How To Invest In Treasury Bonds

There are two common ways to buy individual Treasury securities: from TreasuryDirect, the official U.S. Department of the Treasury website for managing Treasury bonds, or from your online broker.

Many brokers allow you to buy and sell Treasury securities within your brokerage account. However, brokers often require a minimum purchase of $1,000 for Treasury securities. You can buy most securities in $100 increments on the TreasuryDirect website.

Note that the interest paid on Treasury securities is exempt from state and local taxes, but it is subject to federal income tax.

How Close The Bond Is To Maturity

Newly-issued government bonds will always be priced with current interest rates in mind, meaning that theyll usually trade at or near their par value. And by the time a bond has reached maturity, its just a pay out of the original loan meaning that a bond will move back towards its par value as it nears this point.

The number of interest rate payments remaining before a bond matures will also have an impact on its price.

Are You Rich If You Have 2 Million Dollars

According to respondents of a 2019 Modern Wealth Survey from Charles Schwab, once you have $2.3 million in personal net worth, you can call yourself wealthy. On the other hand, people responding to a 2019 survey from the market research website YouGov said you need to earn just $100,000 a year to be rich.

Read Also: How To Get Us Government Security Clearance

Government Bonds Vs Corporate Bonds

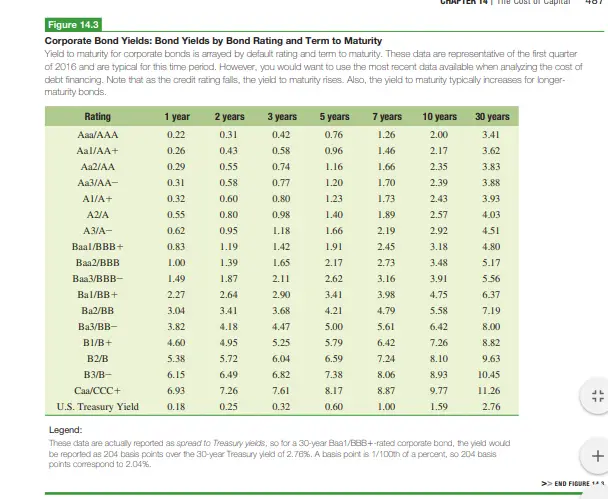

Corporate bonds are also debt securities that are issued by a corporation. Just like Treasury bonds, corporate bonds have their advantages and disadvantages. Typically, corporate bonds pay interest payments, which can be based on a fixed rate throughout the life of the bond. The interest payments can also be based on a variable interest rate, meaning the rate can change based on market interest rates or some type of benchmark. When a corporate bond matures, the investor is paid back the principal amount that was invested.

A corporate bond is backed by the corporation that issued the bond, which agrees to repay the principal amount to the investors. However, when buying corporate bonds, the initial investment is not guaranteed. As a result, corporate bondholders have default risk, which is the risk that the company may not repay its investors their initial investment. Whether the initial investment for a corporate bond is repaid or not depends on the company’s financial viability.

Since investors there is usually more risk with corporate bonds, they tend to pay a higher interest rate than Treasury securities. Conversely, Treasury bonds are guaranteed by the U.S. government as long as the investor holds the bond until maturity. As a result, Treasury bonds typically offer a lower interest rate than their corporate counterparts.

Can You Lose Money Investing In Bonds

Yes, you can lose money when selling a bond before its maturity date since the selling price could be lower than the purchase price. Also, if an investor buys a corporate bond and the company goes into financial difficulty, the company may not repay all or part of the initial investment to bondholders. This default risk can increase when investors buy bonds from companies that are not financially sound or have little-to-no financial history. Although these bonds might offer higher yields, investors should be aware that higher yields typically translate to a higher degree of risk since investors demand a higher return to compensate for the added risk of default.

Recommended Reading: Suing The Federal Government For Constitutional Violations

Is There Any Risk Involved In The Government Bonds

A: There is hardly any risk of default involved with government bonds. If you invest in government bonds, you can be assured that you will get good returns on your investment. Additionally, these bonds are always adversely affected by market volatility. Hence, these provide a certain amount of stability to your investments.

Do Stocks Or Bonds Get Higher Returns

Bonds are generally less risky than stocks because the issuer generally will repay the bond’s principal. Bondholders know what they can expect to get back from their investments. The value of stocks depends on the company they are for. This means that their value can rise and fall rapidly, leading to their volatility. Boiled down, this means that stock’s returns can be higher. If there’s a greater risk, there is a greater return potential.

Also Check: Free Grant Money For Home Improvements Government

Options At Maturity And Before

You can hold a bond until it matures or sell it before it matures.

If you don’t sell, your options at maturity depend on where you hold your bond:

- TreasuryDirect. Redeem the bond or use its proceeds to reinvest into another bond.*

- Legacy Treasury Direct. Redeem the bond.

- Bank or Broker. For your options, consult your bank or broker.

Government Bonds Trading Platform

CMC Marketâs online trading platform allows you to spread bet and trade CFDs across UK government bonds such as gilts. Additional to UK gilts, you can trade Euro bunds, Euro schatzs, Euro OATs and US treasury notes. Our online trading platform comes with an award-winning charting package* and can be adapted to your specific trading needs.

You May Like: Government In America Ap Edition 17th Edition

What Is An Example Of A Government Bonds India In 2021

In India, every bond issued will have a unique number and this number contains all the details.For instance, bond number is 700GS2040A and here is what this means

- Annualized interest 7.00%

- Type Government Securities or Government Bonds

- Maturity 2040

- Issue A means its a New issue

So, let us understand the Best Government Bonds India in 2021.

Bonds Mobile Trading App

You can use also trade using our award-winning mobile trading application**, which can be used to spread bet and trade CFDs on bonds on the go. Available for most mobile devices and tablets, our mobile app has been purposely built to ensure a seamless trading experience. Read more about spread betting and CFD trading.

You May Like: Practice Test For Government Jobs

The Returns Of Short Intermediate And Long Term Bonds

One of the tenets of investing is that with greater risk comes greater return. But this is much truer with stocks than it is with bonds. Stocks come with interest rate risk the ups and downs of an asset or fund in response to changes in rates.

Investors received higher returns while taking on greater interest rate risk from 1982 through 2019, but this is viewed as odd. It doesnt always translate into the average return on bonds that you should always expect.

It’s key to understand the risk and return relationship if you’re thinking of investing in bonds. Look at a few examples to get a better handle on how rates, yields, and risk work together over bond maturity periods.

Types Of Us Treasury Bonds

Treasurys might sometimes seem confusing. You might have heard of Treasury bills, Treasury notes and Treasury bonds, but whats the difference? The distinguishing factor among these types of Treasurys actually, all types of bonds backed by the full faith and credit of the U.S. Department of the Treasury is simply the length of time until maturity, or expiration.

-

Treasury bills : Short-term debt securities that mature in less than one year. Though T-bills are sold with a wide range of maturities, the most common terms are for four, eight, 13, 26 and 52 weeks.

-

Treasury notes : Intermediate-term debt securities that mature in two, three, five, seven and 10 years.

-

Treasury bonds : Long-term debt securities that mature between 10 and 30 years.

-

Treasury Inflation-Protected Securities : Another type of Treasury bond, adjusted over time to keep up with inflation.

Read Also: What Is Government Mortgage Relief Program

All You Need To Know About Government Bonds Purchase

3 min read.Neil Borate

- Bond yields fluctuate according to the size of the governments borrowing programme and the RBIs monetary policy outlook

The RBI, while announcing its policy statement on Friday, said it will allow retail investors to directly purchase government bonds by opening gilt accounts with it. Mint explains the current methods of buying these bonds, how they are taxed and what returns they give.

What kind of returns do government bonds give?

Aditya Birla Sun Life MF launches Nifty IT ETF all you …

The current yield on the 10-year government bond is 6.126%. In other words, if you hold the bond for 10 years, you will get a return of 6.126% per annum. The yield fluctuates according to the size of the governments borrowing programme and the RBIs monetary policy outlook.

Also Read | Vaccination drive picks up slowly

There are also government bonds of shorter tenors than 10 years such as treasury bills . These tend to have lower yields. Apart from these, you can also buy the Government of India Savings Bonds which pay a floating interest rate linked to the rate on National Savings Certificates . This rate is currently 7.15% and it is revised every six months based on the NSC rate. You can buy these Government of India Savings Bonds through certain designated banks such as SBI, HDFC Bank, ICICI Bank, Axis Bank and others.

How are returns on government bonds taxed?

What are the risks involved?

Can retail investors buy government bonds?

Investors Near Or In Retirement

Retirees often buy bonds to generate an income stream in retirement. Their portfolio allocation changes and tends to become more conservative. As a result, the portion of the portfolio that’s composed of bonds tends to rise. A portfolio that includes Treasury bonds, bills, or notes, provides safety and helps to preserve their savings since Treasuries are considered risk-free investments.

With their consistent interest payments, T-bonds can offer an ideal income stream after the employment paychecks cease. Also, bond maturity dates can be laddered to create the continuous stream of income that many retirees seek.

One type of Treasury bond that even offers a measure of protection against inflation called inflation-protected T-bondsalso referred to as I bondshave an interest rate that combines a fixed yield for the life of the bond, with a portion of the rate that varies according to inflation.

A bond ladder involves buying several bonds with staggered maturity dates in which each bond matures in a consecutive year. The strategy provides investors with cash on each maturity date.

Don’t Miss: City Of Las Vegas Government Jobs

How Much Risk Can You Tolerate

There’s more to your investment decisions than just performance. How much risk are you willing to take? The 2020 financial roller coaster is a case in point. It took only about four weeks for the market to lose 32% of its value, plunging from the S& P record high of 3,358 points on Feb. 12 to 2,447 at the close on March 18, with wild swings along the way. The good news is that the S& P had recovered nearly all its losses as of mid-August.

If your time frame is short, or if volatile markets like we saw in 2020 keep you up at night, you have to consider that in your decisions.

The fact is that the average retail investor consistently underperforms the market, especially when the markets are unstable.

If Its Backed By The Government Whats The Risk

While they are relatively safe investments, the primary risk is that inflation will erode your returns over the years. When you get the bonds face value back, it wont have the same purchasing power that it did 30 years earlier.

Treasury bonds yield around 2.24 percent , so they may not keep up with inflation over a longer period.

Investors should plan on inflation over the next 30 years averaging around three percent, McBride says.

McBride says that in three decades, $1,000 will only have the buying power of $476, if inflation averages 2.5 percent over that period.

So, this is not something thats going to grow your buying power or your wealth in any meaningful way, McBride says. And youve got tremendous interest-rate risk if, for some reason, you need to sell prior to maturity.

In that case, youll get more or less than the face value of the bonds.

Read Also: Data Strategy Vs Data Governance

The Rate Of Return Vs Yield

Rate of return and yield both describe the performance of investments over a set period , but they have subtle and sometimes important differences. The rate of return is a specific way of expressing the total return on an investment that shows the percentage increase over the initial investment cost. Yield shows how much income has been returned from an investment based on initial cost, but it does not include capital gains in its calculation.

Rate of return can be applied to nearly any investment while yield is somewhat more limited because not all investments produce interest or dividends. Mutual funds, stocks, and bonds are three common types of securities that have both rates of return and yields.

The formula for rate of return is:

where: D = Dividend \begin & \frac\right)\text+\text\$1\left\text-\text\$50\left}\\ & =0.22*100\\ & =\text\\ & \textbf\\ & \text\\ \end $50$60 + $1 $50=0.22100=22% Rate of Returnwhere:D = Dividend

Consider a mutual fund, for example. Its rate of return can be calculated by taking the total interest and dividends paid and combining them with the current share price, then dividing that figure by the initial investment cost. The yield would refer to the interest and dividend income earned on the fund but not the increaseor decreasein the share price.

What Types Of Bonds Are There

There are three main types of bonds:

- Corporate bonds are debt securities issued by private and public corporations.

- Investment-grade. These bonds have a higher credit rating, implying less credit risk, than high-yield corporate bonds.

- High-yield. These bonds have a lower credit rating, implying higher credit risk, than investment-grade bonds and, therefore, offer higher interest rates in return for the increased risk.

- Municipal bonds, called munis, are debt securities issued by states, cities, counties and other government entities. Types of munis include:

- General obligation bonds. These bonds are not secured by any assets instead, they are backed by the full faith and credit of the issuer, which has the power to tax residents to pay bondholders.

- Revenue bonds. Instead of taxes, these bonds are backed by revenues from a specific project or source, such as highway tolls or lease fees. Some revenue bonds are non-recourse, meaning that if the revenue stream dries up, the bondholders do not have a claim on the underlying revenue source.

- Conduit bonds. Governments sometimes issue municipal bonds on behalf of private entities such as non-profit colleges or hospitals. These conduit borrowers typically agree to repay the issuer, who pays the interest and principal on the bonds. If the conduit borrower fails to make a payment, the issuer usually is not required to pay the bondholders.

Also Check: What Do Government Contractors Do

Who Should Be Looking At Treasury Bonds

Treasury bonds might be a good fit for someone who seeks safety, because Treasury securities are backed by the full faith and credit of the U.S. government, according to the U.S. Securities and Exchange Commission.

If youre heavily invested in stocks, Treasury bonds may be an option to diversify your portfolio.

U.S. Treasury bonds are the de facto safe-haven investment for investors, McBride says.

So when the stock market goes down, youll often see investors flocking to the safety of Treasuries, McBride says.

People are looking for the safety that bonds provide, and arent as concerned with the yield.

Treasury yields below one percent and in some cases very close to zero is evidence that investors seek Treasurys more for the return of their money than the return on their money, McBride says.

Rising Rates Dont Negate Benefits Of Bonds

Roger Aliaga-DíazVanguard Americas Chief Economist

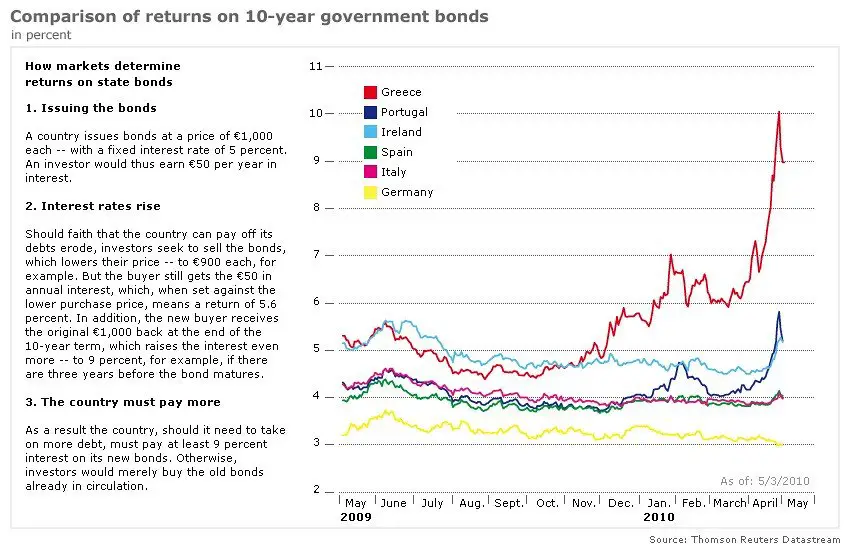

The yield of the 10-year U.S. Treasury note rose more than 100 basis points from August 2020 through late March 2021. Rates also climbed for other government bonds, including those issued by the United Kingdom and Australia. Because bond prices fall as rates rise, and vice versa, some investors are feeling jittery about the near-term risks of bonds.

Also Check: Federal Government Watch List Search

Keep Your Eyes On The Road Ahead

It’s good advice in both driving and investing. Vanguard recommends that investors stay focused on long-term, forward-looking return expectations, not on recent trailing-return performance.

Let your investment goals shape decisions about your strategic asset allocation. Calibrate the riskreturn trade-off in your portfolio accordingly, including setting the right mix of bonds and stocks to meet those goals. And generally ignore market-timing advice, which is mostly based on public consensus information that is already priced into the markets.

Even if rates keep rising, long-term total returns on broadly diversified bond portfolios are likely to remain positive. That would be the natural outcome of reinvesting bond dividends at higher yields, a process thats easily managed by owning mutual funds or ETFs.

Yields That Matter More

Coupon and current yield only take you so far down the path of estimating the return your bond will deliver. For one, they don’t measure the value of reinvested interest. They also aren’t much help if your bond is called earlyor if you want to evaluate the lowest yield you can receive from your bond. In these cases, you need to do some more advanced yield calculations. Fortunately, there is a spate of financial calculators availablesome that even estimate yield on a before- and after-tax basis. The following yields are worth knowing, and should be at your broker’s fingertips:

Three Assumptions

Interest rates regularly fluctuate, making each reinvestment at the same rate virtually impossible. Thus, YTM and YTC are estimates only, and should be treated as such. While helpful, it’s important to realize that YTM and YTC may not be the same as a bond’s total return. Such a figure is only accurately computed when you sell a bond or when it matures.

Bond Fact

Read Also: How To Cash Government Check Without Id