How Medicare Part D Prescription Drug Plans Differ Between States

Medicare Part D prescription drug plans are private insurance plans that work with Original Medicare to help cover the costs of your prescription medicine. Many Medicare Advantage plans also provide prescription drug coverage.

Plan prices and plan availability varies from state to state, but all states are required to have open enrollment in Medicare Part D plans at the same time as open enrollment for Original Medicare October 15 to December 7 every year.

The availability of Medicare Part D plans vary from state to state. The number of plans available in any state in 2019 ranged from 22 choices in Alaska to 30 choices in California, Pennsylvania and West Virginia, according to the Kaiser Family Foundation.

Purchase Of Individual Coverage By Families Not Offered Group Plan

Price Elasticity

Estimates of the price elasticity of demand for individual insurance by families in California who do not have access to group coverage are given in Table 3.9 . Our overall elasticity estimate of 0.2 to 0.4 is similar to those found in earlier studies. But we find significant differences in the price elasticities between younger and older families =4.2, p< .05 in Census data, 2=10.7, p< .05 in NHIS data), the self-employed and others =2.9, p< .10 in Census data, 2=3.3, p< .10 in NHIS data), and by poverty group=117.03, p< .05 in Census data, 2=136.81, p< .05 in NHIS data). The price elasticities and the income elasticity estimates did not differ significantly between the CPS and SIPP data =4.8, p> .10), so we present the pooled estimate. The elasticity estimates for some of the subgroups were statistically higher from the NHIS data than the point estimates made from the Census data, but the general pattern of results was very similar.10. We also explored whether price response differs when premiums are high or low. We found a statistically significant greater response when the minimum offer premium was less than $45 per month than at higher premiums in all datasets. However, the effect was very small. The elasticities shown in Table 3 are estimates at higher premium levels at lower premium levels, the overall elasticity increases from .20 to .25 in the Census data the increase in the NHIS data is from .44 to .46 and was not statistically significant.

How Do I Get The Money

If you choose to get the premium tax credit in advance, the government sends the money directly to your health insurance company on your behalf. Your health insurer credits that money toward your cost of health insurance premiums, decreasing how much you’ll pay each month.

If you choose to get the premium tax credit as a tax refund, the money will be included in your refund when you file your taxes. This could mean a big tax refund. But, you’ll pay more for health insurance each month since youll be paying both your share of the premium and the share that would be have been covered by the subsidy if you’d chosen the advanced payment option. It will come out even in the end, but if your cash flow is relatively low, you might find the advance payment option more user-friendly.

If you get your subsidy when you file your income taxes rather than in advance, youll get the correct subsidy amount because youll know exactly how much you earned that year. You wont have to pay any of it back.

You May Like: Government Commercial Real Estate Loans

Do I Have To Wait Until I File My Taxes To Get The Subsidy Since It’s A Tax Credit

You dont have to wait until you file your taxes. You can get the premium tax credit in advancepaid directly to your insurance company each monthwhich is what most people do. However, if youd rather, you may choose to get your premium tax credit as a tax refund when you file your taxes instead of having it paid in advance.

This option is only available if you enrolled in a plan through the exchange. If you buy your plan directly from an insurance company, you won’t be eligible for up-front premium subsidies, and you also won’t be able to claim the subsidy on your tax return.

If your income is so low that you dont have to file taxes, you can still get the subsidy, although you won’t be eligible for a subsidy if your income is below the poverty level .

When the subsidy is paid in advance, the amount of the subsidy is based on an estimate of your income for the coming year. If the estimate is wrong, the subsidy amount will be incorrect.

If you earn less than estimated, the advanced subsidy will be lower than it should have been. Youll get the rest as a tax refund.

If you earn more than estimated, the government will send too much subsidy money to your health insurance company. Youll have to pay back part or all of the excess subsidy money when you file your taxes.

What Does Subsidy Mean In Health Insurance

To sum it up

- Subsidies are features of Obamacare that make insurance more affordable

- Premium tax credits are subsidies to make premiums affordable

- Cost reduction assistance is a subsidy to reduce expenses, copays, and cost shares

- Medicaid and the CHIP are subsidized healthcare coverage

A subsidy is a form of payment, benefit, or advantage that the beneficiary does not have to repay. Subsidy often goes to people or institutions in need, but the subsidy is also a way of providing an incentive.

In the US health care system, a subsidy is a vital part of the on-going efforts for improvement and fairness.

Subsidy in health care covers some important parts of the Nations health care system. The Obamacare Marketplace, Medicare, Medicaid, and the CHIP are subsidized healthcare systems.

Enter your zip above to discover the most recent low-cost health care policies in your state!

Also Check: How To Get A Government Loan For School

Transferring Medicare To Another State

If you move to another state or region, you will need to find a new Medicare Advantage plan available in that area. According to CNBC, you will have two months to change and update your plan after youve arrived in your new state of residence.

If you have Original Medicare, all you need to do if you move is give Medicare your new address and location info.

What To Do If You Cant Afford Health Insurance: Alternative Health Insurance Options

If you are and individual under the age of 30 or qualify for a hardship exemption and are in generally good health, you may be eligible for a catastrophic plan. Catastrophic plans are low-premium plans that tend to have a high-deductible but offer ACA-compliant coverage.

In most states, you can also buy short-term health insurance plans. Premiums for short-term plans tend to be substantially lower than those of comprehensive health plans available on the marketplace.

Although they are called short-term plans, you typically can keep your coverage up to 3 years in most states by simply renewing your plan annually. While these plans do not offer the comprehensive coverage of a major-medical health insurance plan, they do provide an affordable alternative to ACA-compliant plans that can keep you covered in worst-case scenarios.

If you enroll in a short-term plan, you will pay a monthly premium and a deductible. These plans typically offer the following benefits:

- Some prescription medications

- Visits to your doctor

- Hospitalization due to illness or injury

Keep in mind that short-term plans can deny coverage for these services based on a pre-existing medical condition.

You May Like: Government Grants For Black Women

Why Was Private Cover Subsidised

The 30% subsidy for private health insurance premiums was introduced in 1999, driven more by media coverage than evidence. Following Medicares introduction in 1984, private health coverage had fallen from about 50% of the population in 1985 to just more than 30% in 1998.

The media portrayed this decline as a death spiral that would put unbearable pressure on public hospitals. The public system would no longer be sustainable, the narrative went, as healthy people dropped their private insurance while a pool of sick older individuals with high hospital needs flooded the system.

Evidence for this narrative was flimsy at best, and largely anecdotal. Later analysis demonstrated the insured population was actually a healthier subgroup. So, healthier people were maintaining cover, while sicker individuals still relied on the public hospital system.

Yet health ministers under both Labor and Liberal governments became champions of the policy to subsidise private cover. Michael Wooldridge, as health minister in the Howard government between 1996 and 2000, introduced a 30% premium subsidy to those already insured and new entrants.

The subsidy was accompanied by a Medicare Levy Surcharge of 1% of taxable income for higher-income earners without private cover.

Comparing Employer Group Plans And Individual Health Plans

| Employer-Sponsored Plan | $6,435.00 2 |

While averages can give you an idea of typical costs, the real story is often more complex. In many states, individual plans are less expensive. Thats because individual health insurance spreads the risk over a large group possibly millions of people depending on the plan and insurance company. Plus, as stated above, you may be eligible for a subsidy from the federal government to help pay for your individual insurance policy.

With employer-sponsored health insurance, the premium cost is usually split between your employer and you, which will help you save money. On average, employers paid 82 percent of the premium of single coverage in 2016.2

Ultimately, choosing the best avenue for you will depend on your unique circumstances and what your employer is able to offer.

Recommended Reading: Government Financial Assistance For Seniors

To Calculate The Size Of Your Subsidy For 202:

1) Use the table below to find out where your income falls in relation to the federal poverty level. Youll be looking at your projected 2023 income, but youll be comparing it to the 2022 federal poverty level, which is what the numbers in this table represent. As noted above, the numbers are higher in Alaska and Hawaii.

Normally, an income above 400% of the poverty level would make a household ineligible for premium subsidies. But from 2021 through 2025, premium subsidies are available above that level if theyre necessary in order to keep the cost of the benchmark plan at no more than 8.5% of the households ACA-specific MAGI.

In most states, if your income doesnt exceed 138% of the poverty level, youll be eligible for Medicaid. The other delineations are for determining the percentage of income that youd be expected to pay for the benchmark plan in the exchange, as described in the next step.

| Percent of Federal Poverty Level | |

|---|---|

| Household Size | |

| $14,160 | $18,880 |

2) Find out how much the Affordable Care Act expects you to contribute to the cost of your insurance by consulting Table 2. The expected contribution is normally adjusted slightly each year. The percentages listed below are for 2021 through 2025, and are specific to Section 9661 of the American Rescue Plan .

| If you earn | |

|---|---|

| 6%-8.5% of your income | |

| 400% of FPL or higher | 8.5% of your income |

Health Insurance Subsidies Set To Expire At The End Of 2022 Extended Via The Inflation Reduction Act

WASHINGTON, DC – AUGUST 16: U.S. President Joe Biden signs The Inflation Reduction Act with … Sen. Joe Manchin , Senate Majority Leader Charles Schumer , House Majority Whip James Clyburn , Rep. Frank Pallone and Rep. Kathy Catsor in the State Dining Room of the White House August 16, 2022 in Washington, DC. The $737 billion bill focuses on climate change, lower health care costs and creating clean energy jobs by enacting a 15% corporate minimum tax, a 1-percent fee on stock buybacks and enhancing IRS enforcement.

Getty Images

Americans may not be buying that the Inflation Reduction Act will actually reduce inflation, with 57% of voters surveyed in a Morning Consult poll saying they expect the new law will have no positive impact on inflation and could make it worse.

But for people who buy their health insurance on Healthcare.gov, the new legislation may represent real savings.

Before the American Rescue Plan went into effect, premium tax credits were only available for people who earned between 100% and 400% of the federal poverty level . Tax credits could be taken in advance and paid directly to the health insurance company to directly lower insurance premiums, called Advanced Premium Tax Credits, or credited through annual tax filings. Either way, the subsidies were reconciled at tax time to account for income changes that could affect eligibility.

You May Like: Contra Costa County Government Jobs

Rules For Medicare Advantage Plans

Medicare pays a fixed amount for your care each month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare.

Each Medicare Advantage Plan can charge different

. They can also have different rules for how you get services, like:

- Whether you need areferralto see a specialist

- If you have to go to doctors, facilities, or suppliers that belong to the plan for non-emergency or non-urgent care

These rules can change each year.

D: Prescription Drug Plans

Medicare Part D went into effect on January 1, 2006. Anyone with Part A or B is eligible for Part D, which covers mostly self-administered drugs. It was made possible by the passage of the Medicare Modernization Act of 2003. To receive this benefit, a person with Medicare must enroll in a stand-alone Prescription Drug Plan or public Part C health plan with integrated prescription drug coverage . These plans are approved and regulated by the Medicare program, but are actually designed and administered by various sponsors including charities, integrated health delivery systems, unions and health insurance companies almost all these sponsors in turn use pharmacy benefit managers in the same way as they are used by sponsors of health insurance for those not on Medicare. Unlike Original Medicare , Part D coverage is not standardized . Plans choose which drugs they wish to cover . The plans can also specify with CMS approval at what level they wish to cover it, and are encouraged to use step therapy. Some drugs are excluded from coverage altogether and Part D plans that cover excluded drugs are not allowed to pass those costs on to Medicare, and plans are required to repay CMS if they are found to have billed Medicare in these cases.

Read Also: Master Of Policy And Governance

Can I Get Aca Subsidies If My Employer Offers Health Benefits

If your employer offers coverage thats considered affordable and provides minimum value, youre not eligible to receive a subsidy in the exchange. The family glitch has previously caused some families to be ineligible for subsidies due to the way affordability of employer-sponsored health plans is calculated, but the IRS fixed the glitch in the fall of 2022, meaning that some families are newly eligible for marketplace subsidies in 2023.

If your employer offers affordable coverage that provides minimum value, you already are receiving a subsidy from your employer in the form of pre-tax health insurance benefits and an employer contribution to your premiums. The exchanges offer subsidized health insurance benefits to the self-employed, the unemployed, and employees who work for a company that does not offer affordable health benefits.

Note that some employers offer coverage that is either not affordable or does not provide minimum value . These plans, while technically considered minimum essential coverage, can be quite skimpy and to clarify, employers are subject to a penalty if they offer these plans and their employers opt for a subsidized plan in the exchange instead. If your employer offers a plan that doesnt meet the affordability rules and/or the minimum value rules, you do have access to premium subsidies in the exchange if youre otherwise eligible based on your income, immigration status, etc.

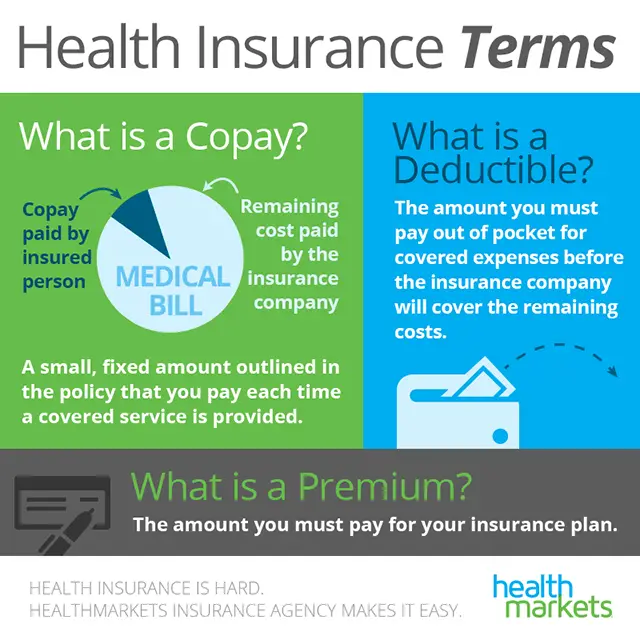

What Is The Difference Between A Deductible A Copayment And Coinsurance

A deductible is the set amount of money you are responsible for annually to cover eligible medical expenses before the insurance policy starts payments.

Coinsurance is the amount you pay to share the costs of services covered by the insurance plan after the deductible has been paid .

A copayment is the flat fee you pay each time you receive medical care, and the insurance company pays the rest. Note that, in most cases, you do not need to meet your deductible before the copayment applies.

Also Check: Government Grants To Buy A Truck

Do I Qualify For Subsidies

If you are a low or middle-income family or individual you might be eligible for subsidies under the Affordable Care Act.

For most subsidies, you would qualify for a premium tax credit if you earn less than four times the federal poverty level. If you earn less than the federal poverty level, you wont qualify for ACA subsidies, but you might be able to get Medicaid, CHIP or some other government program.

There are also some additional criteria:

- You must currently live in the US & be a US citizen or legal resident

- You cannot currently be incarcerated

- In 2018, you would qualify for subsidies if the least expensive plan in your area costs more than 8.05% of your modified adjusted gross income

Note: the Federal Register sets the poverty level annually. In 2018, the poverty level for an individual is $12,140 in annual income. There are adjustments made based on the size of your household.

When applying for subsidies, your income is an estimate of what youll be making during the coverage year NOT what you earned last year. If you earn more during the coverage year than estimated, you will need to pay back some of that subsidy. But if you end up making less, you can get an additional subsidy when filing your tax returns for that year.

If youre curious about how much you or your family might be eligible for, heres a handy subsidy calculator.