What Types Of Bonds Are There

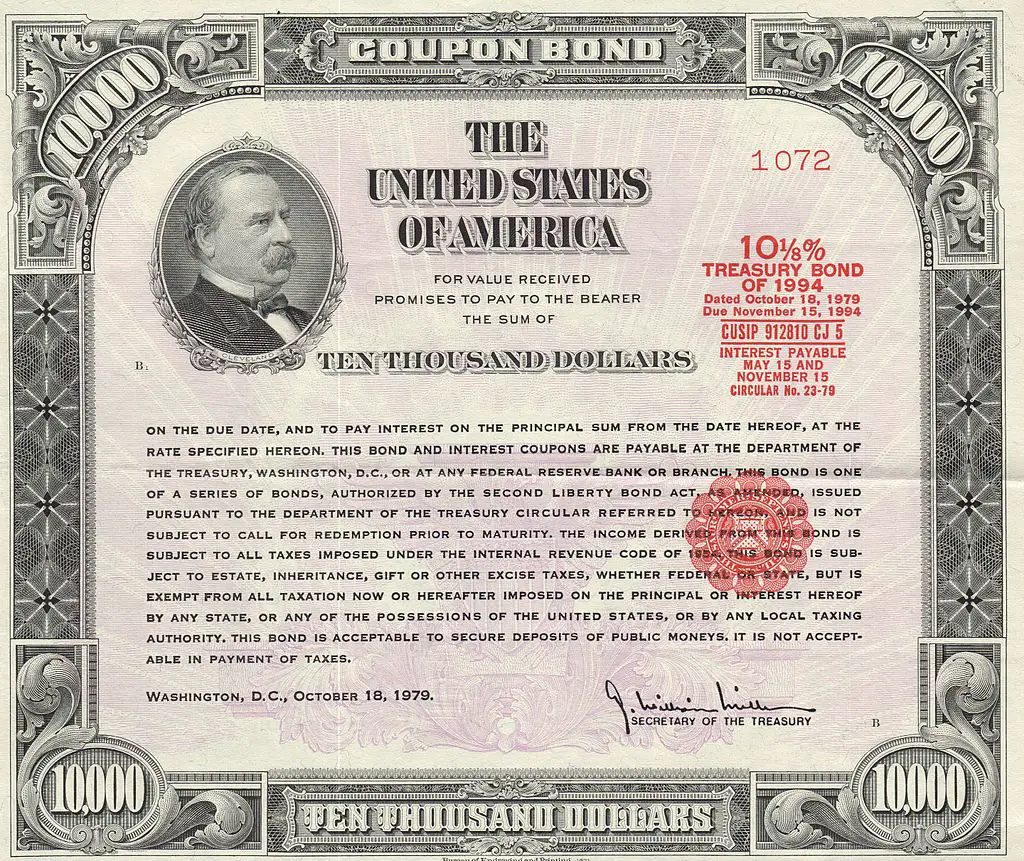

Bonds also known as fixed income instruments are used by governments or companies to raise money by borrowing from investors. Bonds are typically issued to raise funds for specific projects. In return, the bond issuer promises to pay back the investment, with interest, over a certain period of time.

Certain types of bonds corporate and government bonds are rated by credit agencies to help determine the quality of those bonds. These ratings are used to help assess the likelihood that investors will be repaid. Typically, bond ratings are grouped into two major categories: investment grade and high yield .

The three major types of bonds are corporate, municipal, and Treasury bonds:

Where Can You Buy Treasury Bonds

You can buy Treasury bonds directly and electronically from TreasuryDirect through non-competitive bidding. Non-competitive bidding means that you agree to accept the yield determined at auction and youre guaranteed to receive both the amount and specific bond you want, according to TreasuryDirect.

T-bonds are also bought through banks, brokers or dealers by either a competitive or non-competitive bid. In a competitive bid, you specify the yield that youll accept and you may or may not get the bond you want. If you do receive the Treasury bond, it may be less than the amount you requested.

Treasury bond auctions happen four times a year: in February, May, August and November. You must purchase at least $100 worth of Treasury bonds and they are sold in $100 increments. The maximum amount of Treasury bonds you may buy is up to $5 million during non-competitive bidding or up to 35 percent of the initial offering amount via competitive bidding.

How To Buy Treasury Securities

You can purchase Treasury bonds directly from the Treasury Department through its website, TreasuryDirect, or through any brokerage account.

Similar to other stocks and bonds, you can purchase Treasury bonds either individually or as a collection of securities through mutual funds or exchange-traded funds, or ETFs. If you have no particular time frame in mind for repayment, investing in a mutual fund or ETF may be more appealing because of enhanced diversification from owning a collection of bonds.

Unlike individual bonds, bond funds do not have a maturity date and can therefore be subject to greater volatility. In a bond fund, a fund manager buys and sells bonds with varying terms, so your returns can be subject to market fluctuations when you sell the fund, instead of providing a predictable income.

» Ready to start investing? See our picks of best brokerages for fund investors.

Buying individual bonds can make sense when youd like to pinpoint a specific time frame to receive the bonds repayment. Examples include using bonds as a lower-risk way to earn some interest on money set aside for a certain purpose think a wedding, tax or tuition payment next year or as a way to generate a predictable income stream in retirement.

T-bills are sold at a discount from the par amount, or face value, of the bill. Investors receive the full face value amount at maturity. For example, an investor could buy a T-bill for $950 but receive a face value of $1,000 at maturity.

Also Check: Government Assistance Programs For Elderly

How To Buy Individual Bonds

Investors can buy individual bonds through a broker or directly from an issuing government entity. One of the most popular cases for buying individual bonds is the ability for investors to lock in a specific yield for a set period of time. This strategy offers stability, whereas the yield on a bond mutual fund or fixed-income exchange traded fund fluctuates over time.

Its important to keep in mind that individual bonds must be purchased whole. Most bonds are issued in increments of $1,000, so you need to fund your brokerage account balance with at least that amount to get started. Note that while U.S. Treasury bonds have a face value of $1,000, the minimum bid is $100 and they are sold in $100 increments. U.S. Treasury bonds can be purchased through a broker or directly at Treasury Direct.

Whether youre exploring how to buy municipal bonds, corporate bonds or treasuries, the basics of buying an individual bond remain the same: You can purchase them as new issues or on the secondary market.

Featured Partner

Via TD Ameritrade’s Secure Website

How To Buy I

Stocks and bonds alike have plummeted this year, taking the wind out of retirement savings and brokerage accounts. Meanwhile, the interest rates on the highest-paying savings accounts barely reach 3% less than half the rate of inflation.

But there is one financial vehicle that offers a hefty return to savers who don’t need to spend their money immediately. Series I savings bonds commonly known as I-bonds currently offer an interest rate of 6.89%. While that’s lower than the 9.62% they offered during the six months that ended November 1, it’s still an attractive rate for savers who would otherwise be putting money into a savings account or CD.

Typically a niche investment vehicle, I-bonds have exploded in popularity in the last two years as inflation has reached a 40-year high. The Treasury issued nearly a billion dollars’ worth of I-bonds last Friday during a surge of interest from buyers that temporarily crashed a government website.

“For clients who have some extra cash who want to ride out the market, it’s a great investment, especially in the current climate,” Jay Lee, founder of Ballaster Financial, told CBS MoneyWatch. “It’s a bit of a no-brainer.”

Read on to learn how I-bonds work, why they’re nearly inflation-proof and why interested investors have piled into this once-obscure vehicle.

Also Check: How To Get Flood Relief Money From Government

Should I Buy A Government Bond

Government bonds can be a great option for the low-risk portion of an investors portfolio. They can also be a great way to begin investing in the bond market overall with little risk. Yields on government bonds range from approximately 2.20% to 3.00%. Many investors look to government bonds as options for consideration along with money market accounts, certificates of deposit, and high yield savings accounts. Ultimately the investment in a government bond is generally based on investment goals, risk tolerance, and return.

What Is The Time To Maturity For Treasury Bills

A T-bills time to maturity is known at the time of purchase. Its duration in Canada is less than one year.

At maturity, the government that issued will pay its predetermined value. Your profit is the difference between that price and the discounted price you purchase it at.

Treasury bills have maturities of 1 month, 2 months, 3 months, 6 months or 1 year. They are easy to resell before their maturity, so they are a very liquid investment.

Also Check: American National Government College Class

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Are Some Tips For Investing In Bonds

When investing in bonds, its important to:

Don’t Miss: Government Funding For Mobility Scooters

Do Treasury Bonds Pay High Interest

Treasury bonds do not currently pay a high rate of interest relative to history. With interest rates still close to all-time lows, now is not the best time to earn large interest payments as an investor in Treasury bonds. But as inflation picks up, investors may demand more in order to hold the government securities.

Many people like the safety offered by investing in Treasury bonds, which are backed by the U.S. government. But that doesnt mean the bonds are completely free from risk. Changes in interest rates impact the prices of bonds and when interest rates rise, bond prices fall. Purchasing a bond at a 2 percent yield today may seem like a safe bet, but if market rates rise to 4 percent in a year or two, the price youd be able to sell your 2 percent bond for would fall meaningfully.

Some government bonds tied to inflation have started paying higher rates to account for increasing costs. Government issued I-bonds purchased between now and the end of April 2022 will pay interest at an annual rate of 7.12 percent, according to TreasuryDirect. The interest rate on I-bonds is tied to inflation and changes every six months.

How To Buy Treasury Bonds

This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.There are 8 references cited in this article, which can be found at the bottom of the page. This article has been viewed 206,754 times.

Purchasing a Treasury bond is like lending money to the US Government buying the bond means buying the rights to interest payments every six months over the life of the bond, as well as owning the rights to a cash payment of the bond par value on the bond’s maturity date.XTrustworthy SourceTreasury DirectWebsite run by the U.S. Bureau of Fiscal Service that allows individuals to buy U.S. Treasury securitiesGo to source If you are a new investor, treasury bonds are a great way to learn about investing and earn some interest. Non-citizens can also buy Treasury bonds. If you already have a developed securities portfolio, treasury bonds can strengthen your investment and shield it against market changes.

Also Check: Government Assistance For Homeowners Repairs

What Do Treasury Bonds Pay

Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value that you own. The semiannual coupon payments are half that, or $6.25 per $1,000. If you have a TreasuryDirect.gov account and use it to buy and hold U.S. Treasury securities, the coupon interest payments are made directly into your bank account.

The coupon rate stays fixed for the life of the bond. If the coupon rate is higher than the yield, that means the bond is selling at a premium, according to McBride.

With a stock, you know what the price is today but you dont know its future value. But with a bond you know what the end value is going to be when it matures, McBride says.

If the price now is above the future value, then your yield is going to be less than the coupon rate because you may have paid $110 for the bond, its going to mature at 100, McBride says. Conversely, if you buy it for less than face value, your yield to maturity is going to be higher than the coupon rate. Because at maturity, that bond you paid $95 for, is now going to give you $100.

How To Buy Bond Funds

Another way to gain exposure in bonds would be to invest in a bond fund ) that exclusively holds bonds in its portfolio. These funds are convenient since they are usually low-cost and contain a broad base of diversified bonds so you don’t need to do your research to identify specific issues.

When buying and selling these funds , keep in mind that these are âsecondary marketâ transactions, meaning that you are buying from another investor and not directly from the issuer. One drawback of mutual funds and ETFs is that investors do not know the maturity of all the bonds in the fund portfolio since they are changing quite often, and therefore these investment vehicles are not appropriate for an investor who wishes to hold a bond until maturity.

Another drawback of mutual funds is that you will have to pay additional fees to the portfolio managers, though bond funds tend to have lower expense ratios than their equity counterparts. Passively managed bond ETFs, which track a bond index, tend to have the fewest expenses of all.

In addition to the Treasury, corporate, and municipal bonds described above, there are many other bonds that can be used strategically in a well-diversified, income-generating portfolio. Analyzing the yield of these bonds relative to U.S. Treasuries and relative to comparable bonds of the same type and maturity is key to understanding their risks.

Recommended Reading: Government Assistance For Car Repairs

Can You Lose Money Investing In Government Bonds

As laid out, there are two ways you can lose money by investing in Government bonds.

Firstly, if you hold your bond until maturity the Government could default on its debt where you might not recover your entire investment.

Secondly, if you sell your bond on a secondary market at a discount it could result in a loss.

Benefits Of Investing In Bonds With Us

Large Inventories

Access one of the largest bond inventories in Canada.

Wide Range of Choices

Choose from government, provincial and municipal bonds investment grade corporate bonds high yield bonds strip bonds1 and residual bonds.

Filter Opportunities

Use the Fixed Income Screener to filter and identify investments that meet your needs.

Also Check: Is There A Government Program For Credit Card Relief

Which Government Bonds Are The Best To Buy

This depends on your appetite for risk.

The UK, for example, has never defaulted on its principal or interest payments on its gilts, and is therefore seen as a safe investment.

However, for this perceived lower risk, UK gilts typically pay less than other countries offering similarly structured Government bonds.

This could be enticing but remember to be confident in the Governments ability to pay you back.

One way to evaluate the creditworthiness of a country is to keep an eye on its credit rating, which is issued by Moodys, Fitch, and Standard & Poor. The higher the credit rating, the more likely that the Government will pay back its debt.

Remember, you can buy bonds from many different countries. UK gilts arent only available to British investors, and the same goes for some other Government bonds.

How To Invest In Short

If youre considering in investing in these or any of Vanguard bond funds, you need to do your due diligence.

First, think about what you need the bond fund in the first place. Is it to diversify your investment portfolio?

Are you a conservative investor who need a minimize risk at all cost? Or, do you want to invest in a short term bond fund because you need the money to use in a few years for a vacation, buying a house, or planning for a wedding?

Once, you have come up with answers to this question, the next step is to do your research about the best bond fund available to you.

Use this list to start. If its not enough, do your own research.

Look into how much the initial minimum investment is to buy a bond fund. Most Vanguard short term bond funds require a $3,000 minimum deposit.

Some Fidelity bond funds, however, have a 0$ minimum deposit requirement.

Next compare expense rations, performance for different funds to see if they match your investment goals. But you have to remember that past performance is not an indication of future performance.

Your final step is to open an account to buy your bond funds. If you choose Vanguard, you can do so at their website.

You May Like: Government Jobs In Los Lunas Nm