Can I Still File For Unemployment If My Employer Gave Me Severance Pay

It depends. To determine whether you are eligible for unemployment benefits, the Employment Development Department first looks at whether you had a reduction in wages by no fault of your own. Severance pay is usually not considered a continuance of wages for purposes of unemployment insurance, so even if you get severance pay, you are usually still eligible for unemployment benefits.

In all cases, severance pay will not count as wages against unemployment benefits when:

The method of payment, i.e., lump sum or periodic, does not determine whether the severance pay counts as wages.

Unemployment insurance claims cannot be waived in a general release contained in a severance contract. .

You may find more information about unemployment benefits and severance agreements at the EDDs website here.

Is My Employer Required To Give Me Severance Pay

No. Unless a union contract, company policy manual, or employment contract specifically requires payment of a pre-set amount of severance pay to employees who quit or are laid off, your employer is not required to give you severance pay. Severance pay agreements are up to the discretion of the company, which usually requires a release of claims in exchange for the severance pay.

If your employer has a policy that requires them to pay a pre-set amount of severance pay, then your employer must pay the severance amount regardless of whether you sign a release of claims against them. Pre-set severance pay is considered wages and must be paid in full immediately if terminated, on your last day if you provide 72 hours of notice of quitting, or within 72 hours of your last day if you provided no previous notice of quitting.

Waiver At Time Of Request For Final Payment Dooms Contractors Claim

Government contractors need to be conscious of the paperwork they sign on Federal contracts. Signing a waiver or release of claims at any point during a project can result in a lost opportunity to recover damages even if the event giving rise to those damages was already discussed in detail with the Contracting Officer.

In a recent post, we discussed the hazard associated with bilateral project modifications. Even when a modification includes requested relief , it also likely includes broad waiver/release language that will apply to all pending claims. A contractor should not sign a bilateral modification without a full and complete understanding of what claims are being surrendered with the stroke of a pen.

The same logic and advice applies to requests for final payment and really any other document executed during the course of a Federal project.

In a case before the Postal Service Board of Contract Appeals, the contractor notified the Agency that it underestimated the paving area for the project resulting in a significant labor and materials overrun. The contractor informally requested that the Agency share in the associated costs, arguing that the government was aware of the estimating mistake prior to award. The Contracting Officer disagreed with the contractors position and referred it to the contracts disputes clause.

Read Also: How To See Government Contracts

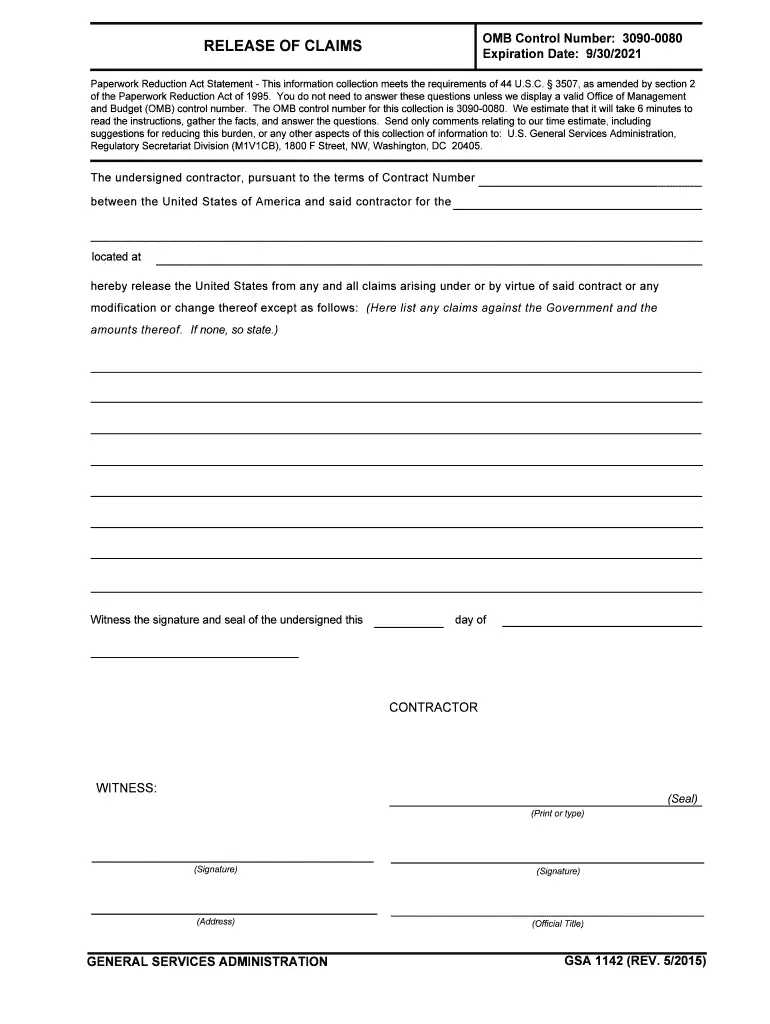

C Executive Orders 12866 And 13563

This is not a significant regulatory action and, therefore, was not subject to review under Section 6 of Executive Order 12866, Regulatory Planning and Review, dated September 30, 1993. This rule is not a major rule under 5 U.S.C. 804. In accordance with Improving Regulation and Regulatory Review, dated January 18, 2011, GSA has determined that this rule is not excessively burdensome to the public, the GSA Form 1142, as prescribed by the rule, is useful to the Government to make certain that the contractor receives proper payment for work performed and aids contractors in presenting their release of claims to the Government.

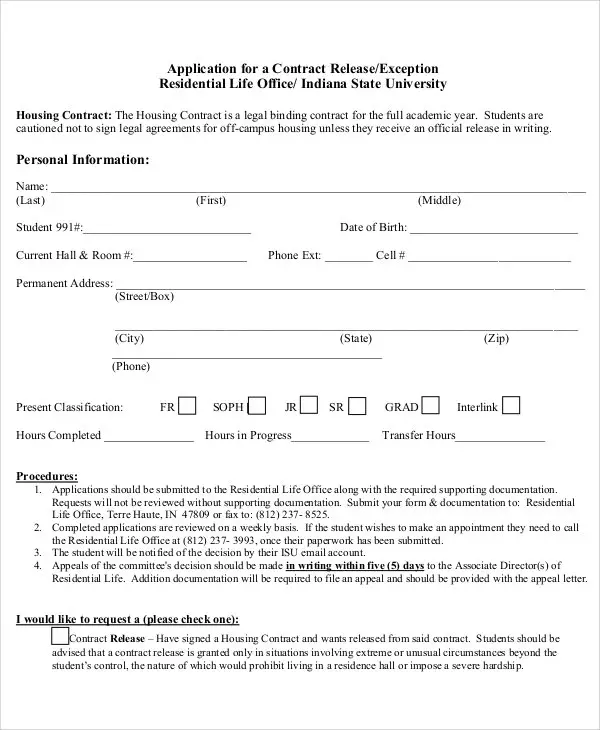

Contract Release: Everything You Need To Know

A contract release is an agreement in which one party agrees it has no claims against the party that’s named in the release.3 min read

A contract release is an agreement in which one party agrees it has no claims against the party that’s named in the release. A release is commonly known as a release of liability or any of the following:

- Release agreement

- Waiver of liability

Also Check: Government Grants For Stroke Victims

What Claims Can Be Released In A Waiver

Statutory Claims

Most statutory claims, including discrimination claims brought to court, may be released by an employee, even if the claim is not specifically referred to in the release. So, a release that states that an employee gives up claims pursuant to Federal laws would be valid as to the employees Title VII discrimination claims. On the other hand, an employer cannot require an employee to waive the right to file a discrimination charge with the EEOC .

Other statutory claims that may be released include claims under ERISA and COBRA. A voluntary release of Family and Medical Leave Act claims is enforceable without the permission of a court or the Department of Labor. You may find more information about discrimination claims and the related laws in our Discrimination and Harassment FAQ found here.

Common Law Claims

Claims made pursuant to state common law may be validly waived in a release of claims.

Disability Claims

A disability plan is a separate entity from the employer who offers it. A general release covering claims only against the employer would not waive continuing disability benefits, unless the release specifically covered claims against the disability plan itself. Thus, any claims under a privately-run disability plan may be waived in a release of claims.

Note: This does not apply to California State Disability Insurance , which is run by the state. Claims under the California SDI cannot be waived.

Class Action Claims

Unknown Claims

E Paperwork Reduction Act

The Paperwork Reduction Act does apply however, these changes to the GSAR do not impose additional information collection requirements to the paperwork burden previously approved under OMB Control Number 3090-0080. This approval was not rescinded when GSAR 532.905-71, which prescribed the use of GSA Form 1142 for releases of claims under construction and building service contracts, was inadvertently deleted as part of the Rewrite of GSAR Part 532, Contract Financing, published in the Federal Register at , October 29, 2009, GSAR Case 2006-G515.

The following procedures apply to construction and building service contracts:

The Government shall pay the final amount due the Contractor under this contract after the documentation in the payment clauses of the contract is submitted. This includes the final release prescribed for construction at FAR 52.232-5, and for building services at GSAR 552.232-72.

Contracting officers may not process the final payment on construction or building service contracts until the contractor submits a properly executed GSA Form 1142, Release of Claims, except as provided in paragraph of this section.

In cases where, after 60 days from the initial attempt, the contracting officer is unable to obtain a release of claims from the contractor, the final payment may be processed with the approval of assigned legal counsel.

The amount of final payment must include, as appropriate, deductions to cover any of the following:

Recommended Reading: Government Employee Car Rental Discount

The Daily Journal Of The United States Government

Legal Status

This site displays a prototype of a Web 2.0 version of the daily Federal Register. It is not an official legal edition of the Federal Register, and does not replace the official print version or the official electronic version on GPOs govinfo.gov.

The documents posted on this site are XML renditions of published Federal Register documents. Each document posted on the site includes a link to the corresponding official PDF file on govinfo.gov. This prototype edition of the daily Federal Register on FederalRegister.gov will remain an unofficial informational resource until the Administrative Committee of the Federal Register issues a regulation granting it official legal status. For complete information about, and access to, our official publications and services, go to About the Federal Register on NARA’s archives.gov.

Legal Status

What Can I Do If My Employer Didnt Pay Me My Severance Pay/benefits According To The Severance Pay Agreement

If the severance plan is regulated by the Employee Retirement Income Security Act , then a plan participant must exhaust administrative remedies by timely appealing a claim denial within 60 days and then filing suit if the appeal is denied. ERISA governs pension plans in the private industry, and to a limited extent, governs employer-provided health and welfare plans. Government employee plans and church plans are generally not governed by ERISA.

If the severance plan is not regulated by ERISA, then claims for benefits may be filed with the CA Division of Labor Standards Enforcement , or in court . To file a claim with Small Claims court, follow the step-by-step guide here.

Don’t Miss: Government Home Refinance Stimulus Package

Release Of Claims: Contractor Signatory Must Have Authority

What goes around, comes around.

The government sometimes refuses to pay a contractor for a modification when the government official requesting the modification lacks appropriate authority. But contractual authority isnt a one-way street benefiting only the government. A recent decision by the Armed Services Board of Contract Appeals demonstrates that a contractor may not be bound by a final waiver and release of claims if the individual signing on the contractors behalf lacked authority.

The ASBCAs decision in Horton Construction Co., SBA No. 61085 involved a contract between the Army and Horton Construction Co., Inc. Under the contract, Horton Construction was to perform work associated with erosion control at Fort Polk, Louisiana. The contract was awarded at a firm, fixed-price of approximately $1.94 million.

After the work was completed, Horton Construction submitted a document entitled Certification of Final Payment, Contractors Release of Claims. The document was signed on Horton Constructions behalf by Chauncy Horton.

More than three years later, Horton Construction submitted a certified claim for an additional $274,599. The certified claim was signed by Dominique Horton Washington, the companys Vice President.

The Contracting Officer denied the claim, and Horton Construction filed an appeal with the ASBCA. In response, the Army argued that the appeal should be dismissed because the claim arose after a final release was executed.

About A Release Of Liability

A release of liability is what happens when two parties agree to waive a legal claim. You agree not to pursue legal action in exchange for compensation. It’s essentially a way to settle a dispute without going to court. For example, you might be asked to sign a waiver before being allowed to take part in a high-risk or physical activity.

The involved parties in a release of liability are the following:

- The releasee: This is the party that makes a payment, so it can be released from possible future claim for damages or injuries.

- The releasor: This is the party that’s receiving money or other type of consideration in exchange for abandoning its claim.

Sometimes, both parties may say that the other party is at fault for damages or injuries. When this occurs, they may sign a mutual release agreement. In the event that one party is more at fault than the other, that party may offer additional compensation.

You May Like: Federal Government Day Care Centers

Release Of Claims Cant Be Undone By Refusing Government Payment

I recall sitting in a mediation one day when the mediator, a judge, told me and my client that we all have lightning in our fingers. He went on to explain that this means, once you sign a contract, its like magic in the sense that you cant get out of the contract and are bound by it, absent certain exceptional circumstances.

I was reminded of this concept while reading a recent opinion from the Armed Services Board of Contract Appeals that dealt with the effect of a contractor signing a release with the government and then trying to back out of that release by refusing payment from the government.

In Central Texas Express Metalwork LLC d/b/a Express Contracting, ASBCA No. 61109, , the ASBCA reviewed an appeal of contractor CTEM, which had contracted to repair and replace certain HVAC systems at an Air Force base for $2,457,237. After partial performance, CTEM submitted a request for equitable adjustment for $643,841.88 in increased costs due to the Air Forces purported delays and changes, including $345,691.07 sought on behalf of a subcontractor called IMS.

CTEM argued that, because it did not accept the final payment from the government, the release was not binding. The ASBCA, referring to case-law dating back to 1860, wrote that nce an offer has been accepted, there is a binding contract. Thereafter, neither the offer nor the acceptance generally can be revoked or withdrawn.

What Claims Cant Be Released

Workers Compensation Claims

Generally, a workers compensation claim cannot be waived in a general release contained in a severance contract. Employers are also not allowed to credit or offset amounts paid under a severance agreement against workers compensation temporary disability benefits.

Age Discrimination in Employment Act Claims

Typically, claims under the Age Discrimination in Employment Act , which prohibits employers from discriminating against employees who are 40 years or older because of their age, cannot be waived unless certain requirements are met. Waivers of ADEA claims in severance agreements are only enforceable if the employer, in addition to meeting other requirements, gives the employee at least 21 days to consider the waiver and advises the employee to consult an attorney.

Minimum Wage and Overtime Claims

An employer cannot put any conditions on the payment of undisputed wages that are due to an employee under Californias wage and hour laws, including minimum wage and overtime pay. If an employee signs such a release, that release is void. On the other hand, an employee may release a claim for wages that were subject to a bona fide dispute between the parties over whether or not such wages were owed.

Releases of wage and hour claims made under the Federal Labor Standards Act are also generally unenforceable unless the release receives court approval or undergoes Department of Labor supervision.

Unemployment Insurance Claims

Don’t Miss: How To Start A Business With Government Grants

How Much Money Is My Employer Supposed To Include In My Severance Pay

No set amount of severance pay is required unless the severance pay is required by a union contract, company policy manual, or some other employment contract. Severance pay is frequently based on length of service. For example, a severance contract could include a severance pay term granting one weeks pay for each year of service to the employer.

Although not required, some employers may also offer other severance benefits, such as job counseling or payment of COBRA expenses, as part of an overall severance package.

If you believe that you have strong employment law claims against your employer and the severance pay depends on your release of those claims, you may be able to negotiate for higher severance pay to compensate you for the alleged harms under those claims.

What Is A Severance Agreement

A severance agreement is a contract that an employer may ask an employee to sign when they are terminated from a job. Severance pay is often offered in exchange for an employees release of their claims against the employer. Severance contracts that contain a release of all claims against an employer in exchange for severance pay or other benefits are legal, enforceable, and binding.

However, an employer cannot require an employee to release their claims in exchange of payment for hours already worked or benefits already owed to the employee. If you suspect that your employer has not paid you all of your wages, you may wish to send your employer a letter telling them so. A template for this sort of letter may be found here.

Don’t Miss: How Much Does The Government Pay For Assisted Living

What Is A Release

When you sign a release, you’re agreeing that you hold no claims of any kind against the named party.

It’s common to find releases in connection with legal settlements. For instance, if you’re involved in a car accident and the other driver’s insurance company says it will fix your car, the company will likely demand that you sign a release. By signing this, you agree that in exchange for repairing your car, you won’t sue the other driver.

Be cautious about signing a release.

Signing a general release means that you essentially give up the right to sue if you later discover any physical injuries you’re currently unaware of. Plus, if you sign a release after an accident settlement, you won’t be able to request that the insurance company pay for damages if a passenger who was in your car decides to sue you later for sustained injuries.

The other type of release commonly referred to as a waiver of claims, a release of liability, or simply a waiver provides that you release a party in advance from liability for claims that may arise later from some activity. For instance, you might sign a release so that your child can attend summer camp or participate in team sports. This release shifts the risk of injury from the other party onto you.

If the agreement is properly worded and you sign it, you may be prevented from suing the other party later, even if the party was grossly negligent.

D Regulatory Flexibility Act

The General Services Administration certifies that this final rule will not have a significant economic impact on a substantial number of small entities within the meaning of the Regulatory Flexibility Act, 5 U.S.C. 601, et seq., because the rule requires the contractor to sign a release of claims form and is considered administrative in nature. Submission of this information should provide a consistent format that the contractor can use to report their claims information to the GSA contracting officer.

Read Also: Entry Level Government Jobs Colorado