similar to how you and your family manage your finances to make sure that monthly payments for your mortgage, car loans and credit cards can be made.

Higher Interest Rates Would Increase Interest Costs

As interest rates rise, the cost of debt service payments will grow. Todays low interest rates are partially the result of the COVID-19 pandemic, economic fallout, and response , and are thus unlikely to last. For example, although the rate on the 10-year Treasury note fell from just below two percent at the beginning of 2020 to nearly 0.5 percent by August, it has since rebounded to around 1.5 percent. CBO projects it will continue growing to 3.3 percent by the end of the decade, though that projection comes with a high degree of uncertainty.

Higher interest rates will mean higher interest payments and deficits. For example, if interest rates were one percentage point higher than projected for all of 2021, interest costs would total $530 billion more than the cost of Medicaid. If rates were two percentage points higher, interest costs would total $750 billion, which is more than the federal governments spends on defense or Medicare. And at three percentage points higher, interest costs would total $975 billion almost as much as is spent on Social Security benefits. On a per-household basis, a one percentage point increase in the interest rate would increase costs by $1,805, to $4,210.

Read Also: How Long Does It Take To Get A Government Phone

Federal Government Spending Nearly Twice As Much As Its Taking In

Viacheslav Lopatin/Shutterstock.com

Two months into fiscal 2021, the federal government has spent nearly twice as much money as it has taken in through revenue after posting a 14th consecutive month of deficit spending.

According to the Treasury Department spending data released Dec. 10, the federal government ran a $145 billion deficit in November, driven heavily by spending on Social Security benefits, health care and national defense. Combinedwith Octobers $284 billion deficit, the federal government has spent $887 billion in fiscal 2021nearly twice the $457 billion it has captured thus far through taxes and other forms of revenue.

The governments deficit spending follows a record-breaking fiscal 2020, wherein agencies combined to spend a record $6.5 trillion, with a total deficit of $3.1 trillion. A sizable portion of spending in late fiscal 2020 was driven by spending on coronavirus relief packages and some decreases in collected revenue. Congress is currently considering another COVID-19 relief bill worth more than $900 billion.

Do Not Sell My Personal Information

Cookie List

Strictly Necessary Cookies

Functional Cookies

Performance Cookies

Sale of Personal Data

Social Media Cookies

Targeting Cookies

Who Owns Most Of Us National Debt

Public DebtThe public holds over $21 trillion, or almost 78%, of the national debt. 1 Foreign governments hold about a third of the public debt, while the rest is owned by U.S. banks and investors, the Federal Reserve, state and local governments, mutual funds, pensions funds, insurance companies, and savings bonds.

Also Check: Government Loans To Build A House

What Role Does The Federal Reserve Play In Financing The Federal Debt

As part of its efforts to keep the economy growing in the face of near-zero short-term interest rates, the Federal Reserve has been buying lots of U.S. Treasury debt in the secondary market That makes it easier for the Treasury to increase its borrowing without pushing up interest rates. Between mid-March and late June 2020, the Treasurys total borrowing rose by about $2.9 trillion, and the Feds holdings of U.S. Treasury debt rose by about $1.6 trillion. In 2010, the Fed held about 10% of all Treasury debt outstanding today it holds more than 20%.

How Much Revenue Does The Government Collect Each Year

4.5/5Government Revenuegovernmentscollecta yeargovernments collectcollect

Likewise, people ask, how much revenue did the federal government collect in 2018?

The Treasury Department reported this week that individual income tax collections for FY 2018 totaled $1.7 trillion. That’s up $14 billion from fiscal 2017, and an all-time high.

Also Know, is federal revenue up in 2019? Specifically, in the 2019 fiscal year, which ended Sept. 30, federal revenues increased by $133 billion , but spending spiked by $339 billion , driving up the deficit by $205 billion to $984 billion.

Also question is, how does the government generate revenue?

The chief way the government gets the money it spends is through taxation. Forty-five percent of federal tax revenue comes from individuals’ personal income taxes. Another 39 percent comes from Social Security and Medicare withholdings.

How much does the government collect in payroll taxes?

To finance benefits and program expenses, both the states and the federal government deposit payroll taxes into a federal trust fund. The federal payroll tax rate is 6.0 percent on the first $7,000 of covered wages, but tax credits reduce the effective federal tax rate to 0.6 percent .

Also Check: Us Government Cars For Sale

What Is The Debt

The debt is the total the U.S. government owesthe sums it borrowed to cover last years deficit and all the deficits in years past. Each day that the government spends more than it takes in, it adds to the federal debt. When the fiscal year ended on September 30, 2019, the federal government owed $16.8 trillion to domestic and foreign investors. By the middle of June 2020, this measure of the debt was up to $20.3 trillion. To see the very latest tally, check the Treasurys The Debt to the Penny website.

Measured against the size of the economy, the debt was around 35% of GDP before the Great Recession of 200709 and had risen to nearly 80% of GDP right before the pandemic. Its headed to around 100% of GDP by the end of Fiscal Year 2020 on September 30, andbarring a major change in tax or spending policyit will keep rising after that to levels never before seen in U.S. history.

Who Controls Government Spending Anyway

Government spending can be broken down into two categories: mandatory and discretionary. Mandatory spending is determined by previous law and includes spending for programs like Social Security and Medicare. Discretionary spending is determined by the President and Congress each year in the budget and appropriations process. First, the President puts together a budget proposal and sends it to Congress. Then, the House and Senate both draft budget resolutions. Congress can change funding levels, as well as add or eliminate programs, taxes, and other sources of revenue. Once the budget resolutions have been finalized in the House and Senate, Congress reconciles the differences and votes on a final budget. The discretionary spending levels in the budget are divided among the twelve Appropriations Subcommittees, who then draft bills providing funding levels for the Departments, bureaus and agencies within their jurisdiction. After the House and Senate agree to a final funding level for each bill, they are sent to the President for approval or veto.

Are federal debt and deficit the same thing? No, but they do affect one another.

Also Check: What Do Government Contractors Do

How Much Does The Federal Government Spend On Interest

Even with exceptionally low interest rates, the federal government is projected to spend just over $300 billion on net interest payments in fiscal year 2021. This amount is more than it will spend on food stamps and Social Security Disability Insurance combined. It is nearly twice what the federal government will spend on transportation infrastructure, over four times as much as it will spend on K-12 education, almost four times what it will spend on housing, and over eight times what it will spend on science, space, and technology.

How Congress Really Spends Your Money

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

The Balance / Hilary Allison

Current U.S. government spending is $4.829 trillion. That’s the federal budget for the fiscal year 2021 covering October 1, 2020, through September 30, 2021. It’s 20.7% of gross domestic product according to the Office of Management and Budget Report for FY 2021.

Don’t Miss: Government Home Refinance Stimulus Package

Federal Government Blows Past Record Spending In Fiscal 2020

Fablok/Shutterstock.com

The federal government spent a record $6.5 trillion in fiscal 2020, according to data released Friday by the Treasury Department, eclipsing the previous spending record of $4.5 trillion set last year.

Collectively, federal agencies spent half a trillion dollars in the month of September$125 billion more than revenue brought in from taxes and other formsresulting in the governments 12th consecutive month running a deficit. In total, the federal governments budget deficit reached $3.1 trillion in fiscal 2020, which more than doubled the previous record of $1.7 trillion set in fiscal 2009 during an economic recession.

According to the nonpartisan Committee for a Responsible Federal Budget, prolonged deficit spending grew the national debt to $21 trillion, or 102% of gross domestic product.

The only other time debt has exceeded the size of the economy was at the end of World War IIand we ran years of mostly balanced budgets afterwards to bring it back down. We should be borrowing now, but once the economy recovers, our debt cannot continue to grow faster than the economy forever, said Maya MacGuineas, president of the Committee for a Responsible Federal Budget. Its disappointing to see both candidates for President proposing trillions of dollars in additional debt instead of plans to save Social Security and Medicare. The deeper we dig this hole, the harder it will be to claw our way out.

Total Outlays In Recent Budget Submissions

- 1996 United States federal budget $1.6 trillion

The budget year runs from October 1 to September 30 the following year and is submitted by the President to Congress prior to October for the following year. In this way the budget of 2013 is submitted before the end of September 2012. This means that the budget of 2001 was submitted by Bill Clinton and was in force during most of George W. Bush’s first year in office. The budget submitted by George W. Bush in his last year in office was the budget of 2009, which was in force through most of Barack Obama’s first year in office.

The President’s budget also contains revenue and spending projections for the current fiscal year, the coming fiscal years, as well as several future fiscal years. In recent years, the President’s budget contained projections five years into the future. The Congressional Budget Office issues a “Budget and Economic Outlook” each January and an analysis of the President’s budget each March. CBO also issues an updated budget and economic outlook in August.

Actual budget data for prior years is available from the Congressional Budget Office see the “Historical Budget Data” links on the main page of “The Budget and Economic Outlook”. and from the Office of Management and Budget .

Also Check: Federal Government Day Care Centers