Train For Federal Local And State Accounting With Online Government Contract Accounting Training

Government contractors need accounting training to stay compliant and to remain competitive. With more professionals competing for government contracts and work, standing out with excellent training and exceptional skills is vital. If you work with government entities in any capacity, you need to understand government structure, reporting, auditing, regulations, accounting software and more.

Government contract accounting training from Lorman Education Services can help by offering you online solutions that let you study on your own time and at your own pace. You can train while you work, or you can use your spare time to develop your skills set for new career opportunities.

Why Online Government Contract Accounting Training With Lorman Education Services?

Government accounting training can be conducted on-site but many professionals have busy schedules and may travel often. With our online training solutions, skills development is only ever a few clicks away. Whenever you have a few spare minutes and wherever you are, you can access our training materials from any phone, tablet or computer with an internet connection.

We also offer training in a variety of formats to serve you better:

- White papers

Keeping Pace With Changes In Government Rules For Finance Management And Accounting

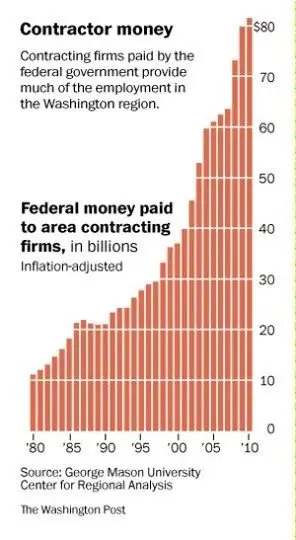

Managing in a perpetual stream of changes of requirements is the way of business in government contracting. Currently, the increased transparency of government finance motivated by the economic stimulus plan provides a good example. But, with merely the usual turnover of new regulations, continuous changes in government financial management and accounting requirements are an ongoing fact of operating as a US government contractor.

Contractors must be skillful in anticipating and implementing modifications to any policies, procedures, and systems that support compliance, in order to maintain pace with changing requirements for their companies.

How To Be Compliant With Far

FAR is one of the major differences between contracting with the federal government versus contracting with a commercial entity. One of the most common questions contractors have relating to FAR is: Does FAR apply to all government agencies? The answer is: No.

FAR only governs contracts with the agencies of the Executive branch. Contracts with the Legislative branch and the judicial branch come under separate regulations. Contracts with the Legislative branch are governed by the Congressional Budget Office contracts with the judicial branch are governed by the Judiciary Policy Volume 14 . That said, most contracts with the federal government are governed by FAR and each contract will contain specific FAR clauses that are applicable to the contract. It is the contractors responsibility to read each contract and understand each FAR clause referenced in the contract prior to signing a binding agreement. Specifically, FAR is applicable to solicitations , federal prime contracts, and subcontracts under federal prime contracts.

Also Check: Grants For Dental Implants

General Ledger Chart Of Accounts: The Backbone Of Your Accounting System

General ledger accounts are the backbone of any accounting system. All transactions, reports and policies and procedures revolve around the location of accounts in a companys books.

Well-written accounting policies and procedures reference specific accounts and account groups and describe how certain costs are treated.

Individual accounts must be homogenous . Each cost pool must also be homogenous.

Categorizing labor creates issues for many contractors. Some companies lump all their direct labor costs for W-2 employees, contract labor and temporary labor into a single account. Since the nature of the labor differs, each type needs a separate account.

Training also can create confusion. A contractor might create an account called training and put it under overhead. This may work if tuition or fees are the only training expenses involved.

If an employee wants to take a training class in another city, however, travel costs should not go in the base training account. The best practice is to create individual accounts for different training expenses, such as tuition, travel and labor while training.

If you combine different expenses into a single account, it becomes difficult to perform proper analysis on those accounts. This creates issues with setting indirect rate structures in the future.

Pools should be homogenous. For example, the Fringe cost pool should only include costs related to fringe benefits for W-2 employees.

Improper Business Practices And Personal Conflicts Of Interest

Part 3 addresses various improper business practices and personal conflicts of interest. Within this section, sub-part 3.6 generally prevents government contracts being knowingly awarded to a Government employee or to an organisation owned or substantially owned by one or more Government employees. Similar wording was previously included in the Federal Procurement Regulations prior to 1984, with several GAO decisions confirming that an agency does not violate this sub-part if neither the Contracting Officer not the selection officer has knowledge of such ownership or business connection.

You May Like: Government Jobs For History Majors

Clear Understanding Of The Government’s Requirements For Contractors

Businesses that embark on contracting with the US government assuming that government accounting merely varies somewhat from commercial business accounting will experience a shock. The government’s already voluminous requirements are constantly changing.

Just a few of those criteria handed down from the Financial Accounting Standards Board , with which government contractors must comply, include:

For example, the federal government limits compensation for an executive to a maximum that the government determines is reasonable”. Compensation higher than this ceiling is deemed unallowable”, which means that your company is not permitted to charge such amounts exceeding the limit to the contract or to recover such amounts under the contract.

Understanding the government’s various areas of emphasis in audits is fundamental. For example, companies must be clear on what the DCAA views as contractors’ responsibilities include in accounting for management of subcontractors, such as DCAA scrutinization of:

- timeliness of payments to subcontractors

- documentation of contractor oversight of subcontractors

- documentation of enforcement of flow downs

- documentation of support for subcontractor billings

- documentation of subcontractor reviews

Using Available Information To Manage And To Achieve Growth

The process of implementing a system for accounting to the federal government, designing special procedures, and implementing regulatory compliance policies naturally generates a wealth of useful information available to the new contractor. However, this cache of information has little value if the contractor does not recognize the benefits of leveraging the information acquired into understanding of governmental purposes, needs, and larger processes, and then use that knowledge to best manage and methodically grow the company.

For just one example, compliance with government requirements necessitates correct calculation of an overhead rate. However, if the contractor’s management does not recognize the importance of learning why the rate is significant, and does not control spending to manage rate variance, then there is not much use for the company in its mere awareness of the overhead rate and of the fact that conformance relies upon its correct calculation.

Today’s technological innovations afford contractors a much better capacity for compliance with government requirements, permitting employment of systems for management and growth, while adapting to keep in step with ever-incoming changes in requirements.

Also Check: Dental Lifeline Network Dental Implant Grant

The Governments Cost Accounting Rules Can Apply To Government Contractors Of All Shapes And Sizes In Every Industry While Anyone Can Read These Rules We Help You Understand Why They Exist How To Interpret Them And How The Government Enforces Them Having Access To This Deeper Level Of Understanding Helps Our Clients Reduce Risk Improve Compliance Effectiveness And Improve Accounting Simplicity Effective Cost Accounting Doesnt Necessarily Require Tedious Complexity

The governments cost accounting rules govern what costs the government will or wont pay , and how much of those costs theyre willing to pay . Political and socio-economic policy frequently underpin the cost allowability rules. This means unallowable costs represent items or activities that the government, as a steward of public funds, wont pay regardless of whether or not the item is a routine business expense. While the government will pay for allowable costs, it will only pay its fair share as determined by its cost allocability rules.

Both of these concepts are important when either negotiating non-competitive contract prices or performing cost-reimbursable contracts. Explore the sections below to learn more about how we help clients distill the rules and keep it simple:

- Cost allowability

- Incurred cost proposals

- Indirect cost structures

View More Government Contract Accounting Training Courses

Instead of having to cover the topics of a specific training session or wade through material you already know, Lorman Education Services lets you focus on those topics you want to learn, letting you maximize your training time. Different formats are also very effective. If you learn best by reading, white papers and articles can help you train. If interactive styles better suit you, OnDemand training is available. You can choose the options that make sense for you.

With our training, you can start exploring government accounting immediately, without having to wait for a class to start. There are thousands of materials for you to access at once, helping you to dive in right away.

If you prefer on-site training, we offer that, too. We can train you, your department or your whole team. We even have custom solutions if you dont see an option that works for you.

Start Training Today With Lorman Education Services

Lorman Education Services has already helped more than 1.4 million accountants, attorneys and other professionals get the professional training they need. When professionals need to meet continuing educational requirements, make the most of their careers or require additional training to stay competitive, they turn to us. We work with only the best minds in each industry and we are always releasing new resources, so professionals know they can trust us for quality, current materials.

Recommended Reading: How Do You Get A Free Government Cell Phone

Is The Cost Allocated Applicable To Accounting Standards And Practices

Youll want to determine whether the cost is applicable to Cost Accounting Standards or U.S. Generally Accepted Accounting Principles and if the accounting practices are appropriate to the circumstances. Certain contractors and subcontractors are required to have written cost accounting practices and are expected to consistently comply with their established accounting practices when performing on the contract.

What Are Allowable And Unallowable Costs In Government Contracts

Government | Contracts | 5 Min Read

If you have come across the terms allowable and unallowable costs in relation to your GSA Schedule contract but you have no idea what they mean, you have come to the right place. As consultants at Winvale, we dont expect all of our clients to be savvy accountants when it comes to costs incurred on their GSA Multiple Award Schedule contract, and we dont expect you to know either.

Not all incurred costs are created equal in government contracts. The Federal Acquisition Regulation , the rulebook for federal government contracting, outlines two types of costs related to your contractallowable and unallowable. Understanding which line item you may allocate and bill as allowable is important to avoid potential government penalties down the road.

FAR 31 provides numerous examples of allowable and unallowable costs, so lets break down these cost types and the rules the U.S. government has put in place to interpret the differences.

Don’t Miss: Government Dental Grants For Seniors

Details Of Far Part 52

On the other side of the coin, FAR Part 52 details allowable costs and payments direct labor, direct travel, supplies, services and includes information on invoicing, reimbursement, bill rates, and payments. One of the most important things to note in this section are the list of Reimbursable Costs. These include:

- Direct Labor

- Services

- Indirect Expenses.

Other important billing and payment information in FAR Part 52.216-7 can be found in these sections:

- 52.216-7 Submission of Final Indirect Cost Rate Proposal

- 52.216-7 Indirect Expense Rates for Billing Purposes

- 52.216-7 Audit of Interim Billings

- 52.216-7 Stipulates Requirements for Final Payment.

Details Of Far Part 31

Generally, FAR Part 31 details contract cost principles and procedures. More specifically, FAR Part 31 breaks down to:

- FAR Part 31.201-3 determining reasonableness

- FAR Part 31.201-4 determining allocability

- FAR Part 31.201-6 accounting for unallowable costs.

What can be even trickier for contractors with FAR Part 31.201-6 is that some unallowable costs are always unallowable and others are usually unallowable. A list of these unallowable costs is included in Delteks guide: Understanding the Basics of FAR & CAS.

Also Check: Government Grants To Start Trucking Business

Who This Course Is For:

- Beginners who have no knowledge of federal contracting

- 176 Students

- 1 Course

Through his community at Scorecontracts Mr. Coffie helps thousands of businesses embark on their journey of navigating the federal waters. His teachings and trainings showcase tips, tricks and tools to successfully winning contracts in the government arena.

Widely considered one of the worlds leading experts on procuring federal contracts. Companies and organizations regularly seek Mr. Coffie for advice, consultation, speaking and matchmaking opportunities to increase their chances of successfully landing a slice of the multi-billion dollar behemoth.

With the launch of his new podcast Govcon Giants Mr. Coffie is interviewing some of the worlds most notable federal contract experts, SBA award winners, contract officers, procurement specialist and Top DOD firms. His one goal, provide the audience with benchmarks and practicable steps of how they can breakthrough this seemingly impenetrable market.

Intellectual Property / Data Rights / Technical Data Rights

| This section is written like a personal reflection, personal essay, or argumentative essay that states a Wikipedia editor’s personal feelings or presents an original argument about a topic. Please help improve it by rewriting it in an encyclopedic style. |

From the Government perspective, the most critical aspect of IP, data, technical data and patent rights revolve around freedom to operate and freedom of contract, namely freedom to have maximum competition. From the perspective of a contractor, the most critical aspect of this area is protection of competitive advantage from disclosure to its competitors. In other words, the contractor/commercial vendor wants to retain its ability to have a product to sell inherent in this desire is a need to prevent the Government from disclosing important technical data, e.g., engineering designs, schematics, specifications, to its competitors when the Government conducts a follow-on acquisition and attempts to seek competition to meet legal and policy mandates in the Competition in Contracting Act and Armed Services Procurement Act.

IP, data rights and technical data rights is a highly specialized practice area in Federal acquisitions. Careful examination of FAR Part 27 and applicable agency FAR supplements must be performed and consultation with a wide variety of Federal statutes accomplished before attempting to deal with IP/data/technical data.

– Required contract clauses and provisions

– Markings provisions

Recommended Reading: City Of Las Vegas Government Jobs

Industry Best Practice For Numbering Accounts

Following industry-accepted best practice for numbering accounts allows apples-to-apples comparisons and analysis of a companys books.

Avoid numbering accounts sequentially without any correlation to how the rest of the accounts are structured.

A DCAA or DCMA auditor wont fail a company if its accounts are not set up in this sequence. But, following industry standards helps assure auditors that the books are structured correctly.

- 1xxx Asset

Flexibility In Change From One Individual Government Point Person To His/her Successor

Contractors often are required to build a system that meets the requirements that a particular individual in government authority believes is appropriate to the contractor, only to have that government authority replaced by another person whose ideas about requirements differ from his/her predecessor.

The successful government contractor systematizes its accounting operations, as the company grows, in order to maintain and improve compliance. The backup position businesses should constantly maintain, if it is financially possible to do so, is one of readiness for transition, in order to seamlessly maintain the integrity of its system if/when essential people leave the company or become unable to fulfill their roles.

For additional information on setting up DCAA compliant accounting systems, and in clearly understanding the suitability of various technologies in order to avoid unnecessary and excessively costly or insufficient accounting platforms for government contracting, contact us below.

Read Also: Entry Level Government Jobs Las Vegas

What Are Unallowable Costs

Expenses acquired by the contractor that do not meet the authorized criteria under the current contract terms in FAR 31 are identified as unallowable by the government and excluded from any billing, claim, or proposal applicable to the contract.

Some common examples of unallowable costs include but are not limited to:

- Tax expenses

Common Accounting Problems Confronting Government Contractors

Federal contractors face critical challenges in aligning accounting methodologies with the demands of the comparatively stringent requirements of their target market, the US government, vs. requirements of the commercial market base. Issues include maintaining constant audit readiness, the need for diligence and adroitness in information leveraging to develop a robust accounting operation, and the demand to stay on the cutting edge of applicable technologies and accounting workforce proficiencies, among others.

Managing difficult financial and accounting challenges has been the status quo of operating for government contractors. The simple reality of government contracting is that the standard is higher than for businesses in the commercial market. And, the government has tightened up systems over recent years, to prove its efficiency in protecting taxpayer funds. Consequently, contractors must even more meticulously demonstrate compliance of their accounting systems, policies, procedures, infrastructures.

But, achieving impeccable systems is an ever-faster moving target in the environment of continuously changing and increasingly complex and strict federal regulatory requirements in government contracting. Accounting to government agencies can overwhelm mid-sized and smaller businesses. Those who show exceptional capacity for adaptability to newly imposed requirements have an enormous advantage over competitors.

Don’t Miss: Las Vegas Rtc Jobs