Need Help Finding Canadian Government Funding

Are you uncertain of your eligibility for any of the Canadian government funding programs listed above? The majority of government grants for small businesses are reserved for established SMEs . If you are established, please send us a message or register for an upcoming small business funding event. From here, we can further evaluate your eligibility for specific Canadian government funding programs and help you choose the funds most optimal for your business growth plans.

Education Loan Statement Can Be Used For Claiming Deduction Under Section 80e

Deduction under Section 80E only available for interest paid on education loan. You need to deduct tax while making payment to a non-resident during purchase.

I had taken an education loan for my sons MBA course from a scheduled bank. I have paid back Rs 1 lakh during the current financial year, i.e., 2022-23. When I requested the bank for certificate under Section 80E for the interest paid, the bank authorities told me that interest accrued during the current year is only eligible for tax relief. Is the bank correct?

Answer: One can claim deduction in respect of interest paid on education loan u/s 80E of the Income-tax Act, 1961. The deduction is available only for interest paid and not for any repayment of principal amount. Only the education loans taken by an individual from a bank, a notified financial institution, or any approved charitable institution for higher education are eligible for this deduction. The deduction is available for eight successive years beginning from the year in which you start paying the interest. The loan can be taken by an assessee for the higher education of himself, his spouse or any child. The deduction for interest is available in the year of payment, irrespective of the year to which it relates. Since the bank is unwilling to issue you a certificate, you can obtain the loan statement by giving details of the principal amount paid along with the interest paid. This should allow you to claim the deduction.

Grants Loans And Programs To Benefit Your Small Business

When you know where to look, help for your small business is there for the taking.

There are many grant programs available to small businesses, depending on a variety of qualifying factors.

Times are tough for small business, but help is available, from both the governmentfederal, state or localand the private sector. It may be in the form of a grant, a loan or a leg up competing in a difficult business environment. Heres a breakdown to help you sort through whats available.

Read Also: How Much Does The Government Take Out Of Your Paycheck

Additional Government Business Loans

Finally, although these SBA programs will likely be your top options for government small business loans, its also worth exploring some of the more specialized programs that are available.

There are additional SBA loan programs, designed for very particular purposes, as well as a USDA program that you might consider based on your businesss financing needs.

Lets learn more.

Iiib Economic Development Councils

Economic Development Councils work with businesses to strengthen opportunities in their region. The following links will take you to listings of economic development councils from there, links are provided to individual websites for further funding opportunity research.

* This document was created with the best information available at the time . For additions or corrections please call the Governors Office for Regulatory Innovation and Assistance at 1-800-917-0043 or email . Please visit our website at .

Monday – Friday, 8am – 5pm

Recommended Reading: Government Listing Of Foreclosed Homes

Write And Submit A Grant Proposal

Various government small business grants exist that provide funding for a wide range of problems. Some of these government small business grants are discussed later in this article. Each grant has specific requirements you should ensure that your business can meet these requirements before investing time and money into creating a grant proposal. It often works best to hire a grant proposal writer because writing a grant proposal is a time-consuming and detailed process.

Government Grants For Small Business

There are technically no direct federal government grants for small businesses, only for nonprofit and education institutions. The good news: It is possible for small businesses to ultimately receive funding through those same nonprofits or schools, plus city or state agencies. Weve listed some of the grant options available below.

Read Also: Us Bank Government Travel Card

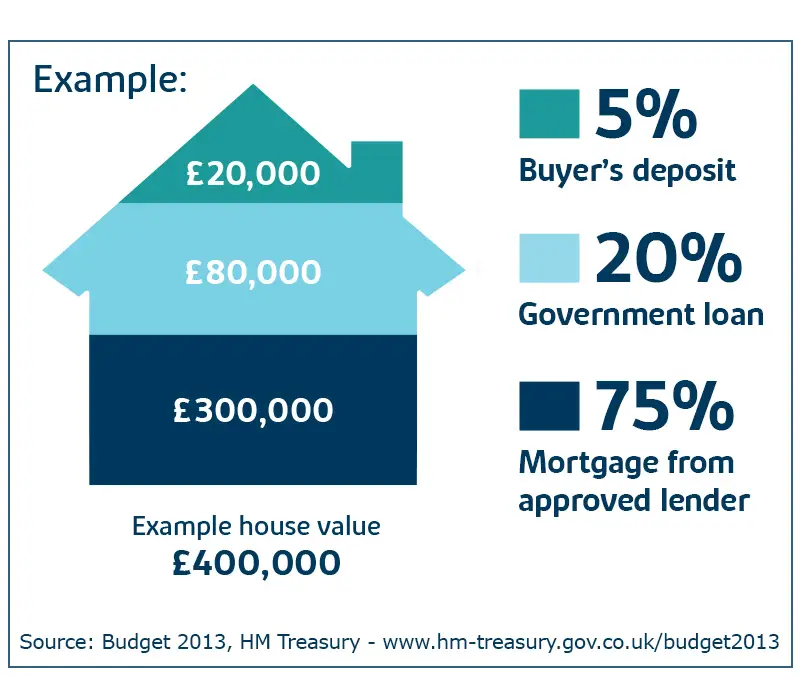

Down Payment Assistance For Buying A New House

Down Payment assistance has become very popular now a days as we all know that the price of lands, the cost of constructions has spiked up. its not easy for everyone to buy a new house with full payment. These down payment assistance help first time home buyer to buy homes with low interest loans. down payment assistance is a state wise programs, so the interest rate may be vary from state to state.

Small Business Grants For Women

Small business grants are available to businesses that need help getting started or growing operations and are typically aimed at helping specific types of businessesincluding those owned by women. In contrast to traditional business loans, small business grants for women do not require repayment, and there arent usually any fees or interest payments required.

In general, grants can be obtained from a range of sources, such as state and local governments, the federal government and corporate organizations. Keep in mind, though, that grants are extremely competitive and the application process can be more rigorous and time-consuming than obtaining a more traditional source of funding.

Consider popular small business grants for women like the Amber Grant and funds offered through the American Association of University Women, Girlboss Foundation or Open Meadows Foundation. Contact your local chamber of commerce to learn about applicable grants in your city or region.

Don’t Miss: How Can I Get A Free Government Phone

Government Hardship Business Grants

There are many grants available by state and federal government which helps small businesses, startups and emerging businesses to grow in their hard time. If you are already in business or planning for a new one government grants for business can help you a lot in the initial phase. What you need to do just research a local charity, government authority, or public and private organizations that help for small business grants.

The USA government Truly believe that New business and startups are compulsory for economic development. New business offers new jobs as well as they contribute to economy tax revenue too. There are many grants available like low-interest loans, Startups expansion programs, skill development training, free counselings.

National Small Industries Corporation

NSIC is an ISO certified Indian Government enterprise under MSMEs. It is working to aid and promote the growth of MSMEs by providing combined support services encircling finance, marketing, technology and other allied services all across the nation. To encourage the growth of MSMEs, NSIC provides various schemes:

Don’t Miss: State And Local Government Jobs

Federal State Marketing Improvement Program

This matching grant program, also known as FSMIP, provides matching funds to State Departments of Agriculture and other appropriate State agencies to assist in exploring new market opportunities for food and agricultural products, and to encourage research and innovation aimed at improving the efficiency and performance of the marketing system.

Do Millionaires Give Away Free Money

Yes, there are a few billionaires who have Given away free money to help lot of people. One of the biggest examples is Bill Gates and Warren Buffett who have donated more than ten billion dollars to charity for a good cause. But still they both have more than 100 billion dollars each. George Soros, is another billionaire who has donated the maximum percentage of his money.

Read Also: Government Of Canada International Scholarships Program

Don’t Miss: Short Term Government Bonds Vanguard

The Final Word On Entrepreneur Loans

Planning properly and ensuring you can meet the obligations of a loan guaranteed by the federal government should be your primary consideration before you accept financing. However, if you can reliably service your debt, you should have little to worry about.

As long as you meet your repayment obligations and provide periodic financial reports as required under your agreement, your banker will be your biggest advocate, Haverty said. But if you fall behind and your loan goes into default, the process could end up being more unpleasant than an audit from the IRS.

Max Freedman and Julie Ritzer Ross contributed to the writing and reporting in this article. Source interviews were conducted for a previous version of this article.

The Streetshares Veteran Small Business Award

The Veteran Small Business Award was created by StreetShares, a small business lending organization that works with veterans and their spouses. Each year, StreetShares offers three grants, with awards ranging from $4,000 to $15,000.

To be eligible for this award, you must be a veteran, reserve, or transitioning active duty member in the United States Armed forces. Gold Star families, or spouses, children, and immediate family of a Military member who died in active duty, are also eligible. Further, you must be 21 and own at least 51% of a business in the early stages of development.

If youre considering this award, youll need to brush up on your video skills. All applicants are required to submit a pitch video. The video must highlight your personal story, your business idea, how your business will positively impact the military community, and how you intend to use the award money.

Also Check: Free Debt Relief Programs Government

Affordable Business Acquisition Financing Through Pursuit

Pursuit offers responsible and affordable options to fund your business ambition. When you start an application online or by phone, well work with you one-on-one to find the program that best fits your financing needs.

Youll have access to the following benefits when funding your business acquisition with Pursuit:

- Loans up to $5 million and beyond

- Requirements designed to put purchasing new franchises and established businesses within reach

- Affordable terms up to 10 years

The Best Options For Government Business Loans

Lets explore your best options for government small business loans.

Ultimately, banks and lenders offer these loans through a variety of SBA loan programs, varying primarily in terms of the loan size and what you can use the loan for.

On the whole, SBA 7 loans, 504/CDC loans, and microloans are the three main government loan programs for small businessesâand therefore, will be your top choices if youre looking for financing.

This being said, however, there are other government business loan programs worth considering depending on the specific needs of your businessâincluding the SBA disaster loan program, Community Advantage program, and more.

Lets learn more about each of these programs.

Recommended Reading: Ap Comparative Government And Politics Online Course

Business Loan From Fullerton India

Get up to Rs. 50 lakhs in business loan from Fullerton India if you intend to purchase machinery, raw materials and equipment to expand your enterprise operations, to invest in fixed assets or even to meet requirements for working capital. Conveniently apply for a business loan online by first checking your eligibility.

- Age Criteria: Minimum 22 years at the time of application and maximum 65 years of loan maturity

- For Individuals: Individuals who have been involved in the present business for a minimum of three years and must possess a total of five years of business experience

- Company Type: Self-employed individuals, proprietors, private limited companies, and partnership firms working in manufacturing, trading, or services.

- Business Turnover: A minimum of Rs. 10 lakhs per year

- Business Vintage: Minimum 2 years in profit

- Business with a Minimal Annual Income of Rs. 2 lakhs per year

Use our business loan EMI calculator to check your monthly instalment before you proceed to make your loan application with Fullerton India.

What Types Of Business Loans Are Available To Business Owners

Term loan

A term loan provides funding for small businesses in a single lump sum. Maximum loan amounts typically exceed those offered by a line of credit or cash advance. Borrowers repay a term loan through a regular schedule of monthly payments. Some term loans, called secured loans, require collateral. Unsecured term loans do not. OnDeck does not require that loans be secured by specific collateral, relying instead on a general lien on the assets of the business.

Line of credit

A business line of credit provides access to a fixed amount of funding that borrowers can tap as needed. Funds are repaid through a regular schedule of payments, with borrowers replenishing their available credit as they repay. A line of credit is a good financing option for recurring expenses it allows borrowers to withdraw within their credit limit without reapplying.

Merchant cash advance

A merchant cash advance provides businesses with lump-sum financing in exchange for a percentage of future sales. Funding is often quick, but interest rates can be much higher than other forms of small business financing.

Equipment loan

Equipment loans are designed for machinery purchases and are offered by many banks and online lenders. Typically, the purchased equipment serves as collateral to secure the loan, which may allow the lenders to offer competitive interest rates. If the borrower defaults, however, the lender can repossess the purchased equipment.

SBA loans

Also Check: Government Housing In San Antonio

What Government Loans Are Available To Entrepreneurs

Government loan programs are available through the federal Small Business Administration and the U.S. Department of Agriculture for qualifying businesses that intend to use the funds for specific purposes.

The main benefit of these loans is they offer small businesses the opportunity to receive financing on terms more favorable than they would otherwise receive with the SBA guarantee, said Lou Haverty, CFA at Financial Analyst Insider. In many cases, small businesses could struggle to find any financing for new and unproven businesses without a partial government guarantee.

Editors note: Looking for an alternative to a traditional bank loan? Fill out the below questionnaire to be connected with vendors that can help.

The SBA is a primary source of financial assistance for entrepreneurs throughout the country. These loans are provided by banks and other lenders such as community development organizations and microlenders, with the federal government guaranteeing a portion of the loan. The SBAs Lender Match tool on the agencys website can help you find a lender.

Government Small Business Loans Overview

As we mentioned earlier, government agencies such as the Small Business Administration partner with banks and other lenders to provide much-needed funding for small business owners across the U.S.

SBA is a government entity whose primary duty is to support and assist small business access timely and adequate financing that guarantees their operations doesnt stall due to cash problems. Apart from their loan programs, SBA offers other services, including training and customized events designed to empower small business owners on the essential skills of running a business successfully.

Read Also: Government Grants To Start A Farm

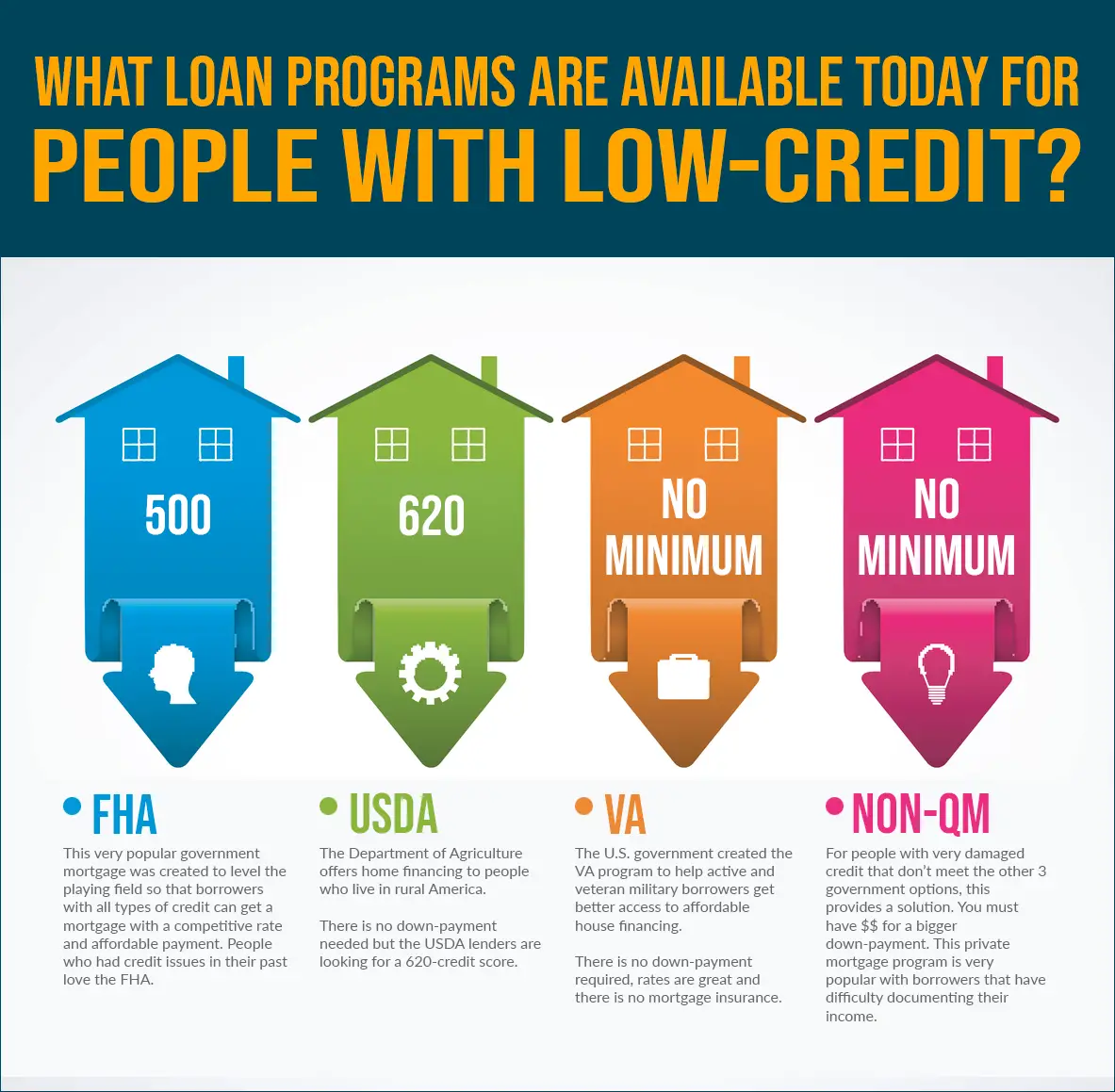

The Bottom Line: A Federal Government Loan May Help You Reach Your Homeownership Goals

Government-backed loans often allow borrowers with lower credit to get the financing they need. Especially if youre a first-time home buyer, a government home loan can give you the chance to become a homeowner.

Get started today with Rocket Mortgage and see what government home loans you may qualify for. You can also give one of our Home Loan Experts a call at 326-6018.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Guide To Government Business Loans

The U.S. government doesnt do much direct lending, but various government-supported programs are designed to offer small businesses access to affordable financing solutions. The most common program is the SBA loan program which offers small businesses long-term and low-interest financing than commercial lenders. Some of the commonly utilized best small business loans include:

- SBA 7 Loans: This loan is ideal for business owners who are looking to fund several small-scale business operations.

- SBA CDC/504 Loans: This product is ideal for business owners looking to finance large projects such as real estate.

- SBA microloans: This product is best for funding the small needs of startups and new businesses.

- SBA Disaster Loans: This loan type is ideal for business owners whose businesses are struggling due to a declared disasters physical or economic damage. If your business is affected by the COVID-19 pandemic, you could qualify for this funding.

- Additional Government Loans: This product is ideal for business owners looking for financing for particular business needs.

Also Check: Which Government Agency Is Responsible For Cyber Security

What Documentation Will I Need To Provide For The Sba 7 Loan

Generally, youll need to include the following documentation with your application package:

-

Agreement to purchase the business

-

Letter of intent to buy the business

-

Business tax returns for the past three years

-

Any outstanding business debt

-

Financial statements, including a balance sheet, profit and loss, and income projection.

The SBA allows applicants to get help filling out the application paperwork, but your lender will be required to submit information about who gave you help to the SBA, so youll need to document who this person is as well.

Can Women Get Business Loans With Bad Credit

Getting a business loan with bad credit can be difficult, but it is possible. That said, having bad credit likely means an applicant wont qualify for the most competitive APRs, and it may be difficult to qualify for the desired loan amount. Likewise, lenders may require borrowers with bad credit to secure a loan with valuable collateral like inventory, equipment or real estate.

Female entrepreneurs with bad credit who do not qualify for a traditional term loan or line of credit should consider alternatives like invoice factoring, merchant cash advances or grants reserved for women-owned businesses.

Read Also: Nato Commercial And Government Entity