Why Are Money Market Rates So Low

Compared to other fixed-income products, money market rates are the lowest because they are the safest. If you instead choose fixed-income options with higher interest rates, then you are taking on additional risk to your principal investment. In a broader sense, interest rate environments reflect economic conditions. Many factors impact interest rates, but as a general rule of thumb, low-rate environments may reflect struggling and deflationary economies, while high-rate environments may reflect booming economies with high inflation.

Types Of Treasury Bonds

The term “Treasury bond” often gets used to generically refer to all government securities. But there are several types of Treasuries. The difference lies in their maturity, which is the time span it must be held before the principal is repaid.

Treasuries come in three maturities:

- Treasury bonds : Known in the investment community as “the long bond,” T-bonds generally mature in 20 to 30 years.

- Treasury notes : These mature within 2 to 10 years. The widely tracked 10-year T-note frequently acts as a benchmark for interest rates on consumer loans, especially mortgages.

- Treasury Bills : T-bills have the shortest maturity available. They can mature in just a few weeks or a few months, with the longest maturity term being up to a year.

Why Is One To Four Years Considered Short Term

Good question. In some cases, such as determining capital gains taxes on an income-producing investment, more than one year is considered long term.

However, with bonds, the opposite is true. Some long-term bonds can span decades, such as the 30-year Treasury bonds. In comparison, a bond that matures in one to four years is considered short term.

Don’t Miss: How To Get A Job In Dc Government

Structure: Coupon Or No Coupon/discount

Investors in Treasury notes and Treasury bonds receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months.

Other Treasury securities, such as Treasury bills or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face value investors receive the full face value at maturity. These securities are known as Original Issue Discount bonds, since the difference between the discounted price at issuance and the face value at maturity represents the total interest paid in one lump sum.

First Let’s Answer A Few Questions

- Why should I invest in the G Fund?

The payment of G Fund principal and interest is guaranteed by the U.S. Government. This means that the U.S. Government will always make the required payments.

- Am I ok with market and inflation risk?

The G Fund is subject to the possibility that your investment will not grow enough to offset the reduction in purchasing power that results from inflation .

- How can I use the G Fund in my TSP?

Consider investing in the G Fund if you would like to have all or a portion of your TSP account completely protected from loss. If you choose to invest in the G Fund, you are placing a higher priority on the stability and preservation of your money than on the opportunity to potentially achieve greater long-term growth in your account through investment in the other TSP funds.

The G Funds investment objective is to ensure preservation of capital and generate returns above those of short-term U.S. Treasury securities.

Don’t Miss: Free Grant Money For Home Improvements Government

How To Invest In Short

If youre considering in investing in these or any of Vanguard bond funds, you need to do your due diligence.

First, think about what you need the bond fund in the first place. Is it to diversify your investment portfolio?

Are you a conservative investor who need a minimize risk at all cost? Or, do you want to invest in a short term bond fund because you need the money to use in a few years for a vacation, buying a house, or planning for a wedding?

Once, you have come up with answers to this question, the next step is to do your research about the best bond fund available to you.

Use this list to start. If its not enough, do your own research.

Look into how much the initial minimum investment is to buy a bond fund. Most Vanguard short term bond funds require a $3,000 minimum deposit.

Some Fidelity bond funds, however, have a 0$ minimum deposit requirement.

Next compare expense rations, performance for different funds to see if they match your investment goals. But you have to remember that past performance is not an indication of future performance.

Your final step is to open an account to buy your bond funds. If you choose Vanguard, you can do so at their website.

First Trust Institutional Preferred Securities And Income Etf

- Average Duration: N/A

- Yield to Maturity: N/A

- Assets Under Management: $254.1 million

The First Trust Institutional Preferred Securities and Income Exchange Traded Fund seeks a high level of current income by investing in institutional preferred and income-producing debt securities. It uses a multivariate approach, screening companies on several fundamental equity characteristics, including historical and expected rates of earnings growth.

You May Like: Government Grants For Higher Education

Who Should Invest In Short

This form of investment is ideal for risk-averse investors and seek to enjoy tax-adjusted returns that are better than an FD. Some invest in high credit risk securities like high yield bonds, while others choose to invest in high-risk securities to compensate for the low yield environment. You must check for the funds fluctuations as compared to its peers before investing in it.

Do You Want To Bet Against Your Country

There are serious implications for short selling U.S. Treasuries. The biggest point of contention is that when you short sell Treasuries, you contribute to their decline. As an individual, you may not have much influence over the market. But as a member of a group shorting U.S. Treasuries, you may influence the behavior of that market and negatively impact our countrys credit.

Do you want your profit to rely on the downfall of this country? Or do you feel that amidst the economic crisis this represents a lifeboat-opportunity to escape intact? As a matter of principle and ethics, this is one aspect investors should consider before they engage in this type of trading.

Also Check: Open Enrollment Government Health Insurance

How To Short The Us Bond Market

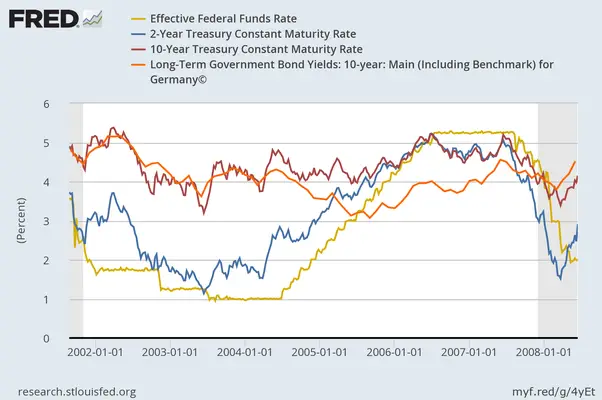

The U.S. bond market has enjoyed a strong bull run over the past few years as the Federal Reserve has lowered interest rates to historic low levels. The price of bonds, which react inversely to changes in interest rates, have recently come under pressure as market participants anticipate that the central bank will soon indicate they will begin to raise the target rate.

Traditionally considered lower-risk investments than stocks, bond prices may fall dramatically depending on how much and how quickly interest rates rise. As a result, savvy investors might consider selling short the U.S. bond market and profit from an anticipated bear market. A short position in bonds also has the potential to generate high returns during inflationary periods. How does an individual gain short exposure to bonds within their regular brokerage account?

Invesco Emerging Markets Sovereign Debt Portfolio

- Average Duration: N/A

- Yield to Maturity: N/A

- Assets Under Management: $2.59 billion

This bond ETF targets US dollar-denominated emerging market sovereign debt with at least three years to maturity. Its underlying index imposes additional liquidity and relative value screens that set it apart from other US dollar-denominated funds.

Read Also: Why Data Governance Is Needed

Ishares Broad Usd High Yield Corporate Bond Etf

- Average Duration: 5.50 years

- Yield to Maturity: 5.92%

- Assets Under Management: $4.45 billion

Made for long-term investors, this bond ETF offers investors cheap exposure to the US high-yield corporate bond market. Compared to HYG and JNK, it holds twice as many issues from more than twice as many issuers. It holds securities primarily from smaller issuers which increases its potential for yield.

What Is A Bond

Like a loan, a bond is an agreement where the borrower agrees to repay the amount borrowed, along with interest. Another way to look at it is, a bond is a loan that has been carved up into smaller pieces that many investors can own the same way the ownership of a company is carved up into shares.

Bonds are typically sold in $100 dollar increments and then the price fluctuates as investors buy and sell the bonds.

Read Also: Keep Your Government Hands Off My Medicare

What Payoff Can I Expect From Long

Your return on investment is another difference to consider between short-term and long-term Treasury bonds. Extremely short-term Treasury bonds, which mature in one year or less, are also known as Treasury bills or T-bills. They do not pay any interest during the life of the bond. Instead, they are sold at a discount of their face value. Upon maturity, the owner can cash in the bond for its full face value. So when you purchase a Treasury bill at a discount, you know exactly how much youll earn when it maturesthe difference between the face value and the discounted rate you paid for the bill.

Other Treasury bonds pay interest in an amount that is half their coupon rate on a semiannual basis. For instance, say you have a $10,000, 10-year Treasury note with a coupon rate of 2 percent. Every six months, youll receive a payment of $100 from the government. When your note matures, you can redeem it for $10,000.

In some interest rate environments, these bonds will sell for more than their face value, while at other times, they may sell for less than face value. The payout you can expect to receive depends on the interest rate, the time to maturity, and the amount you paid for the bond originally.

How To Buy Treasury Securities

You can purchase Treasury bonds directly from the Treasury Department through its website, TreasuryDirect, or through any brokerage account.

Similar to other stocks and bonds, you can purchase Treasury bonds either individually or as a collection of securities through mutual funds or exchange-traded funds, or ETFs. If you have no particular time frame in mind for repayment, investing in a mutual fund or ETF may be more appealing because of enhanced diversification from owning a collection of bonds.

Unlike individual bonds, bond funds do not have a maturity date and can therefore be subject to greater volatility. In a bond fund, a fund manager buys and sells bonds with varying terms, so your returns can be subject to market fluctuations when you sell the fund, instead of providing a predictable income.

» Ready to start investing? See our picks of best brokerages for fund investors.

Buying individual bonds can make sense when youd like to pinpoint a specific time frame to receive the bonds repayment. Examples include using bonds as a lower-risk way to earn some interest on money set aside for a certain purpose think a wedding, tax or tuition payment next year or as a way to generate a predictable income stream in retirement.

T-bills are sold at a discount from the par amount, or face value, of the bill. Investors receive the full face value amount at maturity. For example, an investor could buy a T-bill for $950 but receive a face value of $1,000 at maturity.

Also Check: Government Assistance For Single Person

Best Bond Etfs In Canada

Bond ETFs give you the chance to invest in a variety of bonds while adding more income to your bottom line.

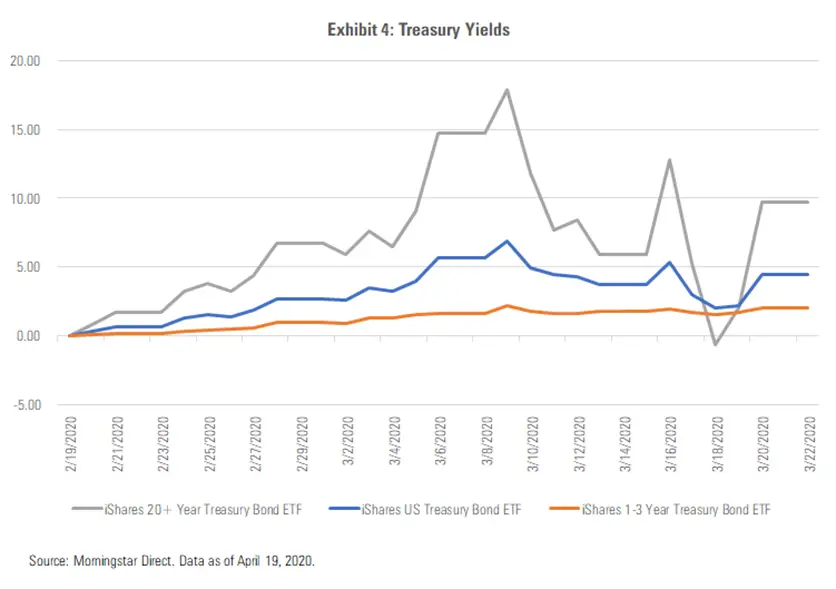

As the stock market saw a drastic selloff frenzy due to the COVID-19 pandemic, bond ETFs may be a safer investment for investor capital.

According to a report from the National Bank of Canada Financial Markets, bond ETFs continued trading at a high volume during the market crash in March 2020.

Despite a discount on prices, the report said that the discounts are not going to affect long-term investors. Canadians are flocking to bond ETFs for the security they offer.

Here is a guide to 20 of the best bond ETFs in Canada you can consider in 2020.

Where Can I Buy Government Bonds

In general there are two broad categories investors can consider when looking to invest in government government bonds: Treasury bonds and municipal bonds. Both are options for investors seeking to build out the low-risk portion of their portfolio or just save money at higher, low-risk rates.

Government bonds can also be a great place to start if you are new to bond investing overall. Treasuries and municipals and are usually top low-risk bond options also considered alongside money market accounts, certificates of deposit, and high yield savings accounts.

Don’t Miss: Government Funding For Private Schools

Types Of Us Treasury Bonds

Treasurys might sometimes seem confusing. You might have heard of Treasury bills, Treasury notes and Treasury bonds, but whats the difference? The distinguishing factor among these types of Treasurys actually, all types of bonds backed by the full faith and credit of the U.S. Department of the Treasury is simply the length of time until maturity, or expiration.

-

Treasury bills : Short-term debt securities that mature in less than one year. Though T-bills are sold with a wide range of maturities, the most common terms are for four, eight, 13, 26 and 52 weeks.

-

Treasury notes : Intermediate-term debt securities that mature in two, three, five, seven and 10 years.

-

Treasury bonds : Long-term debt securities that mature between 10 and 30 years.

-

Treasury Inflation-Protected Securities : Another type of Treasury bond, adjusted over time to keep up with inflation.

Advantages Of Investing In Short

- Good and fixed returns in less period as compared to funds or investments which give average returns, for example fixed deposit.

- A lower degree of risk in bear markets.

- Less sensitive to inflation as compared to long-term bonds.

- Highly liquid and easily convertible into cash.

- Surplus funds can be invested in these bond funds rather than keeping it in the current account.

- These funds can be a source of emergency funds as they are highly liquid. Short-term bond funds will not provide big or huge returns but can be used by investors who need safety for the invested amount and who are looking for a way to earn yields higher than those available on ultra-low risk investments.

These funds are actively managed and can act as an excellent investment return opportunity for people who are looking out for fixed returns. For more details on various bond fund investment options, visit ClearTax, where we offer carefully selected funds based on extensive research and insights.

Read Also: How To Find Money Government Owes You

What Is The Difference Between A T

A T-bill or treasury bill is a short-term bond that does not offer any interest. If the value of the bond is Rs. 100, you can buy it at a discount for Rs. 95 and upon maturity, you will be paid Rs. 100

A G-sec bond will of longer duration and an interest will be paid on the face value of the bond twice a year. You can see the current listing at the NSE site

Cumulative Growth Of A $10000 Investment

| Bloomberg US Treasury 1-3 Year Index | $11,216 |

|---|---|

| Worst Three Months Return | -0.52 |

| Best Three Months Return | +2.83 |

This graph represents the growth of a hypothetical investment of $10,000. It assumes reinvestment of dividends and capital gains, and does not reflect sales loads, redemption fees, if applicable, or the effects of taxes on any capital gains and/or distributions. If the inception date of the Index is less than the time period shown above, the Since Inception period is shown. Best and Worst Return cover the timeframe of the chart.

Also Check: Free Government Phones Merced Ca

Choosing Between The Two

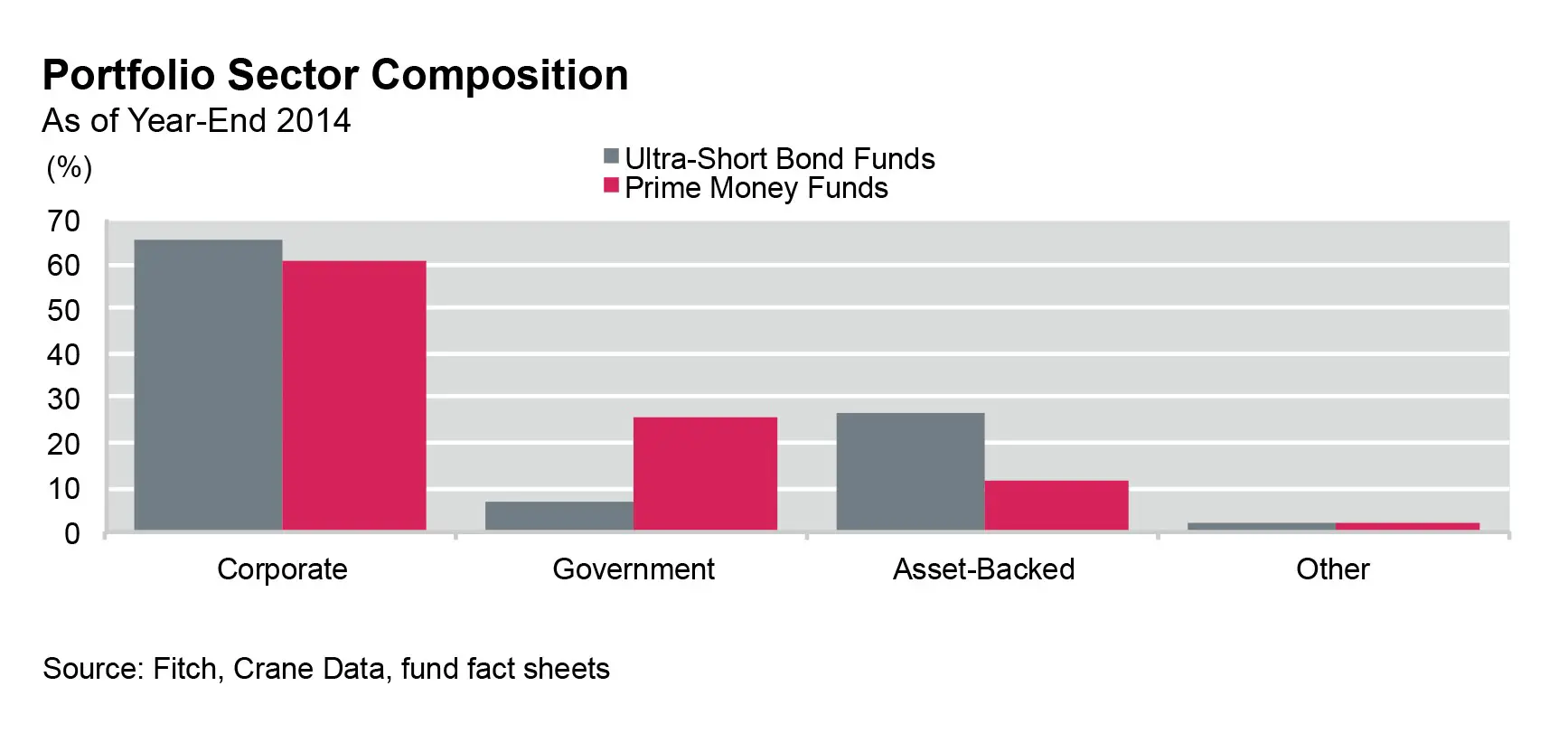

While short-term bond funds have low interest rate risk, they can have other types of risk depending on the securities they hold in their portfolios. Many funds invest in high-quality corporate bonds or mortgage-backed securities, but this isnt always the case. Investors learned this the hard way during the financial crisis of 2008 when many funds that had put too much money in mortgage-related securities experienced huge drops in their share prices.

Short-term doesnt necessarily mean low risk, so read the material from the issuing company very carefully to make sure the managers havent loaded up the portfolio with complicated international investments or low-quality corporate bonds. These are the types of securities that can blow up if the investment environment sours. Since the Federal Reserve hasn’t raised interest rates in a while, its easy to forget that short-term bonds will typically experience share price declines during the periods when the Fed is raising rates. The declines will be modest in comparison to other types of funds, but money market funds won’t experience any downside at all.

Best Emerging Market Bond Etfs In Canada

An Emerging Market Bond ETF consists of fixed income debt issues from countries that have developing economies. These can include government and corporate-issued bonds in Asia, Latin America, Africa, and other countries.

The emerging market bonds usually offer higher returns as opposed to traditional bonds because they are riskier than the bonds from developed countries. The fact that developing countries tend to grow much quicker also contributes to higher potential returns.

They allow investors to diversify positions in emerging market bonds like a mutual fund, but it trades like a stock. If the underlying bonds in the ETF perform well, the ETF does as well.

Read Also: Dell Government Employee Discount Code