Who Is Eligible For The Downpayment Toward Equity Act Of 2021

The Downpayment Toward Equity Act is a bill in Congress. Bills aren’t law, and bills change before they’re passed into law. Therefore, when we discuss eligibility requirements, we have to remember that the rules as they’re written today will be different from when the bill is passed into law.

As of today, eligible home buyers must meet all of the following standards:

Manufactured And Mobile Homes

Manufactured housing is some of the most affordable around. Homes on approved foundations and taxed as real estate can be financed with many mainstream mortgage programs.

Many programs require slightly higher down payments or more restrictive terms for manufactured homes.

HomeReady, for example, increases the minimum down payment from 3% to 5% if you finance a manufactured home.

Mobile homes that are not classified as real estate can be purchased with personal loans like FHAs Title 2 program. These are not mortgages, because the homes are not considered real estate.

Down Payment Assistance Programs: How To Find Help To Buy A Home

A variety of down payment assistance and homeownership programs are out there to help first-time homebuyers.

While theres no question that one of the biggest challenges first-time homebuyers face is to accumulate the funds for a down payment, the reality is that would-be buyers often overestimate the amount of money theyll need and underestimate their ability to qualify for down payment assistance programs.

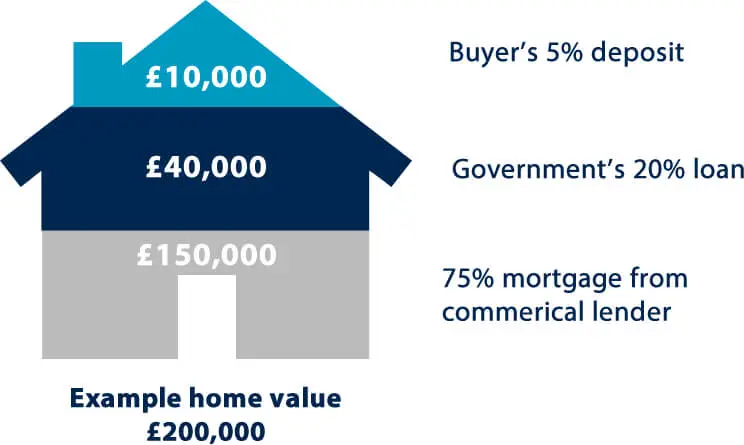

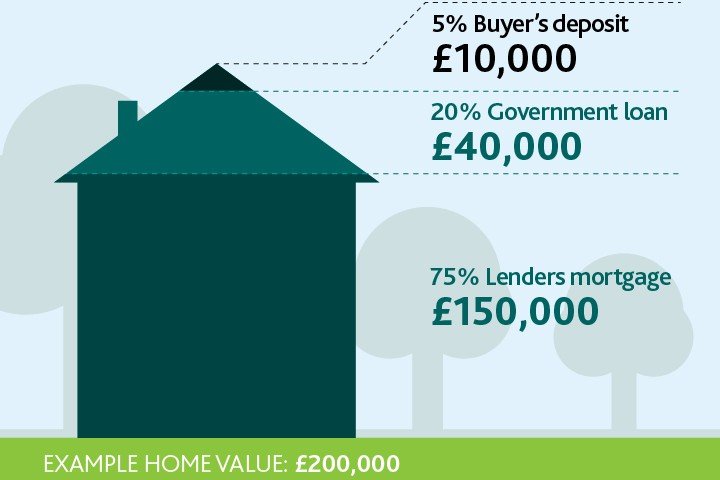

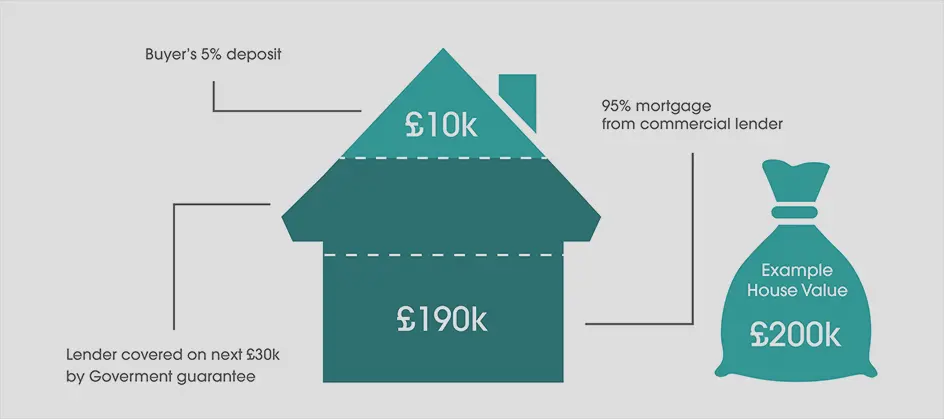

While plenty of potential buyers believe that you need at least 20 percent down to qualify for home financing, this isnt always true. On average, new home buyers put down about 7 percent. Federal Housing Administration loans require a down payment of just 3.5 percent, and Freddie Mac loans have options for buyers to put down as little as 3 percent.

Even with a lower down payment, youll need some cash to buy a home regardless of whether youre opting for a newly built or used home. The median sales price for a newly built home sits around $329,000. This means youll need a down payment of $11,515 for a 3.5 percent down payment $16,450 for a 5 percent down payment or $32,900 for a 10 percent down payment.

The good news: There are more than 2,000 down payment assistance programs available across the country.

Recommended Reading: How To Buy Short Term Government Bonds

How Can The Government Help Me Buy A Home

Government mortgage programs to support Low income Families to acquire a home are of great help for those sectors that do not have enough economic assets to cover the expenses of a property on their own.

A home on their own land is what the Infonavit loan program is geared towards mainly to married couples and couples in a relationship. A commitment to finance is established through registering the land in the public property registry and determining the loan amount based on a quote generated directly from creditors salary, combined with savings accumulated in the housing subaccount.

Co-Housing is a program that provides government support to mainly low-income families and vulnerable groups . Providing various types of support programs through which the applicant can buy a home.

In this sense, some of the alternatives for financing a house are:

- Home purchase Program allows applicants to purchase a home that has already been built, either for use or brand new.

- Lease with option to purchase By choosing to lease with option to purchase, the applicant can acquire a home that is subject to periodic rent payments. A lease contract will establish the conditions of sale, as well as the total price and cancellation period of the property.

- New housing completed this program focuses on financing the construction of housing which meets the requirements for basic services, structural security, private areas, common areas, and common facilities.

How Can You Apply

Research what programs are available in your area, if any. HUD has a list of local homebuying programs by state. Check with your city and county to see if they offer any loans or grant programs. Search their websites for information on how to apply. Reach out to them via email or phone for specific answers you cant find online. Make sure your mortgage lender works with the program.

Don’t Miss: Government Funding For Internet High Speed

What Is $5000 First

The $5000 first time home buyer grant is a helpful grant to cover the cost of your down payment, but how this work? This grant is also known as matched saving program, that mean if you deposit the $5000 amount with your bank, community organization or with any of the government agency the government will additionally deposit $5000 in you account that will reduce the hurdle of your down payment as you can use now $10000.

Who Can Get Down Payment Assistance

Most down payment assistance programs are geared to first-time home buyers. But more than a third, 38%, of homeownership programs are open to eligible repeat buyers, according to Down Payment Resource, a company that tracks more than 2,000 such programs, including those that offer down payment or closing cost assistance.

Even if a program has a first-time home buyer requirement, dont count yourself out just because you’ve previously owned a home. The programs typically define a first-time buyer as one who hasnt owned a home for the past three years.

Some local programs target certain groups, such as teachers, police officers, emergency responders or city employees.

Requirements for down payment assistance programs vary, but typically you must:

Don’t Miss: Government Loans For Working Parents

What’s The Difference Between A Loan And A Grant For My Home

You’ll have to pay back a home loan over a specified period of time, but a grant is essentially a gift that you don’t have to repay. You may have to meet certain ongoing requirements to qualify for your grant, but repayment isn’t one of them. Most grants only fund a portion of your home purchase, so you will probably still need a loan even if you qualify for a grant.

Figure Out Your Budget

Being honest with yourself, your real estate agent and your mortgage lender is key. You dont want to wind up with a house you cant afford. Do a thorough accounting of your own finances, and figure out how much youll really be able to lay out every month. Make sure to factor in maintenance costs and leave room for unexpected emergencies.

Don’t Miss: 9 000 Grant From Government

Consider These With First

Before you apply to the first-time buyer program, It is essential that you meet all requirements and are eligible. Many government and non-profit programs consider the first-time buyer people who have not owned their home for three years. This applies to investors who own rental properties or investment properties, regardless of whether they are their primary residence. Some government-backed programs USDA loans or FHA loans. You will require that the property meets certain standards before it qualifies.. If you are eligible for a government program, income restrictions may apply. It is a very important decision to buy a house.

In other words: You should look for a property you can afford. This includes maintenance costs and any other emergency costs.. Once you have a realistic budget, it is time to start thinking about what you can afford. Ask a reputable lender if they offer and know about first-time buyers programs These can help you save thousands over the long term.

Homeready And Home Possible Mortgages

Fannie Maes HomeReady program and the Home Possible loan from Freddie Mac feature low down payment requirements.

You only need a down payment of 3% of the homes purchase price, and there is no minimum required contribution from the borrower. That means the money can come from a gift, grant, or loan from an acceptable source.

Even better, the home seller is allowed to pay closing costs worth up to three percent of the purchase price. Instead of negotiating a lower sales price, try asking the seller to cover your closing costs.

Private mortgage insurance may also be discounted for these low-income home loans. Youre likely to get a lower PMI rate than borrowers with standard conventional mortgages, which could save you a lot of money month to month.

Finally, Home Possible and HomeReady might make special allowances for applicants with low income.

For instance, Fannie Maes HomeReady program lets you add income from a roommate or renter on your mortgage application even if theyre not on the loan. This can help boost your qualifying income and make it easier to get financing.

You might qualify for HomeReady or Home Possible if your household income is below local income limits and your have a credit score of at least 620.

Don’t Miss: Government Assistance Cell Phone Programs

Seal The Deal At Closing

Once your offer is accepted and an inspection is completed, youre on your way to closing. Youll have to get updated pay stubs and other financial paperwork just before closing to prove your employment status hasnt changed and that youll be able to make your mortgage payments. Within 24 hours of closing, youll do a final walk-through of the property to make sure repairs, if any, were made and that the home is vacant.

At the closing table, youll sign a lot of paperwork to finalize the loan and transfer ownership of the home from the sellers name to yours. Youll also be required to bring a cashiers check made out to the escrow company, or wire closing funds to the company. Dont forget to bring your identification, too.

After signing all of the closing documents, youll be handed the keys to your new home, and youll officially be a first-time homeowner.

Fannie Mae Standard 97% Ltv Loan

Fannie Mae, one of the two largest agencies that buy and sell mortgages, offers a conventional homebuying program called the Standard 97% LTV loan through approved lenders. LTV is short for loan-to-value ratio, which is the percentage of a homes purchase price being financed by a mortgage. A maximum 97% LTV ratio is allowed under this program, which means youd only need a 3% down payment to cover the rest.

You may be eligible if:

- You or a co-borrower are a first-time homebuyer

- One borrower has completed a homeownership education course

- All borrowers have a minimum 620-720 credit score, depending on your debt-to-income ratio and down payment contribution

Don’t Miss: Us Federal Government Registration Sam System For Award Management

Help Only Comes To Those Who Ask For It

Now that you know about these homeownership programs, be sure to ask your Realtor, real estate agent, or housing authority about those that might apply to you.

Its sometimes possible for people to buy a house with low income and pay nothing out of pocket.

Between down payment assistance, concessions from sellers, and other programs like Community Seconds, you could buy a home with very little money saved up, as long as your income and credit fall within the program guidelines.

Fannie Mae Or Freddie Mac

- Conventional loans backed by Fannie Mae or Freddie Mac, which require only 3 percent down

- Best for: Borrowers with strong credit but a minimal down payment

The government-sponsored enterprises Fannie Mae and Freddie Mac set borrowing guidelines for loans theyre willing to buy from conventional lenders on the secondary mortgage market.

Both programs require a minimum 3 percent down payment. To qualify, homebuyers will need a minimum credit score of 620 and a relatively unblemished financial and credit history. Fannie Mae accepts a debt-to-income ratio as high as 50 percent in some cases.

Youll need to pay for private mortgage insurance, or PMI, if youre putting less than 20 percent down, but you can get it cancelled once your loan-to-value ratio drops below 80 percent.

You May Like: Government Jobs That Train You

Home Purchase Assistance Program

The Home Purchase Assistance program provides interest-free loans and closing cost assistance to qualified applicants to purchase single family houses, condominiums, or cooperative units in the District. The loan amount is based on a combination of factors, including income, household size, and the amount of assets that each applicant must commit toward a propertys purchase. The loan is subordinate to a private first trust mortgage.

Eligible applicants can receive a maximum of $80,000 in gap financing assistance and an additional $4,000 in closing cost assistance. The HPAP loan for borrowers with incomes below 80 percent of the area median income is deferred until the property is sold, refinanced to take out equity, or is no longer their primary residence. Moderate-income borrowers who earn between 80 percent and 110 percent AMI will have payments deferred for five years with a 40 year principal-only repayment period.

The maximum first trust loan amount cannot exceed $510,400, the conventional conforming loan limit.

Areas of Interest:

Native American Direct Loan

Since 1992, the Native American Veteran Direct Loan program has helped Native American veterans and their spouses buy homes on federal trust lands. The VA serves as the lender.

If youre eligible, you wont be required to make a down payment or pay for private mortgage insurance .

This first-time homebuyer loan also offers low closing costs and a 30-year fixed-rate mortgage.

You May Like: New Government Agency For Cyber Security

Government First Time Home Buyer Programs

To encourage people to become homeowners, the government offers grants and loans for first-time homebuyers. An example of one of these programs is a loan program for qualified buyers, typically those with good credit scores and limited income. A program for first-time homebuyers can benefit the homeowner as well as the local government as they can help stimulate the economy. There are three zones. Some cities and counties have already allocated funds to these programs and want to use them. These programs help provide stability to communities, and local governments could lose unused funds.

These programs could benefit you in a number of ways:

- Government Grants: Some regions offer cash to help with home-related expenses, such as down payments or closing costs.

- Closing cost assistance: Some loans cap the amount a borrower is responsible for.

- Deferred payments: The owner of certain loans will not be required to pay back the loan until they sell or pay off the mortgage.

- Interest Savings: Some organizations provide borrowers with reduced interest loans or pay or subsidize interest.

- Loan forgiveness: Borrowers who stay in their homes for a certain period of time will have some of their debts forgiven.

- Down Payment Assistance: In some cases, homebuyers are permitted to make a minimal down payment, or none at all.

List Of 11 Programs That Help People With Disabilities Buy Homes

I was recently asked this question. Are there any programs that can help me buy my first home. I have a disability and need help with this hold process. Can you please help me find someone that might specialize in this area to help me and my family. Thank you.

Well, ok. Kind of beyond the scope of what takes place in an IEP meeting, but Ill take a stab at it. What I found was mostly federal programs and federal information, which should be applicable for New Jersey . You may also want to contact your local Arc or other agency that helps people with disabilities. They may know about some local programs. So if you are an adult living with a disability and you are trying to purchase a home, here are some programs that may help you.

Please note, I didnt research making a home accessible. Thats a different post for a different day. Sometimes grants and other programs are available to make a house accessible, which is different from buying a home.

Please check out my list of Federal Agencies that assist people with disabilities which includes a list of all 50 Protection and Advocacy groups. If you feel you are being discriminated against, you may need their assistance.

Recommended Reading: Government Employees Insurance Company Inc

Two Home Buyer Programs: Which Is Right For You

TSAHCs mortgage loans with down payment assistance are offered through the following programs. You dont have to be a first-time home buyer to use either program!

Homes for Texas Heroes Program

If youre in a hero profession, this is the home loan program for you. Hero professions include:

- Professional educators, which includes the following full-time positions in a public school district: school teachers, teacher aides, school librarians, school counselors, and school nurses

- Police officers and public security officers

- Firefighters and EMS personnel

- Correction officers and juvenile corrections officers

- Nursing faculty and allied health faculty

Home Sweet Texas Home Loan Program

If you dont qualify under one of the professions listed above, this is the best program for you.

What Are The Benefits Of First

These are the programs, loans and grants They were established to help people buy their first home. They are an extended form of financial assistance that helps eligible buyers. Buyers must meet certain restrictions. Strong credit scores. First-time buyer programs are a win for everyone-Win situation for all Local government, buyers and sellers it stimulates the economy. Some counties, and even some cities, have the funds available to support these programs already and are eager to use them. Lets face it, These programs provide stability for the community and could cause the government to lose funding.

Don’t Miss: How To Buy Swiss Government Bonds

Are There Restrictions On How I Use My First

Yes, you may use your grant funds to make a downpayment, pay for your real estate closing costs, reduce your mortgage interest rate, and nothing else. In short, if the cost or fee is paid at closing, it’s an eligible cost in the program.

Dan Green

Dan Green is a former mortgage loan officer and an industry expert. He’s appeared on NPR and CNBC, and in The Wall Street Journal, Bloomberg, and dozens of local newspapers. Dan has helped millions of first-time home buyers get educated on mortgages, real estate, and personal finance. Have mortgage questions? Ask Dan in the chat.

Receive real estate and mortgage news by email weekly. Personalized for you & your specific homebuying goals.

Homebuyer is powered by Novus Home Mortgage, a division of Ixonia Bank, NMLS #423065. Member FDIC. Equal Housing Lender

- About