Term Life Insurance For Retired Military

After your separation from the military, you can convert your SGLI into Veterans Group Life Insurance a lifetime renewable term coverage policy. You start with the same coverage you had through SGLI, and, if you desire, you can increase it every five years by $25,000, up to the maximum of $400,000. In order to guarantee your previous benefits, you must submit your application within one year and 120 days of your separation from the military. If you do so later than that, you may have to pass a medical exam, and coverage amounts may be recalculated.

What Are The Expected Costs Of Life Insurance For Veterans

Age, health, gender, and smoking history are a few of the main factors that affect the cost of life insurance for veterans. Another element that can affect the premium is the type and length of the plan.

On the younger side, nonsmoking 35-year-old male veterans can expect to pay between about $9 to about $25 per month for $150,000 in term coverage, depending on their overall health and plan selections.

Nonsmoking 55-year-old males can expect to pay between about $39 to about $86 per month for $150,000 in term coverage, depending on their overall health and plan selections.

Options For Private Veterans Private Life Insurance

Private insurance companies offer coverage for veterans who may not qualify for the life insurance options through the Department of Veterans Affairs, or who want to explore other life insurance alternatives. The types of life insurance available include term life insurance, whole life insurance and universal life insurance.

For example, the American Armed Forces Mutual Aid Association offers veterans term life policies up to $800,000 and whole life policies up to $1 million for veterans who qualify.

The monthly rates for VGLI are extremely low compared to private options. But its $400,000 coverage cap may not be enough for many veterans. If you need life insurance to supplement a VGLI policy, there are many private life insurance options.

Don’t Miss: Government Grants To Start Small Business For Free

Military Funeral Honors And Memorial Items

Almost all veterans can receive military funeral honors at no cost. They are also usually eligible for free memorial items including:

-

Headstones, markers, and medallions

If youre a veteran or the spouse of one, you can apply to learn if you qualify for burial in a VA national cemetery. If you do, youll get a pre-need decision letter confirming your eligibility. This will make it much easier on your family when they schedule your burial.

Normally, the process to schedule a burial starts with verifying the deceased’s eligibility. To schedule a burial at a VA national cemetery, follow these steps.

Arlington National Cemetery

Eligibility for burial at Arlington National Cemetery is stricter than for other national cemeteries. Only active duty, military retirees, former prisoners of war, and recipients of the Purple Heart and other top awards may be buried at Arlington.

See how to schedule a burial at Arlington National Cemetery.

State Veterans Cemeteries

Requirements for burial in a state veterans cemetery are like those for VA cemeteries. They may also have residency requirements.

To schedule a burial at a state veterans cemetery, contact the cemetery directly.

How Do I Manage My Military Life Insurance Policy

You can manage S-DVI and older military life insurance policies online by using the VA life insurance portal. The portal lets you check your policys status, find out more about your plan and renewal options and update your policys beneficiary information. You can manage VGLI policies online at the Prudential website. Prudential has underwritten VGLI policies for the Department of Veterans Affairs since VGLI was established in 1974.

Read Also: Marketing To The Federal Government

What Is The Proposed Pension For Life

Pension for Life is a combination of benefits that provide recognition, income support and better overall stability to Canadian Armed Forces members and Veterans who are living with a disability due to a service-related injury and/or illness.

The Pension for Life benefits package includes: The Pain and Suffering Compensation, the Additional Pain and Suffering Compensation, and the Income Replacement Benefit.

Pain and Suffering Compensation Recognizing service-related pain and suffering

This monthly, lifelong, tax-free payment recognizes pain and suffering experienced by Veterans and CAF members with a disability due to a service-related illness and/or injury. The choice between monthly and lump sum options give Veterans and members the flexibility to decide what works best for them and their families.

Additional Pain and Suffering Compensation Delivering further recognition for those with severe and permanent impairment

This monthly, tax-free payment is for Veterans experiencing barriers to re-establishing themselves after service because of their severe and permanent illness and/or injury.

Income Replacement Benefit Delivering income support when Veterans need it

The monthly, benefit is designed to provide income support to Veterans who are experiencing barriers to re-establishment primarily resulting from service. The benefit is available to Veterans, survivors and orphans, for life, should they need it.

Veterans Life Insurance Riders

If you become totally disabled or terminally ill and have VA coverage, you may qualify for additional benefit options with your veterans life insurance. Your spouse could also qualify if they have a terminal illness.

Waiver of premium rider: If you become totally disabled, a waiver of premium rider means you will no longer have to pay your life insurance premiums. Typically, premium payments can only be waived up to one year before filing a claim.

To qualify, applicants must meet all of the following requirements:

- You have Service-Disabled Veterans Life Insurance coverage

- Your disability prevents you from working

- You became totally disabled before age 65

- Your total disability lasts longer than six months.

There can be exceptions to these eligibility rules.

Accelerated death benefit: For terminally ill policyholders, an accelerated death benefit may be available. With an accelerated death benefit, you can receive up to 50% of your veterans life insurance coverage paid in $5,000 increments before death.

To qualify, you must meet all of the following requirements:

- You must have a VGLI insurance policy

- You or your spouse must have a written letter from your doctors stating you have less than nine months to live

Related:Life insurance riders explained

Don’t Miss: Government Programs For Rural Development

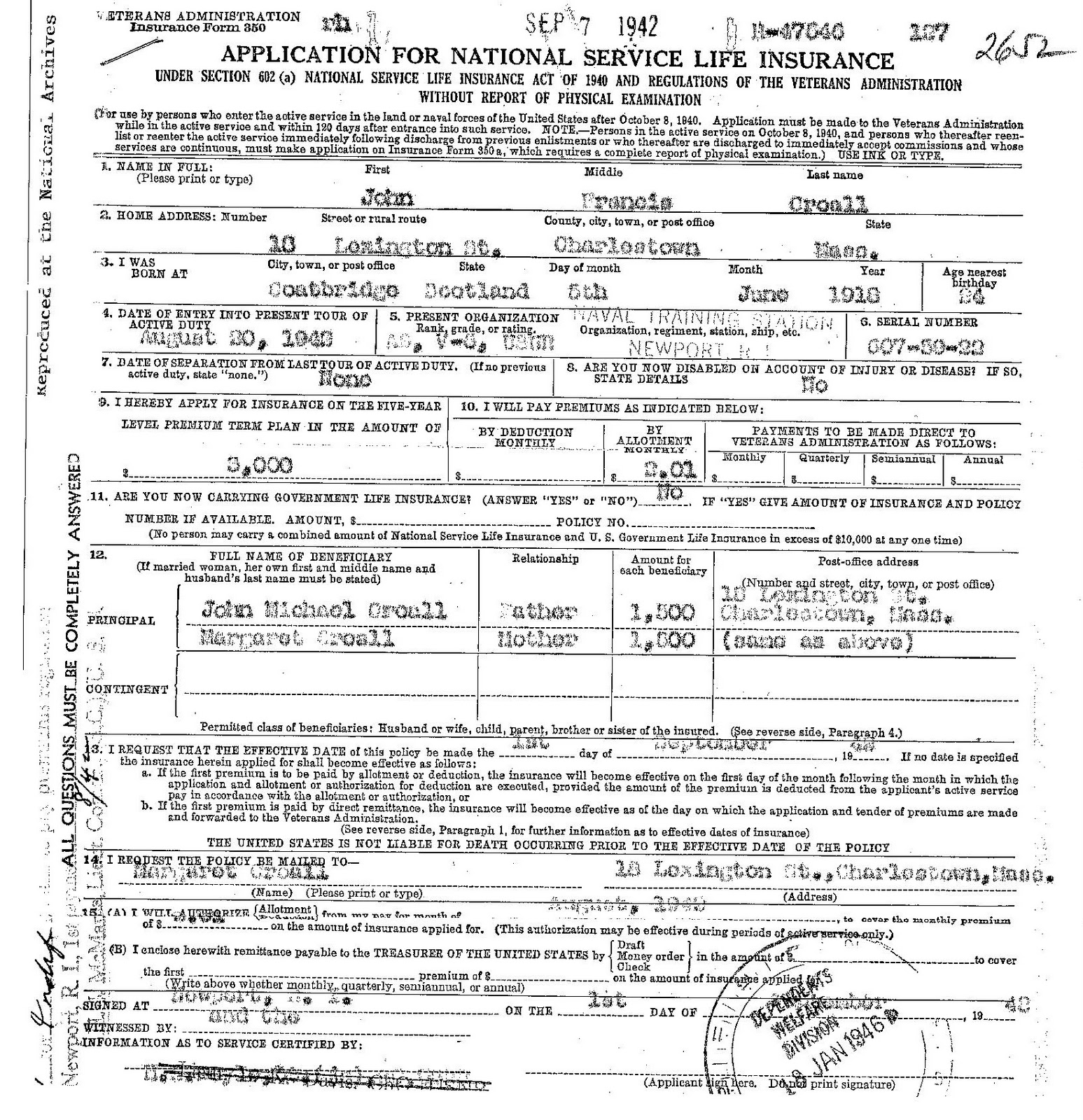

Five Year Level Premium Term

- Available on all programs except “J,” “JR,” “JS”

- Renewable every five years

- May be converted to a permanent plan

- Provides low cost protection at younger ages but premiums increase substantially at older ages

- Provides protection only and has no cash or loan values *

- When premiums are not paid, the protection stops *

* Effective September 11, 2000, “capped” NSLI and VSLI term policies receive a termination dividend that protects against the lapse of the policy. See more information about premium capping.

How Do I Know Which Life Insurance Program Im Eligible For

Different programs cover Veterans , service members , and family members . You may also be able to get short-term financial coverage through TSGLI to help you recover from a traumatic injury. And if youre disabled because of an injury or illness causedor made worseby your active service, you may be able to get coverage through S-DVI to continue your life insurance beyond 2 years after you leave the military.

Note: If youre ending your military tour of duty soon, youll need to get new coverage quickly. In some cases, you must act within 120 days of leaving the military to be sure theres no break in your coverage.

Don’t Miss: Free Government Phones In Wv

Am I Eligible For Service

You may be eligible for S-DVI if you meet all of these requirements.

All of these must be true:

- You were released from active duty on or after April 25, 1951, and didnt receive a dishonorable discharge, and

- You were rated for a service-connected disability , and

- Youre in good health except for any service-connected conditions, and

- You apply by December 31, 2022, or within 2 years of receiving your disability rating

Note: An increase of a rating you had beforeor a rating of Individual Unemployability, meaning you cant workdoesnt qualify you for S-DVI.Play our video about the benefits of S-DVI

What Is The Eligibility Criteria Of The Additional Pain And Suffering Compensation

This benefit is payable to Veterans who have one or more disabilities caused by a service-related injury or illness that is:

- Creating a permanent and severe impairment and

- Creating a barrier to re-establishment in civilian life and

- For which the Veteran has received a Disability Pension, Disability Award or Pain and Suffering Compensation.

You May Like: Loudoun Government Jobs

You May Like: Is Humana A Government Insurance

Military Disability Retirement Pay

If you receive military disability retirement pay, it is excluded from taxable income and is not part of your gross income calculations. This nontaxable amount includes any annuity, pension or other service-connected disability compensation you receive as a disabled veteran.

The U.S. Department of Veterans Affairs determines whether you are a disabled veteran. Generally, you can obtain disabled veteran status with the VA if your disability is from a combat-related injury or sickness that meets any one of these requirements:

- Arose during service

- Worsened or intensified during service

- Was a direct result of your service

What if the VA grants disabled veteran status after you have retired and after you have already paid taxes on military retirement pay based on your years of service?

Your retroactive disabled veteran status, which is based on your service-connected disability, entitles you to claim a refund on the taxes you previously paid on your military retirement pay pay which you would have been able to exclude from income taxes based on your disabled status. Of course, to get your refund, youâll need to file an amended return for every year you paid taxes.

How United States Government Life Insurance Works

The purpose of USGLI was to support American soldiers who may have been unable to obtain life insurance at affordable rates from private insurers. After all, life insurance companies must set their insurance premiums based on the expected frequency and cost of the claims made by their policyholders. Since soldiers are exposed to a much higher risk of injury or death as compared to other occupations, the premiums charged to them under a private insurance plan would likely be very high.

To help support soldiers, the United States government created a series of policies called the War Risk Insurance program. One of the central pillars of this program was USGLI, which effectively subsidized the cost of life insurance for American soldiers. The premiums paid under this program were deposited to the United States Treasury and were used to cover the claims made by its policyholders.

The USGLI program entitled all active military personnel to a life insurance policy payable by the federal government in the case of death or disability caused by war. The maximum face amount of a USGLI policy was $10,000. The program was closed on April 25, 1951. War risk insurance proved to be extremely popular. During World War I, more than four million policies were issued.

Also Check: Government Jobs West Chester Pa

Office Of Servicemembers’ Group Life Insurance

Contact the Office of Servicemembers’ Group Life Insurance if you have questions about Veterans’ Group Life Insurance or Claims for Servicemembers’ Group Life Insurance and Family SGLI .

Toll-free telephone: 1-800-419-1473

Death and accelerated benefits claims only:1-877-832-4943

Death and accelerated benefits claims only: All other inquiries:

Office of Servicemembers’ Group Life InsurancePO Box 41618

New VGLI Applications and VGLI Reinstatements:OSGLIPhiladelphia, PA 19176-9913

Can I Get More Life Insurance Coverage If I Need It

If you carry the basic S-DVI coverage and become totally disabled and unable to work, you can apply to get up to $30,000 more in coverage. This is called supplemental S-DVI coverage.

You may be able to get $30,000 of supplemental coverage if you qualify for a premiums waiver, and you meet both of these requirements.

Both of these must be true:

- You apply for the coverage by December 31, 2022, or within 1 year from the date you get notice of the grant of waiver , and

- Youre younger than age 65

Recommended Reading: The Federal Government Grant Help Commission

Life Insurance Rates For Retired Military

The average retirement age for active duty enlisted retirees is 42 and the average age that officers retire is 46. To compare the costs of VGLI to those of a private policy, we pulled numbers for a nonsmoking, 40-year-old male in good health with no family history of disease. When you get a term life insurance policy, the rate stays the same for the length of the entire policy . VGLI max coverage is $400,000, so we compared that to a private $400,000, 30-year term policy.

Life Insurance For Retired Military

All people retired from the military service are veterans, but not all veterans are military retirees. For the most part, this distinction wont affect the life insurance plans available to you. Military life insurance after retirement includes the same options as veterans, including VGLI, S-DVI, and private civilian insurance. Military life insurance If you want to keep your military provided coverage after retirement, youll have to convert it to VGLI within 485 days of leaving active duty, though that may not be your most affordable option.

Don’t Miss: Is The Government Holding Money That Belongs To Me

Where Can I Find Help With My Military Life Insurance

You can contact the Office of Servicemembers Group Life Insurance at 1-800-419-1473 to get help with Servicemembers Group Life Insurance or Veterans Group Life Insurance. If you have questions about Veterans Affairs Life Insurance , Service-Disabled Veterans Life Insurance or Veterans Mortgage Life Insurance , you can call the VA Life Insurance Center at 1-800-669-8477.

Is This In Fact A Lump Sum Divided Into Monthly Payments Over The Course Of A Veterans Life

No. The new PSC is designed to support ill and injured members and Veterans, and provide them with the ongoing monthly recognition for their service-related illness or injury. If taken as a monthly payment for life, there is no cap on the amount the Veteran can receive. This means that they can receive more than the lump sum cash out amount. It is not a lump sum amount spread out over the Veteranâs life. For a younger Veteran, this could mean receiving more than double the amount of the lump sum.

Recommended Reading: Jobs Hiring In Los Lunas

You May Like: Federal Government Jobs Richmond Va

Veterans Affairs Life Insurance

Veterans Affairs Life Insurance starts on Jan. 1, 2023, and replaces Sevice-Disabled Veterans Life Insurance . VALife coverage goes into effect two years after you enroll, as long as youve kept up with your payments. Your beneficiary only receives premiums paid plus interest if you die during the two-year waiting period. The full death benefit is paid to beneficiaries if you die more than two years after enrolling.

Coverage limits: Veterans with service-related disabilities can receive guaranteed acceptance whole life insurance coverage in $10,000 increments up to $40,000 with VALife.

Eligibility requirements: All veterans age 80 and younger with a VA disability rating are eligible. There is no time limit to apply. Veterans 81 or older who have previously applied for a disability rating before age 81 but received a rating after turning 81 are eligible to apply within two years of their rating.

If you have S-DVI, you can remain in that program. Or you can apply for VALife. If you apply before Dec. 31, 2025, you can keep S-DVI during the initial two-year waiting period for VALife.

Related: Pros and cons of guaranteed issue life insurance

Rates Table For Retired Military

|

$396 |

$59.16 |

VGLI rates as provided by the Department of Veterans Affairs . Rate illustration valid as of 2/08/2022. Term life insurance rates methodology: Sample monthly premiums are for 40-year-old male non-smokers with a Preferred health rating buying a 30-year term life insurance policy Life insurance averages are based on a composite of policies offered by Policygenius from AIG, Banner, Brighthouse, Lincoln, Mutual of Omaha, Pacific Life, Protective, Prudential, SBLI, and Transamerica and may vary by insurer, term, coverage amount, health class, and state. Not all policies are available in all states. Rate illustration valid as of 8/1/2022.

Don’t Miss: Government Grants For Auto Repair Shops

Best For Families: Uniformed Services Benefit Association

USBA

The company is ideal for veterans with families because it offers family plans, coverage for married couples, and coverage for dependents.

-

Has been in business since the 1950s

-

Offers a family plan

-

Not available in all states

Founded in 1959 to meet the needs of military personnel, USBA offers veterans term and whole life insurance to replace SGLI when they leave the military. Policies are underwritten by New York Life Insurance Company, which has received an A++ rating from AM Best.

Instant online quotes are available. You can also call the company and speak with a sales agent Monday through Friday from 9 a.m. to 5:30 p.m. EST.

A nonsmoking 35-year-old male can expect to pay $18 per month for $150,000 of 20-year level term insurance and $163.50 per month for lifetime value whole life insurance. A nonsmoking 55-year-old male can expect to pay $38.50 per month for $150,000 10-year level term insurance and $433.50 per month for life-time value whole life insurance.

What Is The Pain And Suffering Compensation

The Pain and Suffering Compensation is designed to recognize and compensate CAF members and Veterans for the pain and suffering they experience due to a disability caused by a service-related illness and/or injury. It is not intended to replace income, which is why the PSC is not taxable.

Based on the member or Veterans assessed extent of disability, the PSC benefit potentially entitles members and Veterans up to a maximum of $1,150 a month for life. Members and Veterans can also opt to cash out their payments at any time. The intent is to provide the choice of how to receive this benefit, while encouraging recipients to continue the monthly payment.

Don’t Miss: Federal Government Learning Management System