Can Student Loans Be Discharged In Bankruptcy

Except in rare situations, bankruptcy law states that neither federal loans nor private student loans are eligible for a bankruptcy discharge. To discharge a student loan in bankruptcy, you must file an adversarial proceeding . An AP is a lawsuit filed within the bankruptcy court, after a bankruptcy case has already been filed. APs can result in full trials before the bankruptcy judge. APs are very different from normal bankruptcy proceedings.

To file an AP, you may need a bankruptcy attorney that is experienced and skilled in litigation. Many bankruptcy attorneys only want to file straightforward bankruptcies and rarely file APs. You need to be careful in choosing an attorney if you’re going to try to discharge a student loan. Ask any prospective attorney if they have filed APs in the past. Even if you file an AP, you will only be successful in securing a discharge for a student loan if you pass the Brunner Test.

What Are Private Student Loans

Private student loans are made to students by nonfederal lenders such as banks, credit unions, nonprofits, or schools themselves. Like federal student loans, private student loans cover expenses related to school.

The major difference between federal and private student loans is that private student loans are issued by private lenders who set the terms for their loans, so terms may vary from one lender to another. Most private lenders are for-profit lenders, meaning they loan money with the purpose of making a profit from interest and other charges on the loan. However, some nonprofit private lenders do exist.

Most private lenders are for-profit lenders, meaning they loan money with the purpose of making a profit from interest and other charges on the loan.

Can You Transfer Private Student Loans To Federal Loans

Since private loans dont offer as many benefits, you may wish to transfer private student loans to federal loans. But private loans are entirely separate from federal loans. Once your debt is in a private lenders hands, it stays that way.

But some private lenders may offer similar benefits to federal loan programs. Each lender is different, so before taking out a private student loan, be sure to compare lenders and their different repayment plans to see who offers the most generous terms.

Don’t Miss: Rtc Bus Driver Salary Las Vegas

Getting Rid Of Student Loans

Maybe youve already taken out student loans and theyre stealing your peace of mind. Youre not alone. Most of us learn financial lessons the hard wayor as we like to put it: We pay the stupid tax. Its the price of admission to a new and better way of taking control of your money.

Getting out of student loan debt isnt as easy as getting into it, but the payoff is way better. To get started, check out Anthony ONeals 64-page Quick Read, Destroy Your Student Loan Debt. Hes going to teach you how to budget, create an emergency fund, and accelerate your debt snowball to pay off student loans faster.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Student Loan Repayment With Private Lenders What If You Cannot Pay

Federal student loans include many provisions to help borrowers repay their loans. These features include income-based repayment plans, loan forgiveness for work in certain jobs, as well as opportunities for forbearance, and deferment. Private student loans do not generally provide these kinds of relief. Private student loans operate like any other loans from a bank or other financial institution. If you can’t pay on time, the private institutions will engage in collection activities against you.

Note that the Coronavirus Aid, Relief, and Economic Security Act suspends payments for federal student loans until September 30, 2020. Unfortunately, the CARES Act doesn’t apply to private student loans. Some private lenders have created their own internal programs that can help to make your student loan payments easier to manage. However, these programs are not required by law as with federally backed student loans.

Recommended Reading: How Do I Get A Grant To Start A Trucking Company

Stick To A Standard Repayment Plan

While it may be tempting to switch repayment plans to get a lower monthly payment, try to stick to a Standard Repayment Plan if you can. Income-driven repayment or extended repayment plans can add to your overall loan cost.

By lowering the payment, were extending the term and adding to interest, says Streeter.

Stick to a budget and look for expenses that you can eliminate to make your student loan payments more manageable so you can stay on schedule with a 10-year repayment term.

How To Apply For Student Loans

The following are general tips to consider before applying for student loans, whether federal or private.

1. Calculate your financial needs

Consider your schools cost of attendance and then factor in extracurricular living expenses.

If youre considering private loans, take the time to evaluate your credit and whether you will need a cosigner.

Private lenders base interest rates on your credit score, income and employment history. Having bad credit can keep you from getting the best rates or even from getting approved at all. If you have a cosigner, lenders will consider their credit for approval as well.

If you need to improve your credit before applying for a private student loan, start with our guide or check out our best credit repair companies if you don’t want to DIY it

2. Look into federal loans

We recommend you consider federal loans first, as they have several advantages over private loans.

If you need to take out a private student loan, keep in mind that each lender offers different terms, rates and benefits.

Shop around and compare fees and from multiple lenders before making a decision.

3. Seek expert help

Read expert advice from sources like the Consumer Financial Protection Bureau and CollegeBoard before you apply for private student loans. There may be other options available to you, such as grants and scholarships.

4. Choose the right lender for you

Student loan application checklist

To apply for federal student loans you will need:

You May Like: Polk County Fl Forclosure

Can I Discharge A Private Student Loan In Bankruptcy

Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

Private student loans are loans extended by private lenders that are not backed by the federal government. This article will cover the limited relief methods available for private student loans. The article will also discuss dischargeability challenges in a bankruptcy filing.

Written byAttorney John Coble.

Private student loans are loans extended by private lenders that are not backed by the federal government. These loans are only to be used for qualified educational expenses. Private student loans don’t have many of the relief provisions allowed for by federal student loans. There are rarely any income-based repayments, forbearances, and deferments made available when debtors repay these loans. This article will cover the limited relief methods available for private student loans. The article will also discuss dischargeability challenges in a bankruptcy filing.

How Student Loans Are Different Than Other Types Of Loans

Be sure to understand the difference between private student loans and personal loans. They sound similar, but there are important distinctions:

- Private student loans are for education, while personal loans can be used for things like consolidating credit card debt, making home improvements, or paying for a wedding. Some personal loans explicitly state they should not be used for post-secondary education or student loan debt.

- In general, private student loans have lower interest rates than personal loans. They can also offer the choice of a fixed or variable interest rate. A personal loan usually only offers a fixed interest rate, which can impact the amount of your payment.

- Private student loan funds are usually disbursed directly to your schools financial aid office. Personal loan funds are deposited directly into the borrowers bank account.

- Consider consulting with a tax and/or financial advisor to make sure you fully understand the differences.

Recommended Reading: Grants For Homeschooling Parents

What’s The Difference Between A Fixed Rate And A Variable Rate

Importantly, many private lenders set minimum monthly payments that are not high enough to cover a loan’s monthly interest charges, so making minimum monthly payments on a private student loan may not be enough to pay it off. In the case of federal student loans, each monthly payment includes money toward the principle and the interest for that loan.

Few Options For Relief For Student Borrowers

Student borrowers with private loans from for-profit schools have very few, if any, options for relief. Most private student loans have high interest rates, no automatic forbearances or income driven plans. Students are at the mercy of their lenders to provide payment reductions or forbearances.

Student borrowers are locked into contracts with private loan lenders, often including mandatory arbitration clauses, which are unfair and favor schools.

Private student loans have many negative consequences for student borrowers. Student borrowers have ruined credit, cannot buy homes or cars, cannot get access to credit cards and cannot pursue their education further. These loans have impacted their personal lives and relationships and cause a huge amount of stress.

Although not impossible, it is difficult to get any student loans, including private loans discharged in a personal bankruptcy, where students must prove a very high bar of undue hardship. Despite widespread support, even from those in the industry, Congress has still not restored bankruptcy rights to student borrowers. In contrast, for-profit schools are allowed to file for bankruptcy and walk away fairly unscathed, leaving in their wake students with mounting, bogus debt and useless degrees.

Also Check: Las Vegas Rtc Jobs

Are Sallie Mae Loans Better Than Federal Student Loans

In general, federal loans are the best first choice for student borrowers. Federal student loans offer numerous benefits that private loans do not. Youll generally want to complete the Free Application for Federal Student Aid and review federal funding options before applying for any type of private student loan Sallie Mae loans included.

However, private student loans, like those offered by Sallie Mae, do have their place. In some cases, federal student aid, grants, scholarships, work-study programs and savings might not be enough to cover educational expenses. In these situations, private student loans may provide you with another way to pay for college.

If you do need to take out private student loans, Sallie Mae is a lender worth considering. It offers loans for a variety of needs, including undergrad, MBA school, medical school, dental school and law school. Its loans also feature 100 percent coverage, so you can find funding for all of your certified school expenses.

With that said, its always best to compare a few lenders before committing. All lenders evaluate income and credit score differently, so its possible that another lender could give you lower interest rates or more favorable terms.

The Problem With Government

Millennials are the most educated generation in American history, but many college graduates have tens of thousands of dollars in debt to go along with their degrees. Young Americans had it drilled into their heads during high school that their best shotperhaps their only shotat achieving success in life was to have a college diploma.

Secured financing of student loans resulted in a surge of students applying for college.

This fueled demand for the higher education business, where existing universities and colleges expanded their academic programs in the arts and humanities to suit students not interested in math and sciences, and it also led to many private universities popping up to meet the demands of students who either could not afford the tuition or could not meet the admission criteria of the existing colleges. In 1980, there were 3,231 higher education institutions in the United States. By 2016, that number increased by more than one-third to 4,360.

The governments backing of student loans has caused the price of higher education to artificially rise the demand would not be so high if college were not a financially viable option for some. Young people have been led to believe that a diploma is the ticket to the American dream, but thats not the case for many Americans.

There needs to be a major cultural shift away from the belief that college is a one-size-fits-all requirement for success.

Also Check: City Of Las Vegas Government Jobs

What Are Federal Student Loans

Federal student loans are made to students by the U.S. Department of Education. These loans are intended to cover the cost of tuition and fees, books, housing, food, and transportation. Eligible students can apply for federal student loans by completing the Free Application for Federal Student Aid, or FAFSA, which determines the types of financial assistance they qualify for.

Income And Credit Qualifications

Approval for a federal subsidized student loan is decided in part by the borrower’s financial need, which is determined by your family income as reported on the FAFSA. Borrowers with a greater financial need are more likely to be able to borrow a subsidized loan. Unsubsidized federal student loans, however, are offered regardless of your family income.

With the exception of PLUS loans and Parent PLUS loans, federal student loans don’t require a credit check, so having minor credit issues won’t prevent you from being approved for a loan. Private lenders, on the other hand, consider in weighing your loan application. If you have poor credit or don’t have much of a credit history, see if your parents can cosign the loan. If they have good credit, their signature can tip the scales in your favor. Just keep in mind that any missed payments on a cosigned loan will be reported to the parent’s credit report as well as the student’s.

Also Check: Entry Level Government Jobs Colorado

Paying Off Federal Loans Vs Private Loans

Theres no definite answer when it comes to which can be paid off faster, federal student loans or private student loans. It depends on the amount of your loans, how much your payments are, your interest rate, and how much money youre making after school:

- How much is your monthly student loan payment?

- Did you choose a repayment plan where you make payments during school, or did you have a grace period after graduation?

- Is there a cosigner on the loan? Are they helping with payments?

- Are you keeping up with your payments and paying interest that accrues before it capitalizes ?

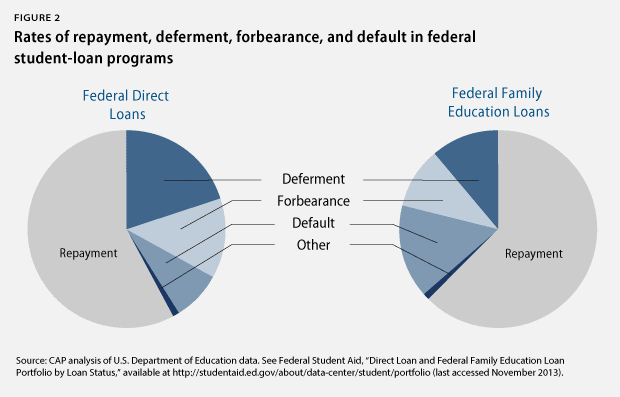

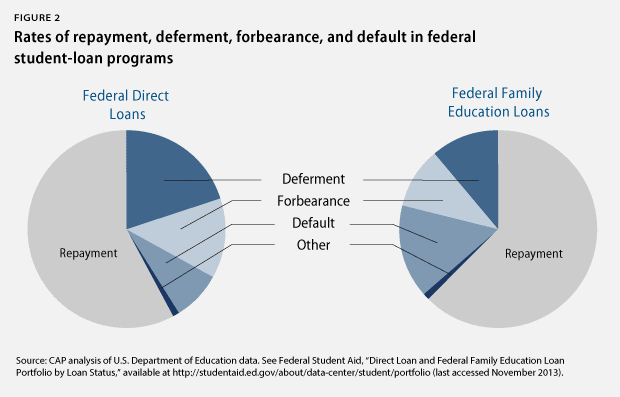

The Federally Guaranteed Student Loan Program Ended June 30 2010 But Many People Are Still Paying On Guaranteed Loans Issued Before Then

Many former students have federally guaranteed student loans. These loans are different from private student loans that the government doesn’t guarantee, and from loans issued directly to the student by the federal government . As of June 30, 2010, Congress stopped the guaranteed student loan program for newly issued loans. But many people are still paying on their federally guaranteed student loans that were issued before June 30, 2010, so they’ll be around for a while.

Tax-Free Student Loan Forgiveness Through 2025

The American Rescue Plan Act of 2021, which President Joe Biden signed into law on March 11, 2021, includes a provision exempting all student loan forgiveness after December 31, 2020, and before January 1, 2026, from federal taxation.

Federal laws generally treat any forgiven student loan debt as a taxable event for the borrower unless they were forgiven for specific reasons, like the death or disability of the borrower . The American Rescue Plan Act makes student debt forgiveness tax-free until January 1, 2026. The tax exemption under this law applies to direct federal student loans, Federal Family Education Loans , and private student loans.

Read Also: Government Grants To Start Trucking Business

What Is A Federal Student Loan

Federal student loans are funded by the U.S. Department of Education for borrowers to put toward college or career school. The federal governments student loan program is called the William D. Ford Direct Loan Program, or Direct Loan for short.

In order to be eligible for a student loan, you have to fill out the FAFSA every year. If youre a dependent student, meaning someone else claims you on their taxes, then the person who claims you must also fill out the FAFSA.

This application lets the government know about your financial situation by asking you to report things like savings and checking account balances, investments, untaxed income like child support and more. Theyll use this information to determine what kind of aid youre eligible for, including loans, grants and work study programs.

Most federal student loans dont require a credit check. Why? Because so many people applying for federal student loans are incoming college freshmen or college-aged students with little or no credit to report.

You can take out a maximum of $12,500 in federal student loans annually, and not more than $57,500 total. For graduate and professional students, those limits go up to $20,500 annually and $138,500 total.5

Private Student Loan Lenders Should Take Note Of Recent Ruling In Bankruptcy Case

Until recently, few people have succeeded in shedding student loan debt through bankruptcy. Courts have required the person to prove that paying back the debt imposed undue hardship, a task that has proven insurmountable in most cases. However, a notable change recently occurred in court that may open the door for certain student loan borrowers to obtain relief from educational debt, and private lenders should take note.

A recent judicial opinion deemed that some student loans may be dischargeable in bankruptcy. In Homadian v. Sallie Mae, the United States Court of Appeals for the Second Circuit affirmed a federal courts decision that some private student loans are not expressly exempt from discharge in Chapter 7 bankruptcy.

Non-dischargable student loans

Student loan debt that courts view as non-dischargable include:

- Loans backed by the government or a nonprofit

- Obligations to repay funds received as an educational benefit, scholarship, or stipend and

- Private student loans that meet IRS guidelines that may make them tax deductible.

In the case, an alumnus from Emerson College sought to eliminate, through bankruptcy proceedings, $12,567 in private student debt that he borrowed to fund his education. The students lender, Navient Solutions, LLC, argued the students debt should be treated as an obligation to repay funds as an educational benefit.

The ruling does not apply to government-funded or backed loans.

Help is available

You May Like: Government Jobs In Las Vegas Nevada