Will An Llc With A Nonprofit Purpose Be Tax

A Texas LLC that states a nonprofit purpose is not automatically exempt from state or federal taxes. For information on whether the IRS will grant a tax-exempt status to such an LLC, contact the IRS or read IRS Publication 557: Tax-Exempt Status for Your Organization. For information on whether the Texas Comptroller will grant tax-exempt status, contact the Comptrollers Exempt Organizations Section.

Before You Start A Business

Before you start a business, you should have researched all licenses and permits you need for the type of business you will be running. You should apply for these after you create your LLC so that you are sure the business name you choose is available.

You should also have a business plan. Even small, family-run companies should have a business plan. The plan outlines the day-to-day operations of the business, financing and marketing strategies, and more. If you need a loan to get your business up and running, the loan officer will give your application more consideration if you have a business plan.

Where Can I Get A Corporate Seal Stock Certificates And A Minute Book

Texas law does not require a business to have a seal therefore the secretary of state does not have information or regulations on how to design a seal or where to obtain one. Seals, stock certificates, and minute books can be purchased from book stores, office supply stores, or corporate service companies.

Don’t Miss: Which Government Agency Is Responsible For Cyber Security

Documents Related To The Operating Agreement

In some cases, you may need the following additional documents that are related to the operating agreement:

- LLC Operating Agreement Amendment If you need to update the operating agreement, you will need an LLC operating agreement amendment. The amendment not only documents the changes in the event that you have a problem with another member later, but it ensures that your LLC operates in a smooth manner and stays compliant. If you add or remove managers or members, add new terms, replace terms that already exist, or correct an error in the operating agreement, you should complete an operating agreement amendment.

- LLC Operating Agreement Addendum If you are simply adding new terms to your operating agreement, you should complete an LLC operating agreement addendum instead of the amendment. As you make changes to the operating agreement, add the new terms to the original agreement with an amendment so that your LLC’s procedures and rules are always up to date.

- LLC Membership Admission Agreement An LLC membership admission agreement documents the addition of new members as owners. When you have an admission agreement, you have officially added a new member or owner. This agreement notifies the rest of the members that the decision is formal, and it also notifies the new member that he or she must abide by the operating agreement that was already in place prior to his or her addition.

What Is A Limited Liability Company

A limited liability company is a business structure in the U.S. that protects its owners from personal responsibility for its debts or liabilities. Limited liability companies are hybrid entities that combine the characteristics of a corporation with those of a partnership or sole proprietorship.

While the limited liability feature is similar to that of a corporation, the availability of flow-through taxation to the members of an LLC is a feature of a partnership rather than an LLC.

Also Check: Government Grants For Home Repairs Seniors

Can I Register My Out

Yes. A series LLC formed under the laws of another jurisdiction will be treated as a single legal entity for qualification purposes. The LLC itself rather than the individual series should register as the legal entity that is transacting business in Texas. The secretary of state has a separate application for registration form for foreign series LLC. See Form 313 . If each or any series of the LLC transacting business in Texas transacts business under a name other than the name of the LLC, the LLC must file an assumed name certificate in compliance with chapter 71 of the Texas Business & Commerce Code. See Form 503 .

How To Obtain A Letter Of No Objection From The Banking Commissioner In Order To Use Certain Words In A Proposed Business Title

Under the provisions of sections 31.005 and 181.004 of the Texas Finance Code, the name of a domestic or foreign entity is prohibited from containing certain words in its title. The Banking Commissioner has the authority to issue a letter of no objection for use of these words or terms. Receipt of the letter from the Commissioner will enable the requestor to submit certain filings to the secretary of state.

The following names, or phonetically similar derivatives of such names, taken from the list of prohibited names, have been determined to require a letter of no objection from the Banking Commissioner.

Persons seeking the issuance of a letter of no objection should submit a letter containing the following information to the Banking Department’s Corporate Activities Division at the address appearing below:

Recommended Reading: Government Grants For Fixing Up Your Home

Create An Llc Operating Agreement

An LLC operating agreement allows you to structure your financial and working relationships with your co-owners in a way that suits your needs. In your operating agreement, you and your co-owners establish each owners percentage of ownership in the LLC, his or her share of profits , his or her rights and responsibilities, and what will happen to the business if one of you leaves.

Why You Need an Operating Agreement

While many states do not legally require your LLC to have an operating agreement, it is foolish to run an LLC without one, even if you are the sole owner of your company.

An operating agreement will help you guard your limited liability status, head off financial and management misunderstandings, and make sure your business is governed by your own rules – not the default rules found in the State of Washington statutes .

Protecting Your Limited Liability StatusThe main reason to create an operating agreement is to help ensure that courts will respect your limited personal liability. This is particularly important in a single-member LLC where, without the formality of an agreement, the LLC may appear to be a sole proprietorship. Having a formal written operating agreement will lend credibility to your LLCs separate existence.

Distributive SharesIn addition to receiving ownership interests in exchange for their contributions of capital, LLC owners also receive shares of the LLCs profits and losses.

Who Inherits When There Is No Will

When a limited liability company member dies, the deceased member’s interest passes to the deceased member’s heirs.

However, if there is no will specifying how an inheritance should be distributed among potential beneficiaries, investors can control how assets are divided up.

To avoid this situation where they have to relinquish inherited member’s interest in the LLC, the member should draft a will.

Though a member may want to keep their assets private, their death can be announced through public records.

Read Also: Government Assisted Apartments For Seniors

How Do I Form A C Corporation An S Corporation Or A 501 Corporation

Filing a certificate of formation with the secretary of state creates a for-profit corporation, professional corporation, close corporation, nonprofit corporation, LLC or limited partnership. Designations such as “S,” “C,” or “501” refer to federal tax provisions. For information on federal tax issues, including how they might affect what you need to include in your certificate of formation, consult a private attorney and/or contact the Internal Revenue Service.

What Is A Registered Agent What Are The Agent’s Duties Where May A Registered Office Be Located Can The Secretary Of State Be The Registered Agent Of A Corporation Limited Liability Company Or Limited Partnership

A registered agent is an individual Texas resident or a domestic entity, or a foreign entity that has qualified or registered to transact business in Texas who is responsible for receiving and forwarding service of process or official notices addressed to an entity. Effective on January 1, 2010, a person who is appointed or designated as an entity’s registered agent must have consented in a written or electronic form to serve as the registered agent of the entity.

An entitys registered office must be a physical address in Texas where the registered agent can be personally served with process during business hours. It cannot solely be the address of a mailbox service or telephone answering service.

The secretary of state cannot serve as an entity’s registered agent.

For more information, please see our Registered Agent FAQs.

Read Also: Government Contract Specialist Job Description

What Are The Differences Between A Corporation A Limited Liability Company A Limited Partnership A Limited Liability Partnership And A Limited Liability Limited Partnership What Are The Benefits Of Forming Each Of These Entity Types

Corporations, LLCs, and LPs are formed by filing a certificate of formation with the secretary of state. Corporations are owned by shareholders, managed by a board of directors, and administered by officers. LLCs are owned by members and managed by members, managers, or both. An LP is a partnership of one or more limited partners and one or more general partners. For more information, see Selecting a Business Structure.

A limited liability partnership is either a pre-existing general partnership or a pre-existing limited partnership that takes the additional and entirely optional step of registering with the secretary of state as an LLP. Tex. Bus. Orgs. Code §§152.801 et seq. and 153.351 et seq. Filing an application for registration of an LLP does not create a partnership or any other entity. Instead, an LLP is merely an optional registration that is made by an underlying, pre-existing partnership.

Each of these entity structures shields its owners from personal liability for the debts and obligations of the entity and may offer tax advantages that are not available to sole proprietorships and general partnerships. Each of these entities must also pay Texas franchise taxes.

The secretary of state cannot determine which entity would be best for any individual situation. A private attorney can assist with that determination.

What Is An Llc

A Limited liability company is a business structure that offers limited liability protection and pass-through taxation. As with corporations, the LLC legally exists as a separate entity from its owners. Therefore, owners cannot typically be held personally responsible for the business debts and liabilities.

The LLC allows for pass-through taxation, as its income is not taxed at the entity level however, a tax return for the LLC must be completed if the LLC has more than one owner. Any LLC income or loss as shown on this return is passed through to the owner. The owners, also called members, must then report the income or loss on their personal tax returns and pay any necessary tax.

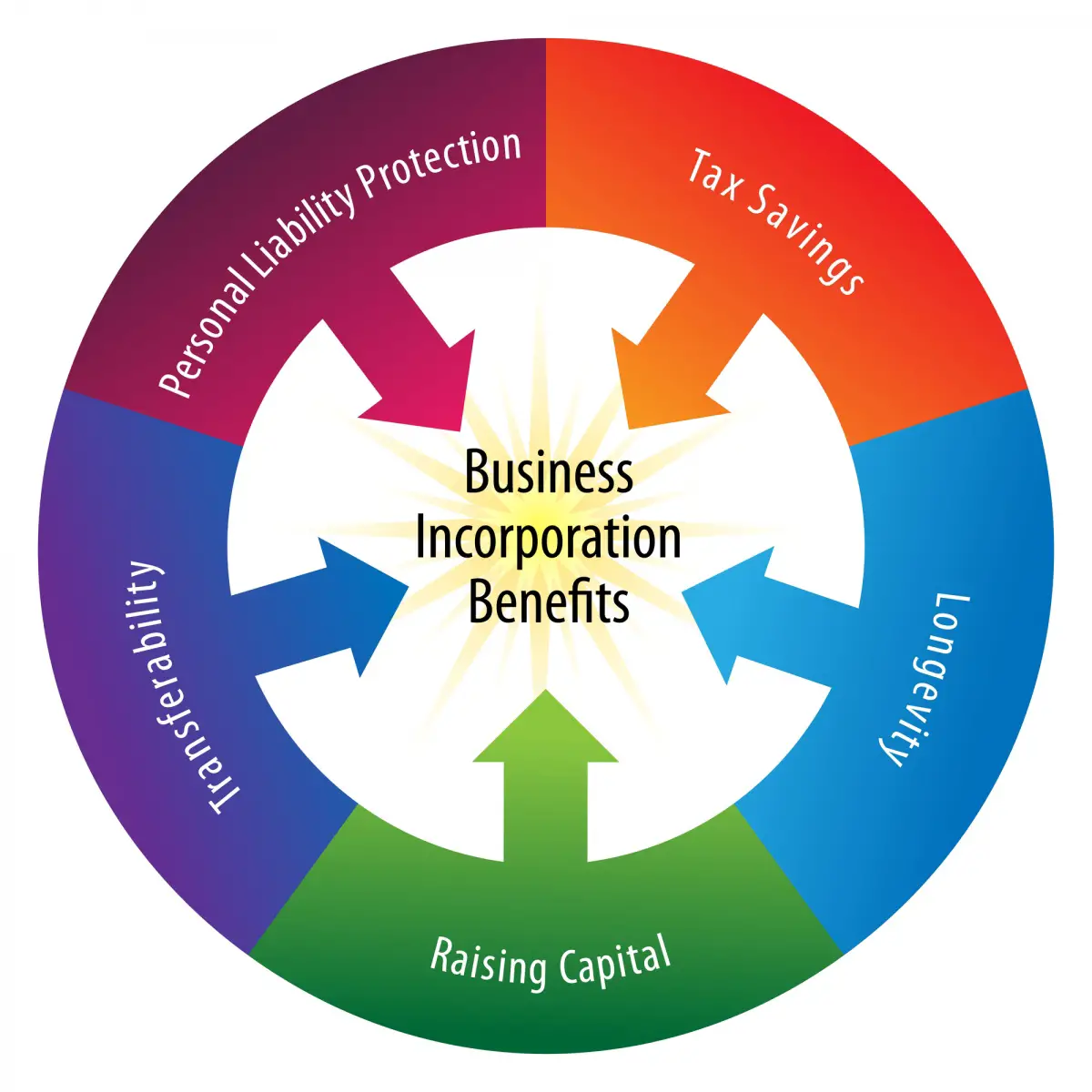

Benefits of forming an LLC

The benefits of creating an LLCas opposed to operating as a sole proprietorship or general partnership, or forming a corporationtypically outweigh any perceived disadvantages.

Read Also: How To Get A Replacement Government Phone

Are There Restrictions On Who Can Be An Owner Governing Person Or Officer Of A Texas Professional Entity

Yes. Depending on the type of professional entity, an owner or governing person may be a professional individual, or in some cases a professional organization. Only a professional individual may be an officer. See BOC §§301.004, 301.007. The table below shows the BOC restrictions for each type of Texas professional entity.

Table Showing Requirements for Owners, Governing Persons, and Officers for Texas Professional Entities.

Texas Professional Entity Type| Professional Limited Liability Company | Professional individual or professional organization | Professional individual or professional organization | Professional individual only |

| Professional individual or professional organization | Professional individual only | ||

| Professional individual only must also be member | Professional individual only must also be member president must be both member and governing person |

Does The Secretary Of State Have A Form I Can Use To Form An Llc With A Nonprofit Purpose

No. Form 205 can be used to create a general purpose LLC, but it is not designed to create an LLC with a nonprofit purpose, and it is not designed to satisfy any requirements that the IRS or Texas Comptroller might impose for tax-exemption. You should consult with your attorney if you want to form a tax-exempt or nonprofit LLC.

You May Like: Government Assistance For Mental Illness

How Do I Form An Llp

You cannot “form” an LLP instead, you can form a partnership ), and the partnership can choose to take the steps to register as an LLP. An LLP is not an entity separate and apart from the underlying partnership instead, it is a registration that is made by the underlying partnership, namely, a pre-existing general partnership or a pre-existing limited partnership to limit the liability of its partners. Registering an LLP does not create a partnership.

Basics Of Llc Operations

Before you can understand the difference between an authorized member and a manager in an LLC, you should know the basics of LLC operations. In 2018 just under 200,000 LLCs were established in the state of Texas alone. The popularity of LLCs comes from its legal protections for owners, tax flexibility, and its less formal establishment process than traditional corporations.

As mentioned, a properly established LLC requires two foundational documents: Articles of Organization and the Operations Agreement. The first key step in how to start an LLC is filing the Articles of Organization with the state to outline the formation and purpose of the LLC. Governing the actual processes of the LLC, the Operations Agreement is important to ensure an efficiently run LLC and that it affords the most protections and benefits to its members.

The owner of an LLC are referred to as its members and the default management is a democratic vote based on the ownership percentage. All the members enjoy protection from any liabilities taken on by the LLC and the LLC is in turn protected from any creditors of its members.

That said, it is imperative that the LLC Operations Agreement is drafted correctly as an ownership interest in an LLC is not automatically protected against personal creditors. If correctly drafted, however, the most a personal creditor of one of the members could obtain is the cash distributions that that member would have been entitled to.

You May Like: Government Jobs In Scranton Pa

I Already Created A General Partnership Or A Limited Partnership How Does My Partnership Register As An Llp What Does The Partnership Need To Do To Maintain Its Llp Registration With The Secretary Of State

To register a pre-existing general partnership as an LLP, or to register a pre-existing limited partnership as an LLP, you must file an application for registration with our office. You may use Form 701 as your application for registration. The filing fee is $200 per general partner.

Effective January 1, 2016, Senate Bill 859 amended Chapter 152 of the Business Organizations Code to add Section 152.806, which requires a Texas LLP to file an annual report with the secretary of state. The annual report is due no later than June 1 of each year following the calendar year in which the application for registration takes effect. The filing fee for the annual report is $200 per general partner as of the date of filing the report. Failure to file the annual report and pay the report filing fee may result in the termination of the partnerships registration as an LLP.

Washington State Llc Approval:

If you form your Washington LLC by mail, it will take 7-10 business days to be approved.

However, during peak filing times, it can take as long as twenty three business days.

Online: If you form your Washington LLC online, it will take 2-3 business days to be approved.

However, during peak filing times, it can take as long as 5 business days.

Note: Filing times may take longer due to the current global situation and government delays. For the most up-to-date LLC processing times, check how long does it take to get an LLC in Washington.

Need to save time? Hire a company to form your LLC:

Don’t Miss: Money For Homeschooling From The Government

Why Didn’t I Receive A File

In order to receive a file-stamped copy of a filing instrument, you must submit a duplicate copy of the filing instrument. The secretary of state does not reject filing instruments that are not accompanied by a duplicate copy if the filing instrument otherwise conforms to the statutory requirements. In addition, the secretary of state is not required to attach a file-stamped copy of an instrument when no duplicate copy has been provided