Irs’s Withholding Tax Calculator

To help you determine if and/or how much to adjust your 2022 withholding, use the IRS’s Tax Withholding Estimator as soon as you can. Have your most recent pay stub and a copy of your 2021 tax return handy to help estimate your 2022 income. Again, you must act quickly, since we’re almost to the end of the year.

We also recommend using the tax withholding calculator early in 2023 to see if additional adjustments are beneficial going forward. In fact, it’s a good idea to check your withholding every year. And the earlier in the year you do it and make any necessary changes the better. That way your tax withholding will be more even and accurate throughout the year.

But remember that you aren’t required to submit a new W-4 form to your employer unless you’re starting a new job. If your company doesn’t receive a new form from you, it will just continue to withhold taxes based on the most recent W-4 it has on file for you.

What Are Tax Withholdings

The law says your employer must take money out of your paycheck for taxes. You can choose how much money to withhold from or take out of your paycheck. When you have a big change in your life, you might owe more or less money in taxes than before. To have the right amount of money come out of your paycheck for taxes, you change your withholdings.

Where Can I Cash My Paycheck

Many businesses let you cash checks. Sometimes, they charge a fee. You can cash your paycheck at:

- banks and credit unions

- some convenience stores, grocery stores, and other stores

- check-cashing stores

Cashing a paycheck at your bank or credit union is usually free. Sometimes, the bank named on the check might cash a paycheck if you do not have an account.

Businesses charge different fees for cashing a check. Call, visit, or go online to find out what a business charges.

Also Check: Government Records Access And Management Act

A Payroll Tax Withholding Example

Lets say a business has an employee named Bob who is married, has two children and a spouse who also works. How would his federal tax withholding each pay period be determined if he earns $1,000 per week?

First, see if Bobs wages need to be adjusted. Since he isnt claiming any additional income from investments, dividends or retirement and hes chosen the standard deduction, his wages remain $1000.

Second, look at the weekly pay period bracket table on 15-T. For married filing jointly with the Form W-4 Step 2 checkbox withholding option, the tentative withholding amount is $88.

Third, account for tax credits. Bob has two children, so he may get $4000 in tax credits. Divide this number by 52 since hes paid weekly and subtract the result from $88 . The result is $11.08.

Finally, if Bob requested an additional $1000 withheld from his taxes each year on his Form W-4, divide that number by 52. The result is $19.23, which when added to $11.08, equates to a final withholding amount of $30.31 per pay period.

What Is The Percentage Taken Out For Taxes On A Paycheck

Precise percentages vary based on state, but according to the Ventures Scholars Program, four primary taxes are withheld from paychecks: federal income tax, state income tax, social security tax and Medicare tax. According to The Law Dictionary, taxes are withheld on a sliding scale that extracts more income from higher-earning individuals, topping out at 39.6 percent in 2014.

The IRS website provides a calculator that allows employees to determine whether the correct amount of federal income tax is being withheld. Withholding tax is paid out of an employees wages directly from the employer to the IRS and is used to fund social security, Medicare, unemployment compensation and workers compensation. The amount is determined by the W-4 form, which is used by employers to calculate how much to deduct. The IRS recommends that a new W-4 be submitted whenever an employees financial situation changes. The W-4 also allows filers to control to some extent how much is withheld, but the U.S. Tax Center advises that the withholding tax match the actual tax liability as closely as possible. While receiving a large tax refund is enjoyable, tax refunds are interest-free loans provided to the government. Withholding too little results in owing the IRS, who may also charge penalties and interest.

You May Like: Us Government Cars For Sale

How We Make Money

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters.

Where Does All Your Money Go Your Paycheck Explained

Payday! Getting your paycheck is exciting, but it can also be a bit disappointing once you realize how much money youre actually taking home. Why arent you making as much as you expected? Your paycheck stub has all the answers.

Though not all paychecks are alike, there are elements that all employers must include. Lets break it down:

Gross Pay vs. Net Pay

Lets say you are making $35,000 a year and you are paid every two weeks that means you should be taking home $1,346.15 each pay period. But unfortunately, this isnt the case. $1,346.15 is your gross pay, or the total amount youve earned before everything is taken out of your check. Then you are left with your net pay, which is the total amount of money you get to take home.

What accounts for the difference between your gross pay and net pay? A ton of deductions and withholdings.

Federal Income Taxes

When you were first hired, you filled out a W-4 form and claimed the number of tax exemptions you have. This amount tells the federal government how much money to take out of each paycheck to cover your taxes. The more allowances you take the less federal income tax the government will take out of your paycheck.

When it comes time to filing your taxes at the end of each year, the amount already taken out will go towards the total you owe. If too much money is withheld from your paycheck, you receive a refund after you file your tax return. If you havent paid enough, you could end up owing at the end of the year.

Read Also: Federal Government Jobs Memphis Tn

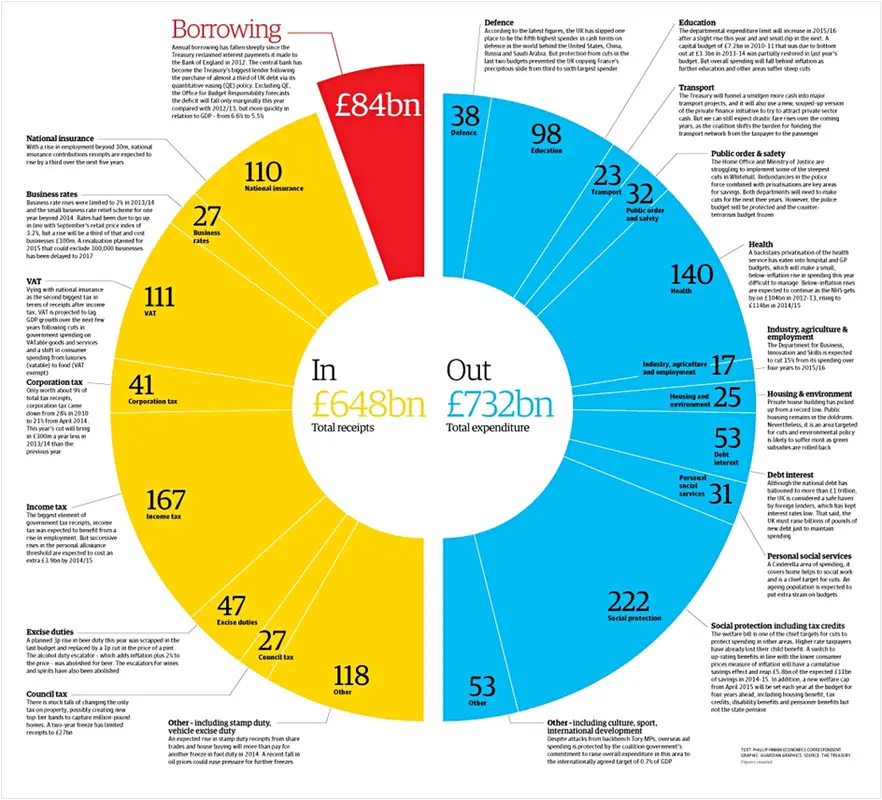

Where Does The Us Government Get Its Money

The US Constitution can be vague at times, but when it comes to taxes, there is little question about the governments power. The Congress, James Madison writes, shall have Power to lay and collect Taxes, Duties, Imposts and Excises. In modern language, the government can tax its citizens, and it does. But just because the government has the power to do something doesnt mean it should. Despite the Constitutions clear mandate that the federal government may tax its citizens, taxes are a very complicated and often problematic part of American life. The US tax code is around 2,600 pages long. And there are additional tens of thousands of pages about the tax code: IRS regulations, revenue rulings, and case law covering court proceedings around the code. But a few fundamental questions can get to the root of how American taxes relate to the US debt.

Recommended Reading: Government Housing Assistance In Arkansas

If You Dont Have Employees

If you run a small business without any employees, youâll still have to remit payroll taxesâfor yourself. This is called self-employment tax and is effectively Medicare plus Social Security for yourself . Learn more in our guide to self-employment taxes.

Payroll taxes when you do have employees gets a little trickier.

You May Like: Am I On A Government Watchlist

What Should You Do With Your Paycheck Stub

Pay stubs are used to verify payment accuracy and may be necessary when settling wage/hour disputes. For this reason, employees may want to save their pay stubs, but arent required to do so. Employers, however, must keep payroll records for the specific lengths of time mandated by federal and state governments.

How Much Federal Taxes Are Taken Out Of Paychecks

Federal income taxes are an unavoidable bother. Uncle Sam will always get its cut of the action, using the IRS to collect whenever people happen to earn. While people who are self-employed may end up with a different situation, the average person with an employer will have taxes withheld from every paycheck. Federal income tax withholding is based on a rough guess from the IRS about what taxes you will owe at the end of the year. If you happen to pay more in taxes than you end up owing, then the money will be returned to you in the form of a tax refund. With this in mind, how much in federal taxes will be taken out of your paycheck? Heres how to figure it out.

Claiming exemptions to reduce tax withholdingWhen you start a new job, youll likely be required to fill out some financial forms. One of those forms will ask you the number of income tax exemptions you happen to have. Income tax withholding exemptions allow you to reduce the amount of tax an employer will take out of your paycheck. You are legally allowed to do this based upon things like dependents and head of household status. This can be dangerous, of course, because it can mean that you end up owing tax at the end of the year. Most people will not be able to claim enough exemptions to reach this level, however.

You May Like: Government Jobs Fort Collins Co

How Much Is Deducted From Social Security For Medicare Part A

For most people, Medicare Part A hospital insurance is premium-free. This doesnt mean it is actually free, because you still have to pay your deductible, co-insurance, and other out-of-pocket costs. However, you will have no monthly premium fees if you qualify.

You are eligible to receive premium-free Part A coverage at age 65 if:

- You or your spouse paid Medicare taxes for ten years or longer

- You already receive Social Security retirement benefits or Railroad Retirement Board benefits

- You are eligible for these benefits but havent yet received them

- You or your spouse had Medicare-covered employment through the government

You can also get premium-free Part A if you are under 65. This will happen if you have received Social Security or Railroad Retirement Board disability benefits for over 24 months, or if you have end-stage renal disease and meet certain other qualifications.

Part A is paid for through income taxes that you pay for while you work. This is why the amount of years that you paid this tax is used to determine how much you pay in premiums.

What Percentage Of My Paycheck Is Withheld For Federal Tax

The federal income tax has seven tax rates for 2020: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent. The amount of federal income tax an employee owes depends on their income level and filing status, for example, whether theyre single or married, or the head of a household.

You May Like: What Is Government Employee Insurance

Pay Stub Deduction Codes What Do They Mean

Below, you will find some of the most common deduction codes that appear on your pay stub. Common pay stub deduction codes include the self-explanatory 401K for retirement savings contributions and 401K ER, which refers to an employers contribution if the employee receives a company match. However, this is by no means an exhaustive list.

Many companies list codes on their paycheck specific to how they do business or the benefits they offer to employees. For example, some businesses may list health insurance as HS while others may call it HI. Unions, savings funds, pensions, organizations and companies all have their own codes too, any of which could appear on your paycheck, depending on your circumstances.

| Code |

|---|

Do I Have To Pay Taxes On My Federal Pension

Pension Income Taxes You will be subject to federal income tax at your regular rate while you receive the money from pension annuities and periodic pension payments. But if you take a direct lump sum payment of your pension instead, you have to pay the total tax due when you file your return for the year you receive the money.

How much of my federal pension is taxable?

In my experience your contributions usually amount to about 2% to 5% of your annual pension income for FERS and about 5% to 10% for CSRS. So that means about 90% to 98% of your FERS or CSRS pension. will be taxed. So most of your FERS or CSRS pension will be taxable.

Recommended Reading: How Do You Qualify For A Free Government Phone

You Are Exempt From Federal Taxes

One more reason why the federal income tax was not withheld from your paycheck might be because you are exempt from paying income taxes altogether. If you are not sure whether that is the case or not, you might want to check with your employers tax settings and see what their status on exemptions is.

That being said, bear in mind that just because you might be exempt from federal income tax, it doesnt mean that you are also exempt from all the other taxable wages. Your W2 will show all of your taxable wages, even if you technically dont have any federal income tax withheld.

Taxes On Pension Income

You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs, 401s, 403s and similar retirement plans, and tax-deferred annuitiesin the year you take the money. The taxes that are due reduce the amount you have left to spend.

You will owe federal income tax at your regular rate as you receive the money from pension annuities and periodic pension payments. But if you take a direct lump-sum payout from your pension instead, you must pay the total tax due when you file your return for the year you receive the money. In either case, your employer will withhold taxes as the payments are made, so at least some of whats due will have been prepaid. If you transfer a lump sum directly to an IRA, taxes will be deferred until you start withdrawing funds.

Smart Tip: Taxes on Pension Income Vary by StateIts a good idea to check the different state tax rules on pension income. Some states do not tax pension payments while others doand that can influence people to consider moving when they retire. States cant tax pension money you earned within their borders if youve moved your legal residence to another state. For instance, if you worked in Minnesota, but now live in Florida, which has no state income tax, you dont owe any Minnesota income tax on the pension you receive from your former employer.

Also Check: Government Grants Anyone Can Get

How Your Paycheck Works: Deductions

Federal income tax and FICA tax withholding are mandatory, so theres no way around them unless your earnings are very low. However, theyre not the only factors that count when calculating your paycheck. There are also deductions to consider.

For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. When you enroll in your companys health plan, you can see the amount that is deducted from each paycheck. If you elect to contribute to a Health Savings Account or Flexible Spending Account to help with medical expenses, those contributions are deducted from your paychecks too.

Also deducted from your paychecks are any pre-tax retirement contributions you make. These are contributions that you make before any taxes are withheld from your paycheck. The most common pre-tax contributions are for retirement accounts such as a 401 or 403. So if you elect to save 10% of your income in your companys 401 plan, 10% of your pay will come out of each paycheck. If you increase your contributions, your paychecks will get smaller. However, making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has grown substantially.

Theres No Income Tax In Your State

If the tax was not withheld from your paycheck, it might also be because your state does not charge income tax. If you live in Alaska, Florida, Nevada, Tennessee, South Dakota, New Hampshire, Washington, Texas, or Wyoming, you will not have to pay income taxes. However, they might charge dividends and interests , so you might want to do a little bit of research on that.

States that do not charge income tax will have their own way of raising revenue for the maintenance of their infrastructure. One common way to do so is sales tax. Florida, for instance, takes a 6% tax on sales, whereas Tennessee takes a 9.55% sales tax. Washington charges a 49.4 cent fuel tax for every gallon of gasoline, which is among the nations highest rates.

So, if you live in one of the states mentioned above and you see that there is no income tax, dont stress yourself out. Youll be paying that tax money one way or another, only that you wont be paying it through federal income tax.

Read Also: Government Land Auctions Washington State

How Much Taxes Are Taken Out Of A $1000 Check

Paycheck Deductions for $1,000 Paycheck For a single taxpayer, a $1,000 biweekly check means an annual gross income of $26,000. If a taxpayer claims one withholding allowance, $4,150 will be withheld per year for federal income taxes. The amount withheld per paycheck is $4,150 divided by 26 paychecks, or $159.62.