What If Im Made Redundant Or My Post Is Terminated Due To Efficiency

If you are 55 or over, been a Scheme member for at least two years, and your employer makes you redundant or you are retired on the grounds of business efficiency under current regulations the pension benefits that you have built up to the date of leaving will become payable immediately, unreduced, and subsequently payable for life. Please note that your Employer will have a policy setting out their stance on the level of compensation that they may offer.

Also, please note the Government will bring forward proposals to tackle exit payments, called the public sector exit cap. The cap will limit the amount of money a public sector employer can pay when an employee leaves their employment. The Government has not confirmed when the exit cap or further reforms will be introduced.

For further information on this matter please contact your Employer.

What Does The Average Retiree Live On Per Month

Average Pension Expenditure on Section. According to the Bureau of Labor Statistics, an American family headed by a person 65 and older spent an average of $ 48,791 a year, or $ 4,065. To see also : Can I retire on $8000 a month?.95 a month, between 2016 and 2020.

How much does the average retiree retire with?

The survey, in general, found that the United States grew its personal savings by 10% from $ 65,900 in 2020 to $ 73,100 in 2021. In addition, the average retirement savings increased by a reasonable 13%, from $ 87,500 to $ 98,800 .

Can I Carry On Working But Gradually Move Into Retirement

It is possible for you to receive all the pension benefits that you have built up to date and continue to work, providing you either reduce the hours you work or move to a post on a lower grade, if you are age 55 or over and have your Employers consent to do so. This is known as flexible retirement.

You should also note that your benefits may be reduced to reflect the early payment .

Don’t Miss: Why Data Governance Is Needed

What Does The Average Canadian Have In Retirement Savings

23. Approximately 32% of Canadians between the ages of 45 and 64 said they had no pension savings. The average Canadian pension savings for 2018 was about $ 184,000. Some 19% of respondents had less than $ 50,000, and 30% had no retirement savings.

What is the average monthly retirement income in Canada?

The average monthly amount paid for new retirement benefits in January 2022 is $ 779.32.

How much does the average person have in savings when they retire?

The survey, in general, found that the United States grew its personal savings by 10% from $ 65,900 in 2020 to $ 73,100 in 2021. In addition, the average retirement savings increased by a reasonable 13%, from $ 87,500 to $ 98,800 .

How Does Government Pension Offset Work

One of the most valuable perks of working for the government is the pension. However, your government pension may reduce or eliminate survivor or disability benefits from Social Security in certain situations due to whats called Government Pension Offset. These unexpected cuts can cause financial concerns when your retirement plan assumed that youd receive both incomes in retirement. In this article, well define what the Government Pension Offset is, how it works and who it affects.

Planning for retirement involves lots of moving parts, and a financial advisor can help you sort through all the pros and cons of your various options.

Recommended Reading: Mcminn County Tn Government Jobs

About The Older Person’s Grant

You can get a grant to see you through your old age. An older person’s grant is paid to people who are 60 years or older. This grant used to be called the old age pension.

How do you know if you qualify?

You must:

- be a South African citizen, permanent resident or refugee

- live in South Africa

- not receive any other social grant for yourself

- not be cared for in a state institution

- not earn more than R86 280 if you are single or R172 560 if married.

- not have assets worth more than 1 227 600 if you are single or R2 455 200 if you are married.

How much will you get?

The maximum amount that you will get is R1 980 per month. If you are older than 75 years, you will get R2 000.

How will you be paid?

The South African Social Security Agency will pay the grant to you through one of the following methods:

- cash at a specific pay point on a particular day

- electronic deposit into your bank or Postbank account

Note: If you are unable to collect the money yourself, you can appoint a procurator at the SASSA office, or give someone power of attorney to collect the grant on your behalf.

When may your grant be reviewed?

When may your grant be suspended?

The following may result in the suspension of your grant:

- when your circumstances change

- the outcome of a review

- if you fail to co-operate when your grant is reviewed

- when you commit fraud or misrepresent yourself

- if there was a mistake when your grant was approved.

When will your grant lapse?

The grant will lapse when you:

Opting To Exchange Part Of Your Pension For A Tax

For every £1 of pension, you wish to give up, you can gain an additional £12 of lump sum limited to 25% of the Capital Value of your pension benefits, as set by the HMRC, which includes your automatic tax-free lump sum based on your membership to 31 March 2008. Remember this is optional and not compulsory. You are also able to give up a lesser amount than the maximum option. The amount of tax-free lump sum you can take from the LGPS may be affected if you exceed the lifetime allowance.

We will ask you for details of any pensions already in payment when you take your pension.

Taking a larger lump sum reduces your pension but does not reduce any survivor pension paid to your spouse, civil partner, eligible cohabiting partner or child after you die.

It is very important that you think carefully about this option before you take your pension. It will not be possible to reverse your decision after your pension has been paid. You may wish to seek Independent Financial Advice on the matter.

You May Like: Free Government Phone Locations In Wichita Kansas

Warning: Net Vs Gross Pension

One of the biggest mistakes that FERS federal employees make when calculating their pension is that they calculate their gross pension and forget to think about their NET pension. Your net pension is the amount of money that you will actually be getting from the government after taxes and all the reductions get taken out.

There are 7 possible reductions to your pension but here is an example with the most common:

As you might imagine, many people are shocked when they see the difference between their Gross pension and their Net pension. But understanding the difference will make a huge difference in your retirement planning.

How Do I Calculate The Value Of A Pension

Updated: by Financial Samurai

If youve got a pension, count yourself as one of the lucky ones. A pension is more valuable than you realize in a low interest rate environment. With a pension, you wont be forced to lower your safe withdrawal rate in retirement like those of use who dont have pensions. This post will help you calculate the value of a pension.

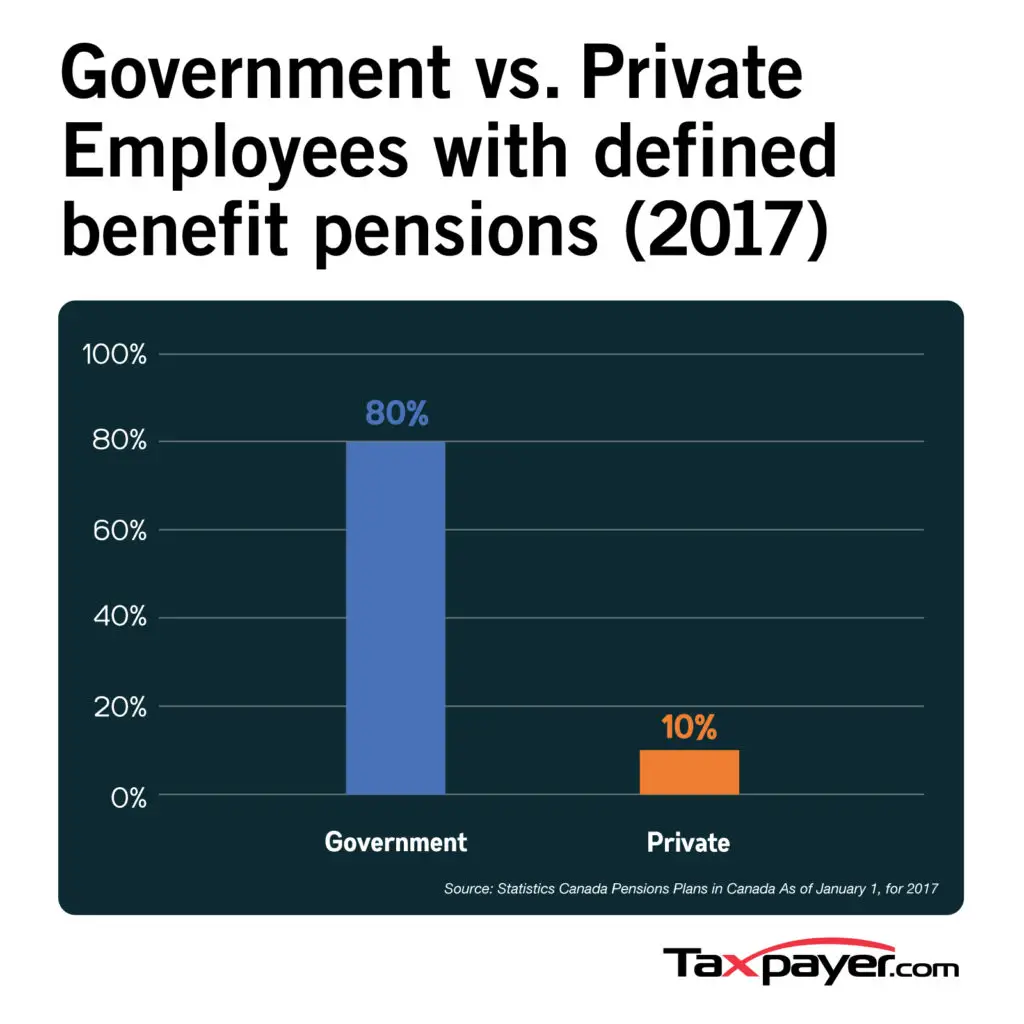

Pensions, also known as Defined Benefit plans, have become rarer as companies force their employees to save for themselves mainly through a 401k, 457, 403b, Roth 401 or IRA. These savings vehicles are also known as Defined Contribution plans.

But as we all know, the maximum amount you can contribute to a 401 or IRA is $20,500 or $6,000, respectively for 2022. Even if you max out your 401k for 33 consecutive years starting today, its unlikely your 401k or IRAs value will match the value of a pension.

Take a look at my latest 401k savings potential chart. After 33 years of maximum contributions, I estimate youll have between $568,000 $1,800,000 in your 401k, depending on performance.

$1,800,000 sounds like a lot, but in 33 years, $1,800,000 will buy just $678,000 worth of goods and services today using a 3% annual inflation rate. However, inflation is currently running at ~7.5%.

Given the power of inflation, to neither max out your 401 nor invest an additional 20%+ of your after-tax income if you dont have a pension is risky. When it comes to your money, its always better to end up with too much than too little.

Recommended Reading: How Do I Get Free Government Internet

How Government Pensions Work

In most industries, employee pensions went out with the stand-alone fax machine and three-button suit, but in government, pension plans are still common. Government retirement systems provide a healthy complement to Social Security and personal investments. These three elements make up the three-legged stool of government retirement.

Tracing Previous Pension Rights

There is currently an estimated £400 million in unclaimed pension savings. People have saved this money for their retirement.

To plan for your retirement, you need to know how much income you will get. This includes income from workplace or personal pension plans and the State Pension.

If you have lost track of a pension, there is a Government service you can use to find contact details for:

- your own workplace or personal pension scheme

- someone elses scheme if you have their permission.

You can access the service through the Pension Tracing Service website.

Remember to keep your pension providers up to date with any change in your home address.

Also Check: Government Housing In San Antonio

How Much Interest Does 2 Million Dollars Earn Per Year

For example, interest on two million dollars is $ 501,845.11 over 7 years with a fixed annuity, which guarantees 3.25% per annum. Find all current fixed annuity rates here.

How much interest does 1 million dollars make a year?

The average savings account rate has been below 1% for a long time. This means that $ 1 million in savings would typically earn much less than $ 10,000 a year in interest.

How many millions do you need to live off the interest?

However, for a more conservative estimate, divide 60,000 by 3%. This gives you a $ 2 million savings goal. If you use a more conservative 1% interest rate , youll need $ 6 million to earn $ 60,000 a year in interest.

Can You Receive Fers And Military Retirement

The best part is that you will be able to apply your active-duty service time to both a guard / reserve pension and FERS pension. Unfortunately, federal law prohibits your military time from counting to an active retirement pension and a FERS retirement pension.

Does military time count towards FERS?

Year of Creditable Service: This is the number of years that count towards your retirement. However unique for the FERS Supplement Calculation years of military service that you repaid for retirement will * not * count in this calculation. However, there are some unique exceptions.

Can a military retiree lose their retirement benefits?

Procedures by military departments may suspend retired pay under the authority of the head of retired pay activity if the pension does not require administrative action on time, or if the pension refuses further payments.

Also Check: Federal Government Truck Driving Jobs

How Much State Pension Are People Getting

The new state pension system was introduced to be fairer and less complex.

Figures from the Department for Work and Pensions now show how much people are getting under the new state pension compared to the old system .

- £153.36 Average payout under the old system

- £164.10 Average payout under the new system

- £166.22 Average nSP payout for men, around £3 less a week than under the old system

- £159.26 Average nSP payout for women, around £18 more a week than under the old system

Certain groups are better off under the new system, whereas some will lose out from the changes.

Can You Cash Out Your Fers Retirement

If you have less than five years of civil service credit, you have 2 options: Leave your money in the retirement fund if you think you can return it to the Federal Government. You can request a refund at any time after the separation.

How do I withdraw my FERS retirement?

If you quit your Federal job and want a refund of your retirement contributions, you can get an application from your staff office, complete it, and return it to them. If you are no longer in the Federal service, you can purchase the appropriate application from our website.

When can you withdraw FERS?

You can request a refund at any time after the separation. Withdrawal of Refund Deductions Complete an application for a refund . If you submit the form within 30 days of separation, return it to the Benefits Office. After 30 days, return it to OPM at the address on the form.

Also Check: Get Your Government Off My Medicare

Who Can Get It

You can claim the Manx State Pension if you reach state pension age after 6 April 2019.

This is the case for men and women born on or after 6 January 1954.

The earliest you can get the State Pension is when you reach state pension age.

If you reached state pension age before 6 April 2019, you’ll get the State retirement pension under what we call the ‘old rules‘ instead.

Youre A Man Born After 5 April 1951

Youll get the new State Pension, introduced in April 2016. The full basic State Pension you can get is £185.15 per week.

You need 35 qualifying years of National Insurance contributions to get the full amount. Youll still get something if you have at least 10 qualifying years – these can be before or after April 2016.

If youve had a workplace, personal or stakeholder pension in the past and been paying reduced National Insurance contributions , your starting amount may be less than the full amount. Contracting out has ended under the new system.

You May Like: How To Bid On Government Contract Jobs

How Does The State Pension Work

The State Pension is paid to people once they reach their State Pension Age and claim it.

If youre reaching State Pension today, or have reached your State Pension since 6 April 2016, it will be based on the new rules. There are transitional rules in place to make sure you dont receive less than you would have under the old system.

If you reached State Pension before 6 April 2016, your State Pension is based on the old rules in existence at that time.

How Much State Pension Will I Get If I Qualified On Or After 6 April 2016

If you reach state pension age on or after 6 April 2016, the starting point for calculating what you get is the full level of the new state pension of £185.15 in 2022-23.

But you may get more or less than this.

- If you have made full National Insurance payments, building up additional state pension, youre likely to get more.

- If you contracted out and paid reduced National Insurance contributions for several years, youre likely to get less.

Youll get whichever is higher – the amount you would have got on the last day of the old system, or the amount you would get had the new system been in place over the whole of your working life.

Government estimates show that only around half of those retiring over the next year will qualify for the full state pension.

Don’t Miss: Fidelity Government Money Market K6

What Is The Highest Possible Monthly Social Security Payment

The maximum number of people who apply for Social Security 2022 benefits can get a month:

- $ 2,364 per person 62.

- $ 3,345 per person filing full retirement age .

Is there really a $16728 Social Security bonus?

$ 16,728 Social Security Allowance Most pensioners completely forget: If you are like the American people, you are a few years behind your retirement savings. But a few things known as âSocial Security secretsâ can help ensure you increase your retirement income.

How much Social Security will I get if I make $75000 a year?

If you earn $ 75,000 a year, you can expect to earn $ 2,358 a month â or about $ 28,300 a year â from Social Security.

Example : Police Officer Retiring After 25 Years Of Service

Here is the example again of how to calculate the value of a pension with some commentary after.

Average income over the last four years: $90,000

Annual pension: $67,500

A reasonable rate of return divisor: 2.55%

Percentage probability of pension being paid until death: 95%

Value of pension = X 0.95 = $2,514,706

Well how about that! After 30 years of service, this police officer will have a pension worth roughly $2,514,706 on top of whatever other assets he has accumulated. Not bad for someone who made a decent, but unspectacular $90,000 year for the last four years of his career.

Lets say this police officer joined the force at age 20. Hes still young enough to start another career making additional money on top of his $60,000 pension. Talk about the perfect early retirement plan to pursue your passions without fear.

Also Check: Data Lake Governance Best Practices

State Benefits During Retirement

As well as the State Pension you could qualify for other benefits. Some of them depend on your age, others on your income. Together they can go a long way towards meeting the cost of living.

Health benefits

- free NHS prescriptions for over 60s

- free NHS eye test for over 60s

- winter fuel allowance, currently only for those born before 5 August 1953.

Plus, if you already receive benefits such as Pension Credit, you could get more support towards your health costs.